The main difference between umbrella liability and excess liability boils down to one key idea: an umbrella policy broadens your coverage and increases your limits, while an excess policy just gives you higher limits. It’s like the difference between building a brand-new, larger roof that also extends over your patio (that’s the umbrella) versus simply adding a second layer of shingles to your existing roof (that’s excess).

Umbrella vs Excess Liability Key Differences Explained

Getting a handle on how these two types of policies work is essential for anyone serious about protecting their assets. Both are designed to kick in after your primary policies, like homeowners or auto insurance, have paid out their maximum. But that's where the similarities end.

Excess liability is a straight-up extension. It mirrors the exact same terms, conditions, and exclusions of the underlying policy it sits on top of. No new protections, no extra features—it just adds more money to the pile.

An umbrella policy, on the other hand, is built to do more. Sure, it gives you higher liability limits, but its real power lies in its ability to “drop down” and cover claims your primary policies won’t touch. Think of things like libel, slander, or false arrest. This is all about understanding insurance policy limits and knowing when and where you might need to go beyond them.

Core Functional Differences

You really see the difference when a major claim hits. An excess policy is rigid—it follows the rules of the policy beneath it, no exceptions. An umbrella is much more flexible, acting as a true safety net to fill in those dangerous gaps in your liability shield. That gap-filling function is exactly why it's such a go-to choice for both families and businesses with a lot to protect.

We dive deeper into the specifics in our guide to excess liability insurance.

This distinction is especially critical in today's world. A 2023 analysis found that umbrella policies protected 40% more high-value assets in litigious areas like New York, where legal awards are soaring. Why? Because a huge chunk of umbrella claims stem from situations where a primary policy offered zero coverage, meaning an excess policy would have been useless.

To help you see the difference clearly, let's look at a quick side-by-side comparison.

Umbrella Liability vs Excess Liability At a Glance

The table below breaks down the fundamental differences between these two policies, giving you a high-level view of what each one is designed to do.

| Feature | Umbrella Liability | Excess Liability |

|---|---|---|

| Primary Function | Increases liability limits AND broadens coverage | Only increases liability limits |

| Coverage Scope | Can cover claims excluded by underlying policies | Strictly follows the terms of the underlying policy |

| "Drop-Down" Ability | Yes, for claims not covered by primary insurance | No, it only follows the primary policy's form |

| Common Use Case | Comprehensive personal or commercial asset protection | Increasing limits for a single, specific risk |

Ultimately, your decision comes down to what you're trying to achieve. Do you just need to beef up the dollar amount of your existing protection? Or do you need a much wider net to catch the kinds of risks you might not see coming?

Analyzing the Scope of Coverage for Each Policy

When you get past the dollar signs, the real difference between an umbrella policy and an excess liability policy comes down to one thing: the scope of protection. They might both add millions to your coverage, but they do it in fundamentally different ways.

An excess liability policy has one job and one job only: to give you more of the exact same coverage you already have. It's a straight vertical boost to your policy limits, nothing more.

This is what we in the industry call a “follow form” policy. It perfectly copies the terms, conditions, and—crucially—the exclusions of your underlying insurance. If your primary business liability policy excludes claims related to professional errors, your excess policy will not cover them either. It can't and won't step in for anything your original policy denies.

The Rigid Nature of Excess Liability

Think of your primary insurance as the foundation and first floor of a building. An excess policy simply adds more floors directly on top. It makes the building taller (higher limits), but the footprint on the ground never changes.

This works perfectly if your main worry is that a covered claim will be bigger than your primary policy can handle. A major car accident with severe injuries is a classic example. Your auto policy covers it, but the costs are huge. The excess policy just kicks in with more money once the auto policy is maxed out.

How Umbrella Policies Broaden Your Protection

An umbrella policy is a different beast altogether. Yes, it also gives you higher liability limits, but its signature move is broadening the types of risks you're protected against. An umbrella policy doesn't just build your coverage higher; it also makes it wider.

