As a consultant, you’re paid for your expertise. But what happens when that expertise is questioned? That’s where Errors and Omissions (E&O) insurance comes in—it's your professional safety net.

This specialized liability coverage is designed to protect your business if a client claims your negligence, mistakes, or inadequate work caused them a financial loss. Simply put, if your advice goes sideways and creates a problem for a client, E&O insurance is there to help handle the legal storm that might follow.

What Exactly Is E&O Insurance for Consultants?

Think of E&O insurance as your professional "malpractice" coverage. You always aim to deliver flawless work, but let's be realistic—no one is perfect. A minor oversight, a recommendation that doesn't pan out, or even an alleged failure to deliver on a promise can quickly escalate into a lawsuit from an unhappy client.

This isn’t a concern just for the big consulting giants. Solo consultants and boutique firms are just as exposed, and a single lawsuit can be financially crippling without the right protection in place. It's become so essential that many clients now require you to carry E&O coverage as a condition of their contract.

For a deeper dive into the fundamentals, our guide on what errors and omissions insurance is is a great starting point.

Core Protections for Your Consulting Practice

The demand for this kind of protection is surging. The global E&O insurance market was valued at around USD 12.32 billion in 2023 and is expected to nearly double to USD 22.75 billion by 2032. This isn't just a random spike; it shows a growing understanding of professional risks everywhere.

It's important to know that E&O specifically covers financial losses your client suffers because of your services. It doesn't cover things like physical injuries or property damage—that’s a job for a General Liability policy.

Here's a key point many people miss: E&O insurance isn't just for when you've actually made a mistake. It also defends you against baseless or frivolous claims, covering your legal bills even when you're completely in the right.

To make this clearer, let's look at the main ways an E&O policy shields your consulting practice. The table below breaks down the key protections and provides some real-world context.

Key Protections of E&O Insurance for Consultants

| Area of Protection | Description | Example Scenario |

|---|---|---|

| Negligence | Covers claims that you failed to meet the accepted standard of professional care. | An IT consultant recommends a new software that turns out to be incompatible with the client's core systems, causing major downtime and lost revenue. |

| Errors and Omissions | Protects against specific mistakes or something you forgot to do, like providing inaccurate advice. | A marketing consultant makes a critical error analyzing market data, which leads to a failed campaign and the client's ad budget going down the drain. |

| Misrepresentation | Defends you if a client claims you exaggerated or made misleading statements about the results they could expect. | A management consultant promises a 25% boost in operational efficiency that the client never sees, prompting a lawsuit over the unfulfilled promise. |

As you can see, these scenarios are all too plausible in the world of consulting. E&O insurance provides the financial backing to navigate these claims without risking your business's future.

What Your E&O Policy Actually Covers

Knowing you have errors and omissions insurance for consultants is one thing. Understanding what it actually does when a client is unhappy is something else entirely. It’s best to think of your policy not as a single, all-encompassing shield but as a toolkit of specific defenses, each designed to protect you from different professional hazards.

When your work is blamed for a client's financial loss, your E&O insurance steps in. It's built to cover your legal fees, potential settlements, and court-ordered judgments.

It’s important to remember this coverage is specifically for the service you provide. It focuses squarely on claims arising from your professional advice, not from a slip-and-fall in your office. Those kinds of accidents fall under a completely different policy called General Liability.

Core Coverage Areas Explained

An E&O policy is really built around a few key pillars of protection. These are the most common situations that trigger claims for consultants. Let’s break them down with some real-world examples.

-

Professional Negligence: This is the big one. It happens when a client claims you didn't perform your duties with the skill or care expected of a professional in your field.

- Example: A management consultant restructures a client's team, but the new workflow is so clunky it causes massive project delays. The client loses thousands in productivity and sues for negligence, arguing a competent consultant would have seen the problems coming.

-

Errors and Omissions: This covers specific mistakes you make or critical details you leave out. It’s for those "oops" moments that have serious financial consequences for your client.

- Example: A marketing consultant launches a digital ad campaign but forgets to set a daily spending cap. The campaign torches the client’s entire quarterly budget in a single week. The client can file a claim to recover those wasted funds.

