When you're trying to understand the difference between claims-made vs occurrence coverage, it all boils down to one simple thing: timing.

An occurrence policy covers an incident that happens during the policy period, even if the actual claim is filed years later. On the other hand, a claims-made policy only covers claims that are reported while your policy is still active. This single distinction creates a ripple effect that impacts your long-term protection.

Defining Your Insurance Policy Timeline

Figuring out what "triggers" your insurance coverage is the most critical part of managing your company's liability. It's the difference between a claim getting paid or denied. Think of it this way: the policy type decides whether a claim filed today for something that happened last year is covered. Getting this wrong can lead to a massive, uninsured financial loss.

These two policy structures exist because they're built for different types of risk.

- Occurrence policies are the go-to for risks that are easy to pinpoint in time, like a customer slipping and falling in your store. You can find more detail on this in our guide to commercial general liability insurance.

- Claims-made policies are designed for professional services—think architects, consultants, or lawyers—where a mistake made today might not be discovered for months or even years.

Core Differences At a Glance

The choice you make here will affect everything, from your yearly premiums to what you have to do if you ever decide to switch carriers or retire. One policy gives you a set-it-and-forget-it type of protection for a specific block of time. The other demands careful management of dates and might mean you have to buy extra coverage later on.

The trigger is everything. An occurrence policy is triggered by the date of the incident. A claims-made policy is triggered by the date the claim is filed. This simple difference has massive implications for long-term financial security.

To really see how this plays out, let's put the two policy types head-to-head. The table below gives you a quick snapshot of their core features before we get into more detailed scenarios and cost comparisons.

Core Differences Between Claims-Made and Occurrence Policies

This table offers a high-level summary to help you quickly grasp the key distinctions.

| Feature | Claims-Made Coverage | Occurrence Coverage |

|---|---|---|

| Coverage Trigger | When the claim is filed and reported to the insurer. | When the incident occurs during the policy period. |

| Policy Status Requirement | Policy must be active when the claim is made. | Policy must have been active when the incident happened. |

| Long-Term Protection | Requires continuous coverage or "tail coverage" to protect against future claims. | Provides permanent coverage for incidents that occurred during the policy term. |

| Premium Structure | Starts lower and increases annually for about five years as risk exposure grows. | Higher, more stable premium from the start. |

| Key Concepts to Manage | Retroactive Date, Prior Acts, and Extended Reporting Period (Tail Coverage). | Primarily concerned with policy limits and the dates the policy was active. |

As you can see, the management and cost structure for each is completely different. The rest of this guide will explore these points in greater detail to help you make the right call for your business.

