What Is Errors And Omissions Insurance: The Basics Explained

Think of Errors and Omissions (E&O) insurance as a professional safety net. Imagine you're a talented consultant who has built a reputation on excellent work. One day, a client claims your advice caused them to lose thousands in revenue. Even if the claim is baseless, the legal fees to defend yourself could be a massive blow to your business. This is where understanding what is errors and omissions insurance becomes essential for any professional who provides a service.

E&O coverage is a financial shield, specifically created to protect you from claims of professional mistakes, shoddy work, or failing to deliver on a promise. It's important to know this isn't the same as a general liability policy, which covers physical incidents like a client slipping in your office. E&O is tailored to protect against financial losses a client experiences because of your professional services. The growing need for this protection is clear; the global E&O insurance market was valued at around USD 15 billion in 2023 and is expected to grow substantially.

The Core Function: A Financial Backstop

At its heart, E&O insurance is a tool for managing risk. It covers the costs tied to defending your business against a negligence claim, whether that claim is justified or completely unfounded. Without it, you would have to pay for lawyers, court fees, and any potential settlement out of your own pocket. These costs can quickly add up to six-figure sums, which could be a major threat to small businesses and solo practitioners.

This policy protects your professional reputation and your financial health. It gives you the confidence to run your business without the constant worry of a client dispute turning into a costly lawsuit. This lets you concentrate on your work, not on the fear of potential legal action.

This screenshot from Investopedia gives a great overview of the key protections an E&O policy offers.

As the text points out, coverage is not just about paying for damages. It also covers legal defense costs and court fees, which can pile up quickly before a case is even decided.

Real-World Scenarios Where E&O Steps In

To see the real value of E&O insurance, let's look at some practical examples where it would be a lifesaver:

- A Marketing Agency: A client sues, claiming a new campaign failed to hit sales targets and hurt their brand, resulting in a financial loss.

- An IT Consultant: You recommend and set up a new software system. A week later, a bug wipes out critical data, and the client blames you for the financial fallout.

- A Real Estate Agent: You accidentally list the wrong square footage for a property. After the sale, the buyer sues you for the difference in the home's value.

- A Financial Advisor: A client's investments perform poorly, and they allege your advice was negligent or didn't match their risk profile, demanding compensation.

In every one of these situations, E&O insurance would kick in to cover legal defense costs and any settlements or judgments, protecting the professional's personal and business finances from disaster.

Who Actually Needs This Protection? (You Might Be Surprised)

The real question isn't whether you're good enough to avoid mistakes—it's whether your business can survive the financial hit when a client claims you made one. When people ask what Errors and Omissions insurance is for, they often imagine traditional professionals like doctors or lawyers. While they absolutely need it, the modern business world has greatly expanded the circle of risk.

Think about a marketing consultant whose new campaign doesn't deliver the promised results, or an IT specialist who gets blamed when a client's network crashes after a routine software update. These situations are more common than you'd think. The growth of service-based and digital professions means more people are exposed to liability than ever before. This expanding need is clear in the professional liability insurance market, which was valued at around USD 272.5 billion in 2022.

The Expanding Landscape of Professional Risk

Today's business environment is built on expertise and advice. This creates a situation where a simple mistake, a miscommunication, or even just failing to meet a client's expectations can quickly turn into a costly legal fight.

Many professionals might be surprised to learn they are at risk. The table below highlights just a few industries where E&O insurance is becoming essential.

| Industry | Common Risk Exposures | Typical Claim Types | Average Annual Premium Range |

|---|---|---|---|

| Technology & IT Services | Software bugs, data breaches, system implementation failures, poor advice. | Negligence, breach of contract, failure to deliver promised services. | $700 – $2,500 |

| Marketing & Advertising | Campaign underperformance, copyright infringement, reputational damage. | Negligence, misrepresentation of results, intellectual property theft. | $600 – $2,000 |

| Consulting (All types) | Flawed strategic advice, financial loss due to recommendations, project mismanagement. | Professional negligence, errors in analysis, breach of fiduciary duty. | $750 – $3,000 |

| Real Estate Agents | Failure to disclose property issues, errors in contracts, misrepresentation. | Negligence, breach of duty, inaccurate property information. | $500 – $1,500 |

| Fitness & Wellness | Client injury from workout plans, unsubstantiated health claims, poor instruction. | Bodily injury claims, negligence, failure to warn of risks. | $400 – $1,200 |

| Industries That Commonly Require E&O Insurance | |||

| A comprehensive breakdown of professional sectors and their specific liability risks that make E&O insurance essential |

This table shows that liability isn't limited to a few traditional fields. As more businesses offer specialized services, the potential for claims based on professional judgment grows, making E&O coverage a wise investment across many sectors.

