Yes, you can absolutely change car insurance at any time. Many people think they're locked into their policy for a full six or twelve months, but that’s a common misconception. Your policy isn't a rigid, unbreakable contract; it's more like a subscription service that you have the right to cancel when a better deal comes along. This puts you in the driver's seat, giving you control over your coverage and what you pay for it.

Why You Have the Flexibility to Switch Insurers

The freedom to switch your car insurance carrier whenever you want is a basic consumer right. Insurance companies know that life happens—you buy a new car, you move, or your financial situation changes—and they are constantly competing for your business. This competition is what gives you the power to shop around for better rates, find an agent who offers better service, or get coverage that actually fits your needs.

But while you have the right to switch, the how and when are critical. You need to handle the transition carefully to avoid any penalties or, even worse, a dangerous gap in your coverage. Two key financial factors pop up when you decide to switch before your policy term is up.

Key Financial Considerations for Switching

First up is the pro-rated refund. If you've paid your premium upfront for a six or twelve-month term, you've paid for coverage you haven't used yet. When you cancel, your insurer is obligated to refund you for that unused portion. It's simple math: if you paid for a six-month policy and cancel it after just three months, you should get a refund for the remaining three months' premium.

The second thing to watch out for is a potential cancellation fee. Some companies charge a small administrative fee if you end your policy before the renewal date. It’s usually a flat fee or a small percentage (like 10%) of your remaining premium. It's not a deal-breaker, but it's something you definitely want to ask about before you make the final move.

Your car insurance policy is not a fixed-term contract that locks you in. It's an agreement that you can end at your discretion, provided you follow the correct procedures to avoid a lapse in coverage.

This flexibility is more important than ever. With U.S. auto insurance rates jumping by about 16% in 2023 and projected to climb another 10% in 2024, drivers are actively shopping around mid-term to find some relief. You can discover more about insurance market trends from McKinsey's global report to see the bigger picture.

Deciding whether to switch now or wait until your renewal date comes down to weighing the pros and cons for your specific situation.

Switching Insurance Mid-Term vs At Renewal

Let's break down the timing. Making a switch in the middle of your policy term looks a little different than waiting for your renewal period. Here’s a quick comparison to help you decide what’s best for you.

| Action | Potential Pros | Potential Cons |

|---|---|---|

| Switching Mid-Term | You can lock in lower rates immediately if you find a better deal. It's also great for aligning coverage with a new car or a move. | You might get hit with a cancellation fee from your old insurer. It also requires careful timing to avoid a gap in coverage. |

| Switching at Renewal | This is the cleanest way to switch—no chance of cancellation fees. The transition from one policy to the next is seamless. | You could miss out on significant savings by waiting, forcing you to overpay until your current policy finally expires. |

Ultimately, there's no single "best" time for everyone. If you find a new policy that saves you hundreds of dollars, paying a small cancellation fee is probably well worth it. If the savings are minimal, waiting until your renewal might be the simpler, cleaner path.

Your Step-By-Step Guide to a Seamless Switch

Switching car insurance providers might feel like a big undertaking, but it’s actually a pretty simple process when you break it down. The secret to a smooth transition is all about smart timing and paying attention to the details. This guide gives you a clear roadmap to change insurers with confidence, making sure you sidestep any dangerous—and often illegal—gaps in your coverage.

Here’s the golden rule, the one thing you absolutely must remember: your new policy must be 100% active and confirmed before you cancel your old one. This is non-negotiable. It’s the only way to prevent a lapse in coverage that could leave you facing disastrous financial and legal problems.

Step 1: Gather and Compare Your New Quotes

First things first, you need to shop around. Get quotes from a handful of different insurance companies, but be sure you're comparing them "apples-to-apples." This means every quote should have the exact same liability limits, deductibles, and optional coverages, like rental reimbursement or roadside assistance.

A lower price is fantastic, but not if it means you're sacrificing critical protection. Dig into what each policy actually offers. You want to be sure you’re getting a genuinely better deal, not just less coverage for less money. This is also the perfect time to check out each company's reputation for customer service and how they handle claims.

