Think of excess liability insurance as your ultimate financial backstop. It’s not a policy you buy on its own; instead, it's a powerful layer of extra protection that kicks in only after your primary insurance limits have been completely used up. It’s designed to shield your assets from those rare but devastating lawsuits and judgments that can easily run into the millions.

Building Your Financial Defense

A smart insurance strategy is like building a multi-layered fortress to protect your financial well-being. Each layer has a distinct purpose, and they all work together to fend off liability claims that could otherwise wipe you out. Understanding this layered approach is the key to seeing where excess liability insurance fits in.

The foundation of this fortress is your primary insurance. These are the policies that handle the more common, everyday risks you face.

- Commercial General Liability: This is your business’s frontline defense against claims of injury or property damage. If you're new to this, we have a helpful guide explaining what is commercial general liability.

- Commercial Auto Insurance: This covers the vehicles essential to your business operations.

- Homeowners Insurance: On the personal side, this provides liability protection for accidents that happen on your property.

These policies are absolutely essential, but they have their limits. A single, severe accident can blow past those limits in a heartbeat, leaving your business or personal assets dangerously exposed.

The Layers of Protection

This is where the higher levels of your fortress come into play. They aren't for the small stuff. Their job is to step in for the major, potentially catastrophic events—the kind of incidents that could threaten everything you've built.

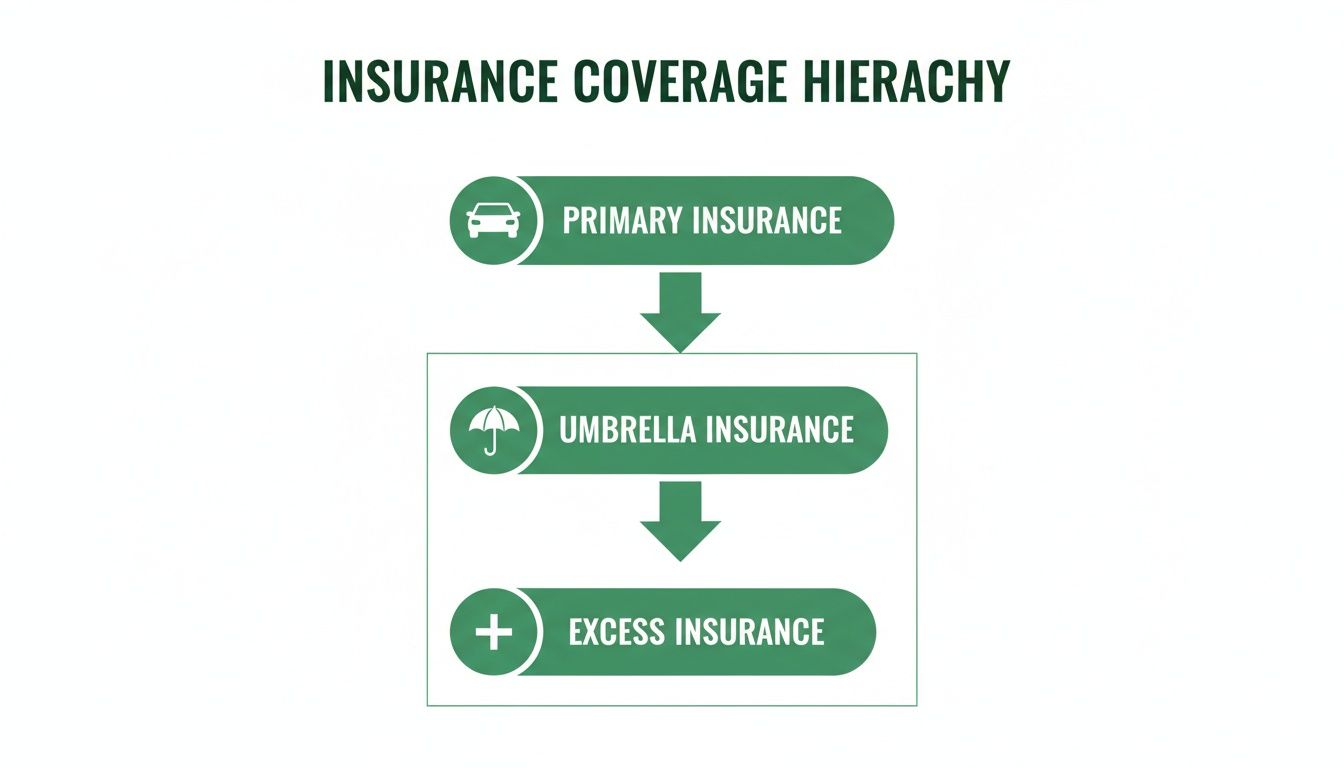

This diagram shows how these insurance layers stack up, creating a comprehensive shield.

