If you use a vehicle for work, you absolutely need a different kind of insurance than what covers your personal car. Business auto insurance is built specifically to protect your company from the unique and often much larger risks that come with using vehicles for commercial purposes.

Think of it this way: your personal auto policy is designed for your daily commute, grocery runs, and weekend trips. It’s not built to handle the liability that comes with running a business.

What Is Business Auto Insurance and Why You Need It

It’s a common, and very risky, assumption that a personal car insurance policy will cover an accident that happens during a work-related drive. Unfortunately, that's not how it works. Personal policies almost always have a "business use exclusion," meaning if you're driving for work and cause an accident, the insurer can—and likely will—deny your claim.

This leaves your business completely exposed to massive costs, from repairing vehicles to covering medical bills and facing potential lawsuits. A single fender bender during a client visit could spiral into a financial disaster for your company.

The Critical Protection Gap

The core issue comes down to risk. A vehicle used for business—whether it’s a contractor’s heavy-duty truck, a delivery van, or a consultant's sedan—is simply on the road more and often in more demanding situations. These vehicles might carry expensive equipment, transport goods, or ferry employees, all of which represent a higher level of liability for an insurer.

That's why business auto insurance is designed with much higher liability limits. While a personal policy might top out at a few hundred thousand dollars, a commercial policy typically starts at $1 million in coverage and can go much higher. This isn't just a nice-to-have; it's the financial firewall that protects your company's assets from being wiped out by a lawsuit.

A single serious accident can lead to legal and medical expenses that far exceed personal policy limits, potentially bankrupting a small or mid-sized business without the proper coverage.

Personal vs Business Auto Insurance At a Glance

To make the distinction crystal clear, here’s a quick comparison of where these two policies differ.

| Coverage Aspect | Personal Auto Policy | Business Auto Insurance |

|---|---|---|

| Primary Use | Commuting, errands, personal travel | Transporting goods, people, or equipment for work |

| Liability Limits | Lower (e.g., $100k/$300k/$50k) | Much higher (typically $1 million or more) |

| Vehicle Coverage | Covers standard cars, SUVs, and personal trucks | Covers a wide range of vehicles, including vans and trucks |

| Property/Equipment | No coverage for business equipment inside the vehicle | Can cover permanently installed tools and equipment |

| Employees | Does not cover employees as drivers | Covers employees operating company vehicles |

| Insured Name | You, the individual | Your business (LLC, Corp, etc.) |

As you can see, these policies are designed for completely different worlds of risk.

More Than Just Higher Limits

Beyond the crucial liability protection, business auto insurance offers coverages that are simply unavailable on a personal policy. For example, it can be tailored to protect expensive tools or equipment that are permanently attached to your vehicle.

For a deeper dive into the specific protections that safeguard your company, you can learn more about commercial auto insurance here. Ultimately, this coverage isn’t just an expense—it’s a fundamental part of a smart risk management strategy. It ensures that a car crash doesn't also become a company crash.

Decoding Your Commercial Auto Coverage Options

Let's cut through the jargon. At its core, business auto insurance is all about protecting your company from the financial fallout of an accident. The best way to think about it is by sorting the risk into three simple buckets, depending on who actually owns the vehicle being used for your work.

These three pillars are Owned Auto, Hired Auto, and Non-Owned Auto coverage. Each one is designed to plug a specific gap, making sure a simple car accident doesn't turn into a financial catastrophe for your business. Let's look at how each one works in the real world.

Protecting Your Company Fleet with Owned Auto Coverage

This is the one most people are familiar with. If your company’s name is on the vehicle title, you need owned auto coverage. It’s the essential protection for any business that owns its vehicles, whether that's a single cargo van or a whole fleet of service trucks.

Think about a local plumbing company, "Reliable Rooter." They own three branded vans that their technicians drive to job sites all day long.

- Scenario: One of their plumbers is driving a company van and accidentally runs a red light, causing a T-bone collision. The other driver is injured and their car is totaled.

