If you're a homeowner, you've probably wondered what you should be paying for insurance. The average homeowner insurance cost is a great starting point for budgeting, but it's really just a national benchmark. The price you actually pay is a whole different story, shaped by where you live, the home you own, and the coverage you choose.

What Is the Average Cost of Homeowners Insurance

Think of the national average as a landmark on a huge map. It gives you a general idea of the territory, but the specific landscape of your state, city, and even your own block will ultimately determine your final premium. Everything from regional weather patterns to the cost of local construction materials gets baked into this national figure, creating a baseline that insurers then adjust for your unique situation.

In 2025, the typical American homeowner is paying about $2,927 per year. This is for a standard policy that includes around $350,000 in dwelling coverage and a $1,000 deductible.

There's a clear link between how much your home is worth and what you'll pay for insurance. For every $100,000 increase in your home's value, you can generally expect your premium to climb by $400 to $500. Following that logic, it’s not uncommon for owners of million-dollar homes to see annual premiums north of $5,300.

How Dwelling Coverage Impacts Your Premium

The biggest piece of the puzzle is your dwelling coverage. This is the part of your policy that covers the cost to completely rebuild the structure of your house if it's destroyed. It makes sense, then, that the more it would cost to rebuild your home, the more you'll need to insure it for, and the higher your premium will be.

To give you a clearer picture, let's look at how premiums scale with the amount of dwelling coverage you have.

Average Annual Home Insurance Premiums by Dwelling Coverage

This table shows how the amount of dwelling coverage directly impacts the average annual home insurance cost, helping you estimate potential premiums based on your home's value.

| Dwelling Coverage Amount | Estimated Annual Premium |

|---|---|

| $250,000 | $2,130 |

| $350,000 | $2,927 |

| $450,000 | $3,755 |

| $500,000 | $4,220 |

| $750,000 | $4,790 |

As you can see, the numbers climb steadily. Getting your dwelling coverage amount right is crucial—it ensures you're not paying for more than you need, but more importantly, it prevents you from being dangerously underinsured if disaster strikes.

Key Takeaway: Your premium is directly tied to the cost of rebuilding your home from the ground up. An accurate dwelling coverage amount ensures you aren't overpaying or, more importantly, underinsured if disaster strikes.

While these averages are helpful for a ballpark estimate, they don't capture the full picture. The only way to find a policy that truly fits your needs and budget is to compare home insurance quotes from a few different providers.

Why Your Home Insurance Bill Keeps Going Up

If you’ve opened your home insurance renewal notice lately and felt a jolt of sticker shock, you’re definitely not alone. It’s a feeling shared by homeowners all across the country as a once-stable bill suddenly becomes a major budget concern. This isn't just a routine price bump; we're seeing a fundamental shift in the insurance market, driven by some powerful and costly trends.

The biggest culprit behind these surging premiums is the dramatic rise in both the frequency and severity of natural disasters. The easiest way to think about it is to picture your insurance company managing a massive pool of money. Everyone pays their premiums into this pool, and when a disaster hits, the insurer pays claims out of it. For a long time, that system was fairly predictable.

But the old math no longer works. That financial pool is being drained faster and more often than ever before by more destructive hurricanes, sprawling wildfires, and intense storms that bring devastating tornadoes and hail.

The New Reality of Climate Risk

Insurers are now on the hook for billions in losses from weather events that are becoming disturbingly common. When the money going out for claims starts to dwarf the money coming in, they have to refill the pool. The only way to do that is by raising premiums for everyone, effectively spreading that massive new risk across all their policyholders.

This is a crucial point: even if your own home has been spared, you're paying for the impact of disasters happening hundreds or even thousands of miles away. The once-abstract idea of "climate risk" has arrived on your doorstep in the form of a much higher insurance bill.

The Bottom Line: Your insurance premium is being recalculated for a world where "once-in-a-lifetime" storms are happening every few years. Insurers are pricing in this volatile new reality.

