Understanding Why Your Homeowners Policy Won't Save You From Floods

A common and dangerous assumption property owners make is that a standard homeowners policy is a complete shield against all forms of water damage. This misunderstanding often comes to light at the worst possible time: in the aftermath of a disaster. The critical difference between flood insurance vs homeowners insurance is centered on how each policy defines and responds to water-related events, a distinction shaped by decades of insurance industry practice.

The Great Divide: Water Damage vs. Flood Damage

Essentially, a homeowners insurance policy is designed to cover sudden and accidental damage that starts inside your property. For example, if a pipe bursts and floods your kitchen or a washing machine hose fails, soaking the laundry room, these are considered internal "water damage" events and are generally covered.

In contrast, insurers define flood damage as water originating from a natural source that covers normally dry land. This specific definition includes:

- Overflow of inland or tidal waters, such as rivers, lakes, or oceans.

- Unusual and rapid accumulation of surface water from sources like heavy rainfall.

- Mudflow resulting from flooding conditions.

- The collapse of land along a shoreline due to erosion from waves or currents.

Because a single flood can cause widespread, catastrophic losses across an entire region at once, private insurers historically viewed the risk as too great to cover profitably. This led to the specific exclusion of flood damage from nearly all standard homeowners policies, creating a major gap in protection for many.

A Glaring Gap in Protection

This fundamental exclusion has created a stark reality in property protection. While an estimated 88-91% of homeowners have a standard homeowners policy, a surprisingly low 4-5% of homeowners carry separate flood insurance. This discrepancy reveals a massive vulnerability, as even a single inch of floodwater can result in tens of thousands of dollars in repairs that a homeowners policy will not cover.

Many property owners who don't have a mortgage—and therefore no lender requirement—incorrectly assume that living outside a high-risk zone means they don't need coverage. This leaves their most significant asset exposed. You can find a deeper analysis of this coverage gap and its implications for financial planners, highlighting how widespread the issue is. Ultimately, recognizing this crucial distinction is the first step toward building a resilient financial strategy for your property.

Decoding What Each Policy Actually Covers In Real-World Scenarios

Understanding the fine print that separates flood and homeowners insurance becomes much clearer when applied to real-world claim situations. The single most important factor is the source of the water. A standard homeowners policy is designed to cover damage from water that originates inside your home, while a flood policy covers damage from water that rises from the ground outside your home.

Gray Areas and Claim Triggers

The distinction can seem straightforward, but certain events create confusion. Let’s analyze how flood insurance vs. homeowners insurance coverage responds in specific, often misunderstood scenarios:

-

Scenario 1: Hurricane Wind and Rain. A hurricane’s powerful winds rip shingles off your roof. This allows hours of heavy rain to pour into your attic and seep into your ceilings and walls. This is a clear-cut homeowners insurance claim. The damage was a direct result of wind (a covered peril) creating an opening, which then allowed the rain to enter.

-

Scenario 2: Hurricane Storm Surge. The very same hurricane pushes a massive wall of ocean water inland, and this storm surge inundates your home's ground floor. This is classified as flood damage. Only a separate flood insurance policy will address the structural damage and ruined belongings. Your homeowners policy will deny this portion of the claim.

-

Scenario 3: Basement Seepage. Following several days of continuous, heavy rainfall, the ground becomes completely saturated. Water then starts to seep through your foundation walls and into the basement. This is considered ground-level flooding and is explicitly excluded from homeowners insurance. Coverage for this type of event requires a flood policy.

To better illustrate the financial impact of these distinctions, the following table breaks down how each policy responds in common water damage events.

Coverage Reality Check: When Policies Pay vs When They Don't

Real-world scenarios showing exactly which policy responds to specific water damage situations, with claim outcomes and homeowner costs

| Water Damage Scenario | Homeowners Insurance Response | Flood Insurance Response | Typical Homeowner Cost |

|---|---|---|---|

| Burst Pipe Inside Wall | Covers water damage and cost to access/repair the pipe. | Denies claim as the water source is internal. | Policy Deductible (e.g., $500 – $2,500) |

| Sewer Line Backup | Denies claim unless a specific "water backup" endorsement is added. | Denies claim as it's not considered a flood. | 100% of repair costs (can be $5,000 – $20,000+) without endorsement. |

| River Overflows Banks | Denies claim as this is a classic flood event. | Covers structural damage and personal property damage. | Policy Deductible (e.g., $1,000 – $10,000) |

| Roof Leak from a Storm | Covers interior water damage caused by the leak. | Denies claim as the water came from above, not the ground. | Policy Deductible for the repair. |

| Heavy Rain Causes Seepage | Denies claim, classifying it as ground-level water intrusion. | Covers damage subject to policy limits and definitions. | 100% of repair costs without flood insurance. |

The scenarios in the table confirm a critical point: relying on just one policy creates significant financial exposure. Identical water damage can lead to vastly different outcomes for a homeowner, based entirely on the water's point of origin.