As you can see, each policy sits on top of the one below it, systematically increasing your total liability protection. It’s this vertical structure that forms the backbone of a solid asset protection plan.

Activating the Excess Layer

An excess liability policy is the top-most layer of this structure. It's specifically engineered to sit above your primary policies and, in many cases, an umbrella policy as well. Its one and only job is to add more coverage dollars to what you already have.

An excess liability policy is what we call "follow form" coverage. This means it mirrors the exact terms, conditions, and exclusions of the policy directly beneath it. It doesn't broaden your coverage to new areas; it just deepens the financial well you can draw from.

Here’s a real-world scenario. Let's say a lawsuit results in a $5 million judgment against your company. Your primary general liability policy has a $1 million limit, which it pays out. Your umbrella policy adds another $2 million. That still leaves a $2 million gap. Without another layer, that shortfall comes directly out of your pocket.

This is exactly the moment an excess liability policy proves its worth, covering that remaining $2 million and preventing a financially devastating outcome.

Excess Liability vs. Umbrella Insurance

In the insurance world, it’s easy to get "excess liability" and "umbrella" coverage confused. People often use the terms interchangeably, but they are not the same thing. While both policies give you another layer of protection when your primary insurance runs out, they work in very different ways.

Getting this right is crucial for properly protecting your assets.

Think of it this way: excess liability insurance is like adding more floors to an existing building—it just makes it taller. An umbrella policy can add more floors and build a new wing, expanding the building's footprint.

An excess liability policy is a simple, straightforward extension of one specific underlying policy. It adds a higher dollar limit but follows the exact same rules, conditions, and exclusions as the policy it sits on top of. This is why we call it “follow form” coverage; it perfectly mirrors the primary policy.

The Critical Difference: Follow Form vs. Broad Form

This is where umbrella insurance really sets itself apart. An umbrella policy is usually a “broad form” policy. Yes, it also boosts the limits over your primary policies (like auto, home, or general liability), but it can do something an excess policy can't.

A true umbrella can step in and cover certain risks that your primary policies don't cover at all. For instance, your standard business liability policy might not cover claims for personal injury like libel or slander. An umbrella policy could potentially cover that lawsuit, filling a critical gap in your protection.

An excess liability policy raises the ceiling on your existing coverage. An umbrella policy raises the ceiling and can patch holes in your primary insurance foundation.

This isn't just a technicality—it has massive real-world consequences when a claim hits. Picking the wrong type of policy could leave you facing a massive bill for something you thought was covered.

A Practical Comparison

To put this into perspective, here's a simple breakdown of how these two policies stack up against each other.

Excess Liability vs. Umbrella Insurance at a Glance

| Feature | Excess Liability Insurance | Umbrella Insurance |

|---|---|---|

| Primary Function | Increases the dollar limit of a single existing policy. | Increases dollar limits and can broaden the scope of coverage. |

| Coverage Structure | Follow Form (mirrors the underlying policy exactly). | Broad Form (can cover risks excluded by underlying policies). |

| Typical Use Case | When you only need higher limits for a specific, well-defined risk. | When you need higher limits plus protection against a wider array of potential liabilities. |

| Claim Example | If your primary policy covers a specific type of water damage, an excess policy pays for the same type once the primary limit is used up. | If your primary policy excludes libel, an umbrella policy may provide coverage for a libel lawsuit from the first dollar (after a small deductible). |

The table really gets to the heart of it. An excess policy is a specialist, designed to beef up one specific line of defense. An umbrella policy is more of a generalist, reinforcing your entire defensive line and sometimes even adding new fortifications.

