If you're looking for ways to lower your homeowners insurance premium right now, there are a few immediate, high-impact moves you can make. The smartest strategies often involve simple adjustments to your policy's financial structure, like raising your deductible, or leveraging your existing relationship with your insurer by bundling multiple policies.

These two tactics alone can make a significant dent in your annual costs without cutting back on the core protection your home needs.

Quick Wins for Lower Home Insurance Premiums

When the goal is fast savings, you don’t need to plan a major home renovation. The easiest wins are often found right within your policy documents. Let's look at the low-hanging fruit: your deductible and your other insurance policies.

Raise Your Deductible for Instant Savings

Your deductible is simply the amount you agree to pay out-of-pocket for a claim before your insurance carrier steps in. By agreeing to a higher deductible, you’re taking on a bit more of the initial financial risk yourself. Insurers like this, and they’ll reward you with a lower premium in return.

The trick is finding the sweet spot. You want a deductible high enough to generate real savings but not so high that you couldn't comfortably cover it if something happened tomorrow. Just bumping a standard $1,000 deductible up to $2,500 can create a noticeable drop in your annual bill.

How much of a drop? Homeowners can save an average of 12% annually just by increasing their deductible from $1,000 to $2,500. For someone with $300,000 in dwelling coverage, that’s about $245 back in their pocket each year.

Unlock Powerful Savings by Bundling Policies

This is one of the easiest and most effective ways to save money. Insurance carriers value loyalty and reward clients who bring more of their business to them. By placing your home and auto insurance with the same company, you can unlock multi-policy discounts that are often substantial.

And it doesn’t have to stop there. Adding an umbrella policy, boat insurance, or other coverage can lead to even deeper savings across the board.

Think about a family in a high-cost state like Florida with separate policies for their home, two cars, and a liability umbrella. By consolidating them with one trusted carrier, they could easily see a discount of 15% or more. This doesn't just cut costs—it simplifies your life with one agent to call and one bill to manage. For a deeper dive, check out our guide on bundling home and auto insurance.

Real-World Impact: We recently helped a client in New York bundle their homeowners, auto, and a valuable items policy for their art collection. The multi-policy discount alone saved them over $800 annually—money that went directly back into their budget.

Don't Overlook Common Discounts

Beyond the big two, insurers offer a whole menu of discounts that many homeowners don't even realize they qualify for. These credits are meant to reward proactive, lower-risk clients. It's always worth asking your agent to do a full review to make sure you're not leaving money on the table.

Here are a few of the most common ones to ask about:

- Claims-Free Discount: If you haven't filed a claim in the last three to five years, you should absolutely be getting a discount for it.

- Loyalty Discount: Sticking with the same insurer for several years often comes with a financial thank you.

- New Roof Discount: A newer roof is far less likely to leak or suffer wind damage. Many carriers offer significant savings for roofs under 10 years old.

- Protective Devices Credit: Monitored security systems, smoke detectors, and fire alarms can earn you a discount of up to 20%.

To help you visualize these quick wins, here's a quick summary of the most effective strategies you can implement right away.

Immediate Savings Strategies At a Glance

| Strategy | Description | Estimated Savings Potential | Best For |

|---|---|---|---|

| Raise Deductible | Increasing the amount you pay out-of-pocket before insurance kicks in. | 5% – 25% | Homeowners with a healthy emergency fund. |

| Bundle Policies | Placing your home, auto, and other insurance with the same carrier. | 10% – 20% | Anyone with multiple insurance policies. |

| Protective Devices | Installing monitored security systems, fire alarms, or water shut-off devices. | 5% – 20% | Safety-conscious homeowners. |

| Claims-Free History | Maintaining a record of no claims for 3-5+ years. | 5% – 15% | Homeowners who haven't had recent losses. |

These straightforward adjustments can add up to hundreds of dollars in annual savings, freeing up your budget for other priorities. It all starts with a simple conversation and a fresh look at your current policies.

