When you hear "home insurance," it's easy to think of it as one big, monolithic thing. In reality, your policy is more like a toolkit, with each tool designed for a very specific job: protecting your biggest investment from different kinds of trouble.

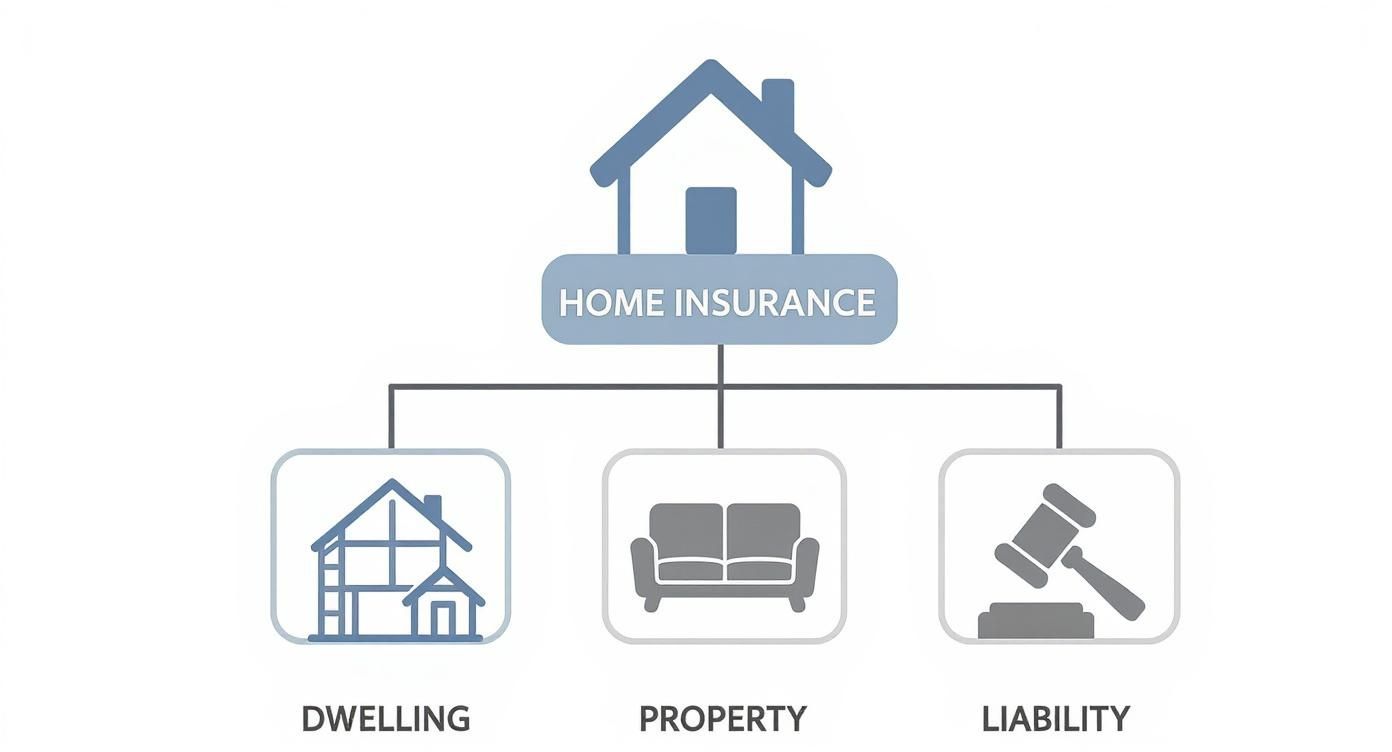

The core protections in your policy are often called dwelling, personal property, and liability coverage. Let's break down what that actually means.

Decoding Your Homeowners Insurance Policy

A homeowners policy isn't a single shield; it's a package of several distinct coverages that work together. Getting a handle on what each one does is the key to making sure you're not left with a massive, unexpected bill after a disaster.

