A premium audit is simply your insurance company’s way of making sure the premium you paid matches your business's actual risk from the past year. Think of it like a final bill settlement. You start with an estimated cost, and the audit is just the process of squaring up the numbers once the year is over. It's a completely standard procedure, not a sign that you've done something wrong.

Your Quick Guide to Understanding a Premium Audit

When you buy certain kinds of business insurance—workers' compensation and general liability are the big ones—the price you’re quoted isn't set in stone. It's really just an educated guess based on the projections you provide, like your estimated annual payroll or sales figures.

But business is never static, right? Payroll might grow, sales could surge, or you might even pivot your operations. The premium audit is how insurers reconcile those initial estimates with what actually happened. It's a routine part of the insurance cycle that keeps things fair for both you and the insurance company.

The Purpose of the Audit

At its core, the audit is all about accuracy. It makes sure you paid the right amount for the real-world risk your business represented. This serves a couple of crucial functions.

First, it protects you from overpaying. If your payroll or sales ended up being lower than you guessed, the audit catches this, and you could get a refund or a credit toward your next policy term.

On the flip side, if your business grew, the audit confirms the insurer collected enough premium to cover that increased risk. This is what keeps the entire insurance system financially sound for everyone. It’s a true-up, plain and simple. Without it, a fast-growing company could find itself dangerously underinsured, while a business that hit a slow patch would be paying too much. This concept is a cornerstone of many coverages, which you can dive into deeper in our guide to business insurance basics.

How Common Are Premium Audits?

They are incredibly common—practically a given for policies where the risk is tied to fluctuating numbers. Take workers' compensation, for instance. Data from the National Council on Compensation Insurance (NCCI) showed that in 2022, over 90% of workers’ comp policies in NCCI states underwent an audit.

The results of those reviews are telling: about 30–40% of policies ended up needing an additional premium, while a significant 20–25% resulted in a refund for the business owner. You can find more data on this from resources like Insureon.

To give you a clearer picture, here’s a quick summary of what a premium audit involves.

Premium Audit At a Glance

This table breaks down the fundamental aspects of a premium audit to give you a digestible overview.

| Key Aspect | What It Means for Your Business |

|---|---|

| Purpose | To reconcile your estimated premium with your actual business activity (like payroll or sales). |

| Timing | Typically occurs within 60 days after your policy period ends. |

| Outcome | Can result in an additional premium, a refund/credit, or no change at all. |

| Common Policies | Most often required for Workers' Compensation and General Liability. |

| Your Role | You’ll need to provide accurate records (payroll, tax forms, etc.) to the auditor. |

This process ensures your final insurance cost is a precise reflection of your business activities, nothing more and nothing less.

A premium audit isn’t an accusation; it's an accounting. Its purpose is to align the premium you paid with the actual risk your business presented, ensuring fairness and accuracy for everyone involved.

Ultimately, this removes the guesswork from insurance pricing, making sure your final cost is spot-on for the year you just had.

Why Your Insurance Company Conducts Audits

Getting a notice for a premium audit can feel like you're being put under a microscope. But in reality, it’s a standard—and necessary—part of the insurance world. It’s all about making sure the premium you pay is fair for both you and the insurance company.

The main reason for an audit is simple: most commercial insurance policies are initially priced based on an educated guess.

When you first buy a policy like workers’ compensation or general liability, your premium is based on projections. You estimate your payroll for the upcoming year, guess at your sales figures, or project what you'll spend on subcontractors. These are all forward-looking numbers. The audit is simply the look back to see what really happened.

From an Educated Guess to the Real Number

Think of your initial premium like a down payment on your coverage. You and your insurer agree on that starting price based on your business forecast for the next 12 months. But business is rarely predictable. You might hire more people than you thought, land a massive contract that spikes your revenue, or even have a slower year than planned.

The premium audit is just the process of squaring up those initial estimates with what actually occurred during your policy term. It’s a true-up that makes sure your final cost perfectly matches your actual exposure to risk.

Why It’s a Two-Way Street

The audit process really has two main goals, and both are designed to keep the insurance market fair and stable.

