A Business Owners Policy, or BOP, is your all-in-one insurance starter pack. It’s a smart bundle that combines three essential protections every small business needs: general liability, commercial property, and business interruption coverage. Buying them together in a BOP is almost always easier and more affordable than getting each policy on its own.

Your Quick Guide To Bop Insurance Coverage

Think of a BOP as a Swiss Army knife for your business's core risks. Instead of piecing together separate policies for every little thing, a BOP packages the essentials into a single, manageable plan. It’s designed specifically for the day-to-day realities of running a small or medium-sized business.

The best way to picture it is like a value meal at a restaurant. You get the main dish (property protection), the side (liability coverage), and the drink (lost income replacement) all for one price. It’s not just more convenient; it's cheaper than ordering everything separately. That's what a BOP does—it gives you a foundational safety net against the most common financial threats.

The Power of Bundled Protection

The real magic of a BOP is its efficiency. It elegantly answers the question, "what does a business owners policy cover?" by merging the three most critical types of protection into one.

- Simple to Manage: One policy, one premium, one renewal date. It cuts down on the administrative busywork so you can focus on your business.

- Real Cost Savings: Insurers love bundles, and they pass those savings on to you with significant discounts.

- Wide-Ranging Coverage: It provides a solid defense for everyday risks, whether a customer slips and falls in your shop or a fire ruins your inventory.

A BOP provides a fantastic foundation. To see how it fits into the larger world of business protection, you can explore in more detail what does commercial insurance cover and build from there.

To help you visualize what's inside a standard BOP, here's a quick breakdown of its core components.

Core Components of a Business Owners Policy

| Coverage Type | What It Protects | Example Scenario |

|---|---|---|

| Commercial Property | Your physical assets, like your building, equipment, inventory, and furniture, from events like fire, theft, or wind damage. | A kitchen fire damages your restaurant's ovens and inventory. This coverage helps pay to repair the building and replace the lost equipment and food stock. |

| General Liability | Your business from claims of bodily injury, property damage, or personal injury (like libel or slander) that you or your employees cause to others. | A customer slips on a wet floor in your retail store and breaks their arm. This helps cover their medical bills and any legal costs if they sue. |

| Business Interruption | Lost income and operating expenses if a covered event (like a fire) forces you to temporarily shut down your business. | After the fire, your restaurant is closed for two months for repairs. This coverage helps you pay your rent, employee salaries, and other bills until you can reopen. |

This table shows how the three pillars of a BOP work together to create a comprehensive safety net for the most common risks a business will face.

A BOP is designed to be the go-to, all-in-one solution for businesses whose insurance needs are relatively straightforward. It removes the guesswork by packaging the essentials, allowing owners to focus on growth instead of worrying about coverage gaps.

Just as a BOP covers these fundamental risks, other industries have their own non-negotiable insurance needs. For instance, trucking companies have to master the very specific FMCSA insurance requirements to stay on the road legally. It’s all about matching your protection to your operation. A BOP is the perfect starting point for most, but it’s the first step in building a truly complete insurance strategy.

The Three Pillars of a Business Owner’s Policy

A Business Owner’s Policy, or BOP, is really built on three core types of coverage. Think of them as the three legs of a stool—each one is essential for keeping your business stable and supported against common risks.

The real strength of a BOP is how these three coverages work together. Property insurance helps you rebuild what was physically lost, general liability shields you from costly lawsuits, and business interruption keeps cash flowing while you get back on your feet. It's a truly integrated defense system for your company.

