A home and auto insurance bundle is simply a way to get both your homeowners and car insurance from the same company. It's a strategic move that does more than just tidy up your finances with one bill and one contact; it usually unlocks a pretty hefty multi-policy discount.

Understanding Your Insurance Bundle

Think about all your different subscriptions—streaming services, gym memberships, you name it. Your insurance policies can feel a lot like that. You've got one for the car, another for the house, and each comes with its own premium, due date, and phone number to call. Juggling them all can be a hassle, and you're often paying more for the inconvenience.

A home and auto insurance bundle is like the insurance industry's version of a value meal. When you buy both policies from the same provider, you get a much more convenient package, almost always at a better price than buying them separately. This simple act of consolidation has become one of the go-to strategies for anyone looking to get a handle on rising insurance costs.

Why Bundling Is Such a Smart Financial Move

Insurance companies value loyalty. When you place your trust in them to protect both your home and your vehicle, they're eager to reward that commitment with a discount. This isn't just some clever marketing tactic; it's a solid business decision for them. Loyal customers are simply more profitable in the long run, creating a win-win that has made bundling incredibly popular.

This trend is picking up speed as homeowners search for any relief they can get from climbing premiums. In fact, during the fourth quarter of 2023, a telling 47% of all homeowners insurance quote requests were bundled with auto insurance. That number jumped to 54% for actual quote submissions. It’s clear proof of a major consumer shift toward bundling for savings, as highlighted in Comscore's market analysis.

But the benefits go way beyond that initial discount. A bundle offers real advantages that make your life easier:

- Simplified Payments: You get one consolidated bill instead of trying to remember multiple due dates for different policies.

- A Single Point of Contact: Whether you have a question or need to file a claim, you only have one company to call. That’s a huge relief, especially after a stressful event like a car accident or storm damage.

- Streamlined Policy Management: With just one insurer, you can typically manage both policies through a single online account, making it simple to review or update your coverage.

A home and auto insurance bundle works by treating you as a preferred client. By entrusting more of your business to one carrier, you unlock savings and convenience that aren't available when your policies are scattered.

Of course, finding the best deal requires a bit of navigating. That's where an independent agent like Wexford Insurance Solutions comes in. We act as your personal insurance shopper, analyzing options from multiple top-rated carriers in states like New York and Florida to find the bundle that truly delivers the most value for you. You can learn more in our home and auto insurance comparison guide. This process ensures you get the perfect combination of coverage and cost, without the guesswork.

The Real Financial Benefits of Bundling Insurance

The promise of savings is what gets most people interested in a home and auto insurance bundle, but the actual financial impact is often bigger than you’d guess. Let's get past the vague promises and look at the hard numbers. The multi-policy discount isn't just a small perk; it’s one of the most significant price breaks you can get.

On average, combining your home and auto policies with a single insurer can knock 10% to 25% off your total premium. For a typical household, that adds up to hundreds—sometimes even thousands—of dollars back in your wallet every year. These aren't just random markdowns; they're a core part of how insurance companies do business.

Why Insurers Reward Bundling

So, what’s in it for them? It’s simple: insurance carriers see bundled clients as more stable and loyal. When you trust one company with both your home and vehicle, you're far less likely to jump ship every renewal period. That loyalty is incredibly valuable to them, and they’re willing to pass some of that value back to you through a discount.

It also helps them get a better handle on their own risk. A client with multiple policies gives an insurer a more complete picture of who they're covering, which they prefer. This creates a win-win, where your loyalty is rewarded with real savings. When you're trying to trim your budget, you'll find that one of the most effective strategies is actively bundling your policies to lower those costs.

The multi-policy discount is a powerful tool for reducing your overall insurance costs. It’s a direct reward for loyalty that allows insurers to build a stronger, more predictable client base while you keep more money in your pocket.