-

Protecting You from Overpaying: If your payroll or sales ended up being lower than you projected, the audit catches it. The result? You get a credit or even a refund for the amount you overpaid. This is a huge benefit, ensuring you only paid for the exact amount of coverage you ended up needing.

-

Making Sure the Insurer Can Cover Claims: On the flip side, if your business grew more than expected, your risk exposure grew right along with it. The audit confirms the insurer collects the right premium to cover that higher risk. This is crucial for the insurer's financial health and its ability to pay claims for all its customers. You can learn more about how insurers balance premiums and claims by reading our guide on what the loss ratio in insurance means.

Without this step, a fast-growing company could be left dangerously underinsured, while a business that had a tough year would be stuck overpaying.

An audit isn't about finding fault; it's about finding facts. Its goal is to replace projections with actuals, ensuring the final premium is a precise reflection of the risk the insurance company covered for the policy term.

It's Often the Law

Beyond simple fairness, audits are frequently required by state regulations, especially for workers' compensation insurance. These rules exist to protect the entire insurance system.

Regulators demand that insurers collect premiums that accurately reflect the risks they're covering. This stops insurance companies from undercharging (which could leave them unable to pay claims) or overcharging (which hurts you, the policyholder). So, when you complete an audit, you’re not just following your insurer’s policy—you're playing a part in a regulated system that keeps pricing fair and ensures money is there when it's needed most.

Which Business Policies Are Subject to an Audit?

Not every insurance policy you own will go through a premium audit. The ones that do have one thing in common: the premium is tied to a business metric that changes throughout the year. To get a better handle on this, it's helpful to see where these policies fit within the broader landscape of essential business insurance policies.

Think of it like this: your insurer gives you a premium based on an educated guess—your estimated payroll or sales for the upcoming year. An audit is simply the process of looking back to see what the actual numbers were. It’s how the insurance company squares up the bill once all the facts are in.

Let’s dig into the three main types of commercial insurance that almost always get this year-end review. Understanding what the auditor is looking for—what we call the "rating basis"—is the key to a stress-free audit.

Workers' Compensation Insurance

This is, by far, the most commonly audited policy. The reason is simple: your entire premium is built on your payroll and what your employees actually do day-to-day.

When you first get the policy, the premium is an estimate based on your projected payroll and the employee classification codes assigned to your team. An office admin has a much lower risk of getting hurt than a roofer, so the rate applied to the admin's payroll is significantly lower.

During a workers' comp audit, the auditor is there to verify a few key things:

- Total Gross Payroll: This is the big one. They'll look at your payroll journals, quarterly Form 941s, and state unemployment filings to confirm exactly how much you paid your employees.

- Employee Classifications: Are your employees sorted into the right job codes? The auditor will check that their assigned roles match their real-world duties. Misclassification is a frequent and expensive mistake that audits are designed to catch.

- Subcontractor Payments: This often trips people up. If you paid subcontractors who didn't have their own workers' comp insurance, their labor costs often get added right back into your payroll for the audit. This is exactly why you always need to collect a Certificate of Insurance from every sub you hire. For a deeper dive, check out our complete guide to workers' compensation for small business.

General Liability Insurance

While workers' comp audits are a given, many business owners are surprised to learn their general liability policy is also up for review. For these policies, the risk isn't about your employees getting hurt, but about your business's exposure to claims from outsiders for bodily injury or property damage.

The rating basis for general liability changes depending on your industry:

- Gross Sales or Revenue: For businesses like retail shops, restaurants, or manufacturers, the premium is tied directly to total sales. More sales usually mean more foot traffic and more products out in the world, which increases the chance of an accident.

- Total Payroll: For many service-based businesses, payroll is the best way to measure the scale of your operations and, therefore, your liability exposure.

- Subcontractor Costs: This is huge for general contractors. Since you can be held responsible for the work your subcontractors do, their cost is a primary factor in calculating your premium.

The principle is identical to workers' comp: the audit is all about confirming your actual exposure. If your sales shot up past your projections, you'll owe a bit more. If business was slower than expected, you could get some money back.

Commercial Auto and Other Policies

Audits aren't just for workers' comp and general liability. A 2020 industry survey of mid-sized businesses found that about 60% of general liability policies and 55% of business auto policies underwent some type of premium audit. Of those audited policies, around 35% resulted in a premium increase from higher-than-expected exposures, while 20% earned a credit.