It accomplishes this with its “drop-down” coverage feature. This is the game-changer. If you face a lawsuit for something that isn't covered by your homeowners, auto, or other underlying policies, the umbrella can "drop down" and act as the primary insurance for that specific claim.

An umbrella policy is a true safety net. It's designed with the understanding that your standard policies have gaps, and it's built specifically to fill them. It offers a much more complete defense against a wider range of unexpected legal threats.

When this drop-down feature is triggered, you'll first have to pay a Self-Insured Retention (SIR). The SIR is a set amount, like a deductible, that you pay out-of-pocket before the umbrella coverage starts. It's typically between $250 and $10,000 and only comes into play when the umbrella is covering a claim that your other policies won't.

For a deeper dive into this, check out our detailed guide on what is umbrella insurance.

Real-World Examples of Broader Coverage

The true value of an umbrella policy shines when you're hit with a lawsuit for things that standard policies almost never cover.

Here are a few common scenarios where an umbrella policy saves the day:

- Libel and Slander: You leave a scathing online review for a contractor, and they sue you for defamation, claiming you ruined their business. Your homeowner's policy won't touch this.

- False Arrest: As a small business owner, you mistakenly accuse a customer of shoplifting, and they are briefly detained. The resulting lawsuit for false arrest isn't covered by standard general liability.

- Wrongful Eviction: You're a landlord, and a former tenant sues you, claiming they were evicted without proper legal cause.

In every one of these situations, an excess liability policy would be useless because the underlying policies don't cover these "personal injury" offenses in the first place. An umbrella policy, however, would drop down. After you pay your SIR, it would step in to cover your legal defense and any settlement or judgment.

This is the core distinction: excess liability adds more money, while an umbrella adds more money and more types of protection.

Putting It All to the Test: Real-World Scenarios

The technical jargon of insurance policies can feel a bit abstract. So, let’s ground these concepts in reality. To truly understand the difference between an umbrella and an excess liability policy, we need to move past definitions and look at how they perform when things go wrong. These scenarios will show you exactly how the choice between "higher limits" and "broader protection" plays out in real life.

The Severe Car Accident

Picture this: a moment of distraction on the freeway causes a multi-car pileup. You’re found to be at fault, and the aftermath is devastating—serious injuries, extensive property damage, and a lawsuit. The total damages climb to $1.5 million, but your auto insurance liability limit is capped at $500,000.

-

How an Excess Policy Responds: An excess liability policy would kick in exactly as intended. It would pay the remaining $1 million after your primary auto policy has been exhausted. It does its job perfectly by simply adding more money on top of a covered claim.

-

How an Umbrella Policy Responds: An umbrella policy would also cover that $1 million shortfall. In this case, since the claim was a standard auto accident covered by your underlying policy, both insurance types perform identically.

The Backyard Pool Party Injury

Let's try another common scenario. You're hosting a summer barbecue, and a guest slips on the wet patio by the pool, sustaining a severe spinal injury. The medical bills and subsequent lawsuit for negligence add up to $1.2 million. Your homeowner's policy provides $500,000 in liability coverage.

-

How an Excess Policy Responds: Just like in the car crash example, your excess policy would cover the $700,000 difference after your homeowner's insurance pays its limit. It follows the form of the primary policy, no more and no less.

-

How an Umbrella Policy Responds: Again, the umbrella policy provides the same $700,000 in extra coverage.

So far, the two policies look like they do the exact same thing. But the next examples are where the crucial differences really come to light.

The true test of a liability policy isn't when it covers something expected; it's when it responds to the unexpected. An umbrella policy is designed for those "what if" scenarios that standard insurance simply ignores.

The Defamation Lawsuit from an Online Comment

You leave a scathing online review for a local contractor, and the business owner sues you for libel, claiming your words caused significant financial damage. They’re seeking $250,000 in damages, not including the astronomical legal fees.

-

How an Excess Policy Responds: This is a problem. Your standard homeowner's policy almost certainly excludes personal injury claims like libel and slander. Since an excess policy only follows the rules of the underlying coverage, it provides zero protection. You’d be on the hook for every penny of your legal defense and any judgment against you.

