Securing Your Legacy: A Modern Guide to Lasting Wealth

Accumulating wealth is a significant achievement, but ensuring it endures for generations is an entirely different and more complex challenge. In a constantly shifting financial landscape, the focus for astute individuals, families, and business owners is moving from pure accumulation to strategic preservation. This means constructing a financial fortress designed to withstand market volatility, tax law changes, legal liabilities, and unforeseen life events.

True wealth preservation is not a passive activity; it is a proactive, multi-faceted discipline that integrates sophisticated investment diversification, robust legal structures, and intelligent risk management. This guide moves beyond generic advice to provide a comprehensive roundup of powerful, actionable wealth preservation strategies. We will explore a framework designed for high-net-worth families, professionals, and business owners seeking to protect their hard-earned capital.

Our listicle breaks down nine distinct approaches, covering everything from the nuances of trust structures and estate planning to the role of tangible assets like precious metals and real estate. You will find practical implementation details and specific scenarios for each item, including advanced topics such as offshore asset protection, alternative investments, and the strategic use of life insurance.

Each strategy is presented with the clear, actionable insights needed to implement these concepts effectively. The ultimate goal is to provide a definitive resource that transforms your assets from a static figure into a dynamic, resilient, and lasting legacy, securing your financial future for years to come.

1. Diversified Investment Portfolio

A diversified investment portfolio is the cornerstone of nearly all effective wealth preservation strategies. This foundational approach involves spreading capital across a variety of different asset classes, geographical regions, and industry sectors. The core principle, rooted in Harry Markowitz's Modern Portfolio Theory, is simple yet powerful: don't put all your eggs in one basket. By doing so, you insulate your total net worth from the inevitable downturns in any single market segment.

How Diversification Protects Wealth

This strategy works by ensuring that the poor performance of one asset does not catastrophically impact the entire portfolio. For instance, while public equities might be volatile, high-quality bonds or real estate holdings can provide stability and income. Legendary examples include the Yale University Endowment, which pioneered the inclusion of alternative investments like private equity and hedge funds, and Warren Buffett’s Berkshire Hathaway, a conglomerate with holdings across insurance, energy, and consumer goods. This multi-asset approach is designed to produce more consistent returns and reduce overall risk.

