Think of commercial umbrella insurance as a heavy-duty financial safety net for your business. It’s not a standalone policy, but an extra layer of liability protection that kicks in when a claim is so large it blows past the limits of your primary insurance.

This policy is designed to handle the big, catastrophic stuff—the kind of lawsuit that could otherwise force you to sell assets or even shut down for good. It covers major claims involving bodily injury, property damage, and even personal or advertising injury, protecting everything you’ve worked to build.

What Commercial Umbrella Insurance Really Is

At its core, commercial umbrella insurance is a shock absorber for your business's finances. It doesn’t activate for everyday claims; instead, it waits in the background, ready to spring into action when a massive liability claim exhausts your underlying policies like general liability or commercial auto.

Its entire purpose is to prevent a single, devastating lawsuit from becoming a company-ending event. In a world where legal battles are more frequent and expensive than ever, this extra coverage isn't a luxury—it's a critical part of a smart risk management strategy. If you want a deeper dive into the basics, check out our guide on what is umbrella insurance.

The Core Protections It Offers

So, what does this look like in practice? An umbrella policy simply extends the dollar limits of your other liability policies. If a court hits you with a judgment that’s higher than your general liability coverage, your umbrella policy steps in to pay the remaining amount, up to its own, much higher limit.

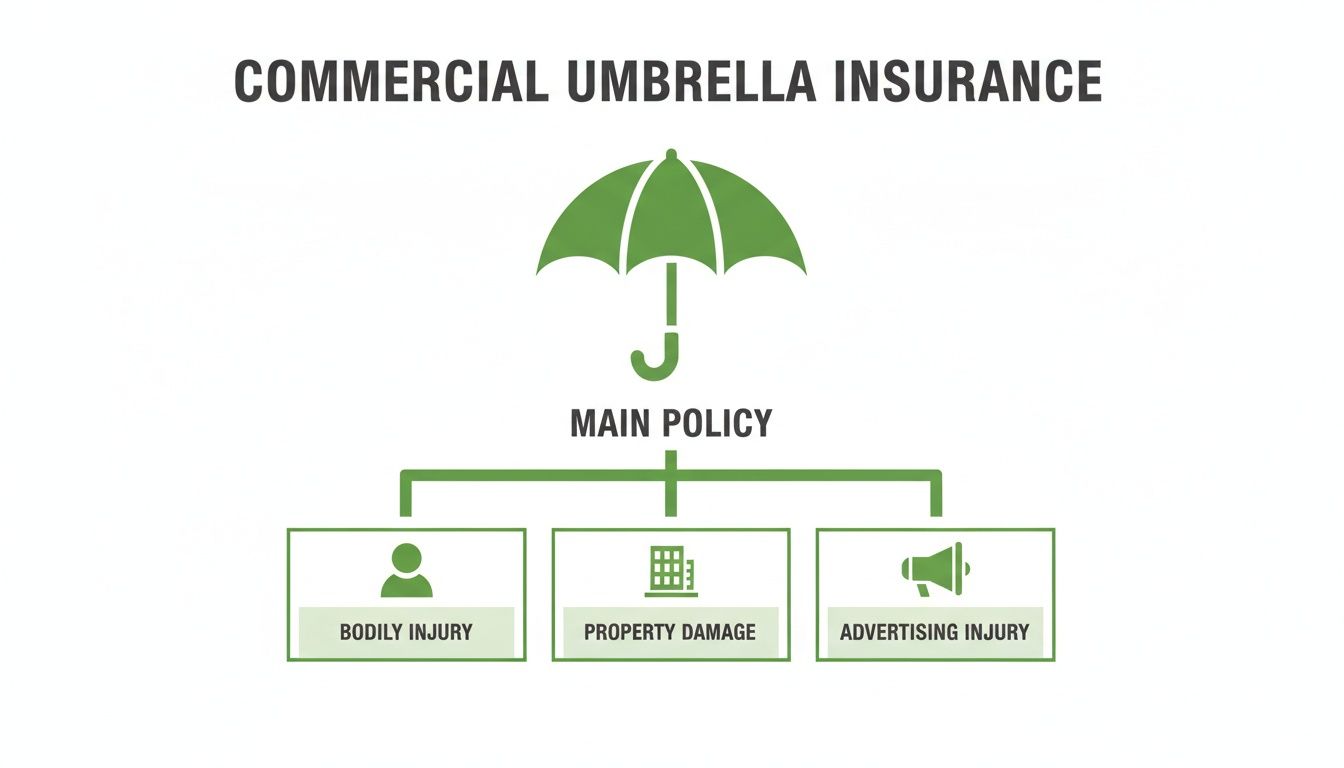

The diagram below shows the main types of liability that an umbrella policy sits on top of, giving you that extra cushion.

