You’ve got your home and auto insurance, and you probably feel pretty well-covered. Those policies are like a good raincoat—they’ll keep you dry in most everyday showers.

But what happens when a real storm hits? I’m talking about a catastrophic event, like a major lawsuit that blows right past your standard coverage limits. That’s where umbrella insurance comes in. Think of it as that big, sturdy golf umbrella that keeps you, and everything you’ve worked for, completely shielded from a downpour.

The Essential Guide to Umbrella Insurance

An umbrella policy isn't something you buy on its own. It’s a powerful extra layer of liability protection that kicks in precisely when your primary insurance—like your home or auto policy—taps out.

Let’s walk through a real-world scenario. Imagine you’re found at fault in a serious car accident, and the damages, medical bills, and legal fees add up to $800,000. If your auto insurance has a liability limit of $500,000, you’re on the hook for the remaining $300,000. Without additional coverage, that could mean draining your savings, selling your home, or having your future wages garnished.

This is the exact moment an umbrella policy becomes your financial lifesaver. It would step in to cover that $300,000 gap, preventing a personal financial catastrophe.

This secondary coverage is a remarkably cost-effective way to protect your financial future. For a surprisingly small annual premium, you can add millions in extra protection, giving you invaluable peace of mind.

To help break it down, here's a quick overview of what umbrella insurance is all about.

Umbrella Insurance At a Glance

The table below provides a simple summary of the core concepts, making it easy to see the role this coverage plays.

| Concept | Explanation |

|---|---|

| What It Is | An extra layer of liability insurance that goes above and beyond your existing policies. |

| Who It's For | Anyone with assets to protect, especially homeowners, and individuals with significant savings or income. |

| Primary Function | To protect you from major claims and lawsuits that exceed the limits of your standard auto, home, or boat insurance. |

As you can see, it's designed as a crucial safety net for your financial well-being.

This coverage doesn't just boost your existing personal liability coverage definition; it also often steps in to cover things your standard policies won't, like claims of libel, slander, or false arrest.

If you're looking to get a firmer grasp on the fundamentals, there are great resources available for understanding umbrella insurance. In today’s world, it’s a vital tool for anyone with assets worth protecting.

How an Umbrella Policy Actually Works in Real Life

Theory is one thing, but let's walk through a real-world scenario to see how this actually plays out. Imagine you cause a serious multi-car accident. Things get complicated fast, and the medical bills and legal claims from the other drivers start piling up.

The final judgment against you comes to a whopping $900,000. You've got a good auto insurance policy, but its liability limit is $500,000. After your car insurance company pays that maximum amount, you're still on the hook for the remaining $400,000. That’s a life-altering sum that could wipe out your savings, investments, and even put your home at risk.

This is exactly where an umbrella policy proves its worth.

The Financial Handoff

Think of that $500,000 limit on your auto policy as the point where it maxes out. In insurance-speak, this is called the underlying limit. Once your primary policy hits that ceiling, its job is done.

An umbrella policy is designed to kick in right when your primary policies—like home or auto—are exhausted. It's a financial safety net that prevents one catastrophic event from destroying everything you've worked for.

Your umbrella policy seamlessly steps in to pay the leftover $400,000, covering the rest of the medical costs and legal awards. Without it, you'd be forced to sell assets or have your wages garnished for years. It’s a true financial shield.

