When you hear the term "insurance deductible," think of it as the portion of a claim you agree to pay yourself before your insurance company steps in to cover the rest. It’s the amount of money you must pay out-of-pocket for a covered incident.

Once you’ve met that amount, your insurer takes over and pays for the remaining costs, up to your policy's coverage limits.

What an Insurance Deductible Really Means

At its core, a deductible is a cost-sharing agreement between you and the insurance company. It’s one of the most critical numbers in your policy because it directly impacts both your premium payments and how much you'll spend if you ever need to file a claim.

Getting a handle on your deductible is the first real step to mastering your insurance coverage. If you want to get more comfortable with the fine print, our guide on how to read an insurance policy is a great place to start.

This setup isn't arbitrary; it serves a couple of important functions. By having you cover a small initial amount, it discourages filing minor claims that would bog down the system. It also gives you some skin in the game, which helps keep overall insurance costs more manageable for everyone.

Key Takeaway: A deductible isn't a fee you send to your insurance company. It's simply the part of a claim you're responsible for before your insurance benefits kick in.

The two terms you'll see most often are the deductible and the premium. They work like a seesaw—when one goes up, the other usually comes down. Choosing a higher deductible tells the insurer you're willing to handle more of the initial financial hit yourself, which reduces their risk. In return, they typically reward you with a lower monthly or annual premium.

Deductible Basics at a Glance

Let's boil these concepts down to their simplest form. This table gives you a quick snapshot of the key terms.

| Concept | Simple Explanation |

|---|---|

| Deductible | The fixed amount you pay for a covered loss before your insurance pays. |

| Premium | The regular payment you make (monthly or annually) to keep your policy active. |

| When It Applies | Your deductible is only paid when you file a claim and it is approved. |

Think of these as the foundational building blocks of your insurance policy. Understanding how they interact is essential to making smart decisions about your coverage.

How Your Deductible Works in a Real Claim

It’s one thing to understand the definition of a deductible, but seeing how it plays out in a real-life situation makes it all click. Let's walk through a common scenario to show you exactly how this works when you actually need to use your insurance.

Picture this: you get into a minor fender-bender. It’s frustrating, but thankfully no one is hurt. You take your car to the shop, and the mechanic estimates the repair cost will be $3,000. Your auto insurance policy has a $500 deductible.

In this case, you are responsible for the first $500 of the repair bill. You'll pay that amount directly to the auto body shop. Once you've covered your part, your insurance company steps in and pays the remaining $2,500.

Your deductible is simply your share of the cost before your insurance coverage kicks in. Knowing the steps for what to do after a car accident is crucial, as it helps you navigate the entire claims process with confidence.

Per-Claim vs. Annual Deductibles

It's also important to know that not all deductibles are created equal. The way they function usually depends on the type of insurance you have.

-

Per-Claim Deductible: This is the most common setup for auto and homeowners insurance. You pay this deductible every time you file a new claim. So, if you had two unrelated car accidents in the same year, you’d have to pay your $500 deductible for each incident. To learn more about how this works for your home, check out our guide on the homeowner insurance claim process.

-

Annual Deductible: This structure is standard for health insurance. You have to spend a certain amount on covered services throughout the year before your insurance starts paying its share. Once you hit that yearly total, your out-of-pocket costs for care typically drop significantly.

The amounts can vary dramatically. For instance, some health insurance plans sold on the ACA Marketplace have deductibles over $5,000, while the average for employer-provided plans is closer to $1,800. Understanding whether your deductible resets with each claim or just once a year is key to managing your finances and avoiding surprises.

Breaking Down the Different Types of Deductibles

When you get into the fine print of your insurance policy, you'll find that deductibles aren't a one-size-fits-all deal. Knowing the different ways they can be structured is crucial, as it directly impacts how much cash you'll need on hand if you ever have to file a claim.

The most common types you’ll run into are fixed (or flat) deductibles and those based on a percentage.

Fixed Deductibles: The Simple, Predictable Choice

A fixed deductible is exactly what it sounds like: a set dollar amount that you pay out of pocket for a covered claim. It’s a straightforward, predictable number, like $500 or $1,000.

No matter how big the repair bill is, your part stays the same. This makes budgeting for a potential claim much simpler. Most auto policies, for instance, use this model. You can see how this works in practice in our guide where your car insurance deductible explained.

It's also worth noting that some specialized policies, like those for understanding Underinsured and Uninsured Motorist coverage, often have their own unique deductible rules you'll want to review.

Percentage-Based Deductibles: Tied to Your Home's Value

Then there are percentage-based deductibles. These can be a little trickier. Instead of a flat fee, your share of the cost is calculated as a percentage of your property's total insured value.

You’ll typically see these on homeowners policies for specific, high-risk perils like hurricanes, wind, or hail, especially in areas prone to that kind of weather.

Let's say your home is insured for $400,000, and your policy includes a 2% hurricane deductible. If a major storm damages your house, you’re on the hook for the first $8,000 of the repair costs ($400,000 x 0.02). This approach helps insurance companies manage their exposure in regions where catastrophic events are a real possibility.