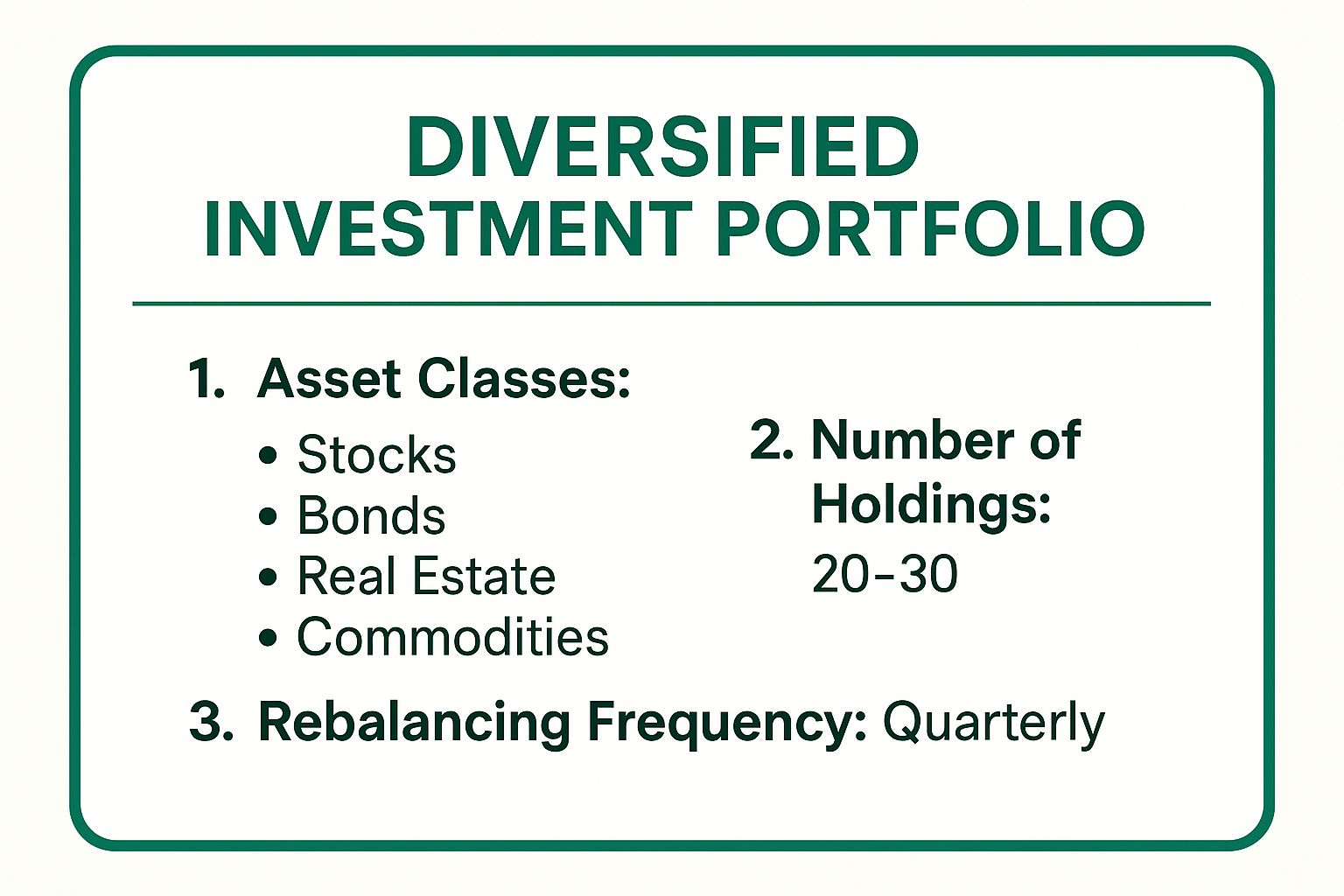

This summary box highlights the core components of a well-structured diversified portfolio.

These guidelines provide a foundational framework for asset allocation, holding concentration, and disciplined maintenance.

Actionable Implementation Tips

To effectively implement diversification, consider these practical steps:

- Establish Your Allocation: Use a simple guideline like the 100-minus-age rule as a starting point. For example, a 40-year-old might allocate 60% (100-40) to stocks and 40% to bonds.

- Rebalance Regularly: Markets shift, and so will your allocations. Review your portfolio quarterly or whenever an asset class drifts more than 5% from its target to maintain your desired risk profile.

- Avoid Over-Diversification: While spreading risk is key, owning too many assets can dilute returns and make management cumbersome. For most investors, a well-chosen portfolio of 20-30 individual holdings is sufficient.

- Go Global: Include international and emerging market funds to capture growth outside your home country and further reduce geographic risk.

For a deeper visual explanation of portfolio diversification, the video below provides an excellent overview.

2. Offshore Banking and Asset Protection

Offshore banking is a sophisticated tool within many advanced wealth preservation strategies. This practice involves holding financial assets, such as cash or investments, in banking institutions located outside of your primary country of residence. The fundamental objective is to legally insulate a portion of your wealth from domestic risks, including political instability, economic downturns, currency devaluation, and potential legal claims.

How Offshore Banking Protects Wealth

This strategy protects assets by placing them in a jurisdiction with a stable political environment and strong, privacy-focused banking laws. This geographical separation can create a significant barrier for domestic creditors or litigants. For centuries, Swiss private banks have provided this service for wealthy European families, while modern hubs like Singapore and the Cayman Islands have become premier destinations for international investment and corporate structures. By diversifying politically and legally, you add a powerful layer of defense to your financial foundation.

This summary box highlights the primary motivations for utilizing offshore financial centers.

These guidelines provide a framework for selecting a jurisdiction and maintaining full legal compliance.

Actionable Implementation Tips

To effectively implement an offshore strategy, consider these critical steps:

- Ensure Full Compliance: Adhere strictly to all home-country reporting requirements, such as the Foreign Account Tax Compliance Act (FATCA) in the U.S., to avoid severe legal and financial penalties.

- Select Strong Jurisdictions: Prioritize countries with a long-standing history of political stability, economic freedom, and a robust rule of law, not just low tax rates.