And this isn't just a feeling—the numbers are stark. Between 2019 and 2024, homeowners insurance rates in the U.S. shot up by a staggering 40.4%. The pace of these hikes tells the real story: after smaller increases from 2019 to 2021, rates leaped by 5.4% in 2022, then accelerated to 11.0% in 2023 and another 11.4% in 2024. You can dig into the data on these rate hikes to see just how fast things are changing.

Inflation and Rebuilding Costs

On top of the weather, broad economic pressures are pouring gasoline on the fire. Widespread inflation has sent the cost of everything needed to fix a home through the roof.

- Lumber and Materials: The price tags on lumber, shingles, siding, and other basic building supplies have skyrocketed.

- Labor Shortages: Finding skilled construction workers is harder and more expensive, driving up the cost of labor for any repair or rebuild project.

What this means is that the potential cost to your insurer to rebuild your home after a total loss is vastly higher than it was just a few years ago. To make sure they have enough funds to cover that bigger potential payout, they have to charge you a higher premium today. It’s a direct pass-through of these inflated construction costs, piling on top of the weather risks and pushing your policy price ever higher.

How Your State Shapes Your Insurance Rate

When it comes to your homeowner insurance premium, your address isn't just a detail—it's often the single biggest factor. Simply crossing a state line can cause your annual cost to jump, turning a manageable bill into a major budget item. That’s because, at its core, insurance is all about local risk, and every state has its own unique set of challenges.

Think of it this way: covering a house in a quiet, low-risk area is like insuring a car for a driver with a squeaky-clean record. On the other hand, insuring a home in a state hammered by severe weather is like handing the keys of a new sports car to a teenager. The potential for a huge claim is much higher, and the premium will absolutely reflect that. This is why you see people in one part of the country paying four or five times what someone with a similar house pays just a few states over.

Why Location Is The Biggest Cost Driver

So, what makes one state so much more expensive to insure than another? It all boils down to the frequency and severity of natural disasters. A state smack in the middle of "Tornado Alley" faces a constant threat from destructive winds, while a Gulf Coast state has to brace for hurricane season every single year. These regional risks are the main reason for the massive price differences you see across the country.