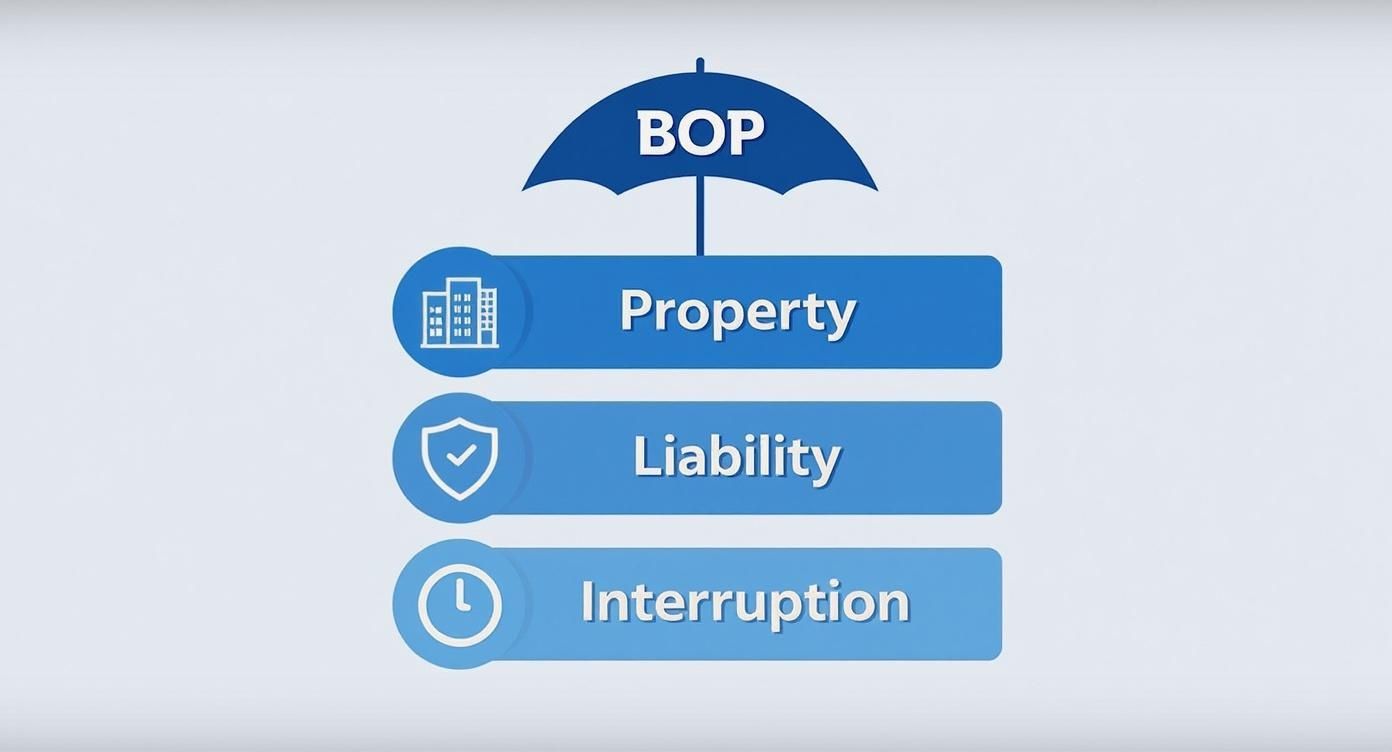

This diagram helps visualize how a BOP bundles these essential protections under one policy.

As you can see, the BOP acts like an umbrella, giving you property, liability, and interruption coverage all in one neat package.

Commercial Property Insurance: Protecting Your Stuff

First up is Commercial Property Insurance. This is the part of the policy that protects the physical things you need to run your business—your tangible assets. It’s the coverage that steps in to help you repair or replace your property after it’s been damaged or destroyed by something like a fire, theft, or major storm.

This protection is broader than you might think and typically covers:

- The Building: If you own your commercial space, this covers the structure itself from the foundation to the roof.

- Business Personal Property (BPP): This is a catch-all term for pretty much everything inside your building—your computers, desks, inventory, specialized machinery, and even the light fixtures.

- Property of Others: If you have customer property in your possession (think of a dry cleaner or an IT repair shop), this can help cover the loss if it gets damaged while in your care.

Put simply, if a disaster hits, this is the coverage that foots the bill to rebuild your shop, restock your inventory, and replace your crucial equipment. A single fire could be a business-ending event without it. For a closer look at all the ways you can protect your business, our guide to commercial insurance types is a great resource.

