Think of an insurance premium as your membership fee for a financial protection club. It's the regular amount you pay an insurance company to keep your coverage active. This payment is what buys you peace of mind, knowing the insurer has your back if a major, unexpected event occurs.

What an Insurance Premium Represents

Let's use an analogy. Picture your insurance policy as a giant, shared safety net. Your premium is your contribution to help hold up that net. When you pay it, you're essentially transferring the risk of a huge financial hit—like the aftermath of a serious car wreck or a fire at your business—from your shoulders to the insurance company's.

The insurer then pools all these payments from everyone they cover. This collective pot of money is used to pay for the claims that inevitably happen among the group. It’s a classic "strength in numbers" model that lets you manage a predictable, fixed payment instead of getting blindsided by a financially crippling expense.

The Price Tag for Protection

Your insurance premium isn't just a number pulled out of thin air. It’s a carefully calculated price based on one simple question: How likely are you to file a claim? The higher the insurer thinks that likelihood is, the higher your premium will be.

For instance, a driver with a history of accidents and speeding tickets is statistically more likely to be in another crash than someone with a spotless record. That higher risk translates directly to a higher auto insurance premium. This core principle explains why premiums can be so different for each person or business.

Your premium is the cost of shifting potential future financial burdens to an insurer. It transforms the possibility of a catastrophic, unknown cost into a fixed, manageable expense.

Ultimately, you are paying for certainty in an uncertain world. It’s important not to confuse this with other costs, like your deductible, which is the amount you pay out-of-pocket before your coverage kicks in. To get a clearer picture, it’s helpful to understand what a deductible is in insurance and how it works with your premium. Think of the premium as the key that unlocks your financial security—a vital part of any solid risk management plan.

How Your Insurance Premiums Are Calculated

Ever wonder what goes into that final number on your insurance policy? It’s not just pulled out of thin air. Insurers are essentially professional risk analysts, and they use a sophisticated mix of data, statistics, and actuarial science to figure out the likelihood you’ll file a claim—and how much it might cost.

Your premium is the price they put on taking that specific risk off your shoulders.

