Trying to make sense of flood insurance can feel like navigating a maze, but for many homeowners, the best path is becoming much clearer. Private flood insurance has emerged as a compelling alternative to the standard government-backed plans, offering policies written by private companies instead of the National Flood Insurance Program (NFIP).

Think of it this way: The NFIP is like an off-the-rack raincoat—it offers basic protection, but it might not be the perfect fit. A private policy, on the other hand, is like a custom-tailored jacket, designed specifically for your property and your financial needs.

Why Homeowners Are Choosing Private Flood Insurance

The move toward private flood insurance isn't just a small shift; it's a real market trend driven by homeowners who want better, more sensible protection. People are actively looking for options that truly reflect their home's value and their own comfort level with risk, and the private market is stepping up to meet that demand.

This shift has fueled incredible growth. The number of private residential flood policies skyrocketed from about 277,000 in 2020 to nearly 569,000 by 2024. That’s a compound annual growth rate of almost 20%, which clearly shows that more and more people are turning to private carriers to fill the gaps left by traditional coverage.

Greater Flexibility and Higher Limits

One of the biggest draws of private flood insurance is the ability to get much higher coverage limits. The NFIP puts a hard cap on building coverage at $250,000, which simply isn't enough for many homes today, especially in high-value areas of New York and Florida. Private policies, however, can offer limits reaching into the millions, making sure your home is covered for its full replacement cost.

This flexibility isn't just about the house itself. It also extends to other critical areas:

- Personal Property: You can secure coverage well above the NFIP’s $100,000 ceiling for your belongings.

- Other Structures: Finally, you can insure detached structures like a garage, pool house, or workshop.

- Additional Living Expenses (ALE): This is a huge one. ALE covers things like hotel bills and restaurant meals if a flood makes your home unlivable—a benefit the standard NFIP policy doesn't include.

For owners of high-value properties, this isn't just a nice-to-have feature; it's a financial lifeline. A private policy can mean the difference between a partial, frustrating recovery and being made whole after a flood.

A More Customized Approach to Protection

Unlike the rigid, one-size-fits-all structure of federal plans, private flood insurance is all about customization. You can actually build a policy that protects what's most important to you.

High-net-worth families, for example, often need specialized coverage for unique assets. Our guide on private client insurance dives deeper into how these bespoke solutions can protect everything from wine cellars to valuable art collections from flood damage.

Of course, the best defense is a good offense. For properties that are naturally prone to water issues, taking preventative steps is just as important as having the right insurance. Looking into expert drainage solutions for yards can be a smart first move to reduce your risk before a storm ever hits. When you pair proactive home maintenance with a well-designed insurance plan, you create a powerful, two-pronged defense against water damage.

Comparing Private Flood Insurance vs The NFIP

When it comes to flood insurance, you essentially have two paths: the government-backed National Flood Insurance Program (NFIP) or a policy from the private flood insurance market. Choosing isn't just about satisfying your mortgage lender—it’s about finding the right financial shield for what is likely your most valuable asset.

Think of the NFIP as the original, one-size-fits-all solution. It was established decades ago to make flood coverage accessible everywhere. In contrast, the private market is dynamic and competitive, with insurers creating more customized products that can be a much better fit for a homeowner's specific needs. Getting into the details reveals just how different these two options can be.

The Critical Difference in Coverage Limits

The first thing most homeowners notice is the stark difference in coverage limits. A standard NFIP policy maxes out at $250,000 for your home’s structure and just $100,000 for your personal belongings. If your home is valued at $500,000, you’ve got a massive, immediate gap in protection right from the start.

This is where the private market really shines. Private carriers can offer significantly higher limits, often running into the millions for both the structure and its contents. This flexibility means you can insure your home for its full replacement cost, giving you the peace of mind that you'll have the funds to rebuild completely after a disaster.

Understanding Additional Coverage Options

Beyond the basic limits, private policies often bundle in essential coverages that the NFIP simply doesn't offer. These aren't just minor perks; they can make a world of difference during a recovery.