- How Coverage Works: Reliable Rooter's owned auto policy is built for this. It would step in to pay for the other driver's medical bills (bodily injury liability) and the cost to replace their car (property damage liability). If Reliable Rooter has collision coverage, it would also pay to repair or replace their own damaged van.

Without it, the plumbing company would be on the hook for every penny of those costs—a bill that could easily put them out of business.

If a vehicle is registered to your business, owned auto liability coverage isn't just a good idea; it's almost always a legal requirement to be on the road. It’s the absolute foundation of any commercial auto policy.

Covering Temporary Vehicles with Hired Auto Coverage

So what happens when you need a vehicle for a short-term project? That’s where hired auto coverage comes in. It provides liability protection for vehicles your business rents, leases, or borrows for work.

Let’s say a consulting firm is flying its team to a different city for a week-long project. They rent a couple of SUVs to get everyone to and from the client's office.

- Scenario: An employee is pulling out of a parking spot in one of the rented SUVs and backs right into a luxury sedan, causing thousands in damage.

- How Coverage Works: The firm's hired auto policy would cover the liability for the damaged sedan. This is huge because you can't rely on the rental counter's insurance to fully protect your business from a lawsuit, and their deductibles can be massive.

Hired auto coverage ensures your company is protected when you're responsible for a vehicle you don't actually own.

Shielding Your Business from Employee Vehicle Risks

This last piece of the puzzle is the one business owners miss most often: non-owned auto coverage. It protects your company when your employees use their personal vehicles for work errands. It’s a common mistake to think the employee's personal policy is enough. That's a dangerous assumption.

Picture a real estate agent who uses their own car to drive clients to showings. On the way to a property, they glance at a text and cause a serious pile-up. Because the agent was actively working, their employer—the real estate brokerage—can be sued for the damages.

If the costs go beyond the agent's personal insurance limits (which happens all the time in major accidents), the injured parties will come after the business's deeper pockets. Non-owned auto coverage is designed specifically to defend your company in this exact scenario. To really dig into this, you can read our complete guide on hired and non-owned auto insurance and see how it all fits together.

Who Actually Needs Business Auto Insurance

It's a common question I hear from business owners: "Do I really need a separate auto policy?" The answer usually boils down to one simple test: is a vehicle being used to make money or do a job for your company? If so, you almost certainly need business auto insurance.

Many people think it’s all about who owns the vehicle, but that’s a dangerous misconception. What truly matters is how the vehicle is used. The moment a car, truck, or van crosses that line from personal errand to business activity, your personal auto policy is no longer the right tool for the job.

From Solo Professionals to Large Fleets

Every business is different, but the need for proper vehicle coverage is a constant. Let's walk through a few real-world scenarios to see how this works.

- The Local Florist: Think about a florist with a small van for making daily deliveries. That van is the lifeblood of the business. For them, business auto insurance isn't just a good idea; it's an absolute necessity.

- The Independent Consultant: A consultant driving their personal car to client meetings might assume their personal policy has them covered. But if they get into an accident on the way to a paid meeting, their insurer could rightfully deny the claim, leaving the consultant on the hook for all the damages.

- The Construction Company: This is the most clear-cut example. A construction firm’s fleet of trucks, trailers, and heavy equipment carries immense risk. One bad accident could lead to devastating injuries and property damage, demanding the kind of high liability limits you can only get with a commercial policy.

This applies to specialized vehicles, too. For instance, if your business uses golf carts for transport on a large property or at an event venue, you'll need to look into specific policies like commercial golf cart insurance to cover their unique risks.