General Liability Insurance: Protecting You from People

Next, we have General Liability Insurance. While property insurance protects your things, general liability protects you when your business is accused of harming other people or their things. In our modern, lawsuit-heavy world, this coverage isn't just a good idea—it’s absolutely essential.

A single slip-and-fall claim can spiral into a financially crippling lawsuit for a small business. General liability insurance acts as your financial shield, covering legal defense costs, settlements, and court-ordered judgments so you don't have to drain your bank accounts.

This coverage is designed to handle three main scenarios:

- Bodily Injury: If a customer slips on a wet floor in your store or a vendor trips over a cord, this helps pay for their medical bills and your legal defense.

- Property Damage: If one of your employees accidentally damages a client's property—like a landscaper breaking a window—this covers the cost of repairs or replacement.

- Personal and Advertising Injury: This covers less tangible harms, like claims of slander, libel, or copyright infringement in your marketing materials.

While a BOP is a powerful financial tool, it works best when paired with a solid legal foundation. It's always a good idea to supplement your insurance by understanding the liability protection offered by incorporating your business.

Business Interruption Insurance: Your Financial Lifeline

The third and final pillar is Business Interruption Insurance. This is often the most overlooked part of a BOP, but it can be the single most important factor in whether a business survives a major catastrophe. It’s designed to replace lost income and cover your day-to-day expenses if a covered property claim forces you to temporarily close your doors.

Imagine a fire makes your restaurant unusable for three months. Your property insurance will pay to rebuild, but what about your mortgage, payroll, and utilities during that time? How do you make up for all that lost revenue? That’s exactly what business interruption coverage is for.

It helps you stay afloat by covering:

- Lost Net Income: Replaces the profits you would have normally earned if the disaster hadn't happened.

- Ongoing Operating Expenses: Takes care of fixed costs like rent, loan payments, taxes, and key employee salaries.

- Temporary Relocation: Helps pay the costs of setting up and operating from a temporary location while your main one is repaired.

The average cost of a BOP for a U.S. business in 2025 is around $1,767 per year. Of course, this varies quite a bit. A low-risk accounting firm might pay under $120 a month, while a high-traffic restaurant could easily pay more than $170 monthly. This price difference reflects the unique risks each business faces, and the potential need for business interruption coverage is a huge part of that calculation.

Understanding Your BOP's Built-In Limitations

A Business Owners Policy is a fantastic starting point, but it's important to be realistic about what it does. Think of it like a starter toolkit. It's packed with the essential tools you'll use almost every day—the hammer, screwdriver, and wrench. But it’s not going to have the specialized gear you’d need for a major plumbing or electrical job.

In the same way, a BOP bundles the most common protections most businesses need, but it has very clear boundaries. Knowing what a BOP doesn't cover is every bit as critical as knowing what it does. Overlooking these built-in exclusions can leave you dangerously exposed when you think you’re protected.

Why Some Risks Aren't Included

The whole point of a BOP is to offer broad, affordable coverage by packaging risks that nearly every business faces, like a fire at your office or a customer slipping on a wet floor. It keeps things simple and cost-effective.

But some risks are highly specific to certain industries or operations. For instance, the risk of a surgeon making a mistake is vastly different from the risk of a bakery selling a stale pastry. Lumping these unique, high-stakes risks into every standard policy would make insurance unaffordable for the average small business owner.

That’s why insurers pull these specialized risks out and offer them as separate policies or optional add-ons. This à la carte approach lets you tailor your coverage to what your business actually does without forcing you to pay for protections you’ll never need.

The most common things you'll see left out of a standard BOP include:

- Professional Liability: This is for mistakes or negligence in the professional services you provide. Think bad advice, not a slippery floor.

- Workers' Compensation: If you have employees, this is almost always required by the state. It covers their work-related injuries and illnesses.

- Commercial Auto: This covers vehicles used for work, from a fleet of delivery trucks to an employee using their own car for a business errand.

- Flood and Earthquake Damage: Coverage for these large-scale natural disasters is almost always sold separately.

