When you first spot the tell-tale signs of termite damage, a single, urgent question probably pops into your head: "Am I covered?" So, let's get right to it—does home insurance cover termites?

The hard, simple answer is almost always no. A standard homeowners insurance policy is not designed to cover damage from termites or other wood-destroying pests.

The Hard Truth About Termites and Your Home Policy

Think of your home insurance policy as your financial first responder for sudden, unexpected disasters. It's there for a kitchen fire, a burst pipe, or a tree crashing through your roof in a storm. These are what insurers call "sudden and accidental" events.

Termite damage, on the other hand, is a slow burn. From an insurance company's perspective, it's a maintenance issue that builds over time. They see it as a preventable problem that could have been caught and managed with regular inspections and upkeep.

This distinction is everything. Insurers expect homeowners to stay on top of gradual wear and tear, and that includes pest control. Since a termite infestation can quietly cause destruction for months or even years, it simply doesn't meet the "sudden and accidental" standard that most claims require to be approved.

If you want to dig deeper into what a standard policy is built to handle, our guide on home insurance explained is a great place to start.

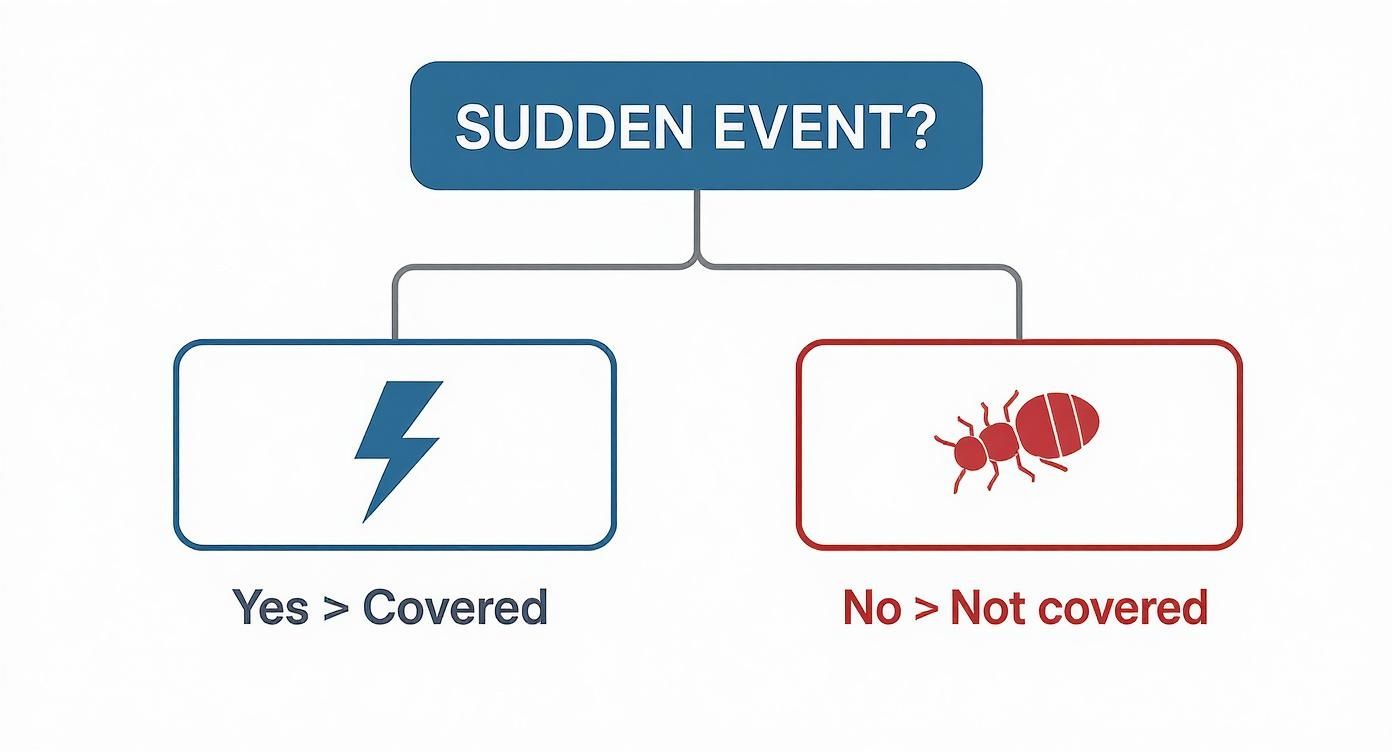

This infographic breaks down how insurers typically think about coverage.

