Here's a simple truth: Personal property coverage is the part of your homeowners or renters insurance that protects the items inside your home. Imagine turning your house upside down and giving it a good shake. Everything that falls out, from your sofa to your socks, is what this coverage is designed to repair or replace if it's damaged or stolen.

What Is Personal Property Coverage Anyway?

Think of your home's structure as the shell and everything you've filled it with as the valuable contents. While dwelling coverage protects the building itself, personal property coverage—often known in the industry as Coverage C—is all about your belongings. It's the financial safety net that steps in after a disaster like a fire or a break-in, helping you get back on your feet without having to pay for everything out of pocket.

Grasping how this works is the first step toward real peace of mind. Without it, the financial burden of replacing everything from your expensive laptop to your everyday dishes would fall squarely on your shoulders. It's a fundamental piece of most home and renters policies for a reason. To see how it fits into the bigger puzzle, you can review the different types of home insurance coverage available.

Everyday Items vs. Valuables

Most standard policies do a fantastic job of protecting the things you use daily—think furniture, clothes, and kitchenware. Where things get a bit tricky is with high-value items. Insurers often place special, lower limits on categories like jewelry or fine art. This distinction is absolutely crucial to understand, because assuming everything is covered equally can lead to some major, and often disappointing, surprises when it's time to file a claim.

Your insurance is there to make you whole again after a loss. Personal property coverage ensures that this extends beyond just the walls of your home to the items that make it your own.

The sheer scale of this protection is massive. The global personal property insurance market was valued at approximately USD 1,163.85 billion in 2021, and that number is only climbing as more people recognize just how essential this coverage is.

At Wexford Insurance Solutions, our job is to help you see the complete picture. We've put together a quick breakdown to give you a clear idea of what’s typically covered and what might need a little extra attention.

Personal Property Coverage at a Glance

Here’s a quick summary of items that are generally covered under a standard policy versus those that typically have special limits or require additional coverage.

| Typically Covered Items | Items with Special Limits |

|---|---|

| Furniture (sofas, tables, beds) | Jewelry, watches, and furs |

| Electronics (TVs, laptops, phones) | Fine art, antiques, and collectibles |

| Clothing, shoes, and accessories | Firearms and related equipment |

| Kitchen appliances and utensils | Silverware and goldware |

| Linens, bedding, and home décor | Cash, securities, and business property |

| Sports equipment and bicycles | Watercraft and their trailers |

This table gives you a starting point. The key takeaway is that if you own anything in that second column, it's worth having a conversation about getting the right amount of protection.

What Your Policy Actually Covers (and What It Doesn't)

Think of your personal property coverage as a safety net. But like any net, it has a specific design—it’s made to catch you when certain things go wrong. In the insurance world, these specific events are called covered perils. These are the incidents, like a fire or a break-in, that your policy explicitly agrees to pay for.

Getting a handle on which perils are on that list is the single most important step to understanding your policy. It’s the difference between feeling secure and actually being financially protected when disaster strikes.

The usual suspects: Common Covered Perils

Most standard homeowners or renters policies are what we call "named peril" policies. It’s a pretty straightforward concept: if a cause of damage isn't specifically named in the policy, it's not covered. While the exact wording can vary between insurers, most policies will protect you from the same core group of disasters.

And this protection is vital. Property damage and theft aren't just minor risks; they account for a staggering 97.3% of all homeowners insurance claims filed in the U.S. Weather, in particular, is a major driver, with events like storms and hail impacting roughly 5.3% of all insured homes each year. If you're interested in the data behind this, you can learn about homeowners insurance statistics at III.org.

So, what are these common perils? Here are a few you'll almost always see:

- Fire and Lightning: A kitchen fire gets out of hand and ruins your cabinets and appliances. Your policy is designed to help you replace them.

- Theft and Vandalism: Someone breaks in and makes off with your laptop and TV, or spray-paints your garage door. This is exactly what theft coverage is for.

- Windstorm and Hail: A nasty storm blows through, shattering your patio table and sending your grill flying. That's typically covered.

- Weight of Ice, Sleet, or Snow: The sheer weight of a heavy winter snowfall causes your porch awning to collapse, crushing the furniture underneath. Your policy can help cover the replacement.

- Certain Types of Water Damage: This one is tricky, so pay attention. We're talking about sudden and accidental events, like a pipe bursting behind a wall and flooding your finished basement.

Getting comfortable with the language in your policy documents is key. For a more detailed guide on this, take a look at our article on how to read an insurance policy.

