For any small business owner, insurance is more than just another line item on the expense sheet or a box to check. It's the essential safety net that stands between your hard-earned dream and an unexpected disaster. It’s what gives you the confidence to take smart risks, knowing one mishap won't bring it all down.

Why Your Business Needs an Insurance Safety Net

Running a business feels a lot like being a trapeze artist. All your energy is focused on performance, growth, and reaching new heights. But without the right insurance, you’re performing without a net. A single slip—a lawsuit from a disgruntled client, a fire at your office, or an employee getting hurt on the job—could mean a catastrophic fall. This is precisely where insurance for small business owners comes in.

It’s not just an expense; it’s a strategic investment in your company’s survival. Having the right coverage in place means you can operate with genuine peace of mind, knowing you have a partner ready to catch you if things go wrong. That frees you up to focus on what truly matters: serving your customers, innovating, and building your business.

Shifting from Cost to Strategy

Too many entrepreneurs see insurance as just another bill to pay. But that’s a limited view. In reality, a well-structured insurance plan is a cornerstone of a smart business strategy, shielding you from liabilities that could wipe you out overnight.

And that’s no exaggeration. Imagine a customer slips and falls in your shop. The resulting medical bills and legal fees could easily eclipse your company's entire cash reserve. Without a general liability policy, you'd be on the hook for every penny, putting your business and even your personal assets on the line.

Insurance transforms a potentially catastrophic risk into a predictable, manageable business expense. It’s a powerful tool for transferring the financial fallout of a disaster to an insurer, so you can keep your capital working for you.

More and more business owners are catching on. The global market for small business insurance was valued at $17,501 million in 2021 and is on track to hit $28,673.1 million by 2033. This growth highlights a major shift: entrepreneurs now see robust protection as a non-negotiable part of doing business. You can dive deeper into these small business insurance statistics and their implications.

At the end of the day, getting the right policies isn't just about being compliant. It's about giving your business the resilience to weather any storm and continue to thrive.

Understanding the Core Insurance Policies Your Business Needs

Diving into business insurance can feel like trying to navigate a foreign city without a map. All the different policy names and technical terms can be overwhelming, but it doesn't have to be. The best approach is to start with the basics—the core coverages that act as your business's primary financial defense.

Think of these policies as the foundation of a sturdy house. Each one is designed to protect you from a specific, common risk, whether it's a customer getting hurt, your equipment being stolen, or an employee getting injured on the job. To get a good overview, it's worth understanding what insurance cover a company should consider to build a complete safety net.

Let's break down these essential policies one by one.

To help you see how these pieces fit together, here's a quick cheat sheet.

Key Insurance Policies for Small Businesses

| Policy Type | What It Protects You From | A Real-World Scenario |

|---|---|---|

| General Liability | Third-party claims of bodily injury, property damage, and advertising injury. | A customer slips on a wet spot in your shop, breaks their wrist, and sues you for their medical bills. |

| Commercial Property | Damage or loss of your physical business assets, including your building, equipment, and inventory. | A kitchen fire destroys your restaurant's cooking equipment and spoils all of your food inventory. |

| Workers' Compensation | Medical costs and lost wages for employees injured or made ill while on the job. | An employee in your warehouse strains their back while lifting a heavy box and needs physical therapy. |

| Professional Liability | Claims of negligence, errors, or omissions in the professional services you provide. | An accountant makes a clerical error on a client's tax filing, leading to costly IRS penalties for the client. |

| Cyber Liability | Financial losses and recovery costs resulting from a data breach or cyberattack. | A hacker breaches your e-commerce site, steals customer credit card data, and you have to pay for credit monitoring. |

Each of these policies plays a critical role. Now let's dig a little deeper into what makes each one so important for a small business owner.

1. General Liability Insurance: Your Everyday Shield

If you only buy one insurance policy, this is almost always the one. General Liability Insurance is the bedrock of business protection, your front-line defense against the common, everyday accidents that can happen when your business interacts with the public.

It's designed to cover claims that your business caused bodily injury to someone (who isn't an employee), damaged their property, or caused an "advertising injury" like libel or slander.

Imagine a client trips over a power cord in your office and gets hurt. General Liability is what steps in to handle the legal fees and any settlement that might result.

2. Commercial Property Insurance: Protecting Your Physical Assets

While General Liability covers accidents involving other people, Commercial Property Insurance is all about protecting your physical stuff. This means your building (if you own it), your computers, inventory, tools, and office furniture.

This policy safeguards your tangible assets against threats like fire, storms, theft, and vandalism. If a burst pipe floods your backroom and ruins $20,000 worth of inventory, this is the policy that helps you get back on your feet without having to pay for it all out of pocket.