As you can see, the core issue is whether the damage was sudden and unexpected. Gradual problems like infestations almost never make the cut. This isn't just a local standard, either. It’s a global one.

For instance, in a termite-heavy country like Australia, where two out of every three homes could face an infestation, the average repair bill can easily top $7,000. Even there, standard policies won't touch it.

Standard Home Insurance Coverage at a Glance

To put it all in perspective, let's look at what your policy is built for versus what it's not. This quick table highlights the fundamental difference in how insurers view various types of damage.

| Event Type | Generally Covered? | Reasoning |

|---|---|---|

| House Fire | Yes | Sudden, accidental, and catastrophic. Exactly what insurance is for. |

| Termite Damage | No | Considered a gradual, preventable maintenance issue. |

| Tornado Damage | Yes | An unpredictable "Act of God" that causes immediate destruction. |

| Water Damage (Burst Pipe) | Yes | Sudden and accidental failure of a home system. |

| Mold (from slow leak) | No | Develops over time and is often linked to poor maintenance. |

| Theft/Vandalism | Yes | An unexpected criminal act causing loss or damage. |

This table really drives home the point: if it's slow-moving and could have been prevented with routine care, you're likely on your own.

Understanding this core principle is the first step toward truly protecting your investment. Instead of banking on an insurance policy that was never meant for this kind of problem, the focus has to shift to diligent prevention and other ways to manage the risk.

Why Insurers See Termites as Your Responsibility

To get why your policy almost certainly says "no" to termite damage, you have to put on an insurer’s hat for a moment. Insurance is all about protecting you from the unexpected—the things that happen suddenly and are completely out of your control. Think of a freak hailstorm that batters your roof or a lightning strike that zaps your home's wiring. That's what insurance is for.

Termite damage, on the other hand, is a whole different beast in their eyes. Insurers don't see it as a sudden accident. They see it as a slow, creeping problem that could have, and should have, been stopped. It’s officially classified as a maintenance issue, which puts the ball right back in your court.

It's a lot like a plumbing leak. If a pipe suddenly bursts and floods your kitchen, you're covered. But if you ignore a slow drip under the sink for five years until the cabinet and floor rot out, you're on your own. Insurers view termites the exact same way.

The Key Difference: Preventable vs. Unforeseen

The whole argument boils down to one critical distinction that's at the heart of every standard home insurance policy: preventable damage versus unforeseen damage.

An unforeseen event is a disaster that hits out of the blue, something you couldn't have reasonably predicted or prevented. A preventable issue is something that develops over time and could have been managed with basic upkeep. From an insurer's perspective, a termite infestation—which can take months or even years to cause real structural harm—is absolutely preventable.

The National Pest Management Association (NPMA) estimates that termites chew through $5 billion in property damage across the U.S. each year. Insurers look at that massive number not as a string of bad luck, but as a widespread failure of routine home maintenance.

This viewpoint shapes everything in your policy. Since the damage is gradual, your insurance company expects you to be the first line of defense. That means regular pest inspections, keeping moisture away from your foundation, and not stacking firewood right against the house.

Your Role in Managing the Risk

This is exactly why it's so critical to understand what your policy doesn't cover. Instead of crossing your fingers and hoping for coverage that isn’t there, it’s far better to shift your focus to managing the risk yourself.

This starts with identifying the holes in your financial safety net. A thorough insurance gap analysis is a great way to see where you might be on the hook for major out-of-pocket costs, not just for pests but for other common exclusions too.

In the end, insurers have drawn a very clear line in the sand:

- Sudden & Accidental Damage: This is their bread and butter. Think fires, windstorms, and theft. These events are covered because they are unpredictable and unavoidable.

- Gradual & Preventable Damage: This is your territory. It includes termites, mold from a steamy bathroom with no fan, and foundation cracks from soil settling over decades. These are excluded because they fall under the umbrella of homeowner maintenance.

Once you grasp this logic, you can stop thinking reactively about filing a claim and start thinking proactively about protecting your biggest investment from the ground up.