A commercial auto policy might be audited if your premium is based on a fluctuating metric like fleet size, total mileage, or revenue (often called "cost of hire" for trucking operations). Likewise, other specialty policies are tied to specific numbers. A Liquor Liability policy, for instance, is audited based on your actual alcohol sales to make sure the premium accurately reflects that unique risk.

Navigating the Premium Audit Process Step by Step

Knowing what a premium audit is gets you in the door, but understanding how the process actually works is what puts you in the driver's seat. It might sound a little daunting, but the whole thing follows a pretty logical and predictable path. Once you know the steps, it stops being a mysterious challenge and becomes just another manageable task for your business.

From the first letter you receive to the final statement that lands on your desk, the entire journey is designed to be methodical. The goal isn't to catch you out—it's simply to make sure the numbers are right.

Step 1: The Initial Notification

The premium audit process officially kicks off when you get a notification from your insurance carrier. You can usually expect this to arrive within 60 days after your policy period ends. This notice is a heads-up that it's time for your audit and will tell you which type of audit they plan to conduct.

This is your signal to start getting your paperwork in order. The letter will lay out exactly what records they need, which almost always includes things like payroll summaries, tax forms, and sales ledgers. It’s really important to act on this promptly—ignoring the notice can create headaches down the line.

Step 2: The Audit Method

Insurers have a few different ways to conduct an audit, and the method they pick usually comes down to the size and complexity of your business. Here’s a quick rundown of the common approaches:

- Mail or Self-Reported Audit: If you're a smaller business with pretty straightforward operations, the insurer might just send you a form or give you access to an online portal. You'll fill in your actual payroll or sales numbers and send over the documents to back them up.

- Virtual or Remote Audit: This is a mix where you connect with an auditor over the phone or on a video call. You might share your screen or upload documents to a secure site while the auditor walks you through everything and asks questions as they go.

- Physical Field Audit: For larger companies or those with more complex operations, the insurer will send an auditor right to your place of business. This on-site visit gives them a chance to look at your original records, see your operations firsthand, and get a real feel for what your employees do day-to-day.

Technology has definitely changed the game here. In 2023, one major U.S. workers’ comp carrier performed over 1.2 million premium audits, and about 60% of them were handled electronically. This shift has slashed the average audit time from 60–90 days down to just 30–45 days. You can find more details about how the modern premium audit process works on compsourcemutual.com.

