Are high car insurance bills weighing on your budget? The good news is you're not stuck. You can take control and lower your car insurance premiums by shopping around, tweaking your coverage, hunting for discounts, and simply being a safe driver. These aren't complicated industry secrets—they're practical steps that can make a real difference to your monthly expenses.

Your Quick Guide To Lowering Car Insurance Costs

High car insurance premiums can feel like a fixed cost, but you have more power here than you might realize. Let's cut through the confusing jargon. Saving money on your policy boils down to a few smart strategies. It all starts with understanding what you're paying for and then finding the opportunities to trim the fat—whether that’s a simple policy adjustment or making sure you get credit for your good driving habits.

Think of this as your roadmap to savings. The best results usually come from mixing and matching different approaches, from making strategic changes to your coverage to asking about discounts your insurer might not advertise.

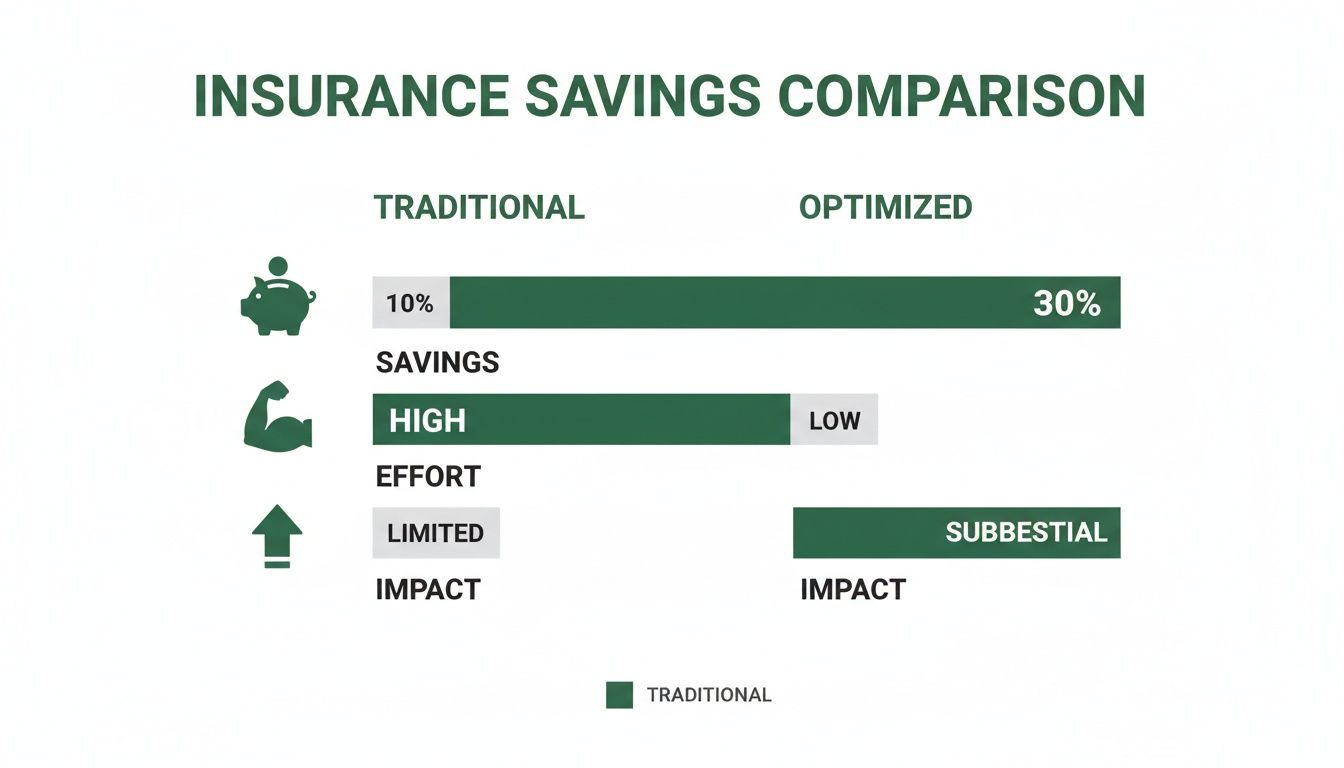

This chart gives you a quick visual breakdown of the most common strategies. It weighs their potential impact on your wallet against the effort they take, so you can pick your battles and start where it counts the most.

