Trying to make sense of a homeowners insurance policy can feel like you’ve been handed a manual written in another language. It's full of letters, jargon, and terms that don't mean much to most people.

But here’s the simple truth: your policy is a package of six core coverages, usually labeled A through F. Think of it as a comprehensive toolkit designed to protect your house, your stuff, and your savings from life’s unexpected curveballs.

Your Homeowners Policy Finally Made Simple

A homeowners policy isn't one giant, monolithic thing. It’s actually a bundle of different protections that work together to create a financial safety net for you and your family. Each piece of that net is designed to catch a different kind of problem, whether it's a kitchen fire or a guest who takes a tumble down your front steps.

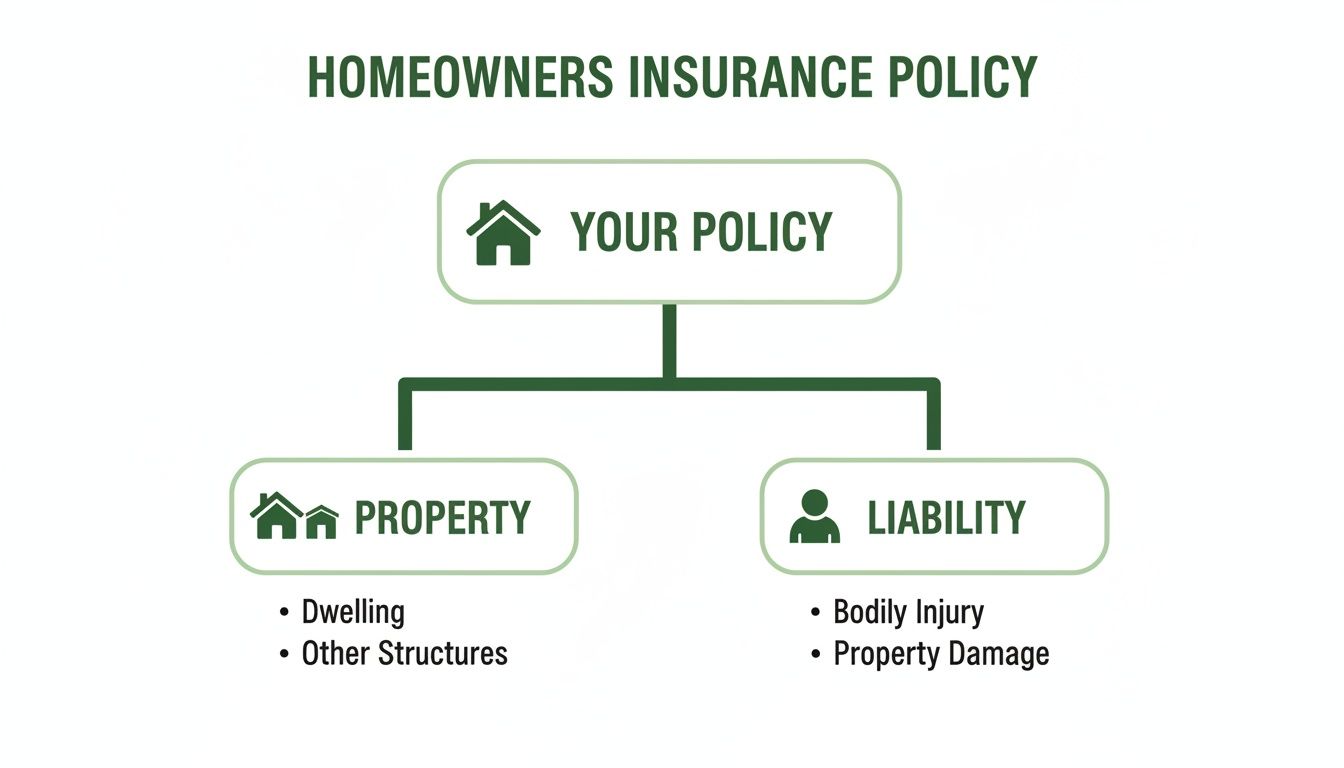

We're going to break down what those homeowners insurance coverages explained in your policy actually mean in the real world. At its core, every standard policy is built on two main pillars of protection:

- Property Coverage: This is all about your physical stuff—the house itself, that new shed in the backyard, and everything you own inside, from your sofa to your socks.