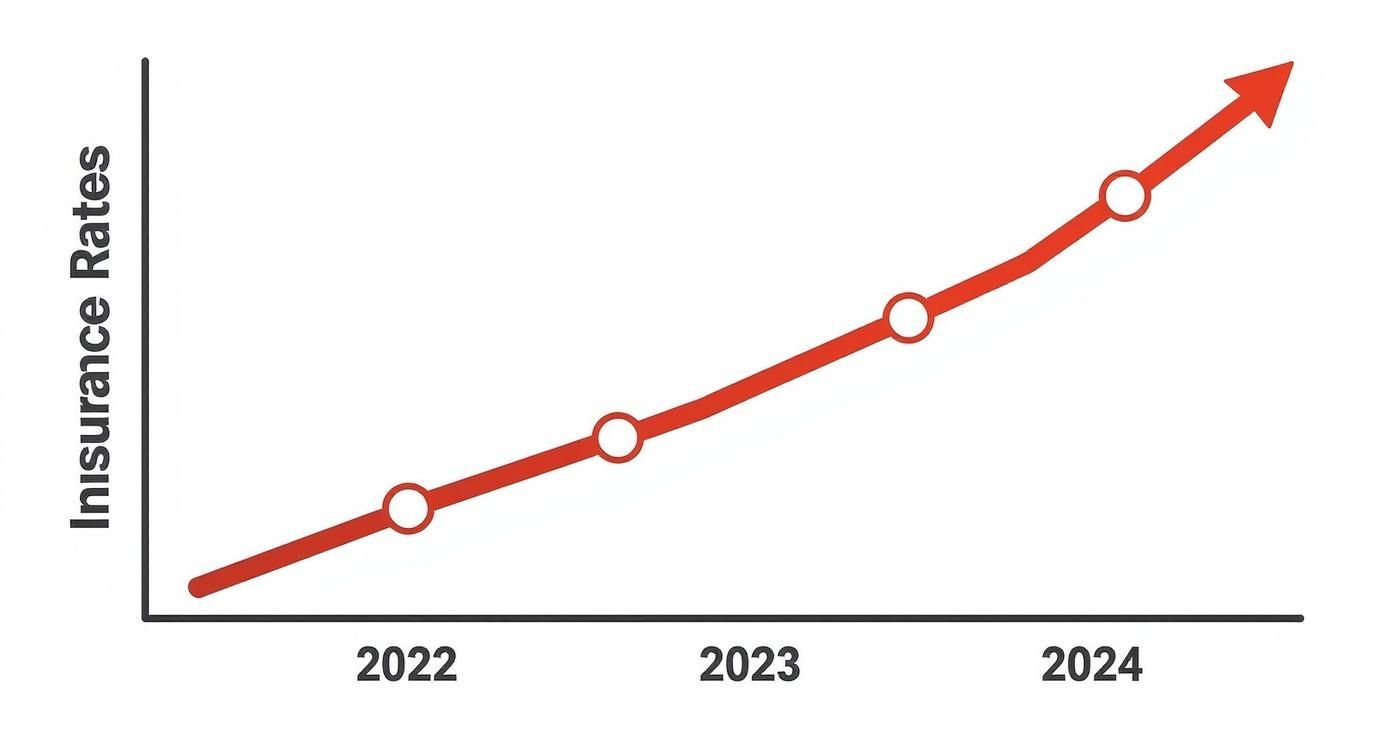

This line graph shows just how much these escalating risks have been pushing insurance rates up lately.

As you can see, the trend is accelerating. Insurers are having to adjust their pricing more aggressively to keep up with the rising tide of weather-related claims.

Let's look at how wildly these geographic differences can swing. Oklahoma leads the pack with an average annual premium of $6,133, with Nebraska right behind at $5,912 and Kansas at $5,412. On the flip side, Hawaii enjoys the country's lowest average premium at just $632 per year. States like California ($1,260) and Vermont ($1,339) also have much more affordable rates.

The table below breaks down these variations, comparing a few states at the high, middle, and low end of the cost spectrum.

Average Homeowner Insurance Costs by State (High, Medium, and Low)

| State | Average Annual Premium | Compared to National Average |

|---|---|---|

| Oklahoma | $6,133 | +231% |

| Nebraska | $5,912 | +220% |

| Texas | $4,456 | +141% |

| Georgia | $2,543 | +38% |

| Pennsylvania | $1,600 | -13% |

| California | $1,260 | -32% |

| Vermont | $1,339 | -27% |

| Hawaii | $632 | -66% |

Seeing the numbers laid out like this really highlights just how much your home’s location matters. It’s the single biggest piece of the puzzle.

Key Insight: Your home's location dictates its exposure to costly perils like hurricanes, tornadoes, wildfires, and hailstorms. This localized risk is the number one driver of your insurance premium.

Understanding the specific risks in your area is crucial. Homeowners in coastal states like Florida face different challenges than those in a place like New York. To see how these local factors come into play, check out our guide on how New York home insurance rates are calculated.

While you can’t exactly pick up your house and move it, knowing your local risk profile is the first step to finding the right coverage and managing your costs.

Key Factors That Drive Your Premium

While your state certainly sets the stage for insurance costs, the final number on your policy comes down to the nitty-gritty details of your home and, believe it or not, you.

At its core, insurance is a game of risk assessment. Every piece of information an insurer collects helps them build a clearer picture of how likely you are to file a claim someday. It’s like they’re putting together a puzzle, and each factor is a piece that shapes the final image of your premium.

These factors generally fall into two buckets: everything about your property and everything about you as the owner. Let's dig into what insurers are really looking at when they put your quote together.

Your Home’s Unique Characteristics

The age, building materials, and overall condition of your house play a massive role in what you'll pay. It makes sense, right? A brand-new build with modern wiring and plumbing is simply a lower risk than a century-old home with infrastructure that’s seen better days.