As you can see, it primarily reinforces your defense against the most common sources of major lawsuits: bodily injury, property damage, and advertising-related claims.

Shielding Your Business From Catastrophic Claims

In today's world, the threat of a massive lawsuit is very real for any business owner. Commercial umbrella insurance is your primary defense, covering liability claims that are too big for your standard policies to handle alone.

This extra layer is more critical than ever, especially with the rise of "nuclear verdicts"—jury awards that climb past $10 million. These kinds of judgments can happen, and they can happen to businesses of any size.

An umbrella policy is all about asset protection. It's the difference between a lawsuit being a manageable business expense and a catastrophic event that shuts your doors. It ensures one bad day doesn’t erase years of hard work.

And this isn't just a concern for massive corporations. Any business with a physical location, company vehicles, or regular interaction with the public is exposed to liability risks that can easily overwhelm a standard policy limit.

The table below breaks down how an umbrella policy layers on top of your existing coverage to give you a clearer picture of how it works.

How Umbrella Insurance Extends Your Core Policies

| Primary Policy | Example of a Covered Claim | When Umbrella Coverage Activates |

|---|---|---|

| General Liability | A customer suffers a severe slip-and-fall injury at your store, resulting in a $1.5 million lawsuit. | Your general liability policy pays its $1 million limit; the umbrella covers the remaining $500,000. |

| Commercial Auto | Your delivery driver causes a multi-car accident, leading to $2 million in damages and medical bills. | Your commercial auto policy pays its $1 million limit; the umbrella covers the additional $1 million. |

| Employers' Liability | An employee sues for a workplace injury, alleging negligence, and wins a $1.2 million judgment. | Your employers' liability policy pays its $500,000 limit; the umbrella covers the remaining $700,000. |

As you can see, the umbrella's job is to kick in right when you need it most—after your primary insurance has done its part but the bills are still piling up.

Covering Bodily Injury And Property Damage Claims

When we talk about business liability, two risks stand out above all others: bodily injury and property damage. These are the kinds of claims that can not only disrupt your operations but threaten the very existence of your company. A commercial umbrella policy is your financial backstop for when a claim turns catastrophic, blowing past the limits of your standard insurance.

Think about a nasty slip-and-fall accident at your shop. Your general liability policy likely has a $1 million limit, which sounds like a lot. But when you factor in major surgery, long-term physical therapy, lost income for the injured person, and a lawsuit for pain and suffering, that million dollars can vanish in the blink of an eye.

This is the exact moment an umbrella policy is designed to step in. It kicks in after your primary policy has paid its full limit, absorbing the rest of the financial shock so your business assets don't have to.

Real-World Bodily Injury Scenarios

To really get a feel for how this works, you need to understand the underlying protection it builds on. For a closer look at the basics, it's worth exploring what bodily injury liability coverage entails. Your umbrella policy simply takes that foundational coverage and adds a much, much higher ceiling.

Let’s walk through a couple of real-world examples:

- A Multi-Vehicle Pile-Up: One of your delivery drivers causes a major accident on the highway, injuring several people in multiple cars. The total for medical bills and legal claims soars well past your $1 million commercial auto limit. Your umbrella policy is what covers the difference, potentially saving your business from financial ruin.

- A Construction Site Mishap: Scaffolding collapses at one of your job sites, injuring a visiting architect and a pedestrian on the street below. The lawsuit that follows is for $2.5 million. Once your general liability pays its $1 million limit, your umbrella policy is there to cover the remaining $1.5 million.

