As a small business owner, you're used to wearing a lot of hats. But "financial strategist" might be the most important one of all. Financial planning is far more than just balancing the books; it's the process of deliberately steering your company's resources to hit your business milestones and secure your personal financial future.

Think of it as the strategic roadmap that connects your budgeting, forecasting, and risk management into one cohesive plan for long-term, sustainable growth.

Why Financial Planning Is Your Business's North Star

Imagine you're the captain of a ship setting out on a long voyage. You have a sturdy vessel and a hardworking crew, but no compass, no map, and no idea what weather lies ahead. You'd be adrift, relying on luck. For an entrepreneur, a financial plan is that map and compass. It turns gut feelings into informed decisions and transforms big ambitions into concrete, achievable steps.

Too many business owners get swamped by the day-to-day grind of managing inventory, serving customers, and leading their team. Finance becomes a chore they react to—usually at tax time. A proper financial plan flips that script completely. It's about being proactive, not reactive. It’s the difference between merely hoping for success and actively engineering it.

Shifting from Reactive to Proactive

A solid financial plan gives you the clarity to make confident choices. When a slow season hits, you aren't scrambling for cash because your cash flow forecast already prepared you for it. When you're considering a new hire, you aren't guessing if you can afford them—your budget gives you a straight answer.

This forward-thinking approach builds incredible resilience, turning what could have been a crisis into a manageable bump in the road. In today's economic climate, that's non-negotiable.

A recent Bank of America report found that while 74% of business owners expect their revenue to grow, they're still worried about inflation and interest rates. History shows that businesses with detailed financial plans are simply better prepared to navigate this kind of uncertainty. You can dig into more of these trends in the 2025 Business Owner Report.

Connecting Business Success to Personal Wealth

At the end of the day, good financial planning does more than keep the lights on. It's the engine that builds lasting personal wealth. It ensures all your sweat equity translates into a secure retirement, college savings for your kids, and a valuable asset you can eventually sell or pass down. It draws a straight line from the health of your business to the future of your family.

A great financial plan acts as a strategic filter, helping you say "no" to distractions and "yes" to the opportunities that truly align with your long-term vision.

The whole process rests on three core pillars:

- Budgeting: Intentionally deciding where every dollar goes.

- Forecasting: Looking ahead to anticipate income and expenses so there are no surprises.

- Risk Management: Protecting your business and your assets from the unexpected.

Getting these elements right is foundational. A crucial piece of managing risk is having a plan for when things go wrong, which you can start building with our business continuity plan checklist. This guide will help you see finance not as a burden, but as your most powerful tool for building the business and the life you've always wanted.