Potential Annual Savings with a Home and Auto Bundle

To put this into perspective, the table below shows how these percentages translate into actual dollars saved across different premium levels. It really helps to see how a seemingly small discount can make a big difference over the course of a year.

| Combined Annual Premium (Home + Auto) | 10% Bundle Discount (Annual Savings) | 15% Bundle Discount (Annual Savings) | 25% Bundle Discount (Annual Savings) |

|---|---|---|---|

| $3,000 | $300 | $450 | $750 |

| $4,500 | $450 | $675 | $1,125 |

| $6,000 | $600 | $900 | $1,500 |

As you can see, the savings can easily cover a few utility bills or a nice dinner out. For those looking for even more ways to save, you can learn more about how to lower home insurance premiums specifically.

More Than Just a Discount

But the financial perks of a home and auto bundle aren't just about the discount itself. The convenience it brings saves you time and cuts down on hassle, and that’s worth a lot. Consolidating your policies simplifies your life in a few key ways.

- Streamlined Billing: Forget juggling two separate bills with different due dates. You get one statement, making it easier to budget and reducing the risk of a missed payment that could put your coverage in jeopardy.

- One Point of Contact: Picture this: a bad hailstorm damages your roof and your car. With a bundle, you make one phone call to start both claims. Having a single point of contact during a stressful time like that is a huge relief.

- Simplified Management: Using a platform like Wexford's 24/7 client portal means you can see your documents, request changes, and manage everything in one spot. No more fumbling with multiple logins and apps to keep tabs on your insurance.

This all-in-one approach simply means less admin work for you. By putting all your insurance needs under one roof, you create a much more efficient way to protect your most important assets.

When Bundling Insurance Might Not Be Your Best Move

While bundling your home and auto insurance often feels like a no-brainer, it’s not always the smartest play. That multi-policy discount is definitely tempting, but chasing it can sometimes lead you to weaker coverage or even cost you more in the long run. The goal is to make sure the "value" you're getting isn't just a lower price tag, but rock-solid protection.

Sometimes, keeping your policies separate is simply the better strategy. The reality is, no single insurance company is the best at everything. An insurer might have fantastic, well-priced auto insurance with a great reputation for handling claims, but their homeowners coverage could be lackluster, especially if you live in a tricky market like Florida or New York.

Specialized Needs Can Outweigh Bundle Discounts

If you have unique assets or circumstances, they need specialized attention that a standard, one-size-fits-all insurer might not be equipped to provide. Forcing a bundle in these situations often means giving up essential protection just to get a mediocre discount. This is exactly when unbundling becomes the right move.

Think about these common scenarios where separate policies usually win out:

- High-Risk Homes: Is your house in a flood zone, a high-risk wildfire area, or does it have features like an old roof or a pool with a diving board? Mainstream insurers might refuse to cover it or charge an outrageous premium. Your best—and sometimes only—option might be a specialized insurer that focuses on high-risk properties, even if their auto rates can’t compete.

- Classic or High-Value Vehicles: Your 1967 Mustang or high-end luxury car needs more than a standard auto policy. It requires an agreed-value policy from a specialty carrier who truly understands its worth. Trying to bundle that with a standard home policy could leave you seriously underinsured if you ever have to file a claim.

- A Bad Driving Record but a Great Homeowner Profile: If someone in your household has a few accidents or tickets, their auto insurance rates are going to be high. Forcing a bundle could cause that high auto premium to drag your otherwise affordable home insurance rate up with it. It's often cheaper to place the high-risk auto policy with one carrier and keep your home policy with another that offers better rates.

Sometimes, the Math Just Doesn't Add Up

Beyond specialized needs, there are times when the numbers simply don't work in your favor. The global home insurance market is huge—projected to hit $234.6 billion in 2024—and the big push for bundling is often a strategy for insurers to grab market share. They use it to attract and keep customers, particularly as climate risks drive up costs. But that doesn't mean a bundle is automatically your cheapest option. You can find more data on the global home insurance market on gminsights.com.

The best insurance strategy isn't always the one with the biggest advertised discount. It's the one that provides the best coverage for your unique assets at the most competitive combined price—whether that comes from one carrier or two.