Drawing the Line: What's Not Covered

Just as crucial as knowing what your policy covers is knowing what it doesn't. These are called exclusions, and they are the clear boundaries of your safety net. Overlooking them is a common mistake that can leave you with a false sense of security and a massive, unexpected bill.

An exclusion is a specific event, situation, or type of damage that your insurance policy will not pay for. Understanding these limits is just as important as knowing your benefits.

Here are some of the most common things a standard personal property policy will not cover:

- Floods: This is the big one. Damage from rising water—whether it’s a hurricane storm surge or a nearby river overflowing its banks—is almost never included in a standard policy. You need separate flood insurance for that.

- Earthquakes: Just like floods, damage from the earth shaking is a standard exclusion. If you live in a seismically active area, you’ll need to add a separate earthquake policy or endorsement.

- General Wear and Tear: Insurance is built for sudden and accidental events, not the slow march of time. It won’t pay to replace your couch just because the cushions are sagging after a decade of use.

- Pest Infestations: Damage from termites, mice, or other pests is considered a home maintenance issue, not an insurable event.

By understanding both the covered perils and the major exclusions, you get a much more realistic picture of your protection. It puts you in the driver's seat, allowing you to spot the gaps and decide if you need to add more coverage where it matters most.

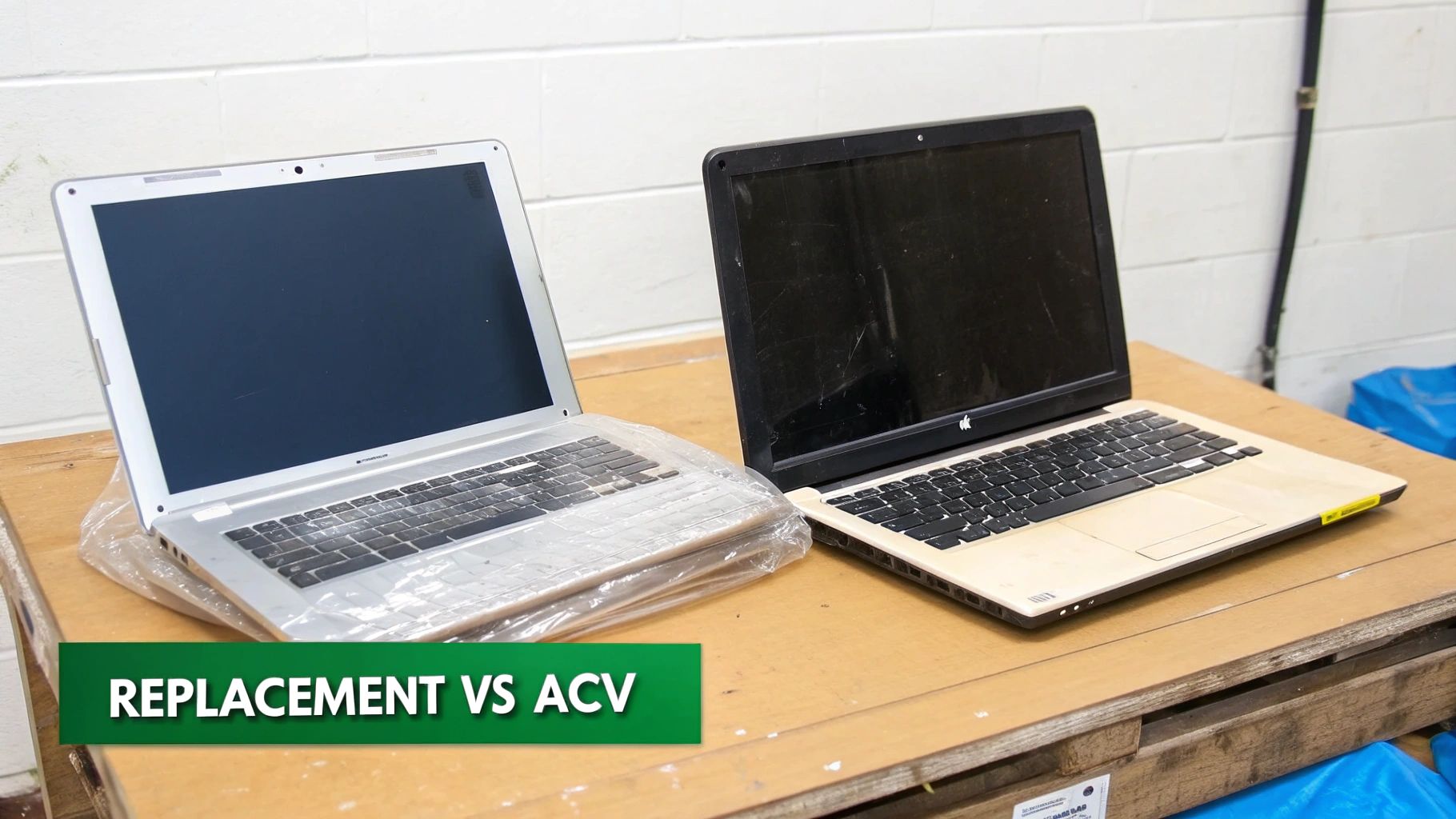

Replacement Cost vs Actual Cash Value Explained

When you file a claim, your insurer has to figure out a crucial detail: how much were your lost or damaged items actually worth? The answer to that question dictates your payout and comes down to two very different approaches: Replacement Cost Value (RCV) or Actual Cash Value (ACV).

Knowing the difference isn't just a technicality—it's everything. It directly impacts your ability to recover financially after a loss.

Let's imagine your trusty five-year-old laptop is destroyed in a fire. It worked just fine, but it was far from new. How your policy responds depends entirely on whether it’s based on RCV or ACV, and the payout from each can be worlds apart.

What is Actual Cash Value?

Think of Actual Cash Value (ACV) as the "garage sale" price of your stuff. It pays you what your item was worth the moment before it was lost. The formula is straightforward: the cost to buy a new, similar item today, minus depreciation.

Depreciation is just a way of accounting for an item's age and the wear and tear it's seen over the years.

Let's look at that five-year-old laptop again:

- A brand-new, similar model today costs $1,200.

- Your insurer calculates that over five years, it has depreciated by $800.

- Your ACV payout would be just $400 ($1,200 – $800).

While an ACV policy usually comes with a lower premium, the payout often falls short of what you need to buy a new replacement. You get the cash value of your old item, and you're on the hook for the rest.

Why Replacement Cost Value is Different

