A Business Owner Policy (BOP) rolls general liability, property coverage, and business interruption into one streamlined package. A standalone General Liability (GL) policy, by contrast, focuses solely on third-party bodily injury, property damage, and advertising injury. In many cases, bundling with a BOP not only broadens your protection but also trims overall premiums.

Quick Comparison Overview

- Bundled Coverage: A BOP combines general liability, commercial property, and business interruption into one policy.

- Focused Protection: GL handles only third-party injury, property damage, and advertising injury.

- Cost Savings: Data shows bundled plans can shave off around $52 per month compared to buying each policy separately.

A BOP typically runs about $57 per month, whereas GL alone is around $42 and a standalone property policy about $67.

Retail shops and businesses with on-site inventory often see the greatest advantage in a BOP. If you’re a solo consultant or service provider with minimal physical assets, a GL policy could be all you need—and at a lower cost.

When To Choose Each Policy

- A BOP is ideal for businesses that need to protect buildings, equipment, and income flow.

- A GL policy fits professionals whose main exposure is third-party claims and who want to keep premiums lean.

Below is a side-by-side snapshot of what each option offers.

BOP Vs GL Comparison At A Glance

| Policy Type | Core Coverage | Typical Monthly Cost | Ideal For |

|---|---|---|---|

| BOP | General liability + Property + Business interruption | $57 | Retail shops, cafes |

| GL | Third-party injury, property damage, advertising injury | $42 | Consultants, service firms |

This table highlights how each policy lines up on coverage scope and cost. Use it to pinpoint which model aligns best with your risk profile.

TechInsurance reports that bundling these protections in a BOP averages $57 per month, compared to $42 per month for general liability alone—delivering roughly $624 in annual savings. Read the full research on Business Owner Policy vs General Liability on HuneycuttGroup.

You might be interested in our guide on commercial general liability.

Putting a Business Owner Policy and a General Liability plan side by side shows how combining coverages can simplify your insurance portfolio and often cut yearly costs.

Reach out to Wexford Insurance Solutions for a tailored quote that matches your business size, location, and exposure profile.

You can start with a free risk assessment to compare quotes instantly.

Understanding The Key Features

General Liability insurance steps in when your business is held responsible for third-party bodily injury or property damage. It also covers advertising injuries, like copyright disputes or defamation in your promotional materials.

Policy limits usually run from $1 million to $2 million per occurrence. Your deductible determines what you pay out of pocket and can be adjusted to balance premiums with risk exposure.

- Additional Insured Endorsement extends protection to partners or contractors.

- Waiver of Subrogation prevents your insurer from pursuing recovery from a third party.

- Claims-Made Endorsement shifts when claims are covered, based on when they’re reported.

A Business Owner Policy (BOP) builds on this foundation by adding two vital layers:

Commercial property coverage shields your building, equipment and inventory from fire, theft or vandalism. Meanwhile, business interruption insurance replaces lost income and covers fixed expenses if a covered peril forces you to pause operations.

Comparing Coverage Elements

Here’s a side-by-side snapshot of what each policy brings to the table:

| Feature | General Liability | Business Owner Policy |

|---|---|---|

| Third-Party Bodily Injury | ✓ | ✓ |

| Property Damage | ✓ | ✓ (Owned Assets) |

| Business Interruption | ✗ | ✓ |

| Advertising Injury | ✓ | ✓ |

Limits and deductibles vary by provider, so it pays to compare quotes. For a deeper dive into property and interruption specifics, explore what a Business Owners Policy covers at Wexford Insurance Solutions.

Lease And Regulatory Factors

Landlords commonly require property insurance for leased premises—making a BOP a smoother fit. Opting for standalone GL could leave you out of compliance with lease clauses and open to penalties.

Consider these industry touchpoints:

- Health Standards: Clinics often need elevated GL limits to meet medical safety codes.

- Industry Codes: Manufacturers might face mandatory property endorsements under local regulations.

- Financial Covenants: Lenders frequently insist on interruption coverage before approving loans.