Why "Good Work" Is No Longer Enough

The core problem is the growing space between performing a service and guaranteeing a specific result. Client expectations are higher, contracts are more detailed, and the line between professional advice and a promise of success has become fuzzy. A great reputation can help you win new clients, but it won't act as a shield in a lawsuit.

Industry oversight bodies like the National Association of Insurance Commissioners (NAIC) work to regulate the insurance market, ensuring that the products available can properly protect businesses against these evolving risks.

The NAIC's role in setting standards helps shape the insurance policies designed to safeguard your business. For business leaders, it's also important to understand how professional liability differs from other policies, like those covered in guides on management liability.

Ultimately, E&O insurance is the essential safety net that allows professionals in both established and new fields to work confidently. It provides protection from claims that could otherwise threaten their livelihood and financial stability.

The Real Situations Your Coverage Handles (Beyond The Fine Print)

Let's move past the insurance jargon and look at what Errors and Omissions (E&O) insurance actually does when a problem arises. Picture this: you're a financial advisor whose client loses money after taking your investment advice. Or maybe you're a consultant whose strategic plan didn't deliver the promised results. In these moments, your E&O policy does more than just pay a claim; it acts as your dedicated legal and financial shield.

Think of it as crisis management in a box. The policy is designed to step in and handle the stressful, practical realities of a professional liability claim from start to finish. It’s not just about covering the final payout if you’re found at fault. It’s about paying for the legal defense—which can easily hit six figures—handling settlement talks, and protecting the professional reputation you’ve worked so hard to build.

How E&O Coverage Works in Practice

When a client claims you've made a mistake, the situation can feel overwhelming. This is exactly where your E&O insurance is meant to step in and absorb the pressure. The instant a covered claim is filed, your policy kicks in to provide support. This typically includes:

- Legal Defense: Your insurance provider will find and pay for an experienced lawyer to defend you. This is a huge relief, as the financial and mental toll of finding a good defense attorney on your own can be massive.

- Investigation Costs: The policy covers the expenses needed to investigate the claim's validity, such as hiring expert witnesses or conducting a forensic analysis of what happened.

- Settlements and Judgments: If the situation ends in a settlement or a court orders you to pay damages, the policy will cover that amount up to your chosen limit.

This screenshot shows some common scenarios where E&O insurance becomes essential.

The main point is the sheer variety of situations. From a simple oversight on a contract to a major project failure, many professional activities carry risks that E&O insurance is specifically designed to cover.

Defending Against Justified and Frivolous Claims

One of the most valuable aspects of an E&O policy is its power to defend your business, whether a claim has merit or not. A key reason for the growing use of this insurance is the protection it provides against baseless lawsuits that can still disrupt or even bankrupt a business. Even if a claim is completely unfounded, you still have to pay to defend yourself.

You can learn more about the market trends behind E&O insurance to see why this protection is becoming so crucial. Imagine a real estate agent sued for not disclosing a property defect they couldn't possibly have known about. They might eventually win the case, but the legal fees could be financially crippling without insurance.

Your policy gives you the resources to build a strong defense and prove your innocence without draining your business or personal savings. While E&O insurance handles professional mistakes, it's smart to consider how other policies create a complete safety net. Our guide on business continuity insurance explains how to build a plan that keeps your business strong against all kinds of threats.

The Real Cost of Protection (and What Drives Your Premium)

A frank discussion about Errors and Omissions insurance must include its cost. The price for this protection, known as the premium, isn't a fixed number. It’s calculated based on your specific professional risk, which means a freelance graphic designer will pay a very different rate than a medium-sized engineering firm. Understanding these cost drivers is the first step to finding a policy that offers solid protection without breaking the bank.

Insurance companies are essentially professional risk assessors. They carefully evaluate multiple factors to determine your premium. Think of it like a home insurance provider looking at a house's location, age, and construction materials. For E&O insurance, they examine your business's unique "blueprints" to estimate the likelihood and potential cost of a future claim.

Key Factors That Influence Your E&O Premium

While every insurer has a slightly different formula, these core elements almost always play a major role in the final price tag:

- Your Industry: This is the biggest driver. Professions with a higher perceived risk, such as healthcare or financial advising where a single mistake can cause enormous financial damage, usually face higher premiums. Fields like freelance writing are generally considered lower-risk and therefore less expensive to insure.

- Business Size and Revenue: A larger company with more employees and higher revenue has greater exposure. More projects and client interactions create more opportunities for a potential error or omission, which translates to a higher premium.

