Think of Commercial General Liability (CGL) insurance as the essential safety net for your business. It's the policy that steps in to protect you financially when your daily operations accidentally cause harm to someone else or their property.

What Is Commercial General Liability? Your Business Safety Net Explained

Let’s make this real. Say you own a small retail shop. On a rainy day, a customer walks in, slips on a wet patch by the door, and breaks their wrist. Suddenly, you're on the hook for their medical bills and maybe even a lawsuit. For a small business, that kind of unexpected expense can be devastating.

That’s exactly where CGL comes in.

It's your first line of defense against the everyday, unpredictable risks that come with doing business. And it’s not just for slip-and-fall accidents. Whether you’re a contractor whose ladder damages a client's window, a consultant whose marketing slogan is too similar to a competitor's, or a shop owner whose product causes an injury, CGL is designed to handle these third-party claims.

A strong CGL policy is a crucial piece of your overall business protection plan, working alongside other strategies like effective construction project risk management. It makes sure one bad day doesn't sink your entire operation.

The Core Purpose of CGL

At its core, a CGL policy is a straightforward deal: you pay a regular premium, and in return, an insurance company takes on the financial risk of specific claims against your business. The insurer agrees to pay for covered losses up to your policy limits, protecting your company's assets from being wiped out by legal judgments and defense fees.

This protection is non-negotiable for a few key reasons:

- Keeps You in Business: It prevents a single lawsuit from emptying your bank accounts, so you can keep the lights on even while navigating a claim.

- Opens Doors to Opportunity: Many clients, landlords, and partners won't even consider working with you unless you have proof of CGL coverage. It's a standard requirement for signing leases and winning contracts.

- Covers Legal Bills: A good CGL policy covers the cost of hiring lawyers to defend you, even if the lawsuit against you is completely frivolous. Those legal fees can add up fast.

To give you a clearer picture, here’s a quick breakdown of what CGL typically covers.

CGL Coverage at a Glance

This table offers a snapshot of the core protections found in a standard Commercial General Liability policy.

| Coverage Area | What It Protects Against | Real-World Example |

|---|---|---|

| Bodily Injury | Physical harm, sickness, or death to a third party caused by your business. | A customer slips and falls in your store, requiring medical attention. |

| Property Damage | Damage to or loss of use of someone else's property caused by your operations. | Your landscaping crew accidentally breaks a client's window with a rock. |

| Personal & Advertising Injury | Non-physical injuries like libel, slander, copyright infringement, or false arrest. | An advertisement for your business accidentally uses a copyrighted image. |

Understanding these basics is the first step toward building a solid financial foundation for your business.

CGL is designed to handle the "what-ifs" of daily business. To see how this policy fits into a complete insurance strategy, you can explore our guide on what commercial insurance covers. Ultimately, having the right coverage gives you the peace of mind to stop worrying about accidents and focus on what you do best: growing your business.

The Three Pillars of CGL Coverage

Think of a Commercial General Liability (CGL) policy less as a single shield and more as a three-legged stool. Each leg provides a different kind of support, and together, they create a stable foundation to protect your business from the most common risks you'll face.

Let's walk through what each of these "pillars" of coverage actually does in the real world, moving beyond the dense insurance jargon.

Pillar 1: Bodily Injury and Property Damage Liability

This is the bedrock of any CGL policy. It's the coverage everyone pictures when they think of liability insurance—it kicks in when your business operations, your products, or something on your property physically hurts someone or damages their stuff.

Bodily Injury coverage is all about protecting you when a non-employee gets hurt. It’s designed to handle the spiraling costs of medical bills, legal defense, and potential settlements.

- Real-World Scenario: A customer browsing your retail shop slips on a freshly mopped, unmarked floor and fractures their wrist. Your CGL policy is built to cover their medical treatment and any legal action that follows.

- Another Example: You run a landscaping crew, and a branch you're cutting falls and strikes a neighbor watching from their yard. This coverage would respond to their injuries.

Property Damage liability works the same way, but for other people's property. If you accidentally break it, this coverage helps pay to fix or replace it.

