The real difference between an insurance agent and a broker comes down to a single, crucial question: Who do they work for?

An insurance agent works for the insurance company. They represent a specific carrier (or sometimes a few) and can only offer you the products that company sells. A broker, on the other hand, works directly for you, the client. Their job is to navigate the entire market, bringing you options from a wide array of insurers.

Agent vs Broker: A Direct Comparison

Grasping this fundamental difference is the key to making the right choice for your insurance needs. An agent’s primary loyalty is to the company they represent. A broker, however, has a legal and ethical duty to act in their client’s best interest. This one detail changes everything, from the policies you see to the advice you get.

This difference in allegiance creates two very different approaches. An agent is compensated based on the policies they sell for their specific carrier. A broker stays impartial, earning a commission from whichever insurer provides the best solution for their client. This client-focused model is a big reason why the global insurance broker and agency market was valued at US$590.32 billion in 2024 and is expected to hit US$1,607.37 billion by 2034.

To make it even clearer, here's a quick side-by-side look at how they stack up.

Insurance Agent vs Broker At a Glance

The table below breaks down the key distinctions between an insurance agent and a broker, giving you a quick snapshot of what sets them apart.

| Attribute | Insurance Agent | Insurance Broker |

|---|---|---|

| Primary Loyalty | Represents the insurance company. | Represents the client. |

| Market Access | Limited to one or a few carriers. | Access to a broad market of insurers. |

| Product Selection | Offers policies from their represented company. | Shops multiple carriers for the best fit. |

| Main Role | To sell the insurer's products. | To advise and advocate for the client. |

| Compensation | Salary and/or commission from the insurer. | Commission from the selected carrier or client fees. |

With this foundation, you can start thinking about what it means for you in the real world. Especially when it comes to protecting your company, knowing the essentials of business insurance is a smart move. Keep this table in mind as we explore how these roles play out, from getting a simple auto policy to structuring complex commercial coverage.

Understanding Allegiance and Representation

When you peel back the layers, the real difference between an insurance agent and a broker isn't about the policies they sell. It boils down to a single, powerful concept: allegiance.

This one distinction—who they work for—is the most critical factor to grasp. It fundamentally shapes the advice you get, the options you see, and the ultimate outcome for your coverage. An insurance agent, especially a "captive" one, has their primary loyalty sworn to the insurance company they represent. Think of them as a dedicated extension of that insurer's sales team, contractually bound to offer that specific company's products.

A broker, on the other hand, works for you. Their primary legal and ethical obligation is to represent your best interests, completely flipping the dynamic of the relationship.

The Fiduciary Responsibility of a Broker

This is where the term fiduciary duty comes into play, and it’s a big deal. A fiduciary is legally and ethically required to act in the best interest of another party—in this case, the client. This isn't just a suggestion; it's a legal standard that obligates a broker to put your needs ahead of everything else, including their own bottom line.

What does that mean in practice? A broker must:

- Act with loyalty and care, hunting down the best possible coverage solutions for your unique situation.

- Provide full disclosure, being completely transparent about how they get paid and any potential conflicts of interest.

- Offer impartial advice, grounding their recommendations in a solid analysis of your needs and the market, not in hitting a sales quota for one carrier.

"A broker's fiduciary duty is the client's greatest asset. It transforms the relationship from a simple transaction to a trusted partnership, ensuring the advice you receive is geared entirely toward your protection and financial well-being."

The distinction is crucial. With an agent, you get an expert on one company's products. With a broker, you get a professional advocate who guides you through the entire marketplace.

A Real-World Analogy: Car Shopping

Let’s put this into a more familiar context. Think about buying a new car.

-

The Insurance Agent is like a dealership salesperson. If you walk into a Ford dealership, the team there knows everything about every Ford model. They can point you to the perfect F-150 or Explorer for your family, but they’re never going to suggest you check out a Toyota or a Honda, even if one might be a better fit. Their loyalty is to the Ford brand.

