Understanding Florida's Workers' Compensation System

Think of workers' compensation as a safety net for your business, protecting both you and your employees when workplace accidents happen. Florida's system has its own specific rules, and understanding them can save you a lot of trouble and expense down the road. It's like knowing the rules of the road – once you understand them, navigating becomes much easier.

This system balances the need to protect workers with the practical realities of running a business. We'll explore why Florida has specific rules that are different from federal regulations, and how those differences affect your day-to-day operations. Through real-life examples, we'll show how workers' compensation isn't just another insurance policy – it's a smart business decision that affects your bottom line, your relationship with your employees, and your legal standing.

This screenshot from the Florida CFO website shows the resources available to employers about Florida's workers' compensation requirements. The site offers important details about coverage, claims, and compliance, highlighting the state's focus on transparency and easy access to information.

It's also important to understand the "why" behind Florida's system. The state aims to create predictable outcomes for both employers and employees. This predictability helps create a stable environment for businesses while also making sure injured workers get the care and compensation they need. This setup encourages proactive safety measures and helps avoid long, drawn-out legal disputes.

For example, imagine a construction worker hurts their back on the job. With a clear understanding of workers compensation requirements in Florida, filing a claim and getting benefits is a much smoother process. For small business owners, our guide on workers' compensation for small businesses offers helpful information. This knowledge lets businesses focus on getting the worker healthy and back on the job, rather than getting bogged down in complicated legal processes. By the end of this section, you’ll have a solid grasp of how and why Florida’s structured system benefits everyone involved.