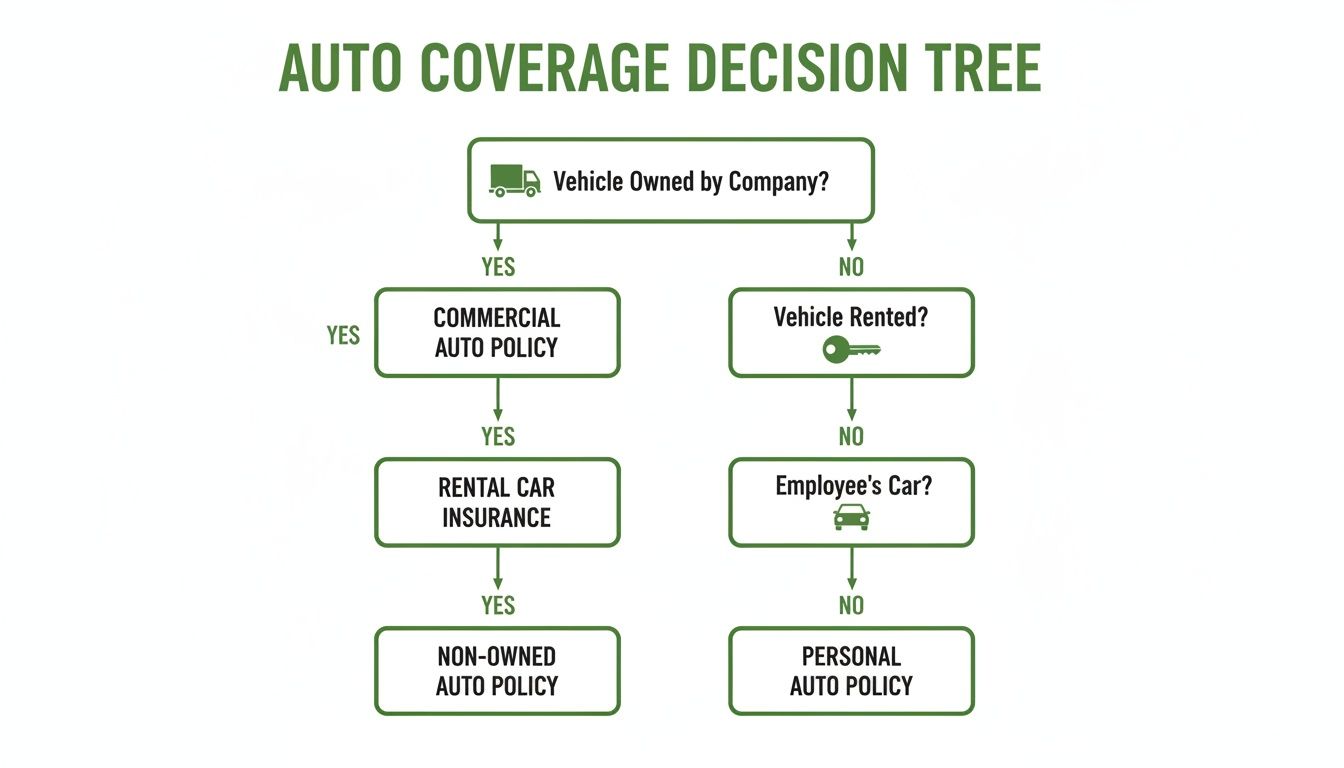

This flowchart can help you quickly figure out what kind of coverage you might need for a company-owned truck, a rented van, or an employee's personal car.

The takeaway here is that you need the right type of commercial coverage for each vehicle situation to ensure there are no gaps in your protection.

Legal and Contractual Mandates

Beyond just being a smart move, having business auto insurance is often required by law and by your clients. Nearly every state sets minimum liability coverage for commercial vehicles, and these limits are usually much higher than what's required for personal cars. Get caught without it, and you could face steep fines or even lose your business license.

It's also incredibly common for contracts—especially with larger corporate or government clients—to demand that you carry specific, often high, limits of business auto insurance. If you can't show proof of that coverage, you'll lose the bid or could even be found in breach of contract.

These requirements aren't going away. The global market for automobile insurance is massive and growing, projected to hit an incredible $1,605.51 billion by 2029. A major driver of this growth is the unfortunate rise in accidents, which just reinforces why solid protection is more important than ever.

Understanding Your Policy Limits and Premium Factors

When a business auto insurance quote lands on your desk, the numbers can look a little intimidating. But getting a handle on what goes into your premium and what those policy limits actually mean is the secret to making a smart, confident decision for your company.