-

The Insurance Broker is like a personal car shopper. This person doesn't work for any dealership. You give them your budget and your wish list, and they go to work, researching every brand—Ford, Toyota, Honda, you name it—to find the one vehicle that truly fits your needs. Their loyalty is 100% to you, the buyer.

This simple analogy cuts right to the heart of how allegiance impacts your choices. An agent offers deep knowledge of a single brand, while a broker provides broad access across the entire market. In an industry as massive as insurance, that difference is everything.

In fact, the United States is projected to capture nearly 40.0% of global revenue for insurance brokers and agencies, hitting an estimated $641.8 billion in 2025. Navigating a market of that scale really demands having someone clearly in your corner.

Ultimately, this difference in who represents whom affects every part of the process, from the first quote to ongoing service and claims support. Properly managing risk often relies on sophisticated insurance policy management systems, and having the right advocate helps you get the most out of them. For a deeper look at how these allegiances and compensation models play out in a related field, the dynamics between fiduciary financial advisor vs. fee-only models offer a strong parallel.

How Market Access and Product Choice Differ

When you get right down to it, the most practical difference between an insurance agent and a broker is the variety of products they can actually offer you. This access to the insurance market directly impacts everything from your coverage terms to the price you pay. It’s all a function of who they really work for.

An agent's world is framed by the insurance companies they have contracts with. It's a critical distinction to grasp.

The Agent's View of the Market

Insurance agents fall into two camps, and each has a very different lens on the market.

-

Captive Agents: These folks work exclusively for one insurance company. They know their carrier's products inside and out, but they’re fundamentally limited to selling only what that single company offers. If your needs don't fit into their narrow product set, they have nowhere else to turn.

-

Independent Agents: An independent agent can offer more variety because they represent several different insurers. While this is a definite step up from a captive agent, their menu is still restricted to the specific companies they hold appointments with. They can’t access the entire market.

This means even when you work with an independent agent, your options are limited to their pre-vetted list of carriers. If the perfect policy for your situation exists with an insurer outside that circle, the agent simply can’t get it for you.

An agent’s product shelf is pre-stocked by the carriers they represent. A broker, on the other hand, holds the key to the entire warehouse. They can find precisely what their client needs, regardless of which company provides it.

The Broker's Expansive Marketplace

An insurance broker doesn't have these ties. Their primary allegiance is to you, the client, which frees them up to source policies from a massive array of insurance companies. This broad market access is a broker’s greatest asset in building a truly effective risk management strategy.

This reach isn't just about the big, well-known insurers. It also includes specialized and niche providers that most agents have no relationship with. These "surplus lines" carriers are often the only solution for insuring complex, unique, or high-risk situations that standard companies won't touch.

Because a broker can scan the entire marketplace, they can pinpoint the absolute best combination of coverage, terms, and pricing for your needs. This is where the true value of a broker becomes crystal clear.

A Scenario-Based Comparison

Let's look at a real-world example to see why this market access is so important.

Scenario: A growing tech startup needs a specialized cyber liability policy. They handle sensitive customer data and face unique digital threats that a generic business policy simply won't address.

-

Working with an Agent: The startup contacts a well-regarded independent agent. The agent shops their roster of five appointed carriers. Three of them offer a basic cyber liability add-on, but none are designed for the specific threats facing a tech company. The best the agent can do is offer a generic, off-the-shelf product that leaves major gaps in coverage.

-

Working with a Broker: The same startup hires an insurance broker. The broker first conducts a deep dive into the company's specific risks. They then go out to the entire marketplace, including specialty insurers that focus exclusively on tech and cyber exposures. After securing quotes from over a dozen carriers, they compare not just the price but the actual policy language, coverage limits, and incident response services. The broker ultimately delivers a policy custom-built for the startup’s operations, providing far superior protection at a competitive price.