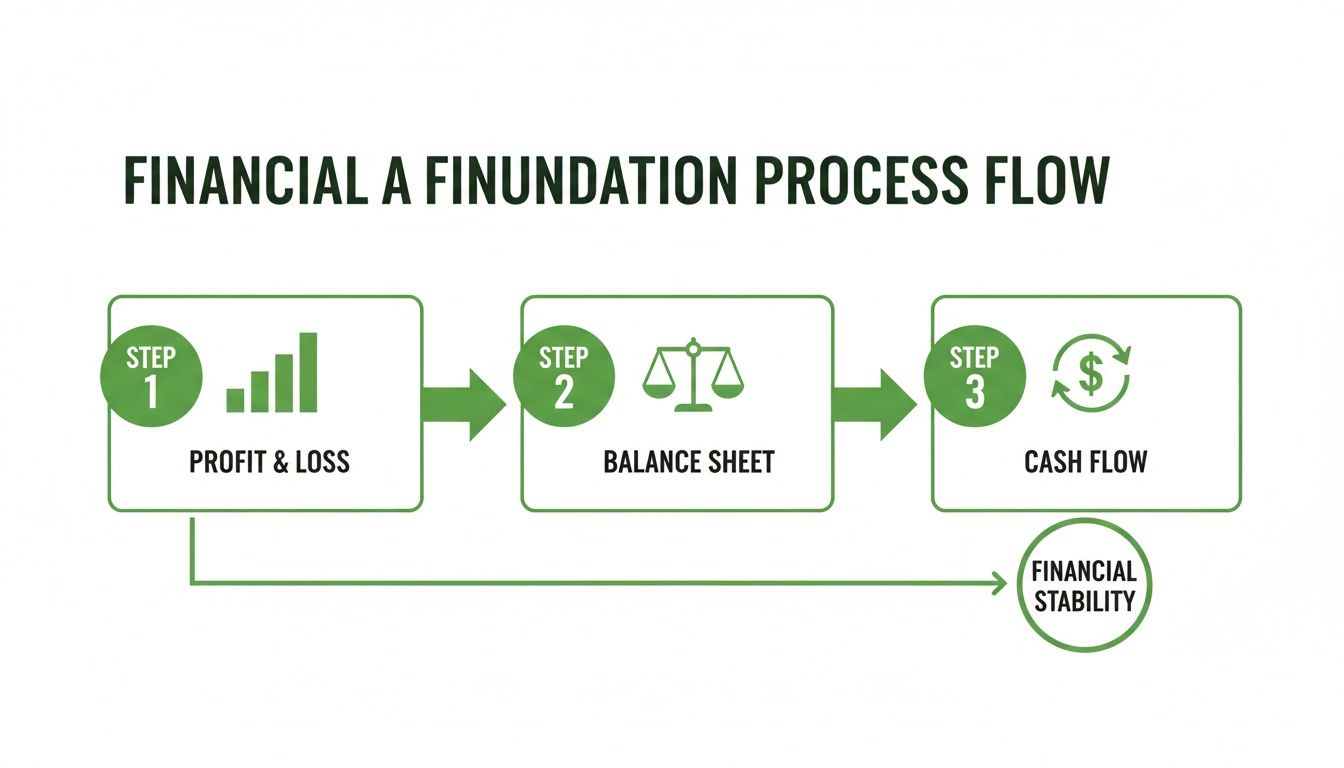

Building Your Financial Foundation Step by Step

Think of your financial plan as the blueprint for your business. You wouldn't start building a house without one, and the same logic applies here. Before you can build something that lasts, you need a solid foundation. For your business, this foundation is built on three core financial statements.

Together, these documents give you a 360-degree view of your company's health, stability, and performance. Without them, you’re flying blind. A lot of entrepreneurs get a little spooked by these reports, but you really don't need a finance degree to get the hang of them. The trick is to see them as storytelling tools, with each one revealing a crucial part of your business's journey.

Your Three Essential Financial Blueprints

Getting comfortable with these documents is the first real step in smart financial planning for small business owners. Everything else—your budget, your forecasts, your big strategic moves—is built right on top of this. Let's break down what each one does.

-

The Profit & Loss (P&L) Statement: Also called an income statement, this is the story of your performance over a set period, like a month or a quarter. It answers one simple question: "Are we actually making money?" It does this by subtracting all your costs and expenses from your total revenue.

-

The Balance Sheet: This is more like a snapshot in time. It gives you a clear picture of your financial health on a specific day. It all comes down to a simple formula: Assets = Liabilities + Equity. In plain English, it shows what you own (assets), what you owe (liabilities), and the value that's left over for you (equity).

-

The Cash Flow Statement: This one is critical. While the P&L can show a profit, that profit isn't the same as cash in your bank account. This statement tracks the real cash moving in and out of your business, answering the all-important question, "Where did our money actually go?"

Grasping these three statements is a non-negotiable skill for any serious business owner. A huge part of this is simply learning how to read company financial statements, as it gives you the clearest possible view of your business's real-world performance.

To help you remember their roles, here’s a quick summary.

