If a fire, flood, or some other disaster forced you to shut your doors tomorrow, how long could you survive with zero revenue coming in? For most business owners, the answer is "not long."

That's where business income insurance comes in. Think of it as paycheck protection for your business. It’s the financial safety net that replaces the income you lose and covers your ongoing expenses while you're shut down, ensuring a physical catastrophe doesn't spiral into a financial one.

Why Business Income Insurance Is Your Financial Safety Net

Picture this: a fire guts your restaurant, or a burst pipe floods your retail store. Your revenue stream vanishes overnight. But the bills? They keep coming. You still have to pay rent, cover payroll for your essential team members, make loan payments, and handle taxes.

This is the exact, high-stakes problem that business income insurance was created to solve.

Many owners mistakenly believe their commercial property policy has them covered. While that policy is crucial for rebuilding your building and replacing equipment, it does absolutely nothing for the income you lose while the repairs are underway. Business income coverage steps into that gap, providing the cash flow to keep you financially stable during that critical "period of restoration."

The Growing Need for Income Protection

The world feels more unpredictable than ever, and the numbers back it up. The Business Income Insurance Market is already valued at $15.2 billion and is expected to more than double to $38.13 billion by 2035.

Why the surge? Businesses are grappling with more frequent and severe risks, from extreme weather to major supply chain breakdowns. With insured losses from natural catastrophes recently topping $106 billion in a single year, protecting your revenue has become non-negotiable. You can dig deeper into these trends in the business income insurance market growth report from Market Research Future.

This policy is fundamentally about survival. It provides the cash flow needed to pay your bills and retain key talent, giving your business the breathing room it needs to recover fully without accumulating devastating debt.

Core Components at a Glance

So, what exactly does this safety net catch? To help clarify, here’s a quick breakdown of what a standard business income policy is designed to cover.

Business Income Insurance at a Glance

| Coverage Component | What It Protects |

|---|---|

| Lost Net Income | Replaces the profits you would have earned had the disaster never happened. |

| Continuing Operating Expenses | Covers necessary, fixed costs like rent, utilities, payroll, and taxes. |

These two components are the heart of the policy, working together to keep your business financially whole while you get back on your feet.

This coverage is often bundled into a larger insurance package. You can learn more about how it fits into a comprehensive plan by reading our guide on what a Business Owner's Policy includes. Getting a handle on these key pieces is the first step toward building a business that can truly weather any storm.

Getting to Grips With What Your Policy Actually Covers

Trying to make sense of an insurance policy can feel like you're learning a new language. It's full of terms that seem simple but have very specific meanings. For business income insurance, everything hinges on two key phrases: the period of restoration and the actual loss sustained. Once you understand these, you'll see how a policy document transforms into a real-world financial lifeline.

The period of restoration is the specific timeframe when your policy is actively paying benefits. It kicks in right after the physical damage happens (usually following a 48 to 72-hour waiting period) and ends once your property is—or reasonably should be—repaired and ready for business again. This isn't an open-ended check; it’s the time it realistically takes to rebuild, restock, and get the lights back on.

During that period, the policy covers your actual loss sustained. This isn't a ballpark figure. It's a carefully calculated amount based on your company's financial history, designed to put you in the exact same spot you would have been in if the disaster never occurred.

A Real-World Scenario: The Restaurant Fire

To see how this plays out, let's picture a popular local restaurant, "The Corner Bistro." Imagine a kitchen fire shuts them down for three months. The owner’s commercial property insurance will handle the cost of a new oven and rebuilding the damaged walls. But what about all the income that vanishes while the doors are locked?

That's where the business income policy comes to the rescue. Here’s what it would cover during that three-month period of restoration:

- Lost Profits: By looking at the bistro's financial records, the policy replaces the net income it would have earned.

- Ongoing Expenses: The bills don't stop just because you're closed. The policy takes care of fixed costs that keep coming, like:

- Rent payments for the building.

- Loan payments on kitchen equipment.

- Property taxes and insurance premiums.

- Salaries for key people you can't afford to lose, like your head chef and manager.

