Think of your auto insurance policy like a protective shield. While some parts of that shield defend you in a crash, comprehensive insurance is the piece that guards your vehicle against almost everything else. It covers damage from events that are completely out of your control—things that happen when you're not even behind the wheel.

Defining Your Shield Against the Unexpected

Let’s be honest, insurance terms can be confusing. Many drivers hear “comprehensive” and mistakenly think it means they’re covered for absolutely everything. In reality, it’s a specific type of coverage that works alongside others, like collision and liability, to create a strong safety net.

Comprehensive insurance is your go-to for the bizarre, the unfortunate, and the downright unpredictable. It’s what pays to repair or replace your car if it’s stolen, vandalized, or damaged by things like fire, falling objects, or even a run-in with a deer. To get a really deep dive into the specifics, this guide on What Is Comprehensive Auto Insurance? is a great resource.

Comprehensive vs. Other Core Coverages

It’s easier to grasp what comprehensive does when you see how it stacks up against the other main types of auto coverage. You might be surprised to learn that these non-collision incidents make up about 25% of all auto claims.

With the average comprehensive claim payout now topping $2,100, thanks in part to a recent spike in car thefts, this coverage is more important than ever.

To clear things up, let's look at a quick side-by-side comparison of the three main players in auto insurance.

Comprehensive vs Collision vs Liability at a Glance

| Coverage Type | What It Covers | Example Scenario |

|---|---|---|

| Comprehensive | Damage to your car from non-collision events like theft, fire, vandalism, or hitting an animal. | A hailstorm dents your car's roof while it's parked in your driveway. |

| Collision | Damage to your car from hitting another vehicle or object, regardless of who is at fault. | You accidentally back into a telephone pole, damaging your rear bumper. |

| Liability | Bodily injury and property damage you cause to others in an accident where you are at fault. | You run a red light and hit another car, injuring the driver and damaging their vehicle. |

So, if you’re wondering, "What happens if a tree branch falls on my car?" or "Am I covered if someone steals my catalytic converter?"—comprehensive coverage is where the answer lies. It's a non-negotiable part of what people commonly call a https://wexfordis.com/2025/08/08/what-is-full-coverage/ policy.

What Comprehensive Coverage Actually Protects You From

When most people think about car insurance, they picture car-on-car accidents. That’s what liability and collision coverages are for. But what about all the other ways your car can get damaged? Comprehensive insurance is your safety net for the unpredictable—the kind of trouble your car can get into when it's just sitting in your driveway.

Think of it as the “anything but a collision” policy. It's designed for the real-world headaches you simply can't see coming.

Protection from Weather and Natural Events

Mother Nature has a mind of her own, and your vehicle is often right in the path of her fury. Comprehensive coverage is built specifically for this, stepping in to cover damage from a whole host of natural and weather-related events.

Storm damage is a perfect example. If a nasty hailstorm leaves your car's hood looking like a golf ball, your comprehensive policy is what pays for the repairs. The same goes if a windstorm topples a massive tree branch onto your roof and shatters your windshield.

Here’s a quick look at the kind of environmental risks it covers:

- Weather Damage: This is the big one—hail, floods, windstorms, and lightning strikes. If your car gets caught in rising water that ruins the engine, this is the coverage you’ll need.

- Falling Objects: This isn't just about storms. It also covers bizarre incidents like a rock falling from an overpass or debris dropping from a construction site onto your parked car.

- Fire: Comprehensive helps with the aftermath of a fire, whether it started from a mechanical issue under the hood or your car was damaged in a larger blaze.

One crucial thing to understand: comprehensive insurance covers "acts of nature." If your neighbor’s tree falls on your car, their insurance probably won't pay because they weren't negligent. It was the storm's fault. Your own comprehensive policy is what you'll rely on.

Coverage for Vandalism, Theft, and Other Incidents

Life isn't just about bad weather; it's also about the unpredictable actions of other people. Comprehensive insurance also protects you from these frustrating, random events.

Imagine waking up to find your car has been vandalized—a deep key scratch down the side, a smashed window, or spray paint. That’s a classic comprehensive claim. It also provides a lifeline in the event of theft of your vehicle. If your car is stolen and can't be found, this policy helps cover its actual cash value so you're not left with a total loss.

Animal Collisions and Other Surprises

Finally, one of the most frequent types of comprehensive claims involves wildlife. Hitting a deer on a back road can easily cause thousands of dollars in damage, and since it’s not a collision with another car or a stationary object, it falls squarely under your comprehensive policy.