Making Your Home a Lower Risk for Insurers

Insurers live and breathe one thing: risk. The more likely they think you are to file a claim, the more you're going to pay. So, if you're looking for real, long-term savings, the secret isn't just about shopping around—it's about making your home a fundamentally safer bet.

When you show an insurance company that you're a proactive partner in protecting your property, they'll reward you for it. We're talking about tangible improvements that make your home more resilient to things like theft, water damage, and storms. These steps can unlock some serious discounts and lead to better rates for years to come.

Fortify Your Home Against Common Threats

Making your home a less appealing target for burglars is one of the most direct ways to lower your insurance premium. It’s simple, really. When you have protective devices, the odds of a theft claim plummet, and insurers often pass those savings on to you with discounts ranging from 5% to 20%.

Even small additions make a big difference. Start with the basics: solid deadbolt locks, motion-activated lights outside, and good window locks. Want to take it up a notch? A centrally monitored security system that automatically contacts the authorities is the gold standard.

To get inside the mind of a potential intruder and make your home less of a target, it helps to understand what burglars hate most.

Here are a few high-impact upgrades that carriers love to see:

- Monitored Security Systems: A system that connects to a central station for police dispatch is your best bet for theft prevention.

- Smart Home Protection: Devices like video doorbells and smart locks not only deter intruders but also create a helpful record of activity around your home.

- Fire Safety Equipment: Don't forget about fire. Centrally monitored smoke and carbon monoxide detectors are critical for safety and can also trim your premium.

Prevent Damage Before It Happens

From my experience, water damage is one of the most common—and most expensive—headaches for homeowners. Taking steps to prevent leaks and flooding before they start is a massive win for your wallet.

One of the best investments you can make is an automatic water shut-off valve. These smart gadgets detect a leak or unusual water flow and instantly cut the main water supply. It’s a simple device that can prevent a small drip from turning into a tens-of-thousands-of-dollars disaster, keeping your claims history clean in the process.

The same logic applies to severe weather. Fortifying your home, especially if you live in a storm-prone area like Florida or New York, can lead to major discounts.

Expert Tip: In windy coastal areas, installing impact-resistant windows or storm shutters can dramatically lower your premium. A hail-resistant roof is a bigger upfront cost, but it can easily pay for itself through insurance savings and avoiding a costly roof replacement down the line.

Stay Ahead with Proactive Maintenance

Think of regular home maintenance as your first line of defense. When an underwriter sees a well-maintained home, they see a lower risk. Why? Because you're preventing the very issues that lead to claims. Faulty plumbing, old wiring, and neglected HVAC systems are top culprits for fires and water damage.

Catching small problems early is everything. That tiny leak under the sink or a frayed wire in the attic might seem like no big deal, but they are often the sparks that ignite huge claims, driving your rates up for years.

The key is to be systematic. Create a simple schedule for inspecting your home's critical systems. If you need a good starting point, our detailed home maintenance checklist can help you cover all your bases.

By investing in your home's safety and resilience, you’re doing more than just protecting your property. You’re building a rock-solid case for your insurer to give you their best possible rates. It’s a smart strategy that delivers both peace of mind and very real financial benefits.

Tailoring Your Policy for Smarter Coverage

A standard, off-the-shelf homeowners policy is rarely a perfect fit. Think of it as a starting point, not the final destination. If you really want to find savings without creating dangerous gaps in your protection, you have to shape your policy to match your home, your belongings, and your unique financial picture.

This goes way beyond just picking a deductible. It’s about learning to think a bit like an underwriter—weighing cost against risk, understanding what your policy actually covers, and, just as crucially, what it doesn't. A well-crafted policy gives you the protection you need without making you pay for coverage you'll never use.

Right-Sizing Your Dwelling Coverage

Here’s one of the biggest and most costly mistakes I see homeowners make: confusing their home’s market value with its replacement cost. They are not the same thing.

Market value is what a buyer would pay for your house and the land it sits on right now. Replacement cost, on the other hand, is the cold, hard cash it would take to rebuild your home from scratch using similar materials at today’s prices.