These situations underscore the core purpose of an umbrella policy: providing excess liability coverage that shields you from the kind of lawsuit that can bankrupt a company.

When Property Damage Claims Escalate

Property damage can be just as financially devastating as an injury claim, often because of a domino effect. One mistake can easily damage multiple properties, triggering a flood of claims that come straight back to you.

Imagine a plumbing contractor soldering pipes in a condo building. A stray spark ignites a fire that spreads to neighboring units, causing extensive smoke and water damage throughout the floor. The final bill to repair the structure and replace the residents’ damaged property hits $1.8 million.

Your standard general liability policy might handle the first million, but your business is still on the hook for the other $800,000. An umbrella policy is the only thing that can bridge that massive gap, preventing a single accident from forcing you to close your doors for good.

The Hidden Cost Of Legal Defense

Beyond just paying out settlements, one of the most valuable things an umbrella policy does is cover the crushing cost of a legal defense. Between attorney fees, court costs, and expert witness retainers, you can easily spend hundreds of thousands of dollars—even on a case you eventually win.

What many business owners don't realize is that once your primary policy's limit is exhausted, its duty to pay for your legal defense often ends, too. Your umbrella policy can pick up right where it left off, continuing to fund your legal fight.

This ensures you can actually afford to mount a proper defense without gutting your company's cash flow. For a refresher on the policy that handles these initial costs, check out our guide on what is commercial general liability.

Protecting Against Personal and Advertising Injury

When business owners think about risk, they usually picture physical accidents—a slip-and-fall, a vehicle crash, or property damage. But some of the costliest lawsuits have nothing to do with physical harm. They stem from damage to a person's or a company's reputation.

This is where personal and advertising injury coverage comes in. These claims can be devastating, and while your general liability policy is your first line of defense, the legal bills and judgments can easily blow past its limits.

That’s why a commercial umbrella policy is so critical. It acts as a massive financial backstop, providing the extra protection you need when a reputational lawsuit threatens to sink your business.

What Is "Personal Injury" in a Business Policy?

First things first: in the world of insurance, "personal injury" doesn't mean a bodily injury. It’s a specific term for offenses that harm someone's reputation or violate their personal rights. A simple mistake by a well-meaning employee can quickly escalate into a lawsuit that costs you a fortune.

Think of it as liability for reputational damage. Your business can face a massive claim without a single piece of property ever being scratched.

Here are a few real-world examples of personal injury claims:

- Wrongful Detention: A retail manager holds a customer they suspect of shoplifting, but they’ve made a mistake. That customer can sue for false imprisonment.

- Slander: During a sales pitch, an employee makes false and damaging comments about a competitor. That competitor can sue for slander.

- Libel: Your company posts a negative online comment about a former contractor that contains false information. The contractor sues for the harm done to their reputation.

In all these cases, your primary general liability policy kicks in first. But if the court awards a judgment that exceeds your policy limit, your commercial umbrella policy steps in to cover the rest.

Understanding Advertising Injury Coverage

Advertising injury covers legal claims that arise directly from your marketing efforts. Every ad, blog post, or social media campaign you run creates a new set of potential risks. An umbrella policy gives you an essential safety net here, too.

These claims usually involve one of the following:

- Copyright Infringement: Your marketing team grabs a cool photo off the internet for a brochure without realizing it was copyrighted. The photographer sues.

- Misappropriation of Advertising Ideas: You launch a brilliant new slogan that, unfortunately, sounds almost exactly like a competitor's. They sue you for stealing their concept.

- Invasion of Privacy: You feature a happy client in a testimonial on your website but never got their written permission to use their picture.

The line between personal and advertising injury can get a little blurry, but they both represent major, non-physical risks. A commercial umbrella policy is built for these exact situations—when a lawsuit’s financial fallout is too big for your primary policy to handle alone. It ensures one marketing blunder doesn’t become a business-ending disaster.

When the limits of your underlying policy are used up, your commercial umbrella insurance extends its protection over these personal and advertising injury claims. For any business owner facing a high-stakes libel suit, that extra layer of coverage can be the one thing that keeps the doors open. To dig deeper into the nuances of high-level liability coverage, it's helpful to compare excess liability vs umbrella coverage.

