What Health Insurance Premiums Actually Mean for You

Let's talk about health insurance premiums – what they are and what they mean for you. Forget the complicated jargon; think of your premium as a monthly membership fee for healthcare services. It's a lot like a gym membership. You pay a fixed amount each month, whether you use the facilities daily or not at all. But that membership is there for you when you need it – like if you injure yourself or decide to train for a marathon.

Similarly, your health insurance premium gives you access to a broad range of healthcare services. This includes everything from regular check-ups and specialist appointments to coverage for unexpected illnesses or injuries. It’s the bedrock of your healthcare coverage, providing financial security when faced with medical expenses. It's important to remember, though, that premiums don't cover everything. They work in conjunction with other cost-sharing elements like deductibles, copays, and out-of-pocket maximums.

Understanding Your Premium

Understanding how health insurance premiums are defined is key to navigating healthcare finances. Your health insurance premium is simply the amount you pay, usually monthly or annually, to your insurance company in exchange for health coverage. The size of your premium reflects the extent of your coverage and the level of risk you represent to the insurer.

Historically, premiums have been rising due to increasing healthcare costs, advancements in medical technology, and changes in population demographics. This upward trend is expected to continue. In fact, the global health insurance market is projected to grow from USD 2.32 trillion in 2025 to USD 4.45 trillion by 2032, a compound annual growth rate (CAGR) of 9.7%. Dive deeper into market trends. This significant growth highlights the increasing importance – and cost – of health insurance. So, what exactly are you paying for with your premium, and why do some people pay more than others for similar plans? Let's explore these questions further.

How Insurance Companies Really Calculate Your Premium

Ever wondered how that health insurance premium number appears on your bill? It's not magic, and it's certainly not arbitrary. Instead, insurance companies rely on actuaries, their in-house statistical gurus, who use sophisticated formulas to figure out the cost of your coverage. These formulas take into account a variety of factors, all aimed at assessing your individual level of risk.

One of the foundational concepts in this calculation is the risk pool. Imagine a large community swimming pool, except instead of water, it's filled with money. Everyone covered by the insurance plan contributes their premiums to this pool. When someone gets sick or needs medical care, the funds to cover their expenses come from this shared pool.

The insurance company's main goal is to keep the pool balanced. They need enough money coming in (premiums) to cover the money going out (claims). This careful balancing act is central to how your health insurance premium is determined.

Factors Influencing Your Premium

So, what specific factors influence the amount you pay? Several key elements play a significant role:

- Age: As we get older, we statistically tend to require more medical care. This is why premiums generally increase with age.

- Location: The cost of healthcare can vary significantly from one city or state to another. If you live in a high-cost area, your premiums will likely reflect that.

- Health History: Pre-existing conditions and your past medical expenses can also have an impact on your premium calculation.

- Lifestyle: Certain lifestyle choices, like smoking or excessive alcohol consumption, can increase your risk of health issues, leading to potentially higher premiums.

These factors, along with many others, are input into complex algorithms. These algorithms help actuaries estimate the probability of you needing medical care in the future, essentially creating a personalized risk profile. Your premium, therefore, isn't just a random number, but a reflection of this individual assessment.

Health insurance premiums are also a vital part of the larger healthcare ecosystem. They reflect not only the cost of providing coverage, but also the financial well-being of the insurance companies themselves. Historically, premium levels have been influenced by government regulations, competition within the insurance market, and even unexpected events like pandemics. For instance, the COVID-19 pandemic, while temporarily decreasing the use of non-emergency healthcare, also underscored the critical importance of having reliable health insurance. Discover more insights. Understanding these complexities makes it clear why understanding your premium is so important.

The Hidden Forces That Drive Your Premium Up or Down

Your health insurance premium isn't some arbitrary number. Think of it more like a carefully crafted recipe with dozens of ingredients, some you can control and some you can't. Knowing the difference can have a big impact on how much you spend on healthcare. Age and location are obvious factors, but others, like your employer’s clout with insurance companies or the general health of your community, might surprise you.

Let's say two 35-year-olds have the same level of coverage. One is a teacher in Denver and the other's a contractor in Miami. They'll likely pay different premiums. Location matters. Lifestyle, family medical history, and even your job can all affect your rates. That's why understanding these factors is crucial for managing your healthcare budget.