When Coverage Becomes Mandatory: Crossing the Line

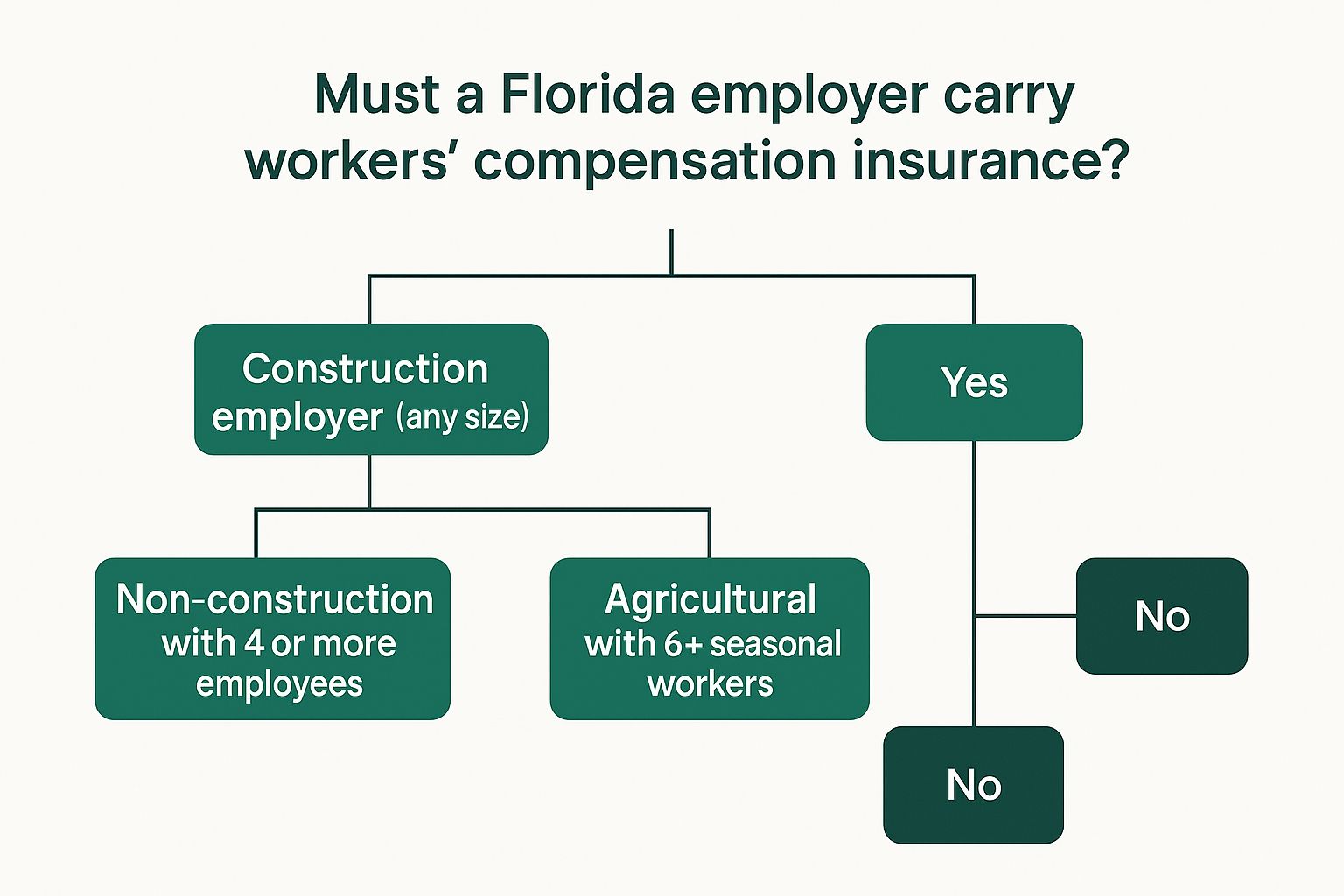

So, you're a business owner in Florida, and you're wondering about workers' compensation insurance. It's a common question: "Do I really need it?" Unlike some states with a simple headcount rule, Florida's system is a little more nuanced. It depends on a few key factors: your industry, how your business is structured, and the types of employees you have. Let's break it down.

Industry-Specific Requirements: Construction, Non-Construction, and Agriculture

Florida law recognizes that some jobs are simply riskier than others. Think of construction: it's inherently more hazardous than, say, office work. Because of this, all construction employers in Florida, no matter how small, must carry workers' compensation insurance. Even if you have just one employee, coverage is required. It’s similar to requiring hard hats on a construction site – a basic safety measure given the potential dangers.

Outside of construction, the rules change. For non-construction businesses, the magic number is four. If you have four or more employees, including both full-time and part-time, you're required to have coverage. This four-employee threshold is a vital benchmark for many Florida businesses.

Agriculture has its own set of rules. If your agricultural business employs six or more seasonal workers, workers' compensation insurance becomes mandatory. This reflects the seasonal nature of agricultural work and the associated risks.

The infographic below visually represents these requirements:

As you can see, the need for workers' compensation coverage hinges on the type of business and the number of employees. These different thresholds highlight how Florida tailors its worker protection laws to various industries.

Counting Employees: Who Counts and Who Doesn't?

Figuring out your employee count might seem straightforward, but there are some important details to keep in mind. Florida law has specific rules about who counts as an employee for workers' compensation purposes. For example, independent contractors generally don't count toward this total. However, be cautious – misclassifying employees as independent contractors can result in significant penalties.

Before we dive further into exemptions, let's take a look at a helpful table summarizing coverage requirements:

To help you navigate these requirements, here’s a handy table summarizing the key information:

Florida Workers Compensation Coverage Requirements by Business Type

Complete breakdown of when coverage becomes mandatory based on your specific business situation

| Business Type | Employee Threshold | Coverage Requirement | Key Exemptions |

|---|---|---|---|

| Construction | 1 or more | Mandatory | Limited exemptions exist, primarily for corporate officers who opt out. |

| Non-Construction | 4 or more | Mandatory | Independent contractors, sole proprietors, partners in a partnership. |

| Agriculture | 6 or more seasonal workers | Mandatory | Independent contractors, family members employed on small farms. |

This table outlines the different employee thresholds for each industry and highlights some common exemptions. Understanding these distinctions is key to ensuring you’re meeting your legal obligations.

Now, let's explore some additional resources to help you understand this even better.

This screenshot from the Florida Chief Financial Officer's website offers more detail on coverage requirements. It reinforces the employee thresholds and provides valuable information about exemptions, a topic we’ll explore in the next section. This website is a valuable resource for navigating Florida's workers' compensation landscape. Getting a solid grasp of these specifics is essential for maintaining compliance and avoiding potential headaches down the line.

Navigating Exemptions and Special Circumstances

Florida's workers' compensation system has some built-in exemptions, allowing certain businesses and individuals to sidestep the usual coverage requirements. Think of these exemptions like express lanes on a highway – they’re there for convenience, but only if you meet specific criteria. Common exemptions apply to corporate officers, certain construction subcontractors, and some agricultural operations. But be warned: claiming an exemption isn't a "set it and forget it" situation. It requires ongoing paperwork, annual renewals, and keeping a close eye on any changes to your business.

This screenshot from the Florida Department of Financial Services website clearly shows the various exemptions available. It gives a good overview of who might qualify, highlighting categories like sole proprietors, partners, and corporate officers.

