When you hear the term "insurance deductible," think of it as your initial stake in any claim. It’s the amount of money you pay out-of-pocket for a covered loss before your insurance company steps in to handle the rest.

Essentially, it's your share of the cost. Once you’ve covered that agreed-upon amount, your insurer takes over and pays for the remaining damages, right up to your policy's limits.

Understanding Your Role in an Insurance Claim

A lot of people think of insurance as just a safety net, but it’s really more of a partnership. Your deductible is where that partnership first comes into play. It’s the fixed amount you agree to handle yourself when something goes wrong.

Let’s put it into real-world terms. Imagine a storm blows through and causes $5,000 in damage to your roof. If your homeowner's policy has a $1,000 deductible, you're on the hook for that first $1,000. After you pay that, your insurance provider covers the remaining $4,000.

This setup isn't just arbitrary; it helps keep insurance premiums from getting out of control by discouraging small, minor claims that could otherwise clog up the system.

Deductible vs Premium: The Basic Trade-Off

Choosing a deductible isn't just a random number—it's a strategic decision that directly affects your budget. The relationship between your deductible and your premium (the amount you pay regularly to keep your policy active) is a simple trade-off.

The table below breaks down this fundamental choice.

| Scenario | Your Deductible Amount | Your Monthly Premium | Your Out-of-Pocket Cost at Claim Time |

|---|---|---|---|

| Lower Risk Tolerance | $500 | Higher (e.g., $150/month) | Lower (You pay the first $500) |

| Higher Risk Tolerance | $2,500 | Lower (e.g., $100/month) | Higher (You pay the first $2,500) |

As you can see, you can either pay more now in premiums for less financial pain later, or save money on premiums now by agreeing to take on a bigger chunk of the cost if a claim occurs.

A deductible is the financial threshold you must cross before your insurance coverage kicks in. It’s the key that unlocks your policy's benefits when you need them most.

Getting this balance right is everything. The concept is pretty universal across the insurance world—for example, understanding what a health insurance deductible is can really clarify the principle. It works similarly for your vehicles, too. To dive deeper into that specific area, you can learn all about how a car insurance deductible works in our more detailed guide. Grasping this core idea is the first step to making truly smart choices about your coverage.

How Insurance Deductibles Work in Real Life

Theory is one thing, but let's talk about what happens when you actually have to use your insurance. This is where the rubber meets the road. Think of your deductible not as a fee, but as your share of the risk—the amount you agree to cover out-of-pocket before your insurance company steps in.

When something goes wrong and you need to file a claim, your deductible is the first part of the bill. You handle that initial amount, and your insurer handles the rest.

A Homeowners Insurance Claim Example

Let's say a nasty storm rolls through, and a heavy oak limb crashes onto your roof. The roofer quotes you $10,000 for the repairs. Not exactly pocket change.

Your homeowners policy has a $1,000 deductible. Here’s how that plays out:

- You Pay First: You’re on the hook for the first $1,000 of that repair cost.

- Insurer Pays the Rest: Once your $1,000 is paid, your insurance carrier cuts a check for the remaining $9,000 to get your roof fixed, as long as it's within your policy limits.

Now, what if the damage was minor—say, only $800? In that situation, you'd cover the entire cost yourself. Since the bill is less than your $1,000 deductible, there’s no reason to file a claim. If you want to get a better handle on the claims process, our guide on how to file a property damage claim is a great resource.

Your deductible acts as a filter. It separates the small, manageable stuff from the major disasters that could seriously damage you financially.

An Auto Insurance Claim Example

It’s the same basic idea for your car, though you’ll often find different deductibles for different coverages (like collision vs. comprehensive). Let’s assume you have a $500 collision deductible.

You get into a parking lot fender-bender, and the body shop says it’ll cost $3,000 to make your car look new again.

- Your Share: You pay the shop the first $500.

- Insurer's Share: Your insurance company then covers the other $2,500.

This setup gives you some skin in the game for every claim, which is a big reason why insurance remains affordable for everyone.

Per-Claim vs. Annual Deductibles

It’s also crucial to know how often you have to pay a deductible. For almost all property and casualty policies—like your home and auto insurance—deductibles are applied on a per-claim (or per-occurrence) basis.