-

How an Umbrella Policy Responds: This is where the umbrella policy proves its worth. Because libel is a risk your homeowner's policy doesn’t cover, the umbrella’s unique "drop-down" feature activates. After you pay a small deductible, known as a Self-Insured Retention (SIR)—often around $1,000—the umbrella policy steps in to cover the legal bills and the $250,000 judgment.

This one distinction is why so many families and professionals see the slightly higher premium for an umbrella policy as a non-negotiable investment. For a deeper dive into figuring out your needs, check out our guide on how much umbrella insurance you might need.

Unique Risks for High-Net-Worth Individuals

For clients with substantial assets, the potential for liability gets more complicated and far more expensive.

Think about these situations:

- Domestic Employee Lawsuit: A long-time nanny or housekeeper sues for wrongful termination.

- Non-Profit Board Liability: You volunteer on a non-profit board, and a decision you voted on leads to a major lawsuit against the organization and its directors.

- Recreational Vehicle Accidents: A fun day out on your boat or ATV ends in an accident that causes serious injury.

These are the types of claims that often fall squarely into the coverage gaps of primary insurance policies. An excess liability policy would be powerless to help, but a true umbrella policy is built to fill these very gaps and stand between a lawsuit and your hard-earned wealth. For more advanced strategies, it's also worth exploring professional advice on protecting assets from lawsuits.

The numbers back this up. A recent industry analysis revealed that 72% of umbrella policies issued since 2018 included drop-down coverage that was critical in preventing asset liquidation in nearly 60% of claims over $2 million. Excess policies, by comparison, only extended the limits and couldn't step in to fill the gaps, leaving policyholders exposed. This highlights just how vital a true umbrella policy is for modern asset protection.

A Business Owner's Guide to Liability Coverage

When you run a business, liability isn't just one risk—it’s a complex web of exposures. A single mishap can trigger multiple policies, and that’s why understanding the difference between an umbrella and an excess liability policy is so critical. This isn't just an insurance detail; it's a strategic decision that can make or break your company's future.

Think of an excess liability policy as a simple booster shot. It provides a straightforward, vertical increase in the limits for a single underlying policy. If your commercial auto policy has a $1 million limit, a $5 million excess policy stacks right on top, giving you a $6 million limit for the exact same covered events. It’s a clean, targeted solution for a very specific, known risk.

But business risks are rarely that clean. Imagine a multi-vehicle accident involving one of your company trucks. It’s not just a commercial auto claim anymore. It could easily loop in your general liability if cargo created a hazard, and even employers' liability if your driver was injured. This is where an umbrella policy really proves its worth.

The Power of Unified Protection: The Commercial Umbrella

A commercial umbrella policy is built for the messy reality of running a business. Instead of just boosting one policy, it spreads a single, unified layer of higher protection over several underlying policies at once. It’s a much more efficient and robust way to manage risk.

A single umbrella policy can extend its higher limits over multiple foundational coverages:

- Commercial General Liability: For things like a customer slipping and falling in your store.

- Commercial Auto Liability: Protecting your fleet of vehicles and drivers out on the road.

- Employers' Liability: Shielding you from lawsuits that might arise from employee injuries.

By covering all these at once, the umbrella prevents a catastrophic claim from wiping out one policy’s limits and leaving your business dangerously exposed elsewhere. It creates a cohesive defense, not a patchwork of individual limits. To learn more, check out our detailed guide on what is commercial umbrella insurance.

How These Policies Respond in the Real World

Let's walk through a couple of common business scenarios to see how each policy would actually perform.

Scenario 1: The Major "Slip-and-Fall" Lawsuit

A customer has a serious fall at your retail location and suffers a life-altering injury. The court awards a $2 million judgment, but your General Liability policy is maxed out at its $1 million limit.

