You’re at the rental car counter, keys almost in hand, when the agent hits you with the inevitable question: "Would you like to purchase our insurance?" It feels like a high-pressure pop quiz you didn't study for.

The truth is, you might not need to buy any of the expensive coverage they're offering. More often than not, your personal auto policy or even the credit card in your wallet provides a solid layer of protection. The key to making a confident, cost-effective decision is knowing what coverage you already have before you walk up to that counter.

Building Your Rental Car Coverage Shield

Think of insuring a rental car less like a single purchase and more like building a "coverage shield" to protect yourself financially. Each type of insurance is a different layer, and your goal is to make sure there are no gaps. You probably already have some of these layers in place, making the pricey options at the counter totally redundant.

This guide will demystify the whole process. We’ll break down the jargon, show you where to look in your existing policies, and give you the tools to decide what, if anything, you actually need to buy. For a deep dive into all the options, this comprehensive guide on rental car insurance is a fantastic starting point.

Understanding Your Options at a Glance

Before we get into the nitty-gritty, it helps to see the big picture. The rental car insurance market is a massive industry, projected to hit USD 13.77 billion by 2029. This growth is fueled by a huge resurgence in travel and the rising popularity of electric vehicle rentals, which just highlights how important it is for you to understand your choices.

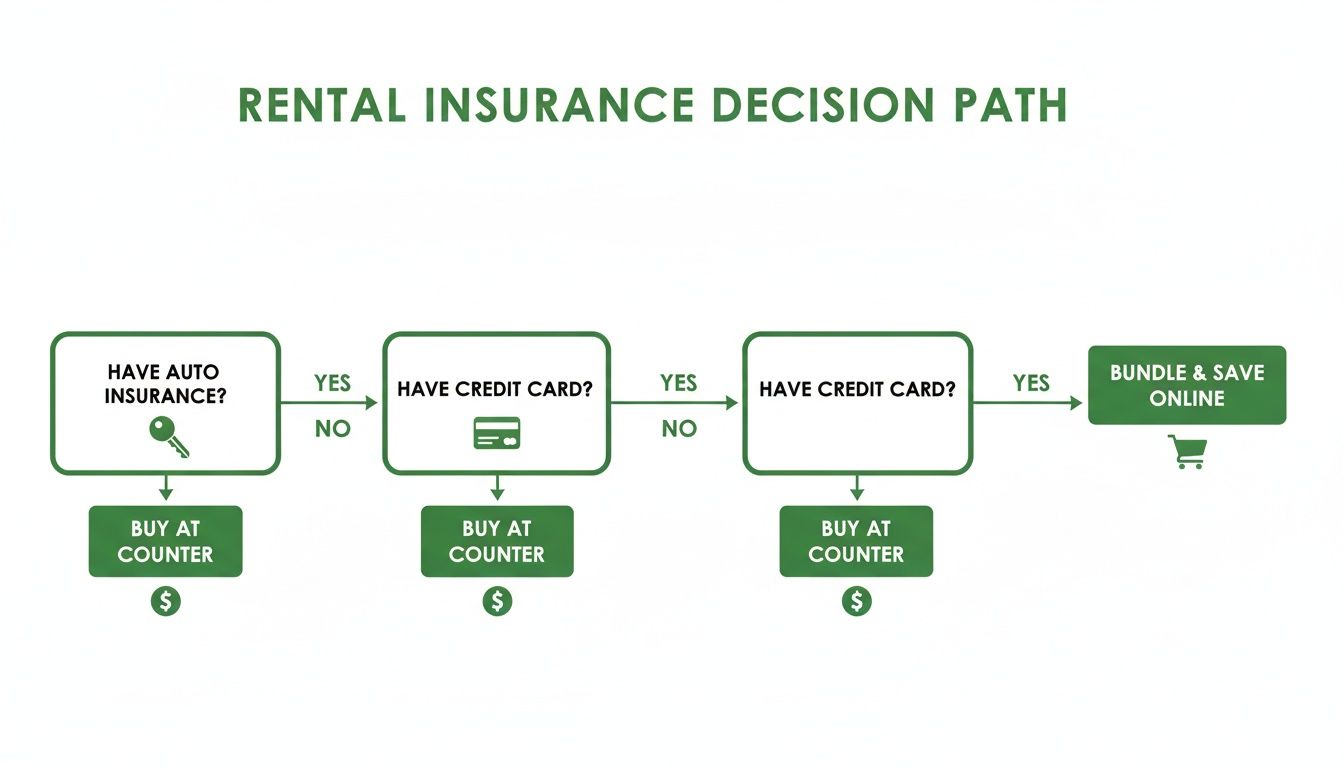

The decision tree below maps out a simple path to figuring out your needs.