This means you pay the deductible for each separate incident.

- Per-Claim Deductible: If a hailstorm damages your roof in May (Claim #1) and you have a kitchen fire in October (Claim #2), you have to meet your deductible for both events.

- Annual Deductible: You see this more with health insurance. You pay out-of-pocket for medical care until you hit a set amount for the year. After that, your insurer starts covering the lion's share of your bills for the rest of the year.

For home and auto policies, you should always assume your deductible resets with every new claim unless your agent has explicitly told you otherwise. Being prepared for a claim can make all the difference, and creating a detailed Home Inventory For Insurance Claims is one of the smartest things you can do ahead of time.

Deductibles Across Different Types of Insurance

Insurance deductibles aren't a one-size-fits-all deal. While the basic idea is always the same—it's the portion of a claim you pay out of pocket—how it actually works can change quite a bit from one policy to another. Getting a handle on these differences is crucial for understanding what you'll be responsible for when a claim hits, whether it’s for your car, your home, or your business.

Think of it this way: your house key and your car key both open locks, but you can’t use them interchangeably. In the same way, a deductible on a homeowners policy is built for a completely different set of risks than one for a commercial auto policy. Let’s break down how these play out in the real world.

Homeowners Insurance Deductibles

When it comes to homeowners insurance, you’ll typically encounter two main types of deductibles: a flat dollar amount or a percentage. This is a really important distinction, especially for those living in areas where events like hurricanes, hail, or earthquakes are a known risk.

- Fixed-Dollar Deductible: This is the one most people are familiar with. You pick a specific amount, like $1,000 or $2,500, and that’s what you pay for a covered claim, such as a kitchen fire or a break-in. It's simple and predictable.

- Percentage-Based Deductible: This one is a little different. It’s calculated as a percentage—usually between 1% and 10%—of your home's total insured value (often called Coverage A). So, if your home is insured for $500,000 and you have a 2% hurricane deductible, you’d be on the hook for the first $10,000 of damage from that specific peril.

It's actually pretty common for a single policy to have both. You might have a $1,000 standard deductible for most things, but a separate, higher percentage deductible that only applies to wind or hail damage. Taking a moment to review your homeowners insurance coverages explained can really help clarify how all these parts work together.

Auto Insurance Deductibles

With car insurance, deductibles are all about protecting your own vehicle. They don't apply to the liability coverage that pays for damage you cause to other people or their property. Instead, you'll choose separate deductible amounts for two key physical damage coverages:

- Collision Coverage: This is for when your car is damaged in a collision with another car or an object, like a fence or a light pole. A $500 deductible is a popular choice here.

- Comprehensive Coverage: This handles just about everything else—theft, vandalism, fire, hail damage, or hitting an animal. You might choose a different amount for this, maybe $250 or $1,000, depending on what you're most worried about.

This structure gives you some control. If you're more concerned about your car being stolen than getting into a fender bender, you could set a lower comprehensive deductible and a higher collision deductible. It’s a great way to fine-tune your policy to fit your budget and risk tolerance.

High-Net-Worth and Commercial Policies

Once we step into the world of insurance for high-net-worth families or businesses, deductibles get even more specialized. These policies are built to protect complex, high-value assets, and their deductible structures are designed to match.

For a high-net-worth client, a policy might have a standard deductible for the primary residence but then feature separate, often lower, deductibles for scheduled items like fine art, jewelry, or a wine collection. Umbrella policies, which provide an extra layer of liability protection, often come with something called a "self-insured retention" (SIR). An SIR functions just like a deductible, but it only kicks in if the claim isn't covered by an underlying policy like your home or auto insurance.

For a business, the deductible is more than just a number—it's a strategic tool for managing risk and controlling costs. A company might deliberately choose a higher deductible on its property policy to get a lower premium, then redirect those savings into better fire suppression systems or other loss-prevention measures.

You'll find a wide variety of deductible types in commercial insurance:

- Business Owner's Policy (BOP): Typically has a straightforward, per-occurrence deductible for property claims.

- Commercial Auto: Works much like personal auto, with separate deductibles for physical damage.