- Work with Qualified Advisors: Engage legal and tax professionals who specialize in international law and cross-border financial structures to ensure proper setup and management.

- Maintain Meticulous Records: Keep detailed and organized records of all offshore accounts and transactions to prove legitimacy and simplify compliance.

- Integrate with Other Tools: For maximum security, combine offshore accounts with other defensive measures. Combining these structures with robust asset protection insurance policies creates multiple layers of defense against unforeseen liabilities.

For a deeper visual explanation of offshore asset protection, the video below provides an excellent overview.

3. Trust Structures and Estate Planning

Effective estate planning, centered on the strategic use of trusts, represents one of the most powerful and enduring wealth preservation strategies available. This approach involves creating legal arrangements where assets are transferred to a trust, an entity managed by a designated trustee for the benefit of chosen beneficiaries. The primary goal is to move beyond a simple will and establish a robust framework for asset protection, tax efficiency, and the controlled transfer of wealth across generations, ensuring your financial legacy is managed according to your specific wishes.

How Trusts Protect and Transfer Wealth

Trusts create a legal shield around assets, separating them from your personal estate. This insulates wealth from potential creditors, lawsuits, and marital property disputes. Furthermore, assets held in certain trusts, like an Irrevocable Life Insurance Trust (ILIT) or a dynasty trust, can pass outside of the taxable estate, significantly reducing or even eliminating estate taxes. The Rockefeller family famously pioneered multi-generational trusts to preserve their fortune and influence for over a century, while philanthropists like Bill Gates utilize charitable remainder trusts to support causes while gaining tax advantages. These structures bypass the public, time-consuming, and often costly probate process, allowing for a private and efficient transfer of assets.

These guidelines offer a starting point for integrating trusts into your financial plan to secure your legacy.

Actionable Implementation Tips

To effectively implement trust-based estate planning, consider these critical steps:

- Start the Process Early: Estate planning is not just for the elderly. Establishing trusts early allows you to take full advantage of current gift and estate tax exemptions, which are subject to legislative changes.

- Choose Your Trustee Wisely: Select a trustee or co-trustees with a blend of financial acumen, fiduciary responsibility, and a deep understanding of your family’s values. This could be a combination of a corporate trustee and a trusted family advisor.

- Incorporate Flexibility: Work with your attorney to include provisions that allow the trust to adapt to future changes in law or family circumstances. A "trust protector" can be appointed with the power to make specific modifications.

- Review and Update Regularly: Your life and the laws governing estates will change. Review your entire estate plan every 3-5 years or after any major life event, such as a marriage, birth, or significant change in net worth. To learn more, you can explore these comprehensive estate tax planning strategies.

4. Precious Metals and Commodities Investment

Investing in precious metals and commodities is a time-honored component of sophisticated wealth preservation strategies. This approach involves allocating capital to tangible assets like gold, silver, and platinum, or to commodity futures, as a powerful hedge against inflation, currency devaluation, and systemic economic risk. Unlike paper assets, their intrinsic value provides a reliable store of wealth when traditional financial markets are volatile.

How Precious Metals and Commodities Protect Wealth

These assets protect wealth by acting as a safe haven during periods of financial stress. Because their value often moves inversely to stocks and bonds, they serve as a critical portfolio diversifier. History is filled with examples, from central banks holding vast gold reserves to back their currencies, to modern pioneers like Ray Dalio incorporating commodities into his famous "All Weather" portfolio. These tangible assets are not subject to the same counterparty risks as financial instruments, offering a fundamental layer of security.

These guidelines offer a practical framework for integrating hard assets into a modern wealth strategy.

Actionable Implementation Tips

To effectively integrate these assets into your strategy, consider these practical steps:

- Determine Your Allocation: Financial advisors often recommend dedicating 5-10% of a portfolio to precious metals to achieve diversification without sacrificing overall growth potential.

- Choose Your Vehicle: Gain exposure through either physical ownership of bars and coins or through more liquid instruments like Exchange-Traded Funds (ETFs) such as GLD (for gold) or SLV (for silver).