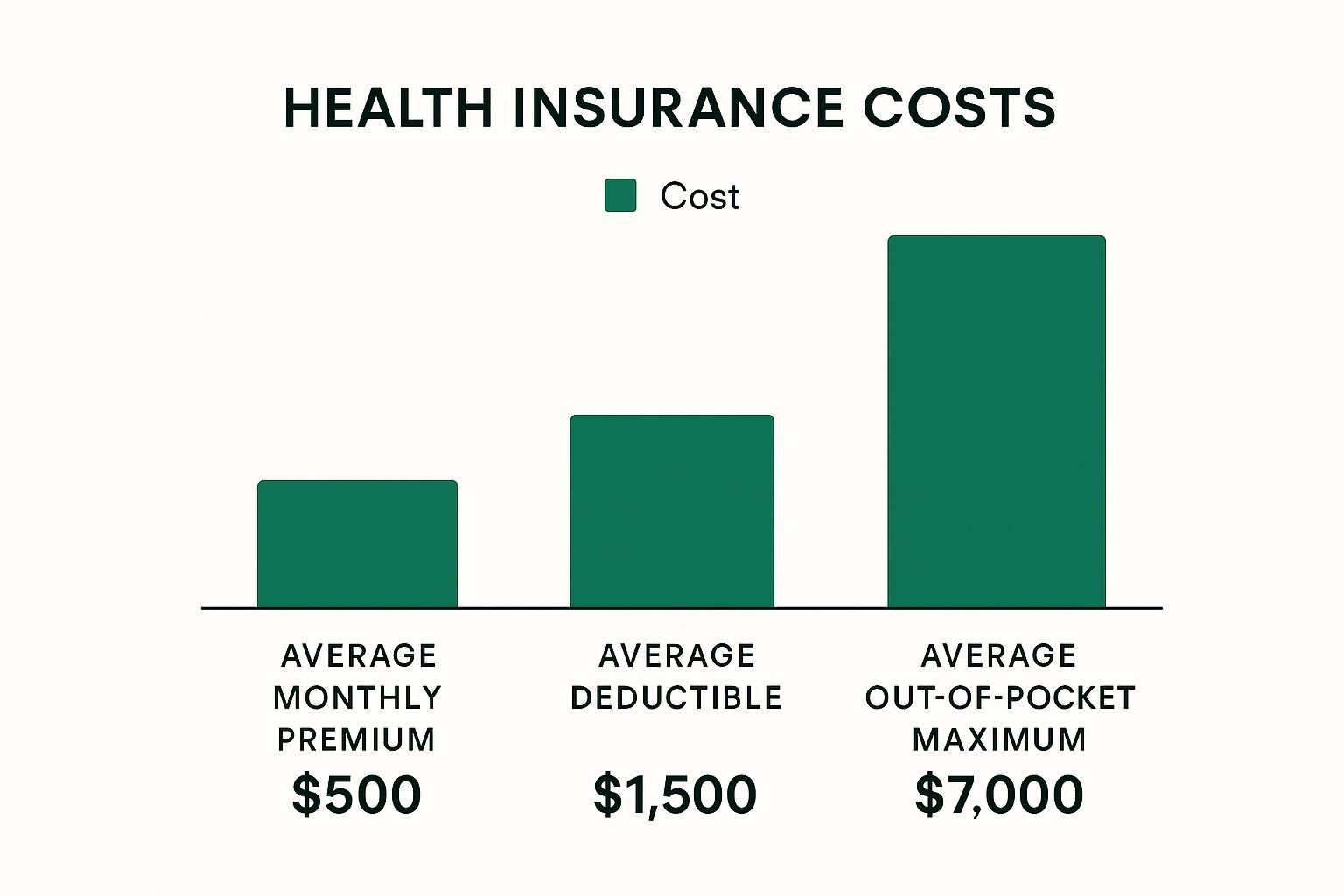

This infographic gives you a visual snapshot of average monthly premiums, deductibles, and out-of-pocket maximums. As you can see, even costs that appear "average" can really add up. This underscores why understanding how these figures are calculated is so important. It's all about effectively planning your healthcare spending.

Factors You Can and Can't Control

Many factors contribute to your final premium. Some, like your age and medical history, are fixed and hard to change. Others, like opting for a high-deductible health plan or joining a wellness program, give you some control over lowering your costs. Navigating these factors is essential to making informed decisions about your health insurance.

But individual factors aren’t the whole story. The relationship between your employer and insurance providers can also affect your premium. For example, your company’s safety record can influence premiums through what's called an experience modifier. Learn more about how employer-related factors can come into play by checking out our guide on workers' compensation experience modifiers. This knowledge helps you make smart choices that balance the coverage you need with a price you can afford.

To get a better grasp on how these factors can shift your premium, let's take a look at this comparison table:

Premium Factors and Their Impact on Costs

Comparison of how different personal and external factors influence health insurance premium calculations

| Factor | Impact Level | Your Control | Typical Cost Difference |

|---|---|---|---|

| Age | High | None | Can vary significantly, typically increasing with age |

| Location | Medium | Limited | Can differ between states and even within the same state |

| Tobacco Use | High | High | Smokers often pay substantially more |

| Individual vs. Family | High | High | Family plans are generally more expensive |

| Plan Type | High | High | HMOs are often cheaper than PPOs |

| Health Status | Medium | Partial | Pre-existing conditions can impact premiums in some cases |

| Employer Plan | Medium | None | Employer's size and negotiating power influence group rates |

| Community Health | Low | None | Overall health of the community can affect regional premiums |

This table highlights the interplay of factors affecting your premium. Some, like age, are entirely out of your hands. Others, like tobacco use and plan type, offer opportunities to take control and potentially save money. Understanding these dynamics is crucial for making informed decisions about your health coverage.