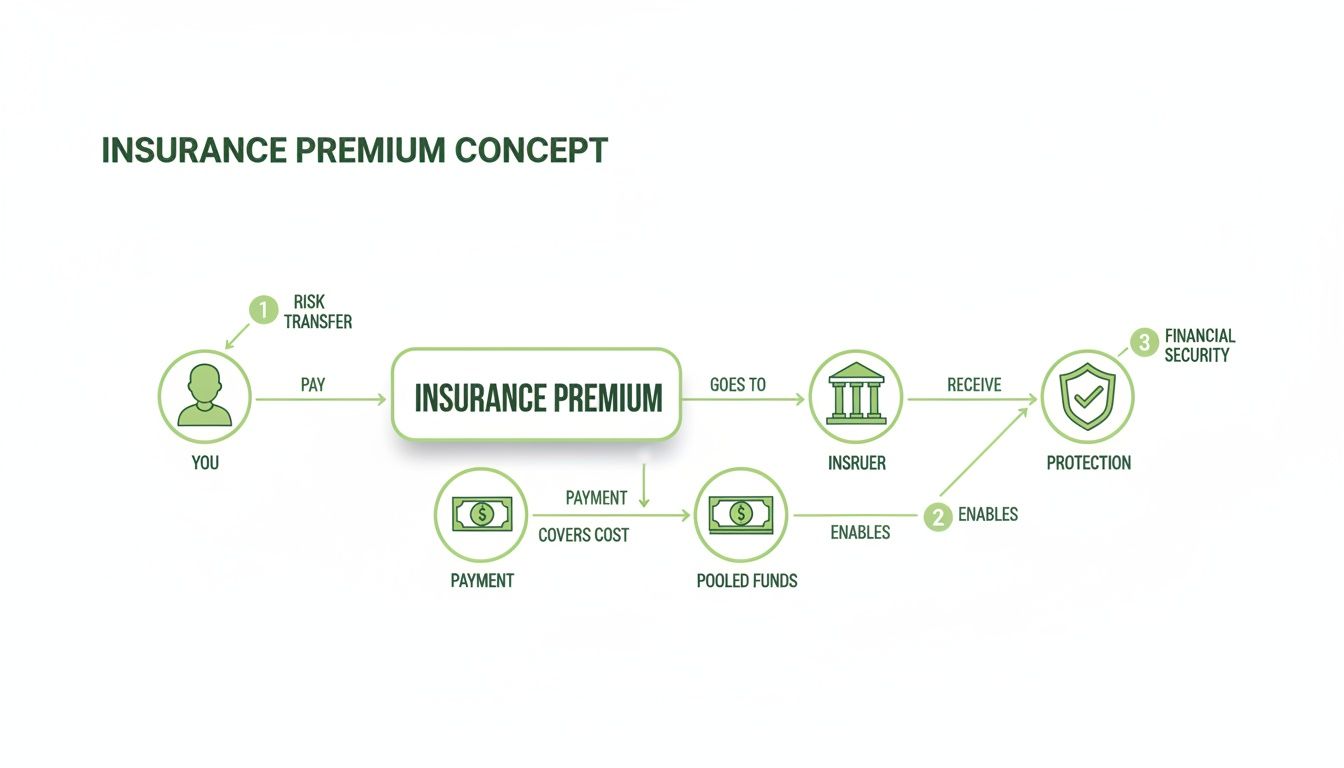

This simple diagram shows the fundamental exchange: you pay a premium, and in return, the insurer takes on your risk, giving you financial protection.

At its core, your payment buys you peace of mind and a safety net when you need it most.

The whole process kicks off with underwriting. This is the insurer's method for digging into the details to evaluate your specific risk. Based on what they find, they'll place you into a risk classification—a group of policyholders with a similar profile. This grouping allows them to establish a fair and consistent base rate for everyone in that category.

The Core Ingredients of Your Premium

So, what actually makes up the premium you pay? Recent reports show that the global insurance industry's total premium income hit EUR 7.0 trillion, growing at a rate of 8.6%. For both businesses and individuals, this highlights just how much risk is being transferred worldwide, influenced by everything from economic shifts to natural disasters. These massive numbers really bring home the value of finding a partner who can help you navigate the market and secure the best possible rates.

The final price tag on your policy is built from a few key components:

- Expected Claims Costs: This is the biggest piece of the puzzle. Using historical data and predictive models, the insurer estimates how much money it will likely pay out in claims for your risk group. If you're curious about how insurers measure this, our guide on what a loss ratio is in insurance dives deeper into the numbers.

- Administrative Expenses: This covers the cost of doing business. Think employee salaries, rent for their offices, marketing, and the technology needed to keep everything running smoothly.

- Profit Margin: Insurance companies are businesses, after all. A small margin is built into the premium to ensure they remain financially healthy, profitable, and, most importantly, have the capital to pay out large claims in the future.

Putting It All Together

Once the base rate for your group is set, the underwriter then adjusts it based on your unique circumstances to arrive at your final, personalized premium. This is why, for example, the calculations for whole life insurance premiums can look very different from those for a commercial property policy.

The ultimate goal of this detailed calculation is to strike a perfect balance. The insurer needs to collect enough in premiums to cover all expected claims and operational costs, all while staying competitive enough to win your business.

At the end of the day, your premium is the insurer’s best expert estimate of the financial risk you represent. In the next sections, we’ll break down the specific personal and commercial factors that can make that number go up or down.

Key Factors That Influence Personal Insurance Premiums

When you get a quote for personal insurance, whether it's for your car or your home, you're getting a price tag that's been calculated just for you. Insurers look at a whole host of factors to figure out how likely you are to file a claim. This is why you and your neighbor could have the exact same coverage but pay completely different premiums.