- Secure Physical Holdings: If you choose to own physical metals, ensure they are stored in a secure, insured, and reputable depository. Do not rely on home safes for significant holdings due to risks of theft and damage.

- Use Dollar-Cost Averaging: The prices of commodities can be volatile. Mitigate this risk by investing a fixed amount regularly over time, a strategy known as dollar-cost averaging, to smooth out your purchase price.

- Monitor Demand Trends: For industrial commodities, stay informed about global manufacturing and industrial demand trends, as these are key drivers of their long-term value.

5. Real Estate Investment and REITs

Investing in physical property or Real Estate Investment Trusts (REITs) is a time-tested component of sophisticated wealth preservation strategies. This approach leverages tangible assets to generate steady income, benefit from long-term appreciation, and provide a powerful hedge against inflation. Unlike purely financial assets, real estate offers a durable store of value that can provide stability and growth across economic cycles.

How Real Estate Protects Wealth

This strategy works by generating dual returns: consistent cash flow from rental income and long-term capital appreciation. Tangible assets like property have historically outpaced inflation, ensuring your capital's purchasing power is protected. Visionary investors like Sam Zell and institutions like Blackstone built their fortunes on this principle, acquiring assets that produce reliable income while growing in value. Furthermore, real estate offers significant tax advantages, such as depreciation and 1031 exchanges, which allow gains to be deferred, accelerating wealth compounding.

Actionable Implementation Tips

To effectively integrate real estate into your portfolio, consider these practical steps:

- Diversify Across Markets and Types: Avoid concentrating in one city or property type. Spreading capital across residential, industrial, and commercial properties in different geographic regions mitigates risk from local downturns.

- Use REITs for Simplicity and Liquidity: To gain real estate exposure without the complexities of direct ownership, invest in Real Estate Investment Trusts (REITs). They offer professional management and can be traded like stocks.

- Target High-Growth Areas: Focus on properties in regions with strong, consistent job and population growth. These demographic trends are leading indicators of future demand and appreciation.

- Maintain a Healthy Capital Reserve: Earmark 1-3% of the property's value annually for maintenance, repairs, and potential vacancies. This liquidity buffer is crucial for preventing financial distress and protecting your investment.

- Optimize Your Tax Strategy: Work closely with a professional to leverage tax benefits like depreciation and 1031 exchanges. Properly structuring your investments can significantly reduce tax liabilities and boost your net returns.

6. Life Insurance as Wealth Preservation Tool

Permanent life insurance has evolved far beyond a simple death benefit, establishing itself as a sophisticated vehicle within advanced wealth preservation strategies. Policies such as whole life and universal life combine a guaranteed payout with a tax-advantaged savings component known as cash value. This dual function allows capital inside the policy to grow tax-deferred and, when structured correctly, be accessed or passed on to heirs completely income and estate tax-free, creating a powerful tool for asset protection and transfer.

How Life Insurance Protects Wealth

This strategy's primary strength lies in its ability to provide immediate, tax-free liquidity exactly when it is needed most. For high-net-worth families, this liquidity can be used to pay estate taxes, preventing the forced sale of illiquid assets like a family business or real estate portfolio. This approach was famously championed by legendary salesmen like Ben Feldman and is a staple for estate planning attorneys. Business owners also use policies to fund buy-sell agreements, ensuring a smooth and funded ownership transition upon a partner's death.

Actionable Implementation Tips

To effectively integrate life insurance into your wealth strategy, consider these practical steps:

- Engage an Independent Advisor: Work with a fee-only or independent insurance professional who can compare products from multiple carriers, helping you avoid the bias inherent with captive agents.

- Scrutinize Policy Illustrations: Do not rely solely on non-guaranteed projections. Focus on the guaranteed cash value and death benefit figures and ask for illustrations based on lower, more conservative return assumptions.

- Prioritize Financial Strength: Select carriers with top-tier financial strength ratings (e.g., A+ or higher from A.M. Best). For whole life policies, review the company's history of paying dividends, as this is a key driver of long-term value.

- Understand All Costs: Demand a full breakdown of all internal policy charges, including the cost of insurance (mortality charges), administrative fees, and potential surrender charges.

- Consider the Alternative: Always weigh the benefits of permanent insurance against the classic "buy term and invest the difference" strategy to ensure it is the right fit for your specific financial goals and discipline.

