Think of commercial auto insurance as a specialized shield for any vehicle your business uses. It's designed to cover everything from liability and physical damage to incidents involving your employees on the road. For any company that puts wheels on the pavement—whether it's a single delivery van or a whole fleet—this isn't just another policy; it's a critical financial backstop.

This is where your personal auto policy bows out. It simply wasn't built to handle the unique risks and higher liability stakes that come with running a business.

Why Your Business Needs Commercial Auto Insurance

Let's say one of your employees has a minor fender-bender while out on a delivery. It might seem like a small issue, but without the right insurance, that little accident could quickly become a huge financial problem for your business. This is exactly why commercial auto coverage is so essential for keeping your company stable and secure.

Here’s a good way to think about it: a personal auto policy is like a basic first-aid kit you keep at home for scrapes and cuts. A commercial policy is the fully-stocked trauma bag a paramedic carries—it has everything needed to handle serious, high-stakes emergencies out in the field.

The Financial Shield for Your Operations

At its core, this insurance is all about protecting your company from a catastrophic financial blow. A single at-fault accident can lead to an avalanche of costs you might not see coming.

- Legal Fees: Just defending your business in a lawsuit can be incredibly expensive, even if you’re not found at fault.

- Medical Expenses: If someone is injured, their medical bills can skyrocket into the hundreds of thousands in no time.

- Property Damage: The cost to repair or replace someone else’s vehicle or property comes straight out of your pocket.

- Vehicle Repairs: You need your own vehicles back on the road to keep business moving, and those repairs don't come cheap.

Without the right coverage, all of these expenses are paid directly from your business assets. That could mean halting operations or, in a worst-case scenario, even bankruptcy. It's no surprise the global commercial auto insurance market is expected to grow from USD 188.44 billion in 2025 to USD 325.72 billion by 2031. The need is real and growing.

A single accident involving a business vehicle can trigger liability claims far exceeding the limits of a personal auto policy, making dedicated commercial coverage a non-negotiable aspect of risk management.

Beyond the Basics of Protection

Getting a handle on this coverage isn't just about checking a box; it's about building a solid financial defense for your company's future. It can be helpful to brush up on some general car insurance insights to get a foundational understanding. From there, you’ll have a much better appreciation for the specific protections your business needs.

If you want to dig deeper into what the law requires, check out our guide on commercial vehicle insurance requirements. In the sections ahead, we’ll walk you through everything you need to know—from core coverages and cost factors to smart risk management strategies.

Understanding the Core Components of Your Policy

Think of a commercial auto policy less like a single blanket and more like a collection of different shields, each designed to stop a specific kind of financial threat. To build a truly effective defense for your business, you need to understand exactly what each of these shields does. Let's break down the essential building blocks of your coverage, cutting through the confusing jargon.

Each piece of your policy serves a distinct and vital purpose. When they all work together, they create a safety net for your operations. Without the right combination, you could be left wide open to significant financial hits from completely unexpected angles.

H3: Liability Coverage: The First Line of Defense

This is the absolute cornerstone of any commercial auto policy. If one of your drivers is found at fault in an accident that injures someone or damages their property, liability coverage is what steps in to handle the costs. It acts as your primary financial shield against potentially devastating lawsuits and claims.

Liability coverage is typically split into two main parts:

- Bodily Injury Liability: This covers the big-ticket items like medical expenses, lost wages, and legal fees for people injured in an accident caused by your driver.

- Property Damage Liability: This pays to repair or replace the other person’s vehicle or any other property your vehicle damaged, like a storefront, a fence, or a light pole.

A single serious accident can easily lead to claims pushing into the six or seven figures. Having the right liability limits isn’t just a good idea—it’s absolutely essential for business survival.

H3: Protecting Your Own Fleet with Physical Damage Coverage

While liability protects you from claims others make against you, Physical Damage coverage is all about protecting your own vehicles. Think of it as the repair and replacement fund for your company’s most important mobile assets.

This coverage is usually broken down into two key types.

First up is Collision Coverage. This is what pays to repair or replace your vehicle if it’s damaged in a collision with another object—whether that’s another car or a telephone pole—or if it overturns. Crucially, it applies regardless of who was at fault.