Real-World Scenarios: Where an Umbrella Policy Saves the Day

It’s one thing to talk about "excess liability" in theory, but it’s another thing entirely to see how it plays out in the real world. Let's move beyond the jargon and look at how a commercial umbrella policy can be the one thing that stands between a thriving business and complete financial ruin.

These aren't just made-up stories; they reflect the kind of catastrophic, high-stakes events that can hit any business, at any time.

Scenario 1: The Fleet Operator's Multi-Car Pileup

Picture a mid-sized logistics company running a fleet of 20 delivery vans. On a rainy afternoon, one of their drivers hydroplanes on a slick highway while trying to make a tight deadline. The van spins out, triggering a chain-reaction pileup that involves five other vehicles. The result is a nightmare: multiple people are left with catastrophic, life-altering injuries.

The lawsuits start pouring in. When all is said and done, the total for medical bills, long-term care, lost wages, and pain-and-suffering judgments hits a staggering $2.5 million.

The company’s commercial auto policy has a liability limit of $1 million per accident. That’s a solid policy, but it's exhausted almost immediately. This leaves the business on the hook for a $1.5 million shortfall—an amount that would mean liquidating assets, laying off the entire staff, and facing almost certain bankruptcy.

This is exactly where the umbrella policy steps up. The business owner had the foresight to purchase a $5 million commercial umbrella policy. As soon as the auto policy paid its full $1 million, the umbrella kicked in to cover the remaining $1.5 million plus the ballooning legal defense costs. The business survived, shaken but still standing, all because of that extra layer of protection.

Scenario 2: The Contractor's Costly Structural Error

Now, let's consider a well-respected general contractor hired to build a new commercial office building. During the project, a subcontractor makes a tiny miscalculation when installing a critical support beam. Months after the building is finished and occupied, that error leads to a partial collapse of one floor—right in the middle of a workday.

By some miracle, no one is seriously injured. But the property damage is immense. The tenant, a tech company, sues the general contractor for the cost of repairing the structure and replacing their destroyed servers and custom machinery. The total comes to $2.2 million.

The contractor's general liability policy provides $1 million for property damage. Once that limit is paid out, the contractor is still facing a $1.2 million bill. This is a business-ending figure that would wipe out years of hard work and force the owner to sell personal assets.

Luckily, the contractor carried a $2 million commercial umbrella policy. It activated right after the general liability was maxed out, covering the entire $1.2 million difference. The umbrella didn't just prevent bankruptcy; it saved the contractor's hard-earned reputation, allowing them to get back to work.

Scenario 3: The Professional Firm's Viral Libel Lawsuit

Finally, imagine a digital marketing agency. After a difficult engagement, the agency’s owner decides to write a case study about the project for their website. They're careful to anonymize the client's details, but a few specific project descriptions are recognizable enough for people in that industry to connect the dots.

The former client is furious. Claiming the case study contains misleading information that has damaged their professional reputation and cost them a major contract, they file a massive libel lawsuit. The story goes viral online. In the end, a jury sides with the former client, awarding a judgment of $1.3 million.

The agency's general liability policy includes coverage for personal and advertising injury, but the limit is $500,000. This leaves a devastating $800,000 gap. For a small but growing agency, that amount is impossible to come up with.

The agency’s $1 million commercial umbrella policy was its lifeline. After the primary GL policy paid its $500,000, the umbrella covered the remaining $800,000. In this case, a single policy saved a business from financial ruin over a claim that didn't involve a single physical injury, proving that some of the biggest risks are the ones you can't see coming.

What Doesn't My Umbrella Policy Cover?

A commercial umbrella policy is a fantastic safety net, but it's not a magic wand. One of the biggest mistakes business owners make is thinking it covers absolutely everything. That's a dangerous assumption that can leave you financially exposed.

An umbrella policy is designed to add higher limits on top of specific liability policies you already have. It’s not a standalone, catch-all policy. Knowing what it doesn't cover is just as important as knowing what it does.

The Most Common Exclusions

The golden rule here is simple: if the claim isn't covered by your underlying general liability, commercial auto, or employer's liability policy in the first place, your umbrella won't cover it either. It follows form.