7. Alternative Investments (Private Equity, Hedge Funds)

Incorporating alternative investments is one of the more sophisticated wealth preservation strategies available to accredited investors and high-net-worth families. This approach involves allocating capital to non-traditional asset classes like private equity, hedge funds, venture capital, and private credit. The primary goal is to access return streams that are not closely correlated with public stock and bond markets, thereby creating a powerful buffer against widespread market volatility.

How Alternative Investments Protect Wealth

This strategy shields wealth by generating returns from unique sources, such as the growth of private companies or specialized trading strategies, that are insulated from public market sentiment. The most famous application is the "Yale Model," developed by David Swensen for the Yale University Endowment. By allocating a significant portion of the portfolio to alternatives, Swensen consistently produced high returns with lower volatility than traditional stock-and-bond portfolios, proving the model's capital-preserving power over decades. These assets offer a different risk-return profile that can stabilize a portfolio during public market downturns.

Successfully navigating the world of alternatives requires a disciplined and informed approach.

Actionable Implementation Tips

To effectively integrate alternative investments into your portfolio, consider these critical steps:

- Conduct Rigorous Due Diligence: Go beyond performance numbers. Thoroughly investigate the fund manager’s track record, investment thesis, risk management processes, and operational integrity before committing capital.

- Understand Illiquidity: Be fully aware of lock-up periods, which can range from 2 to 10+ years, and capital call schedules. Ensure these align with your personal liquidity needs and long-term financial plan.

- Diversify Within Alternatives: Do not concentrate in a single strategy. Spread capital across different types of alternatives, such as private equity, private credit, and real assets, to further mitigate risk.

- Start with Liquid Alts: If you are new to the space, consider starting with liquid alternative funds. These publicly traded vehicles provide exposure to hedge-fund-like strategies but with daily or weekly liquidity, offering an easier entry point.

- Integrate with Overall Planning: Ensure these complex assets are part of your holistic financial and risk management plan. For high-net-worth individuals, specialized private client insurance solutions can be essential for protecting a balance sheet that includes significant alternative holdings.

8. Tax-Advantaged Retirement Accounts

Systematically utilizing tax-advantaged retirement accounts is one of the most accessible yet powerful wealth preservation strategies for individuals and business owners. These accounts, such as 401(k)s, IRAs, and Roth variants, are specifically designed by the government to encourage long-term savings by offering significant tax benefits. The core advantage is that they allow your investments to grow either tax-deferred or completely tax-free, dramatically accelerating the power of compounding over time.

How Tax Advantages Protect Wealth

This strategy protects and grows wealth by creating a legal shield against annual tax drag. In a standard brokerage account, you pay taxes on dividends and capital gains each year, which slows growth. In a traditional 401(k) or IRA, contributions may be tax-deductible, lowering your current income, and the investments grow untaxed until withdrawal. With a Roth account, you contribute post-tax dollars, but all qualified withdrawals in retirement are tax-free. High earners often use "Backdoor Roth IRA" conversions, while small business owners can leverage SEP-IRAs to contribute significantly more than standard IRA limits, maximizing this tax shelter.

Actionable Implementation Tips

To effectively leverage these accounts for wealth preservation, consider these practical steps:

- Prioritize the Employer Match: Always contribute enough to your 401(k) to receive the full employer match. This is essentially a 100% return on your investment and the easiest money you will ever make.

- Choose Roth vs. Traditional Wisely: If you expect to be in a higher tax bracket in retirement, a Roth account (pay taxes now) is often preferable. If you anticipate a lower tax bracket, a Traditional account (pay taxes later) may be more advantageous.

- Leverage Catch-Up Contributions: If you are age 50 or older, the IRS allows for additional "catch-up" contributions to your IRA and 401(k), enabling you to supercharge your savings.

- Plan Strategic Roth Conversions: Consider converting funds from a Traditional IRA to a Roth IRA during years of lower income, such as early retirement or a sabbatical, to pay the conversion tax at a reduced rate.

- Diversify Tax Treatments: Holding a mix of tax-deferred (Traditional 401(k)/IRA), tax-free (Roth 401(k)/IRA), and taxable accounts provides maximum flexibility to manage your tax liability in retirement.