Step 2: Scrutinize Your New Policy Documents

Once you've picked a new insurer, don't just sign and pay. Before the policy goes live, you’ll get a policy declarations page and other documents. Read through every single detail.

Double-check for accuracy in these key areas:

- Vehicle Information: Confirm the VIN, make, and model for every car on the policy.

- Driver Details: Make sure all listed drivers, their names, and license information are correct.

- Coverage Limits: Verify the liability limits and deductibles match what you were quoted.

- Effective Date: This is the most important part. Confirm the exact date and time your new coverage officially kicks in.

If you spot any mistakes, call the new insurer right away to get them fixed before you finalize anything. Taking five minutes to do this now can save you from a world of headaches later. If your situation is complex or you’d rather have an expert in your corner, learning how to choose an insurance broker can connect you with a professional who handles these details for you.

Step 3: Purchase the New Policy and Confirm It Is Active

With all the details confirmed, it’s time to buy your new policy. You'll usually make your first payment at this stage. The most important part is getting confirmation that your policy is officially in force. This proof typically comes as an insurance binder or the final policy documents.

Crucial Tip: Do not move on to the next step until you have written proof—either a digital or physical copy—of your new, active insurance policy. This is your guarantee that you are covered.

Step 4: Formally Cancel Your Old Policy

Only after your new policy is live and confirmed should you reach out to your old insurance company to cancel. To nail the timing and avoid any gaps, schedule the cancellation to take effect on the same day your new policy begins. For example, if your new coverage starts at 12:01 AM on June 15th, your old policy should end at 11:59 PM on June 14th or simply on the 15th.

Follow your old insurer's cancellation process, whether that means a phone call, a signed letter, or filling out an online form. Always ask for written confirmation of the cancellation for your records. This piece of paper is your proof that you ended the contract and prevents any surprise bills down the road.

Step 5: Notify Your Lender or Leasing Company

If you have a loan or lease on your vehicle, this last step is an absolute must. Your lender has a financial stake in your car, and they need to be kept in the loop.

Contact them as soon as you have your new policy and provide them with proof of coverage, which is usually your new declarations page. You’ll need to make sure they are listed correctly as the "loss payee" or "additional insured." Skipping this can lead to your lender force-placing an incredibly expensive policy on your vehicle, and it could even put your loan in default.

How to Correctly Cancel Your Old Car Insurance Policy

Once you have your new car insurance policy up and running, the final step is to break up with your old insurer. Getting this part right is just as important as finding your new coverage. It's a simple process, but you need to follow the right steps to avoid any surprise bills and make sure you get back every dollar you're owed.

When you switch, the two biggest financial questions are about refunds and fees. The answers are always spelled out in your policy documents. This is where knowing how to read an insurance policy really pays off—it gives you a clear picture of your rights before you even pick up the phone to cancel.

Pro-Rated Refunds vs. Short-Rate Cancellations

Ideally, when you cancel, you'll receive a pro-rated refund. This is the fairest and most common way it works. The insurance company simply calculates the exact amount of premium you haven't used and sends it back to you. Let's say you paid for a six-month policy but found a better deal three months in; you should get exactly 50% of your premium back. Easy.

Some policies, however, have what’s called a short-rate cancellation clause. This is a bit different. The insurer will still refund your unused premium, but they’ll first deduct a penalty or an administrative fee for ending the contract early. It's usually a small percentage, but it’s something to be aware of so you can factor it into your savings.

Pro-rated refund: You get back every penny of unused premium. No strings attached.

Short-rate cancellation: You get a refund, but only after they subtract a fee for early termination.

The Right Way to Say Goodbye

Every carrier has its own playbook for handling cancellations, so you have to follow their specific instructions. The one thing you should never do is just stop paying your bill. That can lead to a "cancellation for non-payment" on your record, which is a red flag for future insurers.

Instead, use one of their official channels:

- Make a phone call: Often the fastest way. Just talk to a representative and get the ball rolling.