How Policy Triggers Work: A Real-World Timeline Analysis

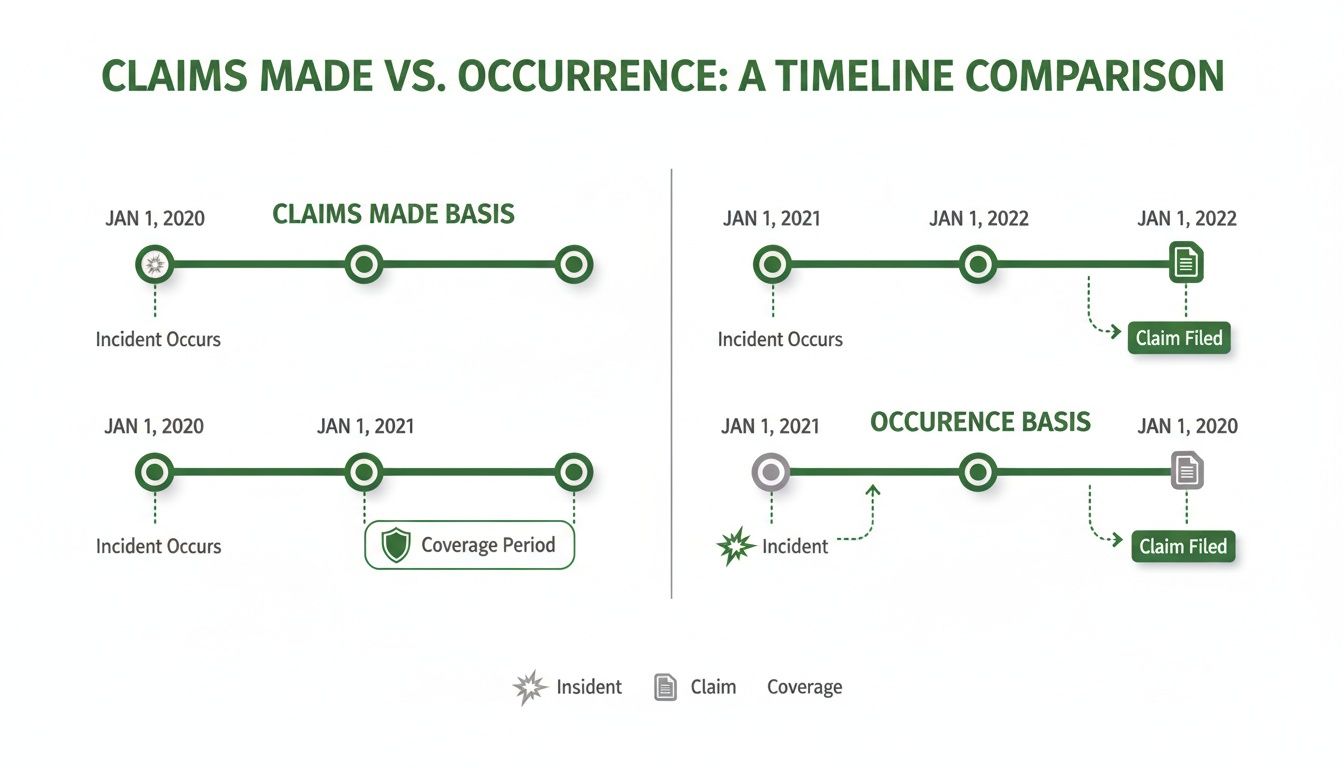

The best way to really wrap your head around claims-made vs. occurrence coverage is to see them in action. The key difference lies in the "trigger"—the specific event that activates your insurance coverage. It’s what determines whether a claim gets paid or denied, and the timing can lead to wildly different outcomes for your business.

Let's walk through a couple of real-world scenarios.

Scenario One: The Long-Tail Claim

Imagine you're a contractor with a General Liability policy written on an occurrence basis, active from January 2023 to January 2024. In June 2023, your crew finishes a big project. Everything seems fine, but a hidden flaw in the work eventually causes serious water damage. The client doesn't even discover the problem until March 2025, long after your policy has expired.

With an occurrence policy, you’re covered.

The trigger was the incident itself—the faulty work occurred during your policy period. It doesn't matter that the claim was filed more than a year later. That coverage is permanent for any incident that happened while the policy was in force.

Now, what if you had a claims-made policy for that same period? If you canceled it in January 2024 without buying an extension (known as "tail coverage"), the claim filed in 2025 would be flatly denied. Why? Because the policy wasn't active when the claim was made. You’d be on your own.

This timeline visualizes how the incident, the claim, and your coverage period all interact under each policy type.

As you can see, an occurrence policy provides lasting protection for incidents that happen on its watch, whereas a claims-made policy's coverage is directly tied to being active when a claim is actually reported.

Scenario Two: The Retroactive Date Pitfall

Claims-made policies have another critical feature you have to watch out for: the retroactive date. Think of it as the starting line for your coverage. Any incident that happens before this date is automatically excluded, even if a claim is filed while your policy is active.

Let's look at an IT consultant who buys a new claims-made Errors & Omissions policy starting January 1, 2025. The policy is brand new, so the retroactive date is also set for January 1, 2025.

In February 2025, a former client hits the consultant with a lawsuit. The suit alleges that bad advice given back in November 2024 led to a massive data breach and significant financial losses.

Critical Point: Even though the consultant has an active policy when the claim is filed, that claim will be denied. The incident—the negligent advice—happened in November 2024, which is before the policy's retroactive date of January 1, 2025.

This is a common and expensive mistake. If you switch insurance carriers for a claims-made policy, it is absolutely essential that your new policy carries forward the exact same retroactive date as your old one. Failing to do this creates a massive gap, effectively erasing all insurance protection for your past work. You can learn more by reading our guide on what a retroactive date in insurance is.

The danger here isn't just theoretical. Industry data suggests that roughly 15-20% of professionals who cancel or switch their claims-made policies don't purchase the right tail coverage. If an incident happens while your policy is active, but the claim doesn't get reported until after it expires, you have zero coverage unless you secured that tail. An occurrence policy, on the other hand, would have covered that same incident regardless of when the claim was filed.