Mapping these requirements against your contracts ensures you pick the right policy structure.

How To Decide Between Policies

Use this quick checklist to guide your decision:

- Asset Inventory: Tally and value your buildings, equipment and stock.

- Income Risk: Estimate potential revenue loss in a shutdown scenario.

- Lease and Loan Terms: Scrutinize coverage mandates in your agreements.

Expert Insight Combining liability, property and business interruption in one policy package can close coverage gaps and simplify administration.

Once you’ve walked through these steps, reach out for personalized advice and quotes.

Example Scenario Comparison

Imagine a busy downtown café: espresso machines, ovens and inventory are all vulnerable to fire or theft. With a BOP, you’d cover equipment replacement and recoup lost income during repairs. Carrying only a GL policy, you’d face those costs yourself.

- Coverage Breadth: BOP secures both assets and income.

- Cost Consideration: Expect BOP premiums to run 20–30% higher than basic GL.

- Risk Threshold: Calculate your asset value to see if the extra cost is justified.

Dig into policy details and collaborate with your broker to customize endorsements and limits. Small tweaks can uncover savings while closing critical gaps.

Act now—contact Wexford Insurance Solutions for expert guidance and a quote tailored to your operation.

Coverage Gaps And Their Impact

Relying solely on a general liability policy can leave your business exposed. You might not realize how steep out-of-pocket costs can climb when your own property or income isn’t covered.

- Damage to owned assets goes unrepaired under a GL-only plan.

- Lost revenue during forced closures isn’t replaced with standalone GL coverage.

- Lease agreements and lender covenants almost always demand property and interruption protection.

Identifying Core Coverage Gaps

General liability steps in when a third party claims bodily injury, property damage or advertising injury. Yet it won’t touch repairs on your own equipment, inventory or building.

Consider a burst pipe in a retail shop that floods display racks. Tack on repair bills and the cost of lost sales, and you could wipe out cash reserves without a business interruption policy.

Insight A single facility shutdown can reduce revenue by 50% or more, underscoring the value of the interruption component in a BOP.

Lease And Lender Mandates

Landlords frequently require proof of property and business interruption insurance. Skip it, and you risk lease violations or financial penalties.

Lenders often include insurance clauses in loan agreements. Typical requirements include named perils coverage and interruption limits equal to several months of gross revenue.

| Requirement | GL Policy | BOP Policy |

|---|---|---|

| Coverage for owned buildings | ✗ | ✓ |

| Compensation for lost income | ✗ | ✓ |

| Lease compliance evidence | ✗ | ✓ |

| Loan covenant fulfillment | ✗ | ✓ |

Illustrating Real World Scenarios

A small café that ran on a GL-only plan paid $8,000 out of pocket to replace ovens after a fire. They also lost three weeks of sales, depleting their emergency funds.

Next door, a bakery with a BOP moved quickly to replace equipment and recouped 80% of its lost income. They kept staff on payroll and avoided late-rent fees.

Another example: a medical practice closed by a severe storm used its BOP to fix equipment and cover payroll. They reopened without missing appointments or falling behind on bills.

Check out our guide on insurance gap analysis for a customized review of your exposures.

Comparing Business Owner Policy Versus General Liability

A General Liability policy alone handles third-party claims for injury and damage. It doesn’t protect your own building or replace lost income after a shutdown.

By contrast, a BOP bundles GL with commercial property and business interruption cover. You get one policy that steps in for repairs and ongoing expenses when unexpected events occur. Learn more about these distinctions on NextInsurance.

Bundling can also reduce your total premium compared to buying separate policies.

How To Evaluate Your Coverage Needs

- Create an inventory of assets with estimated replacement values.

- Calculate potential revenue loss for each day of closure.

- Review lease and loan documents for mandatory insurance clauses.

- Compare standalone GL quotes against bundled BOP options.

Service-based businesses with minimal on-site assets might be fine with a GL policy alone. If you own property or face significant income risks, a BOP often delivers better protection and long-term savings.

Decide with confidence today.