The True Cost of a Termite Infestation

Let's talk about the financial reality of a termite problem, because it's often a much bigger hit than people expect. Since your insurance policy won't be picking up the tab, every single dollar for extermination and repairs has to come straight from your own pocket. This isn’t a small inconvenience—it’s the kind of unexpected expense that can wipe out savings and throw your entire budget off track.

On a national scale, the numbers are just staggering. Termites are responsible for an estimated $5 billion in property damage across the United States every single year. That figure really drives home how widespread and destructive these pests truly are. For an individual homeowner, that national problem becomes a very personal financial crisis.

The Breakdown of Out-of-Pocket Costs

When you find termites, you're looking at a double-whammy of expenses. First up is the professional extermination. Depending on the treatment you need and the size of the infestation, this can cost anywhere from a few hundred to several thousand dollars.

But that's often just the beginning. The second, and usually much more expensive, part is the structural repair work. Termites don't just chew on wood; they compromise the very skeleton of your home—the floor joists, support beams, and wall studs. Fixing that kind of damage is far from a simple DIY project. It requires skilled contractors and can easily spiral into tens of thousands of dollars. To get a handle on it, you’ll need to budget for the necessary home renovations and repairs.

This financial pain is felt even more acutely in certain parts of the country. In termite-heavy regions like the southeastern U.S., the burden is immense. Take Florida, for instance. Residents there spend an estimated $500 million every year on termite treatments and repairs, a number that shows just how serious the local threat is.

From Repair Bills to Property Devaluation

And the costs don’t always end when the contractor leaves. A history of termite damage can seriously impact your home’s resale value. It's a red flag for potential buyers, who will naturally be worried about the possibility of future issues.

A termite infestation is more than a repair bill; it's a direct threat to your home's equity. The final cost isn't just what you pay the contractor—it's also the value your property loses.

Since these expenses are all on you, you're responsible for the full cost of putting your home back together. This is a good time to get familiar with other parts of your policy. For example, understanding what replacement cost coverage entails gives you a better sense of how insurance values property in general, even if it doesn't apply to termites. The big takeaway here? Prevention is the only real financial shield you have.

Finding Financial Protection Outside Your Standard Policy

So, if your standard homeowners policy won't cover termite damage, what's a homeowner to do? Waiting until you see a swarm or a mud tube is a surefire way to face a massive, out-of-pocket repair bill. The good news is, you're not out of options. Specialized solutions exist to fill this crucial gap, and the most common one is something called a termite bond.

It's helpful to think of a termite bond less like an insurance policy and more like a professional service contract. You're essentially hiring a pest control company to be your home's dedicated termite defender. This agreement becomes your primary financial shield against the very threat your main insurance deliberately excludes.

So, What Exactly Is a Termite Bond?

Not all termite bonds are created equal. They come in a few different flavors, and knowing the difference is key to picking the right one for your peace of mind and your wallet. The two main types you'll encounter are treatment-only bonds and repair bonds.

-

Treatment-Only Bonds: This is the basic, more affordable option. If termites show up while the contract is active, the pest control company swoops in and treats the infestation for free. Simple enough. But here's the catch: this bond does not cover the cost of fixing any damage those critters have already done.

-

Repair Bonds (or Treatment and Repair Bonds): This is the heavy-hitter. It includes everything from the treatment-only bond, but it also covers the cost of repairing structural damage from any new infestation that happens on its watch. This provides a much more complete financial safety net.

A termite bond isn’t a one-and-done deal. It's an ongoing relationship with your pest control pro, usually involving an initial inspection and treatment, followed by annual check-ups and renewal fees to keep the protection in place.

The Cost vs. The Value

Getting a termite bond is a smart financial calculation. Every year in the U.S., termites munch their way into roughly 600,000 homes, racking up a staggering $5 billion in control and repair costs. A termite bond, which might run you anywhere from $500 to $2,500 depending on your home's size and location, is your buffer against becoming one of those statistics.

Yes, there's an upfront cost and an annual fee. But that cost is a tiny fraction of what you’d pay for a major structural repair. When your almost-certainly-denied termite damage claim comes back from your insurer, you’ll be on your own. For truly complex and devastating damage, consulting with a public insurance adjuster might help you uncover an obscure angle for coverage, but prevention is always the best strategy.

Some pest control companies also offer broader pest management plans. These are more like subscription services for keeping all sorts of critters at bay, termites included. While they don't always come with a repair guarantee, they're a fantastic tool for proactive home maintenance. In some cases, having a plan like this is even required if major damage forces you to relocate. You can learn more about that in our guide on loss of use insurance.