The Smart Bundle: A Business Owner's Policy (BOP)

For many small businesses, a Business Owner's Policy (BOP) is a fantastic, cost-effective option. It conveniently combines General Liability and Commercial Property insurance into a single package, often at a lower price than buying them separately. To see if it makes sense for you, you can explore what a business owner's policy covers in more detail.

3. Workers’ Compensation Insurance: A Must-Have for Your Team

This one is simple: if you have employees, you almost certainly need Workers' Compensation Insurance. In most states, it's legally required. More importantly, it provides a crucial safety net for your most valuable asset—your people.

Workers' comp covers medical bills and a portion of lost wages for employees who get injured or become ill as a direct result of their job. In exchange, it typically prevents that employee from suing your business over the injury. It’s a win-win that protects both your team and your company's finances.

4. Professional Liability Insurance: Guarding Your Expertise

Also known as Errors & Omissions (E&O) insurance, this policy is essential for any business that provides services or professional advice. Think accountants, consultants, architects, and designers.

Professional Liability protects you from claims of negligence, mistakes, or failing to deliver the promised services. If a marketing consultant's campaign fails to deliver and the client sues, alleging the strategy was flawed and cost them money, E&O insurance would cover the legal defense.

5. Cyber Liability Insurance: Defending Your Digital Presence

In today's world, this coverage is no longer just for tech companies. If you store any sensitive customer data—names, addresses, credit card numbers—you are a target for cybercriminals.

Cyber Liability Insurance helps your business survive a data breach or cyberattack. It can cover a huge range of costs, from notifying customers and providing credit monitoring to public relations and recovering compromised data. It’s the financial lifeline you need when your digital world gets turned upside down.

The High Cost of Being Underinsured

Lots of small business owners think that having "some" insurance is the same as having the "right" insurance. It's not. This is a tough lesson many learn only after it's too late.

Being underinsured—stuck with a policy that has low limits or glaring coverage gaps you never knew about—is like trying to put out a house fire with a water bucket. You might feel prepared, but when things really go wrong, you're not even close to having what you need.

It’s an easy trap to fall into. When you're watching every penny, the policy with the lowest premium looks like a smart move. Or maybe you just got busy and forgot to update your coverage as your business grew. That small policy that was perfect for your solo operation is now a massive liability now that you have five employees and a warehouse full of inventory.

When Small Gaps Create Massive Problems

The fallout from being underinsured can be catastrophic. It can turn a simple accident into something that shuts your doors for good. It's a risk that quietly grows in the background until the worst-case scenario happens.

Think about these all-too-common situations:

- A Devastating Fire: A fire rips through your restaurant kitchen, causing $250,000 in damage. But your commercial property policy—the one you haven't looked at in years—only covers up to $150,000. You're now on the hook for the remaining $100,000, a debt that could easily sink the business.

- A Costly Lawsuit: A customer slips in your shop and sustains a serious injury. They sue, and the court awards them $750,000. Your general liability policy has a limit of $500,000 per incident. That leaves you to somehow come up with the $250,000 difference.

These aren't just hypotheticals. They are the painful reality for business owners who thought their coverage was "good enough." The few dollars you save on premiums vanish in an instant when a claim blows past your policy limits, leaving you to clean up the financial mess alone.

A Widespread and Dangerous Issue

Unfortunately, this isn't a rare problem. A recent study found that a shocking 77% of small businesses in the U.S. are underinsured. That leaves the backbone of our economy dangerously exposed to claims that could easily put them out of business. Learn more about these findings on underinsurance.

This gap often comes from not knowing what proper insurance for small business owners really costs or what it should cover. The result, however, is brutal: one single event can lead to financial ruin.

The true cost of insurance isn't your monthly premium. It's whether your policy can make your business whole again after a disaster. Being underinsured means you're just paying for a false sense of security.

The bottom line is simple. A cheap policy with weak limits isn't a bargain—it's a massive gamble with your livelihood. The goal isn't just to have an insurance certificate to hang on the wall. It’s to have a rock-solid financial shield that protects the business you've poured your life into. That's why regularly reviewing your policies isn't just a good idea; it's a non-negotiable part of being a responsible business owner.

How to Assess Your Unique Business Risks

Figuring out the right insurance for your small business isn't like grabbing a product off the shelf. It’s more like getting a custom-tailored suit—and the first step is taking your measurements. You have to size up your business for its unique risks.

Without a clear picture of where you’re vulnerable, you're essentially buying a policy with a blindfold on, just hoping it covers what matters.