Think of it this way: your home is more than just four walls and a roof. It’s the structure itself, all the stuff you own inside it, and the land it sits on—where accidents can happen. Each of these things faces different risks, and your policy has a specific type of coverage designed to protect each one.

The Core Components of Home Insurance

Every standard homeowners policy is built on a few fundamental pillars of protection. These are the non-negotiables you'll find in just about any plan.

- Dwelling Protection: This is the big one. It covers the physical structure of your house—the foundation, walls, roof, and anything permanently attached, like your plumbing or built-in cabinets.

- Personal Property Protection: This is for all your stuff. It protects the belongings inside your home, from your couch and TV to your clothes and kitchenware, if they're stolen or damaged.

- Personal Liability Protection: This coverage is your financial backstop if someone gets hurt on your property and you're held responsible. It can cover legal fees and medical bills, saving you from a potentially devastating lawsuit.

Let's take a quick look at how these main coverage types fit together in a standard policy.

Home Insurance Coverage at a Glance

This table breaks down the essential parts of a homeowners policy so you can see what each component does at a glance.

| Coverage Type | What It Protects | Common Name |

|---|---|---|

| Dwelling | The physical structure of your home, including the foundation, roof, and walls. | Coverage A |

| Other Structures | Detached structures on your property, like a garage, shed, or fence. | Coverage B |

| Personal Property | Your belongings, such as furniture, electronics, clothing, and appliances. | Coverage C |

| Loss of Use | Additional living expenses if your home becomes uninhabitable after a covered event. | Coverage D |

| Personal Liability | Your financial assets if you are sued for an injury or property damage. | Coverage E |

| Medical Payments | Minor medical bills for a guest injured on your property, regardless of fault. | Coverage F |

As you can see, a complete policy is designed to protect you from multiple angles, from rebuilding your house to covering temporary living costs.

The infographic below gives a great visual of how these core coverages branch out to form a comprehensive safety net.

This really drives home the point that your policy is a collection of protections, starting with the house itself and expanding to cover your belongings and even your legal responsibilities. Learning how to read an insurance policy is a skill every homeowner should have, as it lets you see exactly how these pieces fit together.

Now, let's take a much closer look at each one of these coverages.

Dwelling Coverage: The Foundation of Your Protection

When you buy home insurance, you’re really buying a collection of different coverages bundled together. The absolute core of that bundle is dwelling coverage, often listed as "Coverage A" on your policy documents. It’s the part of your policy that protects the physical structure of your house itself.

A good way to think about it is this: if you could pick up your house and shake it, everything that stays put is what dwelling coverage is designed to protect. It's your financial backstop for the big stuff—the bones of your home.

When a major storm hits, this is the coverage you'll rely on for things like storm damage roof repair. It's meant to provide the funds to put your home back together after a covered disaster. It’s no surprise that dwelling coverage makes up the lion's share of the home insurance market—around 71.1%, according to industry data. Protecting the actual structure is, and always will be, the primary job of home insurance.

What Does Dwelling Coverage Actually Protect?

So, what exactly falls under this umbrella? It’s more than just four walls and a roof. Let's get specific.

- The Structure Itself: This one’s pretty obvious. It covers your home’s foundation, frame, walls, and roof.

- Attached Structures: Your attached garage isn't separate—it's covered. Same goes for a deck, porch, or any other structure that's permanently connected to your house.

- Built-in Systems: All the vital systems that make your house function are included here. Think of your electrical wiring, plumbing, and your HVAC (heating, ventilation, and air conditioning) system.

- Built-in Appliances: Appliances that are considered a fixed part of the house, like a built-in microwave, water heater, or furnace, are typically covered.

In short, if you wouldn’t pack it in a moving box, there’s a good chance your dwelling coverage is what protects it.

Replacement Cost vs. Actual Cash Value

Here’s where you’ll face one of the most important decisions for your policy: choosing between Replacement Cost Value (RCV) and Actual Cash Value (ACV). The difference between the two can easily amount to tens of thousands of dollars when you file a claim.