Getting a handle on these factors is the first real step to taking control of your insurance costs.

It all boils down to risk. Insurers are experts at spotting patterns in data that point to a higher or lower chance of a claim. Every detail you provide helps them build a clearer picture of your specific risk profile.

Your Personal Profile and History

The starting point for any premium calculation is you. Your personal details and history give insurers a foundational understanding of the risk they're taking on. They've found strong statistical links between certain life circumstances and the probability of someone needing to file a claim.

Here are some of the key personal factors they look at:

- Age and Experience: It’s a statistical fact that younger, less experienced drivers are involved in more accidents, which is why they face higher auto premiums. On the flip side, older, more established homeowners often benefit from lower rates.

- Driving Record: For car insurance, this is a big one. A clean record shows you're a responsible driver, while accidents and traffic violations signal higher risk. Many drivers wonder if your insurance rates will go up after a speeding ticket, and the answer is almost always a resounding yes.

- Claims History: If you’ve filed several claims in the past, an insurer might see you as more likely to do so again. This can lead to higher premiums for both home and auto policies.

- Credit History: In many states, your credit history is used to create a credit-based insurance score. Research has consistently shown a connection between this score and the likelihood of filing a claim.

Your Location and Assets

Where you live and what you’re insuring are just as important as who you are. A great deal of risk is geographic, and the specific details of your property or vehicle are weighed heavily.

For instance, someone who owns a home in an area prone to wildfires or hurricanes will naturally face higher premiums. The risk of a major weather event is simply greater. A recent lawsuit even pointed out that in just the first three quarters of 2024, these types of events led to nearly $80 billion in insured losses, which has a direct impact on the premiums everyone pays.

At its heart, the concept is simple: the greater the potential for a loss, the higher the premium needs to be to cover that risk. A driver in a dense city faces more daily traffic hazards than one in a rural town, just as a sturdy brick home might cost less to insure than one with a wood frame.

The choices you make also have a direct effect. If you choose a higher deductible—that’s the amount you agree to pay out-of-pocket on a claim before your coverage kicks in—your premium will go down. Likewise, the coverage limits you select will move the needle. More coverage means a higher premium, so it's all about finding the right balance between robust protection and what you can afford.

Understanding Commercial Insurance Premium Factors

When you're insuring a business, the game changes completely. An insurance premium isn't just about you anymore—it's a reflection of your entire operation's risk profile. While personal policies look at individual habits and assets, commercial insurance dives deep into a much wider, more complex pool of variables tied directly to how your business runs.

The fundamental question for an underwriter shifts from "what's the risk of this person?" to "what's the risk of this entire enterprise?" This means they're looking at everything from operational hazards to liability exposure and employee-related risks. A quiet accounting firm with five employees is playing a totally different sport than a construction company with fifty workers handling heavy machinery.

Your Industry and Operational Risks

The biggest piece of the puzzle is your industry classification. This simple code tells an insurer what your business does, immediately slotting you into a category with a known set of risks. A software startup, for example, is primarily worried about data breaches. A restaurant, on the other hand, has to juggle fire hazards, food safety liability, and the constant possibility of a customer slip-and-fall.

But it goes deeper than just the industry tag. Insurers get into the nitty-gritty of your day-to-day operations:

- Number of Employees: More people on the team usually means a higher chance of a workers' compensation claim. In fact, your total payroll is one of the main drivers of that premium.

- Business Location: Where you set up shop matters. A business in a high-crime area will see higher property insurance costs, just as one in a flood zone will need specific—and often pricey—coverage.

- Annual Revenue: Bigger revenue can signal bigger exposure. A company with millions in sales simply has more to lose from a business interruption than a small local shop, and premiums reflect that.

An insurance premium is the price tag for transferring business risk. Market conditions play a huge role in this pricing. For example, a recent trend saw global commercial insurance rates decline by 4%, with property, cyber, and financial lines all seeing reductions. For fleet operators, professionals needing cyber liability, or builders with risk coverage, this shift signals opportunities for better terms. You can find more details in this global insurance market index report.