The Three Pillars of Your Financial Plan

| Financial Statement | What It Measures | Key Question It Answers |

|---|---|---|

| Profit & Loss (P&L) | Your business's profitability over a period of time (e.g., month, quarter, year). | "Did we make or lose money?" |

| Balance Sheet | Your business's financial health at a single point in time. | "What do we own, what do we owe, and what is our net worth?" |

| Cash Flow Statement | The movement of actual cash in and out of the business over a period. | "Where did our cash come from, and where did it go?" |

Each statement provides a different lens through which to view your business. Used together, they paint a complete and actionable picture.

Gathering Your Data and Choosing Your Tools

To create these reports, you first need clean, organized data. That just means you need a reliable system for tracking every dollar that comes in and every dollar that goes out. This covers everything from sales and invoices to payroll, rent, and inventory costs.

Thankfully, you don't have to do this in a spreadsheet anymore. Modern accounting software makes this incredibly straightforward. Tools like QuickBooks, Xero, or FreshBooks are built for small businesses. They sync with your bank accounts, help categorize your transactions, and can generate these essential financial statements with just a few clicks. Picking the right software early on will save you a massive headache down the road.

It turns out many entrepreneurs are learning on the job. An Intuit QuickBooks survey found that only 16% of small business owners have a business degree, and a staggering 42% start out with limited financial knowledge. This just goes to show how vital it is to build that solid financial foundation from day one. You can check out the full report on small business financial literacy.

Establishing a Routine for Financial Review

Okay, so you've generated the reports. Now what? The real magic happens when you actually use them. Your financial plan isn't a document you create once and file away; it's a living guide that needs regular check-ups.

Here’s a simple rhythm you can adopt to stay on top of things:

- Weekly Check-In (30 minutes): Glance at your bank balances and see who owes you money. Are customers paying on time? Did any big, unexpected expenses pop up? This is all about managing your immediate cash flow.

- Monthly Review (1-2 hours): This is when you pull up your P&L and Cash Flow statements for the month that just ended. Compare your actual numbers to what you budgeted. Did you hit your sales goals? Were your costs in line?

- Quarterly Deep Dive (Half a day): Time to zoom out. Review all three financial statements to spot bigger trends. Is your profit margin getting better? Is your debt under control? Use these insights to tweak your plan for the next quarter.

This simple, disciplined routine is what turns your financial data from a pile of boring numbers into your most powerful tool for making smart decisions.

Mastering Cash Flow Forecasting And Budgeting

You’ve probably heard the old saying, “Profit is vanity, cash is sanity.” It might be a cliché, but it’s one of the most important truths in business. A company can look fantastically profitable on paper but still go under if it runs out of cash to pay its bills, meet payroll, or buy new inventory.

That's why learning how to forecast and budget your cash flow isn't just a "nice-to-have" accounting skill. It’s your core survival mechanism. Think of it as the practical, day-to-day work that turns your big-picture financial goals into a concrete, actionable roadmap.

Why Cash Flow Forecasting Is So Critical

Picture this: you're setting off on a long road trip, but your car's fuel gauge is broken. You’d spend the entire journey stressed out, never knowing if you have enough gas to make it to the next station. That's exactly what running a business without a cash flow forecast feels like.

This forecast is your business's fuel gauge. It projects the cash you expect to come in and go out over a set period, usually 12 months. It’s your early warning system, letting you see potential cash shortages (or surpluses) long before they become a crisis.

How important is this? A staggering 82% of small business failures are tied directly to poor cash flow management. What's truly eye-opening is that many of those businesses were actually profitable. This just goes to show the dangerous disconnect between reporting a profit and having real money in the bank.

This is where the three core financial statements—your Profit & Loss, Balance Sheet, and Cash Flow Statement—come together to tell the full story.

As you can see, while profit and assets are key metrics, it's the actual movement of cash that keeps the lights on.

Building Your 12-Month Cash Flow Forecast

Getting started is less intimidating than it sounds. It’s really just about making educated guesses based on the data you already have. Let's walk through it with a simple coffee shop example.

