So, you've found termites. After the initial shock wears off, your next thought is probably, "Will my homeowners insurance cover this?"

Unfortunately, the answer is almost always a hard no. Standard home insurance policies are designed to protect you from sudden, unexpected disasters, and they see termite damage as a maintenance issue you could have prevented.

The Hard Truth About Termites and Your Home Policy

Insurance is there for the curveballs life throws at you—a kitchen fire, a burst pipe, or a tree crashing through your roof. From your insurer's point of view, a termite infestation just doesn't fit that mold. It's a slow, creeping problem that develops over months or even years.

Think of it this way: if a freak hailstorm shatters your window, that's a sudden event your policy will likely cover. But if the window frame slowly rots over a decade because you never repainted or sealed it, that's on you. Insurers see termite damage in the same light—it's a gradual decay, not an accident.

This isn't a small problem, either. Termites invade an estimated 600,000 homes in the U.S. each year, racking up around $5 billion in treatment and repair costs. Even with those staggering numbers, the exclusion holds firm.

To understand why, it helps to see how insurers draw the line between a covered disaster and an excluded maintenance issue.

Termite Damage vs Covered Perils At a Glance

| Characteristic | Termite Damage (Excluded) | Covered Peril (e.g., Fire) |

|---|---|---|

| Onset | Gradual, occurs over months or years | Sudden, happens in an instant |

| Cause | Lack of maintenance, preventable infestation | Accidental, unforeseen event |

| Visibility | Often hidden, not immediately obvious | Immediately apparent and destructive |

| Homeowner Role | Responsibility for prevention & inspection | Victim of an unexpected event |

This table really highlights the "sudden and accidental" rule that is the bedrock of most insurance policies.

The core principle is simple: your policy is a shield against the unexpected. Because termite infestations are seen as a foreseeable (and preventable) problem, the financial responsibility for dealing with them falls squarely on the homeowner. For a deeper dive into these fundamentals, feel free to explore our full guide on how home insurance works.

Why Insurers See Termites as a Maintenance Failure, Not an Accident

To really get why your homeowners policy won't touch termite damage, you have to step into the shoes of an insurance underwriter. Their entire world revolves around managing risk, but not just any risk. They're focused on covering things that are sudden and accidental.

Think about it: a house fire, a hailstorm that wrecks your roof, a pipe bursting behind the drywall—these are all unexpected disasters. They happen fast and are completely out of your control. Termite damage is the polar opposite.

An infestation doesn't happen in an afternoon. It’s a slow, creeping problem that can take years to chew through your home's structure. For an insurer, that slow-burn process puts termites squarely in the category of homeowner maintenance, not insurable catastrophe.

The Gradual Damage Exclusion

From an insurance company's point of view, termite damage is no different than rust eating away at a metal fence or mold spreading from a leaky faucet you never fixed. These are predictable issues that can be stopped with regular inspections and basic upkeep.

This is a core concept in the insurance world. The whole process of understanding the core principles of underwriting in insurance is about separating unpredictable accidents from foreseeable problems.

Because you, as the homeowner, have the ability to prevent termites, insurers consider any damage a maintenance failure. Ignoring that responsibility is one of the classic reasons for an insurance claim denial.

Think of your homeowners policy as a financial safety net for catastrophes, not a warranty for your house. It’s there for the "what ifs," not for issues that could have been prevented with a little bit of upkeep.

The cost of this distinction can be massive. Beyond the eye-watering repair bills, a termite infestation can tank your property value. That’s why proactive prevention isn’t just a good idea—it’s a critical investment in protecting your home. Insurers expect you to handle pest control long before it ever has a chance to turn into a claim.

Finding the Rare Exceptions for Termite Coverage

While the general rule is crystal clear—homeowners insurance doesn’t cover termites—the world of insurance is full of fine print and complex footnotes. In some very specific and quite frankly, unusual situations, you might find a sliver of coverage. But it all depends on a very tricky chain of events.

These rare exceptions almost always hinge on a covered peril kicking off the whole problem. A covered peril is something your policy explicitly agrees to protect you from, like a fire or a sudden pipe burst. The key here is that the termite damage itself isn't the covered event; it’s the fallout from one.