- Liability Coverage: This side of the policy protects your bank account if you’re found legally responsible for accidentally injuring someone or damaging their property.

Getting a solid grip on these two areas is the key to understanding homeowners insurance coverage and feeling confident that your biggest asset is properly protected.

Breaking Down the Two Pillars of Protection

Every single coverage in your policy, from A to F, fits neatly under one of those two pillars. This diagram gives you a great visual of how it all comes together.

As you can see, property and liability are the two main branches, and all the specific coverages grow from there. Once you grasp this basic split, decoding the rest of your policy becomes so much easier. Those letters (Coverage A, B, C, etc.) might seem random, but they're just organizers for the specific protections within these two groups.

To get started, we've put together a simple table that acts as a cheat sheet for the standard coverages you'll find in most policies.

Quick Guide to Standard Home Insurance Coverages

| Coverage Letter | What It Covers | Simple Analogy |

|---|---|---|

| A – Dwelling | The physical structure of your house. | The "shell" of your home. |

| B – Other Structures | Standalone structures like sheds or fences. | The "accessories" in your yard. |

| C – Personal Property | Your belongings, like furniture and clothes. | Everything you'd pack in a moving truck. |

| D – Loss of Use | Living expenses if your home is uninhabitable. | A "temporary housing" fund. |

| E – Personal Liability | Legal costs if you injure someone. | A "financial bodyguard" for accidents. |

| F – Medical Payments | Minor medical bills for guests hurt on-site. | A "goodwill" fund for small injuries. |

This table gives you the 30,000-foot view. Now, we'll dive into what each of these means for you.

Think of your policy’s declarations page as the CliffsNotes for your coverage. It’s a one-page summary showing your specific coverage limits and deductibles for each section, giving you a quick snapshot of your protection.

Throughout this guide, we'll unpack these coverages one by one with real-world scenarios to show you why they matter. Getting comfortable with this structure is the first step. For a deeper dive, check out our guide on how to read an insurance policy. By the time you're done, you'll know exactly what you're paying for and feel confident that your coverage is right for your life.

Protecting Your Home’s Structure

At the core of every homeowners policy is the coverage that protects the house itself. This is Dwelling Coverage, often referred to as Coverage A. It’s the bedrock of your policy, there to pay for rebuilding your home if it's wiped out by a fire, leveled by a tornado, or otherwise destroyed by a covered disaster.

Think of it as the financial safety net for putting all the pieces back together. If a kitchen fire guts a huge portion of your home, this is the part of your policy that pays for the new lumber, drywall, wiring, and labor to restore it. It covers everything physically attached to the house—from the foundation right up to the roof, including things like your built-in cabinets and plumbing. For a deeper dive, check out our guide on what is dwelling coverage.

Dwelling Coverage Is Not Your Home’s Market Value

Here’s one of the biggest—and potentially most expensive—misunderstandings in home insurance: confusing your home’s market value with its replacement cost. Market value is what a buyer would pay for your house and the land it sits on, which is swayed by things like the school district and curb appeal. Replacement cost is something else entirely; it’s the cold, hard price of materials and labor to rebuild your home exactly as it was.

Key Insight: With supply chain issues and skilled labor shortages, the cost to rebuild can easily be higher than what you could sell your home for. Insuring for market value could leave you dangerously underinsured after a total loss.

Let's say you bought your home for $450,000. A year later, a severe hailstorm and tornado tear through, and it's a total loss. But in that time, construction costs have skyrocketed. Rebuilding it to the same standard now costs $525,000. If your dwelling coverage was only set at the purchase price, you’d be on the hook for that $75,000 difference yourself.