As you can see, your first step should always be checking your personal policies. Your own auto insurance is your primary line of defense, often detailed in what we call a [https://wexfordis.com/2025/08/08/what-is-full-coverage/]. By simply verifying these details ahead of time, you can confidently decline those expensive add-ons at the counter and hit the road with genuine peace of mind.

To make things even clearer, let's break down the main players in the rental insurance game. This table gives you a quick rundown of what's what.

Quick Guide to Rental Car Insurance Options

| Insurance Type | What It Covers | Where to Get It |

|---|---|---|

| Loss/Collision Damage Waiver (LDW/CDW) | Damage to or theft of the rental car itself. | Rental car company |

| Liability Insurance | Damage to other vehicles or property and injuries to others. | Your personal auto policy, or the rental company |

| Personal Accident Insurance | Medical bills for you and your passengers after an accident. | Your personal auto or health insurance, or the rental company |

| Personal Effects Coverage | Theft of personal belongings from the rental car. | Your homeowners or renters insurance, or the rental company |

| Credit Card Coverage | Often provides secondary coverage for damage to the rental car. | Your credit card provider |

Think of this table as your cheat sheet. The options from the rental company are convenient, but they often overlap with coverage you’re already paying for. A quick call to your agent or a check of your credit card benefits can save you a surprising amount of money.

Decoding the Alphabet Soup of Rental Car Insurance

You’ve made it to the rental counter, and suddenly you’re hit with a barrage of confusing acronyms. The agent slides a form across the desk, listing a menu of insurance options that sound more like secret codes than protection for your trip.

It’s an intimidating moment for anyone. Let's translate this rental-counter jargon into plain English so you can walk in knowing exactly what you need—and what you don't.

LDW / CDW: Protecting the Rental Car Itself

The first thing they’ll almost always offer is a Loss Damage Waiver (LDW) or a Collision Damage Waiver (CDW). Here’s the first surprise: it’s not actually insurance. It’s a waiver.

By signing up, the rental company agrees not to hold you financially responsible if their car gets damaged or stolen. It’s essentially a "get out of jail free" card for anything that happens to the vehicle. Without it, you could be on the hook not just for repairs, but also for the rental company's administrative fees and "loss of use"—the money they lose while the car is out of commission. This is usually the priciest option, typically running from $10 to $30 per day.

SLI: Your Shield Against Harming Others

Next on the list is Supplemental Liability Insurance (SLI). While the LDW protects the rental car, SLI protects you from the financial fallout of damaging someone else's property or injuring another person in an accident. Think of it as your financial bodyguard.

Most rental companies include a very basic, state-mandated minimum amount of liability coverage. The problem? These minimums are often dangerously low. A serious accident could easily result in claims that blow past those limits, leaving you to pay the rest out of pocket.

Key Insight: Relying only on the state-minimum liability is a huge gamble. SLI significantly boosts your protection, often up to $1 million, giving you real peace of mind against potentially devastating lawsuits.

PAI: Covering You and Your Passengers

What about injuries to you or the people in your car? That's what Personal Accident Insurance (PAI) is for. This coverage helps pay for medical bills and provides an accidental death benefit for you and your passengers if you're in a wreck.

Before you jump on this, check your personal policies. If you already have solid health insurance or Personal Injury Protection (PIP) on your own auto policy, you’re likely already covered. Buying PAI would be redundant. If you decide you need it, expect to pay around $5 to $10 per day.

PEC: Guarding Your Stuff on the Go

Last up is Personal Effects Coverage (PEC). This one is pretty straightforward: it covers your personal belongings—laptops, luggage, cameras—if they're stolen from the rental car.

Once again, you might already be covered here. Most homeowners or renters insurance policies include "off-premises" coverage, which protects your property even when it's not at home. PEC is often sold in a bundle with PAI and adds another $2 to $5 daily to your rental cost. Knowing this helps you confidently say "yes" to what you need and "no thanks" to the rest.