- Additional Living Expenses (ALE): If a flood makes your home uninhabitable, private policies can cover your hotel bills, meals, and other temporary housing costs. The NFIP provides nothing for this, leaving you to foot the bill yourself.

- Replacement Cost Value (RCV) for Contents: Most private insurers will pay to replace your damaged belongings with brand-new items. The NFIP, on the other hand, typically only pays the depreciated Actual Cash Value (ACV), which is what your used items were worth at the time of the flood.

- Broader Property Protection: Private plans often extend coverage to things like detached garages, finished basements, and swimming pools—assets that are either excluded or have very limited coverage under an NFIP policy.

It's vital to remember that flood insurance is entirely separate from your standard home insurance. To see a full breakdown of what each policy covers, check out our guide on the differences between flood and homeowners insurance.

To make the choice clearer, let’s put the two options side-by-side.

Private Flood Insurance vs NFIP At a Glance

Here’s a direct comparison of the key features you'll find in a typical private flood policy versus the standard NFIP offering.

| Feature | Private Flood Insurance | National Flood Insurance Program (NFIP) |

|---|---|---|

| Dwelling Coverage | Often up to $5 million+ (varies by carrier) | Capped at $250,000 |

| Contents Coverage | Often up to $1 million+ (varies by carrier) | Capped at $100,000 |

| Additional Living Expenses | Usually included | Not available |

| Replacement Cost for Contents | Commonly offered | Not available (pays Actual Cash Value) |

| Detached Structures | Typically included | Not covered |

| Waiting Period | Often 7-14 days (may be waived for loans) | Standard 30-day wait |

| Pricing | Based on property-specific risk; can be lower | Based on FEMA flood zones and rating system |

As you can see, the private market is built for flexibility and more comprehensive protection, while the NFIP provides a standardized baseline of coverage.

Waiting Periods and Eligibility

Timing is another crucial factor. The NFIP has a strict 30-day waiting period before a new policy becomes effective. This can create real problems for homebuyers on a tight closing schedule. Private insurers are much more nimble, with waiting periods as short as 7 to 14 days—and they’ll often waive it completely if the policy is required for a mortgage closing.

This market flexibility is a direct response to a growing need. Between 2010 and 2023, floods in the U.S. caused an estimated $144 billion in economic damage, yet only $50 billion was insured. Private insurers are stepping in to help close this enormous protection gap.

Finally, eligibility isn't universal. While the NFIP is available in any participating community, private carriers use their own sophisticated risk models. This means some high-risk homes may not qualify for a private policy, but it also means many homeowners in lower-risk areas can find much more competitive pricing than what the NFIP offers.

What Your Private Flood Policy Actually Covers

It’s one thing to hear that private flood insurance offers more “flexibility,” but it’s another thing entirely to know what that actually means when your home is underwater. A policy isn't just a piece of paper with a price on it; it’s a promise. Let's peel back the layers and look at what you’re really getting.

Think of a solid private flood policy as having three distinct, crucial layers of protection. Each one is designed to tackle a different part of the chaos a flood leaves behind.

Protecting Your Home Itself

This is the bedrock of your policy: Building Coverage. It’s the money you need to repair or completely rebuild the physical structure of your house—from the foundation it sits on to the roof over your head.

This covers the essentials that are literally part of your home:

- The foundation, walls, and frame that hold everything together.

- All the electrical and plumbing systems that make your house a home.

- Major systems like your furnace, air conditioner, and water heater.

- Appliances that are built-in, like a dishwasher or an over-the-range microwave.

This is where private policies start to pull away from the federal plan. Many will also cover things like detached garages, sheds, or even the cost of cleaning up and repairing your swimming pool—structures and features the NFIP often won't touch.

Covering Your Personal Belongings

Next up is Contents Coverage, which is all about the stuff inside your home. And right here is one of the biggest reasons people choose a private policy: Replacement Cost Value (RCV).

The standard NFIP policy typically only pays out the Actual Cash Value (ACV) for your belongings, which is a fancy way of saying their depreciated, used value. Private plans, on the other hand, almost always offer full RCV.