This process is about stepping back and looking at your company through the eyes of a risk manager. Think about where a potential loss could come from. A customer slipping and falling? A professional error that costs a client money? A fire or flood? Thinking this way helps you become an active partner in your own protection, not just a passive buyer.

A solid risk assessment is the bedrock of a smart insurance strategy. It’s what stops you from overpaying for coverage you don’t need or, even worse, leaving a catastrophic gap in your protection that you never saw coming.

Start with Your People and Your Place

The most common risks usually come from your interactions with people and your physical environment. This is the perfect place to start.

Walk through every touchpoint where your business comes into contact with customers, vendors, and the public. If you run a retail shop, what’s the plan if a customer slips on a freshly mopped floor? For a contractor, what happens if your work accidentally damages a neighbor's property? These are liability risks, and they are one of the most frequent sources of claims out there.

Next, turn your attention to your "stuff." Make a detailed list of every physical asset your business needs to operate.

- Your Building: If you own the space, its replacement value is a huge factor.

- Essential Equipment: This is everything from your laptops and point-of-sale systems to specialized machinery, vehicles, and tools.

- Inventory: Tally up the total value of the products you have on hand. For many businesses, this is a massive financial asset sitting on the shelves.

Once you have that inventory, you can put a real number on what a total loss would mean for your business. That gives you a tangible figure to work with when you start talking about property coverage.

Evaluate Your Operational and Industry-Specific Risks

Beyond the basics of property and liability, every industry faces its own unique set of curveballs. This is where your assessment needs to get specific to what you do every day. Getting a handle on these finer points is a core part of what risk management in business entails.

For instance, a marketing consultant’s biggest nightmare might be a client suing over a failed campaign—making Professional Liability a must-have. On the other hand, an e-commerce store holding customer credit card numbers is staring down a huge cyber threat, which puts Cyber Liability Insurance right at the top of the list.

Don't just think about what could go wrong—think about what would shut your business down completely. Business Interruption coverage, for example, is designed for exactly that. It replaces lost income if a fire or disaster forces you to close your doors for a while, covering rent, payroll, and other ongoing expenses so you can get back on your feet.

Demystifying Limits and Deductibles

Finally, assessing your risk means getting comfortable with two key insurance terms: limits and deductibles. Think of them as the financial dials you can turn on your policy.

- Policy Limit: This is the absolute maximum amount your insurer will pay out for a covered claim. If your limit is $500,000 but a lawsuit ends with a $700,000 judgment against you, you’re on the hook for that $200,000 difference. Your risk assessment should help you choose a limit that’s high enough to handle a realistic worst-case scenario.

- Deductible: This is simply the amount you pay out of pocket before your insurance coverage starts paying. A higher deductible usually gets you a lower premium, but don't get tempted unless you’re positive you can comfortably write that check after a major incident.

