If you're building or renovating in Florida, you've probably heard the term "builders risk insurance." But what exactly is it? Think of it as a temporary, specialized property insurance policy designed to protect your financial stake in a structure while it's under construction. It's the safety net for your project before it's finished.

This coverage is absolutely crucial for anyone with money tied up in a Florida construction project.

What Is Builders Risk Insurance And Who Needs It

Picture this: you're halfway through building a beautiful new coastal home. You've invested hundreds of thousands of dollars into framing, wiring, and materials. Then, a severe thunderstorm rolls through overnight, or worse, a fire breaks out. All that progress, all that money, could be wiped out in an instant.

Without the right insurance, a disaster like that could be financially catastrophic, potentially derailing the entire project and bankrupting the owner or contractor.

This is the exact gap that builders risk insurance is designed to fill. Sometimes called "course of construction" insurance, it’s a specific type of property coverage that wraps a protective bubble around your job site. It safeguards the structure itself and the materials on-site—from the foundation pour to the light fixtures waiting in boxes to be installed.

It’s important to understand that this isn't the same as a standard homeowner's or commercial property policy. Those are for completed, occupied buildings. Builders risk is temporary, kicking in when the work starts and ending when the building is ready to be used, sold, or the policy term runs out.

Who Is Responsible For Buying The Policy?

This is one of the most common questions we get, and the answer isn't always straightforward. The responsibility for securing the policy usually comes down to what's written in the construction contract. At its core, whoever has a financial interest—what we call an "insurable interest"—in the project needs protection.

The key players are almost always one of these three:

- The Property Owner or Developer: They typically have the most significant financial investment in the project. If something happens to the building, their capital is on the line.

- The General Contractor: The GC is responsible for managing the construction and often for the materials stored on-site. A major loss could force them to repurchase everything and redo labor at their own cost.

- The Lender: Any bank or financial institution providing a construction loan will almost always demand a builders risk policy. It's non-negotiable. This protects their collateral (the building) until their loan is repaid.

A well-drafted construction contract will explicitly state which party is required to secure the builders risk policy. This removes ambiguity and ensures there are no dangerous gaps in coverage from day one of the project.

Common Scenarios For Policy Purchase

So, how does this play out in the real world? The goal is to make sure the party with the most to lose is properly insured, and that other stakeholders (like subcontractors or the bank) are listed as "additional insureds" on the policy. The first step is always understanding what does builders risk cover, which helps clarify who should be holding the policy.

Here’s a simple table breaking down who typically buys the builders risk policy in common Florida construction scenarios.

Who Typically Buys Builders Risk Insurance in Florida

| Scenario | Who Buys the Policy | Why It Matters to Them |

|---|---|---|

| New Custom Home Build | Property Owner | The owner has the ultimate financial investment and needs to protect the asset they are paying to have built from the ground up. |

| Commercial Development | Developer or General Contractor | This often depends on the contract. If the contractor buys it, the cost is usually built into their bid for the project. |

| Major Home Renovation | Homeowner or Contractor | For large-scale renovations, the homeowner's existing policy is usually insufficient, requiring a separate builders risk policy. |

| Spec Home Construction | Builder or Contractor | The builder owns the property during construction and carries all the financial risk until the home is sold to a buyer. |

As you can see, the "who" can change, but the "why" is always the same: protecting a significant financial investment from the unique risks that come with a construction site.

Getting to Know Your Florida Builders Risk Policy

A builders risk policy isn't just a document; it's the financial scaffolding that protects your project while it’s most vulnerable. But like any set of construction plans, you have to know how to read it. The policy lays out exactly what is covered—the "covered perils"—and, just as critically, what’s not.

Think of a standard builders risk policy as your project's first line of defense. It's designed to shield you from the common, sudden, and accidental mishaps that can pop up on any job site. This means you're generally covered if a fire unexpectedly breaks out and torches a fresh delivery of framing lumber, or if vandals strike overnight.

