When you hear "inland marine insurance," you probably think of boats and water. It's a common misconception, but the name is actually a bit of a historical holdover. In reality, this coverage has nothing to do with the ocean.

So, what is it? Put simply, inland marine coverage is insurance for your business property while it’s on the move or stored somewhere other than your main business location. It’s designed to protect your valuable assets once they leave the front door.

A Protective Bubble for Your Mobile Assets

Think of your standard commercial property policy. It does a fantastic job of protecting your main office, workshop, or store. But the moment your expensive tools, equipment, or products leave that building, they step outside of that policy's protective umbrella.

That’s where inland marine insurance steps in. It creates a flexible "bubble" of protection that travels with your property. Whether your gear is in the back of a truck heading to a job site, temporarily stored at a client's location, or being shipped across the state, this coverage follows it.

To help clarify the core idea, here's a quick breakdown of what inland marine coverage is all about.

Inland Marine Insurance at a Glance

| Core Concept | Simple Explanation |

|---|---|

| Mobile Property Focus | It’s designed specifically for assets that don't stay in one place. |

| "Floater" Policy | The coverage "floats" with your property wherever it goes on land. |

| Fills a Gap | It picks up where standard commercial property insurance leaves off. |

| Broad Protection | Often covers a wider range of perils than typical property policies. |

This table should give you a solid foundation for understanding why this insurance is so different—and so necessary—for many businesses.

Who Needs This Coverage?

This type of policy is a must-have for just about any business that relies on property that moves. While it’s not the same as the insurance that covers your building and its contents, you can learn more about how standard policies work in our guide to what is personal property coverage.

Businesses that can’t afford to go without inland marine insurance often include:

- Contractors who are constantly moving valuable tools, equipment, and machinery between job sites.

- Photographers and videographers carrying thousands of dollars in high-end camera gear to different shoots.

- Tech companies responsible for shipping servers, laptops, and other delicate electronics.

- Art galleries and dealers who transport priceless artwork to exhibitions, client homes, or storage facilities.

The bottom line is this: if a key part of your business involves property leaving your primary location, this coverage is an essential safety net.

Why Is It Called Inland Marine Insurance?

The name "inland marine insurance" definitely throws people for a loop. It sounds like a contradiction, right? How can something be "inland" and "marine" at the same time? The answer actually takes us back a few centuries to the very beginnings of the insurance world.

Way back when, commerce revolved around the sea. If you wanted to move valuable goods, they went on a ship. To protect against the immense risks of ocean voyages, insurers created "marine" insurance. It was simple: it covered the ship and the cargo it carried across the water.

But then, technology changed the game. With the explosion of railroads and eventually trucking, a huge vulnerability appeared. The moment a crate was lifted off a ship and onto a train or truck to travel "inland," it was no longer covered by that classic marine policy. A whole new set of risks emerged that the old policies just weren't built for.

Insurers had to adapt, creating a new product to protect goods during this crucial overland leg of the journey. This policy would bridge the gap from the port to the final warehouse or storefront.

And just like that, the term "inland marine" was coined. It was a clever way of saying it provided marine-style protection for property, but once it was on land and on the move.

From Historic Roots to Modern Protection

This origin story is more than just a fun fact; it really helps make sense of what is inland marine coverage today. It’s not about boats on lakes. It’s about protecting property that is mobile, in transit, or temporarily stored somewhere other than your main business location.

Think of everything from a contractor’s expensive tools and heavy equipment at a job site to delicate paintings traveling to a gallery. For a closer look at protecting specific high-value items, our guide on insuring fine art is a great resource.

At its core, inland marine insurance was designed to be flexible and to follow valuable property wherever it goes. That foundational principle is exactly why it's still so critical for any modern business with assets that don't just sit in one place.

What Kinds of Property Does Inland Marine Insurance Cover?

It's one thing to know the history of inland marine insurance, but what really matters is how it works for your business today. Think of it as the ultimate protection for any valuable property that leaves your primary location. It’s the safety net for your assets on the move.

Your standard commercial property policy is great for covering your building and the things inside it. But what about the equipment you take to a job site? Or the products you're shipping to a customer? That’s where inland marine insurance steps in. It’s designed specifically for property that's in transit, stored somewhere else, or used out in the field.

