Understanding Vacation Home Insurance And Why It's Essential

Imagine your cozy mountain cabin, sitting peacefully hundreds of miles away while you're at home. Now, picture a pipe bursting in the kitchen. In your primary residence, you'd likely notice the problem within hours. At the cabin, however, that leak could go undetected for weeks, leading to devastating water damage, mold, and costly repairs. This scenario perfectly illustrates why your standard homeowners policy just doesn’t cut it for a second property and why vacation home insurance is so important.

Think of your regular homeowners policy like a daily security patrol for a building you're always in. The guard knows the routines and can respond to issues immediately. Vacation home insurance, on the other hand, is more like a high-tech surveillance system for a property that’s often empty. It's built to handle the unique risks that come with a home that isn't regularly occupied, from burst pipes and storm damage to break-ins.

The Critical Difference: Occupancy And Risk

The fundamental distinction comes down to how insurance providers calculate risk based on occupancy. An occupied home is considered a lower risk because someone is usually there to catch problems early. An empty property is far more exposed. A minor leak can turn into a major flood, a broken window can invite pests or weather damage, and a vacant house is a much more tempting target for thieves.

Because of these increased risks, most standard homeowners policies have clauses that can reduce or even eliminate your coverage if a home is vacant for an extended time, often 30 to 60 days. This is where a specialized policy becomes a necessity. Vacation home insurance is specifically created to cover properties that aren't a primary residence. As the second-home market grows, the insurance industry continues to adapt, a trend highlighted in a financial services outlook from Deloitte. This targeted coverage ensures your getaway stays a source of joy, not a source of financial stress.

Named Peril vs. Open Peril Policies

As you explore your options, you'll encounter two primary types of policies:

- Named Peril: This type of policy only covers damage from specific events, or "perils," that are explicitly listed in your contract. Common examples include fire, lightning, and theft. If the cause of the damage isn't on the list, it's not covered.

- Open Peril (All-Risk): This offers much broader protection. It covers all potential causes of loss except for those that are specifically excluded in the policy. This provides a stronger safety net, which is ideal for the unpredictable nature of an unoccupied home.

While a named-peril policy might seem like a good way to save money, the risk of an uncovered disaster is significantly higher for a vacation property. For those with high-end or unique second homes, the financial stakes are even greater. If your vacation home falls into this category, you may benefit from reading our guide on high-value home insurance for more specific advice. Ultimately, choosing the right policy is about protecting your investment and your peace of mind.

The Unique Risks That Make Vacation Homes Vulnerable

A vacation home sitting empty is a lot like an unattended car with the keys left in the ignition—it’s an open invitation for trouble. The simple fact that you aren't there to keep an eye on things day-to-day dramatically changes the property's risk profile. Standard homeowners insurance isn't designed for this reality, which is why specialized vacation home insurance is so important. The dangers these properties face aren't just more frequent; they are often more severe because they can go unnoticed for long stretches of time.

Think about a small leak from a dishwasher hose. In your primary home, you'd likely spot the puddle within hours. In a vacant cabin, that same drip can continue for weeks, leading to buckled floors, rotted subflooring, and a serious mold problem that could cost tens of thousands to fix. This compounding effect of time and vacancy is the main threat for any second home. A minor issue that would be a simple fix at home can escalate into a major claim at an unoccupied property.

Magnets for Mayhem: Unoccupied Property Perils

When a home is clearly empty, it becomes a target for a specific set of problems that occupied homes rarely encounter. Insurers view these properties as inherently riskier, and for good reason. The most common threats include:

- Vandalism and Theft: An empty house, especially one with mail piling up, is a prime target for criminals. Broken windows, graffiti, and stolen appliances are common claims. Thieves often focus on vacation homes knowing they have a long window of opportunity before being discovered.

- Undetected Damage: Beyond water leaks, imagine a tree branch falling on the roof during a storm. This could go unnoticed for months, allowing rain to seep in and cause structural damage. Similarly, pest infestations can thrive unchecked, causing serious harm to the home’s integrity.

- Weather-Related Catastrophes: For coastal or mountain properties, weather is a constant concern. Hurricanes, wildfires, or heavy snow can cause immense damage. Without someone there to board up windows or clear heavy snow from the roof, the initial damage is often just the beginning of a much larger problem.