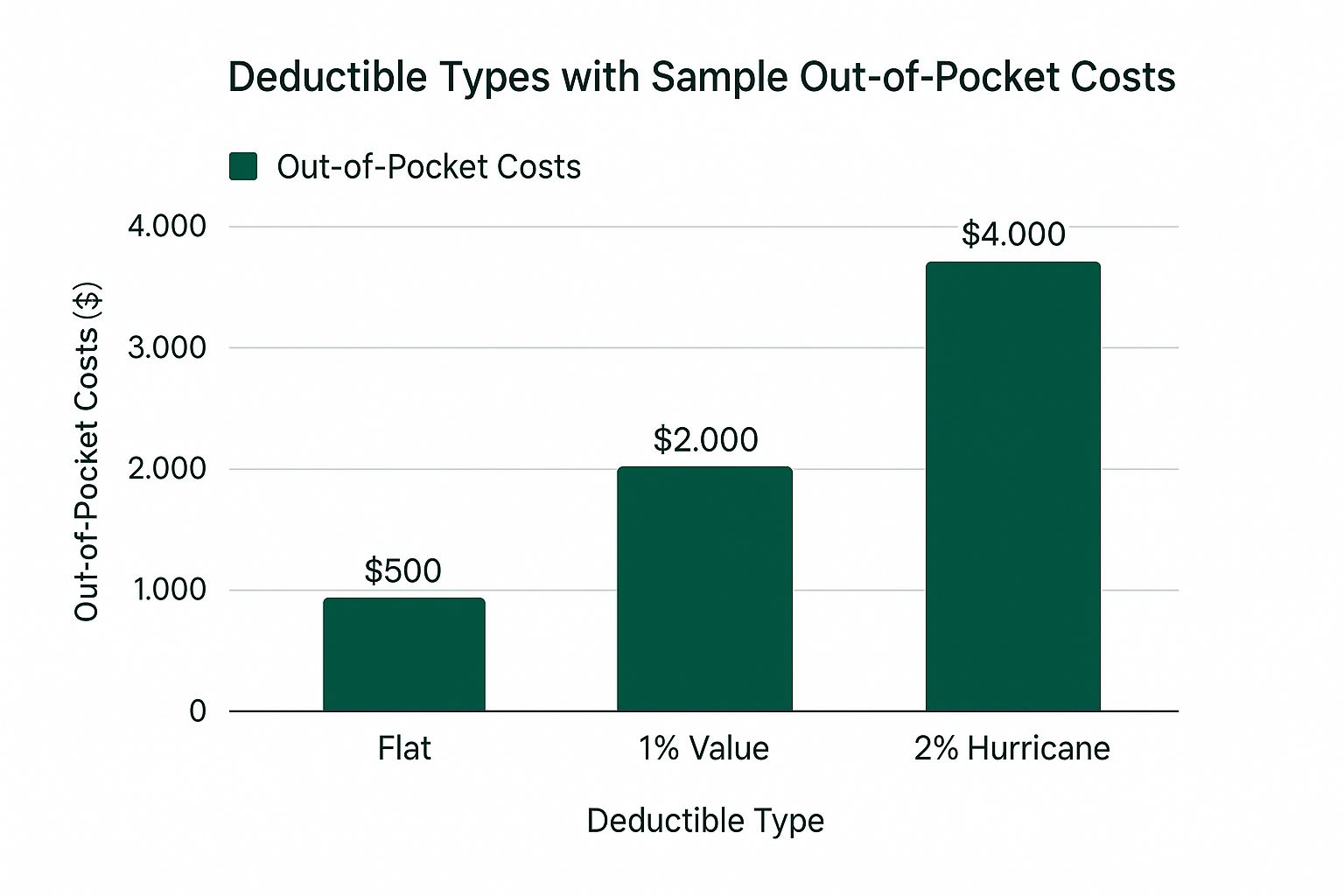

The difference in what you pay can be pretty staggering, as this chart shows.

As you can see, a percentage-based deductible for a catastrophic event can lead to a much larger out-of-pocket expense than a standard flat deductible. It's a key detail to look for in your policy, especially if you live in a high-risk zone. While premiums have actually dropped by around 6% in some less risky markets, areas exposed to natural disasters are seeing deductibles climb. To dig deeper into this, you can check out the global insurance market trends from Aon.com.

The Link Between Your Deductible and Premium

When you're trying to figure out insurance, the single most important concept to nail down is how your deductible and your premium are connected.

Think of them as two ends of a seesaw. When one goes up, the other has to come down. This trade-off is the foundation of how insurance companies price their policies.

By choosing a higher deductible, you're telling the insurer that you’re willing to shoulder more of the initial financial burden if you have to file a claim. In their eyes, this lowers their risk.

And what’s your reward for taking on that risk? A lower monthly premium. It’s one of the most direct ways to control your insurance budget. If you want to explore more strategies, check out our guide on how to lower home insurance premiums.

This isn't just a quirk of your personal policy; it’s a fundamental lever in the entire insurance market. When competition heats up, you’ll see insurers offer things like deductible buy-downs to win new customers, proving just how crucial this balance is.