Think of it this way: your policy limits are the maximum your insurer will pay out for a single covered claim. Your premium is simply the price you pay for that safety net. These two are always linked—higher limits mean more protection, which usually means a higher premium. But chasing the lowest possible premium by picking rock-bottom limits is a huge gamble. One serious accident can blow past minimum coverage in a heartbeat, leaving your business assets completely exposed to a lawsuit.

The real goal is finding that sweet spot: robust protection at a price that makes sense.

Translating Policy Limits into Real-World Protection

Policy limits and deductibles are where the rubber meets the road. They define exactly what you'll pay versus what your insurer will cover when something goes wrong. Let's break them down.

-

Liability Limits: This is the most critical number on your policy. You'll often see it as a Combined Single Limit (CSL), like $1,000,000. A CSL creates one big pot of money that can be used for both bodily injury and property damage, which gives you a ton of flexibility after a major accident. It’s the absolute maximum your policy will pay to other people if you're found at fault.

-

Deductibles: This is your share of the repair bill. If you have a $1,000 collision deductible and your work truck needs $8,000 in repairs, you pay the first $1,000. Your insurance then steps in to cover the remaining $7,000. Choosing a higher deductible can definitely lower your premium, but you have to be honest with yourself—can your business comfortably write a check for that amount without warning?

Imagine the difference between a freelance IT consultant and a general contractor. The consultant just drives their sedan to client meetings and might be perfectly fine with a standard $1 million liability limit. The contractor, on the other hand, operates a heavy-duty truck loaded with expensive equipment. They face a much higher risk of causing serious damage or injury. For that business, a $2 million limit is a much safer, more realistic choice.

The Key Factors That Drive Your Premium

Insurers don’t pull your premium out of a hat. They use a sophisticated process to analyze your company's specific risk profile.

The commercial auto insurance market has been under incredible strain, marking 13 straight years of underwriting losses as of 2025. A big reason for this is the staggering 64% jump in the average cost of liability claims since 2015, driven by massive jury awards that ultimately push up costs for everyone. You can read the full Conning report to see the market data for yourself.

Knowing what the insurance carriers are looking at gives you the power to manage your costs over time. Here’s a look at what truly moves the needle on your premium.

We can summarize the biggest variables in a simple table.

Key Factors Influencing Your Business Auto Premium

| Pricing Factor | Description | How It Impacts Your Rate |

|---|---|---|

| Vehicle Type & Use | The size, weight, and function of your vehicles (e.g., passenger car vs. dump truck). | Heavier vehicles can cause more damage, so they cost more to insure. Long-haul trucking is riskier than local deliveries. |

| Driving Records | The MVR (Motor Vehicle Record) history of every employee who drives for the business. | A team of drivers with clean records will earn you a much better rate. Accidents and violations signal higher risk. |

| Travel Radius | The geographic area your vehicles operate in—local (under 50 miles), intermediate, or long-haul. | The farther you drive, the higher the odds of an accident. Local-only operations typically pay less. |

| Industry & Claims History | The inherent risks of your line of work and your company's specific history of past claims. | High-risk industries like construction pay more. A pattern of frequent claims will raise your premium significantly. |

As you can see, you have more control than you might think.

Strong fleet safety management programs, for instance, can make a huge difference in your risk profile and, by extension, your insurance costs. By being proactive—hiring safe drivers, enforcing clear safety rules, and maintaining your vehicles—you can directly influence what you pay.

For a deeper dive into the numbers, check out our guide on business auto insurance cost.

How to Choose the Right Insurance Policy

Choosing the right business auto insurance policy can feel overwhelming, but it doesn't have to be. Breaking it down into a few simple steps can turn a confusing task into a straightforward business decision. Remember, the goal isn't just to find the cheapest premium—it’s about finding a solid partner who will have your back when things go wrong.

A smart approach starts with getting your ducks in a row before you even ask for a quote. This simple bit of prep work saves a ton of time and makes sure the quotes you get are actually accurate for your business.

Prepare Your Business Information

To get a truly precise quote, you need to give the insurance company a clear snapshot of your company's risks. Think of it as creating a detailed blueprint for them to work from. Having everything ready to go makes the whole process smoother.