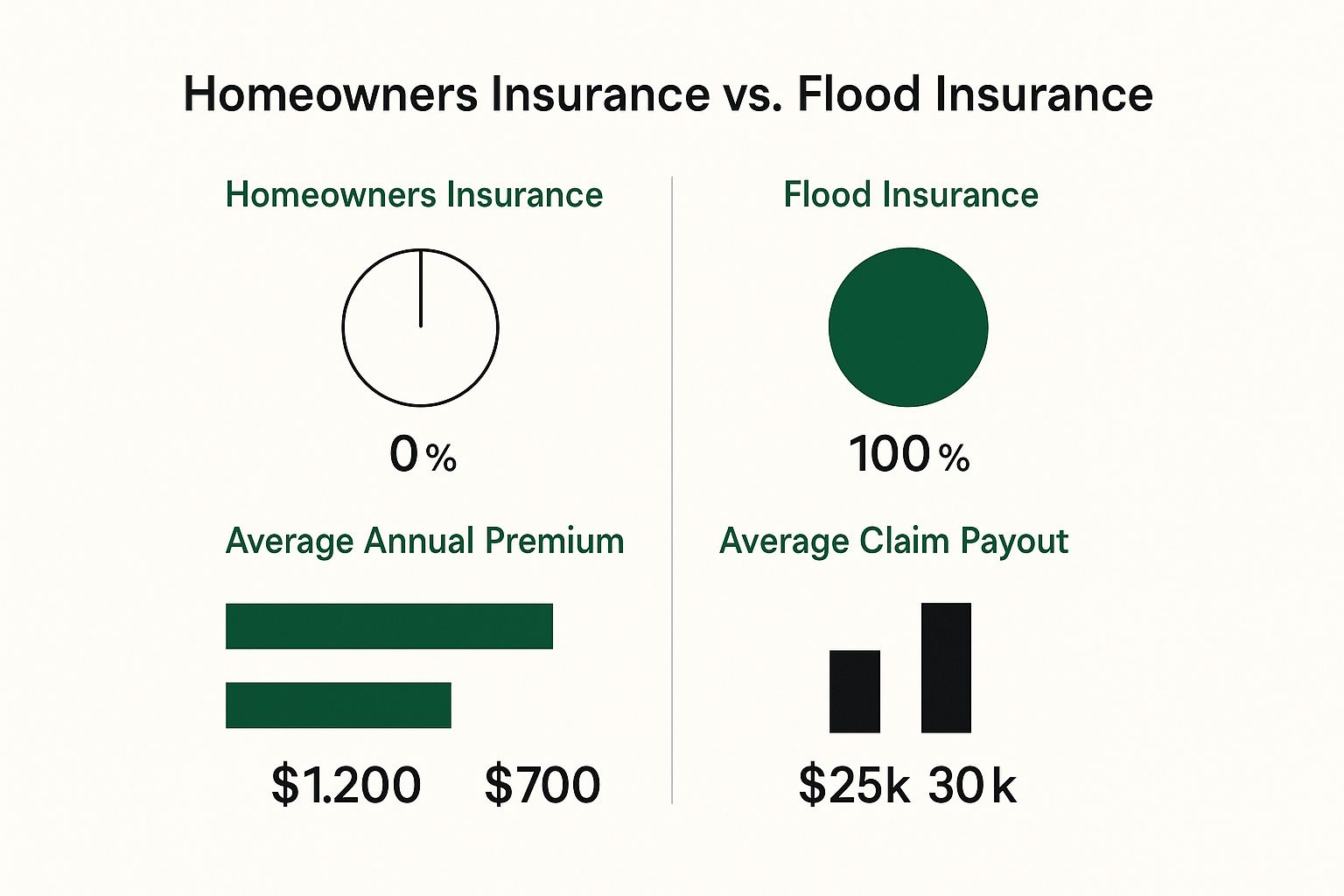

This infographic further visualizes the key data points, comparing the scope and financial realities of each policy type.