An independent agent might find that one company offers an incredible rate on your homeowners policy, while a totally different carrier has the most competitive auto insurance for your specific cars and driving history. Even after forgoing the multi-policy discount, the combined total of two separate, top-tier policies can be less than a single, mediocre bundle.

This is where working with an independent agency like Wexford Insurance Solutions really pays off. We don't work for one insurance company; we work for you. Our job is to shop the entire market, comparing the best bundled options against custom-built plans using separate policies from different carriers. We’re here to find the perfect fit, ensuring you never have to sacrifice crucial protection just to save a few dollars.

Key Factors That Influence Your Bundle's Cost

Finding a great home and auto insurance bundle is about more than just chasing the biggest discount. To get the best value, you have to understand what drives the price in the first place. Think of your premium as a personalized financial puzzle—every piece, from your driving habits to where your home is located, clicks together to form the final cost.

Insurance companies are, at their core, in the business of predicting risk. They need to figure out the odds that you’ll need to file a claim. To do that, they look at a whole range of factors connected to you, your property, and your vehicles. A clean history suggests you're a lower risk, and that almost always translates into lower premiums. On the other hand, things that point to a higher potential risk will naturally increase the cost of your bundle.

Your Personal Profile and History

Your personal history is a huge piece of the insurance pricing puzzle. Insurers look at your past behavior as the best predictor of your future actions, and a solid track record of responsibility is something they'll reward.

Here are the key personal factors they'll look at:

- Driving Record: Nothing works better for securing a low rate than a history free of accidents, speeding tickets, and other moving violations. Every little infraction can add points to your record, signaling to an insurer that you're a higher risk behind the wheel.

- Claims History: If you’ve filed several home or auto claims in the past few years, carriers will see you as more likely to file them again. A long stretch without any claims, however, can earn you some really significant "claims-free" discounts.

- Credit-Based Insurance Score: In most states, insurers use a special score derived from your credit history to help predict risk. A higher score often correlates with lower premiums, as industry data has shown a strong link between financial responsibility and having fewer claims.

Your Home and Its Unique Risks

Now for the "home" side of your home and auto insurance bundle. The premium is heavily influenced by the property itself. Where it’s located and how it’s built are critical parts of the risk assessment, especially in states like Florida and New York that face very specific environmental threats.

An insurer looks at your home a bit like a structural engineer would, sizing up its ability to stand up to potential threats. A well-maintained home in a low-risk area is simply far less expensive to insure than one sitting in a zone prone to frequent storms or other hazards.

The market is definitely feeling the pressure from these risks. As we move through 2026, the homeowners insurance industry is really wrestling with the effects of climate change and a growing number of coverage gaps. This has caused some sharp rate hikes in catastrophe-prone areas, pushing 54% of U.S. quote submissions toward home-auto bundles by the end of 2023. That’s a 15% jump in bundling as people scramble to find some financial relief.

Your Vehicles and Coverage Choices

Last but not least, the cars you insure and the coverage you choose play a massive role. A brand-new luxury SUV is going to cost more to insure than an older, reliable sedan—it's just a matter of how much it would cost to repair or replace it.

When you're building out the auto insurance part of your bundle, it’s also important to understand specific policy choices, like the difference between full and limited tort options. These decisions can have a big impact on both your premium and what you're covered for after an accident.

The deductibles you select also have a direct effect on your rate. Choosing a higher deductible means you’re agreeing to pay more out-of-pocket before your insurance kicks in, which lowers the insurer's risk and, in turn, lowers your premium. You can dive deeper into this by reading our guide that explains what a deductible in insurance is. Ultimately, tweaking these elements is how you strike the right balance between cost and protection.

How to Find the Best Home and Auto Insurance Bundle

Trying to navigate the insurance world on your own can feel like a chore, but finding the right home and auto insurance bundle doesn’t have to be so complicated. The trick is to have a simple, repeatable process. With a clear plan, you can cut through the noise and find a policy that delivers both real value and the protection you actually need.