The main takeaway? Proper documentation is essential. The website's resources really stress understanding the specific requirements for each exemption and maintaining accurate records. This attention to detail is critical to staying compliant and avoiding penalties.

Who Qualifies for Exemptions?

Let's look at some common scenarios where exemptions might apply:

-

Corporate Officers: Sometimes, corporate officers can choose to exempt themselves from coverage. However, this exemption must be formally documented and the officer remains responsible for any employee injuries. It offers flexibility, but also carries a hefty responsibility.

-

Construction Subcontractors: Certain subcontractors in construction might be exempt if they meet particular criteria related to their contracts and insurance coverage. These exemptions often involve complex legal definitions, so carefully reviewing contract language is a must.

-

Agricultural Operations: Some agricultural businesses, especially small family farms, can be exempt from Florida's workers' compensation requirements. This usually depends on the number of employees and the type of agricultural work. It’s a way of recognizing the unique nature of family-run farms.

For example, picture a small family farm with only immediate family members working. They might qualify for an exemption. But, if they hire outside help beyond a certain number, their exemption could be revoked.

Maintaining Compliance: Ongoing Responsibilities

Getting an exemption is just the first step. Staying compliant takes ongoing effort:

-

Annual Renewals: Most exemptions require annual filings to confirm your circumstances haven't changed and that you still meet the requirements. It’s similar to renewing your driver's license – a regular task to maintain your legal standing.

-

Documentation: Meticulous record-keeping is essential. You'll need proof of your initial exemption, all renewals, and any changes to your business structure or operations. This documentation is your safety net.

-

Changing Circumstances: If your business evolves – say you hire more people, restructure, or expand – your exempt status could be at risk. You must proactively update your filings to reflect these changes.

Understanding these exemptions isn't about finding ways around the law. It's about knowing the legitimate alternatives within Florida's workers' compensation system. It's always best to talk to a lawyer or a qualified insurance professional to navigate these exemptions correctly and ensure you comply with Florida law.

Filing Procedures: Getting It Right the First Time

Obtaining workers' compensation coverage in Florida isn't like grabbing a snack at the grocery store. It's more like preparing a Thanksgiving feast – you need the right ingredients, the right tools, and a well-thought-out plan. Precision and attention to detail are your secret weapons for a smooth and successful filing. Small missteps can lead to big headaches, so let's break down the process.

Gathering Your Information: The Foundation of a Smooth Process

Imagine building a house. You wouldn't start pouring concrete without a blueprint, right? Similarly, gathering the necessary information is the first step to securing workers' compensation. This includes your business structure, number of employees, payroll details, and industry classification code. Having these details at your fingertips will streamline the process and prevent frustrating delays. It's like having all your ingredients prepped before you start cooking – it makes the whole process much more efficient.

Choosing Your Coverage: Authorized Carrier, Self-Insurance, or PEO

Florida offers three main avenues for obtaining workers' compensation coverage: through an authorized insurance carrier, through self-insurance (if you meet certain financial criteria), or through a Professional Employer Organization (PEO). Choosing the best fit depends on your company’s unique circumstances – like its size, risk tolerance, and financial resources. It's like choosing the right vehicle for a road trip – a compact car might be perfect for a solo adventure, but a minivan is more practical for a family vacation. Each option has its own set of pros, cons, and requirements.

Completing the Forms: Precision Matters

Once you’ve selected your coverage method, it’s time to tackle the paperwork. Florida has specific forms for different situations, such as the Application for Workers' Compensation Insurance and various exemption forms. Accuracy is paramount – think of these forms as the legal contract they are. Every word and number matters, just like in a complex recipe. Using the wrong measurement could lead to a culinary disaster!

This screenshot from the Florida CFO website shows the vast array of forms needed for different workers' compensation procedures. It's like walking into a massive library – knowing exactly which book you need is essential. Navigating these forms correctly is key to a successful filing.

Submitting Your Application: Meeting Deadlines and Avoiding Delays

Timely submission is crucial. Florida has strict deadlines, and missing them can lead to penalties. Think of deadlines as a train schedule – if you miss your train, you're going to be late. Also, remember the maximum weekly compensation rate for work-related injuries changes. As of January 1, 2025, it’s $1,295 per week for injuries occurring on or after that date. This reflects changes in the overall cost of living and wages. Learn more about compensation rates.