As the data shows, while homeowners insurance carries a higher average premium, it provides zero coverage for flood-related incidents, where claim amounts can be catastrophic. The cost of a homeowners policy is influenced by various factors, and you can explore strategies for managing these expenses in our guide on how to lower home insurance premiums. These examples demonstrate why having both policies is essential for comprehensive protection in many areas.

Why Location Matters More Than You Think For Insurance Decisions

Your property's location is the most significant factor in the flood insurance vs. homeowners insurance discussion, but a simple ZIP code or FEMA flood map offers an incomplete picture. While coastal communities in states like Florida and Louisiana are correctly associated with high flood risk, many inland areas face growing, often unappreciated, threats that standard assessments don't capture. This situation creates a dangerous gap between perceived risk and genuine vulnerability.

Beyond the Flood Zone Designation

Official flood maps should be treated as a starting point, not the definitive word on your property's risk. Several local conditions can introduce significant flood potential in areas designated as low-to-moderate risk, including:

- Aging Infrastructure: In established neighborhoods, older stormwater systems may not have the capacity to manage the runoff from today's more intense and concentrated rainfall.

- Urban Development: Nearby new construction and large paved areas, like parking lots, reduce the ground's ability to absorb water, increasing runoff and channeling it toward properties that were previously unaffected.

- Shifting Weather Patterns: Climate adjustments are leading to record-breaking rainfall in regions unaccustomed to such volumes, transforming "once-in-a-century" storms into more common events.

These hidden factors contribute to a significant disconnect in insurance coverage. Nationally, only about 4% to 5% of homeowners have flood insurance. This figure rises sharply in well-known flood-prone cities. For example, in Houston and Miami, approximately one in three homeowners has a flood policy, a reflection of greater awareness driven by recurring storm events. You can explore more about this insurance gap and voluntary adoption rates in a report by Urban.org.

Assessing Your True Geographic Risk

To make a well-grounded decision, you must look past the official maps and analyze the specific characteristics of your immediate surroundings. Is your property situated downhill from a major commercial development? Does your town's drainage system struggle during heavy downpours? Answering these questions gives you a more precise risk profile than simply relying on a broad zone designation.

A home's true vulnerability is often determined by its hyper-local geography, not just its state or county lines. This localized context is critical for deciding if flood coverage is a sensible investment for your financial security.

The Financial Reality When Disaster Strikes Your Community

When a widespread disaster like a major hurricane hits, the financial distinctions between flood insurance and homeowners insurance become painfully clear, affecting not just individual households but entire local economies. The theoretical gap in coverage becomes a tangible crisis, dictating the pace and success of a community's recovery for years. Catastrophic events are real-world tests, showing how insurance decisions made years earlier determine financial survival.

The true cost of being underinsured goes far beyond the immediate expense of rebuilding a house. Homeowners without dedicated flood coverage face a cascade of secondary financial burdens that a standard homeowners policy will not cover. These often-overlooked costs include:

- Prolonged displacement, leading to high costs for temporary housing.

- The loss of personal belongings, which are often not covered by federal disaster aid.

- The immense cost of professional mold remediation after a flood.

- Significant financial setbacks from operational downtime for small business owners who operate from home. You can learn more about this specific risk in our guide to business interruption insurance cost.

A Community-Wide Ripple Effect

A low rate of flood insurance adoption sends a disruptive ripple effect through a community's economic foundation. When a large percentage of residents cannot afford to rebuild their homes, property values can stagnate or decline. Local businesses suffer from a diminished customer base, and municipal governments see their tax revenue shrink just when the demand for public services is at its peak.

The aftermath of Hurricane Harvey in 2017 serves as a stark case study. In Harris County, Texas, only about 15% of homes carried flood insurance. Analysis later revealed that more than half of the flooded homes were not in officially designated high-risk flood zones, meaning lenders never mandated the coverage. This left a vast, uninsured population to manage on their own, severely slowing recovery efforts across the entire region. More details are available in the full statistical breakdown from the III.