- Real-World Scenario: An employee from your catering company is setting up for an event and accidentally knocks over a priceless vase in the client’s home. Your CGL policy would cover the cost to replace it.

- Another Example: Your construction company is working on a renovation, and a tool drops from a scaffold, smashing the windshield of a car parked below. The property damage portion of your policy would pay for the repair.

The Bottom Line: This is your frontline defense for tangible, physical accidents. It covers the slip-and-falls and the "oops" moments that can lead to some of the most expensive claims a business can face.

Pillar 2: Personal and Advertising Injury Liability

While the first pillar handles physical harm, this one is all about protecting you from claims of non-physical damage—things that can tarnish a reputation or infringe on someone's rights. It's a surprisingly critical defense in today's highly connected world.

Many business owners don't fully grasp this part, but it covers some very modern risks, including:

- Slander or Libel: Damaging another person's or company's reputation through false spoken (slander) or written (libel) statements.

- Copyright Infringement: Using a photo, song, or piece of text in your marketing materials without getting the proper permission.

- Wrongful Eviction: For property owners, this covers claims arising from improperly removing a tenant.

Imagine your marketing team grabs what they think is a royalty-free image from the internet for a new ad campaign. It turns out, it's copyrighted by a professional photographer who then sues for infringement. This is exactly where your Personal and Advertising Injury coverage would step in to handle the legal mess.

It’s easy to confuse this with problems caused by your actual products, which fall under a different type of protection. For a closer look at that, you can learn more by reading our guide on what product liability insurance is.

Pillar 3: Medical Payments Coverage

The third pillar, usually called Medical Payments or MedPay, is a bit different. It’s a proactive, no-fault coverage designed to handle minor medical bills if someone gets injured on your premises or because of your operations.

The key here is "regardless of who is at fault."

Think of it as a goodwill fund. A customer gets a small cut on a sharp corner of a display case in your store. Instead of letting it fester into a potential lawsuit, MedPay allows you to immediately offer to cover the cost of their stitches. It's a simple gesture that can de-escalate a situation and show you're a responsible business owner.

This coverage has a much lower limit than your main Bodily Injury liability, often just $5,000 or $10,000. It’s not meant for major accidents. Its real job is to quickly and quietly resolve minor incidents, preserving your reputation and preventing a small problem from becoming a very large, very expensive one.

Understanding Your Policy Limits and Endorsements

No two Commercial General Liability (CGL) policies are exactly alike. While the core coverages are pretty standard across the board, the real-world protection your policy offers comes down to its specific limits and customizations. Getting these details right is the key to making sure your business is properly protected, without leaving any dangerous gaps.

Two of the most important numbers you’ll find on your policy are the limits of liability. I like to think of a CGL policy as a dedicated bank account for covering claims. This account has two main rules that dictate how much money can be paid out.

Per Occurrence vs Aggregate Limits

The Per Occurrence Limit is the absolute maximum your insurance company will pay for a single claim or incident. It’s like having a daily withdrawal limit on your bank account. No matter how many different costs stack up from one event, there’s a cap on how much you can pull out for that specific occurrence.

On the other hand, the Aggregate Limit is the total amount the insurer will pay for all claims combined during your policy period, which is almost always one year. This is like the total balance in your account for the entire year. Once it's gone, it's gone—and you're on the hook for any costs that come after.

For example, let's say your policy has a $1 million per occurrence limit and a $2 million aggregate limit. If a single lawsuit costs $1 million, your policy covers it fully. But what if you face three separate $700,000 lawsuits in one year? Your policy would cover the first two in full ($1.4 million total), but only $600,000 of the third claim before hitting that $2 million aggregate cap.

Grasping how these two limits work together is crucial. If you want to dig a bit deeper into this, our guide on what aggregate insurance coverage is breaks down how this cap really impacts your overall protection.