This is precisely why getting the dwelling coverage amount right is so critical. The insurance world is grappling with higher rebuilding costs, leading to significant premium increases for homeowners. In fact, between May 2022 and May 2023, renewal premiums shot up by an average of 21% across the country. It’s a clear signal that you need an expert to review your policy limits to make sure they reflect today's real-world costs—a data-driven approach we take at Wexford to prevent our clients from facing these kinds of financial gaps. You can discover more insights about recent insurance pricing trends on Policygenius.

What About Structures Not Attached to Your House?

Your property is more than just the four walls of your home. You might have a detached garage, a shed, or a fence. That’s where Coverage B (Other Structures) comes in. It protects the standalone structures on your property that aren't physically connected to the main house.

Coverage B typically protects things like:

- A detached garage or workshop

- A shed in the backyard

- Fencing around your property

- A gazebo or an in-ground pool

As a rule of thumb, the coverage limit for Other Structures is automatically set at 10% of your main Dwelling (Coverage A) limit. So, if your home is insured for $500,000, you’d have up to $50,000 in coverage for these other structures.

So, if a heavy windstorm sends a tree crashing down on your detached garage, Coverage B is what pays to rebuild it (after your deductible, of course). The same goes if a fire starts in your workshop. If you have a particularly valuable structure, like a large guesthouse or a custom barn, you'll likely want to talk to your agent about increasing this standard limit to make sure you're fully covered.

Insuring Everything Inside Your Home

While your home's structure is the main event, it's the stuff inside that truly makes it your home. That’s where Coverage C (Personal Property) comes into play. Just think of it as a safety net for everything you’d load onto a moving truck: your furniture, clothes, electronics, artwork—you name it.

Even as the insurance world has evolved, the foundational coverages of a standard policy—dwelling, personal property, liability, and additional living expenses—have remained surprisingly consistent. Typically, your personal property coverage is automatically set as a percentage of your dwelling coverage, usually between 50–70%. This industry standard allows experienced agencies like ours to establish a solid baseline and then fine-tune it for clients who need more robust protection. You can find more details on how these coverages work on the NAIC's homeowner's insurance page.

So, if your house (Coverage A) is insured for $500,000, your policy would likely give you between $250,000 and $350,000 for your belongings. It might sound like a lot, but you'd be shocked at how quickly the value of everything you own adds up.

Replacement Cost vs. Actual Cash Value

This is one of the most critical details in your entire policy, and understanding it can save you thousands of dollars when you file a claim. You’ll see two main options for how your belongings are valued: Replacement Cost Value (RCV) and Actual Cash Value (ACV).

- Actual Cash Value (ACV): This pays you for what your item was worth the moment before it was destroyed, accounting for its age and general wear and tear. Think of it as the "garage sale" price.

- Replacement Cost Value (RCV): This pays you what it costs to buy a brand-new, similar item at today's prices. No deductions for depreciation.

Here's how it plays out: Let’s say a kitchen fire ruins the five-year-old sofa you originally bought for $2,000. With ACV, the insurance company might say it was only worth $500 after five years of use. With RCV, you'd get the full $2,000 needed to go out and buy a comparable new sofa.

Paying a little extra for RCV coverage is almost always the right move. It’s the difference between being able to truly replace what you lost and having to cover a huge financial gap yourself.

The Hidden Limits on Your Valuables

Here's a hard lesson many homeowners learn far too late: standard policies have specific, low-dollar limits for certain high-value items. Even with a $300,000 personal property limit, the policy will only pay out a tiny fraction of that for things like jewelry or firearms.

Common items with these "sub-limits" include:

- Jewelry, Watches, and Furs: Often capped around $1,500 for theft.

- Firearms: A typical limit is $2,500.

- Silverware and Goldware: May be capped at $2,500.

- Cash: Often limited to just $200.

If your $10,000 engagement ring is stolen, your standard policy might only pay $1,500, leaving you to absorb an $8,500 loss. The solution is to specifically insure these items with an endorsement called a scheduled personal property floater. This insures an item for its full appraised value and often provides broader protection. We break this down further in our guide to personal property coverage.