To better understand the financial consequences of different insurance scenarios after a disaster, the following table breaks down the typical financial impact on homeowners. It compares average claim payouts, potential out-of-pocket expenses, and the expected time to recover based on the type of coverage held.

| Insurance Coverage Type | Average Claim Amount | Out-of-Pocket Costs | Recovery Timeline |

|---|---|---|---|

| Homeowners Insurance Only | $0 (Flood damage excluded) | Potentially 100% of rebuild costs, relying on savings or loans | 2-5+ years, often dependent on federal aid and personal finances |

| Flood Insurance Only | Average NFIP claim is $69,000 | Deductibles, plus costs exceeding policy limits (e.g., landscaping) | 6-18 months, as funds are directly tied to rebuilding efforts |

| Homeowners + Flood Insurance | Varies (Covers wind & flood) | Deductibles for both policies, potential non-covered items | 4-12 months, representing the fastest and most complete recovery |

This analysis clearly shows that relying solely on homeowners insurance for a flood event results in a devastating financial gap. The combination of both homeowners and flood insurance provides the most robust financial safety net, drastically reducing out-of-pocket costs and shortening the time it takes for a household to recover.

In contrast, communities with higher flood insurance participation rates rebound more quickly. The infusion of insurance capital allows for faster rebuilding, supports local contractors, and helps restore economic activity. This sharp contrast demonstrates that flood insurance is not merely a personal asset shield; it is a critical instrument for community-wide economic resilience.

Smart Investment Analysis Beyond Premium Costs

The comparison of flood insurance vs homeowners insurance requires a look beyond the annual premium. A more strategic financial analysis views insurance not as a simple expense, but as a critical investment in risk management. This involves assessing potential loss scenarios, the effect on your property's value, and your long-term financial stability against the fixed cost of coverage. It's a clear choice between a predictable, manageable premium and an unpredictable, potentially catastrophic financial blow.

Evaluating the True Cost of Risk

Actuarial data consistently shows that the cost of a flood insurance policy is minor compared to the cost of flood recovery. The average claim payout from the National Flood Insurance Program (NFIP) is approximately $69,000. To put that in perspective, a single inch of floodwater can cause over $25,000 in damages. Without insurance, these costs are paid directly from a homeowner's savings, retirement accounts, or high-interest loans, creating a major setback to personal wealth.

Furthermore, having flood insurance can directly influence your property's value and marketability. Homes in flood-prone areas that are properly insured are often more appealing to buyers because the coverage is transferable and assures the lender that the asset is protected. This can prevent delays in real estate transactions and help preserve equity, particularly as climate-related risks become more significant in buying decisions. This perspective is a key part of personal finance and a foundation of many wealth preservation strategies.

Considering Affordability and Alternatives

While the investment argument for flood insurance is strong, affordability is a valid concern for many homeowners. It's important to look into potential subsidies and policy reforms. For instance, FEMA's Risk Rating 2.0 methodology is designed to align premiums more accurately with a property's specific flood risk. This can result in lower costs for some homeowners, especially those with lower-risk properties or those who have installed mitigation measures.

For a select few, especially those with considerable liquid assets and a high tolerance for risk, self-insurance might appear to be a workable alternative. This approach involves setting aside dedicated funds to cover potential flood damage. However, this strategy comes with substantial risks:

- Underestimation: It's incredibly difficult to accurately predict the full cost of a major flood, which includes structural repairs, mold removal, and replacing all of your belongings.

- Opportunity Cost: The money held in reserve for a potential flood is capital that cannot be invested elsewhere for potential growth.

- Discipline: It demands strict financial discipline over many years to avoid using the funds for other purposes.

For the vast majority of homeowners, a formal flood insurance policy offers a much more dependable and cost-effective method of transferring risk than attempting to self-insure against a calamitous event.

Building Your Personal Protection Strategy

Developing an effective insurance plan means looking past general advice to analyze your specific circumstances. The decision between flood insurance vs. homeowners insurance—or, more accurately, the need for both—depends on a personal risk calculation that balances your property's unique features against your financial situation and long-term objectives. Your needs are distinct, and your protection strategy should reflect that.

Assessing Your Complete Risk Profile

A proper assessment involves more than just a glance at a FEMA flood map. It requires a detailed review of your specific situation to find the right blend of coverage. This personalized method helps weigh the cost of premiums against the potential for immense, uninsured losses.

To construct your strategy, consider these important factors:

- Property Characteristics: Is your house built on a slab foundation, or does it have a basement? What is its elevation compared to nearby water bodies or areas with poor drainage? Even small details, like the slope of your yard, can significantly change your actual flood risk.

- Financial Capacity: Objectively evaluate your ability to absorb a major, unexpected cost. Could you pay for $50,000 or more in repairs out-of-pocket without jeopardizing your long-term financial stability? If not, transferring that risk through an insurance policy becomes a necessary defensive action.