-

Project Your Cash Inflows: First, map out all the money you expect to receive each month. This is more than just daily sales from the register. Did you book a catering gig? Do you sell merchandise? Look at your sales history and be realistic about seasonal trends—a busy December holiday season will look much different from a quiet February.

-

Estimate Your Cash Outflows: Now, list every expense you anticipate. To make this easier, split them into two buckets:

- Fixed Costs: These are the bills that stay the same every month. Think rent, your insurance premiums, software subscriptions, loan payments, and salaries for your permanent staff.

- Variable Costs: These expenses move up and down with your sales. For our coffee shop, that means coffee beans, milk, paper cups, and wages for hourly baristas. Don't forget to factor in things like quarterly tax payments!

-

Calculate Your Net Cash Flow: It’s simple math from here. For each month, subtract your total cash outflows from your total cash inflows. A positive result is great—you brought in more than you spent. A negative number is your red flag, signaling a potential cash crunch that you need to plan for.

The Goal Isn't Perfection: Your forecast won't be 100% accurate, and that's okay. Its real power is in giving you a heads-up months in advance, so you have plenty of time to arrange a line of credit, run a promotion, or delay a large purchase.

Choosing The Right Budgeting Method

If a forecast is about looking into the future, a budget is your plan for right now. It’s the tool you use to control your spending and make sure your money is going toward the things that matter most. There are a couple of popular ways to tackle this.

-

Incremental Budgeting: This is the straightforward approach. You take last year's budget and adjust it by a certain percentage to account for things like inflation or planned growth. It’s fast, but the downside is that it can carry over old, inefficient spending habits without question.

-

Zero-Based Budgeting: This method is more involved, but it's incredibly powerful for getting lean. You start every budget period from scratch (from zero) and have to justify every single expense. It forces you to ask, "Is this cost absolutely necessary?" and ensures every dollar has a clear purpose.

For a more detailed guide on building out your financial predictions, check out this excellent resource on mastering cash flow projection.

And before you begin, getting your income data organized is a huge help. Using a simple tool like our https://wexfordis.com/2025/07/13/business-income-worksheet/ can make the whole forecasting process smoother and more accurate right from the start.

Integrating Risk Management and Insurance

A perfectly crafted financial plan is a thing of beauty. It can map out revenue goals and manage cash flow with impressive accuracy, but it’s still fragile without a layer of protection. Think of risk management as building a financial firewall around your business. It's all about spotting potential threats early and putting safeguards in place so one bad day doesn't sink the entire ship.

Let's be blunt: a financial plan without a solid risk strategy is just a plan waiting to fail. It’s like building a dream house in a hurricane zone without reinforcing the foundation or buying insurance. When the storm inevitably hits, all your hard work gets washed away. This is why a core part of financial planning for small business owners is asking, "What could go wrong?" and then preparing for it.

Understanding Your Business Risks

Business risks tend to show up in a few key categories. Just being able to name them is the first step toward building your defenses. Each one can hit your assets, cash flow, and long-term stability in a different way.

- Financial Risks: These are the threats that directly attack your bottom line. Think of a sudden economic downturn, interest rates jumping up on your business loans, or a major client going bust and leaving you with a huge unpaid invoice.

- Operational Risks: These pop up in your day-to-day work. It could be anything from a vital piece of machinery breaking down to a data breach that leaks sensitive customer info.

- Strategic Risks: These are the big-picture threats lurking on the horizon. Maybe a new, aggressive competitor moves into your market, customer tastes suddenly change, or you fail to keep up with new technology and get left behind.

Pinpointing these weak spots lets you shift from being reactive to being proactive. For a much deeper dive into this process, our guide on what is risk management in business lays out a fantastic framework. This forward-thinking approach turns your financial plan from a simple forecast into a resilient, all-weather strategy.