Maintaining Compliance: Adapting to Change

Getting your coverage approved is a big win, but the journey doesn't end there. Ongoing compliance is key. As your business evolves – you hire more people, open new locations, or restructure – your coverage needs to adapt. Think of your business as a living organism – it grows and changes, and its needs change along with it. Keeping your coverage aligned with your operations ensures continued protection.

To help you navigate the process, here’s a handy table summarizing key forms and deadlines:

Essential Florida Workers Compensation Forms and Deadlines

Your complete filing timeline with required forms, deadlines, and consequences

| Form Type | Purpose | Deadline | Consequences of Late Filing |

|---|---|---|---|

| Application for Workers' Compensation Insurance | Initiates the coverage process | Varies by carrier | Potential delays in coverage and possible penalties |

| Employer's First Report of Injury or Illness | Reports workplace injuries to the carrier | 7 days after the employer becomes aware of the injury/illness | Potential fines and penalties |

| Exemption Forms | Allows eligible employers to opt out of coverage | Before the commencement of business operations | Loss of exemption and possible penalties |

This table outlines the essential forms and their corresponding deadlines. Staying organized and meeting these deadlines will help you avoid penalties and ensure your business remains compliant. Remember, staying informed and proactive is the best way to protect your business and your employees.

Understanding Real Costs and Rate Factors

Workers' compensation premiums in Florida aren't pulled out of thin air. They're based on a formula that considers the risks associated with your industry, your total payroll, and your company's history with claims. It's a bit like car insurance—your driving record and the type of car you drive influence your premium. But workers' compensation adds layers related to the specific hazards of a workplace. Florida has made significant improvements to its rate structure in recent years, which has led to lower premiums for many employers. Let’s explore how these premiums are calculated.

Industry Classification Codes: Defining Your Risk Profile

Picture a bakery and a construction site side-by-side. The risks involved are vastly different, right? That's where industry classification codes come in. These codes group businesses based on the type of work they do and the potential for on-the-job injuries. A higher-risk industry like construction usually has a higher classification code and, therefore, a higher premium. Think of it like choosing a difficulty level in a video game—higher difficulty means higher stakes. This isn't about penalizing “risky” businesses; it’s about accurately reflecting the likelihood of claims.

Experience Modification Factor: Reflecting Your Safety Record

Your experience modification factor, also known as your experience mod or e-mod, is a number that reflects your company's claims history compared to the average for your industry. A solid safety record earns you an e-mod below 1.0, which lowers your premiums, much like a "safe driver" discount on your car insurance. On the other hand, a higher-than-average number of claims results in an e-mod above 1.0, driving your premiums up. This underscores the direct connection between workplace safety and your bottom line. You might find this helpful: Workers' Comp Experience Mods and How They Affect Your Premium.

This screenshot from the Florida Office of Insurance Regulation website highlights key information about the agency's role in overseeing insurance rates. The site offers resources and updates, showcasing the state's commitment to transparency and regulation within the insurance industry. Access to this kind of information helps businesses stay informed about regulatory changes and rate adjustments.

Payroll Audits: Ensuring Accuracy

Insurance companies perform payroll audits to double-check the payroll information you provide. This ensures that you're paying the correct premium based on your actual workforce size and wages. It’s similar to a restaurant reviewing your bill to make sure everything adds up. These audits aren't designed to catch businesses out; they’re about maintaining fairness and accuracy across the board. And speaking of accuracy, Florida's workers' compensation landscape has seen considerable positive shifts. As of January 1, 2025, the Florida Office of Insurance Regulation approved a 1% decrease in workers' compensation insurance rates in the voluntary market. This marks a cumulative decrease of 78% since 2003. This shows the positive impact of better workplace safety and claims management. Discover more insights on Florida's workers' compensation rate changes.

By understanding these elements, you can take proactive steps to manage your workers' compensation costs. Implementing strong safety programs can lower your e-mod, leading to lower premiums. Similarly, accurately classifying employees based on their job duties ensures the right premium calculations. Instead of thinking of workers' compensation as a fixed cost, consider it a manageable business investment with predictable factors. This perspective can significantly benefit your bottom line.

Legislative Changes and Medical Care Access

Florida's workers' compensation system is a living, breathing thing. It's constantly being reshaped by legislative updates, striving to find a balance between the needs of employees, employers, and healthcare providers. These aren't just minor adjustments; they have a real impact on your bottom line, your employees' access to care, and the administrative workload you face. Think of it like regularly updating your phone’s operating system—essential for improved functionality, but it also changes how you use it every day.