At the end of the day, these specialized services are your absolute best line of defense.

Your Action Plan for Preventing Termite Damage

Since your home insurance almost certainly won’t cover termites, your best defense is a great offense. The single most effective way to protect your investment is to get proactive and make your property as uninviting to these pests as possible.

Think of it this way: a little consistent effort now can save you an enormous amount of stress and money down the road. You need to treat your home like a fortress. Termites are always on the hunt for a way in, and your job is to seal every potential entry point and roll up the welcome mat.

H3: Smart Landscaping and Yard Maintenance

The battle against termites starts in your yard. How you manage the space right outside your home can either send termites packing or invite them in for a feast. The main goal is to create a dry, wood-free zone directly against your foundation.

- Create a Buffer Zone: Try to maintain an 18-inch gap between the soil and any wood siding, porches, or decks. This simple step removes the hidden highway termites use to get from the ground into your walls.

- Manage Mulch Carefully: Wood mulch is basically a 24/7 termite buffet. If you must use it, keep it at least six inches away from your foundation to create a barrier they’re less likely to cross.

- Store Firewood Properly: Never, ever stack firewood directly against your house or on the ground. It should be elevated and stored at least 20 feet away from your home.

- Eliminate Tree Stumps: Dead trees and old, rotting stumps are termite magnets. It’s worth the cost to have them professionally removed to get rid of a prime nesting spot right next to your house.

H3: Securing Your Home’s Exterior

Next up, turn your attention to the structure of your home itself. The two big things to focus on are moisture and access points. Termites absolutely need water to survive, so cutting off their supply is a potent deterrent. A dry home is a safe home.

Termites thrive in warm, damp conditions. By ensuring your property drains water effectively and sealing potential entryways, you disrupt the environment they need to establish a colony.

Here are the key tasks for locking down your home's perimeter:

- Direct Water Away: Make sure all your gutters, downspouts, and splash blocks are clean and working right. They need to channel rainwater far from your foundation, not let it pool up against the house.

- Fix All Leaks Immediately: Get in the habit of checking outdoor faucets, hoses, and your A/C unit for drips. Even a tiny, persistent leak can be a huge attraction for a thirsty termite colony.

- Seal Cracks and Openings: Carefully inspect your foundation for any cracks or gaps. Seal them up, paying extra close attention to where utility lines and pipes enter your home.

H3: Spotting the Early Warning Signs

Finally, your own vigilance is your secret weapon. Catching an infestation early can be the difference between a minor treatment and a major structural repair bill. While a professional pest inspection once a year is a great idea, you should also keep your own eyes peeled between those visits.

Be on the lookout for these tell-tale signs:

- Mud Tubes: These are pencil-sized tunnels made of soil and wood that termites build on foundations, walls, or crawl spaces.

- Discarded Wings: After swarming to mate, termites shed their wings. Finding little piles of them near windowsills or doors is a massive red flag.

- Damaged Wood: If you tap on wood and it sounds hollow, or if you see wood that looks blistered or darkened, you could have an active infestation.

H3: A Year-Round Approach to Prevention

Staying on top of termite prevention isn't a one-and-done task; it requires attention throughout the year as seasons change. Different conditions create different risks, so a seasonal checklist can help keep your home protected.

Here’s a simple schedule to follow to keep your defenses strong all year long.

Your Seasonal Termite Prevention Checklist

| Season | Key Prevention Tasks | Warning Signs to Look For |

|---|---|---|

| Spring | Clean gutters and downspouts after winter. Check for and repair any wood rot on decks, fences, and siding. Ensure soil around the foundation slopes away from the house. | Termite swarms (flying termites) after rainfall, especially near light sources. Piles of discarded wings on windowsills or spider webs. |

| Summer | Inspect for and fix leaky outdoor faucets, hoses, and A/C units. Ensure mulch and landscaping are at least 6 inches from the foundation. Keep crawl spaces and basements dry. | Mud tubes appearing on the foundation or in the basement/crawl space. Wood that sounds hollow when tapped. |

| Fall | Clear fallen leaves and debris away from the foundation. Store firewood at least 20 feet from the house and off the ground. Seal any new cracks in the foundation before winter. | Blistered or darkened areas on wood surfaces. Small holes in drywall. |

| Winter | Conduct an interior inspection of the basement and attic for signs of moisture or wood damage. Keep an eye out for any signs of activity, as termites can remain active indoors. | Signs of damage that may become more visible as you spend more time indoors. Any unexpected sagging in floors or ceilings. |

By integrating these simple checks into your regular home maintenance routine, you make termite prevention a manageable, year-round habit. Staying on top of these measures is the most reliable strategy. While you probably can't file an insurance claim for termite damage, you can absolutely take control and stop it before it ever starts.