Without this coverage, the owner would be draining their savings or taking on debt just to hold things together with zero revenue coming in. For a closer look at how this fits with other property protections, check out our commercial property insurance guide.

The Power of Extra Expense Coverage

Okay, but what if the owner of The Corner Bistro can't afford to disappear for three months and risk losing their customers? This is where a vital component called Extra Expense Coverage becomes a game-changer. It's often bundled into a business income policy or can be added on.

Extra Expense Coverage is designed to help you get back in business faster, even if it’s at a temporary location. It covers the reasonable and necessary costs you take on to keep operating—costs you wouldn't normally have.

Think of it as the proactive part of your policy. It gives you the funds to minimize the shutdown and keep some revenue flowing, rather than just passively reimbursing you for what you've lost.

How Extra Expenses Help The Bistro Reopen

Instead of just waiting for the main location to be fixed, the bistro owner takes action. With extra expense coverage, they can make some smart moves to stay in business:

- Rent a Food Truck: The owner rents and outfits a food truck to set up in a nearby lot, keeping their brand visible and serving loyal customers.

- Lease a Temporary Kitchen: They lease space in a commercial kitchen to keep their catering operation going and fulfill existing contracts.

- Pay for Overtime and Marketing: The policy covers overtime for staff to get these temporary sites running and pays for marketing to let everyone know where to find them.

Sure, these moves cost more than the bistro's normal expenses, but they drastically cut down the total amount of lost income. By spending an extra $30,000 on these temporary operations, the owner might prevent $100,000 in lost profits. The insurance company is more than happy to pay that extra expense, because it actually reduces the total claim payout. It's a true win-win that gets the business back on its feet faster.

What Your Policy Won't Cover: Common Exclusions and Smart Add-Ons

Business income insurance is a powerful safety net, but it's not designed to catch everything. It's crucial to understand that a standard policy is triggered only by direct physical loss or damage to your own property. If a fire burns down your warehouse, you're likely covered.

But what about the things that can shut you down without physically damaging your building?

Common Policy Exclusions

Every policy has a list of specific events it won't cover. These are often risks that are either too widespread, too catastrophic, or require their own specialized insurance. A standard business income policy almost always excludes losses from:

- Floods and earthquakes

- Pandemics and viruses

- Power or utility outages that start off-site

- Cyber attacks that shut down your systems

Believing you're covered for these events can be a costly mistake. Ignoring these gaps leaves you with a false sense of security and a massive financial exposure when disaster strikes.

Filling the Gaps: How to Customize Your Coverage

This is where you move from buying a generic policy to building a real risk management strategy. You can "patch" these holes with endorsements—also known as riders—which are add-ons that expand the scope of your protection.

Think of a standard policy as a strong, basic frame for a house. Endorsements are the storm shutters, seismic retrofitting, and backup generators you add to protect it from the specific threats common to your region.

By strategically adding these riders, you tailor the coverage to fit your business's unique vulnerabilities. It's a critical step, and you can learn more about the mechanics in our guide on what an insurance policy rider is.

What Happens When Your Supplier Shuts Down?

Imagine your own facility is humming along just fine, but your key component supplier halfway across the country gets hit by a tornado. Suddenly, you can't get the parts you need to build your product, and your revenue stream dries up. A standard policy won't pay a dime for this.

This is precisely the scenario that Contingent Business Interruption (CBI) coverage is built for. This vital endorsement protects your income when a key supplier, a primary customer, or even a major "attraction" business that drives traffic to you (like an anchor store in your shopping center) suffers a covered loss that directly impacts your bottom line.

When the Government Shuts You Down

Here’s another all-too-common situation: a wildfire is burning miles away, but local authorities block all roads into your business district for a week as a safety measure. Your building is untouched, but nobody can get to you. Your income plummets.

This is where Civil Authority coverage kicks in. It's designed to replace lost income when a government order prevents access to your property due to a covered event happening nearby. This coverage is usually short-term, often for two to four weeks, but it provides a critical lifeline until the area reopens.