Uncovering Your Existing Coverage

Before you even step up to that rental counter, the smartest thing you can do is take a look at the coverage you already have. So many people needlessly spend $15 to $30 a day on extra insurance, all because they don't realize their personal policies have them covered. A few minutes of homework can save you a ton of cash and a major headache.

You likely have two main sources of coverage already in your pocket: your personal auto insurance and your credit card. Think of these as your first line of defense. Not checking them first is like buying a whole new set of tools when you’ve got a perfectly good toolbox sitting in the garage.

Checking Your Personal Auto Policy

More often than not, your personal auto insurance will extend its main protections to a rental car, especially when you're traveling within the country. If you have collision and comprehensive on your own vehicle, it usually follows you to the rental. But—and this is a big but—you can’t just assume it does. That’s a risky bet.

The only way to know for sure is to call your insurance agent. Don't just ask a vague question like, "Am I covered?" You need to dig into the specifics to find any potential holes in your policy.

Key Questions to Ask Your Insurance Agent:

- Do my collision and comprehensive coverages actually extend to rental cars?

- Are there limits on the type of vehicle I can rent? (e.g., are luxury cars or moving trucks excluded?)

- Does my policy work in the specific state or country I'm traveling to?

- What about extra fees the rental company might charge, like "loss of use" or administrative costs?

Getting clear on these details is absolutely essential. For example, your policy might be fine with a standard sedan but won't cover that 15-foot moving truck you need for the weekend. And if you're renting for work, you may need a different kind of policy altogether, like hired and non-owned auto insurance.

Figuring Out Your Credit Card Benefits

A lot of credit cards, especially the ones geared toward travel, offer rental car insurance as a perk. This can be a game-changer, but you have to understand one crucial detail: is the coverage primary or secondary?

Primary vs. Secondary Coverage Analogy: Imagine you're in an accident. Primary coverage is the first responder on the scene—it takes charge immediately and handles the claim directly. Secondary coverage is the backup unit; it only shows up to help after your personal auto insurance has already paid out.

Primary coverage is the gold standard here. It lets you sidestep your personal insurance policy completely, which means you won't have to file a claim that could jack up your rates. Secondary coverage is still good—it can cover your deductible and other gaps—but it means you have to get your own insurer involved first.

To find out what your card offers, call the number on the back or look up its "guide to benefits" online. Make sure you get answers to these questions:

- Is my coverage primary or secondary?

- What kinds of vehicles are excluded? (Exotic cars, large vans, and antique vehicles are common exclusions.)

- Are there any countries where this coverage won't work? (Some cards won't cover you in places like Ireland or Jamaica.)

- Is there a limit on how long I can rent the car? (Coverage often maxes out after 15 to 30 consecutive days.)

Once you've checked these two sources, you'll be able to walk up to that rental counter and make a smart, confident decision.

Navigating International and State-Specific Rules

The moment your rental car crosses a state line or an international border, the insurance rulebook can completely change. What feels like ironclad coverage in your home state might leave you dangerously exposed somewhere else. It’s a common pitfall, and one that makes it crucial to understand the local requirements before you ever get the keys.

Think of insurance laws in the United States as a patchwork quilt of state-specific regulations. Each state sets its own minimums for liability coverage, and the difference between them can be shocking. Just skating by with the legal minimum is a gamble; one serious accident could easily blow past those low limits, putting you on the hook for a massive bill.

Renting a Car in Another State

When you’re renting a car somewhere else in the U.S., your personal auto insurance usually travels with you. That's the good news. The catch is that you have to make sure your policy's liability limits meet or, ideally, exceed the requirements of the state you're visiting. For example, Florida’s "no-fault" system and required minimums are a world away from New York's.

A quick call to your insurance agent is the easiest way to get clarity. While you’re on the phone, ask if your policy has any restrictions on the types of vehicles it covers—especially important if you’re renting for work. The line between commercial vs. personal auto insurance can become very important, very fast, if you have to file a claim.

International Car Rental Insurance Rules

Once you go abroad, you should operate under one simple assumption: your U.S. auto policy and credit card benefits are useless. International rentals are a completely different game, often with mandatory insurance requirements baked right into the rental price.