What does that mean in the real world? If your five-year-old couch is ruined, RCV gives you the money to go buy a new couch of similar quality. ACV would only give you what a five-year-old couch is worth, which isn't much. The financial difference is staggering. To see a deeper dive, you can learn more about what replacement cost coverage is and why it’s a game-changer for recovery.

Imagine your high-end home theater system gets destroyed. RCV helps you replace it with today's equivalent models. ACV might leave you with just enough cash to buy a small TV, forcing you to cover the rest yourself.

Rebuilding Your Life Temporarily

This might just be the single most important benefit you’ll find in private flood insurance: Additional Living Expenses (ALE) coverage. If a flood makes your home unlivable, ALE is the financial lifeline that keeps your life from completely derailing.

It’s designed to cover the extra costs you rack up while you’re displaced. This isn’t a blank check, but it helps pay for necessary, above-your-usual expenses like:

- The cost of a hotel or a short-term rental.

- Extra money for restaurant meals since you can't use your own kitchen.

- Laundry services if you don't have a washer and dryer.

- The cost of a storage unit for any belongings you managed to save.

This coverage is all about the human side of a disaster. It provides a safety net so your family has a safe place to live without having to burn through your savings. This is a critical feature you simply won't find in a standard NFIP policy, and it highlights how a private policy is built for a more complete recovery.

Who Benefits Most From Private Flood Insurance

While private flood insurance has some serious upsides, it's not a one-size-fits-all solution. It really shines for certain homeowners whose needs just don't fit into the rigid box of the National Flood Insurance Program (NFIP). Figuring out if a private policy makes sense for you usually comes down to your home's value, where it's located, and how quickly you need coverage.

Let's walk through a few real-world examples. By looking at these distinct homeowner profiles, you’ll get a much clearer picture of where private flood insurance can be a game-changer.

The High-Value Homeowner

Picture someone with a beautiful coastal home in Florida or a sprawling property in a sought-after New York suburb. Their home has a replacement cost of $800,000. The problem? The NFIP's maximum building coverage is capped at $250,000. That leaves a massive $550,000 gap. If a major flood hits, the check they receive would cover less than a third of what it costs to rebuild.

This is the classic candidate for private flood insurance. A private policy can be written to cover the home's full replacement cost, giving the owner the peace of mind that they can actually rebuild their life and property as it was. Private policies also go a step further, protecting other valuable assets the NFIP simply won't touch.

For these homeowners, the ability to cover things like the following is crucial:

- Detached Structures: That guesthouse, workshop, or detached garage can be properly insured.

- Expensive Landscaping and Pools: Coverage can be added to help clean up and repair custom pools, patios, and outdoor living areas.

- High-Value Contents: Private policies can offer protection for personal belongings far beyond the NFIP's $100,000 limit, safeguarding valuable art, furniture, and electronics.

For these folks, a private policy isn't just a "better" option—it's a financial necessity to protect what is likely their biggest asset.

The Savvy Buyer in a Moderate-Risk Zone

Now, let's think about a homebuyer in a place designated as a moderate-risk flood zone, like a Zone X. The NFIP's pricing, even after its recent overhaul, often relies on broad, zone-based calculations. This approach might not fully recognize the specific, positive features of an individual property that make it less of a risk.

Private insurers, on the other hand, use sophisticated modeling to get a much more granular view of the actual risk. They dig into hyper-specific details, like the precise elevation of your foundation, its exact distance from a creek or lake, and even the quality of your local storm drainage.

This data-driven approach means that a home sitting on a slight hill or one benefiting from excellent local drainage might be seen as a much lower risk by a private carrier than by the NFIP. The result is often a much more competitive premium for far better coverage.

This buyer wins because the private market can price risk with a scalpel, not the sledgehammer of a federal program.

The Homebuyer on a Tight Deadline

Finally, imagine a couple who are just two weeks from closing on their dream home. Suddenly, their mortgage lender drops the news: they need flood insurance to get the loan. They are now in a serious time crunch.

The NFIP has a mandatory 30-day waiting period before any new policy kicks in. That kind of delay could completely torpedo their closing date, potentially costing them the house or triggering expensive penalties.