Then there’s Comprehensive Coverage. This protects your vehicles from damage caused by just about anything other than a collision. We’re talking about things like theft, vandalism, fire, hail, or hitting a deer. It's the part of your policy that covers the unpredictable and often uncontrollable risks your vehicles face every single day.

When you're looking at physical damage coverage, you have to understand how your deductible comes into play during a claim. For a clear picture of this crucial detail, you can learn more about what a deductible is in insurance and how it works.

H3: Filling the Gaps with Other Essential Coverages

Beyond the two main pillars of liability and physical damage, several other coverages are designed to fill critical protection gaps. Each one addresses a specific scenario that could otherwise leave your business on the hook for major out-of-pocket costs.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): This helps pay for medical bills for the driver and passengers in your vehicle who get hurt in an accident, no matter who is at fault.

- Uninsured/Underinsured Motorist Coverage: This is your safety net. It protects you if your driver gets into an accident caused by someone who either has no insurance or doesn't have enough insurance to pay for the damages they caused.

- Hired & Non-Owned Auto (HNOA) Coverage: This one is frequently overlooked but absolutely critical. It provides liability protection when your employees use their personal cars for business errands or when you rent vehicles for a job.

To help you see how all these pieces fit together, here is a simple breakdown of the main coverage types and what they protect you from.

Core Commercial Auto Coverages at a Glance

| Coverage Type | What It Covers | Example Scenario |

|---|---|---|

| Liability Coverage | Damages and injuries you cause to others, including legal defense costs. | Your delivery driver rear-ends another car, injuring the driver and damaging their vehicle. |

| Physical Damage | Repair or replacement costs for your own business vehicles. | Your work truck is stolen from a job site or damaged in a hailstorm. |

| Uninsured Motorist | Your expenses when an at-fault driver has no insurance or not enough. | A driver runs a red light and hits your van but has no insurance to cover your repairs. |

| Hired & Non-Owned Auto | Liability for accidents involving vehicles your business uses but doesn’t own. | An employee using their personal car to visit a client gets into an accident. |

As you can see, each coverage addresses a specific risk. Having the right mix is the key to creating a policy that truly protects your business from all sides.