- Actual Cash Value (ACV) pays you for what your damaged property was worth at the moment it was destroyed. It’s the replacement price minus depreciation—the value lost due to age and wear-and-tear.

- Replacement Cost Value (RCV) pays the full amount needed to repair or replace your damaged property with new materials of similar quality, without any deduction for depreciation.

Example Showdown: RCV vs. ACV

Let's say a fire takes out your 15-year-old roof. It originally cost $20,000.An ACV policy might say the roof lost 50% of its value over the years, so it only pays you $10,000.

An RCV policy, on the other hand, pays the full cost to put a brand new, similar roof on your house today. With rising costs, that might be $25,000.

The financial gap is huge. ACV policies have temptingly lower premiums, but they can leave you paying a massive amount out-of-pocket to finish a rebuild. It’s why virtually every mortgage lender will require you to have RCV coverage. We break this down even further in our guide on what is replacement cost coverage.

Why Rebuilding Cost Matters More Than Market Value

This is a point of confusion I see all the time. Homeowners often mix up their home’s market value with its rebuilding cost, but they are two very different numbers.

Market value is what a buyer would pay for your house and the land it sits on. The rebuilding cost is simply what a contractor would charge to rebuild your home from the ground up if it were leveled tomorrow.

Your dwelling coverage limit needs to be based on the rebuilding cost, not what Zillow says your home is worth.

Why is this so critical? Because the value of your land is irrelevant when you’re rebuilding your house. What does matter are the current prices for lumber, copper, and labor. After a major natural disaster, the demand for these resources skyrockets, pushing costs way up. If your dwelling limit is too low, you could find yourself without enough money to finish the job, putting your entire financial future on shaky ground.

Personal Property Coverage: Protecting What's Inside Your Home

While your dwelling coverage is busy protecting the house itself, personal property coverage (often called "Coverage C" in policy documents) is all about protecting everything you own inside it. This is the part of your insurance that springs into action if your stuff gets stolen in a break-in or goes up in smoke in a fire.

Here’s a simple way to think about it. Imagine you could lift your house, turn it upside down, and give it a good shake. Everything that falls out is considered personal property—your sofa, that big-screen TV, the clothes in your closet, and even the forks in your kitchen drawer.

This coverage is what helps you rebuild your life and replace the things that truly make your house feel like home.

Actual Cash Value vs. Replacement Cost: A Critical Choice

Just like with your home's structure, you have a crucial decision to make about how your belongings are insured. This choice directly controls how much money you’ll get from the insurance company after something happens. You can insure your stuff for its Actual Cash Value (ACV) or its Replacement Cost Value (RCV).

- Actual Cash Value (ACV) pays you what your item was worth the moment it was destroyed, taking into account its age and wear-and-tear (depreciation).

- Replacement Cost Value (RCV) pays you the full amount needed to buy a brand-new, similar item at today's prices, with no deduction for depreciation.

The difference in the payout can be massive. Let's walk through a real-world example.

Scenario: Your TV is Destroyed in a Fire

Let's say a fire ruins your five-year-old television, which you originally paid $1,200 for.An ACV policy might calculate that the TV has depreciated by 60% over the years. That means its actual cash value is only $480.

An RCV policy, on the other hand, would give you enough money to buy a new, comparable model today, which might cost $1,000 or more.

While choosing RCV usually costs a bit more in premiums, it’s the only way to ensure you can truly replace what you've lost without having to cover a huge gap out of your own pocket.

High-Value Items and Their Special Limits

Here's something that catches a lot of homeowners by surprise: your policy doesn't cover everything for its full value. Insurers put specific, lower limits on certain categories of expensive items that are particularly attractive to thieves.

Some of the most common items with these "sub-limits" include:

- Jewelry & Watches: Theft coverage is often capped at around $1,500.

- Firearms: Typically limited to $2,500.

- Furs: Coverage might top out at $1,500.

- Silverware & Goldware: Usually has a limit of about $2,500.