Replacement Cost Value (RCV) is a whole different ballgame. It ignores depreciation entirely. This coverage is designed to give you enough money to buy a brand-new, similar item at today's prices. The goal is to make you whole again without you having to downgrade or pay out-of-pocket.

Using the same laptop example:

- The cost to replace your laptop with a new, similar model is $1,200.

- With RCV, your insurance payout would be the full $1,200.

This means you can head to the store and buy a new laptop without touching your savings. If you want to dig deeper into how this powerful coverage works, you can learn more about what replacement cost coverage is and the security it offers.

Key Takeaway: RCV helps you replace old items with new ones. ACV gives you the cash value of your old items, which is almost always less than what you’ll need for a new replacement.

Most insurers pay out RCV claims in two parts. First, they’ll give you the actual cash value. Then, once you've actually bought the replacement and sent them the receipt, they'll pay you the difference. It's their way of making sure the money is used to get you back on your feet.

Yes, RCV policies cost a bit more, but the peace of mind they deliver after a major loss is worth every penny.

Protecting Your Most Valuable Possessions

Your standard personal property coverage does a great job of protecting the everyday stuff in your home, from your couch to your coffee maker. But when it comes to your most valuable and sentimental items, that standard coverage can feel more like a leaky umbrella than a real shield. Why? Because nearly every policy has coverage sub-limits—specific dollar caps for certain types of items.

Think of it this way: your total personal property coverage might be $100,000, which sounds more than adequate. But buried in the policy details, you might find a sub-limit that caps coverage for all your jewelry at just $1,500. If your $10,000 engagement ring is stolen, you’re only getting $1,500 back. That’s a painful gap. Insurers put these limits in place because things like jewelry, fine art, and firearms are prime targets for theft and their value can be tricky to pin down.

Scheduling Your Valuables for Real Protection

So, how do you patch that hole in your coverage? The answer is an insurance strategy called scheduled personal property. This is an endorsement—a simple add-on—to your existing policy that lets you list out your high-value items individually.

Instead of lumping all your valuables under one low category limit, scheduling gives each item its own specific coverage amount, almost always based on a professional appraisal. It essentially takes an item out of the general "stuff" pile and gives it VIP status.

Let’s revisit that engagement ring. By scheduling it, you’re no longer just insuring "jewelry" up to a generic limit. You are insuring that specific ring for its full appraised value of $10,000. If it's lost, stolen, or damaged, you’re covered for the entire amount, not just the base policy’s $1,500. This is a must-do for anyone with high-value collections, and our team can walk you through getting started with valuable personal property insurance.

The Added Benefits of Scheduling

Listing an item on a schedule does more than just raise the coverage limit. It fundamentally changes how it's protected, bringing some powerful perks you won't find in a standard policy.