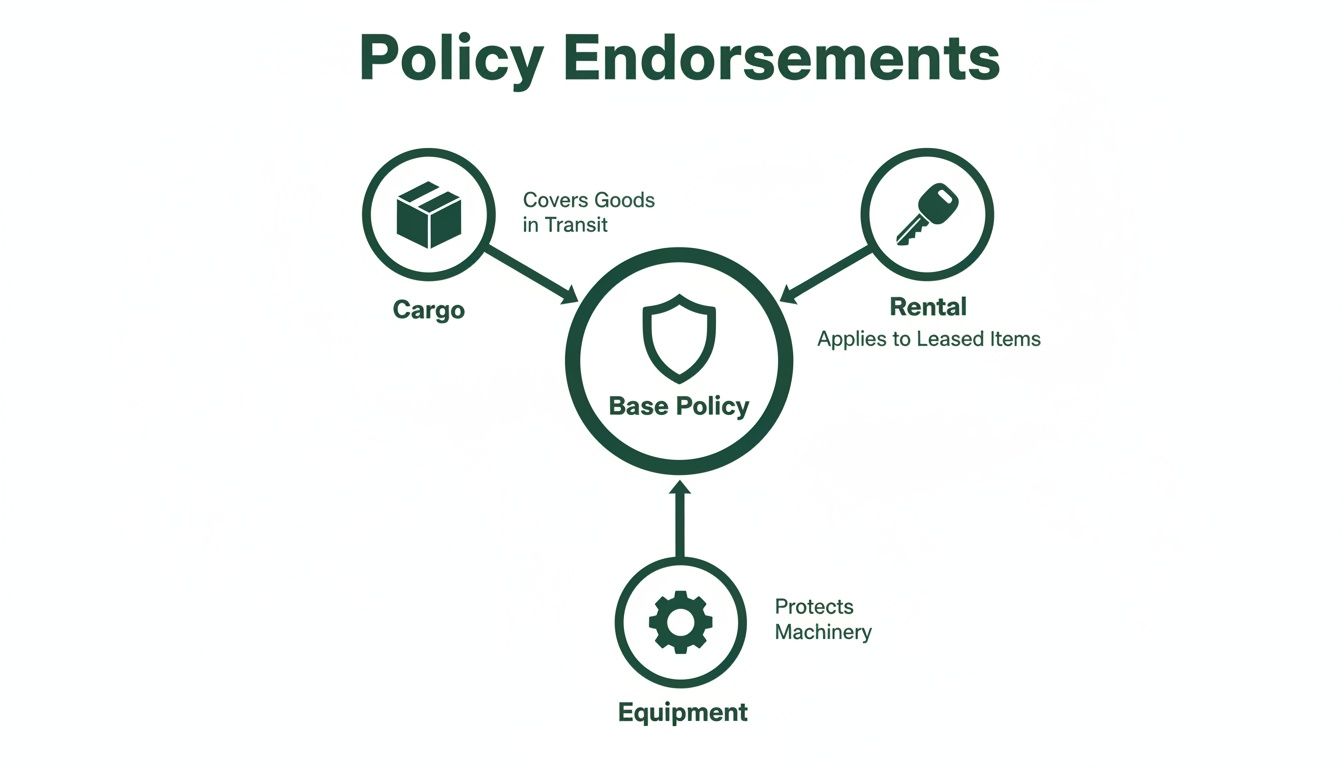

Customizing Your Policy with Specialized Endorsements

A standard commercial auto policy gives you a solid foundation, but let's be honest—most businesses have unique needs that a basic policy just doesn't cover. This is where endorsements, or add-ons, come into play. They're the secret to getting coverage that actually fits what you do.

Think of your base policy like a brand-new work truck right off the lot. It's reliable and gets you from A to B, but it isn't ready for your specific job. Endorsements are the custom toolboxes, ladder racks, and specialized hitches you add to make that truck work for you. Relying on a one-size-fits-all policy is a gamble, and endorsements are how you close the gaps.

Tailoring Protection to Your Operations

The right endorsements can transform a generic policy into a custom-fit suit of armor for your business. Forgetting a key add-on is like a roofer showing up to a job without a nail gun—it leaves you exposed and inefficient.

Here are a few of the most common endorsements businesses add to their policies:

- Cargo Insurance: If you transport goods, materials, or products for your business, this is a must-have. It protects that cargo from theft or damage while it's on the road. For couriers, contractors, or delivery services, it’s non-negotiable.

- Rental Reimbursement: When a covered accident sidelines one of your vehicles, this helps pay for a temporary rental. It’s all about preventing costly downtime and keeping your business running smoothly.

- Towing and Labor: This add-on covers the cost of towing your vehicle to a repair shop after an accident or breakdown. It can also cover roadside help for things like a flat tire or a dead battery.

Each of these addresses a specific risk that could otherwise turn a small hiccup into a major financial headache.

Coverage for Permanently Attached Equipment

For a lot of businesses, a work vehicle's real value isn't just the truck itself—it's the thousands of dollars of equipment bolted onto it. Contractors, food truck operators, and mobile detailers often have a huge investment in permanently installed gear.

A standard physical damage policy often won't cover custom equipment like welders, cranes, or specialized shelving systems attached to your truck. An Attached Equipment Endorsement is crucial to make sure these high-value assets are actually protected.

Picture a plumbing company whose work van gets stolen. The van is a loss, sure, but the $10,000 in custom shelving, racks, and a hydro-jetting unit inside is an even bigger blow. Without the right endorsement, the business is on the hook for replacing it all. This specialized commercial auto insurance coverage makes sure the vehicle and its essential tools are covered.

Expanding Your Liability Shield

Beyond protecting your own property, some endorsements are vital for managing your liability—especially when you use vehicles you don't own. Your core policy has your company-owned fleet covered, but what happens when an employee runs to the hardware store for a quick pickup in their personal car?