Layering these protections is more important than ever. While P&C insurance premiums worldwide recently grew 7.7% to EUR 2,424 billion, the gap between economic losses and insured losses remains enormous. According to research from Allianz, there was an uninsured gap of US$592 billion from recent events.

Smart, tailored endorsements are how small businesses can help close that gap for themselves and build true financial resilience. The table below shows just how different a standard policy is from one that has been customized with the right add-ons.

Standard vs. Extended Business Income Coverage

| Coverage Scenario | Standard Policy | Extended/Endorsed Policy |

|---|---|---|

| Your warehouse burns down. | Covered. This is a direct physical loss to your property. | Covered. This is the core function of the policy. |

| A flood damages your inventory. | Not Covered. Flood is a standard exclusion. | Covered with a specific flood endorsement. |

| Your main supplier's factory is hit by a hurricane. | Not Covered. The damage wasn't to your property. | Covered with Contingent Business Interruption (CBI). |

| Police block access to your street for a week due to a gas leak. | Not Covered. Your property is undamaged and accessible. | Covered under a Civil Authority endorsement. |

| A power grid failure knocks out electricity for days. | Not Covered. The cause is off-premises. | Covered with a Utility Services—Time Element endorsement. |

| A ransomware attack encrypts your data and halts operations. | Not Covered. Cyber events are a standard exclusion. | Covered under a separate Cyber Insurance policy. |

As you can see, a standard policy is just the starting point. True protection comes from working with an expert to identify your specific risks and add the endorsements needed to cover them.

Calculating the Right Amount of Coverage for Your Business

Figuring out how much business income insurance you need isn’t a guessing game. It’s a crucial calculation that could very well decide whether your business makes it through a disaster. If you're underinsured, you might as well have no policy at all—the financial hit can be just as devastating.

The goal here is to land on a number that truly reflects your revenue stream and buys you enough time to get back on your feet. It might sound complicated, but it really comes down to three things: forecasting your future income, identifying the expenses that won't stop, and estimating a realistic recovery timeline.

Gathering Your Financial Building Blocks

First things first, you need a crystal-clear picture of your company's financial health. A solid grasp of how to do accounts for small business is non-negotiable, as accurate financial data is the foundation of a reliable coverage calculation. After all, your past performance is the best crystal ball we have for your future earnings.

You'll want to get your hands on a few key documents before you start crunching the numbers. These reports give you the raw data you need to do this right.

- Profit & Loss (P&L) Statements: Pull these for the last 12-24 months. This will help you spot revenue trends and get a baseline for your normal operating costs.

- Cash Flow Statements: These are key for understanding the actual cash moving in and out, which is what you'll need to cover immediate bills during a shutdown.

- Payroll Records: Having detailed payroll helps you figure out which employees are essential to keep on board and what that ongoing expense will look like.

Once you have these documents, you're ready to start building your coverage estimate. To simplify the process, we've created a downloadable tool to help you organize your figures. You can grab our Business Income Worksheet and follow the guide to get started.

The Core Calculation Method

The basic formula for figuring out your business income needs is actually pretty straightforward. You're essentially projecting what you would have earned and then subtracting the expenses you wouldn't have during the time you're closed.

Projected Gross Earnings – Discontinued Expenses = Required Coverage Limit

This simple equation helps you insure the actual loss you’d face—nothing more, nothing less. It keeps you from overpaying for coverage on expenses that would naturally stop during a shutdown, like the cost of raw materials you're not using or commissions for a sales team that isn't out selling.