As you can see, some of the biggest wins—like shopping for new quotes—don't actually require a ton of work. To really get a handle on this, it helps to understand the basics of what you're paying for. If you're curious, you can get a full breakdown of what an insurance premium is in our detailed guide.

Savings Strategy Impact And Effort

To help you decide where to start, here's a quick comparison of common strategies to lower your car insurance, showing potential savings versus the effort required.

| Strategy | Potential Savings | Effort Level |

|---|---|---|

| Shop Around & Compare Quotes | High (15-25% or more) | Low |

| Increase Your Deductible | Medium (5-15%) | Low |

| Bundle Policies | Medium (5-25%) | Low |

| Ask About All Discounts | High (Varies widely) | Low to Medium |

| Improve Your Credit Score | High (Long-term) | High |

| Take a Defensive Driving Course | Low (5-10%) | Medium |

| Sign Up for Telematics | High (Up to 30%) | Medium |

This table shows that you don’t always have to invest a lot of time to see significant savings. Simple actions like bundling or raising your deductible are quick wins.

Breaking Down The Savings Strategies

Before we get into the nitty-gritty details, let's look at the main ways you can cut costs from a bird's-eye view. Each of these categories targets a different piece of your insurance puzzle.

Policy Adjustments: This is all about looking at your deductibles and coverage limits. For example, simply raising your deductible from $500 to $1,000 can drop your premium almost immediately. It’s a classic trade-off: you agree to pay more out-of-pocket in a claim in exchange for a lower monthly bill.

Discount Optimization: Insurers have a whole menu of discounts, but they don't always hand them out automatically. Bundling your home and auto policies is a big one, but so are good student discounts, having anti-theft devices, or going paperless. You have to ask.

Driver Profile Improvements: The things that make up your personal profile—like your credit score and driving record—have a massive impact on your rates. Taking a defensive driving course can knock a few percentage points off, while working to improve your credit can lead to even bigger long-term savings.

By focusing on these areas, you're not just chasing a one-time discount. You're building a smarter, more sustainable insurance strategy. The goal is to make sure your policy truly fits your needs and risk profile, so you stop overpaying for coverage you don't need. The following sections will walk you through exactly how to put each of these ideas into action.

Your First Stop for Savings: A Deep Dive Into Your Current Policy

Believe it or not, the quickest way to lower your car insurance bill is often sitting right in your glove box or email inbox: your current policy declaration page. So many drivers sign up for coverage and then file it away, never looking at it again. This "set it and forget it" approach can lead to you overpaying for protections you simply don't need anymore.

Think of your policy as a living document, not a fixed contract. It should adapt as your life changes. Did you get a new remote job? Pay off your car loan? Has a child moved out? All of these are moments that should trigger a policy review, because they almost always open the door to savings. The trick is to actively manage your coverage, not just let it auto-renew year after year without a second glance.

A Quick Win: Adjust Your Deductibles

One of the most straightforward ways to shave money off your premium is to take a hard look at your comprehensive and collision deductibles. Your deductible is simply the amount of money you agree to pay out-of-pocket on a claim before the insurance company starts paying. By shouldering a little more of that initial risk yourself, you can get an immediate reduction in what you pay every month or year.

For example, just by raising your deductible from $500 to $1,000, you could easily see your premium drop by 5% to 15%. Sure, that means you'd have to come up with a grand if you have a major accident, but if you're a safe driver with a good track record, the long-term savings can really add up.