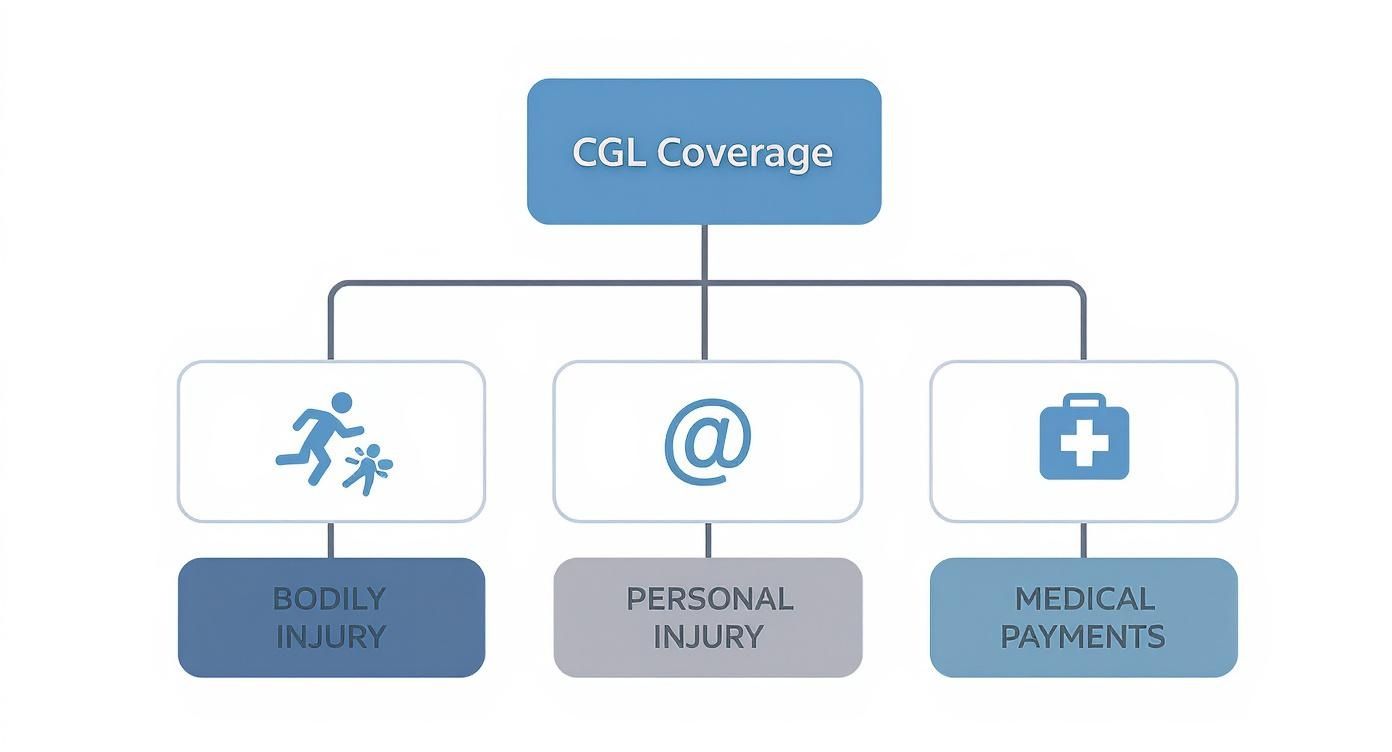

This infographic helps visualize the core coverages that these limits apply to.

As you can see, Bodily Injury, Personal Injury, and Medical Payments are the foundational pillars of CGL, and each one is governed by your policy's occurrence and aggregate limits.

Tailoring Coverage with Endorsements

Beyond the standard limits, we can modify a CGL policy with endorsements. These are essentially add-ons that either expand or, in some cases, restrict your coverage. Think of it like customizing a new car; you start with the base model and then add the specific features you need. Endorsements are what turn a generic policy into one that truly fits the unique risks of your industry.

A few common endorsements that add a ton of value include:

- Liquor Liability: This is non-negotiable for any business that sells or serves alcohol, as standard CGL policies almost always exclude incidents related to alcohol.