The first step is simply knowing where you stand. Before you can even think about comparing new options, you need a clear picture of your current coverage. Grab your latest home and auto insurance declaration pages—think of them as the blueprints for your policies. They spell out all the important details like your coverage limits, deductibles, and what you’re paying.

Starting with a Personal Consultation

Once you have your current policies ready, it’s time to think about what you really need today. Things change. That's where working with an independent agent from Wexford Insurance Solutions makes a world of difference. Instead of you spending hours on the phone with different companies, we start with a straightforward, personal chat.

We’ll sit down with you to talk about what’s new in your life. Did you finish that big kitchen remodel? Buy a piece of art you love? Do you have a new teenage driver in the house? These details are absolutely critical for putting together a bundle that fits your life right now, not the one you had five years ago. Our first goal is always to get a complete picture of your assets and potential risks.

Shopping the Entire Market for You

After we understand your unique situation, we get to work. As an independent agency, we aren't stuck with just one carrier. This gives us the freedom to shop the entire market for you, searching for the best home and auto insurance bundle from a wide range of top-rated insurance companies.

This is a huge advantage compared to working with a captive agent who can only sell you products from their one company. We can analyze dozens of combinations to find that sweet spot between price and protection. Having access to the whole market is the key to uncovering the best possible value out there.

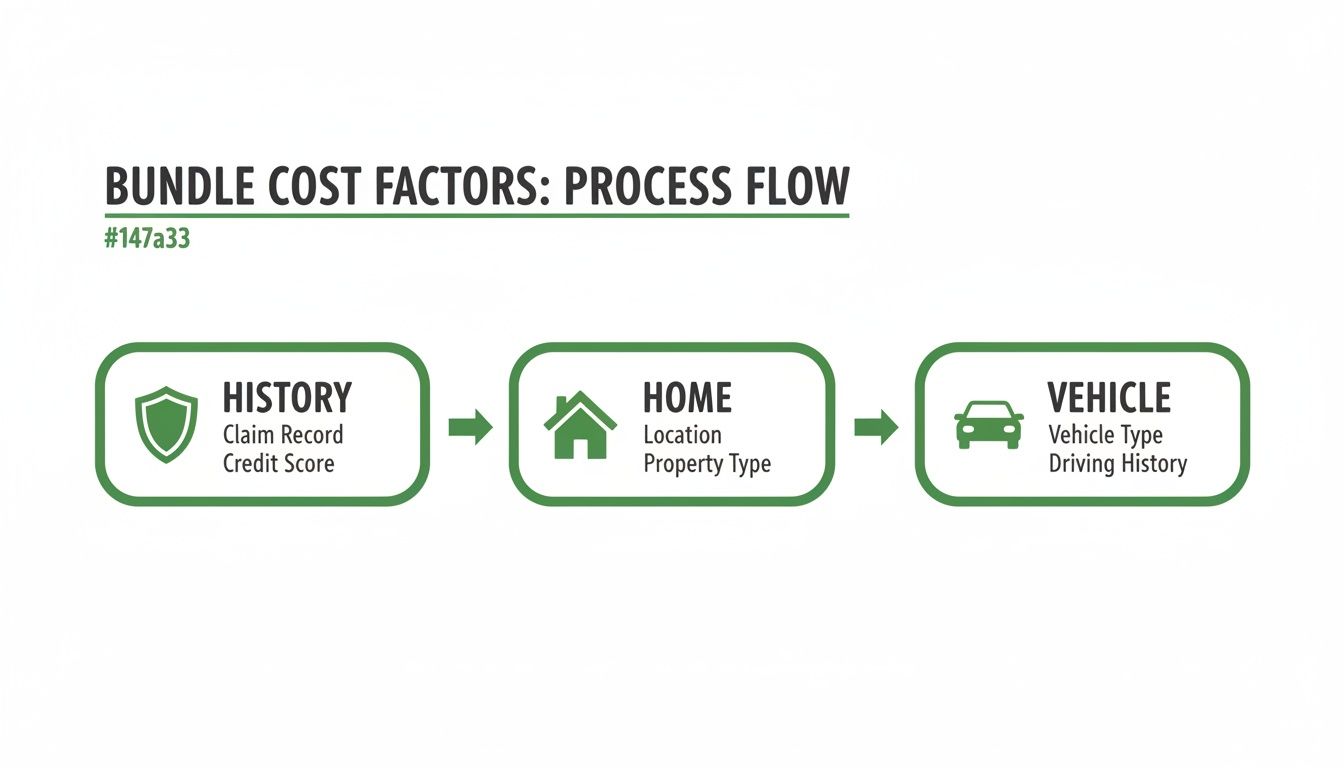

The image below breaks down the main things insurers look at when they price your bundle.

As you can see, it’s a mix of your personal history, details about your home, and the types of vehicles you drive that all come together to determine your final premium.

Making Sense of Your Options

Getting a pile of quotes is one thing, but actually understanding what they mean is another entirely. We take all that complex information and distill it into clear, side-by-side comparisons. You won’t be left trying to decipher insurance jargon or read through pages of fine print. We lay out the top options in a simple format, highlighting the key differences in:

- Coverage Limits: We’ll show you exactly how much protection each policy offers for your home, liability, and vehicles.

- Deductibles: We’ll walk you through how your out-of-pocket costs would change with each option.

- Premiums: You’ll see the bottom-line cost, broken down so there are no surprises.