For businesses with unique needs, having an advisor who can explore all insurance options for small business isn't just a nice-to-have—it's essential. A broker’s unrestricted market access allows them to be a true consultant, delivering solutions an agent simply can't find.

Following the Money: How Agents and Brokers Get Paid

To really get to the heart of the agent vs. broker difference, you just need to follow the money. How each professional gets paid is the single biggest factor shaping their advice, the products they recommend, and where their loyalties truly lie.

An agent's income is directly tied to the insurance company they work for. This usually means a base salary plus commissions for the policies they sell. This structure, by its very nature, can create a conflict of interest. Their primary financial incentive is to sell their employer's products, regardless of whether another company might offer a better solution for you.

How an Agent's Paycheck Works

The compensation model for an agent is pretty simple, but it has big implications for the customer.

- Salary and Commission: This is common for captive agents. They get a regular salary from one insurer, which is then supplemented by a commission on every policy they write. It provides them with stability but also locks in their allegiance to that one company.

- Commission-Only: Independent agents usually operate this way. While they might represent a handful of different carriers, their income is still 100% dependent on selling policies from that curated list.

In either scenario, an agent's financial well-being is directly linked to pushing the products they are authorized to sell. This can create pressure to recommend policies that come with a higher commission or to hit specific sales quotas set by their company.

The Broker's Compensation Model: A Different Approach

A broker's pay is structured to align their success with yours. They are typically paid a commission by the insurance carrier you ultimately select, which is already factored into the premium. For more complex situations, like managing a large commercial account, a broker might charge a separate, transparent fee for their consulting and risk management services.

This might make you wonder: if the insurer is still cutting the check, how can a broker stay impartial? The difference is found in their legal duty and their entire business model.

A broker has a fiduciary duty to you, the client. This is a legal obligation to act in your best interest, period. Their reputation and long-term success hinge on earning and keeping your trust, which means finding you the best coverage and value, no matter which carrier provides it.