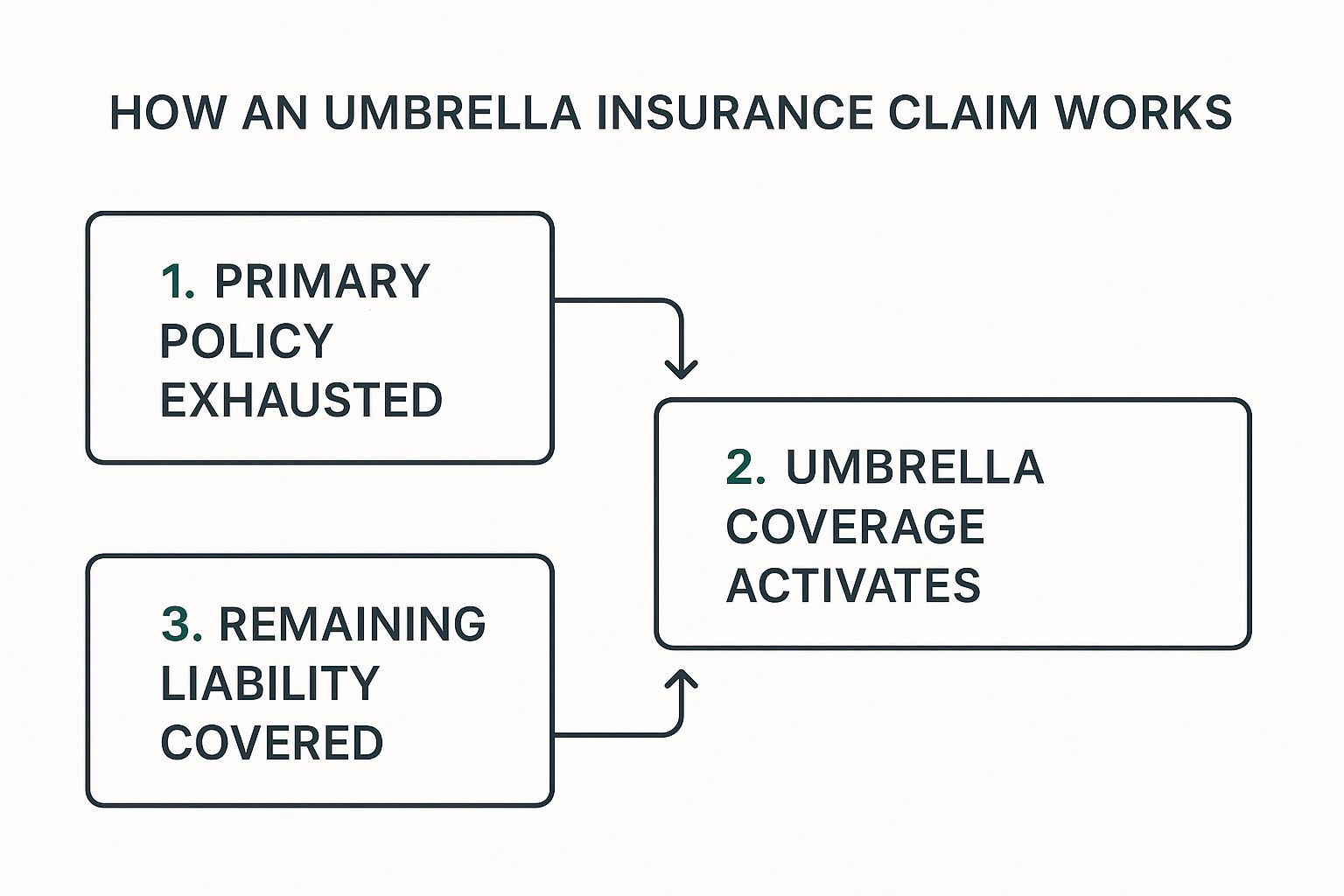

This graphic breaks down the simple, powerful process.

Seeing it visually really clarifies how this coverage acts as a critical backup, activating only when you need it most. Getting comfortable with these mechanics is a huge step in managing your financial risk. If you’re interested in the finer details, learning how to read an insurance policy can give you a much better handle on how all your coverages fit together.

What Your Umbrella Policy Covers and What It Doesn't

When you're figuring out if an umbrella policy is right for you, the most important question is: "What am I actually protected from?" This policy is meant to be a wide-ranging shield against major liability lawsuits, but it has its limits. Knowing where the coverage starts and stops is key.

Think of it this way: your umbrella policy sits on top of your existing insurance, like your home and auto policies. If a guest has a catastrophic fall down your stairs or you cause a multi-car pileup, this policy is designed to kick in when the costs blow past your standard coverage limits.