- Excess Liability Response: If you had an excess policy specifically for your General Liability, it would kick in and cover the remaining $1 million. It does its job perfectly for this single-policy event.

- Umbrella Liability Response: Your commercial umbrella would also step in to pay that $1 million difference. In this particular case, both policies perform identically.

Scenario 2: The Advertising Injury Claim

Your marketing team accidentally uses a copyrighted photo in a new ad campaign. The copyright holder sues you for advertising injury, but you discover your General Liability policy specifically excludes this type of claim.

- Excess Liability Response: Since the underlying policy doesn't cover the claim, the "follow form" excess policy won't either. It offers zero coverage, leaving you to pay the legal fees and any settlement out of pocket.

- Umbrella Liability Response: This is where the umbrella shines. It can "drop down" to fill the gap left by your primary policy. After you pay a small deductible, known as a Self-Insured Retention (SIR), the umbrella policy would step in to cover the legal defense and settlement costs, protecting your business from what could have been a financial knockout.

For any modern business, risks go far beyond physical accidents. An umbrella policy's ability to cover claims for things like advertising injury, libel, or slander isn't a luxury—it's essential protection against the full spectrum of liabilities you face today.

The data backs this up. In complex, multi-policy situations, a commercial umbrella is almost always the more effective tool. A 2023 analysis of 500 construction firms found that umbrella policies successfully mitigated 70% of major losses over $3 million. In contrast, excess policies failed in 40% of those cases because their narrow scope couldn't respond to the nature of the claim. This clearly shows the umbrella's advantage for any business that wants to grow without scaling its risk.

How to Choose the Right Liability Coverage

Picking the right liability coverage is about more than just finding the highest limit for the lowest price. It’s a strategic decision that demands an honest look at your financial situation, your lifestyle, and the unique risks you face. Getting this choice right—deciding between an umbrella and an excess liability policy—is absolutely critical to protecting your assets and your future.

The first step is always to ask the right questions. This isn't just another insurance purchase; it’s a deep dive into your personal risk profile. You need to start by taking a full inventory of what you have to protect and, just as importantly, where you might be vulnerable.

Your Personal Risk Assessment Checklist

Before you can even think about coverage types or dollar amounts, you have to get a clear picture of your exposure. A thoughtful review of your personal and professional life will show you whether a simple limit increase is enough or if you need something much broader.

Use these questions to get the ball rolling:

- What is my total net worth? Tally up everything—your home equity, savings, investments, and even retirement accounts. This number is what a court could potentially go after in a major lawsuit.

- What are my biggest liability risks? Go beyond the obvious. Do you own a swimming pool or a trampoline? Is there a teenage driver in the house? Do you own rental properties or sit on a non-profit board? Each of these adds a layer of risk.

- Does my online activity create risk? We live in a world where a bad online review, a hastily written social media post, or even a blog comment can spark a defamation or libel lawsuit. These are precisely the kinds of risks your standard policies won't touch.

- Do I own any "toys"? Boats, ATVs, and other recreational vehicles dramatically increase your liability exposure, often far beyond what a standard policy will cover.

This exercise helps ground the "umbrella vs. excess" debate in your reality, turning it from an abstract insurance concept into a practical, personal decision. For a more structured approach, a full insurance gap analysis can bring incredible clarity to your situation.