- Send a signed letter: Some companies are a bit old-school and require a formal, signed document (sometimes called a Letter of Cancellation).

- Use the online portal: Most modern insurers let you handle everything, including cancellations, right from their website or app.

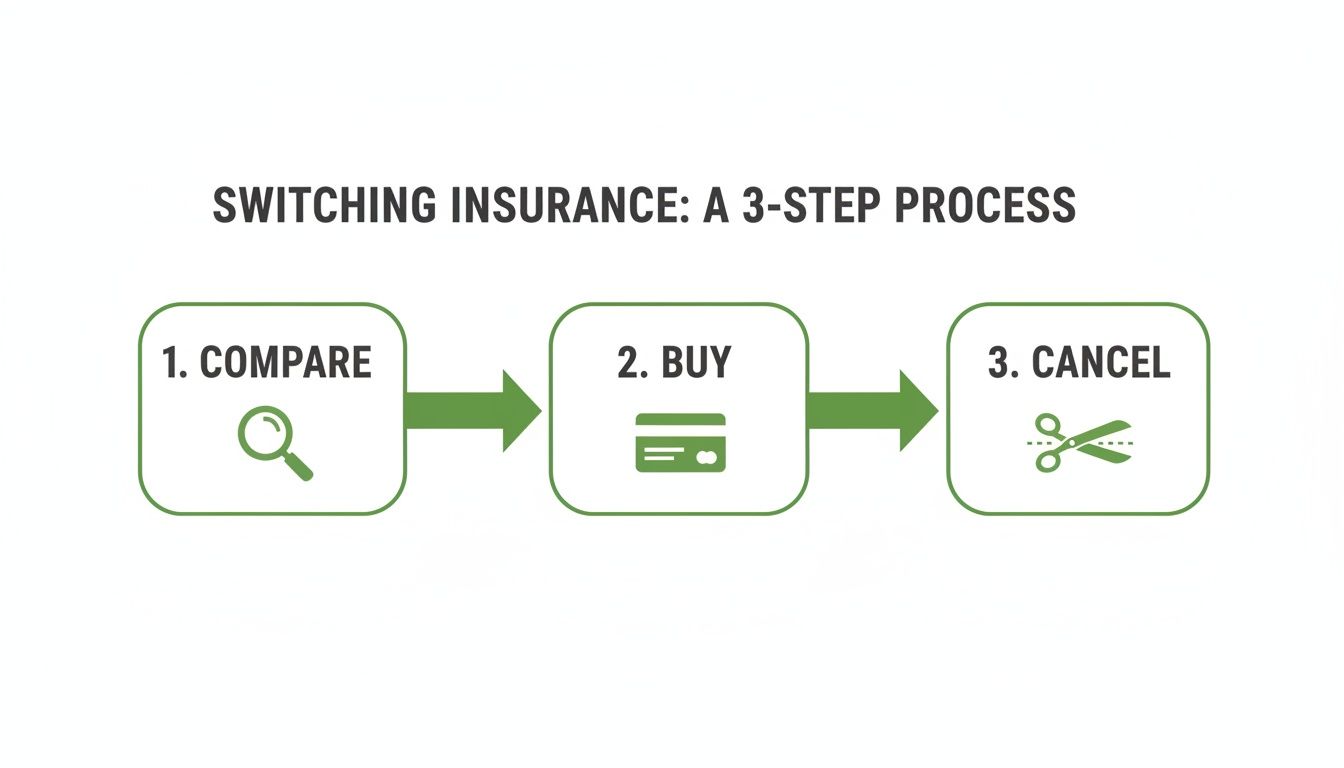

This infographic breaks down the whole process into three simple actions.

As you can see, it’s a logical sequence: compare your options, buy the new policy, and then cancel the old one.

No matter how you do it, the most crucial step is to get written confirmation of the cancellation. This is your proof. It protects you from any billing mix-ups down the road and should clearly state the exact date and time your coverage officially ended. If your refund doesn't show up in a reasonable amount of time (state laws usually set a deadline), this confirmation letter is the key to getting it sorted out.