- Data Breach Coverage: An absolutely vital add-on for consultants, IT firms, or any business that handles sensitive customer data.

- Hired and Non-Owned Auto: This provides liability coverage if you rent vehicles for business or if an employee gets into an accident while using their personal car for a company errand.

Choosing the right endorsements ensures your policy is a perfect fit, not just a close one. The good news is that the commercial insurance market is currently quite favorable for buyers. In the third quarter of 2025, global commercial insurance rates actually declined by 4%—the fifth straight quarter of decreases after seven years of steady increases. This trend, largely driven by fierce competition among insurers, is creating opportunities for businesses to lock in better terms and broader coverage. Having an expert partner like Wexford Insurance Solutions in your corner means you can take full advantage of these market conditions to build a policy that truly protects what you’ve built.

Common Gaps in CGL Insurance Coverage

Knowing what your Commercial General Liability (CGL) policy covers is critical, but knowing what it doesn't cover is just as important. It’s a common mistake for business owners to see a CGL policy as a catch-all for any lawsuit that comes their way. Unfortunately, that assumption can leave you dangerously exposed.

A standard CGL policy is built to handle third-party claims for things like bodily injury and property damage, but its boundaries are very clear.

When you step outside those boundaries without the right kind of specialized coverage, it's like trying to use a hammer to fix a leaky pipe. Sure, you have a tool in your hand, but it’s the wrong one for the job. Spotting these common gaps is the first step to building an insurance plan that truly protects you.

Employee Injuries and Workers' Compensation

One of the biggest mix-ups we see is business owners thinking CGL covers injuries to their own team. That’s a firm “no.” CGL is designed to protect you from claims made by third parties—think customers, vendors, or visitors—not your employees.

If a staff member slips on a wet floor, hurts their back lifting inventory, or gets injured using company equipment, your CGL policy won’t do a thing.

You need a completely separate policy for employee-related injuries: Workers’ Compensation insurance. In most states, it’s legally required for any business with employees. It covers medical bills and lost wages for work-related injuries, protecting both your employee and your business.

Trying to skate by without workers' comp can lead to massive fines, penalties, and even personal liability for an injured employee’s medical costs. It’s a foundational policy that works alongside CGL, not instead of it.

Professional Mistakes and E&O Insurance

Another critical blind spot in a CGL policy is anything related to professional services. Your CGL policy is all about the physical world—it covers the financial fallout when your business operations cause an injury or damage property. What it doesn't cover are financial losses that happen because of your advice, a mistake you made, or an oversight in your work.

Think about it. If you’re a consultant, architect, or IT specialist, your biggest risk probably isn't a slip-and-fall in your office. It's giving advice or delivering a service that ends up costing your client a lot of money.

This is where a different kind of policy steps in:

- Professional Liability Insurance: You’ll often hear this called Errors & Omissions (E&O) insurance. It’s designed to cover claims of negligence, bad advice, or misrepresentation that causes a client financial harm.

For example, an accountant makes a filing error that triggers a huge tax penalty for their client. The E&O policy, not the CGL, would be the one to respond to that claim. To dig deeper into how this works, check out our guide on what Errors and Omissions insurance is.

Company Vehicles and Commercial Auto

Finally, never assume your CGL policy covers accidents involving vehicles used for your business. It doesn't matter if you have a whole fleet of delivery vans or just an employee who occasionally runs errands in their own car. Any accident involving a vehicle on company time falls outside the scope of general liability.

If an employee gets into an accident while driving for work, your CGL carrier will deny the claim for property damage and injuries. For this, you absolutely need a dedicated Commercial Auto policy.

This policy provides liability and physical damage coverage specifically for vehicles used in your business operations. Understanding these clear lines between policies is the only way to build a complete shield for your business, leaving no expensive gaps in your protection.

How CGL Insurance Costs Are Determined

Figuring out the price tag for a Commercial General Liability (CGL) policy can seem a bit opaque, but it's not a random number pulled from a hat. Insurers use a methodical process to size up the unique risks your business faces every day.