Theft is another constant worry. Imagine your crew is set to install $20,000 worth of copper piping and custom fixtures. If thieves make off with those materials from the secured site over the weekend, a good builders risk policy should step in to cover the replacement cost, turning a potential disaster into a manageable problem.

What's Typically Covered in a Base Policy

The core of any builders risk insurance in Florida is built to handle the everyday risks common to construction sites everywhere. These are the incidents that can happen whether you're building in Pensacola or Key West.

Here’s what you can generally expect to be covered:

- Fire: Protects against damage from accidental fires—a huge risk on sites filled with flammable materials and temporary electrical setups.

- Theft: Covers stolen building materials, fixtures, and sometimes equipment swiped directly from the job site.

- Vandalism: Protects against malicious damage, from smashed windows to spray-painted walls.

- Lightning and Explosions: These are standard "perils" included in almost all property insurance policies.

- Wind and Hail (from regular storms): This is a crucial point. Your base policy will likely cover damage from a run-of-the-mill severe thunderstorm, but it will pointedly exclude damage from a named hurricane.

The Most Important Part: What's Not Covered

Knowing what your policy covers is great, but understanding what it excludes is how you survive building in Florida. Exclusions are specific events the insurance company will not pay for under the base policy. Overlooking them is like building on the coast without accounting for storm surge.

In Florida, the standard exclusions aren't just fine print—they represent the single greatest threats to your project. A base policy is almost never enough by itself because it's built to leave out the very catastrophic weather events our state is known for.

The biggest exclusions you’ll find are almost always tied to severe wind and water.

Why Hurricanes and Floods Are Always Separate

Insurance works by pooling predictable risks. In Florida, hurricanes and floods aren't a question of "if" but "when" and "how bad." The sheer scale of damage from a single event—like Hurricane Ian, which racked up over $65 billion in insured losses—is far too massive for a standard policy to handle.

- Named Storms: Your policy will have a specific exclusion for wind or hail damage that happens during a storm that gets a name from the National Hurricane Center. This is, without a doubt, the most important exclusion to get your head around.

- Flood: Damage from rising water is always excluded. This applies to storm surge, overflowing rivers, or even flash floods from torrential rain. You'll need a separate flood insurance policy or a specific endorsement to cover this.

- Earthquake and Earth Movement: While not a top concern in Florida, this is another standard exclusion you’ll see on property policies.

- Faulty Workmanship or Design Errors: The policy is there to cover accidents from outside forces, not to pay for fixing mistakes made by the crew or the architect.

- Ordinance or Law: A base policy won't pay for the extra costs to rebuild a damaged structure to meet today's tougher building codes. This gap can lead to huge, unexpected out-of-pocket expenses after a loss. You can learn more about how to protect yourself by understanding ordinance or law coverage.

Navigating Florida’s High-Risk Environment

A standard builder's risk policy is a decent starting point, but in Florida, it's just not enough. Our unique climate and building codes mean a basic policy leaves massive, costly gaps in your coverage. Real protection comes from adding specific endorsements to shield your project from the risks that are most likely to happen here.

Think of it this way: your base policy is the foundation and frame of a house. That's great, but in Florida, you need hurricane shutters, impact-rated windows, and a storm-rated roof to be truly safe. Those are your endorsements—the specialized add-ons that are absolutely essential for weathering a Florida hurricane season. Without them, your investment is a sitting duck.