9. International Diversification and Currency Hedging

Expanding your portfolio beyond domestic borders is one of the most sophisticated wealth preservation strategies available. This approach involves strategically allocating investments across multiple countries and currencies to insulate your net worth from localized risks. By investing internationally, you reduce concentration risk tied to a single country's economy, political climate, or currency fluctuations, thereby protecting your purchasing power on a global scale.

How International Diversification Protects Wealth

This strategy shields your assets from domestic downturns that might not affect global markets. If your home country's economy stagnates or its currency devalues, international holdings can provide critical stability and growth. A prime example is the Norwegian Government Pension Fund, which invests globally to protect the nation's wealth from oil price volatility. Similarly, wealthy families often hold assets in multiple strong currencies like the Swiss Franc (CHF) or U.S. Dollar (USD) to hedge against instability in their home currency. This global footing ensures that your wealth is not solely dependent on the fortunes of one nation.

Actionable Implementation Tips

To effectively implement global diversification and currency hedging, consider these practical steps:

- Establish an International Allocation: Aim to allocate between 20% and 40% of your equity portfolio to international markets. This provides meaningful diversification without over-exposing you to foreign volatility.

- Balance Your Global Exposure: Invest in a mix of both developed markets (like Europe and Japan) for stability and emerging markets (like India or Brazil) for higher growth potential.

- Utilize Currency-Hedged Funds: To specifically protect against adverse foreign exchange movements, consider using currency-hedged ETFs or mutual funds. These instruments aim to strip out currency risk, so your returns are based on the asset's performance alone.

- Diversify Your Currency Holdings: Beyond stocks and bonds, hold a portion of your liquid assets in several of the world's strongest currencies, such as the U.S. Dollar (USD), Euro (EUR), Swiss Franc (CHF), and Japanese Yen (JPY).

- Address Tax Complexities: Foreign investments come with unique tax implications and reporting requirements. Always consult with a tax professional specializing in international assets to ensure full compliance.

Wealth Preservation Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Diversified Investment Portfolio | Moderate 🔄🔄 | Moderate ⚡⚡ | Steady long-term growth 📊📊 | Broad wealth preservation and risk reduction | Reduces volatility; liquid; steady growth ⭐⭐ |

| Offshore Banking and Asset Protection | High 🔄🔄🔄 | High ⚡⚡⚡ | Asset protection and privacy 📊📊 | Protecting assets from domestic risks | Privacy; political/legal protection ⭐⭐⭐ |

| Trust Structures and Estate Planning | High 🔄🔄🔄 | High ⚡⚡⚡ | Tax efficiency and controlled transfer 📊 | Multi-generational wealth transfer | Tax savings; asset protection; control ⭐⭐⭐ |

| Precious Metals and Commodities | Low to Moderate 🔄 | Low to Moderate ⚡ | Inflation hedge and crisis value 📊 | Portfolio hedge against inflation & instability | Inflation hedge; no counterparty risk ⭐⭐ |

| Real Estate Investment and REITs | Moderate to High 🔄🔄 | High ⚡⚡⚡ | Property appreciation and rental income 📊 | Tangible asset investment with income generation | Tangible; income; inflation protection ⭐⭐ |

| Life Insurance as Wealth Tool | Moderate 🔄 | Moderate ⚡ | Tax-advantaged growth and liquidity 📊 | Estate planning and tax-advantaged wealth growth | Tax advantages; death benefit; creditor protection ⭐⭐ |

| Alternative Investments (PE, HFs) | Very High 🔄🔄🔄 | Very High ⚡⚡⚡ | Higher returns with diversification 📊 | Sophisticated investors seeking diversification | Unique strategies; higher returns ⭐⭐⭐ |

| Tax-Advantaged Retirement Accounts | Moderate 🔄 | Low to Moderate ⚡ | Tax-deferred/free growth 📊 | Long-term retirement and wealth accumulation | Tax savings; compound growth; employer match ⭐⭐ |

| International Diversification & Hedging | Moderate 🔄🔄 | Moderate ⚡⚡ | Risk reduction and global growth 📊 | Reducing domestic risk, access to global markets | Currency diversification; global exposure ⭐⭐ |

Building Your Fortress: Integrating Your Wealth Preservation Plan

Navigating the landscape of wealth preservation can feel like assembling a complex puzzle. We have explored a range of powerful tools, from the growth potential of diversified portfolios and alternative investments to the defensive strength of precious metals and the structural integrity of trusts. However, the most critical takeaway is this: these are not standalone fixes. The true resilience of your financial future is not found in any single strategy but in the thoughtful integration of many. Building a durable financial fortress requires a master blueprint where each component supports and reinforces the others.