This is where you have to think about add-ons that broaden your liability protection. If employees frequently use their own cars for work errands, for example, you have a major gap. You can learn more by reading about the nuances of hired and non-owned auto insurance to see how it fills this common blind spot. Building a policy that truly protects your business means looking at every single way a vehicle is used on your behalf.

How Your Insurance Premiums Are Actually Calculated

Have you ever looked at your commercial auto insurance bill and wondered where that number comes from? It’s not just pulled out of a hat. Think of it like a recipe, where a mix of specific ingredients—each one representing a different risk factor—comes together to create your final premium.

Getting a handle on these ingredients is the first step toward managing your costs. From the trucks you own to the people you hire to drive them, every detail gives an underwriter a clearer picture of your company's risk profile. Let’s break down the key factors that really move the needle.

Key Factors That Influence Your Premium

Insurance companies look at several core parts of your business to figure out your rate. These aren't random; they're direct indicators of risk. If you can manage them well, you can make a real difference to your bottom line.

Here’s what they’re looking at most closely:

- Vehicle Type and Use: It’s simple, really. A heavy-duty dump truck on a busy construction site is a world away from a small sedan used for sales calls. The vehicle’s size, weight, and job function are huge considerations.

- Driving Records: The Motor Vehicle Records (MVRs) of your drivers are non-negotiable. A history of accidents, speeding tickets, or other violations is a major red flag that signals higher risk and, you guessed it, higher premiums.

- Travel Radius: How far do your vehicles go? A local florist operating within a 50-mile radius is a much lower risk than a long-haul trucking company that’s constantly crossing state lines.

- Industry and Cargo: What you do for a living matters. Hauling hazardous materials is inherently riskier than delivering baked goods, and your premium will reflect that.

A standard policy is just a starting point. As you add endorsements to cover specific risks like cargo or specialized equipment, your premium adjusts accordingly.

This is why a one-size-fits-all approach just doesn't work; your coverage has to be built around your actual operations.

Broader Industry Trends Are Pushing Costs Up

It's not just about what's happening within your own company. The entire commercial auto insurance industry has been under enormous financial pressure for years, and that directly impacts what you pay.

For over a decade, many insurers have been losing money on these policies. A big reason is the massive 64% jump in how much claims cost since 2015. This is driven by things like "social inflation," where jury awards in accident lawsuits have skyrocketed. These multi-million dollar "nuclear verdicts" create an unstable environment, forcing insurers to raise rates across the board just to stay in business.

"The persistent financial strain on insurers, marked by loss ratios consistently exceeding 100%, means that external economic and legal trends now play as significant a role in your premium as your own company's safety record."

Taking Back Control of Your Insurance Costs

You can’t stop a lawsuit-happy jury, but you absolutely have control over your own risk factors. Now that you know what insurers are looking for, you can start making targeted improvements where they’ll count the most.

Focus on the fundamentals: hire drivers with clean records, build a rock-solid safety program, and keep your vehicles in top shape. Taking these steps proves to an insurer that you're a responsible partner, which can lead to better pricing over time. To get more practical ideas, check out our guide on how to manage your business auto insurance cost.

Knowing how the system works is the first step toward making it work for you.

Seeing Commercial Auto Insurance in Action

It’s one thing to read about policy terms and endorsements, but it’s another to see how they actually hold up in the real world. That's when abstract concepts like liability limits and exclusions really start to make sense.

These stories show how a well-built commercial auto insurance coverage plan is a vital operational tool, not just another line item on your expense sheet. Let's walk through three common situations to see how the right coverage can be the difference between a minor hiccup and a full-blown financial disaster.

Scenario One: The Caterer's Quick Errand

Picture a small catering business, "Savory Bites." During a chaotic lunch rush, the owner asks an employee to use their own car to run to a wholesaler for extra supplies. On the way back, the employee misjudges a turn and causes a three-car pileup, seriously injuring another driver.

The employee’s personal auto policy has a $50,000 liability limit, but the medical bills and vehicle damages are adding up fast, quickly topping $200,000. Because the trip was for work, Savory Bites gets hit with a lawsuit for the remaining $150,000.