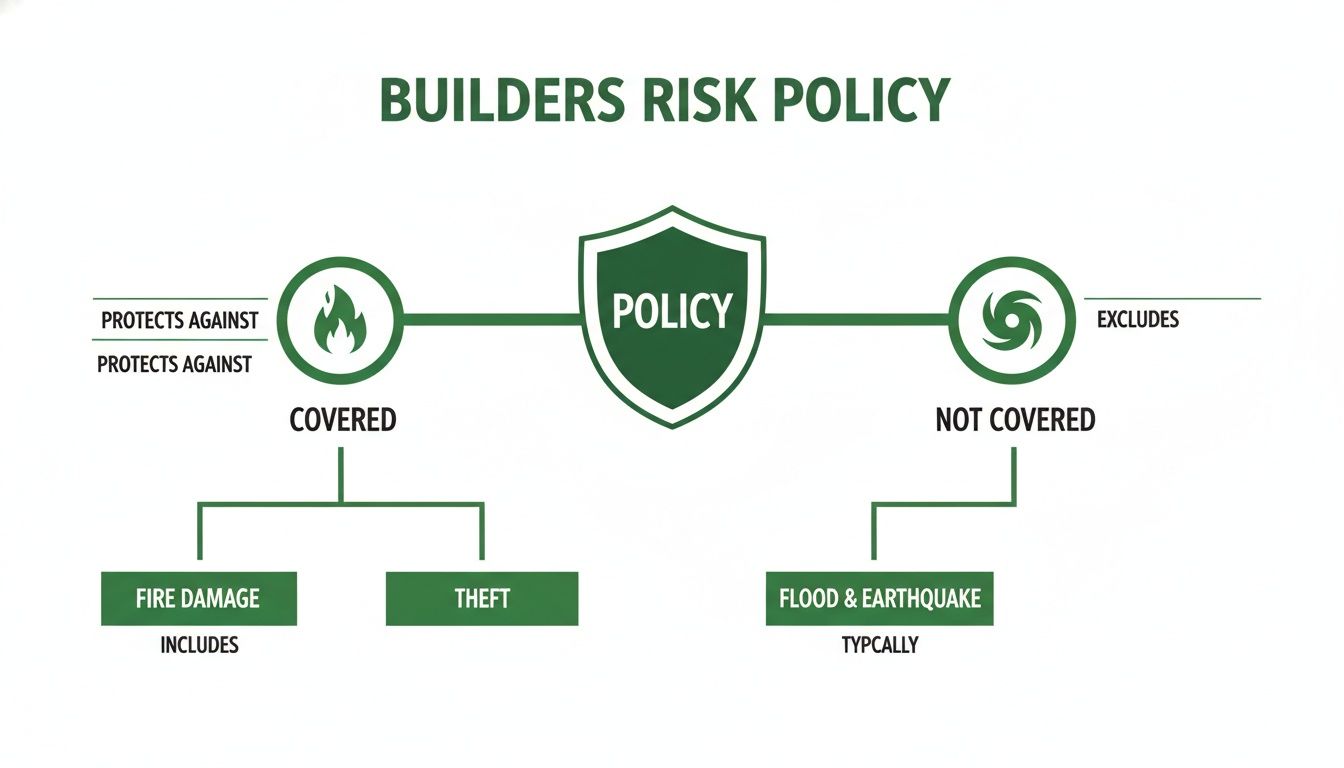

This infographic gives a great at-a-glance summary of what a typical policy covers versus what it leaves out.

Notice a pattern? The biggest and baddest risks here in Florida—hurricanes and floods—are almost always on the exclusion list, meaning you have to specifically add them back in.

Fortifying Against Wind and Water

In Florida, a bad storm isn't just an inconvenience; it's a primary business risk. For any construction project, there are two endorsements that are simply non-negotiable.

- Named Storm or Windstorm Endorsement: This is the big one. It's the most critical add-on for any builder's risk insurance Florida policy because it buys back coverage for wind and hail damage from a hurricane named by the National Hurricane Center. Without this, you have absolutely zero coverage when that storm makes landfall.

- Hurricane Deductibles: This coverage comes with its own special deductible, and it’s a big one. It's usually a percentage—typically 2%, 3%, or 5%—of the total project value, not a flat dollar amount. For a $1 million project with a 5% hurricane deductible, you’re on the hook for the first $50,000 of damage from a named storm before the insurance kicks in.

- Flood Insurance: Standard builder's risk policies explicitly exclude damage from rising water. That means storm surge, overflowing rivers, or even flash floods from torrential downpours are not covered. A separate flood policy or endorsement is the only way to protect against this.