Your Best Friend in a Claim: The Home Inventory

The single most powerful tool you have for a personal property claim is a home inventory. It’s your proof of what you owned, and it becomes absolutely essential when you're trying to recall every last item in a high-stress situation.

Making one is simple with your smartphone:

- Walk and Talk: Go through every room (don't forget closets and the garage!) and take a video. Open drawers and narrate what’s inside.

- Snap Photos of Valuables: Take clear, individual pictures of electronics, jewelry, artwork, and collectibles. Get a shot of any serial numbers.

- Digitize Your Proof: Take pictures of receipts for big-ticket items.

- Store It in the Cloud: Upload everything to a secure cloud service like Dropbox or Google Drive. That way, it’s safe and accessible even if your phone and computer are destroyed.

Coverage That Protects Your Finances and Lifestyle

You might be surprised to learn that the most powerful parts of your homeowners policy often have little to do with rebuilding walls or replacing furniture. The real heavy hitters are the coverages that protect your financial stability and way of life when things go sideways.

These are the unsung heroes of your policy, the parts that guard your savings, shield you from devastating lawsuits, and keep your life on track during a crisis.

Let's start with the one that becomes an absolute lifeline when you can't live in your own home.

Your Financial Lifeline When You’re Displaced

Picture this: a kitchen fire makes your home completely uninhabitable for the next few months while repairs are underway. Where do you go? How on earth would you pay for a hotel or a rental on top of your mortgage?

This is precisely where Coverage D (Loss of Use), sometimes called Additional Living Expenses (ALE), steps in to save the day.

Think of it as a dedicated expense account to help you maintain your normal standard of living. When a covered disaster forces you out, this coverage reimburses you for the necessary increase in your living costs.

That typically includes things like:

- Hotel bills or the cost of a comparable rental home.

- Restaurant meals, since you can't use your own kitchen.

- The cost of using a laundromat.

- Even extra gas money if your temporary home means a longer commute.

Loss of Use is designed to prevent a catastrophe from spiraling into a full-blown financial disaster. To really dig into how this vital protection works, check out our detailed guide on Loss of Use insurance coverage.

Guarding Your Assets Against Lawsuits

Accidents happen. But if one happens on your property, you could be held financially responsible for injuries or damages, and that's a scary thought.

This is where Coverage E (Personal Liability) acts as your financial bodyguard. It's designed to protect you and your assets from lawsuits if someone is hurt or their property is damaged and you're found legally at fault. This coverage is incredibly broad and follows you almost anywhere, paying for both your legal defense and any court-ordered awards, right up to your policy limit.

Real-World Scenario: Imagine a delivery driver slips on an icy patch on your front steps and breaks their leg. They turn around and sue you for medical bills and lost wages totaling $85,000. Your personal liability coverage would handle the legal fees and the final settlement, keeping your personal savings untouched.

Standard policies often start with $100,000 to $300,000 in liability protection, but for most homeowners today, that’s simply not enough. With the high cost of legal battles, we almost always recommend a minimum of $500,000.

For those in high-risk areas, understanding all the angles of financial protection is critical. That includes knowing how much hurricane insurance costs and essential tips for custom homes, as major weather events can create some very unique liability situations.

A Goodwill Fund for Minor Accidents

Finally, let's talk about Coverage F (Medical Payments to Others). This is a smaller, but incredibly useful, part of your policy that pays for minor medical bills if a guest gets hurt on your property—regardless of who was at fault.

Think of it as a "goodwill" fund. If a friend trips over a rug and needs a few stitches, this coverage can pay for their trip to urgent care, usually up to a limit between $1,000 and $5,000.

The key difference here is that fault doesn't matter. It’s a simple, no-blame way to do the right thing and keep a small accident from turning into a big, expensive liability claim. It’s all about managing minor incidents quickly and keeping relationships intact.

Choosing the Right Policy and Custom Upgrades

Now that you've got a handle on the individual coverages, let's zoom out and look at the big picture. Just like cars, homeowners insurance policies aren't all built the same. They come in different "models"—or forms—and each one offers a very different level of protection.