- Risk Tolerance and Life Stage: A first-time homebuyer with minimal savings has a very different risk profile than a seasoned property investor with a varied portfolio. Your current life stage and personal comfort level with financial risk should directly shape your coverage choices.

Making an Informed Decision for Your Situation

Different homeowners require different strategic plans. By understanding your specific context, you can build a more resilient financial foundation. The table below provides recommendations for common homeowner scenarios.

| Homeowner Profile | Mandatory vs. Voluntary Coverage | Key Considerations & Recommendations |

|---|---|---|

| First-Time Homebuyer | Often mandatory for mortgages in high-risk zones. | Recommendation: Seriously consider voluntary flood coverage even if it's not required. An unexpected major repair cost early in homeownership can be financially devastating. |

| Established Homeowner | Mandatory if refinancing a mortgage in a high-risk zone. | Recommendation: Reassess your risk annually. Nearby construction projects or shifting weather patterns can increase your flood risk over time. Your protection needs will evolve. |

| Property Investor | Mandatory for mortgages on rental properties in high-risk zones. | Recommendation: Factor flood insurance into your core operating expenses. Uninsured flood damage can wipe out years of rental income and reduce the asset's overall value. |

Ultimately, insurance is one part of a larger financial framework. It functions alongside your other liability protections to secure your assets. To better understand how these policies interact, you can learn more about the function of personal liability coverage in our detailed guide. By taking this analytical view, you can design a protection strategy that offers genuine security.

Taking Action: Your Step-By-Step Implementation Guide

Moving from a theoretical analysis of flood insurance vs. homeowners insurance to practical application is where your protection strategy truly takes shape. This guide provides a clear path for securing the right coverage, but timing is a critical factor. Most flood insurance policies, especially those from the National Flood Insurance Program (NFIP), enforce a 30-day waiting period before coverage begins. If you wait until a storm is on the horizon, it will be too late, leaving your property and finances exposed.

Your Roadmap to Securing Coverage

A methodical approach is essential to prevent coverage gaps and ensure your decisions are well-informed. By following these steps, you can construct a resilient insurance portfolio designed for your specific circumstances.

-

Assess Your True Risk: Don't rely solely on official FEMA flood maps. A proper risk assessment involves evaluating your property’s specific elevation, its proximity to bodies of water, and the real-world effectiveness of local drainage infrastructure. Consider recent nearby construction, which can alter water runoff patterns and increase your property's vulnerability.

-

Gather Necessary Documentation: To receive accurate quotes, you need to have your documents in order. This includes your property deed, an elevation certificate if available, and current photos of your home’s structure and contents. Compiling this information now not only streamlines the quoting process but is also invaluable if you need to file a claim later.

-

Engage an Independent Insurance Agent: An independent agent is a significant asset because they work with multiple insurance carriers. Unlike captive agents tied to a single company, an independent professional can source and compare policies from both the NFIP and the growing private flood insurance market. This access provides a broader range of options for both coverage features and cost.

Comparing Policies and Making the Right Choice

When you receive insurance quotes, the premium is just one part of the equation. A thorough comparison is necessary to identify the policy that offers the most substantial protection for your investment.

| Comparison Point | What to Look For |

|---|---|

| Coverage Limits | Confirm that the limits for both your dwelling and personal property are high enough to cover a complete loss. |

| Deductible Amounts | A higher deductible reduces your premium, but it also means a larger out-of-pocket expense when you file a claim. Select a deductible you can comfortably pay. |

| Policy Exclusions | Scrutinize what the policy does not cover. Common exclusions include finished basements and personal belongings stored in them. |

| Additional Coverages | Ask about available endorsements, such as coverage for additional living expenses or the cost to comply with new building codes after a disaster. |

After you've purchased your policies, the work continues. An annual review with your agent is crucial. Life events, home renovations, and changes in local flood risk can all necessitate adjustments to your coverage. If you find your current provider no longer fits your needs, don't be afraid to shop around. Our guide on how to switch insurance providers offers a helpful walkthrough of that process.

Feeling overwhelmed? A proactive approach makes all the difference. The team at Wexford Insurance Solutions specializes in simplifying this process, providing personalized guidance to ensure you have comprehensive protection without overpaying. Contact us today for a complimentary review of your insurance needs.

9 Top Wealth Preservation Strategies for 2025

9 Top Wealth Preservation Strategies for 2025 What Is Errors And Omissions Insurance? Your Essential Guide

What Is Errors And Omissions Insurance? Your Essential Guide