Claims History and Coverage Specifics

Your company's track record speaks volumes. A history dotted with frequent or severe claims sends a clear signal to an underwriter: your business might be a higher risk than a competitor with a clean slate. This is where your experience modification rate becomes so important, especially for workers' compensation. You can learn more about how this works by reading our guide explaining what an experience modification rate is. A good "mod rate" can unlock some serious discounts.

Finally, the types and amounts of coverage you choose are direct cost drivers. A basic general liability policy will always cost less than a comprehensive package that includes specialized protections like:

- Professional Liability (E&O): A must-have for any business that gives advice or provides professional services.

- Cyber Liability: Absolutely critical for any company that handles sensitive customer data.

- Commercial Auto: A non-negotiable for businesses that own and operate a fleet of vehicles.

Each layer of protection you add contributes to the final premium. The real art is striking that perfect balance between rock-solid coverage and a cost that doesn't break the bank.

Practical Strategies to Lower Your Insurance Premiums

Once you understand how your insurance premium is calculated, you have the power to influence it. While you can't change things like your age or where you live, many other factors are well within your control. Taking a few proactive steps can lead to some serious savings, putting real money back in your pocket.

This isn't about cutting corners and leaving yourself underinsured. It’s about making smart, strategic adjustments to get the most competitive price for the protection you actually need. You'd be surprised how small changes can add up to big discounts.

Immediate Actions You Can Take

Looking for a quick win? Several straightforward adjustments can lower your premium almost right away. These strategies involve tweaking your policy structure and showing insurers that you’re a responsible, lower-risk client.

Here are some of the most effective tactics to try:

- Increase Your Deductible: This is one of the fastest ways to see your premium drop. By agreeing to pay more out-of-pocket if you file a claim (say, raising your deductible from $500 to $1,000), you take on a bit more of the initial risk. Your insurer rewards this with a lower rate.

- Bundle Your Policies: Insurance companies love loyalty. Most offer a significant multi-policy discount—often between 10-25%—when you bundle different policies like home and auto with them. It also simplifies your life to have everything in one place.

- Install Safety and Security Devices: Insurers see proactive risk management as a huge plus. Installing a monitored security system, smart smoke detectors, or even a water-leak sensor in your home can often qualify you for a nice discount on your homeowner's policy.

Long-Term Strategies for Lasting Savings

Beyond those quick fixes, certain long-term habits and regular check-ins can keep your premiums as low as possible for years to come. It’s all about maintaining a low-risk profile and making sure your coverage keeps up with your life.

It's important to remember that larger forces are at play. An insurance premium is ultimately a payment for financial protection, and its cost is shaped by everything from inflation to major weather events. Globally insured losses from natural catastrophes topped $100 billion in a recent six-month period alone, and that inevitably trickles down to the rates we all pay. This trend, highlighted in a recent global insurance outlook, makes it even more crucial to manage what you can control.

Periodically reviewing your coverage is essential. As your circumstances change—you sell valuable items, your car gets older, or your kids move out—your insurance needs shift. An annual review ensures you aren't paying for protection you no longer need.

Maintaining a good credit score is also surprisingly important, as many insurers use it as a factor to predict risk. Finally, don't be afraid to shop around every so often to see what’s out there. Comparing quotes is one of the best ways to ensure you’re getting a fair price.

For a deeper dive into this topic, check out our article on how to lower home insurance premiums.

Your Partner in Optimizing Insurance Costs

So, now you have a much better handle on what an insurance premium is and what goes into calculating it. You’re no longer just a passive buyer; you're an informed consumer who understands that the premium is the price you pay to hand off risk. We've walked through how your unique story—whether it's about your home, your car, or your business—shapes that price.

Most importantly, you now have practical, real-world strategies to lower your costs without leaving yourself dangerously exposed. But that doesn’t mean you have to figure it all out on your own.