The two most common policy forms you'll run into are the HO-3 and the HO-5. Getting the difference between them is the key to choosing a policy that actually fits your life, instead of just grabbing a generic, one-size-fits-all solution off the shelf.

This choice matters. A lot. The HO-3 is by far the most common, making up more than 90% of all homeowners policies in the country. But that doesn't automatically make it the best choice for everyone. The HO-5, often called a "comprehensive" policy, provides much broader protection and is typically the go-to for higher-value homes. For homeowners with significant assets, deciding between an HO-3 with a few add-ons versus a true HO-5 can have a bigger impact on a claim outcome than the dwelling limit itself.

Named Perils vs. Open Perils: The Core Difference

The real distinction between an HO-3 and an HO-5 policy boils down to two concepts: named perils and open perils. This isn't just industry jargon; it’s the fundamental operating system for your insurance.

-

Named Perils: Think of this as an "if it's on the list, it's covered" approach. Your policy will specifically list every disaster (or "peril") it protects you from, like fire, theft, or a windstorm. If the cause of your damage isn't on that list, you're out of luck.

-

Open Perils: This is the complete opposite. It works on an "everything is covered unless we specifically exclude it" basis. This approach protects you from all types of direct physical loss, except for the handful of events listed as exclusions in the policy, like floods or earthquakes.

This single distinction creates a massive gap in the quality of protection you receive.

Comparing HO-3 and HO-5 Policy Forms

So, how do these concepts play out in the real world? An HO-3 policy is a hybrid. It gives you the superior open perils coverage for your home's structure (Dwelling and Other Structures) but only provides the more restrictive named perils coverage for your personal belongings.

The HO-5 policy, on the other hand, extends that powerful open perils protection to everything—your house and all your stuff inside it. This simple table breaks down the fundamental difference.

| Feature | HO-3 (Special Form) | HO-5 (Comprehensive Form) |

|---|---|---|

| Dwelling Coverage (Your House) | Open Perils | Open Perils |

| Personal Property (Your Stuff) | Named Perils | Open Perils |

| Typical Homeowner | The standard for most homes | Ideal for higher-value homes or those wanting maximum protection |

The practical difference here is huge, especially when it's time to file a claim.

The Bottom Line: With an HO-3 policy, the burden of proof is on you to show that your personal property was damaged by one of the specific perils listed in your policy. With an HO-5, that burden flips. The insurance company has to prove the damage was caused by a specific exclusion.

This is a critical shift that can make or break your claim experience. Our guide on how to choose homeowners insurance dives even deeper into weighing these important options.

Adding Custom Upgrades with Endorsements

No matter which policy form you start with, think of it as a base model. You can (and should) customize and strengthen it by adding endorsements, which are essentially upgrades that plug common and often overlooked coverage gaps.

It's like buying a car. The standard package is fine, but you might want to add heated seats or an upgraded sound system. Insurance endorsements work the same way, allowing you to tailor the policy to your specific home, risks, and lifestyle.

Here are a few of the most crucial endorsements almost every homeowner should consider:

-

Water Backup and Sump Pump Overflow: A standard policy will not cover damage from a backed-up sewer line or a failed sump pump. This is a common and costly disaster, but the endorsement to add this protection is surprisingly inexpensive.

-

Scheduled Personal Property: As we touched on earlier, this is the only way to insure high-value items like jewelry, fine art, or collectibles for their full, appraised value, without a deductible.

-

Ordinance or Law: If your older home is damaged, today's building codes might require expensive upgrades that your base policy won't pay for. This endorsement provides the funds to get your home up to the current code during a rebuild.

Talking through these kinds of upgrades with an experienced agent is how you go from having just an insurance policy to having the right one.

Putting It All Together: From Policy to Protection

Understanding what each part of your policy does is the crucial first step. Now, let’s turn that knowledge into a real-world financial safety net built just for you.