Here’s How It Plays Out in Real Life:

Take Sarah, a 28-year-old who drives a reliable four-year-old sedan. She has a solid emergency fund tucked away. Her current deductible is $500. By bumping it to $1,000, she cuts her annual premium by $180. If she goes five years without a claim, that’s $900 in her pocket—far more than the extra $500 risk she decided to take on.

Of course, this is a calculated trade-off. Before you make the switch, be honest with yourself: do you have enough in savings to comfortably cover that higher deductible tomorrow if you had to? To get a better feel for this, it helps to understand exactly how an auto insurance deductible works so you can find that sweet spot for your own finances.

Are You Paying for Coverage You Don't Need?

As your car gets older, the math on certain coverages starts to change. "Full coverage," which is really just a combination of collision and comprehensive, is a no-brainer for a brand-new car or one you're still making payments on. But is it worth it for a 10-year-old car that's been paid off for years? Maybe not.

A good rule of thumb is to seriously consider dropping collision and comprehensive if the annual cost for that coverage is more than 10% of your car’s actual cash value. Why pay $700 a year to protect a car that’s only worth $3,000?

Dig deeper into the other optional add-ons, too. You might be surprised by what you find:

- Rental Reimbursement: Do you work from home or have a second car in the driveway? If you can get by without a rental while your car is in the shop, this is an easy one to cut.

- Towing and Labor: Check your other memberships. Many people already have roadside assistance through AAA, their credit card benefits, or even their new car's warranty. Paying for it on your insurance policy is often redundant.

- Custom Parts Coverage: Did you sell that car with the fancy stereo system and custom rims two years ago? If you forgot to remove this special coverage rider, you're literally paying for nothing.

Make Sure Your Policy Matches Your Life Today

Life moves fast, and your insurance needs to keep up. The policy that was perfect when you had two kids driving and long daily commutes is probably costing you a fortune now that you're an empty nester who works from home.

Here's a classic example: A family's youngest child heads off to college, leaving their car behind. But the insurance policy still lists them as a primary driver at home.

By simply calling their agent, they could unlock multiple discounts:

- Distant Student Discount: Most companies offer a huge price break when a student on the policy lives more than 100 miles away without a car.

- Lower Annual Mileage: With one less person driving daily, the family's total mileage plummets, making them eligible for a low-mileage discount.

- Vehicle Use Change: That second car that used to be for a daily school commute is now just for weekend errands. Changing its primary use from "commute" to "pleasure" will lower the rate.

Making an annual policy check-up a habit is one of the smartest financial moves you can make. It’s a simple way to ensure you’re only paying for the protection you actually need, right now.

The Financial Power of a Clean Driving Record

While tweaking your policy can deliver some quick wins, the most powerful long-term strategy for keeping car insurance costs down comes down to one thing: your behavior behind the wheel. Insurance companies are, at their core, risk managers. Your driving record is their crystal ball, telling them exactly how much risk you represent.

It's a pretty straightforward calculation on their end. Safer drivers are less likely to file claims, which makes them far less expensive to insure.

Every year you go without an accident or a moving violation, you’re building a history of reliability. That track record is gold. It makes you a prime customer and unlocks the absolute best rates and most significant discounts an insurer can offer.

The Lasting Cost of a Single Mistake

It's all too easy to underestimate the financial shockwave from a single at-fault accident. You see the immediate costs, like your deductible, but the real sting is the premium surcharge that can haunt you for years.

Just one at-fault accident can send your rates soaring by 30% to 50%, sometimes even more, depending on how severe it was and who your carrier is. This isn't a one-and-done penalty, either. It typically stays on your record and inflates your premium for a full three to five years.

Let's put that into perspective. Say you pay $1,800 a year for your policy. You cause an accident, and your premium jumps by 40%.

- Year 1: Your new premium is $2,520. That's an extra $720 out of your pocket.

- Year 2: You’re paying another $2,520.

- Year 3: You’re still at $2,520.

In just three years, that one mistake has cost you an extra $2,160 in premiums alone. That's before you even factor in losing your claims-free discount, which adds insult to financial injury. To see how these events are formally documented, it helps to understand what is a loss run report and how insurers use it.