Seeing the Financial Impact

The best way to really get this is to see it with real numbers. A quick comparison makes the financial impact of your choice obvious.

Your Choice, Your Cost: Selecting a higher deductible is a direct path to a lower premium, but it requires having enough cash saved to cover that higher amount in an emergency.

Let's look at how your monthly payment can shift based on different deductible levels. The table below illustrates the trade-off for a sample policy.

How Your Deductible Choice Affects Your Premium

| Deductible Amount | Risk Assumed by You | Estimated Monthly Premium |

|---|---|---|

| $500 | Low | $150 |

| $1,000 | Medium | $125 |

| $2,500 | High | $95 |

As you can see, jumping from a $500 deductible to $2,500 could put a good chunk of change back in your pocket every month.

The catch, of course, is that you have to be ready and able to pay that $2,500 out of pocket if something happens. The key is finding that sweet spot between what you can afford monthly and what you can comfortably cover from your emergency fund.

How to Choose the Right Deductible for You

Picking the right deductible isn't about finding a magic number. It's really about taking an honest look at your own finances and figuring out what makes sense for you.

The whole decision hinges on one simple, but critical, question: could you comfortably write a check for this amount tomorrow without it causing a major financial headache?

Your emergency fund is the perfect place to start. If a potential deductible is bigger than what you've got stashed away for a rainy day, it’s a strong signal that the deductible is too high.

Find Your Financial Sweet Spot

How you feel about risk and how much you have in savings are the two biggest factors here. Let’s walk through a couple of common scenarios to see how this plays out in the real world.

-

Scenario 1: You're Building Your Savings

If your emergency fund is on the smaller side, a lower deductible, say $500, is probably the way to go. Yes, your monthly premium will be a bit higher, but you're protecting yourself from a massive bill you can't afford if something unexpected happens. -

Scenario 2: You Have a Healthy Safety Net

On the other hand, if you’ve built up a solid emergency fund, a higher deductible like $2,500 could be a savvy financial move. You're taking on a little more of the initial risk, but you'll enjoy lower insurance costs month after month.

The Golden Rule: Never pick a deductible you couldn't pay out-of-pocket, right now. The point of insurance is to reduce stress, not create a new financial crisis when you need to use it.

At the end of the day, it's a trade-off. A higher deductible saves you money on premiums, but it demands the discipline to keep that cash ready. A lower deductible costs more over time but provides more immediate peace of mind. It’s all about finding that perfect balance for your own budget.

Common Questions About Insurance Deductibles

Even once you get the hang of what a deductible is, a few specific questions almost always come up. Let's tackle some of the most common points of confusion so you have a rock-solid understanding of how it all works in the real world.

One of the biggest head-scratchers is where the deductible money actually goes.

Do I Pay the Deductible to My Insurance Company?

Nope. This is a huge misconception. You don't write a check to your insurance company for your deductible. Think of it less like a fee you owe them and more like your agreed-upon portion of the repair bill.

You pay your deductible directly to the person or company doing the work.

- For an auto claim: That money goes straight to the body shop that fixes your car.

- For a homeowners claim: You’ll pay the contractor who's replacing your roof or drying out your flooded basement.

Your insurer simply takes the total approved claim amount, subtracts your deductible, and pays out the rest.

Key Insight: Your deductible is your contribution to the repair cost, paid directly to the service provider. It's not a bill from your insurer.

Understanding this is key because it shows the deductible isn't some extra charge but a fundamental part of how the claim gets settled. It's also tied to other cost-sharing parts of your policy. If you want to dig deeper, our guide explaining what coinsurance is in property insurance is a great next step.

What Happens if a Claim Is Less Than My Deductible?

This is where knowing your policy can save you a lot of hassle. If the repair bill is smaller than your deductible, there’s really no point in filing a claim.

Let's say you have a $1,000 deductible and a minor fender-bender causes $750 in damage. In this case, you're on the hook for the entire $750 yourself. Because the cost doesn't cross that $1,000 threshold, your insurance coverage doesn't activate.

Filing a claim in these situations won't get you a payout, but it can still go on your policy record, which could affect your rates down the road. This is exactly why it often makes more sense to just handle small repairs out-of-pocket.

Can My Deductible Ever Change?

Absolutely. Your deductible isn't locked in forever. Most of the time, you can ask to change your deductible when it's time to renew your policy.

This is a great time to take a fresh look at your finances. Have you built up a healthy emergency fund? You might feel comfortable raising your deductible to get a lower premium. On the other hand, if things are a bit tight, lowering it could give you more peace of mind, even if it means a higher premium. Your insurance company will adjust your rate to reflect the new level of risk they're covering.

Trying to figure out all the details of an insurance policy can feel overwhelming, but you don't have to go it alone. The experts at Wexford Insurance Solutions are here to help you find that sweet spot between your deductible, premium, and overall coverage that perfectly fits your needs. Contact us today for a personalized consultation.

How to Prevent House Fires A Practical Guide

How to Prevent House Fires A Practical Guide What Is Umbrella Insurance and Why You Need It

What Is Umbrella Insurance and Why You Need It