-

Broader Coverage: Scheduled items are usually covered on an "all-risk" (or "open peril") basis. This is a game-changer. It means the item is protected from just about anything that could happen to it, unless a cause is specifically excluded. Standard policies, on the other hand, only cover "named perils" like fire and theft. What does that mean in the real world? If you accidentally lose your scheduled ring down the drain, you're covered. A standard policy wouldn't touch that claim.

-

No Deductible: In most cases, claims for scheduled items come with a $0 deductible. If your $10,000 ring is stolen, you get a check for $10,000. You don't have to first pay your policy's standard $500 or $1,000 deductible out of pocket.

Scheduling a valuable item transforms its protection from a generic, limited safety net into a personalized, comprehensive shield. It ensures that the items you care about most are protected for their true worth against a wider range of potential disasters.

This need for specialized protection is becoming more important every year. The global property and casualty insurance market recently saw personal lines premiums hit $1.1 trillion, a growth rate that’s actually outpacing the global GDP. As the value of our assets and the cost to repair or replace them continues to climb, getting your coverage right has never been more critical. You can discover more insights about these insurance trends to see why this kind of detailed protection matters so much today.

To get an item scheduled, you’ll just need a recent professional appraisal or a detailed bill of sale. This simple piece of paper confirms the item’s value and makes sure you’re buying exactly the right amount of coverage—no more, no less. It’s a small step that provides an incredible amount of security for the things you truly can't imagine losing.

How to Navigate the Claims Process with Confidence

Dealing with a fire, a break-in, or any other disaster is one of the most stressful things a person can go through. Your personal property coverage is there to help you put the pieces back together, but the claims process itself can feel like a mountain to climb. The secret to a smooth claim isn't what you do after something happens—it's all about the prep work you do right now.

The most powerful tool in your arsenal is a detailed home inventory. Think of it this way: without an inventory, you're trying to remember every single thing you own from a frazzled memory. With it, you're simply checking items off a list. It transforms a chaotic guessing game into a straightforward process.

The Power of Proactive Documentation

Creating an inventory isn't as hard as it sounds. A great starting point is using an essential moving inventory list template to get organized. Just go through your home, room by room, and make a record of what's there.

For an inventory that will really work for you, make sure you capture:

- Photos and Videos: A picture is worth a thousand words, and in a claim, it's undeniable proof. Get wide shots of each room and then zoom in on your more valuable items.

- Receipts and Appraisals: For big-ticket items like your new couch or that 4K TV, having a digital copy of the receipt is gold. For jewelry, art, or collectibles, a professional appraisal is a must.

- Serial Numbers: Take a quick photo of the serial numbers on your electronics and appliances. This is critical for proving ownership and can even help track down stolen goods.

Once you have all this information, don't just leave it on your computer. Upload it to a secure cloud service like Dropbox or Google Drive. That way, if your home and your computer are gone, your proof of ownership is safe and sound.

A detailed home inventory is your best advocate during a claim. It provides your adjuster with the clear, organized proof needed to process your settlement quickly and fairly, ensuring you receive the full value you're entitled to.

Steps to Take Immediately After a Loss

When a disaster hits, your head will be spinning. Knowing the first few steps can make all the difference in getting your life back on track.

- Ensure Your Safety: Before anything else, make sure you and your family are out of harm's way. If your home isn't safe, get out.

- Prevent Further Damage: If you can do so safely, take small steps to stop things from getting worse. This could be as simple as putting a tarp over a hole in the roof or boarding up a broken window. Hang on to the receipts for any materials you buy—these temporary repairs are often covered.

- Notify Your Insurer Promptly: Call your insurance agent or the company's claims line as soon as you can. They’ll get the ball rolling and assign a claims adjuster to your case who will walk you through what comes next.

For a deeper dive, check out our complete guide to the homeowner insurance claim process. Having your inventory ready and knowing these initial steps will give you the confidence to manage the situation and turn a moment of chaos into a manageable recovery.

Time for a Personalized Coverage Review?

Figuring out personal property coverage can feel like a maze, but it's one of the most critical financial safety nets you can have. You now know the difference between Replacement Cost and Actual Cash Value, and you can spot which of your valuables might need a little extra attention. A standard policy is a solid starting point, but real security comes from a plan that’s built for your life.

And that’s where an expert can make a world of difference. An off-the-shelf policy just can't see the full picture—your unique collections, your lifestyle, your specific financial situation. Without a professional looking over your shoulder, you could have dangerous gaps in your protection and not even know it until you need to file a claim.

Closing the Gaps in Your Protection

At Wexford Insurance Solutions, we do more than just sell insurance—we craft protection strategies tailored to you. Because we’re an independent agency, our loyalty is to you, not to a single insurance company. That freedom allows us to give your current coverage an honest, unbiased look to find exactly where you might be exposed.