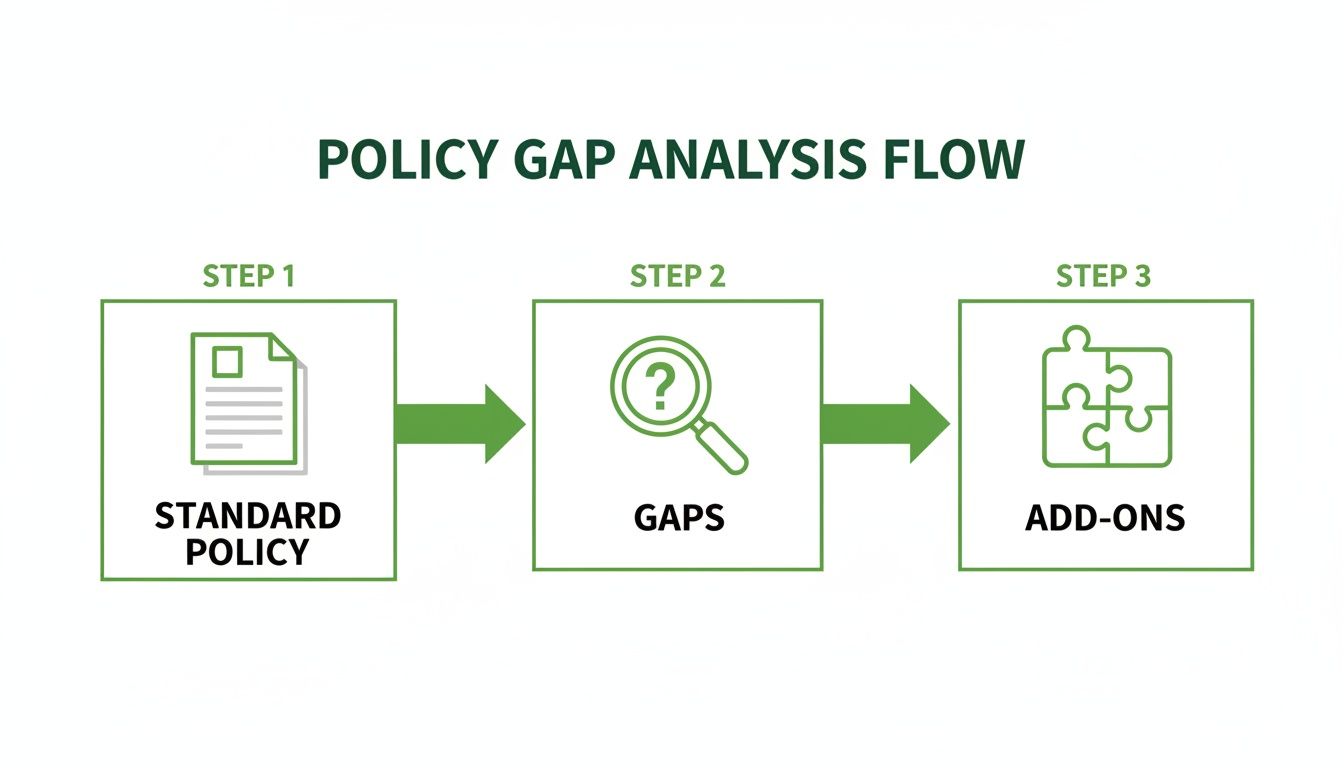

This flow chart shows how we think about moving from a standard, off-the-shelf policy to one that’s truly built for your specific risks.

As you can see, it's all about analyzing a standard policy to find the gaps and then strategically using add-ons to create a complete safety net.

Case Study: A Mid-Sized Manufacturing Firm

Let's walk through an example. Imagine a manufacturing firm that projects $2.4 million in gross earnings for the next year. If a fire shut them down, some costs would vanish, but many—like rent, salaries for key staff, and loan payments—would stick around.

- Project Gross Earnings: Their projected revenue is $2,400,000.

- Identify Discontinued Expenses: During a total shutdown, they'd save $800,000 on things like raw materials and production-specific utilities.

- Calculate the Insurable Amount:

- $2,400,000 (Gross Earnings)

- $800,000 (Discontinued Expenses)

- = $1,600,000 (Annual Insurable Business Income)

This $1.6 million figure is the actual loss the company would face over 12 months, and it's the number they should use for their policy limit. Getting this calculation right is more critical than ever. With premiums in the commercial property and casualty market—which includes business income insurance—growing by an average of 8% annually, every dollar counts. Precision is key.

Navigating the Claims Process After a Disaster

When a disaster hits your business, the last thing you want to deal with is a complicated insurance claim. The whole situation is overwhelming enough. It helps to think of the business income insurance claims process less like a hurdle and more like a structured path designed to get your business back on its feet.