When's the Smartest Time to Make the Switch?

You can change your car insurance policy any day of the week, but that doesn't always mean you should. Having the freedom to shop around is great for your wallet, but a little strategy goes a long way. It’s a bit like booking a flight—sure, you can buy a ticket on any given Tuesday, but timing it right can save you a bundle.

The easiest and often most financially sound time to make a move is when your policy is up for renewal. This is the natural end of your contract with your current insurer, making it the perfect time for a clean break.

The Renewal Window: Your Golden Opportunity

Switching at renewal is the path of least resistance. Because your policy term is ending anyway, you get to completely dodge any early cancellation fees that some companies charge. This means a clean slate and the full financial upside of a lower premium from your new insurer, without giving a chunk of it back in penalties.

As a rule of thumb, the sweet spot for shopping is about 45 days before your renewal date. Most personal auto policies run for six or twelve months. This 45-day runway gives you plenty of time to get quotes, let the new company review your driving record, and lock in your new policy without scrambling at the last minute. This timing also sets you up for a clean comparison, as you can see from expert analysis on U.S. auto insurance trends. To get a better handle on the nuts and bolts, check out our guide on the insurance policy renewal process.

Life Changes That Demand a Policy Review

While your renewal period is the default time to look around, some life events should be an immediate signal to check your insurance. These are moments when your personal situation changes enough that your current insurer might not be the best fit—or the best price—anymore.

Let's be honest, a big reason people shop around is to find out how to get cheaper auto insurance, and these moments are prime opportunities.

Here are the major life events that should trigger an immediate insurance check-up:

- Buying a New Car: A different car means a different risk profile. The safety ratings, repair costs, and value of your new ride will have a huge impact on your premium. Your current company might be great for your old sedan but expensive for your new SUV.

- Moving to a New Zip Code: Where you live is one of the single biggest factors in what you pay for car insurance. A move from a busy city to a sleepy suburb—or the other way around—can change your rates dramatically.

- Adding a New Driver: Putting a newly licensed teenager on your policy is one of the most jarring premium increases you'll ever see. It is absolutely essential to shop around to find an insurer that’s more competitive for families with young drivers.

- A Big Jump in Your Credit Score: In most states, your credit history plays a major role in your insurance rates. If you've been working hard to improve your credit, you've earned a lower premium. Don't let your old rate stick around.

Don't wait for your renewal if a major life event occurs. Proactively shopping for a new policy at that moment can translate into immediate and substantial savings, ensuring your coverage and costs align with your new reality.

Switching Insurance When Your Car is Leased or Financed

When you're still paying off a car loan or have a lease, you're not the only one with skin in the game. Your lender or leasing company has a significant financial stake in your vehicle, and they need to protect their asset. This introduces a critical layer of requirements you have to meet if you want to switch your auto insurance.

Think of it this way: until you make that final payment, the lender is a co-investor. If the car gets totaled or stolen, they stand to lose a lot of money. Because of that risk, your loan or lease agreement legally binds you to carry specific coverages that go well beyond your state's basic liability requirements.

The Coverage Your Lender Demands

Your bank or leasing company doesn't just want any insurance policy; they need you to have the right one. The coverages they mandate are all about protecting the physical car itself, not just the damage you might cause to others.

This almost always means you'll be required to carry:

- Comprehensive Coverage: This is what protects the car from things other than a collision, like theft, vandalism, fire, or even a tree falling on it.

- Collision Coverage: This pays to fix or replace your car after an accident, no matter who was at fault.

- Specific Deductible Limits: Lenders will usually cap your deductible, often at $500 or $1,000. They don't want you stuck with a high deductible you can't afford to pay, which would prevent the car from getting repaired.

Trying to get around these rules is a bad idea. Your lender has the right to buy a policy for you—called force-placed insurance—and tack the massive premium onto your loan. This type of insurance is incredibly expensive and only protects their interest, leaving you without any liability coverage at all.