Our job is to give you the clarity to make a smart, informed decision. We’re big believers that looking past the price tag is essential. After all, a cheap policy with big gaps in coverage isn't a good deal—it's a risk waiting to happen. We also vet every insurer for their financial stability and claims service, so you know you're partnering with a company that will be there when you need them. If you want to learn more, our guide on how to choose an insurance broker offers some great tips.

The best bundle isn’t just the cheapest one. It’s the one that provides comprehensive protection from a reputable carrier at a competitive price, giving you true peace of mind.

Private Client Considerations for Complex Needs

For families and individuals with more significant assets, a standard, off-the-shelf bundle just won't cut it. High-value homes, luxury cars, classic vehicles, or valuable collections all demand a much more sophisticated strategy. This is exactly where our Private Client services come in.

We specialize in building custom insurance portfolios for high-net-worth clients. This isn’t a one-size-fits-all process; it involves:

- Comprehensive Asset Review: We start with a deep dive into all your assets—primary and vacation homes, high-end cars, fine art, jewelry, and personal liability exposure.

- Access to Elite Insurers: We have relationships with exclusive carriers who specialize in the high-net-worth market. They offer higher coverage limits and unique protections you simply can't find in standard policies.

- Tailored Coverage Solutions: We can bundle policies to include powerful personal excess liability (umbrella) coverage, floaters for valuable articles, and other specific protections designed for complex financial situations.

For our Private Client families, the home and auto insurance bundle is just the starting point of a much bigger risk management plan. Our expertise is in making sure every single asset is properly accounted for, protecting you from financial exposure and helping you safeguard your legacy.

Your Essential Bundle Evaluation Checklist

So you've found a home and auto insurance bundle that looks promising. Before you sign on the dotted line, it's time to pause and do one final review. A great discount is what gets your attention, but the real value is in finding a policy that gives you rock-solid protection without any nasty surprises down the road.

This checklist is your final quality-control step. By asking the right questions now, you can be absolutely sure the bundle you're considering is a genuine upgrade, not just a cheaper policy with hidden gaps. The goal here is simple: secure both savings and peace of mind.

Confirm the True Savings

First things first, let's look at the numbers. It seems obvious, but you should never just assume a bundle is cheaper. You need to do the math.

- Calculate the Total Premium: Add up what you're paying right now for your separate home and auto policies. How does that total stack up against the new bundled quote?