Think of it this way: a skydiving instructor is going to have a different risk profile than an accountant. The same fundamental logic applies to your business insurance. The premium you pay is a direct reflection of the potential for a third party to file a claim against you.

Key Factors That Shape Your CGL Premium

Every business has its own story, and insurance carriers look at several specific chapters to determine your final cost. The more risk they perceive in your operations, the higher your premium will be.

Here are the main drivers they zoom in on:

- Your Industry: This is the big one. A roofer working on steep pitches faces a world of different risks than a freelance writer working from home. High-risk fields like construction, hospitality, and manufacturing will naturally start with higher base rates.

- Business Size and Revenue: More foot traffic, more employees, and more sales all add up to more exposure. A bustling coffee shop serving hundreds of customers a day has a much higher chance of a slip-and-fall claim than a small, appointment-only art studio.

- Physical Location: Where you set up shop really matters. A business in a high-traffic urban center or a state known for being litigious will often see higher premiums than an identical business in a quiet, rural town.

- Claims History: Your track record speaks volumes. Much like your personal auto insurance, a clean history without frequent liability claims will work in your favor. Insurers see a history of claims as a red flag, which leads to higher costs.

CGL insurance is a cornerstone of risk management, shielding a business from the financial fallout of third-party claims. According to 2025 industry data, the average annual cost for a small business in the United States hovers around $360. To get a better sense of the market, it's helpful to look at liability insurance statistics and trends, which show typical premium increases of 5% to 10% per year, largely driven by rising claim costs.

Understanding Coverage Limits and Your Final Cost

The final piece of the pricing puzzle is how much coverage you decide to buy. Your policy limits—the maximum amount the insurer will pay—directly impact your premium. A policy with a $2 million aggregate limit will cost more than one with a $1 million limit because the insurance company is taking on a bigger potential payout.

It can be tempting to opt for the lowest limits to save a few dollars, but that can be a costly mistake. It's crucial to choose coverage that truly protects your company's assets. For a more detailed breakdown, you can check out our complete guide to general liability insurance costs.

An experienced agent at Wexford Insurance Solutions can help you find that sweet spot, making sure you have the protection you need without being dangerously underinsured or paying for coverage you don't.

A Practical Guide to Getting the Right CGL Policy

Knowing what a Commercial General Liability (CGL) policy is and actually getting the right one are two very different things. The process can feel like a maze, but if you have a clear roadmap, it becomes less of a chore and more of a smart business move. This guide will walk you through a straightforward way to find coverage that genuinely protects everything you’ve worked so hard to build.

The first step isn’t calling insurance agents. It starts with taking a hard, honest look at your own business. It’s all about figuring out where your specific risks are hiding.

Start with a Thorough Risk Assessment

Before you can even think about getting an accurate quote, you need a crystal-clear picture of what you’re protecting. For a contractor, the biggest risk might be accidentally damaging a client's property on a job site. For a small retail shop, the top concern is probably a customer slipping and falling in the aisle.

Take some time to think through your day-to-day operations and identify potential trouble spots.

- Customer Interactions: How and where do you interact with the public? Is it in a physical storefront, at a client’s home, or on a busy construction site?

- Operational Activities: What do your employees actually do? Are they operating heavy machinery, handling sensitive client property, or installing complex equipment?

- Marketing Efforts: How do you get the word out? Look over your ads, website, and social media for anything that could be misinterpreted or accidentally infringe on a copyright.

Doing this internal check-up is the bedrock of a smart insurance purchase. It arms you with a detailed understanding of your exposures, which makes the conversation with an insurance professional infinitely more productive.

Gather Your Documents and Compare Your Options

Once you've mapped out your risks, it’s time to get your paperwork in order. Insurers need concrete numbers to give you a precise quote. You’ll want to have these details ready:

- Annual revenue projections

- Total payroll figures

- A detailed list of your business activities

- Any history of prior insurance claims

With this info in hand, you can start comparing your options. It's so tempting to just grab the cheapest quote and call it a day, but that can be a massive mistake down the road. Price matters, of course, but the real value is in the policy's details—the limits, the exclusions, and any endorsements. That’s what determines how protected you really are when something goes wrong.