Your dwelling coverage needs to be based on that replacement cost number. Insuring your home based on a hot real estate market is just throwing money away on your premium. On the flip side, underinsuring can leave you financially ruined if you ever face a total loss.

Key Takeaway: Getting your home's replacement cost right is the bedrock of a smart insurance plan. When you insure for market value, you're often paying extra to cover the land, which isn't at risk from things like fire or wind.

Nailing this figure is critical. It involves a detailed look at your home’s specific features, local construction labor and material costs, and other factors. To get a better handle on this, you can check out our detailed guide and use a homeowners insurance replacement cost estimator to find a more realistic number for your property.

Evaluating Your Liability Limits

Your homeowners policy protects more than just the building; it protects your entire financial future. The personal liability part of your policy steps in if someone gets hurt on your property or if you cause damage to someone else's.

In a world where lawsuits are common, the standard liability limits of $100,000 or $300,000 are often frighteningly low.

A single slip-and-fall accident on an icy sidewalk can easily rack up medical bills and legal fees that blow past those standard limits, putting your personal savings and assets on the line. For a surprisingly small increase in your premium, you can usually jump your liability coverage to $500,000 or even $1 million. For our high-net-worth clients, a separate umbrella policy isn't just a good idea—it's an absolute necessity, adding a crucial extra layer of protection over both home and auto policies.

Making Smart Choices with Endorsements

Endorsements (sometimes called riders) are specific add-ons that cover risks your base policy excludes. The key to building a cost-effective policy is knowing which ones to add and which ones you can safely skip.

Here are a few common endorsements worth a serious look:

- Water Backup Coverage: This is a must-have for almost everyone. It covers damage from a sewer backup or sump pump failure—a disaster that is almost never covered by a standard policy.

- Ordinance or Law Coverage: If your older home is damaged, local building codes might force you to make expensive upgrades to things like wiring or plumbing during the rebuild. This endorsement helps pay for those mandated—and often costly—updates.

- Identity Theft Protection: This can help cover the costs associated with the long and frustrating process of restoring your identity after it's been stolen.

Choosing the right endorsements is all about looking at your specific weak spots. If you have a finished basement, water backup coverage is a no-brainer. If your home was built decades ago, ordinance or law coverage could be a true financial lifesaver.

Properly Insuring Your Valuables

Do you own valuable jewelry, artwork, or collectibles? Don't assume your standard homeowners policy has you covered. It almost certainly doesn't—at least not for their full value.

Most policies have very specific, low limits (known as sub-limits) for the theft of valuable items, often capping out around $1,500 to $2,500.

To truly protect these items, you need to "schedule" them. This can be done through a valuable items endorsement or a separate policy altogether. It provides much broader "all-risk" coverage and often comes with no deductible. You'll need a recent appraisal, but the peace of mind you get is well worth the small effort and surprisingly low cost. Never assume your most prized possessions are covered; check the limits and schedule them properly.

Mastering Your Claims History and Insurance Score

Two of the most powerful—and often invisible—forces driving your home insurance premium are your claims history and your insurance score. Unlike your deductible, you can't just change these on a whim. They’re built over time and essentially act as your reputation with insurers, telling them whether you're a safe bet or a potential risk.

Learning to manage this reputation is key to unlocking long-term savings. It's about shifting your mindset from viewing insurance as a home maintenance plan to seeing it for what it is: a financial shield for major, unforeseen disasters.

Deciding When to File a Claim

After a minor incident at home, the big question is always, "Should I file a claim?" The answer is rarely as simple as comparing the repair cost to your deductible.

Here's a piece of advice I give clients all the time: filing frequent, small claims can hurt your rates far more than a single, large claim. Insurers see a pattern of small claims as a red flag—it might suggest a poorly maintained property or a homeowner who is simply "claim-prone."

This pattern can cost you a valuable claims-free discount, trigger a steep surcharge at renewal, or in some cases, even lead to the carrier dropping your policy altogether.

A good rule of thumb is to handle minor repairs yourself, especially if the cost is just a bit over your deductible. Say you have a $1,000 deductible and a broken window costs $1,200 to fix. Paying it out-of-pocket means you avoid a mark on your record for a mere $200 insurance payout.

