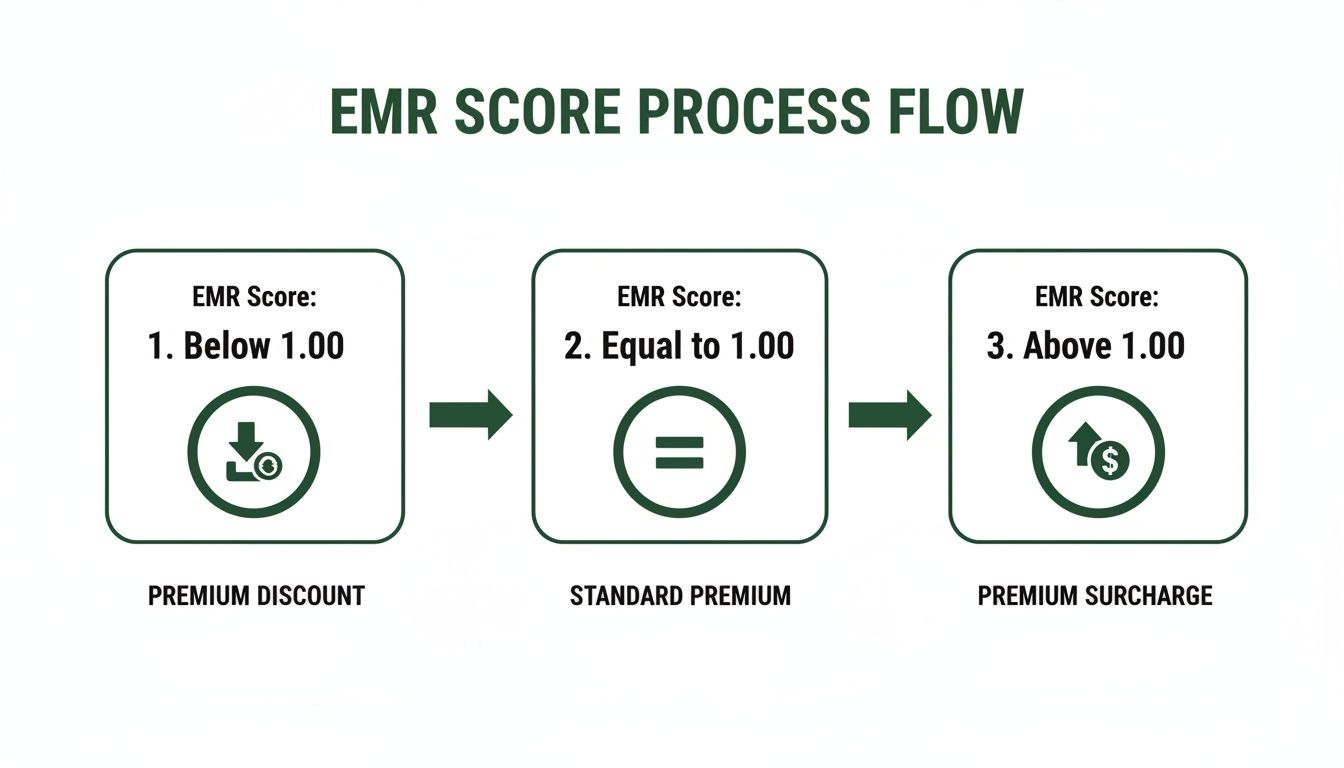

Think of your Experience Modification Rate (EMR) as your company's safety report card. It's a number that directly shapes what you pay for workers' compensation insurance. A good score gets you a discount, while a poor one means you'll pay a penalty.

The magic number is 1.00, which is the industry average. If your EMR is below that, you're saving money. If it's higher, you're paying more than you have to.

What Is An Experience Modification Rate and How Does It Work

Your Experience Modification Rate—often called an EMR, experience mod, or X-mod—is a multiplier that insurance companies use to adjust your workers' comp premium up or down. It’s a straightforward comparison of your company’s actual claims history against the expected claims for a business of your size and in your specific industry.

It really is like a credit score, but for workplace safety. Imagine two construction companies with identical payrolls. One has a great safety program and very few injuries. They'll earn an EMR below 1.00 and get a nice discount on their premium. The other company has a string of accidents and will be hit with an EMR well above 1.00, forcing them to pay a significant surcharge.