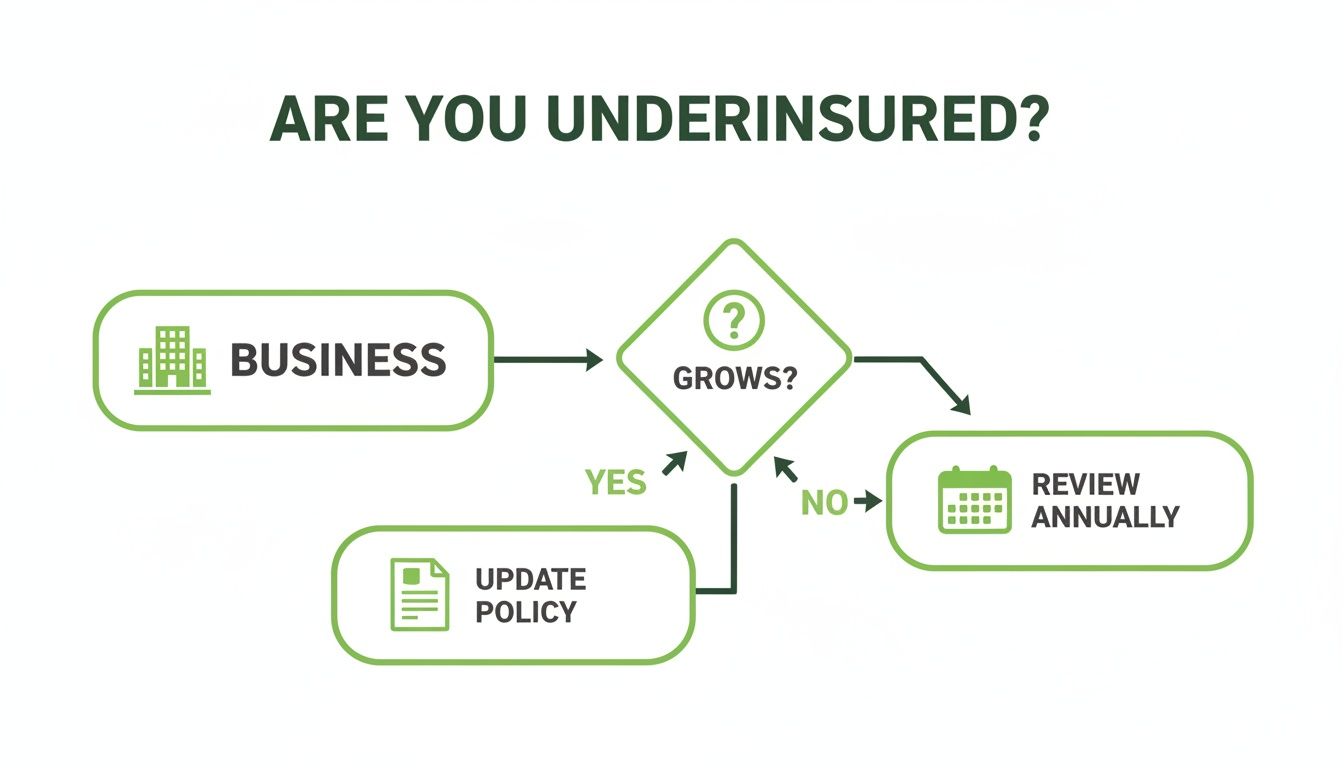

Striking the right balance is everything. A cheap premium looks great until you realize it comes with a deductible you can't afford or a limit that leaves you dangerously exposed. As the chart below shows, your insurance needs will change as your business grows, so this isn't a one-time decision.

The takeaway here is simple: insurance is not a "set it and forget it" purchase. To be effective, it has to grow and adapt right alongside your business.

Proven Strategies to Lower Your Insurance Costs

Getting the right insurance for your small business is non-negotiable, but it shouldn't break the bank. With a bit of foresight and some smart planning, you can bring those premium costs down without sacrificing the protection you need to operate with confidence. It all comes down to showing insurers that you're a good, low-risk partner.

One of the easiest wins is to bundle your policies. You probably do this with your personal home and auto insurance, and the same logic applies here. A Business Owner's Policy (BOP) is a great example—it packages general liability and commercial property coverage together. This move almost always costs less than buying the two policies separately and simplifies your paperwork at the same time.

Another fantastic strategy is to get serious about risk management. Insurers love to see a business that actively works to prevent problems before they start. A few simple, practical changes can have a real impact on what you pay.

Strengthen Your Defenses and Your Bottom Line

Think of it this way: the safer you make your business, the less of a gamble you are for an insurance company. By implementing real-world safety measures, you're proving you’re a lower-risk client, which can directly translate into lower premiums.

Here are a few high-impact actions to get you started:

- Boost Physical Security: Get a monitored alarm system, install security cameras, and use high-quality locks. Anything you can do to prevent theft or vandalism is a clear signal to insurers that you’re protecting your property.

- Prioritize Workplace Safety: Don't just talk about safety—document it. Create a formal safety program, run regular training sessions, and keep your equipment in top shape. These steps are key to reducing workers' compensation claims.

- Develop a Crisis Plan: What happens if a fire or flood hits? Having solid disaster recovery plan examples for SMEs shows you're prepared to minimize damage and get back on your feet quickly, which can help with rates for things like business interruption coverage.

These actions are all part of a larger concept called loss control. It’s all about preventing incidents from ever happening in the first place. For a deeper dive, check out our guide on what loss control in insurance is and learn how it can systematically slash your risks.

Fine-Tune Your Policy for Maximum Value

Beyond physical safety, the way you structure your policy has a huge effect on your costs. It's a balancing act between how much you pay monthly and how much you'd have to pay out-of-pocket if something goes wrong.

Take a look at your deductible—the amount you pay on a claim before your insurance coverage starts. Raising it is one of the quickest ways to lower your premium. If your business has a healthy cash flow and can handle a larger one-time expense, this can be a very smart financial move.

Key Insight: A higher deductible is a calculated risk. It saves you money on premiums, but you must be 100% certain you can comfortably cover that amount if you need to file a claim. Never choose a deductible you couldn't afford to pay tomorrow.

Finally, don't forget the fundamentals. A good business credit score can often lead to better insurance rates, as carriers see it as a sign of reliability and good management. Paying your premiums on time also helps build a positive history. When you combine proactive risk management with smart policy choices, you take control of your insurance costs without ever cutting corners on coverage.