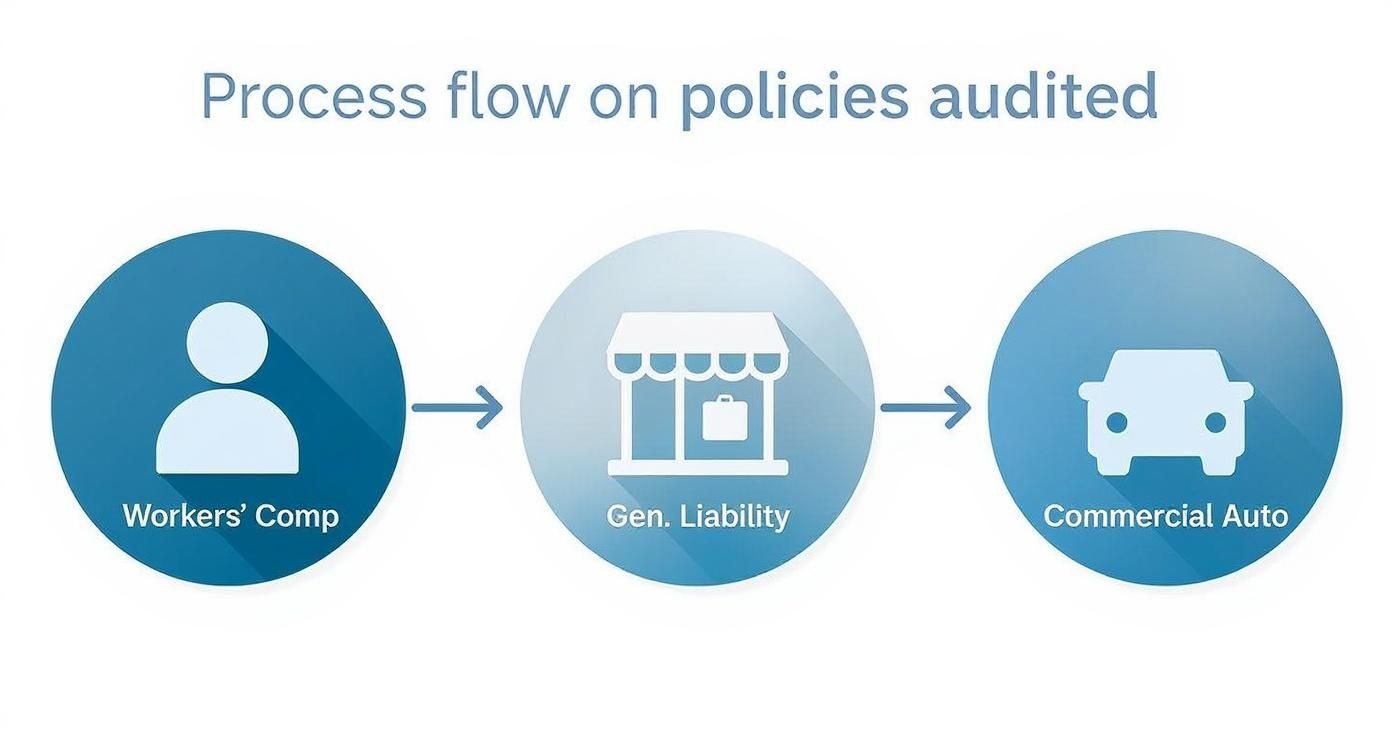

The infographic below shows how this process flows for the policies that get audited most often.

As you can see, even though the policies are different, the main goal of the audit—confirming your actual exposure—is the same across the board.

Comparing the Different Types of Premium Audits

To help you get a quick sense of the differences, here’s a simple table comparing the three main audit methods.

| Audit Type | Typical Process | Best For | Key Tip for Business Owners |

|---|---|---|---|

| Physical Audit | An auditor visits your business in person to review original records and observe operations. | Larger or more complex businesses with multiple employee classifications or significant subcontractor use. | Have a quiet, organized space ready for the auditor and be available to answer questions about your operations. |

| Virtual Audit | You meet with an auditor via phone or video call, sharing documents through a secure online portal. | Mid-sized businesses or those with well-organized digital records who can easily share information remotely. | Test your technology beforehand and have your digital files clearly labeled and ready to upload or screen-share. |

| Mail Audit | The insurer sends you a form to complete with your exposure figures (e.g., payroll, sales) and return by mail or online. | Small, straightforward businesses with one or two class codes and minimal operational complexity. | Double-check your numbers before submitting. Simple math errors are the most common mistake on self-reported audits. |

Choosing the right approach isn't up to you, but knowing what to expect can make the process go much more smoothly no matter which method your carrier uses.

Step 3: The Data Review

Once the auditor has all your information, they get to work on the review. This is the core of the audit, where they compare the estimates you started with to the actual numbers from the past year. They’ll meticulously comb through your payroll records, making sure employees are assigned to the right job classifications, and they'll verify your sales figures.

A big focus here is often on payments to subcontractors. The auditor will want to see a Certificate of Insurance for every single one. If you can't provide one, the money you paid that sub is usually added to your own payroll, which can cause your premium to jump. This is also where your claims history comes into play; learning what a loss run report is can give you a clearer picture of how insurers see your company's risk profile.

Step 4: The Final Audit Statement

After the auditor has finished their review, you’ll receive a final audit statement. This document is the official summary of their findings and breaks down any adjustment to your premium. It will clearly show the initial estimated exposure, the actual audited exposure, and the final financial result.

The final audit statement is the official conclusion of the process. It will tell you if you owe an additional premium, are due a refund, or if the initial premium was accurate with no change needed.

If you owe more money, the statement will come with an invoice and a due date. If you’re getting a refund, it will state the amount and when you can expect it. Go over this document with a fine-tooth comb—this is your chance to spot any errors and ask questions before you pay or accept the refund.