Think of it this way: a pipe bursts inside a wall, which is a classic covered peril. That hidden, constant leak creates the perfect damp environment for a new termite colony to move in. In this very narrow scenario, you could argue the termites are a direct result of the covered water damage. An insurer might then consider the resulting wood destruction an "ensuing loss."

Understanding Ensuing Loss

"Ensuing loss" is a tricky insurance concept. It basically means damage that happens as a secondary result of an initial event, even if that initial event wasn't covered. The problem is, most policies are written to specifically close this loophole when it comes to pests.

Relying on these exceptions is like betting on a long shot at the race track. It’s technically possible to win, but the odds are stacked against you. The burden of proof is incredibly high, and claim denials are far more likely than approvals.

To even have a chance, you'd need to prove a few things:

- The initial problem (like that pipe burst) was sudden, accidental, and definitely covered by your policy.

- The termite infestation happened after and was a direct consequence of that specific event.

- You had absolutely no prior knowledge of any termite issues before the covered peril occurred.

Ultimately, trying to navigate these loopholes is a tough and often losing battle. The core question, "does homeowners insurance cover termites," almost always circles back to the same answer: no. The insurance company’s stance is firm—termite prevention is part of regular home maintenance, making these exceptions the rare outliers, not the rule.

How Termite Bonds Fill The Insurance Gap

So, if your homeowners insurance won't touch termite damage, what's the next step? This is where a termite bond enters the picture. It’s important to understand this isn't an insurance policy in the traditional sense. Instead, it’s a service contract you set up with a professional pest control company.

Think of it as a proactive protection plan for your home. You pay an annual fee, and in return, the company guarantees to handle termite issues that pop up. This shifts the dynamic from hoping your insurance might cover you to having a guaranteed solution ready to go. Running a thorough insurance gap analysis is a great way to pinpoint vulnerabilities like this where a supplemental plan makes all the sense in the world.

Treatment Bond Vs Repair Bond

Now, not all termite bonds are created equal. The two main types offer very different levels of protection, and knowing the difference is absolutely critical to protecting your wallet.

-

Treatment-Only Bond: This is the basic, entry-level option. If the pest control company finds termites while your contract is active, they’ll come out and treat the infestation for free. But here's the catch: it does not cover the cost of repairing any damage those termites caused.

-

Repair Bond: This is the heavy hitter and the far more comprehensive choice. It includes everything from the treatment bond, but it also guarantees payment for repairs to any new termite damage that happens while the bond is active. This is as close as you can get to having actual "termite insurance."

Let's break down the key differences between your standard home insurance and a termite bond to make it crystal clear.

Comparing Homeowners Insurance vs Termite Bond

| Feature | Standard Homeowners Insurance | Termite Bond/Protection Plan |

|---|---|---|

| Purpose | Covers sudden, accidental events (fire, theft, storms) | Provides proactive prevention and treatment for termites |

| Termite Coverage | Almost always excluded as a "preventable" issue | Directly covers termite inspection, treatment, and/or repairs |

| Cost | Included in your annual or monthly premium | A separate annual fee paid directly to a pest control company |

| Provider | An insurance company | A licensed pest control company |

Ultimately, a homeowners policy is reactive, responding to unexpected disasters. A termite bond, on the other hand, is proactive—it's a maintenance plan designed to stop a specific, slow-moving threat in its tracks.