Your job is to paint a clear, accurate picture of your losses. Your insurer's job is to make you whole again.

The process kicks off the moment it's safe to act. Your very first call should be to your insurance provider to report the loss. This gets the ball rolling, assigns a claim number to your case, and creates the official record you'll need for everything that follows.

Your First Steps After a Covered Event

In the immediate aftermath, time is critical. Quick, organized action can make a huge difference in how smoothly the claim goes. The first few hours and days are all about stopping the bleeding and documenting the damage.

- Notify Your Insurer Immediately: Don't wait. The sooner you report the incident, the sooner an adjuster is assigned and your claim is officially open.

- Mitigate Further Damage: You have a responsibility to take reasonable steps to prevent the situation from getting worse. This might mean boarding up broken windows or throwing a tarp over damaged equipment. Hang on to every receipt for these expenses—they may be reimbursable.

- Document Everything: Before anything is touched or repaired, take tons of photos and videos. Get every angle. This visual proof is pure gold when it comes to validating your claim.

I can't stress this enough: meticulous record-keeping is your best friend during a claim. It’s the hard evidence that substantiates your "actual loss sustained" and ensures you get a settlement based on facts, not guesswork.

Proving Your Loss with Documentation

Once the initial shock wears off, your focus needs to shift to gathering the financial proof of your business interruption. This is where all those well-organized business records really pay off. The insurance adjuster needs a clear paper trail to accurately calculate the income you've lost and the ongoing expenses you still have to cover.

Be prepared to hand over documents like:

- Profit and Loss Statements from before, during, and after the shutdown.

- Sales Records and Invoices that show your revenue stream before the disaster.

- Tax Returns to provide a historical baseline for your business's profitability.

- Bank Statements that illustrate cash flow and typical operating expenses.

- Payroll Records to back up any continuing labor costs.

- Receipts for every single extra expense you incur trying to keep the lights on.

The quality of your documentation has a direct line to the speed and fairness of your settlement. When you submit an organized, detailed package, there's little room for debate, helping the adjuster process your claim much more efficiently.

Working with the Insurance Adjuster

The insurance adjuster is the central figure in this process. Their role is to investigate what happened, review all your documents, and calculate a settlement amount based on the specific terms of your policy.

It's best to see the adjuster as a partner in this, not an adversary. Get them the information they ask for promptly and maintain an open line of communication. This is also where having a trusted insurance advisor, like our team at Wexford Insurance Solutions, can be a game-changer. We can act as your advocate, helping you organize your paperwork and making sure you understand what's happening every step of the way.

If this is your first time navigating something like this, getting familiar with the general steps of how to file an insurance claim can give you a better feel for the road ahead. Ultimately, a smooth claims process is what turns your business income policy into the financial lifeline it was always meant to be.

Partnering with an Expert to Protect Your Revenue

Picking out a business income insurance policy isn't like buying office supplies. It’s a crucial strategic decision that directly impacts your company's ability to survive a catastrophe. Trying to navigate co-insurance clauses, valuation methods, and the dozens of available endorsements on your own is a huge gamble. This is precisely where bringing in an independent insurance expert like Wexford Insurance Solutions makes all the difference.

A seasoned advisor does more than just hunt for a cheap quote. They take the time to dig into your specific operations—your revenue streams, your supply chain, your key dependencies—to spot risks you might have overlooked. They know from experience that a standard, off-the-shelf policy is almost always full of gaps that only show up after it's too late.

Beyond the Policy: A Strategic Partnership

Think of a true insurance partner as a risk management advisor, not a salesperson. They'll help you pore over your financial statements to nail down the right coverage limit, saving you from the crippling financial pain of being underinsured. That expert guidance is what turns a guess into a calculated business decision.

For instance, they can walk you through whether you need to bolt on specialized coverage, such as:

- Utility Services Endorsement: What happens if the local power station or water main fails, shutting you down for days? This helps cover that.

- Contingent Business Interruption: This protects your income if a fire at your key supplier’s factory means you can't get the parts you need to operate.