Wading through underwriting guidelines, risk models, and endless policy options can feel like a full-time job. This is where partnering with a dedicated insurance professional makes all the difference. An independent agent or broker works for you, not a specific insurance company. Their entire focus is to be your advocate, using their inside knowledge to find that sweet spot between rock-solid coverage and a premium that makes sense.

Finding the Right Coverage at the Right Price

Think of an expert partner as your personal shopper in the insurance world. They have access to a whole network of different carriers and can hunt down the best rates and policy features for you. They know the little details that add up to big savings, like which companies offer the best bundling discounts or what safety credits you might be missing out on.

The right insurance strategy isn’t just about being covered; it’s about being covered intelligently. A professional review can uncover gaps in your protection or areas where you might be overpaying, ensuring your hard-earned money is working efficiently to protect what matters most.

By teaming up with a knowledgeable professional, you get an ally committed to lowering your total cost of risk. If you're curious about what to look for in a partner, our guide on how to choose an insurance broker has some great insights.

Ready to see how it works? Contact Wexford Insurance Solutions today for a professional review of your policies.

A Few Lingering Questions About Insurance Premiums

Even with all the details laid out, a few questions always seem to pop up. Let's tackle some of the most common ones head-on to clear up any confusion about what goes into your insurance costs and how much control you really have.

"My Premium Went Up, but I Never Filed a Claim. What Gives?"

This is probably one of the most frustrating experiences for any policyholder. You've done everything right—no accidents, no claims—yet your bill goes up. What's going on?

The reality is, your personal history is just one piece of a much larger puzzle. Insurers are constantly looking at the bigger picture, and factors totally outside of your control can push rates up for everyone.

Think about things like:

- More Local Claims: Has your area been hit with more hailstorms, wildfires, or even a jump in auto thefts? If the insurer is paying out more claims in your zip code, they'll often adjust rates for the entire community to cover that increased risk.

- The Rising Cost of Everything: Inflation hits the insurance world hard. The cost of lumber, car parts, and medical services keeps climbing. That means the potential cost for the insurer to fix your car or rebuild your home next year is higher, and premiums have to reflect that.

- Updated Risk Maps: Insurers are always refining their data. A new analysis might show that your neighborhood is now at a higher risk for flooding or other hazards than previously thought, leading to a rate adjustment.

"What’s the Real Difference Between a Premium and a Deductible?"

It’s easy to mix these two up, but they play very different roles.

Think of your premium as your regular subscription fee. It's the amount you pay—usually monthly or annually—to keep your insurance coverage active. It's a predictable, ongoing cost.

Your deductible, on the other hand, only comes into play when you actually need to use your insurance. It's the amount of money you have to pay out of your own pocket for a covered loss before the insurance company steps in to pay the rest.

A simple rule of thumb: a higher deductible usually means a lower premium. By agreeing to cover a larger chunk of the initial cost yourself if something happens, you're reducing the insurer's immediate risk, and they thank you for it with a lower rate.

"Can I Pay My Premium in Monthly Installments?"

Absolutely. Almost every insurance company today offers flexible payment options. You can typically choose to pay monthly, quarterly, semi-annually, or all at once for the year.

Just keep in mind that choosing to pay in smaller installments often comes with a small service or convenience fee. If you can swing it, paying the full annual premium upfront can sometimes earn you a small "paid-in-full" discount.

At Wexford Insurance Solutions, we believe that a clear understanding of your premium is the first step toward taking control of your insurance costs. Our team is here to go beyond the basics, using better analytics and a truly personal touch to find that sweet spot between great coverage and a fair price.

Let us give your policies a professional review to make sure you're protected intelligently. Visit us at https://www.wexfordis.com to get started.

Commercial Property Insurance Guide: Protect Your Business Assets Today

Commercial Property Insurance Guide: Protect Your Business Assets Today Your Guide to the Home and Auto Insurance Bundle

Your Guide to the Home and Auto Insurance Bundle