- Claims History: A clean record with no past claims is one of your best assets. Insurers view it as proof of good risk management and will often reward you with lower rates. On the other hand, a history of frequent claims signals higher risk and will drive your premium up.

- Coverage Limits and Deductible: The amount of coverage you select directly impacts the price. For example, a $2 million policy will cost more than a $500,000 policy. You can also lower your premium by choosing a higher deductible, which is the amount you pay out-of-pocket before the insurance coverage begins.

To better understand how these costs break down, let's look at the factors influencing premiums and some typical cost ranges.

| Cost Factor | Impact Level | Typical Premium Range | Cost Reduction Strategies |

|---|---|---|---|

| Industry Risk | High | $500 – $3,500+ annually | Emphasize niche specialization in lower-risk areas. |

| Business Revenue | Medium to High | Varies with income; higher revenue means higher premium | Implement strict quality control to minimize error frequency. |

| Claims History | High | 0 claims can lower costs by 10-20%; multiple claims can increase costs by 50%+ | Maintain detailed records and use standardized contracts. |

| Coverage Limit | Medium | A $1M policy can be 30-50% more than a $500k policy | Start with a lower limit and increase it as your business grows. |

| Deductible | Medium | Raising a deductible from $1k to $5k can reduce premiums by 15-25% | Choose the highest deductible your business can comfortably afford. |

This table shows that while some factors like your industry are fixed, you have direct control over others, such as your deductible and internal processes, which can help manage your insurance costs effectively.