Important Takeaway: Never assume your domestic insurance works internationally. Most personal U.S. auto policies specifically exclude coverage outside of the United States and Canada. You absolutely have to verify the rules for your specific destination.

The global car rental insurance market is huge—valued at $17.5 billion in 2023 and projected to hit $30.2 billion by 2032. A big driver of that growth is the web of strict regional regulations. Europe, for instance, made up about 30% of the market in 2023, largely because so many countries there require rental rates to include basic Collision Damage Waiver (CDW) and liability coverage.

Here are a few real-world examples to keep in mind:

- Mexico: You are required by law to buy local third-party liability insurance from a Mexican company. Your U.S. policy won't be recognized.

- Europe: Most rentals will include CDW and liability, but don't get too comfortable. This coverage often comes with a sky-high deductible, which is why rental agents will push you to buy "Super CDW" to lower your potential out-of-pocket cost.

- Ireland & Jamaica: These are two countries that often pop up as exclusions on credit card rental insurance benefits, usually because of challenging road conditions and higher accident rates.

For a deeper look into how these practices vary from country to country, it's worth reading up on understanding the international car rental industry. A little bit of research on your destination's rules before you go is the single best thing you can do to stay protected and compliant.

How To Save Money On Rental Car Insurance

Nobody likes that moment at the rental car counter when you're hit with a list of expensive insurance add-ons. The good news? With a little bit of planning, you can get great protection for your rental without breaking the bank. The real secret is figuring out your coverage before you ever get to the counter.

While it's tempting to just say "yes" to what the rental company offers for the sake of convenience, it's almost always the most expensive way to do it. Let's look at a few smarter alternatives that can save you a bundle.

Look Into Third-Party Standalone Policies

One of the best-kept secrets for saving on rental insurance is buying a separate policy from a third-party company. Insurers like Allianz Travel Insurance or Bonzah specialize in this and offer daily rates that are often a fraction of what you'd pay at the rental desk.

The big advantage here is that these policies often provide primary coverage. That means if something happens, they pay out first, before your personal car insurance ever gets involved. This is huge because it helps you avoid filing a claim on your own policy, which can protect you from future rate hikes.

Use Your Premium Credit Card Benefits

Did you know your credit card might already have you covered? Many travel and premium credit cards include rental car insurance as a perk, but you have to read the fine print. The most important question is whether the coverage is primary or secondary.

Primary is the gold standard, as it kicks in first. But even secondary coverage is a great benefit—it can cover your personal auto policy’s deductible or other costs that your main insurer won’t.

Before you rely on it, make a quick call to the number on the back of your card. Ask about coverage limits, what types of vehicles are excluded (fancy sports cars and big vans often are), and if there are any country restrictions. A five-minute call can save you from a massive headache later.

When Buying At The Counter Makes Sense

I know I said it's usually the most expensive option, but sometimes, buying insurance directly from the rental agency is the smartest move.

If you don't own a car and don't have a personal auto policy, it’s the most straightforward way to get covered. The same goes for international travel, where your U.S. policy likely won't work. In these cases, the counter coverage gives you peace of mind and ensures you're following local laws.

Pro Tip: Always book and pay for your rental car with the credit card that provides the best insurance benefits. You typically have to pay for the entire rental with that card to activate the coverage.

Comparing Your Rental Car Insurance Options

To make it easier, here’s a quick breakdown of the cost and benefits for each of the main ways you can insure a rental car.

| Coverage Source | Typical Cost | Pros | Cons |

|---|---|---|---|

| Your Personal Auto Policy | Usually no extra cost | – Already paid for – Familiar coverage |

– May not extend to all rentals – Filing a claim can raise your rates |

| Premium Credit Card | Included with card fee | – No additional out-of-pocket cost – Often primary coverage |

– Strict rules and exclusions – Coverage limits can be lower |

| Third-Party Insurer | $7 – $15 per day | – Often cheaper than the counter – Primary coverage protects your personal policy |

– Requires advance purchase – Need to research the provider |

| Rental Car Agency | $20 – $40+ per day | – Convenient and guaranteed – Zero-deductible options |

– Almost always the most expensive – High-pressure sales tactics |

Ultimately, there's no single "best" choice—it all comes down to your situation. If you feel your current auto insurance just isn't cutting it for your travel and daily driving needs, it might be time to shop around. Our guide on how to switch car insurance companies can walk you through finding a policy that's a better fit for your lifestyle.