Cost Differences And Premium Drivers

Understanding how your monthly insurance bill shifts between General Liability (GL) and a Business Owner’s Policy (BOP) is crucial. Underestimating your needs risks a coverage gap. Over-insuring drains your budget.

Small outfits with few physical assets often opt for a GL-only plan. Meanwhile, businesses holding inventory, machinery or facing downtime concerns tend to lean on a BOP.

Market research shows GL-only premiums typically fall between $20–$50 per month for low-risk operations. A BOP, in contrast, can span $40–$250+ depending on asset values and interruption exposure. Discover more details on business-owner-policy-vs-general-liability at SimplyBusiness.

Key Cost Drivers

Every insurer looks at a handful of core factors when setting your rate:

- Industry Classification: A professional consultant may see base rates near $20 a month. A light manufacturer or retailer might start closer to $40.

- Geographic Location: Metropolitan zip codes often carry 10–20% higher premiums, driven by claim frequency and local repair costs.

- Payroll Size And Risk: More staff equals higher liability exposure. Each additional $10,000 in payroll can bump premiums by 5–8%.

Policy options also make a difference. Choosing higher limits or adding endorsements—say, hired/non-owned auto—can push costs up by 15–30%.

Premium Ranges For GL And BOP Policies

Below is a snapshot of typical monthly ranges by business type. Use it to set expectations before you shop.

| Business Type | GL Monthly Premium Range | BOP Monthly Premium Range |

|---|---|---|

| Low-risk Service | $20–$50 | $40–$100 |

| Retail Or Light Manufacturing | $30–$70 | $80–$250+ |

Even within these bands, you can negotiate based on your claims history and risk controls.

Negotiation Matters: Bundling GL and property coverages with the same carrier can shave 10% off your total premium.

Real World Premium Scenarios

Imagine a solo graphic designer working from a home office. Their monthly GL premium clocks in at around $25, covering client visits and ad-injury exposures. Property value is low, so BOP doesn’t make financial sense.

On the flip side, a downtown bakery with ovens worth $50,000, seating for 20 and a flood-zone address might see a $150-plus BOP bill each month. Staff headcount, equipment value and location risks drive that number up.

Tips to keep in mind:

- Compare your total assets at risk against third-party liabilities.

- Factor in peak-season sales when interruption coverage becomes critical.

- Use a clean claims history to negotiate credits.

How To Negotiate Rates

- Request quotes from at least three insurers to understand the market.

- Tweak deductibles and limits — a higher deductible often leads to a lower premium.

- Bundle multiple lines (GL, property, cyber) to access multi-policy discounts.

- Ask for claim-free credits if you’ve operated without a loss in recent years.

Forecast Your Renewal Budget

Renewal offers can jump if you add staff, upgrade equipment or move locations. Keep your insurer looped in on these changes to avoid surprises.

- Verify building valuations and equipment inventories at least once a year.

- Document claim outcomes and safety improvements to build your credibility.

Prepare For Rate Discussions

Lay out your risk management protocols before talking price. Showing safety audits, employee training schedules or installed sprinkler systems tells carriers you’re serious about loss prevention.

- Share recent safety inspection reports.

- Highlight staff certifications and regular maintenance logs.

Final Steps

Line up your top quotes side by side, factoring in any endorsement costs. Choose the plan that balances coverage depth with your budget limits. Review the fine print on exclusions, and don’t hesitate to ask questions.

Ready to lock in a competitive rate? Contact Wexford Insurance Solutions to get a quote that fits your business.

For more on how GL premiums are calculated, see our detailed guide on general liability insurance cost.

Real World Industry Use Cases

Different businesses juggle unique risks when choosing between a Business Owner’s Policy (BOP) and General Liability (GL). Below, we examine four real-world scenarios—each illustrating policy rationale, risk factors, and claim outcomes.

Retail Shop Scenario

A boutique clothing store holds inventory valued at $80,000 in a leased space, facing slip-and-fall and stock damage exposures. A standalone GL quote came in at $45 per month but offered no property protection.