- Intentional Acts: No insurance policy will cover damage or injury that you or your staff cause on purpose.

Common Exclusions Explained

Let's dig into a few of these a bit deeper. A BOP’s general liability is perfect if a client trips over a power cord in your office. But what if you're an accountant and a calculation error in their tax return costs them thousands in penalties? That’s a professional mistake, and your BOP won't touch it. For that, you need Professional Liability Insurance, often called Errors & Omissions (E&O).

The same logic applies to your team. If an employee hurts their back lifting a heavy box, your general liability coverage isn’t the right tool. State laws mandate that employers carry Workers' Compensation Insurance to handle these situations, providing a clear path for medical care and wage replacement without messy lawsuits.

And then there are vehicles. It’s a common misconception, but a personal auto policy will almost certainly deny a claim if an accident happens while the car is being used for business. Whether it’s your dedicated delivery van or an employee making a quick run to the bank, you absolutely need a separate Commercial Auto Insurance policy.

A BOP is the foundation of your insurance strategy, not the entire structure. Recognizing its limits is the first step toward building a truly complete and resilient protection plan for your business.

Finally, some exclusions are a little less obvious. Catastrophic events like floods and earthquakes are carved out because their risk is so concentrated in certain areas. But consider this: if a fire damages half of your 50-year-old building, your policy will pay to repair the damaged section. It won’t, however, pay for the expensive upgrades the city now requires for the undamaged half to meet modern building codes. This is where an add-on like Ordinance or Law coverage becomes invaluable, saving you from a massive, unexpected bill during recovery.

Fine-Tuning Your BOP: Why Add-Ons Are Non-Negotiable

While a standard BOP gives you a fantastic starting point, it's never the whole story. No two businesses are the same, and your risks are unique to your industry, your operations, and how you use technology. This is where endorsements—often called add-ons or riders—come into play.

Think of your basic BOP as a high-quality, off-the-rack suit. It’s a solid foundation, but it needs a tailor to make it fit perfectly. Endorsements are that expert tailoring. They aren't just extra expenses; they are smart, strategic moves that patch up specific, high-stakes holes in your coverage.

Without them, you could be left dangerously exposed. A standard policy might be fine for a small retail shop, but what about a consultant who handles sensitive client data? Or a caterer who has employees driving their own cars for deliveries? Getting the right add-ons is what turns a good policy into a great one.

Don't Get Caught Without Digital Protection

In this day and age, a data breach isn't a matter of if, but when. It's a shocking reality that a standard BOP’s general liability coverage almost never touches digital risks. This leaves a massive blind spot for any business that sends emails, stores customer information, or even just has a website.

That’s why Cyber Liability Insurance is so critical. This endorsement is built specifically to help your business survive and recover from a cyberattack or data breach.

Here’s what it typically helps with:

- Data Breach Response: Covers the cost of notifying customers, providing credit monitoring, and launching a PR campaign to salvage your reputation.

- Legal & Defense Costs: Pays for lawyers and settlements if customers sue you over their compromised data.

- Cyber Extortion: Provides the resources to handle a ransomware attack, where criminals lock up your data and demand a payout.

A cyber liability add-on takes your BOP from protecting just your physical world to defending your priceless digital one, too.

Covering Cars on the Clock

Here’s one of the most common—and costly—misconceptions we see: business owners assuming their personal auto policy covers them when they use their car for work. It almost never does. If you or an employee gets in an accident while running a work errand—like visiting a client or dropping off a deposit—your personal insurance will likely deny the claim, leaving you on the hook.

To close that gap, you need Hired and Non-Owned Auto (HNOA) Liability Insurance. This endorsement extends your business liability to cover vehicles that your company uses but doesn't actually own.

HNOA isn't a substitute for a full commercial auto policy if you have company-owned vehicles. Instead, it’s a specific fix for liability issues that come from rented cars or employees using their personal vehicles for business.

This add-on is a must-have for businesses like:

- Restaurants whose staff use their own cars for delivery.

- Consulting firms where employees drive to client sites.