The Core Components Of An EMR

This number isn't pulled out of thin air. A rating bureau, like the National Council on Compensation Insurance (NCCI) or a state-specific body, calculates it using a detailed formula. While the math can get complicated, it all comes down to a few key inputs:

-

Actual Losses: This is the hard data from your company's past claims, usually looking back at a three-year period (but ignoring the most recent year to allow for claims development). You can find all this data detailed in a loss run report.

-

Expected Losses: This is the statistical average—what the bureau expects a business like yours (same industry, similar payroll) to have in claims. It’s the benchmark you’re measured against.

-

Claims Frequency vs. Severity: The formula is weighted to more heavily penalize a pattern of frequent, smaller claims over one single, costly accident. Why? Because lots of small incidents often point to a systemic breakdown in safety culture, which is a bigger red flag for future risk.

To get a real handle on your EMR, it's helpful to start by understanding insurance claims and how they flow through the system, since that history is what drives your score.

An experience modification rate is a numeric multiplier used to adjust an employer’s workers’ compensation premium by comparing the employer’s past loss experience to the expected losses for similar employers. Learn more about how this is a standard industry practice from Wikipedia.

What Your Score Means

At its core, your EMR gives you a clear snapshot of your safety performance compared to your direct competitors. This table breaks down what the numbers mean in simple terms.

EMR Score At-a-Glance

| EMR Score | Meaning | Impact on Premium |

|---|---|---|

| Below 1.00 | Better than industry average | You receive a premium credit (discount). |

| Exactly 1.00 | Equal to industry average | You pay the standard, unmodified premium. |

| Above 1.00 | Worse than industry average | You pay a premium debit (surcharge). |

Simply put, a low EMR proves your commitment to safety and directly rewards you with lower insurance costs. A high EMR, on the other hand, is a clear signal that there's room for improvement and comes with a financial penalty.

How Your Experience Modification Rate Is Calculated

Diving into how your Experience Modification Rate (EMR) is calculated can feel like trying to solve a complex puzzle. But at its core, the logic is pretty straightforward. It all boils down to comparing your company's actual claims history to what's expected for a business of your size and type.

Rating bureaus like the NCCI use a specific formula to generate this score. Think of it as a report card for your company's safety performance. The formula creates a benchmark based on your industry and payroll, then measures your actual track record against it. The result determines whether you earn a discount, pay the standard rate, or get hit with a surcharge.

This is where the rubber meets the road—your score directly adjusts what you pay.

As you can see, a score below 1.00 nets you a premium discount. But a score above 1.00 means you're paying a penalty, and it can add up fast.

Key Elements of the EMR Formula

So, what exactly goes into this calculation? A few key ingredients come together to produce your final EMR, and each one tells a piece of your company's safety story.

- Actual Losses: This is the most direct input—it’s the total dollar amount of claims your business has actually filed during the rating period.

- Expected Losses: This is a statistical benchmark. It’s a projection of the losses an average company of your size, in your specific industry, would likely have.

- Payroll Data: Your payroll, carefully sorted by job classification codes, is what helps determine those expected losses. A larger payroll in a high-risk industry naturally has a higher expected loss figure.

- Time Period: The EMR calculation doesn't look at last week's data. It typically uses three years of claims history but intentionally skips the most recent policy year. This "experience period" ensures the data is stable and provides a more accurate long-term picture of your safety record.

The Critical Role of the Split Point

Here’s where it gets interesting. Not all losses are treated equally in the EMR formula. The system uses a concept called the split point, which is a specific dollar amount that divides every claim into two distinct parts: primary losses and excess losses.

The EMR formula is built to penalize a high frequency of small claims more than one single, catastrophic event. The split point is the mechanism that makes this happen.

Here's how it works for each claim:

- Primary Losses: The amount of the claim that falls below the split point is counted in full against your EMR.

- Excess Losses: The amount of the claim above the split point is significantly discounted, softening its impact on your final score.

This design is all about identifying patterns. A single, severe accident could just be terrible luck. But a steady stream of smaller claims often points to systemic safety problems that need fixing. By weighting frequent incidents more heavily, the formula encourages businesses to focus on preventing those seemingly minor slip-and-falls or strains that can secretly drive an EMR through the roof.

This is why getting the data right from the start is so vital. Understanding the ins and outs of a workers comp premium audit ensures your payroll and class codes are accurate. Since this data is the foundation of your EMR calculation, any mistakes can have expensive, long-lasting consequences.