If you'd like to dive even deeper, our complete guide on excess liability vs umbrella insurance breaks it down further.

When One Responds and the Other Does Not

Let's look at a real-world business scenario that makes this crystal clear.

Imagine a contractor has a primary general liability policy with a $1 million limit. However, the policy has a specific exclusion for any liability related to work performed on condominiums. The contractor also bought a $5 million policy for extra protection.

Here’s how a claim plays out:

- If it's an excess liability policy: A lawsuit from a condo project results in a $3 million judgment. The primary policy denies the claim because of the condo exclusion. Since the excess policy is "follow form," it also follows that exclusion and denies the claim. The contractor is now on the hook for the full $3 million.

- If it's an umbrella policy: The primary policy still denies the claim. But the umbrella policy doesn't have that same exclusion. It can step in and respond to the claim, providing coverage where none existed before. The contractor would only be responsible for a small deductible (known as a Self-Insured Retention, or SIR).

This example perfectly illustrates the power of an umbrella policy's broader protection. The right choice for you will always come down to your unique risks and the quality of your foundational insurance program.

Who Really Needs Excess Liability Coverage?

While anyone can get hit with a lawsuit, some people and businesses are just bigger targets. Their daily lives or operations simply carry a higher risk of a catastrophic claim.

Excess liability insurance isn't for everyone. But if you have substantial assets to protect or run a high-risk business, it's not a luxury—it's a critical piece of your financial armor. The first step is figuring out if you fall into that category.

Think of it this way: this coverage is for when a standard liability limit just won't cut it. It’s the financial reinforcement you need to protect your wealth or keep your business afloat after a multi-million-dollar judgment.

Protecting High-Net-Worth Individuals

For families with significant wealth, a standard homeowners or auto policy is like bringing a squirt gun to a wildfire. A single, serious car wreck or a bad accident on your property can easily blow past a typical $500,000 liability limit. When that happens, your entire net worth is on the line.

Let's be blunt: wealthy individuals are often seen as a payday in a lawsuit. An excess liability policy acts as a powerful shield, standing between a judgment and your hard-earned assets, including:

- Real Estate Holdings: It keeps your primary home, vacation properties, and rental units from being seized to pay off a claim.

- Investment Portfolios: It protects the stocks, bonds, and other accounts you've built over a lifetime from being drained.

- Future Earnings: It shields your income from being garnished for years—or even decades—to come.

- Prized Possessions: It ensures that your art, car collections, and other valuable assets stay yours.

The numbers here are pretty stark. Research shows that while a staggering 90% of affluent individuals worry about being sued, only 28% actually have an excess liability or umbrella policy. That's a massive protection gap, leaving the vast majority with millions in assets dangerously exposed. For high-net-worth families, this coverage should be a key part of any strategic legacy planning to preserve wealth for the next generation.

Essential Coverage for High-Risk Businesses

For certain industries, serious risk is just part of the job. Standard general liability policies are often nowhere near enough to cover the potential fallout. For these companies, an excess liability policy is a non-negotiable part of staying in business.

An excess liability policy can be the one thing that separates a business that survives a major claim from one that goes under. It’s the backstop that lets you operate with confidence, even in a high-stakes environment.

A few commercial sectors absolutely depend on this level of coverage:

- Contractors and Construction: Job sites are a minefield of potential disasters. A single crane collapse or structural failure can injure multiple people and cause millions in property damage, far exceeding a primary policy.

- Commercial Vehicle Fleets: Any company with a fleet of trucks, vans, or service vehicles is carrying enormous liability on the road every single day. One bad accident caused by an employee driver can result in catastrophic injuries and astronomical legal verdicts.

- Aircraft Owners and Operators: In aviation, the potential for a major disaster means multi-million-dollar liability limits are the bare minimum. Excess liability is essential for private owners, charter companies, and flight schools.

These are just a handful of examples. Any business whose operations could cause severe harm needs to take a hard look at its liability limits. To see how this fits into a complete risk strategy, take a look at our guide to asset protection insurance.

Professionals in High-Stakes Fields

It’s not just about physical risks. Professionals whose advice and decisions carry immense weight also face huge liability exposure. A single mistake can have devastating financial consequences for their clients, sparking lawsuits that demand massive damages.