Common Types of Covered Property

The beauty of inland marine coverage is its flexibility, but most of the things it protects fall into a few common-sense categories. Each category tackles a specific risk that businesses run into when their property isn't sitting still.

Here’s a look at some of the most frequent uses:

- Contractor's Tools and Equipment: This is a classic. It covers everything a contractor owns, from power drills to heavy machinery like excavators, whether they're at a construction site, on the way there, or stored in a temporary container.

- Photography and Video Gear: Professionals in this field often carry thousands of dollars in cameras, lenses, drones, and lighting to different shoots. This policy is a must-have to protect against theft or damage that happens outside the studio.

- Fine Art and Valuables: Galleries, museums, and private collectors need this to safeguard priceless pieces while they are on loan, being transported to an exhibition, or simply moved between locations. You can dive deeper into this subject in our guide to valuable personal property insurance.

- Mobile Medical Equipment: This covers expensive, high-tech gear like portable MRI machines or ultrasound devices that are transported between hospitals, clinics, and even patients' homes.

This specialized policy is also essential for protecting things like trade show exhibits and equipment, which are constantly being shipped and set up in different cities.

Covering Goods in Transit and Other Unique Situations

Beyond just tools and equipment, inland marine policies can be tailored for all sorts of unique scenarios. It’s this adaptability that makes the coverage so critical for businesses that operate in a mobile world.

The inland marine insurance market is expected to grow from USD 16.5 billion in 2023 to USD 24.8 billion by 2032. This boom is fueled by increasingly complex global supply chains and the massive growth of e-commerce.

That's a huge jump, and it shows just how vital this protection has become for modern commerce.

Another crucial component is bailee coverage. This is for businesses that take temporary possession of their customers' property. Think of a dry cleaner holding onto clothes or a computer shop repairing laptops. If a fire, flood, or theft happened at your shop, bailee coverage would pay to replace your clients' property, protecting not just their assets but your reputation, too.

Comparing Inland Marine and Commercial Property Insurance

It's a common misconception among business owners that a standard commercial property policy is a catch-all for every asset they own. Unfortunately, this assumption can lead to some expensive and painful coverage gaps, especially when it comes to valuable equipment that doesn't stay in one place.

The reality is these two policies serve very different, but equally important, roles.

Think of it like this: your commercial property insurance is like the four walls of your main office or workshop. It’s fantastic at protecting everything inside that fixed location—your building, the inventory on the shelves, and the equipment bolted to the floor. But its protection stops at the door.

The Key Difference: Stationary vs. Mobile Assets

So, what happens to the tools and equipment you take out on the road? That's where inland marine coverage comes into play.

This is the policy that protects your property once it leaves your primary business address. It’s often called a "floater" policy because it follows your mobile assets wherever they go, whether they're in transit to a job site, stored at a temporary location, or in your work vehicle.

Without it, that expensive piece of machinery you're taking to a client's project could be completely unprotected from theft, damage, or loss.

The bottom line is mobility. Commercial property insurance is for your stationary assets. Inland marine insurance is for your assets in motion.