Our whole process is built to give you clarity and confidence. We help you:

- Spot the Hidden Risks: We'll comb through your policy to find those common (and costly) gaps, like jewelry limits that are way too low or missing coverage for things like water backup.

- Get the Full Value: We make sure you’re set up with the right valuation—RCV instead of ACV—so a disaster doesn’t force you to dip into your savings just to get back on your feet.

- Protect Your Valuables Properly: Our team will walk you through scheduling your high-value items, whether it's an engagement ring, a piece of fine art, or a vintage guitar collection, making sure they have the rock-solid protection they need.

Your insurance should be as unique as the life you've built. A personalized review is the only way to ensure every aspect of your property is protected for its true worth.

Expertise for Every Stage of Life

Whether you’re a first-time homeowner just starting out or a high-net-worth individual with a complex collection of assets, our team has seen it all. We understand the unique challenges different clients face and know how to strike the perfect balance between ironclad coverage and a price that makes sense.

Don't leave your financial well-being to guesswork. A quick conversation can reveal ways to strengthen your protection and might even put some money back in your pocket. Let the experts at Wexford Insurance Solutions provide a complimentary, no-obligation review of your personal property coverage.

It's time to get complete peace of mind. Contact Wexford Insurance Solutions today to schedule your personalized policy assessment and make sure the things you value most are properly protected.

Frequently Asked Questions

When you start digging into the details of personal property coverage, a lot of specific questions pop up. It’s only natural. Here are some of the most common ones we hear from clients, with straightforward answers to help you feel confident about your policy.

How Much Personal Property Coverage Do I Need?

This is the big one, and getting it right is crucial. The best way to figure it out? Roll up your sleeves and do a home inventory. Seriously, walk through every room and make a list of everything you own—from the big-ticket items like your couch and TV down to your clothes and kitchen gadgets. Then, estimate what it would cost to buy all of it brand new today.

Sure, a common industry rule of thumb is to set your coverage at 50% to 70% of your home's insured value, but that's just an educated guess. Your personal inventory is the only way to know for sure that you won't come up short if you have to replace everything after a major loss.

Does Coverage Follow Me When I Travel?

Good news—in most cases, yes! Your policy usually includes what’s called “off-premises” coverage. This means if your laptop gets snatched from your car or your jewelry is stolen from a hotel room, you’re still protected.

But here’s the catch: this off-premises coverage is typically capped at a much lower amount, often around 10% of your total personal property limit. It's always a smart move to check your policy for the exact details before you head out, especially if you’re traveling with valuables.

Key Insight: Think of off-premises coverage as a safety net for your belongings wherever you go, but remember that it has its own limits. A quick policy check before a big trip can save you a major headache later.

Is My Roommate Covered by My Policy?

This question comes up all the time, and the answer is a hard no. A standard homeowners or renters policy covers you and relatives who live with you. Your roommate, even if they’re your best friend, doesn't count as a relative in the eyes of an insurance company.

To be protected, every roommate needs to get their own renters insurance policy. It's a simple step that prevents a lot of potential financial pain and awkward conversations if a fire or theft ever happens.

What About Specialized Items Like Boats?

Standard policies are pretty restrictive when it comes to motorized vehicles, and boats are a perfect example. While your policy might offer a tiny sliver of coverage for a small canoe, anything with a motor needs its own protection. That's why so many people look into how much does pontoon boat insurance cost with examples, because it falls into a category that requires a completely separate policy.

Named Peril vs All-Risk Policies Explained

Knowing which type of policy you have makes all the difference in understanding what’s actually covered. It boils down to two main types:

- Named Peril Policy: This is exactly what it sounds like. It only covers losses from specific events—or "perils"—that are explicitly listed in your policy, like fire, theft, and wind. If the cause of damage isn't on that list, you're not covered.

- All-Risk Policy: This is the one you want. Often called an "open peril" policy, it provides much broader protection. It covers you against everything except the specific events listed as exclusions (like floods or earthquakes).

This is why scheduling high-value items is so powerful. Those endorsements almost always provide all-risk coverage, giving your most prized possessions the superior protection they deserve.

Getting the fine print right on your personal property coverage is what lets you sleep at night. At Wexford Insurance Solutions, our specialty is digging into your existing policies, finding the gaps you might not see, and building a plan that truly fits your life.

What Is a Certificate of Insurance? Your Practical Guide

What Is a Certificate of Insurance? Your Practical Guide What Is Commercial General Liability Insurance?

What Is Commercial General Liability Insurance?