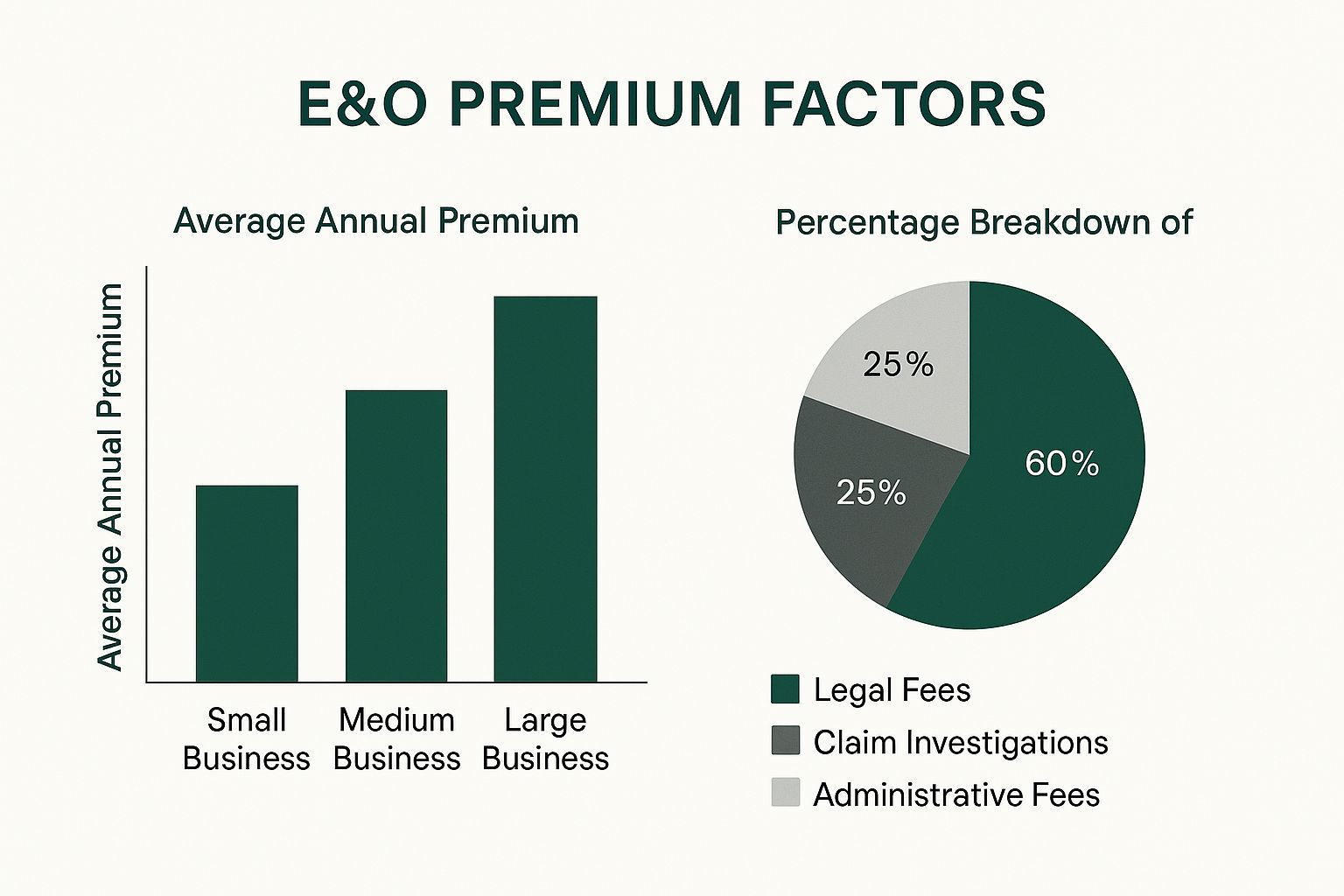

This infographic breaks down how business size and claim-related expenses correlate, offering a clearer picture of the financial elements involved.

The data clearly shows that as a business grows, its potential liability—and therefore its premium—also increases. It also highlights that legal fees often make up the largest part of claim costs.

Proven Strategies for Managing Your Costs

While you can’t change your industry, you can take practical steps to influence your premium. Insurers often give discounts to businesses that demonstrate strong risk management. Simple actions like using standardized client contracts, keeping meticulous project documentation, and pursuing ongoing professional education can all lead to more favorable rates. Think of these as investments in your own insurability.

This screenshot from Insureon shows the median costs for E&O insurance, providing a realistic benchmark for small businesses.

The median cost of $61 per month demonstrates that for many professionals, this essential protection is more affordable than they might think. When weighed against the staggering cost of a single lawsuit, it's a small price to pay for peace of mind.

Real Stories: When E&O Insurance Saved The Day

The true value of errors and omissions insurance snaps into focus when you step away from definitions and look at real-world scenarios. These aren't just abstract risks; they are stories from professionals who faced serious trouble and were saved by their E&O policy. These examples show just how this type of coverage responds to a wide range of professional challenges.

A Marketing Campaign Gone Wrong

Meet Sarah, a skilled marketing consultant hired to manage a major product launch. Despite her thorough strategy and hard work, the launch didn't meet the client's lofty sales goals. The frustrated client sued for $200,000, arguing that Sarah's professional negligence directly caused their financial losses.

For a small business like Sarah's, a lawsuit of that size is a catastrophe. The legal fees alone, which can quickly spiral into tens of thousands of dollars, would have been enough to shut her down. Luckily, her E&O insurance came to the rescue. The policy covered all legal costs and provided expert negotiators who settled the claim out of court, allowing her business to survive a otherwise devastating event.

A Cybersecurity Crisis Averted

Then there's the story of Mike, an IT consultant specializing in cybersecurity. After he gave a client recommendations for their network security, the client experienced a major data breach. They pointed the finger at Mike, accusing him of providing poor advice and failing to secure their systems, resulting in a lawsuit to cover the damages from the breach.

This is where Mike’s E&O policy proved to be his most critical asset. It didn't just cover his substantial legal defense; it also paid for forensic cybersecurity experts. These witnesses were able to show that Mike's advice was in line with industry standards and the breach happened because the client didn't implement all the suggested measures. The policy didn't just save him money—it safeguarded his professional reputation.

Data from the Insurance Information Institute reveals the huge financial scope of commercial insurance claims, which includes professional liability.

This data shows that billions of dollars are paid out annually in commercial claims, highlighting the major financial risks businesses face. It serves as a stark reminder that even one claim can have significant financial repercussions.

These stories offer powerful lessons. They show that E&O insurance is more than just a financial safety net; it provides business continuity and vital peace of mind. The experiences of professionals like Sarah and Mike underscore the importance of understanding policy limits, deductibles, and keeping detailed records. Furthermore, when claims involve your staff, knowing the details of liability insurance for employees is just as essential for complete protection.

Dangerous Myths That Leave Professionals Exposed

The most expensive professional mistakes often begin with what we think we know about liability protection. Several common, but dangerous, beliefs can stop professionals from getting the right Errors and Omissions (E&O) coverage. Busting these myths is the first step to understanding why this insurance is so important.

Myth 1: "If I Do Good Work, I Won't Get Sued"

This is probably the most hazardous assumption a professional can make. The truth is, a lawsuit isn't always about the quality of your work; it's often about the client's perception. Client satisfaction is subjective. An architect can design a flawless building that meets every code, but still face a lawsuit from a client upset about project delays or budget issues.