Decoding The True Cost of Your Insurance Policy

It’s easy to get tunnel vision and only look at the initial premium when comparing claims-made versus occurrence coverage. But that's a classic rookie mistake, and it can be a costly one. The real financial story of your policy plays out over many years, shaped by its structure, your business's trajectory, and the career choices you make down the line. To budget properly and sidestep nasty financial surprises, you have to look at the total cost of ownership.

With an occurrence policy, what you see is largely what you get. The premium is typically higher and more predictable from the get-go. That straightforward cost buys you permanent coverage for any incident that happens during that policy year, no matter when the claim is filed. You pay a consistent price for permanent peace of mind, making long-term financial planning much simpler.

The Claims-Made Premium Escalator

Claims-made policies are a completely different animal, built on a financial model called "step-rating." The first-year premium is deceptively low because the insurer is only on the hook for claims made that year from incidents that also happened that year. It's a very small window of risk.

But each year you renew, that window gets bigger. The insurer is now covering a growing number of past years, so their potential exposure—and your premium—creeps up. You can expect this predictable climb in premiums for the first five to seven years. Once the policy "matures," the premium finally levels off at a rate that's often comparable to an occurrence policy. While the initial savings are tempting, you absolutely have to budget for these planned increases.

The Hidden Cost of Tail Coverage

The biggest financial wildcard with a claims-made policy is the eventual need for tail coverage, which you'll see listed in policy documents as an Extended Reporting Period (ERP). Think of it not as an optional extra but as a mandatory final payment if you ever cancel your policy, switch to an occurrence form, or retire. If you don't buy it, you've essentially paid for years of temporary coverage that just vanished.

The cost of tail coverage is significant and can't be an afterthought. It's the final purchase that converts your years of claims-made coverage into the permanent protection that an occurrence policy provides from day one.

This one-time expense can be a real shock if you're not ready for it. For instance, a claims-made policy might look great on paper, with first-year premiums often 30-50% lower than an occurrence policy. A professional could pay $1,200-$1,500 for a first-year claims-made policy, while the same coverage on an occurrence form might be $2,000-$2,500. But when it's time to get that tail coverage, the price tag is typically between 150% to 300% of your final year's premium. It’s a huge deferred cost.

Calculating Your Total Cost of Ownership

To make an informed decision, you need to map out the costs over the entire lifecycle of the policy.

For a Claims-Made Policy:

- Years 1-5 Premiums: Project the annual increases as the policy matures.

- Stabilized Premiums: Factor in the cost for the years after it hits that plateau.

- Potential Tail Coverage Cost: Calculate this lump-sum payment by taking your estimated final premium and multiplying it by 1.5 to 3.

For an Occurrence Policy:

- Annual Premiums: Simply project the stable annual premium over the same period.

When you lay it all out like this, the picture becomes much clearer. While the claims-made policy is cheaper upfront, the total long-term outlay—especially with tail coverage factored in—can easily match or even surpass the cost of an occurrence policy. The right choice really comes down to your business's cash flow, your long-term plans, and how much financial certainty you need. For a deeper look into liability expenses, check out our analysis of general liability insurance costs.

Getting a Handle on Key Claims-Made Policy Terms

To really get to the heart of the claims-made versus occurrence debate, you need to speak the language. A claims-made policy isn't as straightforward as its occurrence counterpart; it has its own unique vocabulary and a few moving parts that all have to work together perfectly to protect you.

Understanding these terms isn't just for insurance nerds—it's absolutely critical for avoiding a catastrophic gap in your professional liability coverage. Concepts like the retroactive date, prior acts, and tail coverage are the gears that make a claims-made policy run. They control the entire timeline of your protection, defining which past actions are covered and for how long.

Defining Your Retroactive Date

Think of the retroactive date as your coverage starting line. It's a hard-and-fast date on your policy, and the insurer simply will not cover any claim that comes from professional services you provided before that date. This is one of the most important dates you'll find on your policy's declaration page.

When you buy your very first policy, the retroactive date is usually just the policy's start date. No problem there. The real challenge comes when you switch insurance carriers. If that new policy doesn't carry over the original retroactive date from your old one, you’ve just wiped out your insurance protection for your entire professional history.

Expert Insight: Maintaining your original retroactive date when you renew or switch carriers is non-negotiable. It is the only thing that guarantees continuous coverage for your past work under a claims-made policy.

Understanding Prior Acts Coverage

So, how do you keep that original date when you move to a new insurer? That's where prior acts coverage comes in. This isn't some extra policy you buy; it's a fundamental feature of your new claims-made policy. It's the new insurer's agreement to honor your original retroactive date, effectively covering you for all "prior acts" that happened between that date and the start of your new policy period.