The distinction between comprehensive and collision can get a little tricky, so let's break it down with a few real-world examples:

| Scenario | Type of Claim | Why It's Covered That Way |

|---|---|---|

| A deer sprints out in front of your car. | Comprehensive | A collision with an animal is a classic "act of nature" event. |

| You swerve to miss the deer and hit a guardrail instead. | Collision | You didn't hit the animal; you collided with an object. |

| A truck kicks up a rock that cracks your windshield. | Comprehensive | This is considered damage from a flying or falling object. |

Ultimately, understanding what does comprehensive insurance do means seeing it as protection from the world around your car, not just from what happens when you're behind the wheel.

Knowing the Common Exclusions and Policy Limits

While comprehensive insurance is a fantastic safety net for a lot of life's curveballs, it’s not a magic wand that covers everything. To avoid frustrating surprises when you need to file a claim, it's just as important to understand what's not covered as what is.

Think of your auto policy as a toolkit. You have different tools for different jobs, and comprehensive is the specialized tool for non-collision events. It's powerful, but it has its specific purpose.

What Comprehensive Insurance Typically Won't Cover

The biggest thing to remember is that comprehensive insurance doesn't cover damage from a collision. If you hit another vehicle, a fence, or even a nasty pothole, you'll need collision coverage to handle those repairs. The line is drawn at the cause of the damage.

Here are a few other common situations where comprehensive coverage doesn't apply:

- Medical Bills: If you or your passengers are injured, your medical payments coverage or personal injury protection (PIP) is what kicks in, not comprehensive.

- Normal Wear and Tear: Insurance isn't for routine upkeep. Things like aging tires, worn-out brake pads, or engine trouble from high mileage aren't covered.

- Stolen Personal Items: This one trips people up. If a thief smashes your window to steal your laptop, comprehensive pays to fix the glass. But the stolen laptop itself? That's usually a claim for your homeowners or renters insurance.

A classic point of confusion is the deer vs. pothole scenario. Hitting a deer is a random, unpredictable event—that’s a comprehensive claim. Hitting a pothole, on the other hand, is considered a collision with an object in the road, which falls squarely under collision coverage.

Understanding Your Policy Limits

Beyond what's excluded, every policy has financial limits. For a comprehensive claim, the maximum payout is almost always your vehicle's actual cash value (ACV) right before the incident occurred. ACV isn't what you paid for the car; it’s the market value after factoring in depreciation.

For a deeper dive, our guide on the difference between actual cash value and replacement cost breaks this down even further.

Your deductible is the other key number. It’s the amount you agree to pay out-of-pocket before your insurance kicks in. For example, if you have a $500 deductible and a hailstorm causes $3,000 in damage, you'll pay the first $500. Your insurance company then covers the remaining $2,500.

Getting a handle on these limits and exclusions is the key to building a truly solid insurance plan, one without any gaps or costly surprises down the road.

Figuring Out If You Truly Need Comprehensive Insurance

Deciding whether to add comprehensive insurance to your policy isn't a simple yes or no. The right answer really depends on your financial situation, your car's value, and even where you call home. For some people, it's an absolute must-have; for others, the cost might not be worth the potential payout.

The trick is to weigh the cost of the premium against the risk of getting hit with a huge, unexpected repair bill. It's a personal risk calculation, and what works for your neighbor might not work for you.

The New Car Owner with a Loan

If you’re financing or leasing a new ride, the decision is pretty much made for you. Nearly all lenders and leasing companies require both comprehensive and collision coverage for the entire term of the loan. Why? It's all about protecting their investment.

Think of it from their side: your car is the collateral for the loan they gave you. If it gets stolen or crushed by a falling tree, they need to know their asset is covered. Without it, you could be stuck making payments on a car you can't even drive—a financial nightmare for everyone involved.

The Owner of an Older, Paid-Off Car

This is where things get more interesting and you have a real choice to make. Once your car is paid off, you're free to drop comprehensive coverage. The big question to ask yourself is: “If my car were totaled tomorrow by something other than a crash, could I afford to replace it without breaking the bank?”

A good rule of thumb is to compare what you pay annually for comprehensive coverage to your car's actual cash value (ACV). If your premium is more than 10% of what your car is worth, it might be time to rethink. For instance, paying $300 a year for comprehensive on a car valued at only $2,000 probably doesn’t make financial sense.