For example, picture a beachfront condo that’s just weeks from completion. A hurricane hits. The storm surge swamps the ground floor, ruining drywall, electrical systems, and all the materials stored there. The wind endorsement will cover the roof damage, but only a flood policy will touch the catastrophic water damage below.

For a deeper dive into this crucial protection, check out our guide on private flood insurance.

Protecting Against Unseen Costs and Delays

The physical damage from a storm is obvious, but the financial fallout doesn't stop there. Smart owners and builders add endorsements to cover the other costs that can bleed a project dry after a loss.

The Ordinance and Law endorsement is a perfect example. Let’s say a fire heavily damages 50% of an older building you’re renovating. Local building codes might force you to demolish the undamaged half and rebuild the entire structure to current standards. Your base policy only pays to fix the fire damage. This endorsement, however, covers three critical extras:

- The value of the undamaged part of the building that has to be torn down.

- The cost of the demolition and debris removal for that undamaged section.

- The increased cost of construction to bring the entire building up to modern code.

Another lifesaver is an endorsement for Soft Costs. These are the non-physical expenses that start racking up when a covered event, like a storm, brings your project to a grinding halt.

Soft costs often include:

- Extra interest on your construction loans.

- Lost rental income or sales revenue from the delay.

- Ongoing real estate taxes.

- New architectural and engineering fees to redesign and restart.

These endorsements directly impact your premium, which in Florida’s complex market generally runs from 1% to 5% of the total project value. Due to the extreme catastrophe exposure, it's now common for Florida insurers to mandate 5% wind deductibles statewide—a significant line item developers must factor into their pro-forma.

How Project Costs Are Calculated in Florida

Figuring out the cost of builders risk insurance in Florida isn’t as simple as punching a few numbers into a calculator. Your premium is a direct reflection of your project's unique risks, all set against the backdrop of one of the country's most volatile insurance markets. Insurers essentially act like financial architects, meticulously reviewing every detail of your project's blueprint to forecast the potential for loss.

Think of it this way: insuring a wood-frame home on the coast during hurricane season is a completely different ballgame than insuring a concrete block warehouse inland during the dry season. Every single detail, from the materials you choose to the month you break ground, will nudge the final price up or down. Before you even get to insurance, it helps to understand all the moving parts of starting the home building process in Florida, from budgeting to site prep.

Core Factors Driving Your Premium

Before even considering Florida's unique challenges, insurers start with the basics. These core factors define the scope and risk profile of your construction and form the foundation of your premium calculation.

- Total Project Valuation: This is the big one. Your policy limit is tied to the final "completed value" of the structure, which includes all materials and labor costs. It’s simple math—a $5 million commercial build has a lot more value to protect than a $500,000 custom home, so the premium will naturally be much higher.

- Construction Type and Materials: What you build with matters. A lot. A classic wood-frame structure is simply more vulnerable to fire and high winds than a steel-frame or concrete block building. Because of this, projects using less resilient materials almost always come with higher insurance costs.

- Project Duration and Timeline: Time is money, but in insurance, it’s also risk. The longer your project runs, the longer it's exposed to potential threats like theft, vandalism, or a sudden storm. A quick six-month renovation will be cheaper to insure than a new build that’s scheduled to take 18 months.

Florida’s Unique and Costly Risk Landscape

Now, here's where things get complicated—and expensive. Florida's environment is a perfect storm of severe weather, soaring material costs, and nagging labor shortages, all of which send insurance premiums skyward. Insurers have to price their policies to account for the very real possibility of a catastrophic event and the eye-watering cost of rebuilding afterward.

Florida's construction industry faces unprecedented challenges with builder's risk insurance costs reflecting the state's escalating catastrophe exposure and material inflation. From 2017 to 2023, Florida suffered over $50 billion in insured losses from catastrophic events, with Hurricane Ian alone causing $65 billion in insured losses, making it the second-costliest hurricane in U.S. history. Discover more insights about how these factors are impacting the Florida property insurance crisis.