The Liability Factor: When Guests Become a Risk

If you rent out your vacation home, you introduce an entirely new layer of risk. While platforms like Airbnb and Vrbo offer some host protection, it’s often not a substitute for a solid insurance policy. A guest slipping on a wet deck or a child getting injured near a pool can lead to significant liability claims.

This is a business activity, and your personal insurance simply won't cover it. This distinction is critical; running a vacation rental changes your property's risk profile from a personal asset to a commercial one, requiring a specific type of coverage to protect you from financial trouble.

Breaking Down Vacation Home Insurance Coverage Options

Think of your vacation home insurance policy as a custom-built shield. Each component is a different layer of metal, designed to protect against specific threats. To create a strong defense for your getaway property, you need to understand how these layers work together. Knowing the difference between policy options can prevent a major financial headache if something goes wrong.

Core Coverage Components

At its heart, vacation home insurance mirrors a standard homeowners policy but is adjusted to handle the unique risks of a property that isn't always occupied. Most policies are built on these fundamental protections:

-

Dwelling Coverage: This is the bedrock of your policy. It covers the physical structure of your vacation home—the roof, walls, and foundation. If a fire or a severe storm damages your cabin, dwelling coverage provides the money to rebuild it.

-

Personal Property Coverage: This protects the items inside your second home. It covers everything from the couch and coffee maker to your towels and cookware. Since unoccupied homes can be more attractive to thieves, this coverage is critical.

-

Liability Coverage: This acts as your financial buffer if someone gets hurt on your property and you're held responsible. For instance, if a guest slips on a patch of ice on the porch, liability coverage can help with their medical expenses and your legal costs, protecting your personal assets from a lawsuit.

Essential Add-Ons and Special Considerations

Beyond the basics, certain coverages are especially important for a second home. A great example is Additional Living Expenses (ALE). If a covered event, like a burst pipe, makes your vacation spot unlivable, ALE helps cover the cost of temporary lodging, like a hotel room. This way, your vacation plans don't have to be completely canceled.

