When people talk about excess liability vs. umbrella insurance, they're often talking about adding an extra layer of protection. But the way each policy provides that protection is fundamentally different.

The simplest way to think about it is this: excess liability adds more money to one existing policy. An umbrella policy, on the other hand, provides extra liability coverage over multiple policies and can even step in to cover claims your other policies don’t.

An excess liability policy is like making a single fence taller. An umbrella policy is more like building a protective roof over your entire property.

Excess Liability vs Umbrella: A Quick Comparison

While both types of insurance are designed to kick in when a catastrophic claim exhausts your primary coverage, they aren't interchangeable. Getting the structural differences right is the first step in making a smart choice for your business or personal assets.

Excess liability insurance is what we call a "follow form" policy. It literally follows the exact terms, conditions, and exclusions of the specific, underlying policy it's attached to. If your general liability policy has a specific exclusion, your excess policy will have the same one. It does one job and one job only: add more money for covered events.

Umbrella insurance is a different beast altogether. It’s far more versatile. Yes, it increases your liability limits across multiple policies (like your general liability, auto, and employer's liability). But it can also "drop down" to fill in gaps, providing coverage for claims your primary policies might not touch, such as libel, slander, or false arrest.

This broader scope makes it a much more comprehensive safety net. For a deeper dive into how these limits work in practice, you might find our guide on what is aggregate insurance coverage helpful.

The Bottom Line: The decision comes down to scope. Excess liability is narrow and deep—it just boosts a single policy's limits. Umbrella insurance is both broad and deep, extending over multiple policies and plugging potential coverage gaps.

Key Differences at a Glance

To make this even clearer, let's put the core features side-by-side. This table breaks down the essential differences to help you see which approach aligns better with your risk management needs.

| Feature | Excess Liability Insurance | Umbrella Insurance |

|---|---|---|

| Coverage Scope | Follows the exact terms of one underlying policy. | Broadens coverage and can cover risks excluded by underlying policies. |

| Policy Structure | Stacks vertically on a single policy (e.g., General Liability). | Spreads horizontally over multiple policies (e.g., Auto, General, Employer's). |

| Flexibility | Less flexible; strictly mirrors the primary policy. | More flexible; provides its own terms and conditions for new risks. |

| Common Use Case | Meeting a specific contractual requirement for higher limits. | Comprehensive protection for businesses with diverse risk exposures. |

Ultimately, choosing the right policy depends entirely on the specific risks you or your business face. An excess policy is a great tool for satisfying a contract that demands high limits on one specific line of coverage. An umbrella policy, however, is often the go-to choice for anyone seeking robust, well-rounded protection against a wider variety of potential claims.

Understanding Excess Liability Insurance

When you just need higher liability limits without any extra bells and whistles, excess liability insurance is usually the go-to solution. Think of it as simply stacking more money on top of an existing insurance policy. Its one job is to kick in with more funds after your primary policy’s limits are completely used up.

This type of policy works on a principle called "follow form." In plain English, this means it copies the exact same terms, conditions, and exclusions of the underlying policy it covers. If your general liability policy covers a specific incident, your excess policy does too. But if your primary policy excludes something, the excess liability policy will also leave you on your own for that risk.

The Simplicity of a Follow Form Policy

The biggest selling point for excess liability is its straightforwardness. There are no new terms to get your head around or different coverage scenarios to analyze. You're just boosting the total dollar amount available if a covered claim happens, which makes it a perfect fit for situations with very specific requirements.

For example, a big client might require you to have $5 million in general liability coverage as part of your contract. If your primary policy maxes out at $2 million, a simple excess liability policy can add the extra $3 million you need to seal the deal, all while perfectly mirroring the original coverage. You can dive deeper into what is excess liability coverage in our detailed guide.

Potential Pitfalls and Coverage Gaps

While that simplicity is great, the "follow form" structure can also be its biggest weakness. Because an excess liability policy strictly matches the terms of the underlying insurance, it can leave you with surprise coverage gaps if your primary policy has limitations you didn't know about.