- Any company that rents a van for a one-off event or project.

Without HNOA, a single fender bender during a work errand could trigger a lawsuit that your standard BOP won’t touch.

Protecting Your Most Important Machines

For many businesses, one or two key pieces of equipment are the lifeblood of the entire operation. It could be the HVAC system in your store, the walk-in freezer at your restaurant, or the diagnostic computer at your auto shop. If that machine goes down, so does your business.

Your standard property insurance covers damage from outside forces like a fire or a storm, but it usually excludes failures from within—like a mechanical or electrical malfunction. This is precisely the vulnerability that Equipment Breakdown Coverage is designed to fix.

This endorsement protects you from the cost of repairing or replacing essential equipment when it fails due to:

- A power surge that fries your servers.

- Mechanical failure, like a motor burning out on an assembly line.

- An explosion in a boiler or pressure vessel.

It doesn’t just stop at repair costs, either. This coverage can also help replace lost income and pay for inventory that spoiled because the equipment failed. It’s crucial to understand how a breakdown can ripple through your finances, a topic we explore in our guide on business interruption insurance cost.

How a BOP Works in The Real World

It’s one thing to read about policy coverages in a document. It's something else entirely to see how they actually save a business when disaster strikes. That's when the true value of a Business Owner's Policy becomes crystal clear.

Let's step away from the jargon and walk through a few real-world situations. These aren't just hypotheticals; they’re the kinds of events that can turn a thriving business upside down overnight, showing how a BOP can be the difference between a temporary hiccup and a permanent closure.

Scenario 1: The Cafe Fire

Imagine you run a beloved neighborhood coffee shop. Late one night, a faulty refrigerator sparks a fire that rips through your kitchen. The damage is severe, forcing you to close your doors indefinitely. This is exactly the kind of multi-faceted crisis where a solid BOP acts as your financial first responder.

Here’s how the different pieces of the policy would jump into action:

- Commercial Property Coverage: This is your first line of defense. It kicks in to cover the costs of repairing the building's fire damage, replacing those expensive destroyed espresso machines and ovens, and restocking all your lost inventory—from coffee beans to pastries.

- Business Interruption Coverage: While your shop is being rebuilt, the revenue stops, but the bills don’t. This is where business interruption saves the day. It helps replace the income you're losing and covers ongoing expenses like rent, utilities, and payroll for your essential staff.

- Extra Expense Coverage: A key part of business interruption, this helps you get back on your feet faster. It can cover the costs of renting temporary kitchen equipment or paying contractors overtime to speed up the repairs.

Without a BOP, the owner would be staring at a mountain of debt, likely forcing them to close for good. With it, they have the funds to rebuild, restock, and reopen their doors.

Scenario 2: The Retail Slip and Fall

Now, picture a trendy clothing boutique on a busy Saturday. It's raining, and a customer slips on a wet patch of floor near the entrance, fracturing their wrist. A few weeks later, a letter arrives from their lawyer, demanding payment for medical bills and lost wages.

This is a textbook general liability claim. Your BOP's General Liability Insurance would immediately take charge.

It would cover:

- Legal Defense Costs: It pays for the attorney needed to defend your business, whether you settle or the case goes to trial.

- Medical Payments: The policy can cover the injured customer’s immediate medical bills up to your policy limit.

- Settlements or Judgments: If you’re found liable, the policy pays the settlement amount or the court-ordered damages, shielding your business assets.

A single slip-and-fall lawsuit can be financially ruinous for a small business. The legal fees alone can be overwhelming, which is why general liability is a non-negotiable part of every BOP.

Scenario 3: The Marketing Agency Water Damage

Think about a digital marketing agency leasing an office on the third floor of a commercial building. Over the weekend, a pipe bursts in the unit above them, flooding their space. On Monday morning, the team walks in to find their laptops, servers, and office furniture completely soaked and ruined.