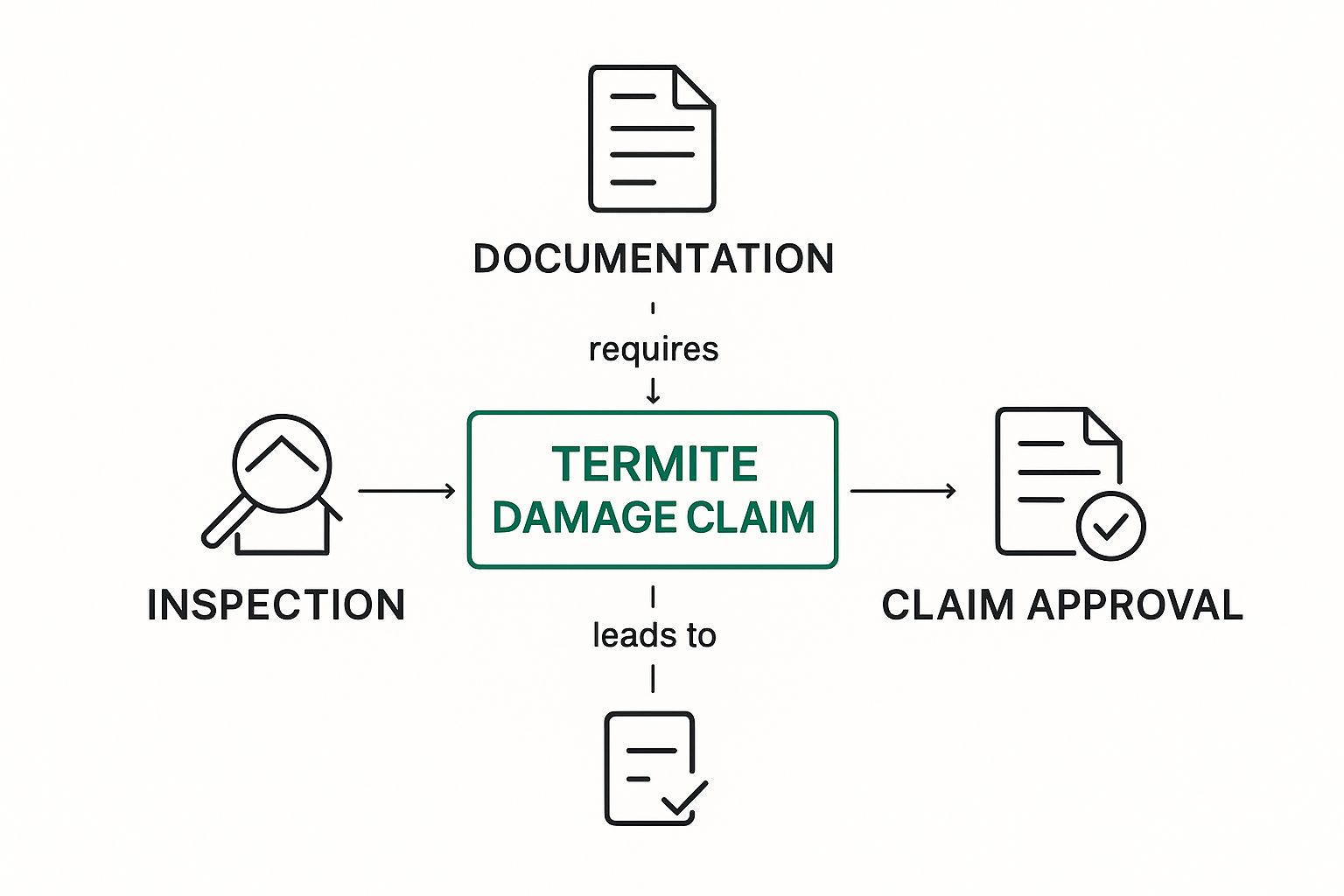

The infographic below walks through the typical claims process, highlighting the steps from discovery to resolution.

This kind of structured approach is exactly what a good termite bond offers, laying out the inspection, treatment, and repair protocols long before you ever have a problem.

Your Proactive Termite Prevention Checklist

Since your homeowners insurance almost certainly won't cover termite damage, prevention is your best—and only—line of defense. Being proactive isn't just about dodging a huge repair bill; it's about protecting your home's value and your own peace of mind.

Here’s a straightforward checklist to make your property a place termites want to avoid.

Control Moisture: Turn Off the Waterworks

The battle against termites really begins with controlling moisture. These pests need a damp environment to thrive, so cutting off their water supply is the most critical step you can take.

- Grade Your Landscape: Make sure the ground around your foundation slopes away from the house. This simple fix prevents rainwater from pooling up against your walls.

- Maintain Gutters and Downspouts: Keep your gutters clean and check that downspouts are channeling water at least three feet away from your foundation.