Key Insight: An excess liability policy will never be broader than the insurance it sits on top of. Any weakness, exclusion, or gap in your primary policy is automatically carried up to the excess layer, leaving you exposed to the exact same risks.

This rigidity is a critical point of difference when comparing excess liability vs umbrella insurance. This policy won't fill any gaps or add new types of protection; it only deepens the financial well for the coverage you already have.

Ultimately, its effectiveness hinges entirely on how solid your primary insurance is. If your foundational coverage is comprehensive and strong, an excess policy is an incredibly powerful and cost-effective way to get more protection.

Exploring What Umbrella Insurance Covers

While an excess liability policy is fairly straightforward—it just adds more money to an existing policy—umbrella insurance is a much more dynamic and protective tool. It's best to think of it as a comprehensive safety net that performs two crucial jobs for your business or personal assets.

First, an umbrella policy does what an excess policy does: it boosts the financial limits on your existing liability policies. This means it sits on top of your general liability, commercial auto, and employer’s liability policies, creating a unified pool of extra funds to draw from after your primary policy limits are maxed out. This alone is a huge benefit when dealing with a catastrophic claim.

But the real magic of an umbrella policy lies in its second function.

Broader Coverage That Fills Critical Gaps

The crucial difference in the excess liability vs. umbrella conversation is that an umbrella policy comes with its own, broader coverage terms. It can "drop down" to cover claims that your primary policies flat-out exclude. This is where you see the true value, as it shields you from a much wider variety of modern risks.

For example, your standard general liability policy probably won't touch claims arising from things like:

- Libel or slander: A heated online exchange or a bad review turns into a defamation lawsuit.

- False arrest or imprisonment: An employee wrongly detains a suspected shoplifter, leading to legal trouble.

- Invasion of privacy: Your business mishandles sensitive customer data, resulting in a claim.

In these situations, an excess liability policy wouldn't do you any good because there's no underlying coverage to begin with. An umbrella policy, on the other hand, can step in and cover the legal defense and settlement costs directly.

An umbrella policy doesn't just raise the ceiling on your existing protection; it builds new walls where none existed, offering a much wider shield against unforeseen liabilities.

Understanding Self-Insured Retention (SIR)

When your umbrella policy "drops down" to cover a claim your primary insurance won't, you’ll typically have to pay a self-insured retention (SIR) first. Think of it like a deductible—it’s the amount you pay out-of-pocket before the umbrella coverage kicks in. The SIR amount usually falls somewhere between $1,000 and $10,000.

This structure is what allows an umbrella policy to affordably cover such a broad range of risks. By truly getting a handle on what is umbrella insurance, you can see its value as a powerful defense mechanism, protecting your assets from liabilities that other policies simply leave exposed.

Comparing Coverage Scope and Policy Structure

When you get down to the brass tacks, the real difference between excess liability and umbrella insurance lies in how they're built. One gives you “vertical” coverage, and the other offers “horizontal” protection. This isn't just jargon—this structural difference completely changes how each policy shields your assets from risk.

An excess liability policy is a textbook example of vertical coverage. Think of it like adding more stories to a single building. You're increasing the height of your protection, but you're not expanding the foundation. It latches onto one specific underlying policy—say, your general liability—and just boosts the dollar limit for the exact same risks covered by that original policy.

On the other hand, an umbrella policy delivers horizontal coverage. Picture a massive, sturdy roof that extends over your entire property, covering several different buildings at once. This single policy spreads its high limits across multiple underlying policies, like general liability, commercial auto, and employer's liability, creating one unified, comprehensive shield.

Policy Language and the Follow Form Rule

The mechanics behind this difference come down to the policy language itself. Excess liability is almost always a "follow form" policy. This means it strictly copies the terms, conditions, and exclusions of the policy it sits on top of. It doesn't think for itself; it just follows the leader. If your primary policy has a coverage gap, the excess policy has the exact same gap.

Umbrella insurance, however, often uses its own unique policy form. While it also extends your limits, it can introduce its own broader terms, effectively filling in the gaps your primary policies leave behind. That’s a crucial distinction that creates a far more robust safety net.