Start by pulling together a quick file with:

- Vehicle Details: The make, model, year, and Vehicle Identification Number (VIN) for every single vehicle you need to insure.

- Driver Information: A full list of every employee who will get behind the wheel, along with their driver's license numbers and birth dates.

- Operational Scope: A simple description of how you use your vehicles. What's your typical travel radius? What kinds of materials or equipment are you hauling?

- Insurance History: Details on your current or past commercial auto policies and any claims you've filed in the last three to five years.

With this information handy, applying for coverage—whether with an agent or directly with a carrier—becomes a much faster and more efficient experience.

Compare Quotes Beyond the Price Tag

Once you have a few quotes in hand, the real work begins. Of course, the price matters, but it’s just one part of the equation. A cheap policy from an insurer that’s slow to respond or financially shaky can end up costing you a fortune down the road.

Look past the premium and dig into these details:

- Insurer Financial Strength: Check the carrier’s rating from an agency like A.M. Best. A strong financial rating (think A- or better) is a good sign that the company can actually afford to pay out claims, even the big ones.

- Claims Handling Reputation: What happens when a customer actually needs help? Search for reviews or ask your agent about their firsthand experience with the carrier's claims department. A fast, fair process minimizes your downtime and stress.

- Policy Details: Make sure you're comparing apples to apples. Check that the liability limits, deductibles, and endorsements are identical on every quote you review. Getting comfortable with the fine print is key, and you can learn more about how to read an insurance policy to build your confidence.

Choosing an insurance partner is about more than just the policy; it's about trusting that the company will deliver on its promise. A slightly higher premium for a top-rated carrier with excellent service is often a wise investment.

This kind of careful evaluation is more important than ever. Industry projections for 2025 show that commercial auto insurance continues to be a tough market, with an expected combined ratio of 104.3. In plain English, that means for every $100 insurers collect in premiums, they expect to pay out $104.30 in claims and expenses. This highlights just how much financial strain the sector is under and why picking a stable insurer is so critical.

Work with an Independent Agent

Trying to navigate all of this on your own can be a real headache. This is where partnering with an independent insurance agent, like our team at Wexford Insurance Solutions, makes a huge difference. Unlike a captive agent who works for just one company, an independent agent works for you.

We can source quotes from multiple top-rated carriers, saving you the legwork of shopping around. But more importantly, we act as your guide and advocate, helping you compare complex policy language, spot potential coverage gaps, and find the best possible terms for your specific needs.

Common Claim Scenarios and How Coverage Protects You

Reading through policy details can feel abstract. But seeing how business auto insurance actually works in a real-world crisis is when its value truly hits home. It’s a piece of paper until it’s the only thing standing between your business and a financial disaster.

Let's look at a few common situations we see all the time. These examples show how specific coverages become your financial backstop, preventing a bad day from turning into a business-ending event.

The Multi-Vehicle Pile-Up

It happens in an instant. Your delivery driver, behind the wheel of a company cargo van, gets distracted and causes a chain-reaction crash on the freeway. Three other cars are involved, people are hurt, and the property damage is massive.

Suddenly, your business is facing a storm of medical bills, vehicle repair costs for multiple parties, and the threat of expensive lawsuits. We're talking about a financial hit that could easily climb into the hundreds of thousands of dollars.

- How Coverage Responds: This is where your owned auto liability coverage springs into action. It's designed specifically for this nightmare scenario, covering the other drivers' medical treatments (bodily injury) and the costs to fix or replace their wrecked vehicles (property damage). This coverage protects your business assets from being liquidated to pay for a judgment.

Theft from a Parked Work Van

Think about a plumbing or electrical contractor. An employee leaves a locked work van at a job site overnight, fully stocked for the next day. They show up in the morning to a shattered window and discover $15,000 in specialized equipment is gone—the permanently installed shelving, a heavy-duty generator, the works.

Beyond the immediate financial loss, the van is now useless, bringing operations to a grinding halt.