Proactive Steps to Build a Safer Profile

Keeping your record clean isn't about luck—it's about making a conscious effort to drive defensively. Of course, a huge part of that is knowing what to do after a motor vehicle accident to handle things correctly and minimize the long-term impact.

You can also take concrete steps to solidify your status as a low-risk driver. One of the best ways is by completing a state-approved defensive driving course.

These courses aren't just for getting out of tickets. They refresh your knowledge of traffic laws and teach advanced accident-avoidance techniques. Once you're done, most insurers will give you a discount of 5% to 10% that can last for up to three years.

This is an absolute must if you have a new teen driver in the house. It not only reinforces good habits for your most inexperienced driver but also helps take the edge off the sky-high premiums that come with insuring a teenager.

Actionable Tips for Safer Driving

Turning the idea of "safe driving" into muscle memory is what ultimately protects your record and your budget. These aren't just fluffy suggestions; they are practical habits that directly cut your risk.

- Ditch the Distractions: Put your phone away. Seriously. Out of sight, out of mind. Even a hands-free call can pull your focus away from the road when you need it most.

- Master Your Following Distance: The "three-second rule" is your best friend for avoiding rear-end collisions, which are incredibly common. If the weather is bad, make it five or six seconds.

- Be Boringly Predictable: Use your signals well before you turn. Avoid sudden swerves. Maintain a steady speed. The more predictable you are, the easier it is for other drivers to react to you.

- Always Check Your Blind Spots: Make it a habit to physically turn your head before every single lane change. Relying only on your mirrors is a recipe for disaster.

These aren't just good habits; they're investments. They build a reputation with your insurer that you are a responsible, low-risk client—and that’s exactly who gets rewarded with the best rates.

Uncovering Every Available Insurance Discount

Insurance companies have a whole menu of discounts, but here’s a little secret from inside the industry: they rarely get applied automatically. If you want the savings you deserve, you almost always have to ask. Being proactive can directly lower your car insurance premiums, often without touching your coverage at all.

Think of it as a scavenger hunt where every clue you find puts real money back into your wallet. The trick is knowing what to look for, because the list goes far beyond the discounts you see in commercials. It's time to make sure you're not leaving any savings on the table.

Beyond the Obvious Bundles

Just about everyone has heard of bundling home and auto policies. It's probably the most common way to save, and for good reason—it can easily slash your total insurance bill by 5% to 25%. If you want to dig deeper into this, our guide on the benefits of a home and auto insurance bundle has all the details.

But the savings shouldn't stop there. Insurers offer a surprising number of discounts tied to your profession, lifestyle, and the car you drive. Many of these fly under the radar but can really add up when you start stacking them.

For example, your job could be your ticket to a lower rate. Many carriers offer special pricing for professionals in fields they consider to be lower-risk.

- Educators: Teachers and professors are often seen as responsible drivers.

- First Responders: Police, firefighters, and EMTs frequently get a well-deserved break on their rates.

- Medical Professionals: Nurses, doctors, and other healthcare workers can often qualify.

- Scientists and Engineers: Analytical minds sometimes translate to preferred pricing.

If your career falls into one of these buckets, a quick call to your agent could unlock a discount you never knew existed.

Vehicle and Driver-Based Discounts

The car you drive and your habits behind the wheel open up another huge category of potential savings. At the end of the day, insurers just want to reward anything that reduces their risk of paying a claim.

Modern cars are loaded with safety tech, and insurance companies definitely notice. Make sure your agent knows if your vehicle is equipped with features like these:

- Anti-theft systems: An alarm or a LoJack can make your car less of a target.

- Passive restraint systems: Things like automatic seatbelts and airbags can make accidents less severe.

- Daytime running lights: These make you more visible on the road, which is always a plus.

- Advanced safety features: Anti-lock brakes (ABS) and electronic stability control (ESC) are pretty standard now, but it never hurts to confirm you’re getting credit for them.