A Real-World Example of an EMR Calculation

Theory is great, but let's be honest—nothing makes the experience modification rate click quite like seeing it in action. To show you how it all works, we'll walk through a real-world scenario with a hypothetical company, "SafeBuild Construction," and see how their data translates into an EMR score.

This example will connect the dots between payroll, actual claims, and that final multiplier that can seriously impact a company's workers' compensation premium.

Setting the Stage for SafeBuild Construction

First, the rating bureau needs SafeBuild's data from the three-year experience period. For our example, here are the key numbers:

- Total Payroll: $3,000,000 over the three years.

- Industry Classifications: All employees work under standard construction codes.

- Expected Losses: Based on their payroll and industry risk, the rating bureau calculates that SafeBuild's expected losses should be $60,000. This is the benchmark—the average performance they're measured against.

With that baseline set, we can now dig into what actually happened at SafeBuild during that same three-year window.

Analyzing SafeBuild's Actual Claims

Over the rating period, SafeBuild’s record was pretty good, but they did have three claims:

- Claim A: A minor injury that cost $4,000 in medical bills.

- Claim B: A more significant strain injury that resulted in $12,000 in costs.

- Claim C: A serious fall that led to a $50,000 claim.

This puts SafeBuild's total actual incurred losses at $66,000. At first glance, you might think their EMR is going to be high. After all, their actual losses ($66,000) are more than their expected losses ($60,000). But it’s not that simple, thanks to something called the split point.

Let's assume the state's split point for this rating period is $18,500. This is a crucial number. Every claim is divided into a "primary" portion (the amount up to $18,500) and an "excess" portion (anything above $18,500).

The split point ensures that a high frequency of smaller claims weighs more heavily than a single, large, unlucky incident. It's the formula's way of rewarding consistent safety practices.

Here’s how SafeBuild's claims get split up:

- Claim A ($4,000): $4,000 Primary / $0 Excess

- Claim B ($12,000): $12,000 Primary / $0 Excess

- Claim C ($50,000): $18,500 Primary / $31,500 Excess

This gives them total Actual Primary Losses of $34,500 and Actual Excess Losses of $31,500. The formula is designed to heavily discount the excess portion, so while their total losses were $66,000, their "ratable" losses are considered much lower.

When these figures are plugged into the full EMR formula—factoring in their expected losses and other weighting factors—SafeBuild's final calculated EMR comes out to 1.08.

This means SafeBuild Construction will pay an 8% surcharge on their next workers' compensation policy. It’s a perfect illustration of how just a few claims can turn a potentially average EMR into a costly one. This is why proactively managing claims data and ensuring its accuracy, a key part of any workers' compensation audit checklist, is so critical each year.

The True Financial Impact of Your EMR Score

Your Experience Modification Rate (EMR) isn't just some abstract safety metric buried in your insurance paperwork. Think of it more like a financial lever that directly dials your workers' compensation premium up or down. Once you grasp its true impact, that number transforms from a policy detail into a critical KPI for your company's financial health.

The connection between your EMR and what you pay for insurance is simple, direct math. Your final premium is calculated by multiplying your base premium (the "manual rate") by your EMR. This means every single point your score moves has a real, dollar-for-dollar consequence on your bottom line.

From Score to Dollars: An EMR Premium Scenario

Let's make this tangible. Imagine your company has a standard workers' compensation premium of $100,000 before the EMR gets applied. This figure is based on your industry classification and total payroll.

Now, watch how your safety performance—captured by your EMR—changes what you actually have to pay.

Here’s a quick look at how different EMR scores would affect that $100,000 manual premium.

EMR's Impact on a $100,000 Manual Premium

| EMR Score | Calculation | Final Premium | Annual Savings/Cost vs. Average |

|---|---|---|---|

| 0.85 (Excellent) | $100,000 x 0.85 | $85,000 | $15,000 Savings |

| 1.00 (Average) | $100,000 x 1.00 | $100,000 | $0 |

| 1.25 (Poor) | $100,000 x 1.25 | $125,000 | $25,000 Additional Cost |

As you can see, the difference between a great EMR and a poor one creates a $40,000 swing in annual costs in this example alone. For larger companies, the financial stakes are exponentially higher. Because the EMR is a direct multiplier, even a small shift can justify significant investments in safety. A firm with a $500,000 manual premium and a 1.25 EMR would pay $625,000, while a 0.85 EMR would drop that premium to just $425,000.