Understanding Your CLUE Report

Every home or auto insurance claim you file gets logged in a massive database. The output is a document called a Comprehensive Loss Underwriting Exchange (CLUE) report. When you apply for insurance, carriers pull this report—which contains up to seven years of your claims history—to see what kind of risk you represent.

Think of it like a credit report, but for insurance. A clean CLUE report is a huge asset when shopping for a new policy because it signals to carriers that you're a responsible client. To get a better handle on how this works, our guide explains in detail what is a loss run report and its impact.

You're entitled to a free copy of your own report every year. It’s a smart move to review it for accuracy, as a mistake could be unfairly inflating your premiums.

The Impact of Your Insurance Score

Many people are surprised to learn that a version of their credit history directly influences their insurance costs. Carriers use a credit-based insurance score, which isn't the same as your FICO score but is derived from much of the same information in your credit file.

Why do they do this? Decades of data show a strong correlation between how people manage their finances and how likely they are to file insurance claims. A higher insurance score indicates financial stability and responsibility, which almost always translates into lower premiums.

Improving your insurance score involves the same good habits that build strong credit:

- Pay your bills on time. Late payments are a major drag on your score.

- Keep credit card balances low. High credit utilization suggests financial strain.

- Don't open too many new accounts at once. This can be seen as a red flag.

By strategically managing your claims and keeping your financial house in order, you build a positive insurance reputation. This positions you as the kind of client every carrier wants, opening the door to the best rates and coverage options on the market.

Using Local Expertise to Your Advantage

Where you live is one of the biggest, if not the biggest, factor driving your homeowners insurance premium. Everything from regional weather patterns and local crime rates to how far your house is from the nearest fire hydrant gets plugged into an insurer’s risk calculation. It’s exactly why a homeowner on the coast of Florida is playing a completely different game than someone in upstate New York.

That reality can feel like something you have no control over, but it actually opens up a huge opportunity to save money. When you understand the unique challenges and quirks of your local market, you can find coverage that isn't just cheaper—it’s smarter.

Navigating Regional Insurance Challenges

Insurance costs are going up everywhere, but the pain isn't being felt equally. The regional differences are staggering. Some states have been hit with massive premium hikes—Utah, for example, saw an increase of nearly 59% over three years. Meanwhile, homeowners in places like Florida and Louisiana are already dealing with some of the highest costs in the nation.

