For an independent contractor, insurance isn't just another line item in your budget—it's the bedrock of your business. Clients insist on it to shield themselves from the financial fallout if something goes wrong with your work. Think of it less as a hurdle and more as a professional credential. Without it, you're a risk. With it, you're a trusted partner ready to land bigger and better contracts.

Why Your Clients Demand Proof of Insurance

Let's use a simple analogy. Say you hire an electrician to rewire your office. If a mistake on their part sparks a fire, you'd rightfully expect their insurance policy to cover the damage, not your own. That’s exactly how your clients see you. They view you as a key component of their operations, and their insurance requirements are simply a financial firewall against any potential accidents or errors.

When a client asks for proof of insurance, they are effectively transferring risk. They’re making sure that if a project goes sideways—whether it's property damage, a costly professional error, or an injury on their premises—you have the financial resources to handle it. Without that guarantee, the liability could land squarely on them, triggering expensive legal fights and damaging their reputation.

More Than Just a Contractual Hurdle

Seeing insurance as just a box to check is a huge missed opportunity. The right coverage sends a powerful message of professionalism and stability, immediately giving you an edge over less-prepared competitors. It shows you’re serious about your business and have a plan for the unexpected. That confidence is often the very thing that helps you secure more lucrative, long-term contracts.

This has become even more important as more businesses embrace freelance and contract work. In fact, the contractors insurance market was valued at USD 44.34 billion and is expected to more than double by 2032. Yet, an alarming 60% of small contractors are shut out of projects because they can’t provide the required insurance documents. You can dive deeper into these market trends in this detailed industry report.

At its core, a client's request for insurance is a request for accountability. It demonstrates that you are a reliable business partner prepared to stand behind your work, no matter what happens.

This proof usually comes in the form of a Certificate of Insurance (COI). This one-page document is your passport to getting started, summarizing your coverage types and policy limits for your client. Understanding how Certificates of Insurance work is essential for every contractor, as it’s the piece of paper that makes your protection real to your clients.

To help you get started, here's a quick look at the most common types of insurance that clients will ask to see before signing a contract.

Quick Guide to Essential Contractor Insurance

| Insurance Type | What It Covers | Who Typically Requires It |

|---|---|---|

| General Liability | Third-party property damage and bodily injury. | Virtually all clients, especially if you work on-site. |

| Professional Liability | Financial losses from errors or negligence in your professional services. | Clients in consulting, tech, design, marketing, and other expert fields. |

| Workers' Compensation | Your own medical expenses and lost wages if you get injured on the job. | Often required by state law and by most large corporate clients. |

While this table covers the basics, the specific policies and limits you'll need can vary widely depending on your industry and the client's own risk management standards.

Understanding Your Core Insurance Policies

Diving into contractor insurance can feel like trying to read a foreign language. You’ll see a lot of terms that sound alike but protect you from completely different things. To win client contracts and keep your business safe, you have to get a handle on the core coverages. Let's break down the three most common policies you'll run into.

Think of your insurance policies like a specialized toolkit. You wouldn't bring a sledgehammer to fix a watch, right? The same logic applies here—you need the right policy for the right risk. For most independent contractors, the foundational tools are General Liability, Professional Liability, and Workers' Compensation.

General Liability: The Shield for Physical Mishaps

General Liability Insurance is your first line of defense if you're accused of causing bodily injury to someone or damaging their property. It’s the policy that deals with tangible, real-world accidents that can happen while you’re on the job. There's a reason people often call it "slip-and-fall" insurance.

Say you’re an IT consultant working at a client’s office. You’re setting up a new server rack, you trip over a cable, and you send their huge, expensive monitor crashing to the floor. Your General Liability policy is what would pay to replace that shattered screen. Or, if a client visits your home office, trips on a rug, and breaks their wrist, this policy would cover their medical bills and any legal fallout.

This coverage is non-negotiable for any contractor who:

- Works at a client’s location.

- Has clients come to their place of business.

- Handles a client's physical property or equipment.

Professional Liability: The Safety Net for Your Expertise

While General Liability covers physical accidents, Professional Liability Insurance protects you from a totally different kind of risk. Often called Errors & Omissions (E&O) insurance, this policy covers financial losses a client suffers because of a mistake you made in your professional services. It’s all about the quality and outcome of your work, not physical mishaps.