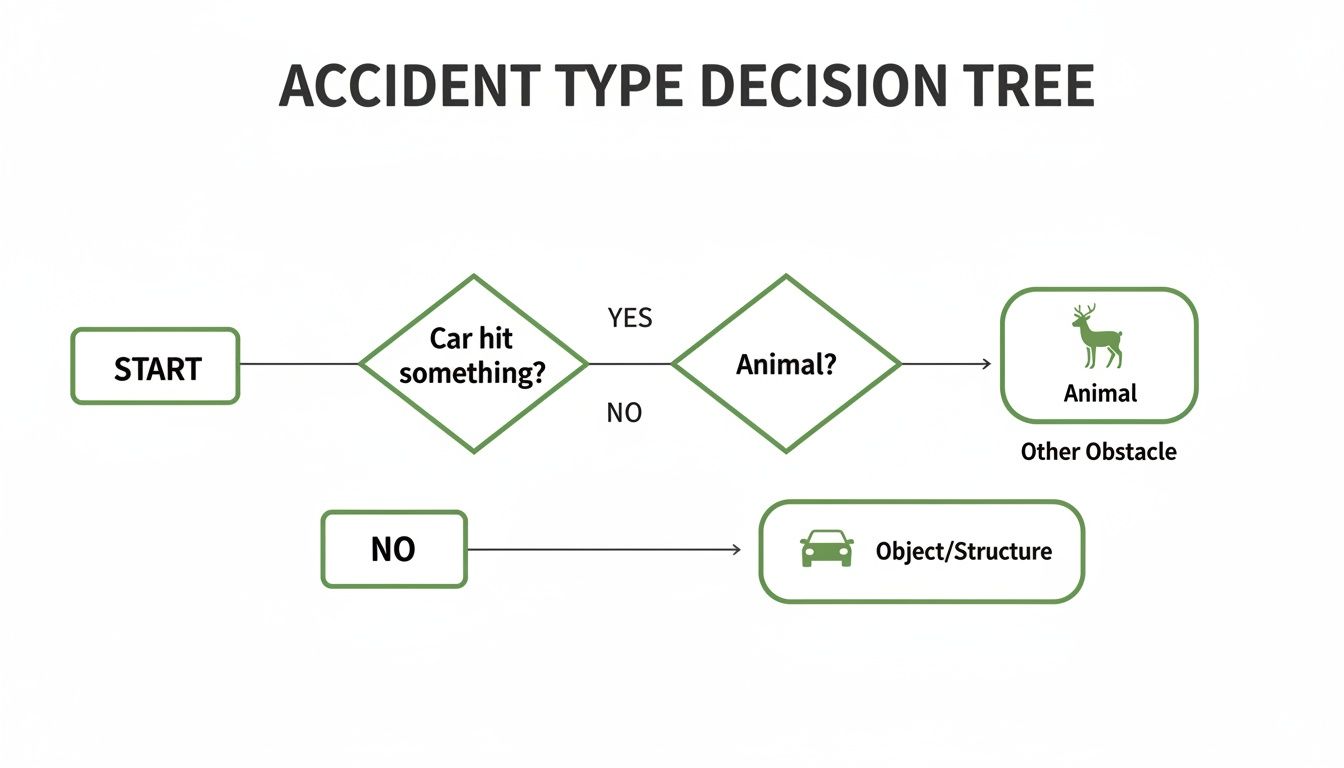

This decision tree helps clarify the often-confusing line between comprehensive and collision claims.

As you can see, hitting an animal is a comprehensive event, but hitting something inanimate like a pothole falls squarely under collision.

Your Location and Lifestyle Matter

Your personal risk profile plays a huge part in this decision, too. Where you live and where you park your car can seriously ramp up the odds of needing to file a comprehensive claim.

Think about these risk factors:

- High-Crime Areas: If you live somewhere with high rates of car theft or vandalism, comprehensive coverage acts as a vital safety net.

- Severe Weather Zones: For those in regions prone to hailstorms, flooding, or hurricanes, comprehensive becomes far more valuable.

- Rural Environments: If you’re often driving on country roads where deer are common, your risk of an animal collision is much higher.

The core of the decision is balancing the premium against your peace of mind and financial stability. If a sudden $5,000 repair bill for hail damage would derail your budget, keeping comprehensive coverage is a wise investment, regardless of your car's age.

Ultimately, figuring out if you need comprehensive insurance comes down to a simple cost-benefit analysis. For those looking to manage costs, there are several ways for how to lower car insurance premiums without ditching essential protection. By taking a hard look at your car's value, your personal risk factors, and your ability to handle a sudden loss, you can make an informed choice that fits your life and your budget.

How Your Premium and Deductible Work Together

When you’re looking at comprehensive insurance, two numbers really matter: the premium and the deductible. Think of them as two ends of a seesaw. When one goes up, the other usually comes down. The trick is finding the perfect balance for your budget and how much risk you're comfortable with.