Key Takeaway: An excess liability policy is a follower—it can never provide better coverage than the policy beneath it. An umbrella policy can be a leader, offering its own, often broader, coverage definitions for scenarios your other policies won’t touch.

The Game-Changer: Drop-Down Coverage

This fundamental structural difference is what makes an umbrella policy’s most powerful feature possible: drop-down coverage.

Let’s say a claim comes in that isn't covered by any of your primary policies, like a lawsuit for libel or slander. An umbrella can "drop down" and act as the primary insurance for that specific claim, kicking in after you pay a deductible known as a self-insured retention (SIR). An excess policy simply can't do this. If there’s no underlying coverage to follow, it provides no protection at all.

In-Depth Structural and Coverage Comparison

To really see how these policies operate in the wild, it helps to put their core features side-by-side. The table below breaks down the key distinctions in how they are structured and what they cover.

| Aspect | Excess Liability | Umbrella Insurance |

|---|---|---|

| Coverage Direction | Vertical: Stacks on a single underlying policy. | Horizontal: Spreads over multiple underlying policies. |

| Policy Language | Follow Form: Mirrors the terms of the primary policy exactly. | Own Form: Can have its own, often broader, terms and conditions. |

| Gap Filling | No: Cannot cover what the primary policy excludes. | Yes: Features "drop-down" coverage for risks excluded by primary policies. |

| Typical Use | Increasing limits for a specific, known risk exposure. | Providing broad, comprehensive protection against a wide range of liabilities. |

As you can see, the right choice really boils down to your specific risk management strategy.

If you just need to satisfy a contractual requirement for higher limits on one specific policy, the simple, vertical structure of an excess policy is a clean and efficient solution. But if your goal is to build a comprehensive defense against both the risks you see coming and the ones you don't, the horizontal, gap-filling power of an umbrella policy is the smarter play.

Analyzing Modern Costs and Market Pressures

When you're weighing excess liability vs. umbrella insurance, cost is naturally one of the first things to come up. It's a practical question, and understanding what's behind the price tag for each policy really helps you see their true value.

As a general rule, an excess liability policy is the more budget-friendly option. But that lower cost comes with a trade-off: its scope of protection is much narrower.

Because an excess policy is a "follow form" product, it just sits on top of one of your existing policies and copies its terms. Insurers aren't taking on new, unknown risks—they're just boosting the financial limit for risks they've already agreed to cover. This makes the underwriting process simpler and keeps the premiums down, making it a great choice for businesses that just need to hit a specific contractual requirement without a major overhaul.

The Higher Price of Broader Protection

On the other hand, umbrella insurance almost always has a higher price tag. That premium reflects the significantly broader safety net it provides. The insurer isn't just extending your limits; they're also plugging gaps and covering liabilities that your primary policies don't even touch.

This expanded scope requires a much deeper dive during underwriting, since the carrier has to evaluate a whole new set of potential claims.

That added cost buys you a far more robust defense. It shields your business across multiple policies and fills critical gaps—the kind of protection that can be the difference between a minor hiccup and a financial disaster when an unexpected claim hits. If you're wondering if that investment makes sense for you, our guide on how much umbrella insurance you might need can help put things in perspective.

Impact of Nuclear Verdicts on the Market

The insurance market today is also feeling the heat from a sharp rise in "nuclear verdicts"—jury awards that are astronomically higher than anyone expected. These massive payouts are forcing insurers to rethink risk and tighten their underwriting, which has a direct effect on the cost and availability of high-limit liability coverage.

We're seeing a significant and worrying trend: jury awards exceeding $10 million are becoming much more common. This volatility has made carriers extremely cautious, leading to higher premiums and stricter requirements for both excess and umbrella policies.

In 2024 alone, the number of these verdicts shot up to 135, a staggering 52% increase from the year before. This surge has pushed many insurers to slash their lead umbrella limits from $5 million down to $2 million or $3 million.

This shift makes it much harder and more expensive to secure the high levels of coverage you might need. You can read more about how verdicts are reshaping the market on ohioinsuranceagents.com. With this kind of market pressure, a careful cost-benefit analysis is more critical than ever.