What Is Typically Covered

An umbrella policy extends your financial safety net well beyond the basics, often covering situations you might not even think about. Here’s a look at the core protections it provides:

- Bodily Injury Liability: This is a big one. It covers the astronomical costs—medical bills, lost income, legal fees—if you're found responsible for injuring someone else, whether it’s from a car crash or an accident on your property.

- Property Damage Liability: If you accidentally damage someone else’s property—say, you back your car into a neighbor’s expensive custom fence—this covers the repair or replacement costs that exceed your auto policy’s limit.

- Personal Injury Liability: This is different from bodily injury. It protects you from claims like slander (damaging someone's reputation with spoken words), libel (the same, but written), false arrest, or invasion of privacy.

- Landlord Liability: For those who own rental properties, this adds a crucial layer of protection against lawsuits from tenants, like if they sue you over an injury that happened in the unit.

In short, an umbrella policy is your financial defense in situations where you are legally on the hook for someone else's injury or property damage. It’s built to protect your assets and your future earnings from being wiped out by a single lawsuit.

What Is Typically Excluded

Just as crucial is knowing what an umbrella policy won't cover. Understanding the exclusions prevents nasty surprises down the road. For a deeper dive into specific examples, you can check out our detailed guide on what does umbrella insurance cover.

Here are the most common things that are not covered:

- Your Own Injuries or Property Damage: This is a liability policy, meaning it only pays for damages you cause to other people. Your personal health insurance handles your medical bills, and your homeowners policy covers damage to your own house.

- Intentional or Criminal Acts: No surprise here. Insurance won't cover liability that stems from something you did on purpose or as part of a criminal act.

- Business-Related Liabilities: A personal umbrella policy is strictly for your personal life. If a claim arises from your business or professional services, you'll need a separate commercial umbrella policy to be protected.

It’s worth noting that the commercial umbrella market is its own world. In 2025, for example, many businesses can expect fairly stable rates, but companies in high-risk industries could see premium hikes of up to 20%.

What Does Umbrella Insurance Actually Cost?

When you hear about adding $1 million or more in liability coverage, it's easy to assume the price tag will be astronomical. But here's the surprising truth: umbrella insurance is one of the biggest bargains in the entire insurance industry.

The reason it's so affordable is simple. Your umbrella policy only steps in after the limits on your primary policies (like home or auto) have been completely maxed out. Because it's not the first line of defense, insurers see it as a lower-risk product, and that translates into significant savings for you.

What Goes Into Your Premium?

Of course, the final price isn't one-size-fits-all. Insurance companies will look at a handful of key factors to figure out your specific premium.

- How Much Coverage You Want: This is the most obvious one. A $2 million policy will cost more than a $1 million policy, but the cost per million usually gets cheaper as you buy more.

- Your Personal Risk Factors: They'll look at things like your driving history, how many homes and cars you own, and whether you have what they consider "attractive nuisances"—think swimming pools, trampolines, or even certain dog breeds.

- Where You Live: Your zip code matters. Premiums can change based on state laws and local lawsuit trends.

A lot of people get this wrong, but a standard $1 million umbrella policy often costs just $150 to $300 a year. For most families, that’s a pretty small investment for such a huge safety net.

Given how inexpensive it is, it's a financial tool well worth considering. For a deeper dive into current pricing and trends, sources like NerdWallet offer great insights.

Once you understand the cost, the next question is how much you really need. We break that down in our guide on how much umbrella insurance you might need.

So, Do You Actually Need an Umbrella Policy?

It’s a common myth that umbrella insurance is just for the super-rich. The truth is, you don't need a sprawling estate to get hit with a million-dollar lawsuit. This coverage is really for anyone whose assets and future earnings are worth more than the liability limits on their current auto or home insurance.

Think of this as a quick gut-check to see if your lifestyle puts you at a higher risk. If any of the situations below sound familiar, it's time to seriously consider getting an umbrella policy.

Who Should Strongly Consider Umbrella Insurance?