Several statewide issues directly pump up your builders risk insurance costs:

- Location, Location, Catastrophe: Your project's proximity to the coast is easily the single biggest multiplier for Florida premiums. A project in Miami-Dade or Tampa Bay will face dramatically higher rates than one in an inland county like Polk. The reason is simple: hurricane risk.

- Material Cost Inflation: Since January 2020, the cost of building materials has shot up by 35.7%. Because your policy needs to cover the full replacement cost, insurers must factor in these inflated values, which directly drives up your premium.

- Labor Shortages: A persistent shortage of skilled labor across Florida has pushed construction wages up 20-25% in many trades. This inflates the total project valuation, and a higher valuation means a higher insurance cost.

Sample Cost Ranges for Florida Projects

While no two projects are ever the same, looking at some sample numbers can give you a realistic idea of what to budget for insurance. Keep in mind these are just estimates that can swing wildly based on the factors we've covered, but they provide a solid baseline for planning. For a more precise estimate on a finished structure, our guide on using a commercial property insurance calculator might be helpful.

Here’s a snapshot of what you might expect for a 12-month policy in Florida:

| Project Type | Estimated Project Value | Estimated Annual Premium Range |

|---|---|---|

| Interior Commercial Remodel | $250,000 | $1,500 – $3,000 |

| Single-Family Home (Inland) | $750,000 | $5,000 – $9,000 |

| Single-Family Home (Coastal) | $1,500,000 | $15,000 – $30,000+ |

| New Commercial Building | $3,000,000 | $18,000 – $45,000+ |

These ranges clearly show the powerful impact of location and value. Getting a handle on these drivers is the first step toward accurately budgeting for your project and successfully navigating the complex world of builders risk insurance in Florida.

Let an Expert Guide You Through Florida Builders Risk Insurance

Trying to figure out builders risk insurance in Florida on your own can feel like trying to read a complicated set of blueprints during a hurricane. The policies are loaded with fine print, the exclusions can be massive, and with Florida's weather and soaring construction costs, the financial stakes are enormous. Go it alone, and you risk dangerous coverage gaps you won't find until a disaster strikes.

This is exactly why having an expert in your corner isn't a luxury—it's a necessity. Instead of you having to sort through a dozen quotes from different insurance companies, each with its own confusing language and hidden clauses, partnering with a specialist independent agency changes the game. It takes the weight off your shoulders and puts it onto a professional whose entire job is to protect your project.

The Independent Agency Advantage

An independent agency like Wexford Insurance Solutions isn't tied to one insurance company. Unlike a direct writer that can only offer its own products, we work for you. That’s a critical distinction, as it opens up the entire insurance marketplace to find the best fit for your project.

We take your project details and shop them to multiple A-rated carriers, making them compete for your business. By putting different policies and prices side-by-side, we can pinpoint the most comprehensive coverage at the best possible rate. It’s the surest way to avoid overpaying or leaving your investment dangerously exposed.

Choosing the right insurance partner is just as critical as choosing the right contractor. A good broker is your advocate and risk manager, making sure your financial interests are locked down from the first shovel of dirt to the final inspection.

This kind of advocacy is especially vital in Florida's tough insurance market. We know exactly what local carriers are looking for and how to present your project in a way that gets their attention for all the right reasons.

Turning Expertise into Real Value

You can't fake a deep understanding of the Florida market. It’s not just about finding any policy; it's about building the right one. Our team is skilled at cutting through the insurance jargon and explaining things in plain English, so you know precisely what you’re paying for. We'll walk you through the specifics of hurricane deductibles, show you why an Ordinance and Law endorsement is a must-have, and make sure your policy limits are high enough to cover today's inflated rebuilding costs.

We back up this hands-on expertise with technology that makes your life easier. Our 24/7 client portal gives you instant access to:

- Your policy documents, anytime and from anywhere.

- The ability to issue Certificates of Insurance (COIs) to subs or lenders on the spot.

- A simple way to manage payments and review your coverage.

This mix of personal service and smart tech gets rid of the administrative headaches, freeing you up to do what you do best—run your construction project. To further tighten up your project's financial and legal framework, good construction contract management is another key piece of the puzzle that helps minimize disputes and streamline your operations.