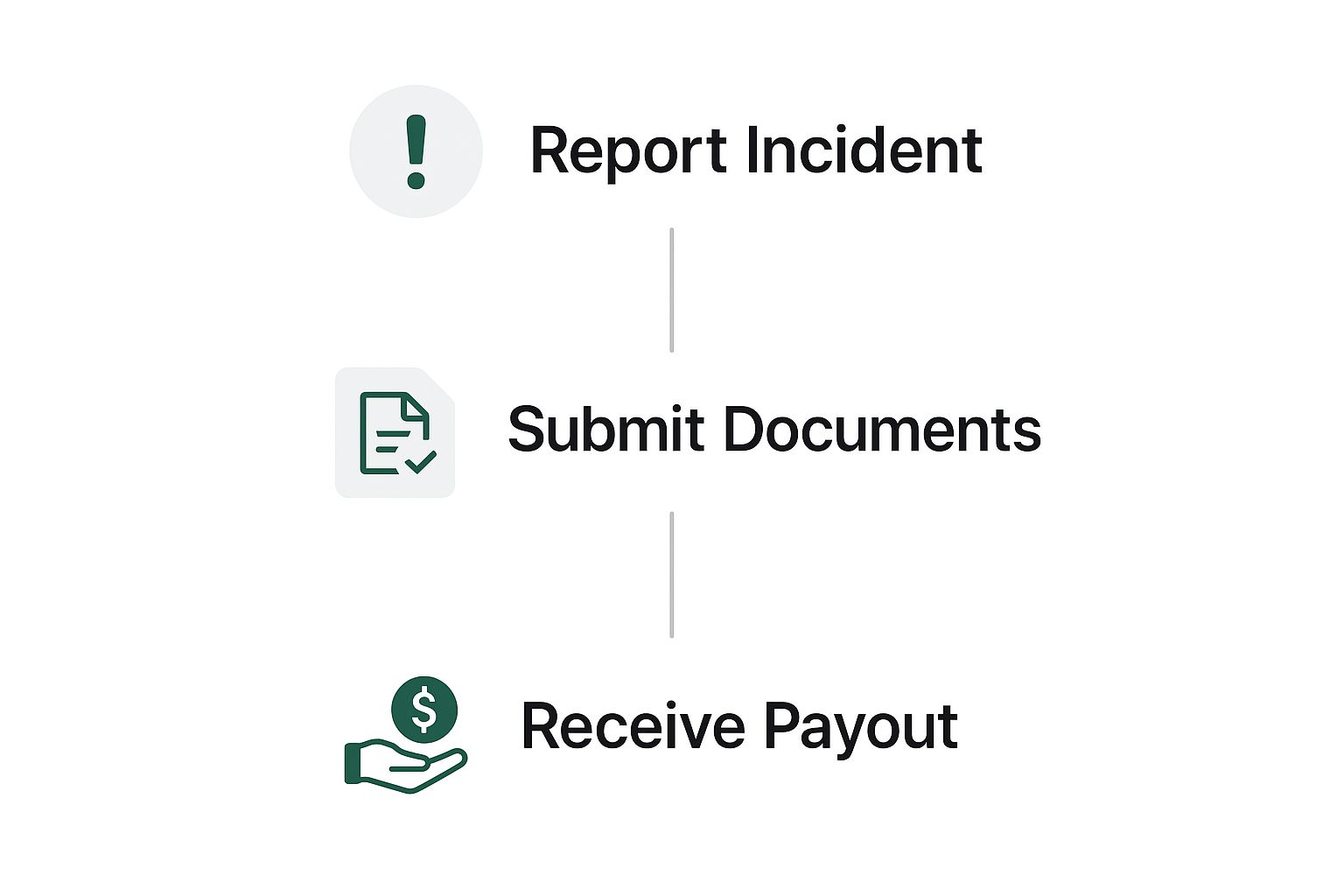

If you ever need to use your insurance, the claims process generally follows a clear path.

This visual guide shows that after an incident is reported, providing the right documents is the key step toward getting your payout. A smooth claims process often depends on how organized you are with your policy information and proof of damage.

Renting out your property adds another layer of complexity. While some rental platforms offer basic host protection, these are not a replacement for a dedicated insurance policy. To better understand the basics of property protection, take a look at our guide to homeowners insurance. Mastering these concepts will give you a solid footing when choosing coverage for any property you own.

The True Cost of Protecting Your Vacation Investment

If you’ve ever looked into insuring a second home, the premium costs might have given you a bit of sticker shock. It’s a common reaction, but understanding the puzzle behind the pricing is the first step toward making a smart financial decision. The reality is, insuring a vacation property usually costs quite a bit more than your primary residence, and for good reason.

Insurers view a home that sits empty for long stretches as a higher-stakes game. A small leak under the kitchen sink that you'd spot immediately at home could go unnoticed for weeks at your cabin, leading to massive water damage. These increased risks are directly reflected in the price, which is calculated based on a variety of factors unique to your property.

What Drives Your Vacation Home Insurance Premium?

Several key factors influence the price you'll pay. Think of them as the main ingredients in your insurance cost recipe. While you can't change some of them, others are within your control.

- Location, Location, Risk: Where your property is situated is one of the biggest cost drivers. A secluded cabin in a high-risk wildfire zone or a beach house in a hurricane-prone area will naturally have higher premiums because the threat of a major claim is much greater.

- Property Use: How you use the home is a major consideration. A cottage used only by your family is seen as less risky than one you rent out to a steady stream of short-term guests. If you do rent it out, features like a pool or hot tub add another layer of liability, which will also bump up your premium.

- Home Characteristics: The age of the home, its construction materials, its replacement value, and the condition of major systems (like the roof, electrical, and plumbing) all play a part. An older home with dated wiring, for instance, may be more expensive to insure.

- Proximity to Services: Insurers look at how close your property is to the nearest fire station and fire hydrant. If you're in a remote spot far from emergency services, a longer response time in a crisis means a higher chance of severe damage.

Regional Costs and Market Realities

The cost of vacation home insurance can differ dramatically from one state to another. In areas with high exposure to natural disasters, premiums reflect this reality. For example, in Florida, the constant threat of hurricanes has a direct impact on insurance prices. The state's average homeowners insurance premium hit $2,625 in 2025, which is about 24% higher than the national average. This highlights how location-specific risks can inflate costs. To learn more about this, you can review the latest data on Florida homeowners insurance.