Imagine you're a graphic designer hired to create branding for a huge product launch. You miss the deadline, the client can't launch on time, and they claim they lost thousands in projected sales. They could sue you for those financial damages. Professional Liability is the policy that would kick in to cover your legal defense and any settlement.

This policy is a must-have for any contractor providing advice, expertise, or skilled services. It's designed for the abstract risks tied to your professional judgment, whether it's a consultant's bad advice or a developer's buggy code.

Nailing down the difference between these two liability policies is a huge part of managing your risk. We actually break it down in much more detail here: professional liability vs. general liability.

Workers' Compensation: Protecting Your Most Valuable Asset

A lot of solo contractors think Workers' Compensation Insurance is just for companies with a team of employees. That's a common and costly mistake. Many states and client contracts will require you to carry it, even if you’re a business of one. This policy is what covers your own medical bills and lost income if you get hurt on the job.

Without it, a work-related injury could be financially crippling. If you're a freelance carpenter and you fall off a ladder, breaking your leg, Workers' Comp would pay for your hospital bills and give you a portion of your income while you can't work. Without that coverage, you're stuck with those bills yourself, all while your income is at zero.

The rules for this coverage get complicated and change a lot from state to state and industry to industry. Some states, like Minnesota and New Jersey, have very strict tests to decide if you're truly a contractor, making Workers' Comp a necessity to avoid misclassification penalties. The construction world is a great example of this; you can see how strict general contractor insurance requirements often are.

At the end of the day, having the right mix of these policies shows clients you're a serious, professional business owner. It proves you've thought ahead and are prepared for the risks, which protects both their interests and your own future. That’s what separates a freelancer from a true independent business.

How to Read a Client's Insurance Requirements

That multi-page client contract can feel like a monster, especially the dense section packed with legalese about insurance. It's tempting to just skim it, but don't. That clause is your client's exact instruction manual for the protection they need from you before you can even think about starting work.

Instead of seeing it as a legal maze, think of it as a checklist for your insurance agent.

Learning to decipher this language is a game-changer. It lets you get things done fast, avoid project delays, and show your client you’re a true professional. Honestly, getting this right is just a core part of running your business and a crucial element of effective contract management strategies.

Decoding Key Phrases in Your Contract

When you dig into the insurance section, you’re really just hunting for a few specific terms. These tell you exactly how your policy needs to be set up. Your insurance agent needs this info to create the right Certificate of Insurance (COI) that gets you approved.

Here are the big three you’ll almost always run into:

-

Additional Insured: This is the most common request by a long shot. It simply means your client wants to be added to your General Liability policy. This gives them a direct line of protection under your coverage for any claims that pop up because of your work. If someone sues you both over an accident you caused, your policy steps up to defend them.

-

Waiver of Subrogation: This one sounds way more complicated than it is. In short, it stops your insurance company from suing your client to get back the money it paid out on a claim you were responsible for. It’s another layer of protection that clients insist on to keep themselves out of messy legal fights.

-

Primary and Non-Contributory: Think of this as setting the pecking order for insurance. It makes it crystal clear that your policy is the primary one and must pay first if there's a claim. It also means your insurer can't ask the client's own insurance to chip in (non-contributory).

Don’t let these phrases spook you; they're standard operating procedure. They are just the tools clients use to make sure your insurance does its job: protecting them from the risks that come with your project.

From Contract Clause to Certificate of Insurance

Once you've spotted these key requirements, the next step couldn't be simpler: email the entire insurance clause from the contract directly to your agent. Don't even try to translate it yourself—that’s their job. They speak this language fluently and will know instantly if your current policy is good to go or needs a few tweaks.

If you want to get more comfortable with the lingo yourself, our guide on how to read an insurance policy is a great place to start.

Your Certificate of Insurance (COI) is the final piece of the puzzle. It’s that one-page document proving to your client that you have the right coverage, limits, and special endorsements locked in. Nailing this is your green light to get to work.

Getting this process down is more important than ever as insurance costs keep climbing. Right now, U.S. contractors are seeing general liability premiums jump by 5% to 15%, while commercial auto liability is spiking by 10% to 15%. With inflation and labor shortages pushing these rates up, you want to get your coverage right the first time to avoid surprise costs later. By understanding exactly what your client needs, you can make sure you’re properly covered without paying for things you don't.

Getting a Handle on Your Insurance Costs and Limits

Alright, let's talk about the dollars and cents. Budgeting for your insurance is a must, but trying to decipher the numbers you see in a contract can feel like you're just guessing. Clients will often insist on certain liability limits, and you absolutely need to know what they mean—and what they’ll cost you—to protect your business and price your work properly.