The Hidden Costs and Lost Opportunities

The pain of a high EMR doesn't stop with your insurance bill. It can become a major barrier to growth, quietly costing your business opportunities you might not even know you're missing out on. A high score is a serious competitive disadvantage.

Your EMR is not just an insurance metric; it's a public-facing indicator of your company's operational reliability and commitment to safety.

Many lucrative contracts, especially in construction, manufacturing, and government work, have strict pre-qualification rules. It's incredibly common for general contractors and project owners to refuse to even look at bids from companies with an EMR above the 1.00 average. They see a high EMR as a red flag for unacceptable risk—a sign of potential project delays, on-site incidents, and liability headaches they don't want to inherit.

A high score can also signal deeper operational problems to potential partners, lenders, and even top-tier job candidates. In the worst cases, a persistently high EMR can make it nearly impossible to find coverage in the standard insurance market, forcing a business into a state-run assigned risk workers' compensation pool. These "markets of last resort" almost always come with much higher costs and far less flexibility.

Ultimately, your EMR is a reflection of your company's overall health, impacting your finances, reputation, and your very ability to compete.

Actionable Strategies to Lower Your EMR

Knowing what an EMR is and how it’s calculated is one thing; taking control of it is another. Lowering your experience mod isn't a passive exercise. It’s an ongoing effort that blends proactive safety measures with a smart, disciplined approach to managing claims when they do happen.

The work to get a lower EMR starts long before anyone gets hurt. It’s all about building a culture where safety is second nature, not just a policy collecting dust on a shelf.

Build a World-Class Safety Program

Your first and best line of defense is a top-notch safety program. This is more than just checking compliance boxes. It requires a genuine commitment to sniffing out and neutralizing risks before they can cause an injury.

A truly effective program has a few key ingredients:

- Regular Hazard Identification: Get out on the floor and walk the site. Actively look for potential problems, whether it's a simple trip hazard or someone using equipment the wrong way.

- Consistent Safety Training: Run regular training sessions that are specific to what your employees actually do every day. The statistics are eye-opening: nearly 35% of workplace injuries occur within an employee's first year on the job. That fact alone screams for solid onboarding and continuous training.

- Providing Proper PPE: Make sure every single person has the right Personal Protective Equipment for their role. Just as critical, train them on how to use it correctly every single time.

A strong safety culture always starts at the top. When leadership makes it clear that safety trumps deadlines, employees feel empowered to do the same. This is the very heart of effective loss control in insurance.

Master Your Claims Management Process

Even with the best safety measures, accidents can still happen. What you do in the moments, days, and weeks that follow has a massive impact on your EMR. Smart, empathetic claims management is where you play defense.

Your primary goal is to minimize the impact of every claim, both financially and on the person involved. The only way to do that consistently is to have a crystal-clear, documented process that your team can execute immediately after an incident.

Implement a Powerful Return-to-Work Program

One of the single most effective tools for wrestling your EMR down is a formal Return-to-Work (RTW) program. Why? Because the EMR formula severely penalizes claims for lost time. An RTW program gets injured employees back on the job in a modified or light-duty role as soon as their doctor gives the okay.

This strategy pays off in several huge ways:

- Reduces Claim Costs: By keeping the employee productive and earning a wage, you slash the indemnity (lost wage) payments, which are often the most expensive part of a claim.

- Minimizes EMR Impact: In many states, if you can keep a claim from becoming a "lost-time" claim, you can reduce its impact on your EMR calculation by as much as 70%. That’s a game-changer.

- Boosts Employee Morale: It sends a clear message that you value your people and are invested in their recovery. It keeps them engaged and connected to the company, which is great for everyone.

Remember, a high EMR doesn't just hurt your insurance premiums; it can actively cost you business. Insurers and trade groups alike will tell you that a bad EMR, especially in fields like construction, can get you disqualified from bidding on lucrative contracts. For a deeper dive on this, you can learn about the NCCI's view on experience rating.

Partnering with Experts to Master Your EMR

Getting a handle on your experience modification rate isn't a "set it and forget it" task. It's an active, ongoing effort, and frankly, having the right expert in your corner can make all the difference. This is where a strategic partner moves beyond simply selling you a policy and starts actively helping you lower costs and build a safer workplace.