Surgeons, prominent attorneys, architects, and financial advisors all work in fields where one error can ruin lives or fortunes. While they all carry professional liability insurance (often called Errors & Omissions), an excess policy provides that crucial second layer of defense. It ensures their personal assets—the wealth they've spent a lifetime building—are shielded if a professional judgment blows past their primary coverage.

How an Excess Liability Policy Responds to a Real-World Claim

It’s one thing to talk about insurance policies in theory, but where the rubber really meets the road is in a real-life claim. To truly understand how these coverage layers work together, let's walk through a scenario that shows exactly how each policy kicks in to protect a business from a devastating financial blow.

Let’s imagine a mid-sized logistics company called "Rapid Freight." They run a fleet of commercial trucks, and one day, the unthinkable happens. A driver runs a red light, causing a catastrophic multi-vehicle accident that results in severe injuries and massive property damage.

After a long and difficult legal process, a court finds Rapid Freight liable and issues a judgment for a staggering $8 million.

First Up: The Primary Policy

The first line of defense is always the company's primary insurance. In this case, it's their commercial auto liability policy, which has a $1 million limit per occurrence. This policy is built to handle the everyday bumps and bruises of the business.

As soon as the claim comes in, the primary insurer steps up. They handle the legal defense and, once the $8 million judgment is finalized, they pay out their full $1 million policy limit. The foundation of the coverage tower has done its job, but there's a long way to go.

After that payment, Rapid Freight is still on the hook for $7 million. Without more insurance, they'd be looking at liquidating assets, draining cash reserves, and likely facing bankruptcy.

Next in Line: The Umbrella Policy

This is exactly where the next layer of protection, the umbrella policy, comes into play. Fortunately, Rapid Freight had a $5 million commercial umbrella policy that provides an extra layer of liability coverage over both their auto and general liability policies.

Once the primary insurer confirms its $1 million limit is exhausted, the umbrella insurer is triggered. They contribute their full $5 million limit toward the judgment. This is a huge help, but a gap still remains.

The primary and umbrella policies have now paid a combined $6 million, but the total judgment was $8 million. That leaves a very dangerous $2 million shortfall.

The Final Layer: Excess Liability Saves the Day

That remaining $2 million is precisely the kind of catastrophic risk that an excess liability insurance policy is designed to cover. Rapid Freight’s risk manager had strategically purchased a $10 million "follow form" excess liability policy that sits directly on top of their commercial auto coverage.

Because it’s a "follow form" policy, its job is simple. It waits for the underlying limits—in this case, the $1 million primary and $5 million umbrella—to be completely paid out. The moment that $6 million is exhausted, the excess liability policy is activated.

An excess liability policy is the ultimate financial backstop. It stays on the sidelines for smaller claims but provides the high-limit protection needed to absorb a "nuclear verdict" and prevent a company from going under.

The excess liability insurer steps in and pays the final $2 million. Thanks to this last critical layer, the entire $8 million judgment is covered by insurance. Rapid Freight is saved from financial ruin, protecting its assets, its employees, and its ability to continue operating.

Scenarios like this are why the excess liability insurance market continues to expand. A global market report projects it will reach $20.94 billion by 2029, largely driven by the rising frequency of these huge, multi-million dollar verdicts.

This layered structure ensures financial responsibility is handled in a clear, sequential order. Understanding this interaction is also crucial when considering how aggregate insurance coverage limits can be impacted by multiple claims over the course of a policy year.

Navigating the Cost and Market for Coverage

When it comes to excess liability insurance, the first question on everyone's mind is usually, "What's this going to cost me?" There's no one-size-fits-all answer, because premiums aren't pulled out of thin air. They're the end result of a meticulous underwriting process where an insurer digs deep into your specific risk profile.

Think of it as a detailed risk assessment. For a business, underwriters will look at everything from your day-to-day operations and employee safety records to the fine print in your client contracts. If you're buying personal coverage, they'll want to know about your assets, your public visibility, and even the driving habits of everyone in your household. It all comes together to paint a picture of potential risk.

Key Underwriting and Cost Factors

At the end of the day, the price you pay is a direct reflection of the risk you’re asking an insurer to take on. Understanding the levers they pull can give you a much better handle on managing your costs.