Here are a few things that your umbrella policy will almost certainly not pay for:

- Damage to Your Own Stuff: Umbrella insurance is all about liability—the damage you cause to other people or their property. It won't pay to fix your own building after a storm or replace your stolen tools. That’s what your commercial property insurance is for.

- Intentional or Illegal Acts: This one is pretty straightforward. If you or an employee deliberately cause harm or break the law, insurance isn't going to step in. Policies are designed to cover accidents, not intentional wrongdoing.

- Workers' Compensation Benefits: While your umbrella adds limits to the lawsuit portion of your workers' comp policy (known as employers' liability), it does not cover the standard, no-fault medical bills and lost wages owed to an injured employee. That requires a separate workers' compensation policy mandated by the state.

To make this crystal clear, let's look at a side-by-side comparison.

Covered Vs Not Covered A Clear Comparison

This table breaks down common scenarios to show what an umbrella policy is designed to handle versus what falls outside its scope, requiring a different type of insurance altogether.

| Typically Covered by Umbrella | Typically Not Covered (Requires Separate Policy) |

|---|---|

| Catastrophic third-party bodily injury claims | First-party property damage (your building, inventory) |

| Major third-party property damage lawsuits | Claims of professional negligence or mistakes (E&O) |

| Libel, slander, and reputational harm claims | Cyber liability incidents like data breaches or ransomware |

| Lawsuits from employees alleging negligence | Fines and penalties from regulatory bodies |

| Severe auto accidents caused by employees | Pollution cleanup or environmental damage |

| Liability from products that cause widespread harm | Intentional or criminal acts |

Understanding this distinction is the key to building an insurance program without any hidden—and potentially devastating—gaps.

Specialized Risks That Need Their Own Policies

Some risks are just too unique or complex to be bundled into a standard liability policy. They require their own dedicated insurance with specialized underwriters who truly understand the exposures. Trying to rely on an umbrella for these is a recipe for disaster.

A common and costly mistake is assuming an umbrella policy covers professional mistakes or a data breach. In reality, these are major exclusions that require their own dedicated policies. Failing to secure the right coverage for these risks can be a business-ending oversight.

Think of these as risks that need their own expert protection:

- Professional Liability: Often called Errors & Omissions (E&O), this covers you if your advice or professional service causes a client a financial loss. An umbrella won't protect an architect from a lawsuit over a design flaw or an IT consultant whose advice leads to a system failure.

- Cyber Liability: This is a huge one. Your standard umbrella will not touch the costs of a data breach, ransomware attack, or other cyber incidents. You absolutely need a standalone cyber liability policy for that.

- Pollution Liability: Claims related to pollutant cleanup or environmental damage are highly specialized and almost always excluded. If your business handles materials that could contaminate soil or water, you need a dedicated pollution policy.

Getting a handle on these details is the first step toward building a truly resilient business. For a closer look at navigating policy language, our guide on how to read your insurance policy can help you spot these critical exclusions yourself.

How To Determine The Right Coverage Amount

Okay, so you've got the basics of what an umbrella policy does and doesn't cover. The next logical question is always the big one: "How much is enough?"

Figuring out the right coverage limit is one of the most important decisions you'll make, a true balancing act between cost and risk. There’s no magic number here. It’s about a careful, strategic look at your business to land on a limit that lets you sleep at night, knowing you're protected if the worst happens.

Assess Your Specific Industry Risks

First things first, you have to get real about the risks baked into your line of work. A small accounting firm operating out of a quiet suburban office has a completely different risk profile than a general contractor overseeing a downtown construction project. The odds of facing a multi-million-dollar lawsuit just aren't in the same ballpark.

Think through your day-to-day operations and your contact with the public. Here's what to consider:

- Public Exposure: Do clients and vendors come to your place of business often? The more foot traffic you have, the higher your risk for a simple slip-and-fall claim that could spiral into something much bigger.

- Vehicle Usage: Do you have a fleet of vehicles on the road? Commercial auto accidents are a primary driver of massive lawsuits. If your business depends on driving, higher limits are non-negotiable.

- Nature of Operations: Some industries are just plain riskier. If you’re in construction, manufacturing, or trucking, you inherently need much higher liability limits because the potential for a severe, life-altering accident is part of the job.