From Individual Tactics to a Unified Strategy

The effectiveness of your plan hinges on synergy. The sophisticated wealth preservation strategies detailed in this article are designed to work in concert, creating a whole that is far greater than the sum of its parts. A business owner might use a tax-advantaged retirement account to build personal wealth while protecting their company's assets with robust commercial liability insurance. A high-net-worth family might use an Irrevocable Life Insurance Trust (ILIT) to ensure their estate has immediate liquidity to pay taxes, preserving hard assets for the next generation.

Think of it this way: your international investments provide a hedge against domestic market volatility, while your domestic real estate provides stable, tangible value. Your estate plan dictates how these assets are transferred, while your insurance policies protect their value against unforeseen calamities. This interconnectedness is the hallmark of a sophisticated and robust wealth preservation plan, one that is customized to your unique goals, timeline, and risk tolerance.

The Architect's Blueprint: Your Actionable Next Steps

Constructing this integrated plan is not a passive exercise. It demands proactive engagement and expert guidance. If you are serious about securing your assets for the long term, here are the essential first steps to take:

- Conduct a Comprehensive Audit: Your first task is to gain a complete, 360-degree view of your current financial position. Gather all relevant documents, including investment statements, current insurance policies, business balance sheets, wills, trust documents, and property deeds. You cannot build a new blueprint without understanding the existing foundation.

- Assemble Your Professional Team: Wealth preservation is a team sport, not a solo endeavor. A truly effective plan requires the coordinated expertise of several key professionals. This team should include a Certified Financial Planner (CFP) for investment strategy, a CPA or tax advisor for tax efficiency, and an estate planning attorney for legal structuring and succession.

- Stress-Test Your Current Plan: Once you have your team and your audit, rigorously challenge your existing strategy. Ask the tough "what-if" questions. What happens to your portfolio in a prolonged recession? How would your family or business fare after a major liability lawsuit? Are your assets adequately shielded from creditors or a potential cyber attack? This process will reveal the vulnerabilities that need to be addressed immediately.

The Unseen Shield: The Critical Role of Risk Management

Among all these moving parts, the most crucial yet often overlooked layer is risk management. All the brilliant financial planning, asset allocation, and estate structuring in the world can be undone in an instant by a single catastrophic event. A lawsuit, a fire, a professional liability claim, or a major auto accident can decimate unprotected assets, derailing decades of careful planning.

This is why a comprehensive insurance portfolio is not an expense but the foundational shield of your entire financial fortress. For individuals, HNW families, and business owners alike, the right insurance solutions are the bedrock of true wealth preservation strategies. This goes beyond a simple policy; it involves proactive risk mitigation, intelligent claims advocacy, and a deep understanding of your specific exposures, whether you are insuring a private aircraft, a commercial vehicle fleet, or your family’s legacy. This integrated shield provides the ultimate return on investment: genuine peace of mind.

Securing your assets is an active, ongoing process of stewardship. By integrating these strategies and partnering with the right team of experts, you can build a resilient financial fortress capable of withstanding market volatility and life’s uncertainties, ensuring your legacy endures for generations to come.

Your insurance portfolio is the critical risk management layer of your wealth preservation plan. The experts at Wexford Insurance Solutions specialize in designing integrated personal and commercial insurance programs that reduce your total cost of risk and provide comprehensive protection. To start building your shield, contact Wexford Insurance Solutions today for a personalized consultation.

Business Continuity Insurance: Protect Your Business Today

Business Continuity Insurance: Protect Your Business Today Flood Insurance vs Homeowners Insurance: Complete Guide

Flood Insurance vs Homeowners Insurance: Complete Guide