They selected a BOP at $110 monthly to combine general liability, property, and business interruption coverage. When a backroom water leak destroyed $12,000 in inventory, the BOP covered replacement costs without tapping into reserves.

- Business Profile: On-site stock and steady foot traffic

- Key Exposures: Inventory loss, customer injuries, forced closures

- Outcome: Inventory replaced; doors reopened within a week

Expert Insight A BOP can cut property claim approval times by 30% compared to separate policies.

Small Café Case Study

A neighborhood café owned cooking equipment worth $35,000 and generated roughly $250,000 in annual revenue. A GL-only plan at $50 per month left equipment breakdown and income interruption gaps.

They upgraded to a BOP at $95 monthly. Two months later, their espresso machine failed. The policy not only paid for a replacement but also covered $8,500 in lost revenue over four days.

| Metric | GL Only Plan | BOP Plan |

|---|---|---|

| Monthly Premium | $50 | $95 |

| Equipment Breakdown | No | Yes |

| Income Interruption Coverage | No | Yes |

| Out-Of-Pocket Claim Cost | $8,500 | $500 Deductible |

This streamlined approach kept the café’s cash flow stable and avoided surprise expenses.

Professional Service Example

A consulting firm billing $120,000 a year worried about lawsuits over advice errors. They had no storefront or equipment to protect. A GL policy at $30 per month covered bodily injury and advertising injury—but not professional mistakes.

Rather than adding a pricey professional liability policy, they stayed with GL only. Over three years, they saw zero claims and saved about $720 in premiums.

For further reading on similar businesses, check out our guide on general liability insurance for painters.

Key Takeaway When asset exposures are minimal, a GL-only policy may suffice.

Light Manufacturer Example

A small furniture maker owned machinery and displays totaling $150,000, exposing them to equipment damage and theft risks. A GL-only quote came in at $60 per month with no property coverage.

They chose a BOP at $200 monthly. A fire partially damaged machines valued at $18,000, and the policy covered repair costs plus $6,200 in lost sales during downtime.

- Machinery Value: $150,000

- Monthly Cost Difference: $140

- Claim Payout: $18,000 (repairs) + $6,200 (interruption)

Their experience shows how a BOP can close major coverage gaps under one policy.

Comparing Policy Outcomes

When you line up these scenarios, clear trends emerge:

| Use Case | Policy Selected | Monthly Cost | Key Benefit |

|---|---|---|---|

| Retail Shop | BOP | $110 | Inventory and interruption cover |

| Small Café | BOP | $95 | Equipment breakdown protection |

| Consulting Firm | GL Only | $30 | Lower premiums for liability only |

| Furniture Maker | BOP | $200 | Property and income replacement |

Retail and hospitality businesses often see the greatest value in a BOP, while service firms with minimal assets may lean toward GL only. Manufacturers carrying expensive equipment typically benefit from the bundled simplicity of a BOP.

Ready to explore your options? Contact Wexford Insurance Solutions for a tailored review and quote.

How To Choose Your Policy

Deciding between a Business Owner Policy (BOP) and a General Liability (GL) plan takes more than a quick glance at price tags. You need a clear picture of what each covers—and, just as importantly, what falls through the cracks. This guide walks you through every step, from spotting exposure gaps to tailoring endorsements and balancing costs.

Assess Your Asset Exposure

Start by cataloging every piece of property that matters: your building, machinery, office furniture, inventory—anything you’d hate to replace out of pocket.

Estimate each item’s current market or replacement value, not just its tax basis. This exercise exposes property risks that a GL-only policy can’t touch. For many businesses—especially those with leased equipment or tenant improvements—a BOP often becomes the smarter choice.

- Asset Inventory: Tally owned premises, fixtures and equipment.

- Replacement Cost Estimates: Base numbers on up-to-date appraisals.

- Contractual Requirements: Match your policy limits to lease or lender mandates.

If you lease office or retail space, remember to check whether your landlord demands tenant-improvement coverage. A standard BOP often includes that endorsement at no extra charge.