One of the most common requirements you’ll run into is for $1 million per occurrence / $2 million aggregate. It sounds intimidating, but the concept is actually pretty straightforward.

The $1 million per occurrence is the maximum amount your insurance company will pay out for any single claim. The $2 million aggregate is the total cap on what they will pay for all claims combined over your policy period, which is typically one year.

Think of it like a credit card limit. Your "per occurrence" is like your single transaction limit, while the "aggregate" is your total credit limit for the year. Meeting this standard shows clients you’re a serious professional who is prepared for the worst-case scenario.

Breaking Down Typical Costs and Coverages

So, what will this actually cost you? Well, it depends. Your industry, where you're located, the exact services you offer, and your claims history all play a big role. A freelance graphic designer working from home has a completely different risk profile than a roofer on a commercial job site, and their premiums will show it.

Still, we can lay out some general ranges to give you a starting point for your budget.

For a more tailored quote based on your specific business, our business insurance cost calculator can give you a much clearer financial picture.

To give you a ballpark idea, here’s a look at what independent contractors can generally expect to pay each year for the core policies.

Estimated Annual Costs for Independent Contractor Insurance

This table outlines the most common insurance policies for freelancers and contractors, along with typical coverage limits and their estimated annual costs.

| Insurance Policy | Common Coverage Limit | Estimated Annual Cost Range |

|---|---|---|

| General Liability | $1M Per Occurrence / $2M Aggregate | $400 – $900 |

| Professional Liability | $1M Per Occurrence / $1M Aggregate | $600 – $1,500 |

| Workers' Compensation | Varies by State and Payroll | $750 – $2,500+ |

| Commercial Auto | $1M Combined Single Limit | $1,500 – $3,000+ |

Keep in mind, these are just estimates for a solo operator. If you hire subcontractors, use heavy machinery, or work in a higher-risk field, you can expect these numbers to go up.

State-Specific Rules You Absolutely Cannot Ignore

Insurance is regulated state by state, meaning what’s required in Texas might not cut it in New York. This is especially true for Workers' Compensation, where the rules for independent contractors can be incredibly specific and unforgiving. As an agency licensed in both New York and Florida, we deal with these regional quirks every single day.

Navigating state-specific regulations isn't just about ticking a box for compliance; it's about avoiding massive fines and legal nightmares that could shut you down.

Let's look at two prime examples:

-

Florida’s Construction Industry Rules: Florida has some of the toughest Workers' Compensation laws in the country, especially for anyone in construction. In most cases, construction contractors are legally required to carry this coverage—even if they're a one-person LLC. Getting caught without it can lead to immediate stop-work orders and fines as high as $5,000 per day.

-

New York’s Employee-Like Requirements: New York is another state that’s serious about worker protections. If you're an independent contractor and you hire even a single part-time helper or a subcontractor, you’ll almost certainly be required to provide Disability and Paid Family Leave (DBL/PFL) insurance. These state-mandated benefits are completely separate from Workers' Comp and are essential for staying on the right side of the law.

These examples really drive home why local expertise matters so much. Working with an agent who actually knows the laws in your state ensures you get the right coverage without overpaying, satisfying both your clients and the government.

How to Get Yourself Insured: A Step-by-Step Guide

Alright, you’ve got a handle on the different policies and you can actually make sense of a client's contract. Now it's time to put that knowledge into action. Getting the right insurance isn't complicated once you know the path. It all starts with taking an honest look at your business and the specific risks you face every day.

Think about what could realistically go wrong in your line of work. If you're a web developer, your nightmare scenario might be a single line of bad code that takes a client's e-commerce site offline for a day. If you're a commercial photographer, it could be as simple as someone tripping over a light stand on set. Nailing down these potential disasters is the crucial first step to finding coverage that actually has your back.

Gather Your Business Vitals

Before you can even think about getting a quote, you’ll need to pull some basic information together. Insurance carriers need to understand what you do to figure out your risk level. It's a bit like applying for a loan—the more prepared you are, the faster and smoother it will be.

Make sure you have these details handy:

- Business Name and Address: Your legal business name and where you operate from.

- Description of Services: A simple, clear summary of the work you do.

- Annual Revenue: A solid estimate of your gross income for the year.

- Business Structure: Are you flying solo as a sole proprietor, or are you an LLC or S-Corp?