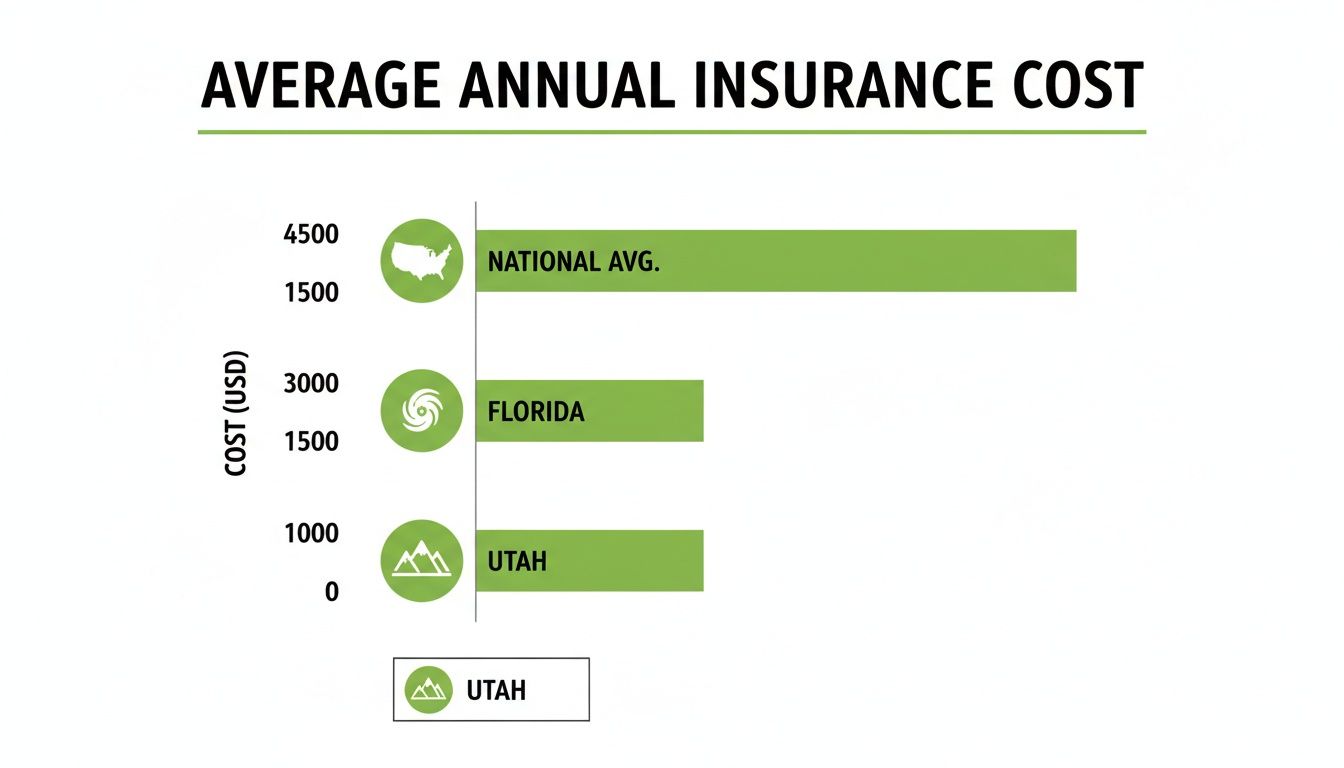

To get a clearer picture of just how much location matters, take a look at the average premiums across a few key states.

Comparing Average Premiums in Key States

This table showcases the significant differences in average annual homeowners insurance premiums across various states, highlighting high-cost and low-cost regions.

| State | Average Annual Premium | Primary Risk Factor |

|---|---|---|

| Florida | $10,996 | Hurricanes & Flooding |

| Louisiana | $7,644 | Hurricanes & Severe Storms |

| California | $2,987 | Wildfires & Earthquakes |

| New York | $2,385 | Winter Storms & Coastal Risk |

| Ohio | $1,430 | Tornadoes & Hail |

| Vermont | $933 | Winter Storms |

Source: 2024 Insurance Information Institute data.

As you can see, the state you call home can mean a difference of thousands of dollars a year. This is precisely where having local knowledge becomes your most powerful tool.

An expert who lives and breathes the risks in your area—whether it’s hurricanes in Miami, nor’easters on Long Island, or wildfire threats out west—knows exactly which insurance carriers are equipped to handle them. They know which companies are hungry for new business in your zip code and, just as importantly, which ones are pulling back.

Expert Insight: I see this all the time. People assume the big national brands they see on TV must have the best rates. But so often, it's a smaller, regional carrier that specializes in your state's unique risks that can offer more competitive pricing and, frankly, better claims service because they get the local landscape.

The Independent Agent Advantage

Think about it this way: when you call a captive agent who works for one of the big-name insurance companies, you get one quote from one carrier. That's it. They aren't going to tell you if their direct competitor down the street is offering the same coverage for 20% less. It’s a fundamental limitation that can easily cost you hundreds, if not thousands, of dollars.

An independent agent or broker, on the other hand, works for you. Their entire job is to shop the market on your behalf, putting dozens of carriers side-by-side to find the absolute best fit for your home and your budget.

This approach turns the market's complexity into your advantage. An independent agent can:

- Access Niche Carriers: They have long-standing relationships with regional and specialty insurers you'd probably never find on your own.

- Pinpoint Local Discounts: They're dialed into specific credits available in your area, like discounts for certain storm shutters in Florida or using specific roof materials in a hail-prone state.