So, if your $10,000 engagement ring is stolen, a standard policy might only pay out that $1,500 limit, leaving you with a staggering $8,500 loss. To avoid this, you need a special addition to your policy.

The Solution: Scheduled Personal Property

The best way to fully protect your most valuable belongings is with a scheduled personal property endorsement, which you might also hear called a "floater" or a "rider." This is an add-on that specifically lists—or "schedules"—your high-value items right on your policy, insuring each one for its full, appraised value.

Scheduling an item does more than just increase the dollar amount. It often gives you broader protection, covering situations like accidental loss or "mysterious disappearance"—things a standard policy won't touch.

To get a deeper understanding, you can check out our detailed guide on what is personal property coverage and how these vital endorsements can fill a critical gap in your protection. It’s an extra step that ensures your most cherished possessions are truly safe.

Liability Coverage: Your Financial Shield from Accidents

So far, we've talked about protecting your physical stuff—your house and your belongings. But what happens when an accident on your property threatens your financial future? That's where liability coverage comes in. It's the part of your policy that stands between you and a financially devastating lawsuit.

Think of it as your personal legal defense team on standby. If someone gets hurt at your home, or you or a family member accidentally break someone else’s property, this coverage kicks in. It’s designed to handle the staggering costs of lawyers, court fees, and any settlements you’re ordered to pay, all the way up to your policy limit. Without it, everything you've worked for could be on the line.

How Personal Liability Works in the Real World

You don't need a dramatic, once-in-a-lifetime event for a liability claim to pop up. More often than not, they spring from everyday mishaps that get out of hand.

Here are a few classic examples where liability coverage becomes your best friend:

- The Slip and Fall: A package delivery person takes a tumble on your icy front steps, breaking their arm. Suddenly, you're looking at their medical bills and lost wages.

- The Dog Bite: Your normally sweet dog gets spooked and nips a neighbor's kid. A seemingly small incident can quickly lead to a serious lawsuit.

- The Stray Baseball: Your kid’s backyard baseball game ends with a ball smashing through your neighbor’s brand-new, custom-installed picture window.

In any of these situations, you could be held legally responsible. Your liability coverage is the crucial buffer that keeps you from paying for it all out of pocket.

Medical Payments to Others: A Goodwill Gesture

Tucked inside your liability protection is a smaller but incredibly useful feature: Medical Payments to Others. This is designed to cover minor medical bills if a guest gets injured on your property, and here's the key part: it doesn't matter who was at fault.

This is often called "goodwill" coverage for a reason. It lets you do the right thing and cover someone's minor injury costs right away, no questions asked and no lawyers involved.

Let's say a friend trips on a rug in your hallway and needs a few stitches. This coverage can pay for their trip to the urgent care clinic. Taking care of small bills like this immediately can often stop a minor accident from snowballing into a major lawsuit.

Choosing the Right Liability Limit

Most standard home insurance policies start with a base liability limit of $100,000. Frankly, in today's world, that's rarely enough. A single lawsuit can easily blow past that number, leaving you to pay the rest.

That's why most insurance experts recommend carrying at least $300,000 to $500,000 in liability coverage. The best amount for you really depends on your net worth. A solid rule of thumb is to have enough coverage to protect all of your assets—your home equity, savings, retirement accounts, everything.

If you have a higher net worth, even the maximum limit on your home policy might not cut it. This is when you need an extra layer of security. To learn more, check out our guide on what is umbrella insurance, which explains how you can add a much higher limit on top of your existing home and auto policies for ultimate peace of mind.

Loss of Use Coverage When Your Home Is Uninhabitable

When a disaster like a fire or major storm tears through your home, the damage isn't just to the walls and your possessions. Suddenly, your life is turned upside down because you can't even live there. This is exactly when Loss of Use coverage—often called Additional Living Expenses (ALE)—steps in to become an absolute financial lifeline.

Think of it as your "normal life" insurance. Its entire purpose is to cover the extra costs you rack up when you’re forced out of your home during repairs or a rebuild. It ensures a catastrophe that wrecks your home doesn't also create a second, ongoing financial crisis for your family.