What to Do When You Find Termites

Finding termites in your home is enough to make any homeowner's stomach drop. That feeling of dread is completely normal, but the absolute worst thing you can do right now is act on that initial panic. The key is to take a deep breath and follow a calm, methodical plan to get the situation under control.

Your first instinct might be to grab a can of bug spray or start ripping out the damaged wood. Fight that urge. Do not disturb them. Stirring up the nest will only cause the colony to scatter and burrow deeper into your home, making a bad problem much, much worse for the professionals to handle.

Instead of playing whack-a-mole, your first real move should be to call a licensed and insured pest control professional. Don’t just go with the first name that pops up in a search. It’s smart to get at least two or three different inspections and quotes to make sure you’re getting an accurate diagnosis and a fair price.

Choosing the Right Treatment Plan

Once the experts have taken a look, they'll likely walk you through a few treatment options. Knowing the basics will help you feel more confident in your decision.

-

Liquid Termiticides: This is a classic, tried-and-true method. A professional creates a chemical barrier in the soil around your foundation, which stops termites from getting in and eliminates those who try to cross.

-

Baiting Systems: This approach is a bit more like a covert operation. Bait stations with a slow-acting poison are placed strategically around your property. Foraging termites find the bait, think it's food, and carry it back to share with the rest of the colony, eventually wiping it out from the inside.

Each approach has its own benefits when it comes to cost, environmental footprint, and how quickly it works. A good pest control expert will explain exactly why one method might be better for your home's construction, the specific type of termite you have, and the scale of the infestation.

While your top priority is getting rid of the pests, it's also important to remember that the repair bill for the damage they've caused won't be covered by a standard policy. To understand how insurance claims work in other situations, you can read our guide to the homeowner insurance claim process. Taking these measured steps helps you move from panic to a clear path forward.

Got Questions About Termites and Your Insurance? We've Got Answers.

When you're dealing with the possibility of termite damage, a lot of specific questions pop up. Let's tackle some of the most common ones homeowners ask so you can get a clear picture of your coverage and options.

Are There Any Loopholes for Termite Coverage?

This is a big one, and the answer is almost always no, but there's a tiny sliver of an exception. In some very specific situations, your policy might step in.

Imagine a powerful storm rips a hole in your roof—a clear "covered peril." If that water leak goes unnoticed and creates the perfect damp environment for termites to move in, your policy will pay to fix the storm-damaged roof. However, it will not cover the resulting termite damage. The root cause was the storm, but the termite infestation is still seen as a separate, preventable maintenance issue.

Do Home Warranties Help With Termite Damage?

Unfortunately, no. A home warranty is designed for a completely different purpose. It's a service contract that helps you repair or replace major appliances and systems, like your air conditioner or water heater, when they break down from normal use.

Think of it this way: your home warranty is for a busted refrigerator, not a chewed-up floor joist. Pest control and the structural repairs they cause fall firmly outside the scope of what a home warranty is built to handle.

Is a Termite Bond Actually Worth the Money?

For homeowners living in areas where termites are common, a termite bond can be an incredibly smart financial move. Yes, there's an annual fee, but that cost is usually just a small fraction of what you'd be forced to pay out-of-pocket for a major infestation and the subsequent repairs.

To figure out if it's right for you, do a little research. Compare the annual cost of a bond with the average price of termite treatments and structural repairs in your neighborhood. More often than not, the peace of mind and financial protection make it a worthwhile investment.

Trying to figure out your insurance policy on your own can feel overwhelming. The experts at Wexford Insurance Solutions are here to cut through the confusion and help you find the right protection for your home. Visit us online to get a personalized quote today.

Professional Liability Insurance Coverage Explained

Professional Liability Insurance Coverage Explained difference between agents and brokers in insurance: Guide

difference between agents and brokers in insurance: Guide