Your premium is simply what you pay to keep your policy active. It could be a monthly, semi-annual, or yearly payment.

The deductible, on the other hand, is the amount you agree to pay out-of-pocket when you make a claim before your insurance kicks in to cover the rest.

It’s a bit like a co-pay at the doctor's office. You handle a smaller, set amount first, and the insurance plan takes care of the big stuff. So, if a nasty hailstorm leaves your car with $4,000 in damage and your comprehensive deductible is $500, you’ll pay that first $500, and your insurer will cover the remaining $3,500.

Finding Your Financial Sweet Spot

The relationship between your premium and deductible is pretty straightforward: a higher deductible almost always means a lower premium. Why? Because by agreeing to cover more of the initial cost yourself, you’re taking on more financial risk. The insurance company sees this as a good thing and rewards you with a lower ongoing bill.

This inverse relationship puts you in the driver's seat when it comes to cost. To dive deeper, check out our full guide on what is a deductible in insurance.

To see how this plays out in practice, let's look at some typical numbers.

How Your Deductible Choice Affects Your Annual Premium

This table gives you a clear picture of how adjusting your deductible can directly impact your yearly insurance costs for comprehensive coverage.

| Deductible Amount | Estimated Annual Premium | Potential Out-of-Pocket Cost Per Claim |

|---|---|---|

| $250 | $450 | $250 |

| $500 | $380 | $500 |

| $1,000 | $310 | $1,000 |

As you can see, jumping from a $250 deductible to a $1,000 one could save you $140 a year on your premium. Of course, the trade-off is that you’d need to have that $1,000 saved and ready to go if something unexpected happens.

Factors That Shape Your Premium

Beyond the deductible you choose, insurers consider several other variables when calculating your comprehensive premium. These factors help them paint a picture of how likely you are to file a claim.

Some of the key things they look at include:

- Your Vehicle's Value: It costs more to repair or replace a brand-new, high-end car, which naturally leads to a higher premium.

- Your Location: If you live in an area prone to car theft, vandalism, or extreme weather events like hailstorms, your risk profile goes up.

- Your Claims History: A history of filing frequent claims can suggest to an insurer that you're a higher risk.

The bottom line is to pick a deductible you can genuinely afford to pay at a moment's notice. While saving money on your premium is smart, it doesn't help if a high deductible makes your insurance unusable when you actually need it.

Finding the Right Insurance Partner

Knowing what comprehensive insurance covers is a great start, but finding the right policy at the right price is another beast entirely. The insurance world is a jungle of confusing jargon, endless options, and conflicting quotes. Going it alone can feel like you're just guessing, leaving you wondering if you're actually protected or simply paying too much.

This is where having a dedicated, independent partner in your corner makes all the difference. Unlike an agent who works for one big insurance company, an independent agency works for you. Their job isn’t to push a specific product; it’s to be your advocate, shopping the market across dozens of carriers to find coverage that fits your life, your assets, and your budget.

The Independent Advantage

Think of an independent agent as your personal insurance shopper and risk advisor. They get to know you and your unique situation—whether you’re insuring a family home, a small business, or a valuable collection. That’s a level of detail you just can't get from an online quote form.

A real expert brings several key things to the table:

- Custom-Fit Coverage: They dig into your risks to build a policy that fits just right, making sure you aren't exposed to dangerous gaps or paying for extras you don't need.

- Wider Market Access: They have relationships with a huge range of insurance carriers, including specialty ones you might never find on your own. More options almost always mean better, more competitive pricing for you.

- A Simpler Process: They do the legwork—the research, the paperwork, and the negotiating. They translate the industry-speak into plain English, so you’re always confident about what you're buying.

An expert turns insurance from a confusing chore into a solid financial tool. It’s the difference between just being insured and being correctly insured.

More Than a Policy, It's a Partnership

A great insurance partner doesn’t just sell you a policy and disappear. They’re there for you for the long haul, offering ongoing support and smart advice.

When you need to file a claim, they become your champion, guiding you through every step to make sure the process is as smooth and fair as possible. Having that support during a stressful event is priceless.

Ultimately, this relationship is about building a long-term strategy to protect what you’ve worked so hard for. If you want to learn more, our article on how to choose an insurance broker is a great resource for finding the right fit.

At Wexford Insurance Solutions, we build relationships on a foundation of trust and real-world expertise. Our team is here to give you the personalized guidance you need to feel secure in your coverage. Get in touch with us today to see how we can build a smarter insurance plan for you.

A Guide to Commercial Auto Insurance Coverage

A Guide to Commercial Auto Insurance Coverage