Research Insurer Strength

Even the best policy is only as solid as the company standing behind it.

Look up carrier ratings on A.M. Best or Standard & Poor’s, focusing on financial stability grades. An insurer’s ability to pay claims quickly can make your life infinitely easier if disaster strikes. Don’t stop there—scan customer reviews for feedback on claims responsiveness and digital tools.

- Client Portal: Can you file a claim, review documents or pay premiums online?

- Claims Satisfaction: Seek out real-world accounts of insurer turnaround times.

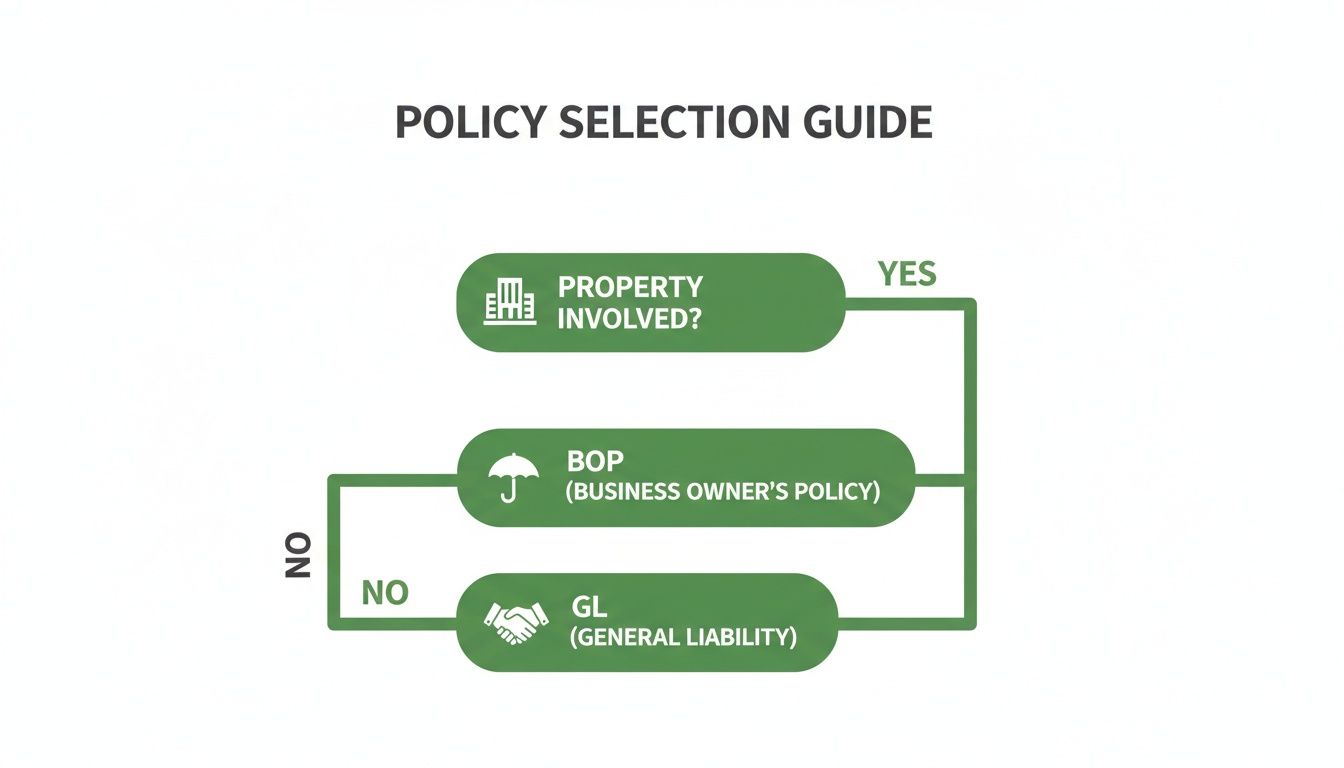

This infographic shows the decision path: minimal physical assets often point toward a GL policy, while owned real estate usually calls for a BOP bundle.