- Cyber Liability: This is a big one. A cyber policy might have different deductibles for different parts of a claim, like one for the initial data breach response and another for the business interruption losses that follow.

The commercial insurance landscape is always shifting to keep up with new threats, from climate-related disasters to soaring inflation. While deductibles have stayed relatively flat in some sectors, insurers are getting smarter. They are less willing to lower deductibles for high-risk areas like commercial auto or for properties in catastrophe-prone regions. This dynamic environment, where global insured losses from weather events alone can hit $105 billion in just nine months, really highlights why the deductible is such a critical part of the risk management puzzle.

How to Choose the Right Deductible for You

Picking the right insurance deductible isn't about finding some magic number; it's a very personal financial call. The best choice for you hinges on your specific circumstances, how comfortable you are with risk, and your overall financial health.

Think of it as a balancing act. You need to take a good, honest look at your savings and figure out what you could reasonably pay out of pocket if something went wrong.

The most important question to ask yourself is this: "What amount could I comfortably pay tomorrow, without any warning, that wouldn't put me in a serious financial bind?" Your answer is the cornerstone of a smart deductible strategy.

Take Stock of Your Personal Risk

Before you can land on a number, you have to know where you stand. This means looking beyond your bank balance and thinking about your lifestyle, the assets you're protecting, and how likely you might be to file a claim.

Start with your emergency fund. A solid rule of thumb is to have at least three to six months of living expenses tucked away. If you’ve got a healthy safety net, you can probably handle a higher deductible in exchange for lower monthly premiums.

On the other hand, if you're still building up your savings, a lower deductible is likely the safer bet. Yes, your premium will be a bit higher, but it shields you from a large, unexpected bill that could completely derail your financial goals. It’s a little extra cost for priceless peace of mind.

High Deductible vs Low Deductible Which Is Right for You?

The choice between a high and a low deductible boils down to a classic trade-off: save money now or reduce your risk later. Neither one is automatically better—it’s all about what fits your financial reality at this moment.

This table cuts through the noise and lays out the pros and cons of each approach.

| Consideration | High Deductible Plan | Low Deductible Plan |

|---|---|---|

| Monthly Premium | Lower (Saves you money every month) | Higher (Costs you more every month) |

| Out-of-Pocket Cost | Higher (You pay more when you file a claim) | Lower (You pay less when you file a claim) |

| Best For | People with a strong emergency fund, a lower risk profile, or those who rarely file claims. | People still building their savings, those with a higher likelihood of claims, or anyone who values predictable costs. |

| Potential Risk | A large, unexpected claim could be a huge financial burden if your savings aren't ready for it. | You might pay much more in premiums over time, especially if you go years without filing a claim. |