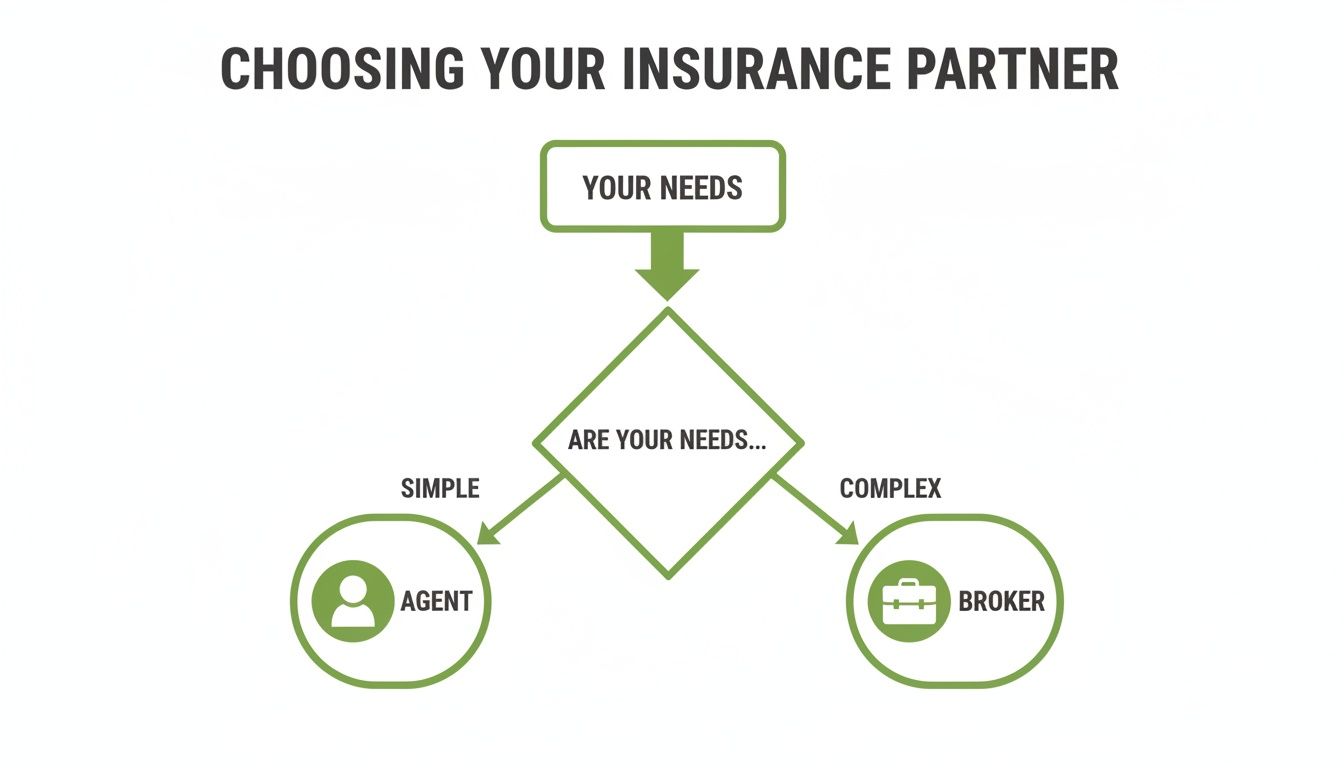

This flowchart can help you visualize whether your needs are simple enough for an agent or if they require the broader expertise of a broker.

As the chart shows, straightforward insurance needs can often be met by an agent. But when things get complicated, a broker’s market access and client-first duty become indispensable.

What This Really Means for You

This difference in how they're paid directly shapes the options you see and the advice you get. Think of it this way: an agent is a salesperson for their company. A broker is your personal shopper in the massive insurance marketplace.

Let's say you need to identify gaps in your coverage. An agent can only offer you solutions from their company's catalog to plug those holes. A broker, on the other hand, can scan the entire market to find the perfect policy from any number of carriers. A great starting point for this is a detailed risk review, which you can learn more about in our guide on how to conduct an insurance gap analysis.

This isn't just a theoretical distinction; it has real-world financial consequences. A broker's ability to get quotes from dozens of insurers often means they can find better coverage at a more competitive price. Their loyalty isn't to a sales manager—it's to you. That client-first focus is what truly defines a broker’s value.

Navigating Your Choice: Agent or Broker

Deciding between an insurance agent and a broker really boils down to your specific circumstances. There’s no single right answer for everyone; it all depends on your risk profile, how complex your life or business is, and what you’re trying to protect long-term.

An agent can be a perfectly good, straightforward choice for many people. If your needs are pretty standard—say, a basic home and auto policy—and you already like a particular big-name insurance company, a captive agent is a great fit. They know their company's products inside and out and can get you set up quickly and efficiently.

But the moment your situation gets even a little complicated, the conversation shifts, and a broker starts to make a lot more sense.

When a Broker Becomes Essential

For anything beyond the basics, an independent broker holds a significant strategic advantage. Their ability to shop the entire market isn't just a nice-to-have feature; it’s a fundamental part of smart risk management. This independence is a major reason why the global market for insurance brokers and agencies is expected to hit $641.8 billion by 2025. You can read the full research on why businesses increasingly favor brokers for holistic solutions and see the data for yourself.

You should absolutely be talking to a broker in these kinds of situations:

- Complex Commercial Insurance: Businesses are magnets for risk, from liability lawsuits to crippling cyberattacks. A broker digs into your specific operations to piece together specialized coverage that one carrier just can’t offer.

- High-Value Assets: If you’re insuring high-end homes, luxury vehicles, or valuable art collections, a broker has access to the niche, private client insurers who actually understand how to cover these assets properly.