Insurance as a Powerful Financial Tool

Once you know what you’re up against, insurance becomes your best friend for offloading that risk. Way too many business owners see insurance as just another bill to pay. The smarter way to look at it is as a powerful financial instrument that protects your balance sheet from getting wiped out.

The right policies aren't just a safety net; they're an active part of your financial plan. They preserve the cash that you'd otherwise have to pull from your operations to cover legal fees, property damage, or liability claims. A single lawsuit or fire could easily erase years of profit and hard-won assets.

An integrated insurance portfolio acts as a non-negotiable shield for your financial plan. It guarantees that the resources you've allocated for growth, operations, and personal wealth aren't suddenly diverted to cover a crisis.

Key Insurance Policies for Your Financial Firewall

While every business is unique, a few types of commercial insurance are the bedrock of any strong risk management plan. They directly counter the financial, operational, and strategic threats that could knock you off course.

General Liability Insurance

This is the absolute foundation of business protection. It has your back if someone claims you caused them bodily injury or damaged their property, either on your premises or through your operations.

- Example: A customer slips on a wet floor in your shop. General Liability can cover their medical bills and your legal defense, saving you from a massive, unplanned cash outlay.

Professional Liability Insurance (Errors & Omissions)

If you provide a service or give advice, this is a must-have. It protects you if a client claims you were negligent, made a mistake, or failed to deliver as promised.

- Example: A marketing consultant’s advice leads to a client losing a ton of money. Professional Liability can cover the legal battle and any settlement, protecting both the business’s finances and the owner’s personal assets.

Cyber Liability Insurance

Let’s face it, we all live online now, making this coverage essential. It helps you bounce back from a data breach or cyberattack by covering costs like notifying customers, credit monitoring, and regulatory fines.

- Example: A hacker gets into your customer database. Cyber Liability helps you manage the huge financial and reputational disaster, letting your business get back on its feet much faster.

Building this firewall isn't about getting rid of risk completely—that's impossible. It’s about controlling it. By weaving a tailored insurance portfolio into your financial plan, you turn a strategy based on hope into one built on resilience. You’re making sure your business can take a punch and keep moving toward long-term success.

Planning for Taxes, Retirement, and Your Exit Strategy

So far, we’ve been focused on building a rock-solid financial plan for the here and now—managing cash, keeping risks at bay, and pushing for growth. Now, it’s time to shift our gaze to the horizon. This part is all about making sure the blood, sweat, and tears you pour into your business today translate into real, lasting personal wealth and a secure future.

Your business isn't just a job; it's probably the biggest asset you'll ever build. To truly make the most of its value, you need a forward-looking strategy that weaves together three critical threads: smart tax planning, a solid retirement fund, and a well-defined exit strategy. Think of them as the bridge between your company's success and your own financial freedom.

Smart Tax Planning Beyond the April Scramble

For too many business owners, "tax planning" is a frantic, once-a-year scramble to find receipts. A truly powerful financial plan flips that script. It turns your tax strategy into a proactive, year-round discipline that can save you thousands. The goal isn't just to file on time, but to legally minimize what you owe, freeing up cash to pour back into the business or your own savings.

One of the first and most important decisions is your business structure. An LLC offers great flexibility, but electing to be taxed as an S-Corporation, for example, can potentially slash the self-employment taxes you pay on profits. That alone can be a game-changer.

Beyond structure, it's about making every single available deduction and credit work for you. This means meticulously tracking:

- Day-to-day business expenses, from vehicle mileage and home office use to software subscriptions and industry conference fees.

- Retirement contributions, which pull double duty by lowering your taxable income now while building your future wealth.

- Health insurance premiums for yourself, your spouse, and your dependents, which are often deductible.

Building Your Retirement Nest Egg

It's easy to think of your business as your retirement plan, but banking everything on its future sale is a high-stakes gamble. A recent study found that while a staggering 78% of owners plan to fund their retirement by selling their business, an equally shocking 60% haven't even sat down with a financial advisor to map it out.