Getting Your Business Insured: A Simple Checklist

Diving into the insurance world can feel like a chore, but getting your business covered doesn't have to be a headache. With the right info and a solid game plan, you can lock in the protection your business needs to grow confidently.

This checklist breaks it all down into a few straightforward steps. Think of it as your road map—follow it, and you’ll know you haven’t missed a thing.

Step 1: Gather Your Business vitals

Before you can even get a ballpark quote, an insurance provider needs a clear picture of your company. Having all your information ready from the start makes the whole process faster and way more productive.

Think of it like getting your documents ready for a loan—the more organized you are, the smoother things will go. Get these details together:

- The Basics: Your official business name, address, and Employer Identification Number (EIN).

- What You Do: A simple description of your business operations, whether you sell products or offer services.

- Your Team: How many full-time and part-time employees you have and your total estimated annual payroll.

- The Numbers: Your projected or actual annual revenue.

- Your Assets: A list of any significant equipment, inventory, or property the business owns.

- Past Claims: Any details on previous insurance claims your business has filed.

Step 2: Talk to an Insurance Pro

Once your paperwork is in order, it’s time to bring in an expert. A good independent agent is worth their weight in gold. They can pinpoint your unique risks, explain your options without the jargon, and check with different carriers to find you the best coverage for your budget.

This is where all that risk assessment you did earlier really comes into play. It helps you have a smarter, more focused conversation about what you truly need. Be ready to talk about your day-to-day work, what keeps you up at night, and where you see your business heading.

This isn't just about buying a policy. It's about finding a partner who gets your business and can guide you. That relationship becomes critical when it's time to review your coverage or, more importantly, file a claim.

Step 3: Review the Proposal and Lock It In

After your meeting, you’ll get an official insurance proposal. This is the document that lays it all out: what’s covered, your policy limits, deductibles, and the final cost. Read it carefully.

Don't be shy about asking questions. You need to be 100% clear on what is covered and—just as crucial—what isn't.

Once you’re comfortable with the plan, you'll sign the paperwork and pay the first premium to put the coverage in force. Your agent will then give you proof of insurance, which is usually a certificate of insurance or an insurance binder. If you're wondering about that temporary proof, this guide explains what an insurance binder is and why it's important. With those documents in hand, you're officially covered.

Frequently Asked Questions About Small Business Insurance

Stepping into the world of business insurance can feel like learning a new language. You've got questions, and you need clear, no-nonsense answers to make the right call for your company. Let's break down some of the most common things we hear from business owners.

What Is the First Policy a New Business Should Get?

If you're just starting out, your first move should almost always be getting General Liability Insurance. It's the bedrock of business protection. This policy covers you for the everyday mishaps—think a customer slipping in your shop or you accidentally damaging a client's property. It’s the fundamental safety net every business needs.

Even better, look into a Business Owner's Policy (BOP). This is a smart package deal that bundles general liability with commercial property insurance. Buying them together in a BOP is usually much cheaper than getting them separately, giving you great foundational coverage without breaking the bank.

Do I Need Business Insurance If I Work from Home?

Yes, you absolutely do. This is a huge blind spot for many home-based business owners. Your personal homeowner's or renter's policy is not designed to cover your business and will almost certainly deny a business-related claim.

A common mistake is assuming your homeowner's policy will cover you if a client trips in your home office or if a fire destroys your work inventory. It won't. You need a dedicated business insurance policy to protect your professional assets and shield you from liability.

How Much Does Small Business Insurance Cost?

This is the million-dollar question, but the answer is: it depends. There’s no flat rate because every business is different. Your final price tag is a direct reflection of your company's specific risks.

A few key factors will shape your premium:

- Your Industry: A roofer is exposed to far more risk than a graphic designer, so their insurance will cost more. It’s just a fact of life.

- Number of Employees: More people on your team means a higher likelihood of needing things like workers' compensation.

- Location and Revenue: Where you operate and how much you earn are big factors in how insurers calculate your rates.

- Coverage Needs: The types of policies you choose and the coverage limits you set will obviously drive the final cost.

The only way to know for sure what you'll pay is to get a quote based on your specific situation. Every state also has its own set of rules, so it’s critical to understand the small business insurance requirements that apply where you do business.

Ready to get the right protection for your business without all the confusion? The expert team at Wexford Insurance Solutions is here to help you sort through your options and build a policy that actually fits your budget and your needs. We make it simple. Start your free quote with Wexford today.

Protect Your Project with builders risk insurance florida Essentials

Protect Your Project with builders risk insurance florida Essentials A Plain-English Guide to Property & Casualty Insurance

A Plain-English Guide to Property & Casualty Insurance