The same logic applies directly to your roof. A new, well-installed roof is your home’s first line of defense against the weather. Think of it like putting fresh, high-quality tires on your car—it tells the insurer you’re less likely to have problems, especially with wind and hail, which drove a staggering 42% of all home insurance claims from 2018 to 2022.

Insurers also zero in on these specific property details:

- Construction Materials: Homes built with fire-resistant materials like brick or stone usually get better rates than standard wood-frame houses.

- Rebuild Cost: This is a big one. It’s not your home's market value, but what it would cost to rebuild it from the ground up after a total loss. Understanding your home's true rebuild cost for insurance is crucial because it directly sets your dwelling coverage amount.

- Protective Devices: Simple things like smoke detectors, deadbolts, and a security alarm can often knock a few percentage points off your premium.

Your Personal Profile And History

It’s not just about the house; your personal details also have a major impact. One of the most significant factors is your insurance score, which is closely related to your credit history. Homeowners with poor credit might pay nearly double what those with excellent credit pay—we're talking an average of $4,638 a year versus $2,329.

Key Insight: From an insurer's perspective, a strong credit history suggests you're financially responsible. They believe this correlates with a lower likelihood of filing claims.

Your claims history is another critical piece of the puzzle. If you’ve filed several claims in the past few years, an insurer will see you as a higher risk and will almost certainly charge you more. Even a pattern of small, frequent claims can be a red flag, as it might signal underlying maintenance issues.

Getting a handle on all these variables is the first step toward managing your costs. Each one contributes to the different home insurance coverage types that make up your policy. Once you know what insurers value, you can start to see where you have some control over that final number.

Practical Ways to Lower Your Home Insurance Costs

Knowing what goes into the average homeowner insurance cost is one thing. Actually doing something to lower your own bill is another entirely. While you can't change the weather or stop inflation, you have a surprising amount of control over your premium.

The trick is to start thinking like an underwriter. Your mission is to prove that your home is a safer bet than the next person's. Every step you take to reduce the risk of a claim can put money back in your pocket.

Start With Your Policy Structure

Often, the fastest path to savings is by tweaking the policy you already have. These aren't big, expensive projects—just simple adjustments that can make an immediate difference to your bottom line.

One of the most powerful levers you can pull is your deductible. This is simply the amount you agree to pay yourself on a claim before the insurance company steps in. Bumping it up from, say, $500 to $1,000 can slash your premium by as much as 25%. The key is to choose a number you could comfortably afford to pay tomorrow if disaster struck.

Another easy win? Bundling. If you have your home and auto insurance with different companies, you're probably leaving money on the table. Most insurers will give you a multi-policy discount, often saving you 5% to 15% on both policies.

Make Your Home Safer and Stronger

Insurance companies love homeowners who are proactive about preventing problems. Investing in a few key home improvements can pay you back year after year in the form of lower premiums.

Think about upgrades that tackle the most common (and expensive) claims:

- Install a security system: A centrally monitored system that calls the fire or police department automatically makes your home a much lower risk for theft and fire. Even adding new smoke detectors or deadbolts can earn you a small discount.

- Upgrade your utilities: Outdated electrical wiring, old plumbing, and aging HVAC systems are ticking time bombs for fire and water damage. Modernizing them is a big signal to your insurer that you're serious about risk management.

- Reinforce your roof: In areas that get hit with high winds or hail, a new, impact-resistant roof is one of the best investments you can make. It can lead to some of the biggest discounts available.

Pro Tip: Always call your agent before starting a big project. They can tell you exactly which upgrades will give you the most bang for your buck on your premium.

Be a Savvy Insurance Shopper

Finally, don't let loyalty blind you to a better deal. The single most effective thing you can do to control your costs is to shop around. The average homeowner insurance cost can vary dramatically from one company to the next, even for the exact same coverage on the exact same house.