Choosing an insurance policy is about finding the right partner. An experienced agent doesn't just sell you a policy; they help you analyze quotes and understand the fine print, ensuring you get the best value, not just the lowest price.

At Wexford Insurance Solutions, we make this entire process easier. We start by helping you assess your risks and gather the right information. Then, we take that to our network of top-rated carriers and do the shopping for you. Our goal is simple: present you with clear, competitive options and give you the expert advice you need to pick a policy that provides solid protection without breaking the bank. We turn a complicated task into a confident, informed decision, so you can get back to focusing on what you do best—running your business.

Got Questions About CGL? We've Got Answers.

Even after you get the hang of the basics, some specific questions about Commercial General Liability (CGL) insurance always seem to pop up. Let's tackle some of the most common ones we hear from business owners, clearing up any confusion you might still have.

I Have an LLC, So I’m Protected, Right? Do I Still Need CGL?

This is probably one of the biggest misconceptions out there. Yes, you absolutely still need CGL insurance.

An LLC (Limited Liability Company) is a legal tool that separates your personal assets—like your house or your savings account—from your business. It builds a legal wall so if the business gets into trouble, your personal life isn't on the line.

But here’s the key: an LLC does absolutely nothing to protect the business itself. If your company gets sued, its bank accounts, equipment, and property are fair game. CGL insurance is what steps in to protect the business's assets by covering legal bills and settlements. Without it, one bad lawsuit could easily wipe out everything you've built.

What's the Difference Between CGL and Professional Liability?

It’s easy to mix these two up, but they cover very different types of risk. The simplest way to think about it is "doing" versus "advising."

CGL is all about tangible, physical harm. It covers claims if your business operations cause bodily injury to someone or damage their property. Professional Liability, on the other hand, is about financial harm caused by your expertise or services. It's often called Errors & Omissions (E&O) insurance for a reason.

Here's a quick way to keep it straight:

CGL covers what your business does. (Example: A plumber accidentally floods a client's kitchen.)

Professional Liability covers what your business knows or advises. (Example: A financial advisor gives bad advice that costs a client thousands.)

Is CGL Insurance Actually Required by Law?

While state or federal law doesn't always mandate it, CGL is very often a contractual requirement. In plain English, that means other people won't do business with you unless you have it.

You'll almost certainly be asked to show proof of CGL coverage in situations like these:

- Leasing an office or storefront: Landlords won't hand over the keys without it.

- Landing a big client project: Most companies, especially larger ones, build this requirement right into their contracts.

- Applying for a business loan: Banks want to know their investment is protected from a lawsuit.

So, while it might not be a "law" in the traditional sense, it’s a non-negotiable part of playing the game for most businesses.

Can I Just Bundle CGL with My Other Policies?

You sure can, and for many small businesses, it’s the best way to go. Insurers offer a package deal called a Business Owner's Policy (BOP), which is designed for this exact purpose.

A BOP typically combines CGL with commercial property insurance, and often throws in business interruption coverage as well. Bundling these essentials into a single policy isn't just more convenient—it's usually cheaper than buying each one separately. Talking to an insurance pro can help you figure out if a standalone CGL policy or a bundled BOP makes more sense for you.

Figuring out the ins and outs of CGL can feel like a chore, but it doesn't have to be. The team at Wexford Insurance Solutions lives and breathes this stuff. We can cut through the complexity, pinpoint your actual risks, and find coverage that’s both comprehensive and competitive.

Let us worry about the insurance so you can get back to growing your business.

Ready to feel more confident about your coverage? Visit us online to get started with a free quote from Wexford Insurance Solutions.

Your Guide to Personal Property Coverage

Your Guide to Personal Property Coverage Your Ultimate Fleet Vehicle Maintenance Checklist for 2025

Your Ultimate Fleet Vehicle Maintenance Checklist for 2025