Choosing the Right Policy for Your Business Needs

Figuring out the right policy—whether it's excess liability or umbrella—isn't about picking the "best" one. It's about taking a hard look at your company's unique risk profile and deciding which type of coverage truly fits the bill.

The right answer depends entirely on the kind of work you do and the specific liabilities you're likely to face.

When a Straightforward Boost is Enough

Let's take a marketing agency, for example. Say they land a major client who contractually requires them to carry a higher general liability limit than they currently have. In this case, an excess policy is the perfect solution.

Their need is clear and specific: they just need to add more dollars on top of that one existing policy. Since the agency isn't dealing with a ton of diverse, unpredictable risks, this targeted approach is both smart and cost-effective. It gets the job done without overcomplicating things.

When You Need a Wider Safety Net

Now, think about a construction company. Their world is filled with risk from every angle—company trucks on the highway, active job sites with heavy machinery, and constant interaction with the public. Their exposures are all over the map.

This is where a broad umbrella policy really shines. It provides a single, unified layer of extra protection over their auto, general liability, and even employer’s liability policies. It's a comprehensive shield for a business that faces a multitude of threats.

Ultimately, the decision boils down to one simple question: Are you trying to solve a single, specific problem, or are you building a comprehensive defense against a wide range of potential disasters? Many businesses will secure their base liability policies with limits around $2 million per occurrence and $4 million aggregate before even considering this next layer.