- The Coverage Solution: Thankfully, Savory Bites had Hired & Non-Owned Auto (HNOA) coverage.

- The Outcome: The HNOA policy kicked in right where the employee’s personal insurance left off. It covered the rest of the liability costs, legal defense, and the final settlement. This single piece of coverage saved the business from a crippling expense that could have easily shut its doors for good.

This is a classic example of a huge, often-ignored risk. If any of your employees ever use their personal cars for a work-related task—even once—you have this exposure.

Scenario Two: The Contractor's Stolen Truck

Next up is "Bedrock Builders," a local construction firm. Their workhorse is a heavy-duty truck outfitted with a $15,000 custom-welded ladder rack and a permanently bolted-on $20,000 industrial generator. One morning, the crew shows up to the job site and the truck is gone.

A standard policy would cover the truck's blue book value, sure. But what about all that expensive, specialized equipment that makes the truck so valuable to the business? This is where many contractors find a nasty surprise in their coverage.

A standard comprehensive policy often excludes or severely limits coverage for any equipment that wasn't installed at the factory. The real value is in the custom modifications, and that's exactly what needs specific protection.

- The Coverage Solution: Bedrock Builders was smart and added an Attached Equipment Endorsement to their policy.

- The Outcome: When they filed the claim, their commercial auto insurance coverage didn't just pay for the stolen truck. It also covered the full replacement cost for the custom rack and the generator, allowing them to get a new, fully equipped vehicle back to work with minimal downtime.

Scenario Three: The Delivery Fleet's Highway Pileup

Finally, let’s look at "Rapid Parcel," a delivery service with a fleet of 20 vans. A driver, distracted for just a second, triggers a chain-reaction crash on the highway involving five other vehicles. Multiple people are injured, and the resulting claims start pouring in.

The total liability for medical expenses and property damage skyrockets to $1.8 million. This is the kind of catastrophic event that can wipe out a business if it’s not properly insured.

- The Coverage Solution: Rapid Parcel had worked with their agent to layer their protection. They had a primary auto policy with a $1 million liability limit, backed by a $2 million commercial umbrella policy.

- The Outcome: The main auto policy paid out its full $1 million. The umbrella policy then seamlessly stepped in to cover the remaining $800,000, protecting the company's assets from being seized to pay the settlement. For any business with multiple vehicles on the road, this layered strategy is non-negotiable.

These scenarios prove that getting the right coverage isn't about luck—it's about smart, proactive strategy. Taking the time to identify your unique risks and build a policy that truly matches them is fundamental to your business's survival.

When an incident does happen, knowing what to do next is crucial. If you're ready to learn more, our guide on how to file an insurance claim walks you through the entire process.

How to Lower Your Insurance Costs

You have more sway over your insurance premiums than you might realize. Sure, market trends can drive up costs for everyone, but by actively managing your risk, you can take direct control of the factors that are unique to your business. This turns your insurance bill from a simple expense into a return on a smart investment in safety.

Good risk management is more than just checking a box for compliance. It’s about creating a true safety-first culture that protects your team, your vehicles, and your company's financial health. When an underwriter sees a business with a rock-solid safety program, they see a lower risk. That's what opens the door to better rates.

Let's dig into a few practical strategies you can put into action.

Build a Real Driver Safety Program

A formal safety program is your cornerstone. It moves you past simply telling drivers to "be careful" and into a system of clear, consistent standards for anyone who operates a company vehicle.

A strong program needs a few key things:

- Smart Hiring: Don't just hire anyone with a license. A strict screening process, including a thorough check of Motor Vehicle Records (MVRs), is your first line of defense. You want to make sure you're only putting people with clean driving records behind the wheel.

- Constant Training: One-and-done training doesn't cut it. Regular sessions keep safe habits top of mind, introduce defensive driving tactics, and ensure everyone is up-to-date on traffic laws and your own company rules.

- Rules of the Road: Put it in writing. A clear, documented safety policy should spell out your rules on everything from cell phone use and speeding to the exact steps a driver must take after an accident.

For businesses operating larger trucks, a major step is implementing robust HGV accident prevention measures, as this can have a massive impact on claim frequency.