A much safer approach is to systematically build a separate nest egg. This ensures your retirement isn't hanging on a single, uncertain event. Luckily, as a business owner, you have access to some incredibly powerful, tax-advantaged retirement accounts.

These plans are more than just a savings account for your golden years; they are powerful tax-saving tools you can use right now. Every dollar you contribute is often a dollar you can deduct from your current business income, lowering your tax bill today.

Choosing the right plan depends on your business size and goals. Here’s a quick rundown of the most common options to help you see what might fit best.

Retirement Plan Options for Small Business Owners

| Plan Type | Contribution Limits | Best For | Key Feature |

|---|---|---|---|

| SEP IRA | Up to 25% of compensation, with high annual limits. | Self-employed individuals or small businesses with few employees. | Very flexible; employer contributions are not required every year. |

| Solo 401(k) | High contribution limits, allowing both "employee" and "employer" roles. | Sole proprietors or businesses with only a spouse as an employee. | Can allow for Roth contributions and participant loans. |

| SIMPLE IRA | Lower contribution limits, with required employer match or contribution. | Small businesses (under 100 employees) wanting a simple-to-administer plan. | Straightforward for employees and employers to understand and manage. |

Each of these plans offers a fantastic way to turn business profits into personal retirement security, but it's wise to consult with a financial professional to pick the one that aligns perfectly with your specific situation.

Crafting Your Exit and Succession Plan

Every single business owner will leave their business one day. The only real question is whether that exit will be on your terms—carefully planned and profitable—or a rushed decision forced by burnout, health issues, or a market shift. Your succession plan is the answer to that critical "what's next?" question.

Thinking about your exit isn't a sign of weakness; it's the ultimate strategic move. It forces you to build a business that can run smoothly without you, which, by its very nature, makes it far more valuable to a potential buyer or the next generation. This process also ties directly into your personal legacy, a topic we dive into deeper in our guide to estate tax planning strategies.

Generally, you have three primary paths for your exit:

- Sell to an Outside Party: This could be a competitor in your industry or a private equity firm. This route often brings the highest price tag, but it requires years of prep work to get your financials and operations in perfect shape.

- Pass It to Family: A wonderful legacy, but one that needs meticulous planning. You have to navigate fairness among siblings, manage tax implications, and be honest about whether the next generation is truly ready to take the helm.

- Sell to Your Employees: An Employee Stock Ownership Plan (ESOP) is a tax-savvy way to sell the company to the very people who helped you build it. It’s a powerful way to reward loyalty and ensure your legacy continues.

Starting this conversation early gives you the runway you need to maximize your company's value, mentally and financially prepare for the transition, and perfectly align your business exit with your personal retirement dreams.

Using Key Performance Indicators to Track Progress

Think of your financial plan as the road map for your business journey. If that's the map, then your Key Performance Indicators (KPIs) are the gauges on your dashboard—the speedometer, the fuel gauge, the engine temperature. They’re the real-time data points that tell you if you’re actually making progress or heading for a ditch.

Tracking the right KPIs is what separates a static, forgotten plan from a living, breathing tool that helps you make smarter decisions, fast.

Without them, you're essentially flying blind. You might be celebrating a jump in sales, but completely miss that your cost to land each new customer is spiraling out of control. Or you might see a healthy profit on paper, while your actual cash in the bank is dwindling to a dangerously low level. Good financial planning for small business owners is all about having this kind of deep-dive visibility. It’s how you spot trouble before it becomes a full-blown crisis.

Essential KPIs for Your Dashboard

The good news is you don’t need to track a hundred different numbers. The key is to focus on the vital few that give you the clearest, most immediate picture of your business's health.

Here are a few must-haves for any small business dashboard:

-

Gross Profit Margin: This is your core profitability. It shows how much money you make from your products or services before accounting for overhead like rent or salaries. Simply put: (Revenue – Cost of Goods Sold) / Revenue. A strong margin here means your pricing and production costs are in a good place.