Beyond the car itself, how you drive matters. If you've gone remote or just have a short commute, you could be eligible for a low-mileage discount. Many insurers offer savings for drivers who log less than a certain number of miles each year—often around 7,500 miles.

A Real-World Example of Stacking Discounts

Take the Miller family. They were paying a high premium for two cars, one of which was driven by their teen son. After a quick policy review, we uncovered a few missed opportunities.

- Mrs. Miller is a nurse, which qualified her for a 5% professional discount.

- Their son's good grades earned them a 15% good student discount.

- They agreed to use a telematics device for their son's car, which cut another 20% off its premium for safe driving.

- We also discovered their older sedan had an anti-theft system they'd never mentioned, saving another 3%.

Just by stacking these four discounts, they lowered their annual premium by over $450.

Leveraging Technology for Savings

One of the most powerful tools for saving money today is a telematics program, sometimes called usage-based insurance. These programs use a small plug-in device or a smartphone app to monitor your actual driving habits.

The technology tracks metrics like:

- Hard braking and quick acceleration

- The times of day you typically drive

- Your total mileage

- Speeding events

If you're a safe, consistent driver, the data works in your favor by proving you're a low risk. This can translate into some serious savings—sometimes as high as 30% off your premium. It's a fantastic way to turn your good habits into cash.

To make sure you're not missing out, be direct with your agent. Try a simple script like this: "I'd like to do a full discount review on my policy. Can you walk me through every single discount your company offers so I can see what I might be eligible for?" This puts the ball in their court and shows you're serious about finding every way to lower your car insurance premiums.

How Smart Shopping Can Dramatically Lower Your Premium

Here’s a hard truth about the insurance industry: loyalty doesn't always get you the best deal. You might assume that sticking with the same company for years earns you some kind of reward, but the opposite is often the case. Rates can quietly creep up year after year, a practice some in the industry call "price optimization."

This is why shopping your policy is, without a doubt, the single most powerful tool you have for slashing your premium.

It’s the only way to truly know if you’re getting a fair price. The insurance market is constantly in flux—the carrier that gave you a great rate three years ago might be far from the most competitive option for you today. Smart shopping isn't just about chasing the lowest price, either. It’s about getting an apples-to-apples comparison of coverage from quality carriers so you can make an informed choice.

Captive Agents vs. Independent Agents

When you decide to shop, you'll generally run into two types of insurance professionals. Knowing who you're talking to makes a huge difference.

Captive Agents: These agents work exclusively for one company, like State Farm or Allstate. They are experts on their company's products, but their toolbox is limited—they can only sell you what that one carrier offers.

Independent Agents: This is where we come in. An independent agent (like Wexford Insurance Solutions) works for you, not a specific insurance company. We partner with a wide range of carriers, allowing us to scan the entire market to find the right policy for your specific needs and budget. It saves you from having to make a dozen phone calls yourself.

An independent agent is your advocate. We do the heavy lifting of comparing quotes from multiple companies to find that sweet spot of great coverage at a competitive price, simplifying the whole process for you.

Your Pre-Shopping Checklist

To get fast, accurate quotes, you’ll want to have some information handy before you start making calls. Being prepared ensures you're comparing the same levels of coverage everywhere and shows agents you’re a serious shopper.

Try to gather these details first:

- Your Current Policy's Declaration Page: Think of this as your cheat sheet. It has all your current coverages, limits, and deductibles, making it easy to ask for an identical quote.

- Driver Information: You’ll need the full name, date of birth, and driver’s license number for everyone on the policy.

- Vehicle Information: Get the year, make, model, and Vehicle Identification Number (VIN) for each car you want to insure.

- Driving History: Be prepared to discuss any accidents, tickets, or claims within the last five years for all drivers.

Having this ready to go makes the process incredibly smooth and helps us pinpoint the best rates for your profile right away.