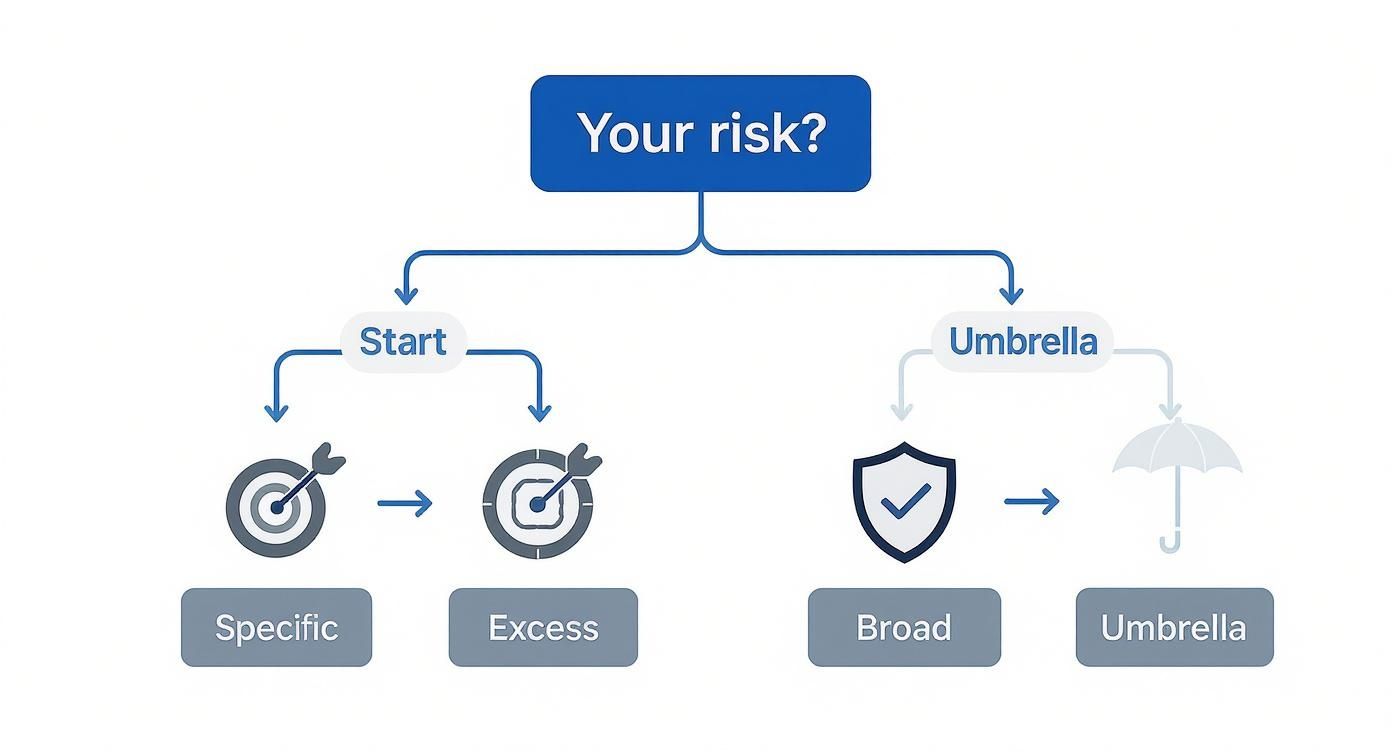

This decision tree infographic breaks it down visually, focusing on whether your risks are narrow or broad.

As you can see, if you just need to deepen the coverage for a risk you already know and have insured, the excess policy is your direct route. But if you need a much wider shield to guard against varied and sometimes unforeseen liabilities, the umbrella policy is the strategic move.

To help you get clear on your own needs, ask yourself a few key questions:

- What are the biggest risks I face that my primary policies don't cover?

- Do I have multiple contracts that all demand different liability limits?

- Is my main goal here to simply raise my policy limits, or do I need to plug potential coverage gaps?

These policies don't exist in a vacuum, either. They are a critical piece of a much larger puzzle. It's wise to also explore proven methods for protecting assets from lawsuits to ensure your entire financial foundation is secure.

By carefully thinking through your unique situation, you can choose the policy that gives you true peace of mind. For a deeper dive into this, check out our complete guide on what is commercial umbrella insurance.

Common Questions About Excess Liability and Umbrella Policies

When you're trying to decide between an excess liability and an umbrella policy, a few key questions always seem to pop up. Let's tackle some of the most common ones to help you get a clearer picture.

Can I Have Both an Excess and an Umbrella Policy?

Technically, yes, but it's not a common strategy. You might see a business with highly specific risks do this. For instance, they could use an excess liability policy to satisfy a very high, contractually required limit for their general liability, and then layer a separate umbrella policy on top for broader protection over all their other coverages. This kind of setup is usually reserved for companies with particularly complex or high-stakes risk profiles.

Is One Policy Always Cheaper?

More often than not, excess liability insurance comes with a lower price tag. The reason is simple: it’s a "follow form" policy. The insurer is just agreeing to cover more of the same risks your primary policy already handles, not new ones.

An umbrella policy, on the other hand, costs more because it provides broader coverage. It's designed to step in and cover claims your underlying policies might specifically exclude. For the insurance company, that wider net of potential claims represents a greater risk, which is reflected in the premium.

Key Insight: Think of it this way: the price difference boils down to the scope of protection. A lower premium for an excess policy buys you deeper pockets for your existing coverage. A higher premium for an umbrella policy buys you both deeper pockets and a wider safety net.

How Does a Self-Insured Retention (SIR) Work?

A self-insured retention (or SIR) is a feature unique to umbrella policies. It’s essentially a deductible that you have to pay only when your umbrella policy “drops down” to cover a claim that isn’t covered at all by your primary insurance.

Here's a quick example: Imagine your business is hit with a $150,000 slander lawsuit. Your general liability policy excludes this, but your umbrella policy covers it, and it has a $10,000 SIR. In this case, you would pay the first $10,000 yourself, and your umbrella policy would then kick in to cover the remaining $140,000.

Picking the right liability protection is a crucial part of safeguarding your business's future. The experts at Wexford Insurance Solutions are here to help you sort through your specific risks and find the perfect fit. To make sure you have the comprehensive coverage you truly need, get in touch with us by visiting https://www.wexfordis.com.

How to negotiate insurance settlement: Win your claim

How to negotiate insurance settlement: Win your claim 7 Cyber Insurance Claims Examples You Need to See in 2025

7 Cyber Insurance Claims Examples You Need to See in 2025