Impact of Recent Legislative Actions

Recent legislative actions in Florida have significantly impacted how medical care is reimbursed within the workers' compensation system. These changes influence how many healthcare providers are willing to treat injured workers and the overall cost of the system.

This screenshot shows the Florida Senate website, your go-to source for keeping up with the latest legislation impacting workers' compensation. It provides access to bills, analyses, and a wealth of information, making it an indispensable tool for any employer in Florida. Staying on top of these changes is crucial for maintaining compliance with Florida's workers' compensation requirements.

For example, Senate Bill 362, which takes effect on January 1, 2025, increased the maximum reimbursement allowances for physician services by approximately 50%. This change aims to ensure that injured workers continue to have access to quality medical care within the system. This is a substantial adjustment that will likely affect your workers' compensation premiums. You can delve deeper into the specifics of this legislative update here.

Understanding the Rationale Behind Changes

Knowing what changed is important, but understanding why these legislative changes occur is just as crucial. Several factors contribute to these modifications, including the ever-rising cost of healthcare, advancements in medical practices, and the ongoing fight against fraud and abuse. By understanding the driving forces behind these changes, you can better anticipate future adjustments and proactively prepare your business.

Staying Informed: Resources and Best Practices

Staying informed about legislative updates is like having a roadmap for navigating Florida's workers' compensation landscape. The Florida Division of Workers' Compensation website is an invaluable resource for tracking new legislation and understanding its impact. You can also stay ahead of the curve by subscribing to industry newsletters, attending relevant webinars, and consulting with legal counsel specializing in workers' compensation. This proactive approach allows you to anticipate how potential changes might affect your workers' compensation program and ensures you're always prepared for Florida's ever-evolving regulatory environment. Staying ahead of these changes will not only help you maintain compliance but could also help minimize costs in the long run.

Consequences of Non-Compliance: The Real Cost of Mistakes

Ignoring Florida's workers' compensation requirements isn't just a minor oversight; it's a serious offense. The potential consequences far outweigh any perceived savings from skipping coverage. Think of it like driving without car insurance—you might be fine for a while, but an accident could lead to devastating financial repercussions. Florida is serious about enforcing these laws, and they have robust mechanisms in place to ensure businesses comply.

Penalties and Stop-Work Orders: Immediate Consequences

Non-compliance can result in immediate and severe penalties. One of the most impactful is a stop-work order. This effectively shuts down your business operations until you obtain the required coverage. Imagine the lost revenue and disruption to projects if your business is suddenly forced to stop.

On top of that, you'll also face daily fines, which can range from $100 to $500 per employee for each day you're not in compliance. These aren’t just minor inconveniences; they're designed to encourage swift action.

This screenshot from the Florida CFO website details the penalties for non-compliance with workers' compensation laws. The financial consequences can be substantial, including significant fines and even the potential for criminal charges. It underscores the importance of having proper coverage.

Long-Term Impact: Beyond the Immediate Fines

The immediate financial penalties are only the beginning. Non-compliance can have a lasting impact on your business in several ways:

-

Reputational Damage: Operating without workers' compensation can severely damage your reputation with customers, partners, and potential employees. It suggests a lack of concern for employee well-being and can make attracting and retaining talent more challenging.

-

Insurance Availability and Rates: Your future insurance costs could increase dramatically, and you might even find it difficult to obtain coverage at all. Think of it like having a bad credit score affecting your ability to get a loan—past non-compliance can follow you.

-

Contract Eligibility: Many contracts, especially government projects, require proof of workers' compensation coverage. Not having it can disqualify you from bidding, limiting your business opportunities.

For a broader look at business insurance needs, check out our guide on business insurance basics.

The Value of Prevention: Avoiding Costly Mistakes

While these consequences might sound intimidating, they are entirely preventable. Securing and maintaining proper workers' compensation coverage is more than a legal requirement—it's a smart business practice. It protects your employees, safeguards your operations, and helps ensure your business’s long-term stability. Being proactive and compliant with the law is far less expensive and stressful than dealing with the consequences of non-compliance.

Want to protect your business and ensure compliance with Florida's workers' compensation requirements? Visit Wexford Insurance Solutions today to learn more about our comprehensive coverage options and personalized service. We can help you navigate the complexities of Florida’s workers’ compensation system, making sure you have the right coverage for your business and your employees.

Personal Liability Coverage Definition: Your Complete Guide

Personal Liability Coverage Definition: Your Complete Guide Business Continuity Insurance: Protect Your Business Today

Business Continuity Insurance: Protect Your Business Today