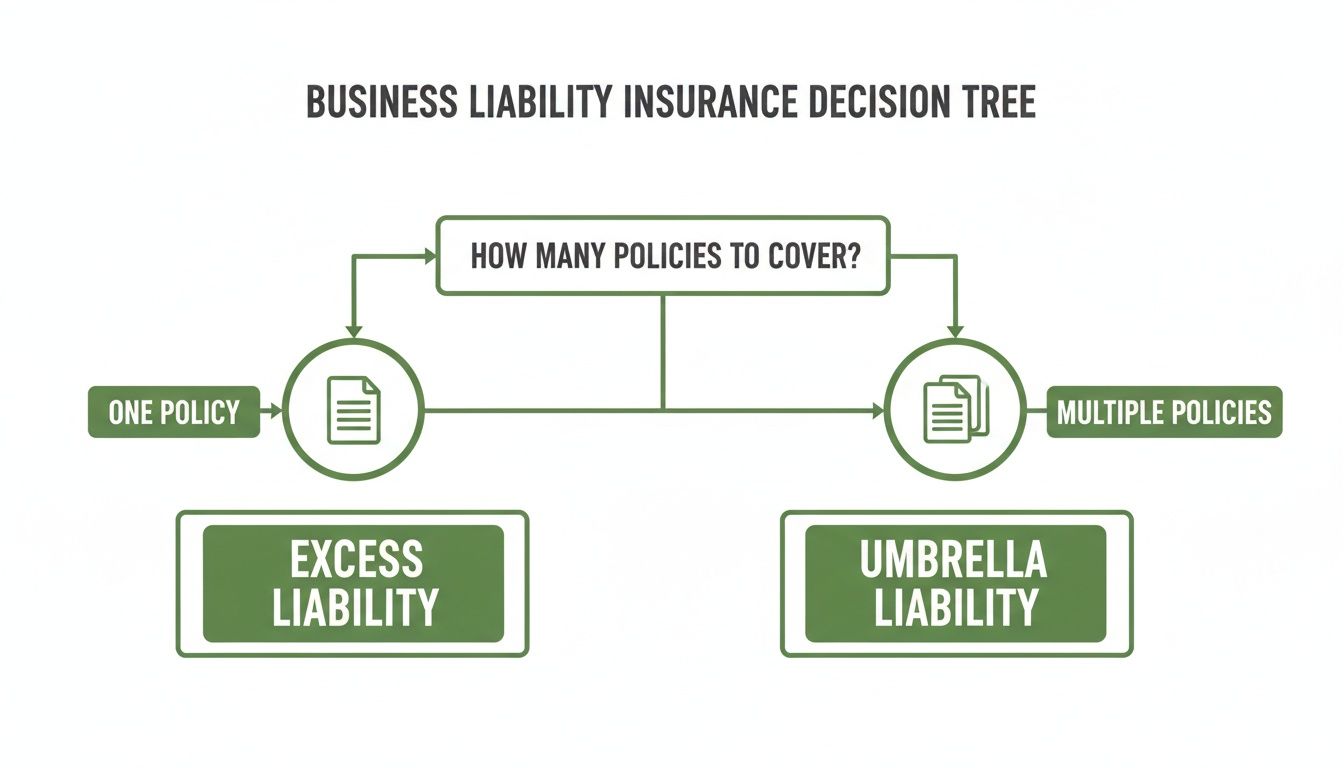

Visualizing Your Coverage Decision

For many business owners, the decision really comes down to the complexity of their current insurance program. The decision tree below lays out a common thought process for figuring out which policy makes the most sense.

As you can see, if your only goal is to jack up the limits on one specific policy, excess liability is a straight shot. But if your risks are spread out over multiple areas and covered by different policies, an umbrella provides a much more cohesive and comprehensive layer of security.

Evaluating Cost Versus Comprehensive Value

Of course, you’re going to compare premiums. An excess liability policy will almost always look cheaper on paper. But this is a classic case where looking at cost alone is a big mistake. That slightly higher premium for an umbrella policy is buying you something far more valuable than just higher limits—it’s buying broader protection and genuine peace of mind.

The real value of an umbrella policy isn't measured by its annual premium, but by the catastrophic financial loss it prevents. It's an investment in resilience, designed to protect you from the unexpected risks that can bypass standard insurance defenses.

Think of it like this: an excess policy reinforces one wall of your financial fortress. An umbrella policy expands the fortress itself, protecting new and previously exposed territory. That expanded coverage—for claims like libel, slander, or false arrest—is what justifies the modest additional cost, especially as jury awards and legal defense fees continue to skyrocket.

For many people, a $1 million personal umbrella policy can cost as little as $150 to $300 per year. That's a tiny price to pay to safeguard a lifetime of hard work. Ultimately, the choice is about moving beyond a simple price tag to make a smart assessment of your entire risk profile.