How to Prepare for a Smooth Insurance Audit

A premium audit doesn’t have to be a major headache that grinds your business to a halt. With a bit of organization upfront, you can turn it into just another administrative task on your checklist. The secret is to treat audit prep as an ongoing habit, not a last-minute fire drill.

Think about it like doing your taxes. You wouldn't wait until April 14th to start hunting for a year's worth of receipts, right? The same logic applies here. By keeping your records in order throughout your policy period, the audit becomes a predictable and smooth process without any costly surprises at the end.

The Power of Proactive Organization

Here’s the simplest, most effective strategy I share with clients: create a dedicated "audit folder" the day your policy begins. This can be a physical file or a digital one on your server.

Then, just make it a habit. Every time you process payroll, hire a subcontractor, or run a sales report, drop a copy into that folder. This small discipline pays off big time when the audit notice shows up. Instead of a mad scramble through a year's worth of files, you'll have everything the auditor needs in one spot. For more ideas, check out these tips on making your business audit-ready. It’s a simple system that saves a ton of stress.

Your Essential Document Checklist for a Workers Compensation Audit

For a workers' compensation audit, the auditor has two main goals: to verify your total payroll and to make sure every employee is classified correctly. Getting your documents organized is the single most important thing you can do to ensure an accurate outcome. For a more granular list, our workers' compensation audit checklist can be a huge help.

At a minimum, you'll need to have these core documents ready:

- Detailed Payroll Records: The auditor needs to see a full breakdown of gross payroll for the policy term, employee by employee. This must include overtime, bonuses, severance, and any other payments.

- Employee Job Descriptions: Don't overlook this! Clear descriptions of what each person actually does are crucial for confirming they're in the right—and most affordable—classification code.

- Quarterly Tax Filings (Form 941s): These federal forms are the gold standard for auditors. They provide an official summary of the wages you’ve paid, making them a key tool for cross-referencing your payroll records.

- Certificates of Insurance (COIs) for Subcontractors: This is a big one. You absolutely must have a valid COI for every single subcontractor you paid, proving they had their own workers' comp policy. If you can't produce one, the auditor is required to add their labor cost directly to your payroll, which can be a very expensive mistake.

Key Takeaway: An audit is a document-driven process. The quality and organization of your records directly impact the speed, accuracy, and final cost of your premium audit. Being prepared is your best defense against unexpected bills.

Preparing for a General Liability Audit

A general liability audit feels similar to a workers' comp audit, but the focus is different. Here, the auditor is working to verify your "rating basis"—the metric used to calculate your premium. Most often, this is your gross sales, but it can also be your total payroll or subcontractor costs.

The documentation required usually includes:

- Sales Records: This could be your sales journal, detailed profit and loss statements, or reports from your accounting software. The goal is to clearly show your total revenue for the policy period.

- Subcontractor Cost Documentation: Just like with workers' comp, you'll need to show what you paid your subs. While their insurance status is still important, the primary focus here is the total dollar amount, as that figure directly influences your liability exposure.

Pulling these documents together ahead of time does more than just speed up the audit. It gives you a chance to review the numbers yourself, ensuring you can confidently answer the auditor's questions and stand your ground if any discrepancies pop up.

Common Audit Mistakes and How to Dispute Findings

Even if you’ve prepared perfectly, mistakes can happen during a premium audit. Sometimes the error is on your side, and sometimes it’s on the auditor’s. Knowing the most common pitfalls is your best defense against a costly surprise.

More importantly, you need to understand your rights. An audit might be a contractual obligation, but its findings aren't automatically set in stone. If something looks off, you have a clear path to challenge the results and make sure your final premium is fair.

Frequent and Costly Audit Errors

It's often the simple things—clerical errors and honest misinterpretations—that cause the biggest headaches and disputes. A few key issues pop up time and time again, and just being aware of them can save you a ton of money and stress.

Here are the top three mistakes to watch for:

-

Employee Misclassification: This is, by far, the most common error. An auditor might mistakenly lump a low-risk office worker into a high-risk operational code. That one little change can send the premium calculated for that employee’s payroll through the roof.

-

Forgetting Subcontractor Paperwork: This one can be a killer. If you can’t produce a valid Certificate of Insurance (COI) for a subcontractor, the auditor will almost always add their entire labor cost to your payroll. This can lead to a massive, completely unexpected bill.