At Wexford Insurance Solutions, we give you the tools and the know-how to take control of your workers' comp costs. Our approach is hands-on and proven, tackling every angle of what goes into your EMR. It all starts by digging deep into your data to see what’s really going on.

Advanced Analytics and Forecasting

We kick things off with a thorough analysis of your loss history and payroll data. We’re looking for trends, costly reporting errors that might be flying under the radar, and most importantly, we project your future EMR. This forecast is huge—it shows you where your score is headed, letting you make smart moves before your next renewal instead of getting hit with an expensive surprise.

This data-driven foundation is what allows us to build a real strategy. We can pinpoint the exact types of claims that are pushing your costs up, so you can focus your safety efforts where they’ll actually make a difference.

This isn't just about insurance; it's about giving you the tools and expertise to take command of your costs and build a more resilient business.

Proactive Claims Advocacy and Strategic Advice

Next comes proactive claims advocacy. We don't just stand on the sidelines; we work directly with you and the insurance carrier to manage claims from start to finish. Our goal is to ensure reserves are set accurately and that return-to-work programs are used effectively to close claims faster. This hands-on management minimizes the financial sting of every single incident.

Finally, we provide strategic advice to strengthen your defenses against future losses. We’ll help you implement powerful safety programs and operational best practices that are proven to reduce how often claims happen in the first place. For businesses looking to navigate the complexities of safety regulations, expert health and safety consulting can be an invaluable resource.

Our integrated services include:

- EMR Forecasting: We project your future mod so you can budget accurately and intervene early.

- Claims Review: We audit your loss runs for errors that could be inflating your EMR.

- Strategic Planning: We help you develop and implement targeted safety initiatives.

When you partner with Wexford, you get a dedicated team obsessed with reducing your total cost of risk. We’re here to help you turn your EMR from a liability into a real competitive advantage.

Your Top EMR Questions, Answered

The world of experience modification rates can be a bit confusing, and it's natural to have questions. Let's tackle some of the most common ones that come up when businesses are trying to get a handle on their workers' comp costs.

How Long Does a Single Claim Stick to My EMR?

Think of it as a three-year echo. A workers' compensation claim will typically influence your EMR for a full three years. The formula uses a rolling three-year window of your claims history, but with a slight delay.

Here's how it works: the calculation always skips the most recent policy year to let all the claim data settle. So, if a claim happened during your 2022-2023 policy period, you'd see its impact on your EMR for your 2024, 2025, and 2026 policies before it finally fades away.

Can My EMR Change in the Middle of My Policy Year?

Generally, no. Your EMR is calculated once a year, right before your policy renews, and it’s locked in for that entire 12-month term.

The only real exception is if a major clerical error is found. If the rating bureau discovers that your EMR was calculated using incorrect payroll numbers or claims data, they can issue a mid-term correction. This is rare, but it would adjust your premium up or down.

An EMR below 1.00 is the goal. It proves your business has a better-than-average safety record and earns you a direct discount on your workers' compensation premium. The lower your score, the more you save.

What's Considered a "Good" Experience Modification Rate?

Anything under 1.00 is good news. That 1.00 mark is the industry average, so dipping below it means you're outperforming your peers. For example, an EMR of 0.85 shows your company is 15% safer than similar businesses.

This directly translates to a 15% credit on your premium. Beyond the savings, a low EMR is a badge of honor. Many contracts, especially in fields like construction, require bidders to have an EMR of 1.00 or lower just to be considered.

Does Every Single Business Get an EMR?

Not automatically. To get your own unique EMR, a business first has to meet a minimum premium threshold set by the state. This shows you have enough data for a statistically valid score.

Smaller or newer companies that haven't hit this threshold are usually "non-rated." They're simply assigned the neutral EMR of 1.00 until they build up enough premium and claims history to qualify for their own rating.

Managing your EMR isn't something you should leave to chance. At Wexford Insurance Solutions, we dig into the data and fight for your best interests to help you gain control of your score and lower your total cost of risk. Find out how we can help turn your EMR into a real competitive advantage at https://www.wexfordis.com.

How to Calculate Home Replacement Cost Accurately

How to Calculate Home Replacement Cost Accurately Best tips for cleaning business insurance: Coverage and Compliance

Best tips for cleaning business insurance: Coverage and Compliance