This is where the private market's speed is a total deal-saver. Most private flood policies have waiting periods of only 7 to 14 days. Even better, when a mortgage is involved, private insurers will almost always waive the waiting period entirely. This allows the policy to go into effect on the day of closing, keeping the transaction on track. That speed and flexibility make private flood insurance an indispensable tool for anyone navigating a real estate deal.

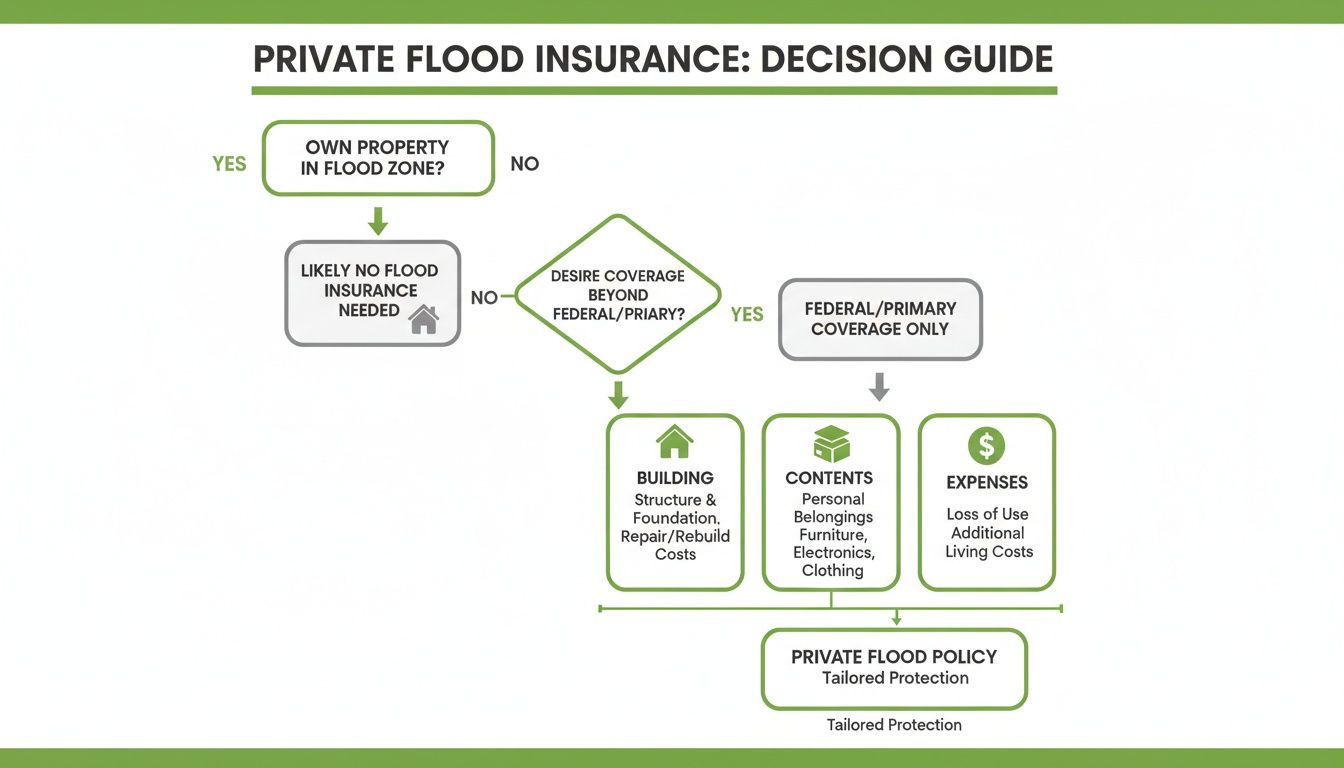

This decision guide can help you visualize how private coverage might work for you.

The chart breaks down coverage into three key pillars—the building, its contents, and other expenses—to help clarify your policy choices.

How Private Flood Insurance Premiums Are Determined

Ever wonder how an insurance company lands on the exact dollar amount for your flood insurance premium? For private flood insurance, it's a world away from the broad-stroke, zone-based approach you see with federal programs. It’s less about your general zip code and all about your specific doorstep.