This coverage is a non-negotiable part of any solid home insurance policy, especially today. The U.S. home insurance industry is seeing average annual premiums climb to around $3,520, an 8% jump fueled by severe natural disasters. With wind and hail damage now making up a staggering 40.7% of claims, events that make homes unlivable are all too common. You can find more home insurance industry statistics on coinlaw.io.

How Does Additional Living Expenses Work?

The concept behind ALE is beautifully simple: it pays for the increase over and above what you would normally spend. It’s not a blank check for all your bills, but it covers the difference between your usual budget and your new, higher costs.

Let's walk through an example. A kitchen fire makes your house unsafe, and you’ll be out of it for three months. Your mortgage is $2,000 a month. To keep life as normal as possible for your family, you find a similar furnished rental nearby, but it costs $3,000 per month.

Your ALE coverage would step in and pay that $1,000 difference. This keeps your budget from breaking, allowing you to continue paying your mortgage and regular bills without the crushing weight of a full second rent payment on top of everything else.

What Expenses Does Loss of Use Cover?

You might be surprised by how broad this coverage actually is. It’s designed to handle the real-world, practical problems that come with being displaced and goes way beyond just rent.

Here are some of the most common expenses ALE can help with:

- Temporary Housing: This covers everything from a hotel for a few nights to a rented house or apartment for a longer-term stay.

- Restaurant Meals: If your temporary place doesn't have a kitchen, ALE can reimburse the extra money you spend eating out versus your normal grocery bill.

- Storage Fees: You’ll need somewhere to put your belongings while your home is being worked on. The cost of a storage unit is often covered.

- Extra Commuting Costs: Is your temporary rental farther from work or school? The extra you spend on gas or public transit can be claimed.

- Pet Boarding: If you can’t find a pet-friendly rental, the cost to board your furry family members is usually included.

To really dig into the specifics of what this protection includes, it's worth reading a complete guide on loss of use insurance.

Navigating the Claims Process

If you ever need to use your ALE coverage, remember one word: documentation. Your insurance company will need proof of every single extra expense, so you have to become a meticulous record-keeper from day one.

Key Takeaway: Treat your ALE claim like you're submitting an expense report at work. Save every receipt, invoice, and statement related to your temporary living arrangement.

Start a folder—physical or digital—and put everything in it. We're talking hotel bills, the rental agreement, grocery receipts (to show the difference in cost), gas receipts, everything. The more organized you are, the smoother the process will be, getting you the money you need to keep things running.

Fine-Tuning Your Policy With Endorsements

Think of your standard homeowners policy as a high-quality, off-the-rack suit. It fits pretty well and covers all the basics, but it isn’t perfectly tailored to you. Insurance endorsements, sometimes called riders, are the custom alterations that make the policy a perfect fit for your life.

These are simply small additions that plug specific coverage gaps in your main policy. They’re the key to making sure your protection matches the real-world risks you face, from the ground under your house to the valuables inside it.

Plugging Major Gaps: Catastrophic Events

Some of the biggest and most misunderstood exclusions in a standard policy are for floods and earthquakes. It's a hard truth, but nearly every base home insurance plan specifically leaves out damage from these events. Without a special add-on, you have zero coverage.

- Flood Insurance: This covers damage from things like storm surges, overflowing rivers, or even just heavy rain that pools and seeps into your home. You can usually get this coverage through the National Flood Insurance Program (NFIP) or a private insurance company.

- Earthquake Coverage: If you live anywhere near a fault line, this is non-negotiable. It covers structural damage and personal property losses from tremors, which would otherwise be a financially devastating, out-of-pocket expense.

Homeowners can be wiped out financially after a natural disaster, only to discover too late that their standard policy won't help them rebuild. These endorsements close that dangerous gap.

Covering Sneaky Household Problems

Beyond the big disasters, endorsements can also protect you from common but surprisingly expensive household headaches that a basic policy won't cover.