-

Customer Acquisition Cost (CAC): How much does it really cost you to bring a new customer through the door? Divide your total sales and marketing spend by the number of new customers you gained in that period. If this number is climbing too high, your growth engine isn't sustainable.

-

Cash Runway: This one is a pure survival metric. It answers the question: "If everything went wrong and we didn't make another sale, how many months could we stay in business?" You find it by dividing your Current Cash Balance / Monthly Burn Rate.

Turning Data Into Actionable Decisions

Just watching these numbers isn't enough. The real magic happens when you use them to make course corrections.

Is your Gross Profit Margin dipping? It’s a clear signal to look at your pricing or try to renegotiate with your suppliers. Is your CAC going up? Maybe it's time to rethink which marketing channels you’re spending money on.

By consistently monitoring your KPIs, you create a feedback loop. The data informs your decisions, your decisions impact the business, and the new data tells you if those decisions worked.

This is what it means to be a data-driven business owner. It's a powerful approach being adopted across all industries, with fields like data analytics for insurance now using similar principles to forecast risk and boost performance.

You can set up a simple dashboard in a spreadsheet or right within your accounting software. By doing so, you give yourself the tools to steer your business with precision and confidence, making sure your financial plan leads you straight to success.

Answering Your Top Questions About Small Business Financial Planning

When you're running a business, financial questions are bound to pop up. Getting straight answers is the best way to feel confident in your decisions. Let’s tackle some of the most common questions we hear from business owners just like you.

How Often Should I Actually Look at My Financial Plan?

Your financial plan isn't a "set it and forget it" document. Think of it more like a GPS for your business—you need to check it regularly to make sure you're still on the right path.

- A Monthly Check-In: At a minimum, glance at your financial statements every month. This is your chance to compare your budget to your actual spending and keep a close eye on your cash flow. It’s the best way to catch small issues before they become big problems.

- A Quarterly Strategy Session: Every three months, it’s time to zoom out. Dig a little deeper into your forecasts and see how you’re tracking against your bigger goals. Are you hitting your KPIs? This is the perfect time to make strategic adjustments.

- An Annual Overhaul: Once a year, give your entire plan a thorough review. This is when you'll want to update your tax strategies, talk to your insurance agent about your coverage, and set new, ambitious financial goals for the coming year.

What's the Single Biggest Financial Mistake I Can Make?

If I had to pick just one, it’s mixing your personal and business finances. It’s an incredibly common mistake, especially when you're just starting out, but it can cause a world of headaches later on.

When your accounts are tangled together, you can't get a clear picture of whether your business is actually profitable. Even more important, it can destroy the legal protection that separates you from your business. This means if the business gets sued, your personal assets—your house, your car, your savings—could be on the line. The fix is simple: open a separate business bank account and credit card from day one.

Separating your finances isn't just a bookkeeping tip. It's one of the most fundamental things you can do to protect yourself and your family from business risks.

Can I Handle Financial Planning Myself, or Do I Need to Hire Someone?

Honestly, you can probably handle the basics yourself. Creating a simple budget or tracking expenses with software like QuickBooks is well within reach for most owners. But when the stakes get higher, bringing in a pro is one of the smartest investments you can make.

For specialized areas, an expert is worth their weight in gold. A good CPA can find ways to lower your tax bill that you'd never spot on your own. A financial advisor can help you plan for retirement, and an independent insurance agent can build a safety net to protect everything you've worked for. Their expertise doesn't just prevent costly mistakes; it uncovers opportunities.

Protecting your business is the cornerstone of any solid financial plan. At Wexford Insurance Solutions, we specialize in creating customized insurance portfolios that shield your assets and support your growth. Secure your free policy review today.

Understand what does commercial umbrella insurance cover and protect business

Understand what does commercial umbrella insurance cover and protect business Your Guide to the Homeowners Insurance Replacement Cost Estimator

Your Guide to the Homeowners Insurance Replacement Cost Estimator