Here are the big ones:

- Industry and Operations: A general contractor will always face higher premiums than a graphic design studio. The work is just inherently riskier.

- Total Asset Value: This applies to both businesses and individuals. The more you have to protect, the larger the potential claim, and your premium will reflect that.

- Underlying Policy Limits: Insurers want to see that you have a solid foundation. Stronger primary policies with higher limits often earn you a better price on your excess coverage.

- Claims History: This is huge. A history of frequent or expensive claims is a red flag for underwriters and will almost certainly lead to higher costs.

Keeping a close eye on these factors is one of the best ways to control your insurance spending. For a more detailed breakdown of pricing, our article on general liability insurance cost is a great resource.

The Modern Excess Liability Market

If you're shopping for excess liability coverage today, you’ll find the landscape is much tougher than it was a few years back. The market has tightened considerably, especially for commercial buyers, and insurers are being much more cautious.

The days of easily finding a single carrier to write a $25 million excess policy are pretty much over. Building a tall coverage tower now means layering multiple policies from different insurers.

This new reality has some major knock-on effects. We're seeing a market where capacity is reduced and rates are under constant upward pressure. An insurer that might have comfortably offered a $25 million limit is now more likely to cap their initial layer at $5 million or $10 million.

What does that mean for you? Building a $50 million tower of coverage might now require policies from five or more different carriers. This makes the underwriting process more complex and, unfortunately, often drives up the total premium.

This complexity is precisely why having an expert in your corner is so critical. To see how excess liability fits into your larger financial picture and to navigate this challenging market effectively, it’s wise to engage with providers of professional financial services. A skilled partner can help you build the right protection without breaking the bank.

Frequently Asked Questions About Excess Liability

Diving into excess liability insurance often brings up some very practical questions. Let's clear up a few of the most common ones so you can feel confident about protecting your assets and business.

How Do I Know How Much Coverage Is Enough?

Figuring out the right amount of excess liability coverage isn't just about picking a number out of a hat. It's a strategic calculation that starts with understanding your total exposure.

A great first step is to calculate your net worth. Tally up everything you own—real estate equity, investments, savings, and even valuable personal property. But don't stop there. You also need to think about your future earning potential, because a major lawsuit can go after not just what you have today, but what you stand to earn for years.

A smart approach for many businesses and high-net-worth individuals is to get enough coverage to make settling out of court look far more appealing to a plaintiff than a long, drawn-out legal battle. This usually means securing limits that are comfortably above your total assets.

Do I Need an Umbrella Policy First?

In almost every case, yes. Think of insurance as being built in layers. Your excess liability policy is the top layer, and it needs a solid foundation underneath it.

Insurers will almost always require you to have high limits on your primary policies (like your auto or general liability) and an umbrella policy sitting right below the excess coverage. This tiered structure means the excess policy is only tapped for truly catastrophic events, while the primary and umbrella layers handle the more common claims.

What Factors Influence My Premiums?

The price you pay for an excess liability policy is a direct reflection of your risk profile. Insurers look at several key things to figure out your rate, making sure the premium matches the level of risk they're taking on.

Here are a few of the biggest factors that will affect your premium:

- Your Industry or Lifestyle: A construction company, with its obvious physical risks, is going to have a higher premium than a marketing agency. On the personal side, things like owning a swimming pool, having teenage drivers, or maintaining a high public profile can all bump up your costs.

- Your Claims History: A history of frequent or large liability claims is a major red flag for underwriters and will definitely lead to higher premiums. Keeping your claims record clean is one of the best things you can do to keep your costs down.

- Underlying Coverage Limits: How much coverage you carry on your primary and umbrella policies really matters. In fact, having higher underlying limits can sometimes lower your premium for the excess layer because it shows the insurer you're responsibly managing the first tiers of risk.

Building the right tower of protection for your unique risk profile is what we do best. The experts at Wexford Insurance Solutions can analyze your specific needs to find the right excess liability insurance for you. Contact us today to learn more at https://www.wexfordis.com.

How to determine replacement cost of home: Quick Guide to Accurate Coverage

How to determine replacement cost of home: Quick Guide to Accurate Coverage