- Client Contracts: Keep any contracts that spell out specific insurance requirements close by.

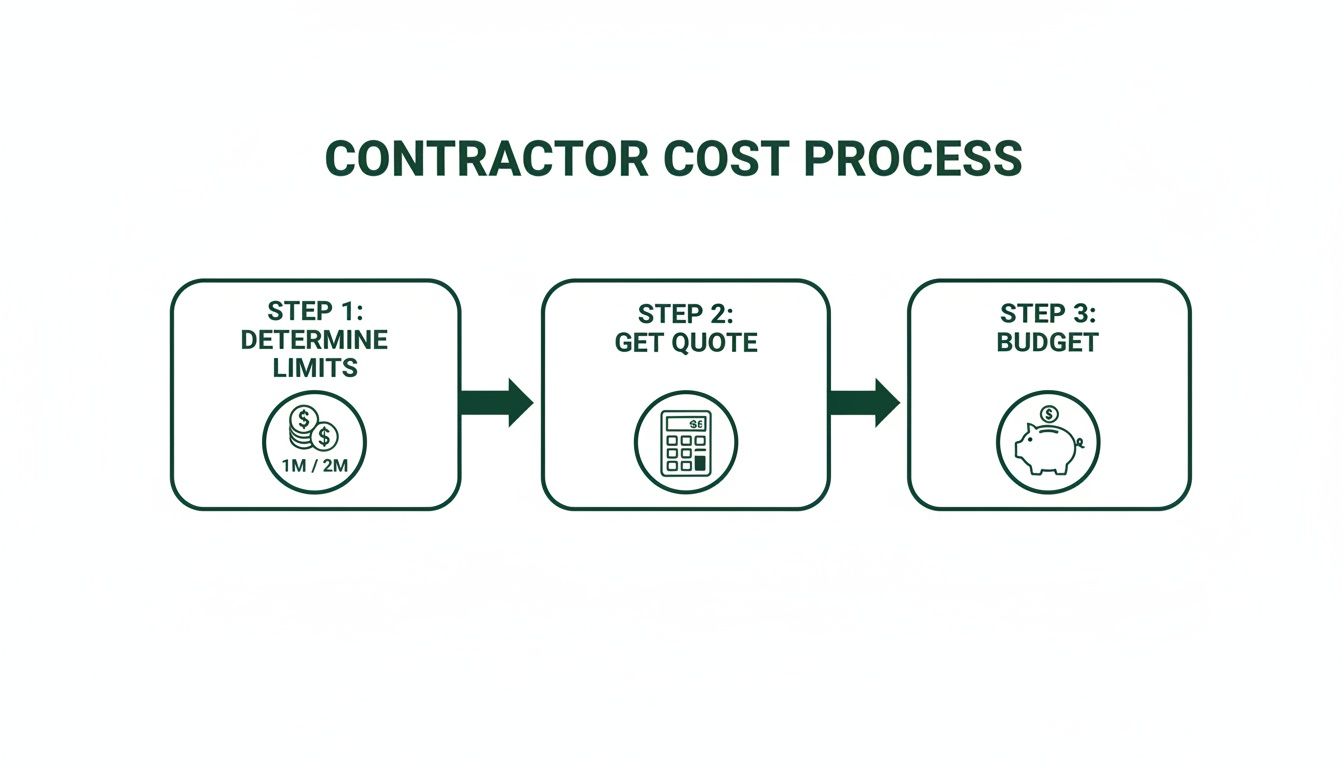

This simple graphic shows you how to go from figuring out your needs to getting a quote and setting your budget.

Think of this as your roadmap—it takes you from understanding the limits you need to confidently locking in your annual premium costs.

Find an Independent Agent to Be Your Advocate

With your information in hand, the next step is finding the right professional to guide you. You could go directly to an insurance company, but you'll almost always get a better result by teaming up with an independent insurance agent. Why? Because they work for you, not for one specific carrier.

This is a huge advantage. An independent agent takes your application and shops it around to multiple carriers, making them compete for your business. The result is better coverage at a much more competitive price, all designed specifically for you.

Once you’re approved and you’ve made your first payment, your agent can issue an insurance binder. This acts as your temporary proof of coverage until the official policy documents arrive. You can find out more about what an insurance binder is and why it's important to keep your business moving without delay.