This table gives a general idea of how premiums can vary based on risk:

| Risk Factor | Low-Risk Property (e.g., Midwest) | High-Risk Property (e.g., Coastal Florida) |

|---|---|---|

| Typical Annual Premium | $1,200 – $2,500 | $4,000 – $8,000+ |

| Primary Cost Driver | General liability, theft | Hurricane, flood, liability |

| Deductible Impact | Standard percentage (1-2%) | Separate, higher hurricane deductible |

Knowing these pricing dynamics is key for budgeting accurately. While you can't move your beach house, there are still ways to manage your expenses. For practical advice on controlling costs without sacrificing essential protection, you can check out our guide on how to lower home insurance premiums. By pinpointing what's driving your policy's cost, you can focus on the areas where you have the most influence.

Vacation Rentals And The Insurance Revolution

The moment you decide to list your vacation home on a platform like Airbnb or Vrbo, you cross an important threshold. What was once a personal retreat is now a commercial business, and this shift completely changes your insurance needs. The incredible growth of the sharing economy has introduced a new kind of property risk, catching many homeowners by surprise. A standard homeowners policy, or even a basic vacation home insurance policy, simply wasn't built to handle the constant flow of paying guests. This creates a serious coverage gap that could lead to financial trouble.

This new reality has prompted insurance companies to innovate. A whole new market for specialized short-term rental insurance has appeared, created to address the specific liabilities that come with hosting. The global vacation rental market is growing quickly, with one report estimating it will expand from USD 92.53 billion in 2021 to a projected USD 317.76 billion by 2030. This boom means more owners than ever are trying to figure out this complex insurance situation. You can explore more insights on short-term rental market trends to see just how much this industry is changing.

The Liability Minefield of Hosting

When you rent out your property, you're doing more than just handing over the keys—you're accepting a significant amount of responsibility. A standard insurance policy will almost certainly reject a claim that involves a paying guest. Imagine these common situations that call for specialized coverage:

- Guest Injuries: A guest slips on a wet patio by the pool or trips over a rug, leading to a major injury. Without the right insurance, you could be on the hook for their medical bills and legal fees, which can easily climb into the six-figure range.

- Guest-Caused Damage: A guest accidentally starts a fire in the kitchen or floods a bathroom. Your regular policy likely sees this as a business-related incident and will probably refuse to pay for the repairs.

- Theft by Guests: While it’s not common, a guest might steal valuable items from your home. This is often excluded from typical theft coverage, which doesn't account for theft by someone you willingly allowed onto your property.

Insurer Responses: Embracing vs. Avoiding

The insurance industry has had a mixed reaction to the short-term rental boom. Some companies see it as an opportunity and have created specific products, often called home-sharing endorsements or separate commercial policies. These are made to cover the unique risks of renting, from property damage caused by guests to liability claims.

On the other hand, many traditional insurers want to avoid this risk altogether. It's common for them to cancel or choose not to renew a policy if they find out a property is being used for short-term rentals without proper coverage. They see the risk as too unpredictable. This divide in the market makes it critical for hosts to be upfront with their insurance provider. Not telling your insurer about your rental activity is a frequent but risky mistake that could void your entire policy, leaving you without any protection when you need it most.

Selecting The Perfect Vacation Home Insurance Policy

Choosing the right vacation home insurance is a bit like picking a guardian for your property while you're away. You wouldn't hire the cheapest applicant without checking their references; similarly, settling for a bare-bones policy can be a costly mistake, leaving you unprotected when you need it most. The goal is to find an insurer who views your second home as a unique asset to protect, not just a high-risk liability.

The secret is to look beyond the monthly premium. A policy with a surprisingly low price tag might seem like a great deal, but it often hides insufficient coverage and major gaps. To truly protect your investment, you need to dig into the policy details, understand the deductible, and, most importantly, know the exclusions. For instance, some standard policies might deny a claim for a burst pipe if the home was empty for more than 30 days—a very real possibility for a vacation property.

Evaluating Insurers and Comparing Quotes

Not every insurance company has the expertise to properly cover a second home. Some specialize in this market, offering policies designed for seasonal use, while others apply a one-size-fits-all approach that often falls short. When you compare quotes, it’s vital to compare the actual coverage being offered, not just the price tag.

To make this easier, it helps to have a checklist ready when you speak with potential insurers. This keeps the conversation focused and ensures you gather all the critical information. Don't forget to ask about discounts. Many owners are unaware that bundling home and auto insurance with the same provider can often extend to a second property, leading to significant savings without sacrificing protection.