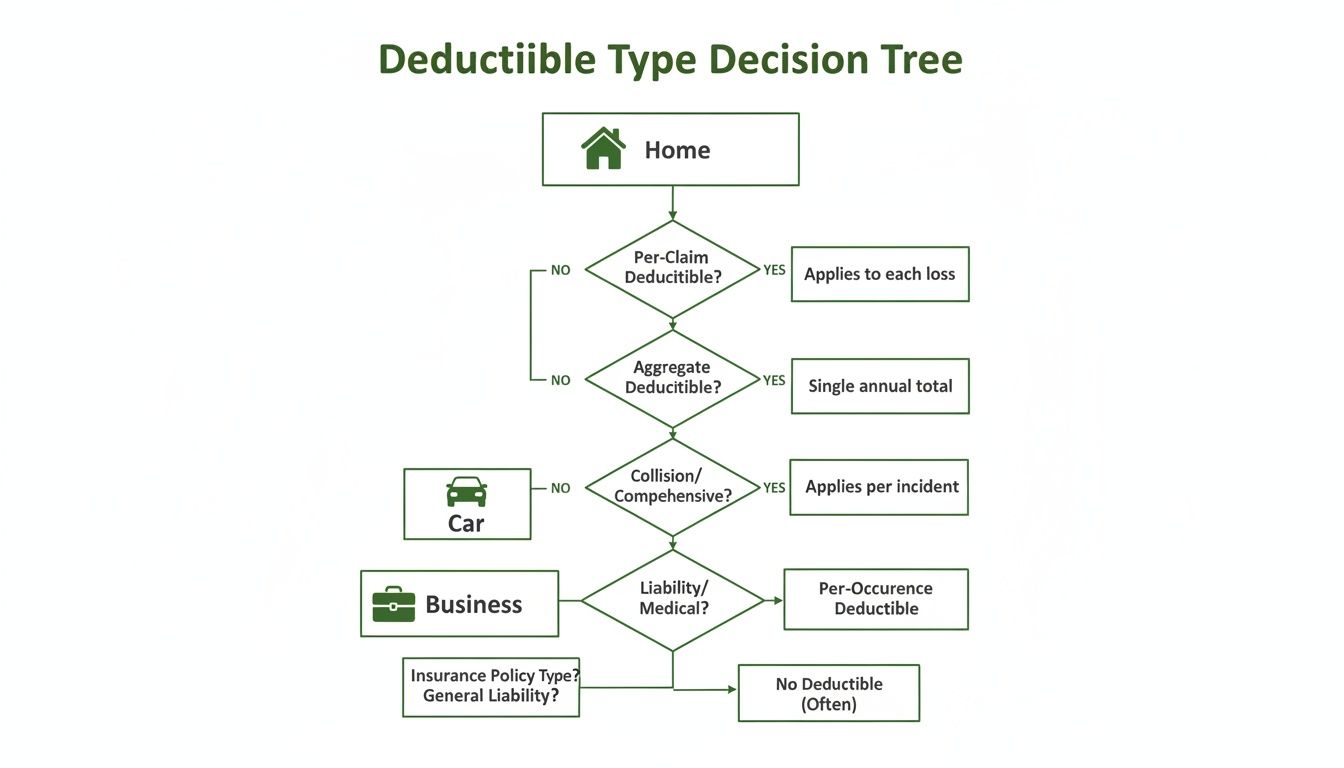

This infographic gives you a great visual for how different deductibles work across common types of insurance, helping you make the right call for your specific needs.

The big takeaway here is that every policy—whether it's for your home, car, or business—comes with its own unique set of factors that should influence your deductible strategy.

Matching Your Deductible to Your Life

Your ideal deductible isn’t a set-it-and-forget-it number. It’s something that should evolve right along with your life. What makes sense for a young family just starting out won’t be the best fit for a small business owner or a high-net-worth individual.

-

For Homeowners: If your emergency fund is a work-in-progress, a lower deductible on your home and auto policies can be a lifesaver, protecting your budget from nasty surprises.

-

For Small Business Owners: Cash flow is king. A slightly higher deductible can be a smart move to lower your fixed costs, as long as the business has enough liquid cash to cover it if a claim arises.

-

For High-Net-Worth Individuals: When you're protecting more complex assets, the strategy often involves layering deductibles—maybe a higher one on the main residence and smaller ones for scheduled items like fine art or jewelry.

Ultimately, choosing your deductible puts you in the driver's seat of your insurance costs. If you’re weighing your options, it's incredibly helpful to compare home insurance quotes at different deductible levels. This is the best hands-on way to see the direct impact on your premium and find that perfect sweet spot between cost and comfort.

Common Deductible Mistakes and How to Save Money

Knowing what a deductible is gets you halfway there, but avoiding the common pitfalls is what truly protects your finances. It's surprisingly easy to make a simple oversight that turns a manageable claim into a major financial headache.

The good news is that with a little know-how, you can steer clear of these traps and even use your deductible to your advantage.

Mistake #1: Overlooking the Fine Print

This is the big one. Many people assume they have a single, standard deductible for everything, but that's almost never the case—especially with homeowners insurance. Digging into the details is crucial.

Policies often hide separate, and usually higher, deductibles for specific types of damage.

- Wind and Hail Deductibles: If you live in a storm-prone area, your policy might have a 2% or 5% deductible for wind or hail. This could mean a bill for thousands of dollars, not the flat amount you were expecting.

- Hurricane or Named Storm Deductibles: These only kick in for specific, named weather events and often carry a hefty percentage-based cost.

- Separate Coverages: On your auto policy, you have one deductible for collision and another for comprehensive claims. You need to know both.

Getting caught off guard by a special deductible is a painful surprise. Always check your policy's declarations page to see exactly what you’re responsible for.