Those with property on the balance sheet typically unlock more value—and broader protection—through a BOP.

Evaluate Income Interruption Risk

No coverage for business interruption? That’s exactly what a standalone GL plan delivers. To see if you need a BOP’s interruption feature, run these numbers:

- Calculate your average daily revenue.

- Estimate a realistic downtime, using local fire or flood statistics.

- Multiply daily revenue by downtime to gauge potential income loss.

Next, compare that figure to common BOP interruption limits. If your projected loss exceeds what a GL policy offers, a BOP (or an added interruption endorsement) can plug that critical hole.

Focus on the waiting period too—every extra day you’re shut down is money out of your pocket.

Customize Endorsements To Fill Gaps

No two businesses are identical, and your policy shouldn’t be, either. As you review quotes side by side, watch for coverage gaps and top them up with targeted endorsements:

- Hired and Non-Owned Auto: Protects staff using rental cars or personal vehicles on company time.

- Cyber Liability: Essential if you store client data or process payments online.

- Equipment Breakdown: Covers costly downtime when vital machinery fails.

- Employee Dishonesty: Guards against internal theft or fraud.

These add-ons let you fine-tune protection without inflating your base premium.

Balance Coverage And Budget

Lower premiums often come with higher deductibles—so gauge how much out-of-pocket risk you can swallow. Bundling multiple policies under a BOP or with the same carrier frequently unlocks 10–15% discounts compared to stand-alone plans.

- Compare GL-only vs. BOP rates line by line.

- Implement safety measures—alarms, sprinklers, cybersecurity protocols—to negotiate better terms.

- Leverage a clean claims history for further credits.

Project upcoming changes (new equipment purchases, lease renewals) and factor them into your renewal estimate. That way, you won’t be caught off-guard by hidden costs or shifting risk profiles.

Consult An Insurance Advisor

Sometimes it makes sense to bring in an expert. An independent agent can model multiple scenarios—varying limits, deductibles, endorsements—and recommend the optimal mix for your operation.

For a free risk assessment and personalized quote, reach out to Wexford Insurance Solutions. Their specialists will walk you through both GL and BOP options so you can choose with confidence.

Frequently Asked Questions

Many small business owners wonder whether a Business Owner’s Policy (BOP) or a standalone General Liability (GL) plan best suits their needs. A GL policy provides essential liability protection, but a BOP bundles property, liability, and business interruption coverages—making it a solid choice when you have on-site assets or face revenue-loss risks.

If your operation is service-only with minimal physical exposure, sticking to a GL-only plan can help you manage costs without over-insuring.

Typical BOP Beneficiaries

- Retail & Hospitality: Protect storefront fixtures, café equipment, and lost income

- Light Manufacturing: Cover machinery, tools, and inventory against damage

- Leased Properties: Satisfy landlord or lender insurance requirements in one package

- Professional Offices: Safeguard specialized tech and sensitive data on site

How Do You Layer Property Coverage Onto A GL Policy?

- Add a commercial property endorsement to your existing GL plan

- Specify covered perils and list each asset’s replacement cost

- Adjust policy limits to reflect true replacement values

Adding property coverage to a GL policy often increases premiums by 15–30%, but it’s a smart move to close costly gaps.

How Do Policy Limits Affect Premiums?

- A $1 million per-occurrence limit sets your baseline rate

- Raising that to $2 million can bump premiums by about 20%

- Choosing a higher deductible helps offset some of those increases

What Info Streamlines A Quote Request?

- A detailed inventory with replacement-cost estimates

- Projected annual revenue to size business-interruption limits

- Any lease or lender insurance mandates

- Recent claims history and current risk controls

Use these answers to guide your conversation with carriers and brokers. Ready to optimize your coverage? Contact Wexford Insurance Solutions for a tailored quote

What Is Dwelling Coverage and How Does It Protect Your Home?

What Is Dwelling Coverage and How Does It Protect Your Home? How to Calculate Home Replacement Cost Accurately

How to Calculate Home Replacement Cost Accurately