Similarly, a consultant might offer solid, data-backed advice. But if the client had unrealistic hopes for the outcome, a claim could still be filed. A lawsuit doesn't require an actual "error." A client's feeling of failure is often enough to start a legal battle. Defending your business, even against a baseless claim, costs a lot of time and money, making E&O coverage a necessity no matter how skilled you are.

Myth 2: "My General Liability Insurance Covers Professional Mistakes"

This is a very common and costly misunderstanding. General liability insurance is there to protect you from claims of bodily injury or property damage. Think of a client slipping and falling in your office—that's what general liability is for. It does not cover financial losses a client experiences because of your professional services, advice, or failure to deliver.

If you're only counting on a general liability policy, you have a huge gap in your protection. E&O insurance is made specifically to fill this gap. It covers claims of negligence, mistakes, and bad advice that your general liability policy won't even consider. These policies have very different jobs. You can explore similar concepts of specific protection in our guide on the personal liability coverage definition, which explains why specialized coverage matters.

This screenshot from the International Risk Management Institute (IRMI) helps show the specific purpose of E&O insurance.

The definition clearly states this insurance protects against liability for an "error or omission in the performance of professional duties," which shows just how specialized it is.

Myth 3: "E&O Insurance Is Too Expensive for My Small Business"

While E&O insurance is another business expense, it's better to think of it as an investment in your company's survival. The cost to defend just one professional liability lawsuit—which can easily range from $10,000 to over $100,000, even if you're found not at fault—is far greater than the yearly premium for a solid E&O policy.

The reality is that a single unproven claim can wipe out a small business that doesn't have the right coverage. When you look at it as a tool for managing risk, the price of an E&O policy is a small amount to pay for financial stability and peace of mind.

Your Action Plan For Getting The Right Coverage

Getting the right Errors and Omissions insurance might seem daunting, but you can make it a straightforward process by breaking it down into a clear action plan. This simple roadmap will walk you through everything from understanding your risks to managing your policy, making sure your professional services are properly protected. The first move is to look at your own business to figure out your specific vulnerabilities.

Step 1: Assess Your Specific Risk Exposure

Before you can start shopping for a policy, you need to know exactly what you’re protecting. This calls for a candid self-audit. Think about these key areas:

- Your Industry: Are you in a high-stakes field like finance or technology, where a single mistake could cost a client a fortune? Or do you work in a creative field where things like copyright infringement are a bigger concern?

- Client Contracts: Take a look at your agreements. Are the scopes of work and deliverables crystal clear? Ambiguous contracts are a common starting point for disagreements and claims.

- Services Offered: Which of your services has the highest chance of a client claiming you made a mistake or failed to deliver? A single high-risk service can significantly shape your insurance requirements.

Answering these questions helps you understand what E&O insurance means for your business, which is the key to figuring out how much coverage you truly need.

Step 2: Navigate the Application and Selection Process

Once you have a solid grasp of your risks, you can start the application process. Insurance companies will want to see that you run a tight ship. Be ready to share details about your annual revenue, your team’s qualifications, and any risk management practices you already have in place, like using standard client contracts or having a quality control checklist.

When you're comparing insurers, don't just focus on the price tag. Ask some important questions:

- Does the policy include "defense outside the limits"? This is a crucial feature meaning your legal defense fees won't eat into the total coverage amount available for a settlement.

- What's the insurer’s track record for handling claims? A good reputation is worth its weight in gold.

- Does the policy specifically address the risks you uncovered in your assessment?

This screenshot from Progressive shows some common scenarios for professional liability claims. Looking at these can help you think about your own potential risks as you fill out applications.

Seeing these typical claims makes it clear why choosing a policy that matches the real-world challenges of your profession is so important.

Step 3: Ongoing Policy Management and Review

Your E&O policy isn't something you can buy and forget. As your business changes, your coverage needs to change with it. Make it a habit to schedule an annual review of your policy. This ensures your coverage limits are still adequate for your revenue and that any new services you've started offering are included. It's also smart to maintain a positive relationship with your insurer and report any potential claim situation immediately, just as your policy outlines.

Understanding how different insurance policies fit together is also a big plus. For a wider view on protecting your company, you can learn more about business insurance basics in our comprehensive guide. A proactive approach to managing your insurance is the best strategy to keep your professional protection solid as your business grows.

Finding the right E&O insurance is a fundamental step in building a resilient business. At Wexford Insurance Solutions, we help professionals work through this process with clarity. Contact us today to get a personalized quote and gain the security you need to focus on what you do best.

Flood Insurance vs Homeowners Insurance: Complete Guide

Flood Insurance vs Homeowners Insurance: Complete Guide Your Essential Guide to Homeowners Insurance in 2024

Your Essential Guide to Homeowners Insurance in 2024