Navigating Different Premium Types and Payment Options

Health insurance premiums aren't one-size-fits-all. Understanding the different types and how you pay can significantly impact your overall healthcare expenses. Let's explore the key differences between individual, family, and employer-sponsored plans, going beyond just the initial price tag.

Individual vs. Family vs. Employer-Sponsored Plans

Think of individual plans like a solo trip – they cover just one person. You often purchase these through the Health Insurance Marketplace or directly from an insurance company. Family plans, on the other hand, are like a family vacation – covering multiple people, usually including spouses and children. These plans typically offer better value than buying several individual policies, but the overall premium will be higher.

Employer-sponsored plans are a perk of your workplace, like a company car. They often come with the advantage of premium sharing, where your employer chips in towards your monthly premium. Think of it as your company covering part of the gas. This can make these plans more affordable than individual or family plans you buy yourself. The power of group buying also helps – larger employee groups often negotiate better rates with insurers.

Subsidies, Tax Credits, and Payment Schedules

If you're buying individual or family plans, subsidies and tax credits can be lifesavers, significantly lowering your premium. These financial assistance programs are based on your income and can make coverage much more accessible. Understanding these programs and checking your eligibility is crucial for saving money.

Your payment schedule matters too. Most plans offer monthly payments, but some might offer a small discount if you pay annually. It's like choosing between paying for your gym membership monthly or getting a slightly better deal by paying for the whole year upfront. Weighing up the pros and cons is an important part of the process.

Age-Based and Community Rating

Insurance companies use different methods to set premiums. Age-based pricing considers your age as a key factor. Older individuals usually pay more due to the higher likelihood of needing medical care. Community rating, conversely, bases premiums on the overall health risks of a specific geographic area. Imagine everyone in your neighborhood pitching in for a shared emergency fund – everyone contributes a similar amount, regardless of their individual likelihood of needing it. Understanding these rating systems can help you anticipate future premium changes and make smarter decisions about your coverage.

Real Premium Costs Across Different Life Situations

Let's shift gears from the theoretical to the practical. How do all these factors play out in real-world premium costs?

Real-World Examples

Let's meet Sarah, a 26-year-old graphic designer shopping for an individual health insurance plan. She might find a plan with a moderate deductible for around $350 a month. This figure reflects her age, generally good health, and the average cost of healthcare where she lives. But what if Sarah lived somewhere with higher healthcare costs? Her premium could easily jump another $50 or more each month.

Now, imagine the Martinez family. They have two kids and get their health insurance through Mr. Martinez's job. Their monthly premium is $800, but their employer covers half. This illustrates a key advantage of employer-sponsored health plans: shared costs and potential group discounts. If the Martinezes had to buy a similar plan on their own, they might be looking at closer to $1,200 a month.

Then there's Robert, a 52-year-old consultant. He wants comprehensive coverage and is happy to pay a higher premium for it. His monthly payment comes in at $700, reflecting his age and the extensive coverage his plan offers. Could he lower this cost? Sure, by choosing a higher deductible. But that would mean paying more out of pocket if he needed serious medical care. You might be interested in: 15 Life Changes to Tell Your Insurance Agent About.

To help illustrate these varying scenarios, let’s take a look at the table below:

Premium Cost Scenarios by Demographics

This table presents real-world premium examples, showcasing how costs can fluctuate based on factors like age, family size, and the level of coverage.

| Profile | Plan Type | Monthly Premium | Annual Cost | Key Factors |

|---|---|---|---|---|

| Sarah (26, Single) | Moderate Deductible | $350 | $4,200 | Age, individual plan |

| Martinez Family (2 Adults, 2 Children) | Employer-Sponsored | $800 (employer pays $400) | $4,800 (employee portion) | Family size, employer contribution |

| Robert (52, Single) | Comprehensive | $700 | $8,400 | Age, comprehensive coverage |

As you can see, the cost of premiums can change significantly based on a few key factors. Employer contributions can make a big difference, while age and the type of plan chosen also have a major impact.

Understanding the Factors at Play

These examples aren't just hypothetical; they're based on actual market data. They show how much individual circumstances and plan choices can affect your health insurance premium. Where you live, how old you are, the size of your family, and the kind of plan you choose all contribute to the bottom line. Even seemingly similar situations can result in significantly different premiums. Another thing to keep in mind? Timing. Open enrollment periods and qualifying life events can influence when and how you can change plans, which in turn affects your costs. Understanding these factors is crucial for making smart decisions about your health coverage.