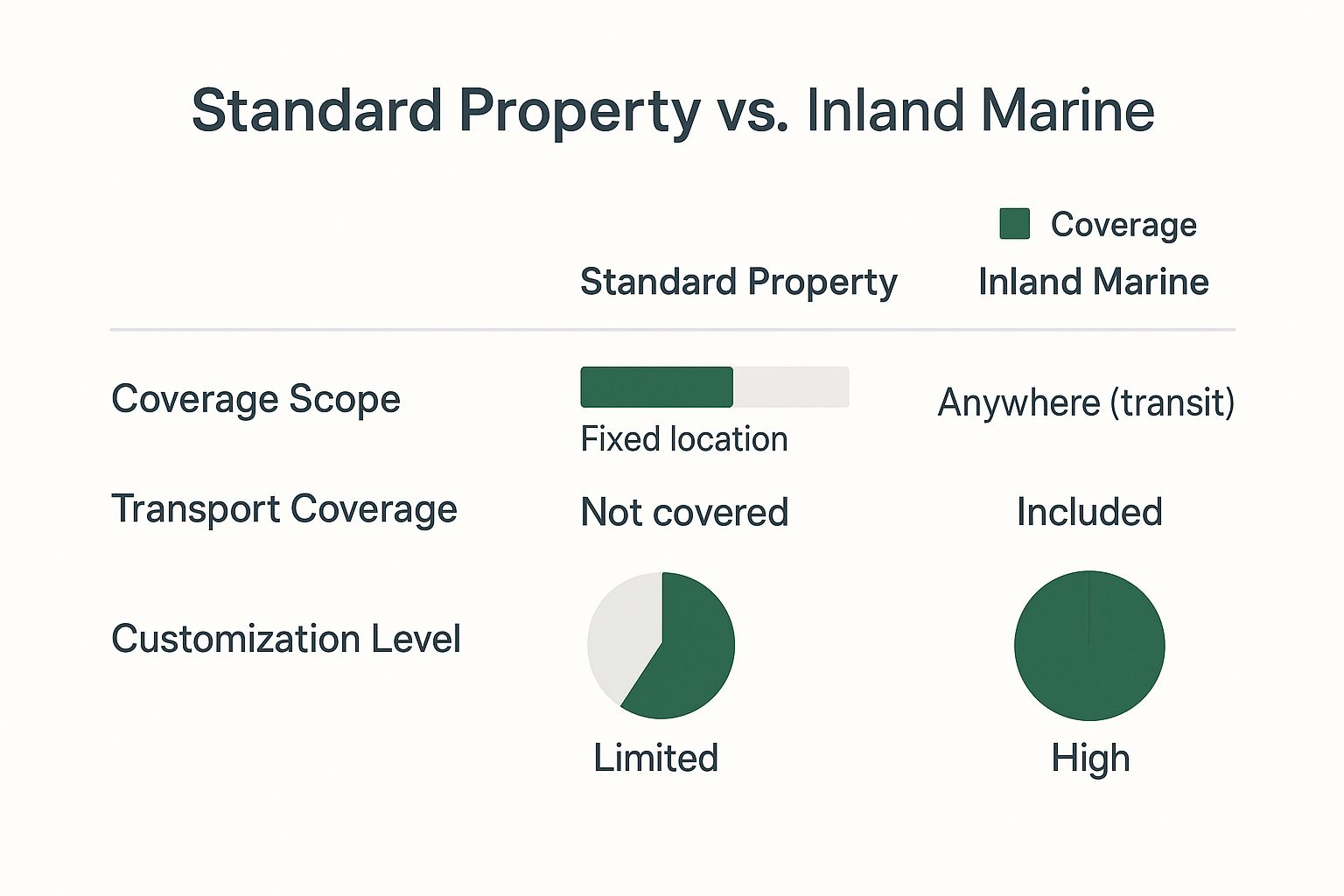

To make this even clearer, let's break down the primary distinctions between these two essential business policies.

Inland Marine vs. Commercial Property Coverage

| Feature | Commercial Property Insurance | Inland Marine Insurance |

|---|---|---|

| Primary Focus | Protects assets at a fixed, named location (e.g., your office, warehouse). | Protects assets that are mobile, in transit, or stored off-site. |

| Asset Type | Buildings, inventory, furniture, permanently installed equipment. | Tools, mobile equipment, electronics, fine art, goods being transported. |

| Geographic Scope | Limited to the specific address listed on the policy. | Coverage "floats" with the property, providing protection anywhere. |

| Flexibility | Standardized coverage for common property risks (fire, theft, etc.). | Highly customizable to cover unique and high-value items against specific perils. |

As you can see, they aren't interchangeable—they're designed to work together to create a seamless shield for your business.

The infographic really drives the point home. A standard policy is rigid, built for one location. An inland marine policy, on the other hand, offers the flexible, specialized protection your moving assets demand. Grasping this difference is the first step to ensuring your business is truly covered, no matter where your work takes you.

How Inland Marine Floater Policies Work

To really get what inland marine coverage is, you have to understand the idea of a "floater" policy. It’s a wonderfully descriptive name. Unlike your standard property insurance that’s chained to a specific address, a floater policy isn't stuck in one place.