Your Renter’s Checklist for a Smooth Trip

Figuring out your insurance is half the battle. The other half? Following a few simple steps before you grab the keys and while you're on the road. A little prep work can be the difference between a minor inconvenience and a major headache.

Think of it as your pre-flight checklist. Here’s how to make your next rental experience completely hassle-free.

Before You Even Leave Home

The most important work happens before your trip even begins. This is where you confirm your coverage and get everything organized so there are no surprises at the rental counter.

- Review Your Policies: Pull out your personal auto and homeowners/renters insurance policies. Don't just skim them; you need to understand the details. If you're not sure what you're looking at, our guide on how to read an insurance policy can help cut through the jargon.

- Make Two Quick Calls: First, call your insurance agent. Then, call the number on the back of the credit card you plan to use. Ask them to confirm your rental car coverage, and have them email you written proof.

- Pack Your Documents: Don't rely on cell service. Bring a printed copy of your auto insurance card and the confirmation emails you received.

At the Rental Counter

Once you're at the counter, your attention should turn to the car itself. This is your only chance to document its condition before you're responsible for it. Rushing this step is a rookie mistake that can cost you dearly.

My Go-To Pro Tip: Before you even put the key in the ignition, pull out your smartphone. Take a slow, detailed video of the entire car—inside and out. Narrate what you see, calling out every single scratch, ding, or stain. This creates a timestamped record that’s nearly impossible for a rental company to argue with later.

Take a slow walk around the vehicle. Check for any dings on the doors, scuffs on the bumpers, or cracks in the windshield. Inside, check the upholstery for tears or stains. Finally, snap a quick photo of the dashboard showing the fuel level and mileage.

What to Do If an Accident Happens

Even with the best preparation, accidents can happen. If you find yourself in a fender-bender, the key is to stay calm and methodical.

- Safety First: Your first priority is safety. Move the vehicle out of traffic if you can and check on everyone involved. If there are any injuries, call 911 immediately.

- Call the Police: No matter how minor the incident seems, always file a police report. This official document is non-negotiable for any insurance claim you'll need to file.

- Gather the Facts: Get the other driver's name, contact information, and insurance details. If there are any witnesses, get their names and numbers, too.

- Become a Reporter: Use your phone to take pictures and videos of everything—the damage to both cars, the license plates, the accident scene, and even the weather and road conditions. You can't have too much documentation.

- Notify the Rental Company: As soon as it's safe, call the rental agency. They will have a specific process you need to follow, so listen carefully and take notes.

Common Questions About Rental Car Insurance

Even after you've got the basics down, you're bound to run into some specific situations that can still leave you scratching your head. Let's walk through a few of the most common questions that come up right at the rental counter.

What About Moving Trucks or Business Trips?

This is a big one. Your personal car insurance is built for just that—your personal car. It's almost never going to cover a commercial vehicle like a big U-Haul or a Penske moving truck. Those fall into a completely different category.

The same caution applies to business travel. If you're renting a car for work, your personal policy might not step in. In most cases, you'll need to rely on your company's corporate travel policy or buy the insurance offered by the rental agency.

Understanding Extra Fees and Other Drivers

Ever heard of "loss of use" fees? If you get into an accident, this is the charge the rental company hits you with for the income they lose while their car is stuck in the repair shop. It's a sneaky fee that many personal auto policies and credit card benefits simply won't cover, which can make the rental company's waiver look a lot more attractive.

What if your friend is driving?

Here's what you need to remember: Insurance follows the car, not the driver. If you've listed a friend on the rental agreement and they have an accident, it's your insurance that's on the hook. That could be your personal policy, your credit card coverage, or the plan you purchased at the counter.

That’s why it's absolutely crucial to officially list any and all additional drivers on the rental agreement before you leave the lot.

Trying to untangle rental car insurance on your own can feel like a maze. If you want a clear, straightforward review of your current auto policy to see exactly what's covered (and what's not), the experts at Wexford Insurance Solutions can help. Get the peace of mind you deserve by visiting https://www.wexfordis.com today.

What Is a Named Insured in an Insurance Policy?

What Is a Named Insured in an Insurance Policy? Can You Change Car Insurance at Any Time: A Quick Switch Guide

Can You Change Car Insurance at Any Time: A Quick Switch Guide