To help you vet potential policies and providers, we've created a straightforward checklist. Use it to guide your questions and compare your options clearly.

| Vacation Home Insurance Shopping Checklist | |||

|---|---|---|---|

| A comprehensive checklist comparing key factors to evaluate when choosing vacation home insurance providers and policies | |||

| Evaluation Factor | Questions To Ask | Red Flags | Ideal Response |

| Dwelling Coverage | Is my coverage based on Replacement Cost or Actual Cash Value? What are the limits? | Offering only Actual Cash Value, which pays out less because it subtracts for depreciation. | A clear commitment to full Replacement Cost Value to rebuild your home to its previous state. |

| Vacancy Clause | How long can my property be unoccupied before coverage is impacted? | A short vacancy period (like 30 days) or unclear language that leaves you guessing. | A policy specifically built for seasonal use with a generous and clearly defined vacancy clause. |

| Liability Limits | Does this policy cover guest liability? What are the limits for bodily injury claims? | Low liability limits (e.g., $100,000 or less) or no dedicated coverage for guests. | Robust liability protection of at least $300,000 to $500,000. |

| Deductible Structure | Are there separate, higher deductibles for specific events like hurricanes or windstorms? | Multiple, complex deductibles that are confusing or unusually high, making claims impractical. | A simple, straightforward deductible that you can comfortably afford out of pocket. |

| Claims Process | Who will handle my claim—an in-house team or a third-party administrator? | Outsourced claims handling, which can cause delays and poor communication during a stressful time. | A dedicated, in-house claims department known for responsive and fair service. |

By systematically reviewing these points, you shift from simply shopping for a price to making an informed decision. This careful approach ensures your vacation home insurance acts as a reliable safety net, ready to support you when things go wrong. Choosing the right insurer delivers more than just a policy; it delivers peace of mind.

Proven Strategies To Safeguard Your Property Investment

Choosing the right vacation home insurance is a critical first step, but truly protecting your getaway involves more than just a policy. Think of your insurance as the emergency response team that shows up after a disaster. A smart maintenance and security plan, however, is the 24/7 guard working to prevent that disaster from ever happening. By combining great coverage with proactive measures, you not only shield your asset but also make your property more appealing to insurers, which can lead to lower premiums.

A vacant home presents a unique set of risks, so an active protection strategy is essential. This means building layers of defense that address the specific vulnerabilities of an unoccupied property, from potential break-ins to unexpected maintenance issues.

Building Your Property's Defense System

The best way to protect your investment is to use a mix of modern technology and reliable, traditional methods. This shows your insurer that you are a responsible owner, which can work in your favor.

Key strategies include:

- Smart Technology Integration: Equip your home with devices that serve as your remote eyes and ears. This can include security cameras, smart locks for granting temporary access to guests or repair staff, and even noise monitors to detect unauthorized parties. Water leak detectors and smart thermostats are also vital, as they can help you prevent major damage from burst pipes—a common and expensive problem in empty houses.

- Regular Maintenance and Inspections: Establish a consistent, seasonal maintenance calendar. This schedule should cover tasks like clearing gutters, inspecting the roof, and servicing the HVAC system. It's also a great idea to hire a trusted local property manager or ask a neighbor to do regular walk-throughs to spot any early signs of trouble. This person becomes your local partner in protecting your investment.

- Creating an Emergency Plan: Put together a clear emergency plan and keep it somewhere accessible. It should list contact information for local plumbers, electricians, and restoration companies. When a problem occurs, having this information at your fingertips can significantly cut down response times and limit the damage.

The Power of Documentation and Local Relationships

Good record-keeping is a powerful asset. Maintain detailed logs of all maintenance, repairs, and inspections. Take photos and videos of your property's condition before each season. This thorough documentation can be incredibly valuable if you ever need to file a claim. To see how organized records can simplify things, check out our guide on the homeowner insurance claim process. A well-documented claim is often settled much more quickly.

Building relationships with local service providers is just as important. A dependable handyman or property management company provides peace of mind, offering swift action when you're miles away and turning a potential catastrophe into a manageable issue.

Ready to pair a strong insurance policy with your proactive protection plan? The experts at Wexford Insurance Solutions can help you find coverage that rewards your diligence. Contact us today to secure your peace of mind.

Builders Risk Insurance: Your Complete Protection Guide

Builders Risk Insurance: Your Complete Protection Guide Your Guide to Valuable Personal Property Insurance

Your Guide to Valuable Personal Property Insurance