One of the most valuable add-ons is water backup coverage. Imagine your sewer line backs up or your sump pump fails, flooding your basement. A standard policy won’t touch that, but this endorsement will. Considering the sky-high cost of water removal and repairs, it’s a small price for huge peace of mind.

Another one gaining popularity is identity theft restoration. If your identity is stolen, this rider gives you access to specialists who handle the nightmare of restoring your credit and good name, often covering legal fees and other costs along the way.

Your home insurance policy should be a living document that adapts to your needs. Endorsements are the tools that allow you to fine-tune your protection, ensuring you are not just covered, but correctly covered for the risks you actually face.

You can also add endorsements for equipment breakdown (covering your HVAC or water heater), service line coverage (for the underground utility lines you own), and even home security discounts. In fact, installing some affordable home security systems can sometimes lower your premium.

Talking through these specific home insurance coverage types with your agent is the best way to make sure your financial safety net has no holes.

Common Questions About Home Insurance Coverage

Diving into a home insurance policy can feel like you’re trying to learn a new language. It’s no surprise that most homeowners run into the same handful of questions time and time again.

Getting a handle on these key concepts is the best way to make sure your coverage is actually doing its job. Once you understand the fundamentals, you can talk confidently with your agent and make smarter choices to protect your biggest investment.

What Is the Difference Between an HO-3 and an HO-5 Policy?

This is one of the most common questions, and it really comes down to how your personal belongings are protected. Think of it as the difference between a list of things that are covered versus a much shorter list of things that aren’t.

An HO-3 policy is the workhorse of the insurance world; it's the most common type you'll find. It gives your house itself fantastic protection against almost anything that could happen, unless a cause of damage (a "peril") is specifically excluded in the policy. This is called open perils coverage.

For your personal property, however, it works the opposite way. Your stuff is only covered for a specific list of events, like fire, theft, or a burst pipe. This is called named perils coverage. If the damage is caused by something not on that list, you're out of luck.

An HO-5 policy is the premium upgrade. It wraps both your house and your personal belongings in that superior open perils protection. This means all your possessions are covered from any kind of damage, unless the cause is on that short list of exclusions. It costs a bit more, but it's the most comprehensive protection you can get.

How Much Dwelling and Liability Coverage Do I Need?

Getting these two numbers right is probably the most important part of setting up your policy.

For dwelling coverage, the goal isn't to match your home's Zillow estimate or what you paid for it. The number you need is the rebuilding cost—what it would take to rebuild your home from scratch at today's prices for labor and materials. This is often a completely different number than its market value.

When it comes to liability coverage, the standard $100,000 included in many policies is dangerously low. A slip-and-fall accident on your property could easily lead to a lawsuit far exceeding that amount. Most experts agree you should have at least $300,000 to $500,000 in coverage.

A great rule of thumb is to carry enough liability insurance to protect your total net worth. If your assets are higher than the limit on your home policy, it's time to look into an umbrella policy for that extra layer of security.

Are Floods and Earthquakes Covered by My Standard Policy?

This is a huge—and often costly—misconception. The answer is a clear and simple no.

A standard homeowners policy will not pay for damage from floods, earthquakes, landslides, or mudflows. These events are specifically excluded.

To be protected, you have to buy separate, specialized policies for them:

- Flood Insurance is usually purchased from the National Flood Insurance Program (NFIP) or a private insurance company.

- Earthquake Coverage is typically added as an endorsement to your home policy or bought as a completely separate policy.

Without these, you are 100% on the hook for the repair costs, which could be financially devastating.

Sorting through the different home insurance coverage types is much easier when you have an expert in your corner. At Wexford Insurance Solutions, we specialize in providing clear answers and building policies that genuinely protect your family and your future. Get your personalized insurance quote today.

What does builders risk cover: A quick guide to protections

What does builders risk cover: A quick guide to protections Your Guide to Assigned Risk Workers Compensation

Your Guide to Assigned Risk Workers Compensation