Why You Absolutely Must Notify Your Lender

Here’s the most important takeaway: when you switch insurers on a financed or leased car, you have to tell your lender immediately. It's not optional. You need to provide them with official proof that your new policy is active and meets all their requirements. A good way to bridge the gap is by learning what is an insurance binder, as it acts as temporary, official proof while the full policy is being issued.

When you send over the new policy information, there are two magic phrases you need to look for.

Loss Payee & Additional Insured

Your lender must be listed on the policy as both a "loss payee" and an "additional insured." This is the legal language that guarantees two things: they get included on any check for a major claim (like if the car is totaled), and they are automatically notified if your policy is ever changed or canceled.

If you don't update them, they might assume you've dropped coverage entirely. This can trigger a default on your loan, lead to that costly force-placed insurance, or in a worst-case scenario, even result in them repossessing the vehicle. A quick call or email to your lender is a simple action that protects your car, your credit, and your peace of mind.

Common Questions About Changing Your Car Insurance

Even when you know the steps, making the switch can feel a little daunting. A few lingering "what ifs" are completely normal. Let's tackle some of the most common questions head-on so you can move forward with confidence.

Will Changing My Car Insurance Hurt My Credit Score?

Nope, this is a common myth. Switching your car insurance provider will not directly harm your credit score.

When you're shopping around, insurers run a "soft inquiry" to get your credit-based insurance score—which is a different beast entirely from the FICO score lenders use. These soft pulls don't show up to banks or credit card companies and have zero effect on your credit rating.

The only way it could cause an issue is if you leave your old insurer with an unpaid final bill or cancellation fee. If that debt gets sent to collections, that could eventually show up on your credit report. Just make sure you settle up, and you'll be fine.

Can My Old Insurance Company Refuse to Cancel My Policy?

In a word, no. An insurance company can't legally refuse to cancel your policy. As the policyholder, you're in the driver's seat and can end your coverage whenever you want.

That said, you do have to play by their rules. They'll require you to follow their specific cancellation process, which might mean a phone call, a signed letter, or filling out a form on their website. They have to process your request and send you any prorated refund you're owed, but they can still charge a legitimate cancellation fee if it was part of your original agreement.

The bottom line is simple: you are in control. While you must follow their procedural rules, your right to cancel is protected. An insurer can’t hold your policy hostage if you decide to leave.

What Happens If I Forget to Cancel My Old Car Insurance Policy?

Forgetting to cancel is a surprisingly common—and costly—mistake. You end up with dual coverage, which means you're paying for two auto policies at the same time for no good reason.

Besides wasting money, it creates a huge headache if you need to file a claim. If you have an accident, both insurance companies could get into a standoff over who is responsible for paying. That leaves you stuck in the middle, waiting for repairs or financial help. Always make sure your old policy is officially canceled the same day your new one kicks in.

Do I Have to Give a Reason for Switching Insurers?

Absolutely not. You are never obligated to explain why you're switching. Your reasons are your own.

Maybe you found a better price, are fed up with poor customer service, or simply need different coverage. Many drivers start shopping after seeing a rate hike and want to understand how a speeding ticket can impact your car insurance rates. That alone is a perfectly good reason to look elsewhere.

While a new insurer will ask about your driving history and prior coverage to write your policy, you don't owe anyone an explanation for your decision. Understanding the factors that affect your premium, like how your car insurance deductible is explained, gives you the power to make the smart financial move without needing to justify it.

Navigating the world of insurance can be tricky, but you don't have to do it alone. The experts at Wexford Insurance Solutions are here to help you compare options, find the best coverage for your needs, and handle the entire switching process for you. Contact us today to see how much you could save. https://www.wexfordis.com

A Smart Traveler's Guide to Insurance When Renting a Car

A Smart Traveler's Guide to Insurance When Renting a Car Deductible Car Insurance Definition A Complete Guide

Deductible Car Insurance Definition A Complete Guide