A Partner for Protection and Claims

At the end of the day, the real value of an insurance policy shows up when you actually need to use it. If a loss happens, we're right there with you, acting as your claims advocate. We’ll help you navigate the entire process, deal with the adjuster, and fight for a fair and fast settlement. That support is priceless when you're dealing with the stress of a project setback.

Getting the right builders risk coverage in Florida doesn't have to be a nightmare. With an expert guide, you can eliminate the guesswork and feel confident that your investment is properly protected, no matter what comes its way. If you want to dig deeper, our article on how to choose an insurance broker offers even more helpful advice.

Common Questions About Florida Builders Risk Insurance

Once you get past the basics, the real-world questions start popping up. Getting the details right with builders risk insurance in Florida is what separates a policy that just checks a box from one that actually protects you when disaster strikes.

Let's tackle some of the most common questions we hear from owners and contractors every day.

Does Builders Risk Cover Renovations And Additions?

You bet. A lot of people think builders risk is only for new, ground-up construction, but it’s absolutely essential for major renovations and additions. Your standard homeowner's policy just isn't built to handle the chaos of a construction site, from stacks of exposed lumber to the risks that come with tearing down walls.

For example, if you're adding a second story to your home, a builders risk policy is designed to cover that new structure and all the materials going into it. It specifically protects the value of the new work, which is a massive gap that your existing homeowner's policy almost certainly won't cover.

How Is The Policy Value Determined?

This is a big one. The value of a builders risk policy boils down to one simple idea: the completed project value. This isn’t just the cost of your materials; it's the total, all-in cost to finish the project. Think labor, materials, overhead, and even the contractor's profit—it’s the final number on your construction contract.

Your policy limit has to match the project's total finished value. Trying to save a few bucks on the premium by underinsuring is a recipe for disaster. If you have a total loss, the insurance company will only pay up to your policy limit, which could leave you short by hundreds of thousands of dollars.

If you’re building a new home with a contract price of $800,000, the builders risk policy needs a limit of $800,000. This makes sure you're covered for the full value, whether a fire happens in the first month or a hurricane hits the week before you get the keys.

What Happens If My Project Is Delayed?

Construction delays feel like part of the job these days, thanks to everything from supply chain headaches to bad weather. Your builders risk policy has a set term—usually 6, 9, or 12 months—so if your project runs long, you’ll need to extend your coverage.

Most insurers are happy to grant extensions, but you have to be proactive. Get in touch with your agent before the policy expires. They'll want a quick update on the project's progress and will adjust the premium for the extra time. Letting your policy lapse mid-build is the worst-case scenario; any loss that happens after it expires is coming straight out of your pocket.

Do I Still Need General Liability Insurance?

Yes. One hundred percent. This is probably the most critical distinction to get right. Builders risk and general liability cover completely different things, and you absolutely need both.

- Builders Risk Insurance: This is first-party property coverage. It protects your financial stake in the building and materials from being damaged (like if a fire burns down the framing).

- General Liability Insurance: This is third-party liability coverage. It protects you when your work causes injury or property damage to someone else (like if a visitor trips over your tools and sues).

Picture this: a crane drops a bundle of trusses on your new neighbor’s car. Builders risk won't pay a dime for that car. Only your general liability policy will step in to cover that kind of third-party property damage. On any Florida job site, having both policies is non-negotiable for true protection.

Figuring out the ins and outs of builders risk insurance shouldn’t be another source of stress on your project. At Wexford Insurance Solutions, our job is to make it simple and ensure your investment is buttoned up from every angle. Our team knows Florida construction and will find the right coverage for your specific project, giving you peace of mind from groundbreaking to completion.

Ready to secure your project? Visit us at https://www.wexfordis.com to get started.

How to Save on Homeowners Insurance A Practical Guide

How to Save on Homeowners Insurance A Practical Guide A Practical Guide to Insurance for Small Business Owners

A Practical Guide to Insurance for Small Business Owners