Let's say your first policy kicked in on June 1, 2020. Five years later, on June 1, 2025, you decide to switch to a new carrier. For your coverage to be seamless, that new policy must list June 1, 2020, as its retroactive date. If it doesn't, that five-year block of work is now completely uninsured.

The Critical Role of Tail Coverage

What happens when your career path changes? Maybe you're retiring, selling your business, or even just switching from a claims-made to an occurrence policy. Your claims-made coverage stops, but your liability for past work certainly doesn't. This is the exact scenario tail coverage was designed for.

Formally known as an Extended Reporting Period (ERP), tail coverage isn't new insurance. It's an endorsement you buy from your outgoing insurer that gives you an extended window to report future claims that arise from work you did while the policy was active. Without it, the moment your policy ends, so does your protection.

Here's the lowdown on what you absolutely need to know:

- Its Job: Tail coverage bridges the gap between when your policy cancels and when a claim from your past work gets filed. It keeps you protected.

- The Cost: Be prepared. This is a one-time purchase, but it's a big one, often running 150% to 300% of your final annual premium. It's a major business expense you have to plan for.

- When It's a Must: It is absolutely essential if you are retiring, closing your firm, or moving to an insurance policy that doesn't offer prior acts coverage (like an occurrence form).

Skipping tail coverage is one of the most common—and financially devastating—mistakes I see professionals make. We've put together a full guide on what is tail coverage insurance to walk you through the specifics. It's what turns years of paying claims-made premiums into the permanent protection your career deserves.

Choosing The Right Policy For Your Industry

The claims-made versus occurrence debate isn't just an academic exercise—it has real-world consequences for your business. The right choice hinges entirely on the kinds of risks you face day in and day out. What makes sense for a general contractor is almost always the wrong fit for a financial advisor.

The key is to match the policy structure to your profession. There's a reason certain industries have well-established standards; they're built on decades of claim data and an deep understanding of risk. Aligning your coverage with these norms is one of the smartest things you can do for your risk management strategy.

Professional Services: E&O and D&O

For any professional selling their expertise—think architects, lawyers, IT consultants, and company directors—claims-made policies are the industry standard. This applies to essential coverages like Errors & Omissions (E&O) and Directors & Officers (D&O) liability. The logic is straightforward: the fallout from a professional mistake often doesn't show up for years.

Imagine a flaw in an architectural design or a poor piece of financial advice. A lawsuit might not be filed until long after the project is finished or the advice was given. A claims-made policy is specifically designed for this kind of "long-tail" risk. It allows insurers to price your coverage based on a constantly updated picture of your past work. The trick is to be diligent about managing your retroactive date to keep that seamless protection for all your prior acts.

The rise of claims-made insurance wasn't an accident. It was a direct response to an insurance crisis in the 1970s and 1980s, driven by long-tail claims that nearly buckled the industry. Insurers realized that claims for things like occupational diseases could take decades to materialize, creating unpredictable and massive losses on old occurrence policies. In response, claims-made forms took over the professional liability world. You can find more on this history from HPSO.

General Business Operations: Commercial General Liability

For most businesses with a physical presence and public interaction, occurrence policies are the foundation of a Commercial General Liability (CGL) program. This coverage is built for tangible, in-the-moment risks: a customer slipping on a wet floor, a product causing an injury, or accidental property damage at a job site.

These incidents are tied to a specific point in time. An occurrence policy gives you permanent, clear-cut protection for that event, no matter when the claim is eventually filed. This is a huge advantage because you don’t have to worry about maintaining continuous coverage for old incidents or buying expensive tail coverage. You pay your premium for a specific policy period, and any incident from that year is covered forever, up to your policy limits.

An occurrence CGL policy is like a snapshot in time. Once that policy period is over, the protection for incidents that happened during it is locked in for good. This provides a ton of certainty and makes long-term risk management for physical liabilities much simpler.

Specialized and Emerging Risks: Cyber Liability

When it comes to digital risk, claims-made policies are overwhelmingly the norm for Cyber Liability insurance. The threat landscape here is in constant motion, with new strains of malware and ever-changing data privacy laws. A network breach might go undiscovered for months, and figuring out the full scope of the damage can take even longer.

The claims-made structure gives insurers the agility they need to adapt coverage and pricing to this fast-paced environment. It lets them write policies based on today's threats, not the ones that were common years ago. For you, this means your policy is more likely to address current cyber risks, but it also places the responsibility on you to manage your policy continuity carefully to avoid any gaps in coverage. To see how cyber insurance fits into a complete risk management plan, take a look at our guide on the different types of commercial insurance coverage.