The Best Times to Shop for Insurance

You can shop for insurance anytime, but certain moments are practically begging for a rate check. Timing your search strategically can lead to some serious savings.

Keep an eye out for these opportunities:

- Before Your Policy Renews: The ideal window is 30-45 days before your current policy expires. This gives you plenty of time to explore your options without feeling rushed. If you find a better deal, our guide on how to switch car insurance companies breaks down just how simple it is.

- After a Major Life Event: Getting married, buying a home, or even moving to a new ZIP code can drastically change your risk profile and open the door to new discounts.

- When Your Driving Habits Change: Did you land a remote job or switch to a much shorter commute? Fewer miles on the road often means lower premiums.

- After Improving Your Credit Score: In most states, a healthier credit score can have a surprisingly big and positive impact on your insurance rates.

As you explore your options, don't forget to look into specialized situations that might apply to you, like finding affordable cover for a category car, as some vehicles have unique insurance requirements. A little bit of time spent shopping around is a small investment that can easily save you hundreds of dollars a year.

Common Questions About Lowering Car Insurance Costs

Car insurance can feel like a maze, and it's natural to have questions. To clear things up, we've pulled together answers to the questions we hear most often from clients looking to get a better handle on their premiums.

Getting a grip on these key points can help you make smarter decisions, uncover savings you didn't know existed, and feel a lot more confident about your coverage.

How Often Should I Be Shopping for New Car Insurance?

The best practice is to shop your policy at least once a year. A good time to do this is about 30 to 45 days before your policy renews, which gives you plenty of time to look at your options without feeling rushed.

But don't just wait for renewal time. You should absolutely shop around after any big life change. These events can totally change the math on your insurance rates, and the company that gave you the best deal last year might not be your best bet now.

It’s a good idea to get fresh quotes if you:

- Move to a new address, especially a new ZIP code or state.

- Buy a new car or add one to your policy.

- Get married—insurers often give better rates to married couples.

- Add a new driver to your policy (looking at you, parents of teens).

- See a major improvement in your credit score.

Will Filing a Small Claim Actually Raise My Premium?

Yes, almost certainly. Even a minor claim will likely trigger a rate increase when your policy renews. Besides the surcharge itself, you'll probably lose any claims-free discount you’ve had, which can be surprisingly valuable.

So, what should you do? Always get a repair estimate first. If the cost to fix the damage is not much more than your deductible, it’s often smarter to just pay for it yourself.

Think of it this way: if your deductible is $500 and the repair is $700, filing a claim only nets you $200. But the resulting premium hike could easily cost you far more than that over the next three to five years. An agent can help you do the math and figure out the best move.

Does My Credit Score Really Affect My Car Insurance Rate?

It absolutely does, in most states anyway. Insurance companies use something called a credit-based insurance score to predict how likely you are to file a claim. Over the years, they've found a strong statistical link between credit history and the number of claims a person files.

What this means for you is that a better credit history can lead directly to lower car insurance bills. Working on your credit—by paying bills on time, keeping credit card balances down, and not opening a bunch of new accounts—is a great long-term strategy for cheaper insurance.

Can I Lower My Rate in the Middle of My Policy Term?

You sure can. You don't have to be stuck waiting for your renewal to make a change. Give your agent a call anytime to see if there are new ways to save.

For instance, did you just pay off your car loan? You might be able to drop collision and comprehensive coverage if it's an older car. Or maybe you switched to working from home and are barely driving. That could make you eligible for a low-mileage discount you didn't qualify for before. A quick policy review can turn up these kinds of savings opportunities at any time.

Finding that sweet spot between great coverage and a great price doesn't have to be something you tackle alone. The team at Wexford Insurance Solutions can do the heavy lifting for you, comparing policies from dozens of carriers to find the perfect fit. Contact us today for a free, no-obligation quote!

Your Guide to the Home and Auto Insurance Bundle

Your Guide to the Home and Auto Insurance Bundle How to File an Insurance Claim Like a Pro

How to File an Insurance Claim Like a Pro