Use Technology to Your Advantage

Today's tech gives you an incredible window into what's happening on the road. Telematics systems, which use GPS and onboard diagnostics, are a game-changer. They give you real-time data on vehicle location, speed, hard braking, and rapid acceleration.

Armed with this data, you can spot risky driving habits before they lead to an accident. It allows you to have specific, data-backed coaching conversations with the drivers who need a little extra guidance. Many insurance carriers even offer premium discounts for fleets using telematics because it proves you’re serious about safety.

Telematics technology is reshaping how insurers assess risk. Instead of relying on averages, they can see your fleet's actual on-road behavior. This direct data gives them a much clearer, more accurate picture of your company's risk profile, which can work in your favor.

Stick to a Strict Maintenance Schedule

A well-maintained vehicle is a safe vehicle. It's that simple. Things like brake failures, tire blowouts, or burnt-out headlights are often the cause of accidents that were entirely preventable. A disciplined maintenance plan isn't just about extending the life of your vehicles—it’s a non-negotiable part of your safety strategy.

Keep meticulous records of every oil change, tire rotation, and repair for every single vehicle. This paper trail demonstrates to your insurer that you're doing everything you can to keep a safe, reliable fleet on the road. That kind of proactive care looks great on your risk profile and can directly help manage your commercial auto insurance coverage costs.

Common Questions About Commercial Auto Insurance

It's one thing to understand the pieces of a commercial auto policy, but it's another to see how they fit together in the real world. Business owners always have practical, "what if" questions about how their coverage actually works day-to-day. Let's tackle some of the most common ones we hear.

Getting these details straight is the key to making sure your policy actually does its job when you need it to.

Does My Personal Auto Policy Cover Business Use?

This is probably the most frequent—and most critical—question we get. The answer is almost always a hard no.

A personal auto policy is built for personal driving, period. Think commuting, running errands, or family road trips. The moment a vehicle is used to earn revenue—whether that's making deliveries, visiting clients, or hauling equipment—it crosses a line that personal policies just aren't designed to cover.

If you get into an accident while on the job, your personal insurer has every right to deny the claim. That could leave you and your business on the hook for everything. This single point is precisely why dedicated commercial auto insurance coverage isn't just a good idea; it's essential.

What if an Employee Uses Their Own Car for Work?

This scenario opens up a huge can of worms for your business. Let's say you send an employee to the post office or to meet a client using their own sedan. If they cause an accident along the way, your company can be dragged into a lawsuit. Suddenly, that simple errand has put your entire business at risk.

This is exactly what Hired and Non-Owned Auto (HNOA) coverage is for. It's a crucial add-on that shields your business from liability when employees drive vehicles you don't own for company purposes. It works in concert with the employee's own insurance to protect your company's assets.

Without HNOA coverage, a simple trip by an employee to a client meeting in their own car can become a million-dollar liability for your business. It's a non-negotiable for any company whose team members might drive their personal vehicles for even the smallest work task.

Is My Expensive Equipment Covered?

Here’s another common and costly blind spot. A standard commercial auto policy is great at covering the truck or van itself. But what about the thousands of dollars of tools, equipment, or products inside it? Usually, that’s not included.

For tradespeople, caterers, tech installers, and countless other businesses, the value of what's in the vehicle can easily exceed the value of the vehicle itself. To properly protect those assets, you need specific additions to your policy:

- Cargo Insurance: This covers the goods you're hauling, whether they belong to a client or are part of your own inventory. It protects against things like theft, damage in transit, or even spoilage.

- Attached Equipment Coverage: This is for the gear that's permanently bolted or welded onto your vehicle. Think custom ladder racks, hydraulic lifts, or specialized plumbing rigs.

You have to be intentional about this. Always double-check that your policy is built to protect not just your vehicle, but the valuable equipment that makes your business run.

Ready to build a policy that truly protects your business? The experts at Wexford Insurance Solutions can help you navigate your options and close critical coverage gaps. Contact us today for a comprehensive policy review.

What Is Completed Operations Coverage And Why Your Business Needs It

What Is Completed Operations Coverage And Why Your Business Needs It