How to Make the Right Insurance Decision

Choosing between claims-made and occurrence coverage can feel like a high-stakes decision, but it gets much simpler when you anchor it to your company's real-world risks and future plans. The best policy isn’t just about the lowest premium; it’s about finding predictable, gap-free protection that grows with you.

At Wexford Insurance Solutions, we skip the generic advice. We start by digging into a detailed risk analysis to pinpoint the specific liabilities your business faces day-to-day. From there, we walk you through how each policy type would actually respond to potential claims, making sure abstract concepts like retroactive dates or tail coverage feel concrete and understandable.

Crafting Your Coverage Strategy

Think of us as your advocate, not just your agent. We steer you through the crucial decisions by zeroing in on a few key areas:

- Your Unique Risk Profile: We look at your industry, the services you provide, and where you're headed. This helps us determine which coverage structure makes the most sense for you.

- Long-Term Financial Picture: We map out the total cost of ownership for both policy types over time. This includes how premiums mature and the potential future expense of tail coverage, so there are no surprises in your budget.

- Negotiating the Best Terms: We fight to maintain your retroactive date if you ever switch carriers, which is critical for preventing gaps in your coverage. We make sure you understand every line of your policy.

This hands-on approach turns a complex choice into a confident one. We get into the weeds of the technical details, so you can stay focused on running your business, knowing you're protected by a solid, well-built policy.

Choosing the right liability coverage is a foundational business decision. It’s about creating a safety net that protects your past work, current operations, and future success. Our role is to ensure that net has no gaps.

By pairing our expert guidance with practical tools, like our 24/7 client portal, we simplify everything from purchasing a policy to managing claims. Our commitment is to help you secure the right coverage not just for today, but for the entire life of your business.

Frequently Asked Questions About Liability Coverage

When you're digging into the differences between claims-made and occurrence policies, a lot of practical questions naturally come up. Getting those questions answered is key to protecting your company's financial future and making sure you don't get blindsided by a coverage gap down the road. Here are a few of the most common ones we hear from business owners.

Can I Switch From a Claims-Made to an Occurrence Policy?

Yes, you absolutely can, but you have to be smart about it to avoid leaving yourself unprotected. When you move away from a claims-made policy, you open up a gap. Your old policy is no longer active, so it won't respond to any new claims that come in.

You really have two ways to handle this:

- Buy Tail Coverage: This is the most common solution. You'll purchase an Extended Reporting Period (ERP) from your old insurance carrier. This add-on keeps the reporting window open for claims that stem from work you did while that old policy was in force.

- Secure Prior Acts Coverage: This is much less common, but sometimes your new occurrence policy can be written to cover your past work. Don't count on it, though. Buying tail coverage is the most dependable way to close the gap.

What Happens If My Business Closes with a Claims-Made Policy?

Shutting down your business doesn't magically erase your liability for past work. If you have a claims-made policy, you need to think of tail coverage as a final, must-have business expense.

Without it, any claim filed after you've closed up shop—even for a project you finished years ago—is your personal problem. Your business is gone, so that claim will come after your personal assets.

It's helpful to first have a solid grasp of a company's legal obligations, like the liability of corporations, to see why this ongoing protection is so critical.

The Bottom Line: Closing your business doors doesn't close the door on liability. Tail coverage is what essentially turns your temporary claims-made policy into the permanent protection you need to retire or start your next chapter without worry.

Is One Policy Type Always Cheaper?

It's not that simple, especially when you look at the total cost over many years. A claims-made policy looks very attractive at first because the premium is low. But that's by design. The cost steps up every year for about five to seven years before it finally levels off at a "mature" rate.

An occurrence policy, on the other hand, starts with a higher, more stable premium right out of the gate. The key difference is that you won't ever need to buy tail coverage for it. A claims-made policy might feel cheaper for the first few years, but when you add up the rising premiums and the eventual six-figure price tag for good tail coverage, the total long-term cost often ends up being very close to what you would have paid for an occurrence policy all along.

At Wexford Insurance Solutions, our job is to cut through the jargon and build a coverage plan that actually fits your business. Reach out today for a personalized look at your liability needs at https://www.wexfordis.com.

How to File an Insurance Claim Like a Pro

How to File an Insurance Claim Like a Pro A Practical Guide to Home and Auto Insurance Bundles

A Practical Guide to Home and Auto Insurance Bundles