A business auto policy isn't just for collisions. Comprehensive coverage is specifically designed to protect against non-accident-related events like theft, vandalism, fire, or severe weather, safeguarding your valuable mobile assets.

- How Coverage Responds: In this case, your comprehensive coverage is the key. It pays to replace that stolen, permanently affixed equipment and repair the van's window, less your deductible. It gets your vehicle back on the road and earning money again without you having to dip into your cash flow.

The Errand in a Personal Car

Here’s a situation that catches many business owners by surprise. You ask an employee to use their personal car for a quick trip to the office supply store. In the parking lot, they accidentally back into another vehicle. It’s a minor fender-bender, but the other driver isn't happy.

Worse yet, your employee has low limits on their personal auto policy. The other driver's attorney decides to sue both your employee and your company, since the accident happened while your team member was "on the clock."

- How Coverage Responds: This is the exact reason non-owned auto coverage exists. It kicks in to provide liability protection for your business when an employee gets into an at-fault accident using their own vehicle for work purposes. It handles the legal fees and damages that go above and beyond your employee's personal policy limits, stopping a simple errand from becoming a costly legal battle. It’s a critical safeguard, especially since navigating claims isn’t always easy. You can learn more about common insurance claim denial reasons to be better prepared.

Common Questions About Business Auto Insurance

Even after you've got the basics down, you're bound to have a few specific questions. Let's tackle some of the most common ones we hear from business owners every day.

Can I Just Add My Work Truck to My Personal Auto Policy?

This is easily the most common question we get, and it's a dangerous one. The short answer is a hard no. Your personal auto policy is written with very specific language that excludes coverage for business activities.

Think of it this way: your personal insurance is for driving to the grocery store, not for hauling equipment to a job site. If you get into an accident while working, your personal insurer can—and almost certainly will—deny the claim. That leaves you personally on the hook for every penny of the damages, a risk no business owner should take.

What’s the Minimum Coverage I Legally Need?

This really depends on where you operate. Each state sets its own rules for minimum liability coverage, and these requirements are always higher for commercial vehicles than for your personal car. Why? Because a work vehicle often carries more risk.

But here’s the critical takeaway: meeting the state minimum is just the first step. Those legal minimums are often dangerously low and wouldn't come close to covering the costs of a serious accident. A single lawsuit could wipe out your business if you're underinsured.

On top of state laws, your clients might have their own rules. Many larger companies or government contracts will demand you carry much higher liability limits—often $1 million or more—before they’ll even consider hiring you.

How Can I Get a Better Rate on My Business Auto Insurance?

Everyone wants to save money, but you never want to do it by cutting essential coverage. The good news is there are plenty of smart ways to lower your premiums without putting your business at risk.

- Hire Drivers You Can Trust: An employee's driving record is one of the biggest factors in your premium. Running MVR checks and hiring people with clean records is your best first move.

- Build a Culture of Safety: Insurers love to see a proactive approach. A formal safety program, regular driver training, and a strict vehicle maintenance schedule can earn you significant discounts.

- Raise Your Deductible: If you have the cash flow to handle a larger out-of-pocket cost after an accident, increasing your deductible is a straightforward way to lower your monthly premium.

- Bundle Your Policies: Just like with personal insurance, you can often get a discount by placing your commercial auto policy with the same carrier that handles your general liability or Business Owner's Policy (BOP).

Am I Covered If an Employee Uses a Company Car for Personal Errands?

Generally, yes. A standard business auto policy is designed to cover a company-owned vehicle even when an employee is using it for personal reasons (with your permission, of course). This "permissive use" provides seamless protection, which is a huge relief.

That said, it's a very good idea to have a written company policy that clearly spells out what is and isn't acceptable personal use. This simple document can prevent a lot of headaches and clarifies expectations for everyone on your team.

Figuring all this out can feel like a lot, but you don't have to go it alone. The team at Wexford Insurance Solutions specializes in making commercial insurance simple and clear. Let us handle the details so you can get back to running your business. Visit us at https://www.wexfordis.com to get started.

What Is Personal Property Insurance and How Does It Work?

What Is Personal Property Insurance and How Does It Work?