- Unique Personal Risks: Do you own multiple rental properties or need an umbrella policy that covers assets in different states? A broker is the only one who can build a cohesive plan, often using multiple insurance companies to close every gap.

- You Want a True Market Comparison: If you simply want to know for sure that you're getting the best price and terms out there, a broker is the only professional who can deliver that full picture.

Think of a broker as more than just a policy-finder; they are your personal risk advisor. Their job is to build a protective strategy that grows and changes right alongside your life or business.

A Practical Decision Matrix

To help you make the call, I've put together a simple decision matrix. It lines up common scenarios with the professional who is typically the best fit. This should help you match your needs with the right expert. For a deeper dive, you can also check out our guide on how to choose an insurance broker for more tips.

Decision Matrix: When to Choose an Agent vs. a Broker

This table breaks down common insurance needs to help you quickly identify whether an agent or a broker is the better fit for your situation.

| Your Situation or Need | Best Choice: Agent | Best Choice: Broker |

|---|---|---|

| Simple Home & Auto Policy | A strong option if you prefer a specific carrier and want direct service. | Great for comparing rates from multiple top-tier carriers to find the best value. |

| Small Business Owner's Policy (BOP) | Can work for very standard, low-risk businesses like a small retail shop. | The best choice. Finds specialized coverage for your industry and advocates for you at claim time. |

| High-Net-Worth Individual | Limited, as standard policies often have insufficient liability and asset protection. | Essential. Accesses private client insurers for tailored high-value coverage. |

| Unique or Hard-to-Place Risks | Not suitable, as they lack access to the necessary specialty markets. | The only choice. Connects with surplus lines carriers built for complex risks. |

Ultimately, choosing the right partner is about ensuring you have the right advocate in your corner, ready to help you protect what matters most.

Frequently Asked Questions

When you're trying to pick the right insurance professional, a few key questions always seem to pop up. Getting straight answers is the best way to make sure you're partnering with the right person for your home, business, or family. Let's clear up some of the most common points of confusion.

Does It Cost More to Use a Broker Than an Agent?

Not usually. A broker’s commission is already part of the insurance premium, just like an agent's is. The real difference is that a broker can scan the entire market for you, often finding better rates that can save you money in the long run.

For businesses with really complex risks that need a deep dive into risk management, a broker might charge an advisory fee. But this is always discussed and agreed upon upfront, so you'll never be caught off guard.

Who Handles a Claim When I Need to File One?

You can start with either, but how they respond really shows the core difference between an insurance agent and a broker. An agent will help you get the claim started with the one company they work for, acting as a go-between.

A broker, on the other hand, is your personal advocate. They don't just file the claim; they actively work on your behalf with the insurance company to push for a fair and prompt settlement. That kind of support can make all the difference during a stressful time.

A broker's job during a claim is to champion your interests. They use their market knowledge and industry relationships to make sure the insurance company holds up its end of the bargain when you need it most.

Is an Independent Agent the Same as a Broker?

This is a great question, and the answer is no—though they can seem similar. An independent agent definitely gives you more options than a captive agent because they can offer policies from a handful of different insurance companies.

But they still have contracts with and allegiances to those specific carriers. A broker is different. Their legal and fiduciary duty is 100% to you, the client, not to any insurance company. This freedom allows a broker to be completely impartial and search a much bigger market—including specialized insurers—to find the absolute best fit. For more answers to common questions, check out these general insurance FAQs.

At Wexford Insurance Solutions, we’re an independent brokerage. That means we work for you, and only you. Our team takes the time to understand exactly what you need, then we search the entire market to find the right coverage at the best price. From complex business policies to personal insurance, we deliver the expert advocacy and market access you deserve.

Ready to work with a partner who puts you first? Contact Wexford Insurance Solutions today for a comprehensive risk review.

Business Insurance New York A Small Business Owner's Guide

Business Insurance New York A Small Business Owner's Guide Your Guide to the Insurance Policy Rider

Your Guide to the Insurance Policy Rider