- Navigate State-Specific Rules: They're experts in the local insurance laws and regulations, making sure your policy is totally compliant while squeezing out every possible saving.

Understanding who you're working with is a critical first step. For a deeper dive, you can learn all about the difference between an insurance agent and a broker in our guide.

At the end of the day, partnering with an expert who has deep roots in your local market is one of the single most effective ways to lower your homeowners insurance bill. They cut through the noise, sidestep the carriers that are overpriced for your area, and zero in on the companies that truly want your business. It’s all about using specialized knowledge to find that sweet spot where great coverage meets a great price.

Answering Your Top Questions About Home Insurance Savings

As you start digging into ways to lower your homeowners insurance costs, you're bound to have a few questions. It’s only natural. Let's tackle some of the most common ones we hear from clients every day.

This chart really puts the location factor into perspective, showing just how much rates can swing from one state to another.

You can see why a homeowner in a high-risk state like Florida needs to be especially proactive. The right strategies can make a massive difference when your starting point is already so high compared to the national average.

Will Making My Home Safer Really Lower My Premium?

Without a doubt. At its core, insurance is all about risk. When you take concrete steps to make your home less risky, carriers will reward you for it.

Things like a monitored security system, automatic water shut-off sensors, or a new hail-resistant roof directly reduce the chances of you needing to file a claim. Insurers love to see that, and they show their appreciation with discounts that can knock anywhere from 5% to 20% off your premium. Yes, there's an upfront cost to these upgrades, but the long-term savings and peace of mind are often well worth it.

How Often Should I Shop for New Homeowners Insurance?

Here’s a good rhythm to follow: sit down with your agent for a detailed policy review every year, and then take a serious look at what else is out there on the market every two to three years.

Life changes, and your insurance needs to keep up. Big events can open the door to new savings or signal that your current coverage is no longer the right fit.

- Just finished a major kitchen renovation?

- Finally got that new roof put on?

- Paid off the mortgage? (Congratulations!)

- Acquired a valuable art collection?

On top of that, the insurance market is always shifting. New companies move into your state, and existing ones constantly adjust their pricing. An independent agent can do the heavy lifting, comparing dozens of carriers to make sure you're always in the best position.

Expert Takeaway: Loyalty to a single insurance carrier can be an expensive habit. The company that gave you the best deal five years ago might be one of the priciest options for you today. Don't assume; always compare.

Does My Credit Score Actually Affect My Home Insurance Rates?

Yes, and in most states, it plays a surprisingly big role. Insurers don't look at your FICO score directly, but they use a very similar "credit-based insurance score" derived from your credit history.

Why? Years of industry data have shown a clear link between this score and how likely a person is to file a claim.

Good financial habits—paying your bills on time, keeping credit card balances low, and not opening new credit lines needlessly—can have a direct, positive impact on your insurance premiums. It’s one of the most overlooked yet powerful factors in how your rate is calculated.

Is It a Bad Idea to File a Small Homeowners Insurance Claim?

Honestly, in most cases, yes. It's almost always better to handle minor repairs out of your own pocket, especially if the bill is just a little more than your deductible.

Filing claims, particularly small ones, can backfire in a couple of ways. First, you could lose a hefty "claims-free" discount that you’ve had for years. Second, a history of frequent claims can flag you as a higher risk, leading to a steep rate hike at renewal. In a worst-case scenario, the carrier could even decide to non-renew your policy altogether.

Your insurance should be your safety net for a true financial catastrophe, not a home maintenance plan. Keeping your claims history clean is a crucial part of your long-term strategy to keep rates down.

Ready to turn these strategies into real savings? The team at Wexford Insurance Solutions is here to guide you. As an independent agency serving clients in New York and Florida, we do the shopping for you, finding a policy that truly fits your home, your life, and your budget. Get in touch with us at https://www.wexfordis.com.

Who Needs Professional Liability Insurance: A Must-Read Guide

Who Needs Professional Liability Insurance: A Must-Read Guide Protect Your Project with builders risk insurance florida Essentials

Protect Your Project with builders risk insurance florida Essentials