- Leader Property Coverage: Own a gift shop next to a major tourist attraction? This coverage can safeguard your income if that anchor location suffers damage and foot traffic disappears.

An expert translates the dense policy jargon into plain English, so you understand exactly what you're buying. They help you build a financial shield that's actually designed for your business, not just a generic piece of paper. For companies looking to bring in high-level financial leadership for this and other strategic decisions, one option is to explore Fractional CFO Services.

Advocacy When It Matters Most

Perhaps the most critical moment to have an expert in your corner is when you actually have to file a claim. Your business is already in crisis mode; the last thing you need is a fight with your insurance carrier. A professional advocate on your side is invaluable. They help you organize the mountain of paperwork, communicate clearly with the adjuster, and make sure the whole process moves along as fairly and quickly as possible.

At Wexford Insurance Solutions, we see ourselves as part of your team. Our job is to turn the intimidating process of buying business income insurance into a clear, collaborative effort that truly protects your revenue and your company’s future.

Working with us means you have an ally whose sole focus is protecting your bottom line and giving you peace of mind. We analyze the risks, advise on the solutions, and advocate for you at every step. That lets you get back to what you do best: running your business with the confidence that a real financial safety net is in place.

Frequently Asked Questions

When you're running a business, you're bound to have questions about insurance. Let's break down some of the most common ones we hear about business income coverage so you can see exactly how it fits into your company's financial safety plan.

Is Business Income Insurance Required by Law?

Straight to the point: no, business income insurance is generally not required by law. This isn't like workers' compensation or commercial auto insurance, where states typically mandate coverage.

That said, you might be required to carry it by contract. It's common for commercial landlords to write this coverage into a lease agreement to ensure their tenants can continue paying rent after a disaster. Likewise, a bank or lender might make it a condition of a business loan to protect their investment if your operations grind to a halt.

How Is It Different from General Liability Insurance?

This is a great question because they cover completely different worlds of risk. The easiest way to think about it is that general liability protects you from claims that you hurt others, while business income insurance protects your own business from financial harm after a disaster.

- General Liability Insurance: This is your shield against third-party claims. It kicks in if a customer slips and falls in your shop (bodily injury) or an employee accidentally breaks something at a client’s office (property damage).

- Business Income Insurance: This is your financial lifeline. It covers your lost income and fixed costs when you can't open your doors because of physical damage to your property, like from a fire or major storm.

They aren’t an either/or choice. They’re two critical, non-overlapping parts of a complete risk management strategy.

Think of it like this: General liability is your shield against lawsuits from the outside world. Business income insurance is your company’s internal survival fund. A truly protected business needs both.

How Long Does Coverage Last After a Disruption?

The length of time you’re covered is defined by your policy’s “period of restoration.” This coverage doesn't start the moment the damage occurs; there's usually a short waiting period, often 48 to 72 hours.

From there, the clock starts ticking. The period of restoration lasts until your property is reasonably repaired and you're ready to get back to business as usual. It's not indefinite, though. Most standard policies cap this at 12 months, but you can extend this with an endorsement. It’s absolutely vital to be realistic about how long it would take you to rebuild, get new equipment, and restock when you're setting up your policy.

Does It Cover Payroll for All Employees?

That depends entirely on how your policy is set up. A standard policy will typically cover the payroll for your key employees—the people you absolutely cannot afford to lose while you rebuild. We’re talking about your top managers, specialized technicians, or anyone essential to getting the business back on its feet.

But what about everyone else? You can add an endorsement for “ordinary payroll coverage.” This extends your policy to cover the wages of all your employees for a set amount of time, like 90 or 180 days. This is a powerful tool for employee retention, ensuring your whole team is ready and waiting for you the day you reopen your doors.

Getting a handle on the specifics of business income insurance is the first step toward making your business truly resilient. Here at Wexford Insurance Solutions, our job is to help you dig into your unique risks and put together a policy that will actually be there for you when it counts. Contact us today to schedule a comprehensive review of your coverage.

Your Complete Guide to Construction Defect Claims

Your Complete Guide to Construction Defect Claims