Evaluate Your Total Business Assets

At its core, your umbrella policy is there to shield your assets. That means the value of what you own is a huge factor in deciding how much coverage to buy. You need to take stock of everything the business owns.

Add it all up: your commercial property, your expensive equipment, the inventory in your warehouse, and the cash in your business bank accounts. If a lawsuit blows past your primary and umbrella limits, those are the assets a court can go after to pay the judgment. Your coverage needs to be robust enough to protect everything you've built.

The rise of "nuclear verdicts"—jury awards exceeding $10 million—has completely changed the risk landscape. Yesterday's $1 million or $2 million limits may no longer be adequate to protect a business from a single, catastrophic lawsuit in today's litigious environment.

Review Your Contractual Requirements

Sometimes, the choice isn't entirely yours. Your clients might make it for you. It's common for larger corporations and government agencies to demand that their vendors carry specific, high liability limits before they’ll sign a contract.

These requirements aren't suggestions; they're deal-breakers. They exist to protect the client, ensuring you have the financial backing to handle a major incident without them being pulled into it.

Before you buy or renew, pull out your client contracts and read the insurance section carefully. They’ll often spell out the minimum umbrella limit required, which could be anything from $2 million to $10 million or even more. Falling short here could mean losing a major contract, so it’s a critical piece of the puzzle.

For a more detailed walkthrough, you can learn more about how much umbrella insurance you might need in our dedicated guide.

Frequently Asked Questions

Even after you've got the basics down, commercial umbrella insurance can feel a little tricky. Let's tackle some of the most common questions business owners ask, so you can feel confident about your coverage.

How Much Commercial Umbrella Insurance Do I Really Need?

This is the million-dollar question—sometimes literally. There’s no magic number, as the right amount of coverage really depends on your specific business, your industry, and the risks you face every day.

A small local retailer might be perfectly fine with a $1 million to $2 million umbrella policy. But a large contractor with a fleet of trucks and heavy equipment on job sites? They’re likely looking at $5 million, $10 million, or even more to properly protect their assets.

Don't forget about contractual obligations. Many clients will require you to carry a certain limit before you can even bid on a project. The best way forward is to sit down with an insurance advisor. They can help you analyze your real-world exposure and pinpoint a limit that truly shields your business from a devastating lawsuit.

Is Commercial Umbrella Insurance The Same As Excess Liability?

Not quite, though people often use the terms interchangeably. They both kick in when your underlying policy limits are exhausted, but there's a key difference.

An excess liability policy is like a simple extension cord for your primary insurance—it just gives you more of the exact same coverage. A true commercial umbrella policy can be broader. It can sometimes step in to cover claims that your underlying policies don't cover at all, though you'll typically have to pay a deductible first, known as a self-insured retention (SIR).

Think of it this way: Excess liability just adds more money on top. An umbrella can add more money and potentially fill in some coverage gaps. It's a subtle but important distinction.

Why Are My Umbrella Insurance Premiums Increasing So Much?

If you've noticed your umbrella premiums creeping up, you're not alone. The main culprit is a phenomenon the insurance industry calls "social inflation." It’s a perfect storm of several factors driving up the cost of claims for insurers:

- Skyrocketing litigation costs in general.

- Massive jury awards in liability lawsuits, which are often called "nuclear verdicts."

- A growing tendency to sue businesses over just about anything.

When insurers have to pay out more for catastrophic claims, especially those involving commercial auto accidents, they have to adjust their pricing to stay in business. That means higher premiums and tougher underwriting standards for everyone. Working with an independent agency gives you the advantage of shopping the market to find the most competitive option for the coverage you need.

Figuring out the ins and outs of business insurance is a crucial part of protecting everything you’ve built. The experts at Wexford Insurance Solutions are here to help you evaluate your unique risks and find the right commercial umbrella policy for your company. Contact us today for a personalized consultation.

Is Private Flood Insurance the Right Choice for Your Home?

Is Private Flood Insurance the Right Choice for Your Home? Financial Planning for Small Business Owners A Practical Guide

Financial Planning for Small Business Owners A Practical Guide