- Verify the Discount: Make sure the multi-policy discount is clearly listed and applied. The savings can often be 15% or more, but you want to see that number reflected in black and white on your quote.

- Factor in All Fees: Are there any administrative or other fees tucked into the new policy? It’s always good to ask.

This quick comparison will tell you if the financial benefit is real. For a deeper dive into what drives costs, our guide to compare home insurance quotes can shed more light on the subject.

Scrutinize Coverage and Exclusions

Here's where the rubber meets the road. A lower price means nothing if it leaves you exposed. The single most important thing you can do is comb through the coverage details for both policies in the bundle.

A home and auto insurance bundle should enhance your protection, not compromise it. Never sacrifice essential coverage on one policy just to get a discount on the other.

Pay very close attention to these key areas:

- Review Coverage Limits: Are the liability limits on your auto policy still adequate? Is the dwelling coverage on your homeowner's policy enough to rebuild? Make certain these haven't been quietly lowered to hit a target price.

- Understand All Deductibles: Check the deductibles for both policies. Be especially aware of any special deductibles, like a separate—and often much higher—one for wind or hurricane damage, which is a common feature in states like Florida.

- Check for Critical Exclusions: Get into the fine print. Does the home policy now exclude mold or certain types of water damage? Has a new exclusion popped up on your auto policy that wasn't there before?

Evaluate the Insurer

Finally, take a step back and look at the company behind the policy. A fantastic policy is only as good as the insurer's promise to be there when you need them.

Check the carrier's financial strength ratings from independent agencies. Just as important, see what other customers are saying in reviews about their claims process. A smooth, fair claims experience is what you're really paying for.

By running through this checklist, you're putting yourself in the driver's seat to make a smart, informed decision. When you're ready, reach out to Wexford Insurance Solutions. We can walk you through this entire process with a complimentary review and help you find the perfect bundle for your unique needs.

Your Top Questions About Insurance Bundles Answered

It's one thing to understand how a bundle works in theory, but it's another to see how it plays out in real life. You’ve probably got a few questions, and that’s a good thing. Let's tackle some of the most common ones we hear from clients.

What If I'm a Renter? Can I Still Bundle?

You sure can. Insurers are just as happy to bundle your renters and auto insurance as they are a home and auto policy.

The logic is identical: you're giving them more of your business, so they reward you with a discount. It's a smart and simple way for renters to get the same benefits of policy bundling.

What Happens If I Cancel Just One Policy?

Let's say you sell your car and no longer need auto insurance. When you cancel that policy, the multi-policy discount on your remaining home or renters policy will disappear.

This means you should expect the premium for that policy to go up on its next renewal. The best move is always to call your agent before you make a change so you can understand exactly how it will affect your costs. No one likes a surprise bill.

If I File a Claim on My Car Insurance, Will My Home Insurance Go Up?

Generally, no. A claim on one policy typically only affects the premium for that specific policy. So, an at-fault car accident will raise your auto insurance rates, but it shouldn't directly touch your home premium.

That said, keep in mind that a major claim can change how the insurer sees your overall risk. You might lose a "claims-free" discount that was applied to the entire bundle, which could cause a small rate increase on both policies.

Is It a Hassle to Switch Companies When My Policies Are Bundled?

It might seem complicated, but it's actually not—especially when you have an expert in your corner. An independent agent can do all the heavy lifting for you.

They will shop for new bundled options (or even separate policies, if that makes more sense) and manage the entire switch. This ensures there are no gaps in your coverage as you move from one carrier to another, making the whole process surprisingly smooth.

Ready to figure out if bundling your home and auto insurance is the right call for you? The team at Wexford Insurance Solutions is here to help. We offer a no-obligation review of your current policies to find the perfect fit and best value.

Get in touch with us today to get started at https://www.wexfordis.com.

What is an insurance premium: what is an insurance premium explained simply

What is an insurance premium: what is an insurance premium explained simply Save on Car Insurance: how to lower car insurance premiums

Save on Car Insurance: how to lower car insurance premiums