-

Incorrectly Reported Payroll: Auditors sometimes include payroll that should have been excluded. This could be certain types of overtime pay (depending on your state) or failing to cap executive salaries at the state-allowed maximum.

The best way to handle a premium audit is to prevent mistakes from happening in the first place. But if an error slips through, remember this: the initial audit statement is a proposal, not a final verdict. You have every right to review it and dispute it.

Your Step-by-Step Guide to Disputing an Audit

If you get your final audit statement and the numbers don't add up, don't just sigh and pay the bill. Taking quick, organized action gives you a great shot at getting it corrected. The process is pretty straightforward if you know what to do.

Follow these steps to formally challenge the results:

-

Do Not Pay the Invoice Immediately: This is critical. Paying the bill can be seen as you accepting the audit's findings, which can make it much harder to argue your case later.

-

Contact Your Insurance Agent First: Your agent is your advocate here. Right away, send them a copy of the audit statement. Pinpoint exactly what you disagree with and provide all the documents that back you up—things like payroll reports, detailed job descriptions, or those COIs.

-

Submit a Formal Written Dispute: Your agent can help you draft a formal letter or email to the insurance carrier’s audit department. State your case clearly and concisely. Don't just say it's wrong; explain why it's wrong and attach your proof. Reference specific employees, figures, or classification codes.

-

Follow Up Persistently: Getting an audit revised isn't always a quick process. Stay in touch with your agent and the insurer for updates. A polite but firm follow-up every week or so shows them you’re serious about getting this fixed.

By arming yourself with clear evidence and following the official process, you stand the best chance of getting the audit revised. The goal is to ensure your final premium is a true reflection of your risk, and not a penny more.

Your Top Premium Audit Questions, Answered

Even with a solid grasp of the process, a few questions about premium audits almost always pop up. Let's tackle some of the most common ones we hear from business owners.

What Happens If I Just Ignore the Audit Request?

This is one of those things you really don't want to ignore. If an insurer doesn't get the information they need, they won't just let it go. Instead, they'll be forced to estimate your exposure, and they will almost always assume the highest possible risk category for your industry.

This can lead to a massive, unexpected premium bill. In more serious cases, the carrier could cancel your policy for non-compliance, making it incredibly difficult (and expensive) to find coverage elsewhere. It's always, always better to cooperate.

Is It Possible to Get Money Back from an Audit?

Yes, and it happens more often than you might think! If the audit reveals that your actual payroll, sales, or other exposure metrics were lower than what you initially estimated, you’re due a refund or a credit on your next policy term.

This is a perfect example of why the audit is a good thing. It ensures you only pay for the coverage you actually used.

Think of the audit as a final true-up. It protects the insurance company from being short-changed, but it also protects you from overpaying. The goal is fairness.

How Do I Stop My Subcontractors from Driving Up My Premium?

This is a big one, and the solution is simple but requires discipline: get a Certificate of Insurance (COI) from every single subcontractor before they set foot on a job site.

This piece of paper is your proof that they carry their own workers' compensation insurance. Without a valid COI for the policy period, the auditor has no choice but to treat their labor costs as part of your payroll, which can cause your premium to skyrocket. No COI, no work—make it a non-negotiable rule.

How Far Back Can the Insurance Company Look?

For a standard premium audit, the scope is almost always limited to the policy period that just ended, which is typically one year.

However, there are exceptions. If there's a reason to suspect fraud or if major discrepancies are found, some state laws allow insurers to go back and audit your records for the previous three years. This is why keeping clean, organized financial and operational records for at least that long is just smart business practice.

Navigating the ins and outs of a premium audit is much easier when you have an expert in your corner. At Wexford Insurance Solutions, we work with our clients to prepare for audits and make sure their policies are set up correctly from day one to avoid surprises.

Contact us today to learn how we can protect your business and simplify your insurance experience.

General Liability Insurance for Painters A Practical Guide

General Liability Insurance for Painters A Practical Guide How to Choose Homeowners Insurance a Guide to Protecting Your Home

How to Choose Homeowners Insurance a Guide to Protecting Your Home