Frequently Asked Questions About Liability Insurance

Sorting through the details of liability insurance always brings up a few questions. Let's tackle some of the most common ones we hear about umbrella and excess liability policies. My goal here is to cut through the jargon and give you the straightforward answers you need to feel confident about your coverage.

Can I Have Both an Umbrella and an Excess Liability Policy?

You absolutely can, though it’s a strategy reserved almost exclusively for complex commercial insurance needs. A massive corporation, for instance, might layer an umbrella policy over its primary coverage to broaden its protection, then stack several excess liability policies on top to build up massive limits for very specific, high-stakes risks. Think of it as constructing a skyscraper of liability defense.

For most people, families, and even small to mid-sized businesses, that’s just overkill. A single, well-chosen umbrella policy is almost always the smarter, more efficient solution. It gives you both higher limits and broader coverage in one clean, simple package.

What Is a Self-Insured Retention in an Umbrella Policy?

Think of a Self-Insured Retention (SIR) as a special kind of deductible. It only comes into play when your umbrella policy has to step up and cover something your primary insurance policy won't touch. This is what allows for the "drop-down" coverage that makes an umbrella policy so powerful.

Here's how it works in the real world. Imagine you get sued for slander because of a comment you made online. Your homeowner's policy will likely have a "personal injury" exclusion, meaning it offers zero coverage. This is where your umbrella policy saves the day. Before it starts paying, you’d first cover the SIR amount yourself—usually a manageable sum like $1,000 or $2,500. After you've met that, the umbrella policy takes over completely, paying for your legal defense and any settlement, all the way up to its limit.

It's crucial to remember: the SIR doesn't apply if your underlying policy is already covering the claim. In a typical car accident where your auto insurance pays first, you won't pay a SIR for the umbrella coverage to kick in on top.

Are Umbrella Policies Considered Expensive?

That’s one of the biggest myths out there. When you consider the sheer amount of protection they offer, umbrella policies are an incredible bargain. For a typical individual, a $1 million personal umbrella policy usually runs somewhere between $150 and $300 a year. That’s just $12 to $25 a month for a huge safety net.

Of course, the final price tag is tied to your specific risk profile. Insurers will look at things like:

- How many homes, rental properties, and cars you own.

- Any "attractive nuisances" like a swimming pool, trampoline, or even certain dog breeds.

- Teenage drivers on your policy.

- Your own claims history.

For businesses, the cost is naturally going to depend on the industry, revenue, and day-to-day operations. But no matter the context, when you weigh the small annual premium against the devastating cost of a single major lawsuit, an umbrella policy delivers some of the best value for your insurance dollar.

Should My Primary and Umbrella Policies Be With the Same Insurer?

While you don't have to, it is highly recommended. Keeping your primary policies (home and auto) and your umbrella with the same insurance company just makes life so much easier.

The biggest advantage is a seamless claims experience. When a big claim happens, having one carrier means no finger-pointing between different companies about who pays what and when. This can save you from long delays and headaches right when you need support the most.

Beyond that, most carriers give you a significant multi-policy discount for "bundling" your coverage. So, not only do you streamline everything, but you also save money. Having a single point of contact for all your liability insurance simplifies payments, policy questions, and everything in between.

Figuring out the right liability protection is a critical step in building a secure financial future. Here at Wexford Insurance Solutions, our team specializes in looking at your unique situation to see if an umbrella or excess liability policy makes the most sense for you or your business. We’re here to offer expert guidance and find the right fit, so you can have genuine peace of mind.

Ready to build a stronger financial defense? Contact Wexford Insurance Solutions today for a complimentary policy review and personalized quote.

What Is a Deductible in Insurance and How Does It Work?

What Is a Deductible in Insurance and How Does It Work? Commercial Property Insurance Guide: Protect Your Business Assets Today

Commercial Property Insurance Guide: Protect Your Business Assets Today