Common Questions About Contractor Insurance

When you're an independent contractor, navigating the world of insurance can feel like a minefield of jargon and what-ifs. The details really do matter, and getting them right can save you a ton of money, headaches, and project delays down the road. Let's tackle some of the most common questions we hear from contractors every single day.

Do I Need Insurance If I Work from Home and Have an LLC?

Yes, you absolutely do. This is probably the biggest misconception we see among freelancers and consultants. Setting up an LLC is a great first step—it's designed to protect your personal assets, like your house and car, from any business debts. But it does absolutely nothing to protect you from a lawsuit related to your actual work.

An LLC draws a line between you and your business, but it doesn't make your business bulletproof. Say you’re a developer and a bug in your code takes a client's e-commerce site offline during a Black Friday sale. They can—and likely will—sue your business for the lost income. In that situation, it’s your Professional Liability insurance that steps in to cover the legal bills and any settlement, not your LLC.

Think of it this way: Your LLC is the fortress protecting your personal life. Your liability insurance is the army defending the business itself. You really need both to be secure.

Even if your office is just a corner of your living room, the professional risks are very real. A marketing campaign that backfires, a missed deadline that costs a client a major contract—these things happen. Insurance is the financial backstop that keeps a single mistake from derailing your entire business.

What Happens If a Client Demands Higher Insurance Limits?

First off, don't panic. This is a normal part of growing your business, especially when you start landing bigger, more corporate clients. The most important thing to remember is do not sign that contract yet. If you agree to terms you can't actually meet, you’re in breach of contract before you even start.

Instead, just follow these simple steps:

- Call Your Agent: Immediately forward the insurance requirements from the contract to your insurance agent. They look at these all day long and know exactly what’s being asked of you.

- Get a Quote to Up Your Limits: Your agent can tell you exactly what it will cost to increase the limits on your policies. Often, it's a simple adjustment that adds a prorated amount to your premium for the rest of the year.

- Ask About an Umbrella Policy: If the client is asking for something substantial, like $5 million or more, an Umbrella Policy is almost always the cheapest way to get there. It’s an extra layer of liability coverage that sits right on top of your existing policies, like General Liability and Commercial Auto.

A good agent can usually get this sorted out in a day or two, provide an updated Certificate of Insurance, and give you the green light to sign the contract with confidence. It's just a sign that you're moving up in the world.

Are My Business Insurance Premiums Tax Deductible?

For almost every independent contractor, the answer is a big, resounding yes. The IRS considers business insurance premiums a necessary and ordinary business expense, which means they are tax-deductible.

This covers all the essential policies you carry to protect your business:

- General Liability Insurance

- Professional Liability (E&O) Insurance

- Workers' Compensation Insurance

- Commercial Auto Insurance

- Cyber Liability Insurance

Deducting these premiums lowers your overall taxable income, which directly helps offset the cost of having the coverage in the first place. It's a key financial perk of being self-employed. Of course, tax law is complex, so it's always smart to run everything by your accountant to make sure you're getting the most out of your deductions and staying compliant.

Why Does a Client Want to Be an Additional Insured?

When a client asks to be listed as an "Additional Insured," they're essentially asking to share your insurance coverage for the specific work you're doing for them. This is an extremely common request that almost always applies to your General Liability policy.

Here’s why they ask. They want to make sure they're protected from lawsuits that arise because of your work. Let’s say you’re an IT consultant working on-site to install a new server. You leave a tool bag on the floor, someone from their team trips over it, gets hurt, and decides to sue. They’re not just going to sue you; they’re going to sue your client, too.

By being an Additional Insured on your policy, your client ensures that your insurance is the first line of defense. Your policy would have to pay for their lawyer and any settlement that comes out of that claim. Without that endorsement, they’d be stuck filing a claim on their own insurance for an accident they didn't cause. It's a standard way for them to manage their risk, and agreeing to it shows you're a professional who takes full responsibility for your work.

Making sense of these requirements is just part of running a successful independent business. At Wexford Insurance Solutions, our job is to help contractors get the right coverage without all the confusion. We know the rules in New York and Florida inside and out, so you can be sure you’re protected and compliant.

Ready to get clear answers and expert guidance? Contact Wexford Insurance Solutions today for a no-obligation consultation.

A Guide to Certificates of Insurance for Your Business

A Guide to Certificates of Insurance for Your Business Types of Commercial Insurance Policies (types of commercial insurance policies)

Types of Commercial Insurance Policies (types of commercial insurance policies)