Even though the agency doesn't own the building, the Business Personal Property (BPP) coverage within their BOP is designed for exactly this. It would activate to cover the cost of replacing all the destroyed electronics and furniture, allowing the agency to get set up again and back to work with minimal downtime. If this happens, knowing how to file a property damage claim is a critical next step.

These scenarios are anything but rare. In fact, a recent 2025 market update revealed that roughly 87% of business owners reported making an insurance claim. Of those, a staggering 57% involved losses of more than $25,000, highlighting the very real financial risks that businesses face every day.

Answering Your Top Questions About BOP Insurance

Even after getting the basics down, it's natural to have a few lingering questions. Let's walk through some of the most common ones we hear from business owners. Getting these details straight is key to making a confident decision.

Who Is a Business Owners Policy Actually For?

A BOP isn’t a one-size-fits-all solution. It’s specifically crafted for small and medium-sized businesses whose risks are pretty straightforward. Think of the kinds of companies you see on Main Street—businesses that own or lease a physical space and regularly interact with the public.

These types of businesses are often a perfect match:

- Retail shops and boutiques

- Restaurants and local cafes

- Professional offices (like accountants or marketing agencies)

- Barbershops and hair salons

- Small contractors, such as painters or landscapers

On the flip side, a business with more complicated or high-stakes risks—like a large manufacturing plant or a specialized surgical center—will usually need more than a standard BOP can provide.

BOP vs. a Commercial Package Policy: What's the Difference?

This is a big point of confusion for many. Both a Business Owners Policy (BOP) and a Commercial Package Policy (CPP) bundle different coverages together, but they’re built for very different needs.

Here’s a simple way to think about it: A BOP is like a combo meal at your favorite restaurant. It bundles the most popular items together for a great price and total convenience. A CPP is more like ordering à la carte—you get a much bigger menu and can pick and choose every single item to create a completely custom meal.

Let's break it down.

Business Owners Policy (BOP)

- Best For: Smaller, lower-risk businesses with common needs.

- Structure: Pre-packaged with property, general liability, and business interruption insurance.

- Flexibility: You can add some optional coverages (endorsements), but the core is set.

- Cost: Typically more affordable because of the bundled, standardized nature.

Commercial Package Policy (CPP)

- Best For: Larger businesses or those in industries with unique, complex risks.

- Structure: Completely customizable. You choose from a wide menu of coverage options.

- Flexibility: Far more adaptable, allowing for specialized policies like professional liability, fleet auto, and more.

- Cost: The price is based entirely on the specific policies you select.

So, while a BOP is perfect for a business that fits a standard profile, a CPP offers the freedom to build a truly tailored protection plan for those that don't.

How Much Coverage Do I Actually Need?

This is the million-dollar question. Getting the right amount of coverage is a balancing act—too little and you're gambling with your company's future, but too much and you're wasting money. There's no single magic number, but you can land on a solid estimate by looking closely at three parts of your business.

- Figure Out Your Property Value: Start with the replacement cost of your physical assets. This isn't just the building itself (if you own it). It's everything inside: your equipment, inventory, computers, and even the furniture. Your property limit needs to be high enough to rebuild and restock from zero after a catastrophic event.

- Gauge Your Liability Risk: How much risk do you face from interacting with the public? A busy coffee shop with constant foot traffic has a much higher chance of a slip-and-fall claim than a freelance writer working from home. Your general liability limit should reflect your public exposure and the potential cost of a lawsuit in your field.

- Calculate Your Business Income Needs: Look at your financials. How much revenue do you need to cover your operating expenses each month? Your business interruption coverage should be enough to keep you afloat for the time it would realistically take to get back up and running after a disaster. For some, that's a few months; for others, it could be a year or more.

Trying to figure all this out can feel overwhelming, but you're not in it alone. The experts at Wexford Insurance Solutions can help you perform a proper risk assessment and build a BOP that provides exactly the right protection for your business. To get started, visit https://www.wexfordis.com and secure your peace of mind today.

How to File a Property Damage Claim The Right Way

How to File a Property Damage Claim The Right Way General Liability Insurance for Painters A Practical Guide

General Liability Insurance for Painters A Practical Guide