Mistake #2: Setting a Deductible You Can't Afford

It's tempting to jack up your deductible to get that lower monthly premium. It feels like a smart move, but it can backfire in a big way if you're not careful.

The biggest mistake is setting a deductible so high that you can't actually pay it when you need to. If your emergency fund can't cover it, your deductible is too high.

Think about it. A $5,000 deductible might save you a few hundred bucks a year, but what good is that if you can't come up with $5,000 after a major car wreck? Your savings become meaningless. Your deductible should never be more than what you have set aside and can access quickly.

Smart Strategies to Save on Insurance

Once you've avoided the common mistakes, you can start making strategic moves to lower your costs.

1. Know When to Skip a Claim

If you have a minor fender-bender and the repair cost is only slightly more than your deductible, it’s often smarter to just pay for it yourself. Filing a small claim can trigger a premium increase at renewal, costing you far more over time than the repair itself.

2. Bundle Your Policies

Combining your home and auto insurance with one company isn't just about a multi-policy discount. Some carriers offer a "single deductible" benefit. If one event—say, a tree falls on your garage and your car—damages both, you might only have to pay one deductible instead of two. Our guide on how to save on homeowners insurance dives deeper into these perks.

3. Review Your Coverage Annually

Life changes, and so does your financial picture. As your savings grow, you might become more comfortable raising your deductible to lower your premium. A quick chat with your agent once a year ensures your deductible is always aligned with your current financial reality.

Your Insurance Deductible Questions Answered

Even when you feel like you've got the basics down, deductibles can still be tricky. Let's tackle some of the most common questions that pop up, so you can handle your policy with more confidence.

Does My Deductible Apply to Every Insurance Claim?

Not always, and this is a big one that trips people up. Many assume the deductible applies to every single part of their policy, but that’s rarely how it works.

A perfect example is the liability coverage on your auto insurance. If you cause an accident, the part of your policy that pays for the other person's car or medical bills typically has no deductible.

Deductibles are usually for damage to your stuff. You’ll see them pop up for:

- Auto Insurance: When you're fixing your own car using collision or comprehensive coverage.

- Homeowners Insurance: When you're repairing your house or replacing your personal property after a covered event.

The best place to get a straight answer is your policy's declarations page. It'll spell out exactly which coverages have a deductible and for how much.

Can I Change My Deductible Amount?

Absolutely. You can change your deductible pretty much anytime—you don't have to wait for your policy to renew.

Let's say your emergency fund has grown and you're feeling more financially secure. A quick call to your agent is all it takes to raise your deductible. It's one of the simplest and most powerful ways to manage your insurance costs. Raising your deductible lowers your premium right away, while lowering it will cost you more. It's a lever you can pull to make sure your coverage fits your financial reality today.

What Is a Vanishing Deductible?

Think of it as a loyalty reward from your insurance company. A vanishing deductible (sometimes called a disappearing deductible) is an add-on that reduces your deductible for every year you don't file a claim.

For example, your deductible might drop by $100 for each claim-free year. Stick with it long enough, and your deductible could shrink to nothing. It's a nice little incentive for being a safe driver or a responsible homeowner, and it can save you a bundle if you eventually do need to make a claim.

Should I Report a Claim That Is Less Than My Deductible?

This is a great question. Even if the damage looks minor and the repair bill seems like it will be less than your deductible, it’s often smart to at least talk it over with your agent.

Why? Because initial estimates can be wrong. What looks like a small dent could be hiding bigger problems underneath, and costs can quickly spiral.

Plus, giving your insurer a heads-up creates a record of the incident. This can be a lifesaver if another person was involved who later decides to claim more serious injuries or damages. Reporting it—even if you don't open a claim—gets your side of the story on the books from day one.

Navigating the fine print of an insurance policy can feel like a maze, but you don't have to go it alone. The experts at Wexford Insurance Solutions are here to give you clear answers and personalized guidance, making sure your coverage is a perfect fit for your life. Find peace of mind by exploring your options at https://www.wexfordis.com.

12 Essential Types of Commercial Insurance Coverage for Your Business in 2026

12 Essential Types of Commercial Insurance Coverage for Your Business in 2026