- Fix Leaks Immediately: A dripping outdoor faucet, a leaky pipe under the sink, or even a pooling A/C condensation line is an open invitation for termites. Repair them right away.

Eliminate Their Food Source

Next up: remove easy access to wood. Simple adjustments to how you store things and manage your landscaping can make all the difference in keeping termites at bay.

Termites are essentially looking for two things: moisture and cellulose (wood). By controlling these two factors, you are actively removing the welcome mat and making your home far less appealing than your neighbor's.

You want to create a clear buffer zone between any wood and the soil around your home.

- Store Firewood Properly: Keep firewood, scrap lumber, and other wood debris stacked well off the ground and at least 20 feet from your house.

- Mind Your Mulch: Think twice before piling wood mulch directly against your foundation. If you must use it, leave a clear inspection space of at least 12-15 inches from the exterior walls.

- Trim Vegetation: Cut back any tree branches, overgrown shrubs, or ivy that makes contact with your siding or roof. These act like bridges for pests to march right onto your home.

Taking these preventative steps is more important than ever. In recent years, homeowners have seen their insurance premiums climb, often due to an increase in climate-related events. This trend makes it crucial to minimize your exposure to other major, uncovered risks like termite damage. Recent analysis from the Brookings Institution highlights how climate change is increasingly impacting insurance markets.

Ultimately, the best strategy combines these DIY efforts with annual professional inspections. An expert can spot the subtle signs of trouble you might miss, ensuring your home’s defenses are solid. Protecting your property from termites goes hand-in-hand with your overall financial health, much like finding ways to learn how to lower home insurance premiums.

A Few Common Questions About Termite Coverage

Knowing that your standard policy won't cover termites is one thing, but figuring out what to do next is another. Let's walk through some of the most common questions homeowners have when they're facing a potential infestation.

What Should I Do The Moment I Suspect Termites?

If you spot something suspicious—maybe a few discarded wings on a windowsill, tiny mud tubes climbing your foundation, or wood that sounds hollow when you tap it—you need to act fast. Every day you wait could mean more damage.

Here’s your immediate game plan:

- Don't Disturb Them: It's tempting to poke at the damage or grab a can of bug spray, but don't. All that does is scatter the colony, forcing them to find a new, hidden spot in your house to continue their work.

- Contact a Professional: Get on the phone and schedule an inspection with at least two reputable pest control companies. They have the expertise to identify the exact type of termite, find the source of the infestation, and lay out the best treatment options.

- Document Everything: Pull out your phone and take plenty of clear photos and videos. You'll want a detailed record of any damage or signs of termites for your own files, which can be especially important if you decide to sell your home down the road.

Am I Required To Disclose Past Termite Damage When Selling?

Absolutely. In most states, you have a legal duty to tell potential buyers about any past or current termite issues. Trying to hide it isn't just unethical; it can land you in serious legal hot water later on.

Honesty is your best friend here. Being upfront and providing records of professional treatment and repairs actually builds confidence. It shows buyers you tackled the problem head-on. On the other hand, failing to disclose the issue could lead to a lawsuit for misrepresentation long after you've handed over the keys.

How Much Does Professional Termite Treatment Cost?

The cost can be all over the map, but one thing is certain: paying for treatment now is far cheaper than paying for structural repairs later. Think of it as a necessary investment in your home's health.

A typical professional termite treatment can run anywhere from $500 to over $2,500, depending on the size of your home and the extent of the problem. But the cost to fix structural damage? That can easily climb into the tens of thousands of dollars.

For a broader look at how homeowners policies operate, you might find these common homeowners insurance FAQs helpful. It's always good to understand what is and isn't covered.

And don't forget, if an infestation gets so bad that your home becomes unlivable during repairs, your policy might help with temporary housing. To see how that part of your coverage works, check out our guide on additional living expense coverage. At the end of the day, proactive treatment will always save you money compared to footing the bill for massive repairs that insurance won't touch.

At Wexford Insurance Solutions, we're committed to giving homeowners the clarity they need to protect their biggest investment. While dealing with termites falls under home maintenance, our team is here to make sure you're properly covered for all of life's other surprises. Contact us today to review your policy and get the peace of mind you deserve at https://www.wexfordis.com.