It literally "floats" right alongside your covered property, acting as a continuous shield of protection no matter where your work takes it.

This flexibility is what makes these policies so powerful. Picture a contractor who’s constantly hauling expensive gear between job sites. A floater makes sure that equipment is covered at Site A, Site B, and even during the drive between them. You don't have to call your agent every time you move to a new location. The same goes for a photographer's camera bag or a consultant's laptops.

Scheduled vs. Unscheduled Coverage

Now, within a floater policy, you typically have two ways to insure your stuff. Figuring out which one is right for you really comes down to what kind of assets you're protecting.

-

Scheduled Property: This is for your big-ticket, high-value items. You'll list out (or "schedule") each specific item on the policy along with its appraised value. This is perfect for something like a specialized piece of construction machinery or a one-of-a-kind camera lens.

-

Unscheduled Property: This is more of a blanket approach. It covers a whole category of lower-value items, like a contractor's collection of hand tools or a landscaper's small equipment. Instead of listing every single drill and saw, you just insure the total value of the group.

One of the most important jobs of inland marine insurance is covering property that belongs to someone else but is in your care, custody, or control. This is what we call bailee coverage.

This kind of coverage is absolutely essential for businesses like repair shops, dry cleaners, or storage facilities. If a customer’s property gets damaged or stolen while you have it, bailee coverage steps in to cover the loss. It’s a lifesaver for both your finances and your reputation.

For those in construction, our guide on builders risk insurance dives deeper into protection specifically for projects.

The need for this kind of flexible coverage is growing worldwide. The Asia-Pacific region, for example, has become a huge market for inland marine insurance. This is largely fueled by massive infrastructure projects and a booming e-commerce industry that needs to protect goods on the move. You can dig into the numbers by exploring some insights on the inland marine insurance market.

Common Questions About Inland Marine Coverage

As we wrap up, it's totally normal to have a few more questions. Inland marine coverage can be a bit tricky since it’s so specialized. Let’s clear up some of the most common things business owners ask.

Do I Need This if My Property Is Rarely Off-Site?

That's a great question, and the short answer is almost always yes. Even if your tools or equipment only leave your main location once in a while, that’s when they're most vulnerable.

Think about it: your standard property policy is designed to protect what's at your insured address. The moment that expensive piece of equipment is on the road, at a client’s site, or stored in a trailer overnight, it's likely no longer covered. Inland marine insurance is specifically built to fill that gap.

It’s also important to understand the distinction between insurance and warranty. A warranty might cover a manufacturing defect, but it won't help you if your gear is stolen from a job site.

Don't mistake occasional use for low risk. Inland marine coverage is absolutely essential for any business with mobile assets—one bad day could lead to a massive financial hit without it.

How Is My Premium Calculated?

There's no single price tag for an inland marine policy; the cost is unique to your business. Insurers look at a few key things to figure out your premium.

It really comes down to a risk assessment. They’ll consider:

- The Value of Your Property: Insuring a $50,000 piece of heavy machinery will naturally cost more than covering a set of hand tools. The higher the value, the higher the premium.

- Your Line of Work: A contractor moving equipment around a bustling construction site faces very different risks than a photographer at a quiet wedding shoot.

- Where You Operate: Your geographic location, travel radius, and even your business's claims history all factor into the final cost.

The higher the potential risk to your property, the more you can expect to pay for coverage. Of course, the policy limits and deductibles you choose will also play a big part. A good agent will walk you through these variables to find that sweet spot between solid protection and a price that makes sense for your budget.

Figuring out the ins and outs of business insurance is what we live and breathe. At Wexford Insurance Solutions, we’re here to give you straight answers and build a policy that truly protects what you’ve worked so hard to create.

Ready to get started? Contact us for a quote designed for your unique needs by visiting us at https://www.wexfordis.com.

Does Homeowners Insurance Cover Termites? Find Out Now

Does Homeowners Insurance Cover Termites? Find Out Now How to Dispute Insurance Claim: Proven Steps to Win

How to Dispute Insurance Claim: Proven Steps to Win