Private insurers essentially become financial detectives, digging into your property's unique risk profile. They use sophisticated tools to analyze dozens of data points, building a complete picture of your home's vulnerability to water damage. This granular method is precisely why they can often offer such competitive pricing.

The Technology Behind the Quote

The secret sauce is something called catastrophe modeling. Think of it as a highly advanced computer simulation. These systems run thousands of "what-if" flood scenarios—everything from a freak summer downpour to a massive storm surge—against a digital replica of your local geography. It's a much more dynamic process than just looking at a static, and sometimes outdated, flood map.

This high-tech analysis is then combined with hyper-local data to zero in on your individual risk. The most critical factors include:

- Precise Elevation Data: They don't just know you're on a hill; they know the elevation of your foundation, often down to the inch.

- Distance to Water: The exact distance from your home to any potential source of flooding—a river, a lake, or the coastline—is carefully measured.

- Local Infrastructure: The condition of nearby storm drains, levees, and other water management systems can play a surprisingly big role in your rate.

By using this detailed, property-specific information, private carriers can price their policies with a scalpel, not a sledgehammer, often rewarding homeowners who have a lower actual risk.

Key Factors That Influence Your Premium

While the technology is complex, the elements that drive your final quote are pretty straightforward. When you get a quote for private flood insurance, the underwriter is going to look closely at a few core things about your home.

A private insurer's goal is to create a premium that directly reflects your home's unique risk profile. Two houses on the same street could have very different premiums based on a few key differences in elevation or construction.

Here are the main drivers that will shape your cost:

- Your Home's Construction: How your house was built really matters. A home with a concrete block foundation, for example, is going to hold up better against floodwaters than one with a simple wood frame, and your premium will reflect that resilience.

- Flood-Proofing Measures: Have you already taken steps to protect your property? Insurers love to see proactive measures and often give discounts for them. This could be anything from installing flood vents in your foundation to elevating your HVAC system and electrical panel above the base flood level.

- Chosen Coverage and Deductibles: This one is more obvious, but the amount of coverage you buy directly affects the price. Choosing higher limits for your home and personal belongings, or picking a lower deductible, will naturally lead to a higher premium.

Getting a handle on these factors takes the mystery out of the quoting process. It's also how an insurer manages their own financial exposure, a fundamental concept in the business. For a great explanation of how insurers balance the premiums they collect against the claims they pay, check out our guide on what a loss ratio in insurance is. Understanding what drives the cost puts you in a much better position when it's time to review your options.

Getting Your Hands on a Private Flood Insurance Policy

Finding the right private flood insurance policy might feel like a huge task, but it doesn't have to be. When you break it down, it's really just a few simple steps. Think of this as your roadmap, guiding you from that first bit of research all the way to activating your new, more protective coverage.

The whole key is to be methodical. You want to make sure you have the right information and, just as importantly, the right professional guiding you through the market. Follow this process, and you’ll land a policy that not only satisfies your lender but gives you genuine peace of mind.

Step 1: Get Your Property Details in Order

Before you can even think about getting a quote, you need to have the essential facts about your home ready to go. Insurers need this stuff to run their risk models. You're essentially creating a complete profile of your property so they can see exactly what they're being asked to insure.

Make sure you have these details handy:

- Your Full Property Address: This is the starting point for all location-based risk data.

- An Elevation Certificate (if you have one): While private insurers don't always demand one, an EC provides hard data about your home's height relative to flood zones and can unlock some serious discounts.

- Home Construction Details: Know the year it was built, its total square footage, and how many stories it has.

- Foundation Type: Is it a slab, a crawlspace, or a full basement? This detail matters a lot in flood underwriting.

Having all this ready from the start makes the quoting process way faster and much more accurate.

Step 2: Find a Good Independent Agent

This might be the most important step of all. Instead of calling a single insurance company you saw on a commercial, your best move is to work with an independent insurance agent or broker. This gives you a massive advantage. They don't work for one company; they work for you, shopping the entire market to find the best policy for your specific situation.

An independent agent is your personal insurance shopper and expert guide. They have access to multiple private carriers—many you'd never find on your own—and can cut through the jargon to explain what you're actually buying.