Proven Strategies for Lowering Your Premium Costs

So, you want to lower your health insurance premiums? You're not alone! It's a common goal, and thankfully, there are some proven ways to do it without sacrificing the coverage you need. Let's explore some strategies used by insurance advisors and those in the know.

Timing Is Everything

Finding the right health insurance plan is a bit like booking a flight. Prices change, and when you buy matters. Open enrollment is your chance to compare different plans – don’t just automatically renew your existing one. Big life changes, like getting married, having a child, or a job change, also open up special enrollment periods. Use these times to reassess your needs and potentially find better rates. For more on switching providers, check out this helpful guide: How to Switch Insurance Providers.

Making the Most of Employer Benefits

If you have insurance through your job, take a close look at your benefits package. Many employers offer a few different plans, each with its own premiums and coverage levels. Understand how premium sharing works (how much your employer contributes). Also, see if a Health Savings Account (HSA) is an option. HSAs can reduce your taxable income and help you save for medical expenses. Some employers even have wellness programs that can lower your premiums.

Choosing the Right Plan

A high-deductible health plan (HDHP) might be a good fit for some. It has lower monthly premiums, but you pay more upfront for medical care until you meet your deductible. If you're generally healthy and don't need to see the doctor often, this could save you money. But, if you expect to need a lot of medical care, the higher out-of-pocket costs might not be worth the lower premiums.

Negotiation and Advocacy

Don't be afraid to negotiate with insurance brokers. They sometimes have wiggle room on pricing, especially for group plans. Knowing the market rates and being clear about what you need can help you get a better deal. If your premium goes up, call your insurance provider and ask why. Sometimes mistakes happen, and speaking up can lead to corrections and savings.

Balancing Premiums and Out-of-Pocket Costs

Remember, a low premium doesn't always mean low overall costs. Think about potential out-of-pocket expenses – deductibles, co-pays, and coinsurance – for different scenarios. For instance, a plan with a $50 higher premium might have a $1,000 lower deductible. If you think you’ll meet your deductible, the higher-premium plan could actually be cheaper in the end. Looking at the total cost of coverage, not just the premium, helps you make the best choice for your health and your wallet.

Avoiding Expensive Premium Mistakes Most People Make

Health insurance can feel complicated, but understanding a few key concepts can save you a lot of money and headaches down the road. Let's explore some common mistakes people make when choosing a plan, so you can steer clear.

Mistake #1: Focusing Only on the Monthly Premium

It’s tempting to choose the plan with the lowest monthly payment. But focusing only on that number is like choosing a car based solely on the sticker price without considering gas mileage or repair costs. That "cheap" plan might have high out-of-pocket costs – things like deductibles, copays, and coinsurance – that add up quickly when you need care.

Mistake #2: Overlooking the Out-of-Pocket Maximum

The out-of-pocket maximum is the most you’ll pay for covered healthcare services in a year. It’s like a financial safety net. Once you hit this limit, your insurance company picks up the rest of the tab for covered services. A low monthly premium might be paired with a very high out-of-pocket maximum, leaving you vulnerable to hefty bills if you experience a major illness or injury.

Mistake #3: Getting Caught by Clever Marketing

Insurance companies are skilled marketers. They often highlight appealing features like low premiums while downplaying less attractive details like high deductibles or limited coverage networks. It's like a store advertising a great sale but only offering a handful of items at the discounted price. Always read the fine print and understand exactly what you're getting.

Mistake #4: Automatically Renewing Without Checking Other Options

Just because you were happy with your plan last year doesn’t mean it’s still the best fit. Life changes, and so do insurance needs. During open enrollment, take the time to compare plans. It's like shopping around for a better cell phone deal – a little effort can lead to significant savings or better coverage.

Mistake #5: Not Grasping Different Plan Types

HMOs, PPOs, and EPOs…it can feel like alphabet soup! These different plan types offer varying levels of flexibility and coverage. An HMO might have lower premiums but restrict your choice of doctors. A PPO offers more freedom but typically comes at a higher cost. Understanding the differences is key to choosing the plan that works best for your lifestyle and healthcare needs.

By avoiding these common pitfalls, you can navigate the world of health insurance with confidence and choose a plan that protects your health and your wallet.

Ready for a simpler way to find the right insurance? Wexford Insurance Solutions offers personalized guidance and innovative technology to help you find the perfect coverage. Visit Wexford Insurance Solutions today to learn more.

How to Switch Insurance Providers: Real Strategies That Work

How to Switch Insurance Providers: Real Strategies That Work How to Lower Home Insurance Premiums: Top Tips & Tricks

How to Lower Home Insurance Premiums: Top Tips & Tricks