Get into the habit of getting fresh quotes from at least three different insurers every couple of years. Underwriting rules change, and the company that offered you the best deal last time might not be the most competitive one today. For more ideas, our guide on how to lower home insurance goes into even greater detail. An hour of your time could easily save you hundreds of dollars a year.

The Future of Home Insurance in a Changing Climate

If you feel like your insurance bill is getting out of hand, you're not wrong. This isn't just about your personal budget; it's a symptom of a massive, industry-wide shift. Insurance companies are being forced to completely rethink how they calculate risk in an age of wilder, more unpredictable weather.

Simply put, this isn't a temporary price bump. It's the new normal for homeowners.

The climate's growing volatility means the old rulebooks for predicting risk are pretty much useless. A recent report from the U.S. Department of the Treasury drove this point home, finding that from 2018 to 2022, average homeowner premiums shot up 8.7% faster than inflation. That surge is directly linked to the ballooning costs of climate-fueled disasters like wildfires, hurricanes, and massive floods. You can dig into the numbers yourself in their assessment of climate-related financial risk.

Navigating the New Insurance Landscape

In this new reality, insurance in high-risk areas isn't just getting more expensive—it’s getting harder to find at all. On top of that, many standard policies won't cover certain events, like flooding. It’s critical to understand the difference between flood insurance vs homeowners insurance to make sure you don't have a dangerous hole in your coverage.

The Path Forward: You can't stop a hurricane, but you can control how you prepare for it. The best strategy is to stay informed, get crystal clear on your property's specific risks, and take an active role in managing your policy.

At the end of the day, your best defense against uncertainty is knowledge. When you understand the big-picture forces driving up costs, you can make smarter, more strategic decisions to protect both your home and your wallet for years to come.

Common Questions About Home Insurance Costs

It's easy to get lost in the weeds when you're trying to understand home insurance. But once you get a handle on a few key ideas, the whole picture starts to make a lot more sense. Let's walk through some of the questions I hear most often from homeowners.

How Often Should I Shop for New Insurance?

This one comes up all the time. While it feels like sticking with the same company year after year should earn you some loyalty points, the insurance market moves fast. As a general rule, it's smart to compare quotes at least every two years. You should also shop around anytime you make a big change, like a major home renovation, that impacts your property's value.

Should I File a Small Claim?

It's tempting, isn't it? Something minor breaks, and you think, "This is what I have insurance for!" But hold on. Filing small claims can flag you as a higher risk, causing your premiums to jump at renewal time. In many cases, it's better to cover small repairs out of pocket and save your insurance for the big, truly damaging events. Think of it as your financial safety net, not a home maintenance fund.

Understanding Your Coverage Details

This is where the fine print really matters. Homeowners often ask about how they'll actually get paid after a disaster, and it all comes down to two very different terms.

- Replacement Cost: This is the good stuff. It pays to rebuild your home and replace your possessions with brand-new items of similar quality. No deductions for wear and tear.

- Actual Cash Value (ACV): This is replacement cost minus depreciation. If your five-year-old couch is destroyed, ACV pays you what a five-year-old couch is worth, which isn't much.

Key Takeaway: Replacement cost coverage offers far better protection if you suffer a total loss. It costs a bit more, but it’s the difference between starting over and truly being made whole again.

Finally, what your policy doesn't cover can be a nasty surprise. Standard policies almost never include damage from floods or earthquakes—you need separate policies for those. People also ask about specific scenarios, like what the deal is with homeowners insurance coverage for tree removal after a storm. It’s critical to know these gaps in your coverage before you need it.

Knowing what's actually in your policy is the single best way to make sure you're protected without paying for things you don't need. At Wexford Insurance Solutions, we help you find that perfect balance. Get in touch with us to review your policy and get a clear, competitive quote today at https://www.wexfordis.com.

Errors and Omissions Insurance Explained

Errors and Omissions Insurance Explained What is retroactive date in insurance? Key insights

What is retroactive date in insurance? Key insights