They'll also help you compare the subtle but critical differences between quotes, making sure you get a policy that’s both well-priced and genuinely comprehensive. To get a better handle on what they do, it's worth understanding the difference between an insurance agent and a broker and how that expertise works in your favor.

Step 3: Compare Your Quotes—The Smart Way

When your agent comes back with a few quotes, your eyes will naturally jump to the price. Resist that urge. The cheapest policy is almost never the best one. A smart comparison means looking at the total value of what you’re being offered.

Dig into these three areas for each quote:

- Coverage Limits: Is the policy offering enough to cover the full replacement cost of your house and everything in it?

- Deductibles: How much will you have to pay out-of-pocket before the insurance kicks in? A low premium might be hiding a painfully high deductible.

- Exclusions and Endorsements: What isn't covered? More importantly, does it include must-have protections like Additional Living Expenses (ALE) or coverage for your basement contents?

Doing this kind of deep dive ensures you aren’t trading crucial protection for a few dollars in monthly savings.

Step 4: Finalize and Activate Your Policy

Once you’ve picked the winner, the rest is easy. Your agent will walk you through the application, which is usually a simple digital process. You’ll review the documents, sign them, and make your first payment to lock in the coverage.

One of the biggest perks here is how fast it all happens. Forget the NFIP’s standard 30-day waiting period. Many private flood policies can be active in as little as 7-14 days. Even better, that waiting period is often waived completely if you need the policy to close on a home loan. It’s an efficient process that makes the whole experience feel smooth and painless.

Common Questions About Private Flood Insurance

Even after you've weighed the pros and cons, a few questions about private flood insurance can still pop up. It's completely normal. Let's walk through the most common things homeowners ask so you can move forward with total confidence.

Will My Mortgage Lender Accept a Private Policy?

Yes, they almost certainly will. Thanks to the Biggert-Waters Flood Insurance Reform Act of 2012, federal law mandates that most lenders must accept private flood policies.

There's just one simple condition: the private policy has to offer coverage that is "at least as broad as" a standard NFIP policy. Any good independent agent will make sure the policy they find for you checks this box, so you won't have to worry about running into any compliance headaches with your bank.

Can I Switch From an NFIP Policy to a Private One?

You absolutely can. Many people make the switch every year. The key is to get the timing right. The cleanest way to do it is at your NFIP policy's renewal date. This ensures a smooth transition and avoids any hassle with getting a refund for the old policy.

The golden rule here is to never leave a gap in your coverage. Make absolutely sure your new private policy is active before the old NFIP policy expires. Even one day without flood insurance is a risk you don't want to take.

What Happens if My Private Insurance Company Fails?

That's a fair question, and one the industry has a solid answer for. Private insurance companies are backstopped by state-run organizations called "guaranty funds." If your insurer were to go out of business and couldn't pay its claims, this fund would step in to cover them up to a certain limit, which varies by state.

The best way to sidestep this risk is to work with financially sound companies from the start. A reputable agent will only place you with insurers that have high marks from rating agencies like A.M. Best—you’ll want to see an "A" rating or better. This is a clear signal that the company is on solid financial ground and can meet its obligations.

How Long is the Waiting Period?

This is one of the biggest perks of going private. The NFIP has a standard 30-day waiting period before a new policy kicks in, which can feel like an eternity.

Private insurers are much faster. Most private policies have waiting periods of just 7 to 14 days. And in many cases, like when insurance is required for a home closing, that waiting period can be waived entirely, meaning your coverage starts right away.

Protecting your home isn't about finding a one-size-fits-all policy; it's about finding the right fit for you. At Wexford Insurance Solutions, our specialists in New York and Florida are here to help you navigate your options and find a private flood insurance policy that gives you better protection and peace of mind. Get in touch with us today for a personalized consultation by visiting us at https://www.wexfordis.com.

What Is Commercial Umbrella Coverage and How It Protects Your Business

What Is Commercial Umbrella Coverage and How It Protects Your Business Understand what does commercial umbrella insurance cover and protect business

Understand what does commercial umbrella insurance cover and protect business