Let's get practical. Your everyday life carries certain risks, and some activities and assets can dramatically increase your exposure to a major lawsuit. Extra protection in these cases isn't just a good idea—it's a smart financial move.

You might be a prime candidate for an umbrella policy if you are:

- A Homeowner with Equity: Your home is probably your biggest asset. If a lawsuit judgment blows past your homeowners insurance limits, that equity is on the line.

- A Parent of Teen Drivers: We all know the statistics—teen drivers are just more likely to be in an accident. An umbrella policy can be a financial lifesaver if a serious crash occurs.

- Someone with "Attractive Nuisances": Got a swimming pool, hot tub, or a trampoline? These are magnets for fun, but they also significantly raise the odds of a guest getting injured on your property.

- A Landlord: Renting out property automatically opens the door to potential lawsuits from tenants, whether it's for an injury on-site or another liability claim.

The financial fallout can be devastating, especially from severe incidents like wrongful death lawsuits, which really highlights why that extra layer of liability coverage is so critical. This is about being proactive to defend your financial future. For more on this, our guide on asset protection insurance dives deeper into strategies for protecting what you've worked so hard to build.

Here's the bottom line: If your total net worth—your savings, investments, home equity, and even future income—is greater than your existing liability limits, you have a coverage gap. An umbrella policy is specifically designed to fill that gap.

The need for this kind of protection is growing as the cost of lawsuits continues to climb. While the U.S. Personal Umbrella market was valued at $6.6 billion in 2024, its importance is becoming more obvious as insurers push for rate hikes to cover rising claim costs. You can read more about personal umbrella market trends at genre.com to understand why this coverage is getting so much attention lately.

Got Questions About Umbrella Insurance? We've Got Answers.

Let's dig into some of the practical questions that pop up when people start considering umbrella insurance. Getting these details straight will help you see exactly how this coverage fits into your financial picture.

Do I Have to Get My Umbrella Policy From My Current Insurance Company?

It’s not always a hard and fast rule, but it’s definitely the smartest move. Most insurance companies strongly prefer to handle your home, auto, and umbrella policies together. Why? It makes everything a whole lot simpler if you ever have to file a major claim.

Think about it: one company, one claims process. Plus, bundling your policies almost always lands you a nice discount, making this extra layer of protection even more affordable. Shopping for a standalone policy from a different carrier is usually tougher and almost always costs more.

What Kind of Liability Limits Do I Need on My Home and Auto Policies First?

This is a big one. Before an insurer will even sell you an umbrella policy, they need to see that you have a solid foundation of liability coverage already in place. These are often called your "underlying limits."

While the exact numbers can differ between companies, here’s a common baseline:

- For your auto policy: At least $250,000 in bodily injury liability per person and $500,000 per accident.

- For your homeowners policy: At least $300,000 in personal liability coverage.

Always check with your specific insurance agent to confirm their requirements. They need to know you've got the basics covered before they'll add the extra protection on top.

Think of your home and auto liability limits as the first floor of your financial house. An umbrella policy is the roof, but you can't build a roof without a solid foundation underneath it.

Will an Umbrella Policy Cover My Business?

Here’s a crucial point to remember: no, a personal umbrella policy is designed exclusively for your personal life. It draws a very clear line and does not cover business-related risks.

If a client sues you over a professional error, an employee gets hurt at your workplace, or any other liability arises from your business operations, your personal umbrella policy won't step in. For that, you need a dedicated commercial liability or commercial umbrella policy. It's absolutely vital to keep your personal and business insurance separate to make sure you're properly protected on all fronts.

Figuring out the ins and outs of liability coverage can feel a bit overwhelming, but you don't have to go it alone. The experts at Wexford Insurance Solutions can walk you through it, helping you find the right level of protection that ensures all your policies work together perfectly. Contact us today for a personalized insurance review.

What Is Deductible in Insurance? How It Affects Your Coverage

What Is Deductible in Insurance? How It Affects Your Coverage What Is Cyber Liability Insurance? Protect Your Business Today

What Is Cyber Liability Insurance? Protect Your Business Today