Relying on a generic, off-the-shelf policy is like rolling the dice with your biggest asset. A truly personalized strategy, on the other hand, is an investment in your family's security and your own peace of mind.

This guide has peeled back the layers of homeowners insurance to show you it's not just a static document—it’s a dynamic tool. The real goal is to forge a shield that fits the contours of your life, whether you're just starting out as a first-time homeowner or managing a portfolio of complex assets.

Why Partnering with an Expert Matters

This is where having a seasoned guide makes all the difference. An independent agency like Wexford Insurance Solutions doesn't just sell you a policy; we help you build a comprehensive protection strategy. We take the time to understand your specific risks and then find the right mix of coverages and endorsements from a wide range of carriers.

The best insurance strategy isn't about finding the cheapest price tag. It's about securing the most effective protection, ensuring you can completely rebuild after a disaster without wrecking your financial future.

Our entire process is designed to make sure your coverage isn’t just "good enough," but perfectly suited to your needs. We help you strike that critical balance between ironclad protection and a premium that makes sense for your budget, so you’re never left with a dangerous gap you didn’t see coming.

Ready to build an insurance plan that works as hard as you do? Reach out to Wexford Insurance Solutions for a complimentary policy review. Let’s build your confidence and your protection, together.

Got Questions? Let's Talk Home Insurance FAQs

Even with a full breakdown of your policy, it's natural to have a few more questions rattling around. Let's tackle some of the most common ones we hear from homeowners. Think of this as clearing up the final details so you know exactly how your policy works when you actually need it.

What's the Difference Between a Deductible and a Limit?

This is a big one, and it's all about who pays what during a claim.

A limit is the ceiling on your coverage—it’s the absolute maximum amount your insurance company will pay out for a claim. If your home (your dwelling coverage) is insured for $400,000, that’s the most you'll get from the insurer to rebuild it. Simple as that.

Your deductible, on the other hand, is the part you pay first. It's the amount you have to cover out-of-pocket before your insurance kicks in. Say a storm causes $15,000 in damage and your deductible is $1,000. You pay the first $1,000, and your insurer handles the remaining $14,000.

The Bottom Line: A higher deductible usually means a lower premium, which can be tempting. Just remember that you're agreeing to take on more of the initial cost if you ever have to file a claim.

Does My Homeowners Policy Cover Floods or Earthquakes?

In a word: no. This is probably the single most important exclusion for homeowners to understand. A standard home insurance policy does not cover damage from flooding or earthquakes.

These events are considered so catastrophic and localized that they require their own separate insurance policies.

- For Flood Damage: You’ll need a dedicated flood insurance policy, which is often provided through the National Flood Insurance Program (NFIP) or private insurers.

- For Earthquake Damage: This requires a separate earthquake policy or an endorsement you can add to your existing home insurance.

If you live in an area prone to either of these, going without the right coverage is a massive financial gamble. You'd be on your own to cover the repairs.

What If I Run a Business From Home? Am I Covered?

This is a classic blind spot, especially with more people working from home than ever before. Your standard homeowners policy is designed for your personal life, not your professional one, and it offers almost no coverage for business activities.

Think about it this way: your policy covers a friend slipping on your steps, but it likely won't cover a client who trips on the way to your home office. Your expensive work computer and any business inventory? That's probably not covered by your personal property coverage either.

To be properly protected, you'll need a specific business endorsement added to your home policy or, for more robust protection, a separate Business Owner's Policy (BOP). This is the only way to make sure your business assets and liability are truly covered.

Feeling confident about your coverage is priceless. The experts at Wexford Insurance Solutions can review your current policy and build a custom protection strategy that leaves no room for doubt. Schedule your complimentary consultation today by visiting https://www.wexfordis.com.

Auto Insurance Deductible: How auto insurance deductible Impacts Your Premium

Auto Insurance Deductible: How auto insurance deductible Impacts Your Premium How to determine replacement cost of home: Quick Guide to Accurate Coverage

How to determine replacement cost of home: Quick Guide to Accurate Coverage