-

Inaccurate Advice or Misrepresentation: This comes into play when your recommendations don't pan out or were based on faulty information.

- Example: An IT consultant confidently recommends a new software platform, assuring the client it integrates perfectly with their existing systems. After buying it, the client discovers it’s totally incompatible. They could then file a claim for the software cost and the useless implementation fees.

What Is Typically Excluded from Coverage

Knowing what’s covered is only half the battle. You also have to understand what isn't. No insurance policy covers absolutely everything, and E&O is no exception. Being clear on these boundaries is key to managing your risk properly.

An E&O policy's job is to protect you from claims related to your professional services. Exclusions exist to keep it from overlapping with other types of insurance and to avoid covering intentional, wrongful acts.

Here are some of the most common exclusions you'll find in an E&O policy:

- Illegal Acts or Willful Fraud: Your policy won't have your back if you intentionally deceive a client or knowingly break the law.

- Bodily Injury or Property Damage: As we mentioned, this is the domain of General Liability insurance.

- Employment Disputes: Claims from your own employees, like wrongful termination, are handled by a separate policy called Employment Practices Liability Insurance (EPLI).

- Patent and Trade Secret Infringement: While some policies cover copyright issues, patent infringement is often excluded and may require a special add-on to your coverage.

It is absolutely crucial to read your policy documents carefully to see where these lines are drawn. For a deeper dive into how different policies work together, you can explore the details of consultants' insurance coverage to get a complete picture of your professional safety net.

Why E&O Is a Business Asset, Not Just an Expense

It's easy to look at errors and omissions insurance for consultants as just another number on a spreadsheet—one more expense chipping away at your bottom line. But that's a shortsighted view. Experienced consultants know this coverage is a powerful business asset, acting less like a mandatory cost and more like a strategic investment that builds trust and opens doors.

When you present a potential client with a certificate of E&O insurance, you're sending a clear message about your professionalism and accountability. It shows you've thought about worst-case scenarios and have a plan. For many clients, especially larger corporations, this can be the single factor that makes them choose you over a competitor who hasn't taken the same precautions.

Think of it this way: A consultant without E&O insurance is essentially asking a client to bear 100% of the risk. A consultant with coverage proves they are a true partner, fully prepared to stand behind their work.

This commitment to managing risk doesn't just benefit your clients; it gives you the confidence to take on bigger, more challenging projects without the constant worry that one mistake could sink your entire business.

Turning Insurance into a Growth Engine

A solid E&O policy does far more than just protect you—it actively helps you grow. It's the key that unlocks access to larger, more profitable contracts that are often completely off-limits to uninsured consultants.

Here’s a breakdown of how E&O insurance can directly impact your reputation and your revenue:

- Meets Contractual Requirements: Many corporate and government contracts include non-negotiable insurance requirements. If you don't have an E&O policy, you can't even submit a bid for these high-value projects.

- Enhances Professional Credibility: It instantly bolsters your reputation as a stable, reliable expert. This builds trust right from the start, making it easier to close deals and justify higher fees for your consulting services.

- Provides Peace of Mind: Knowing you're shielded from potentially ruinous legal fees allows you to concentrate on what truly matters: delivering outstanding work for your clients and strategically growing your practice.

To get a better sense of how this policy fits into your overall risk management, it helps to understand the critical difference between professional and general liability insurance.

A Competitive Edge in a Growing Market

The demand for professional liability coverage is on the rise, and for good reason. The global market for E&O insurance was valued at around USD 15 billion in 2023 and is expected to hit USD 25 billion by 2032. This isn't just a random statistic; it shows a growing recognition across industries of the real risks involved in professional services.

This trend means that having E&O insurance is quickly becoming the baseline expectation, not a nice-to-have. Of course, the best consultants pair this essential coverage with proactive strategies to avoid lawsuits from the outset.

When you shift your perspective and see your E&O policy as a strategic tool instead of a burdensome cost, you put your consulting business in a much stronger position for resilience and long-term success.

Real-World Claims Scenarios Consultants Face

https://www.youtube.com/embed/QXFXk0Apofk

It’s one thing to talk about risk in the abstract. It's another thing entirely to see how a project you poured your heart into can suddenly unravel into a lawsuit. The real value of errors and omissions insurance for consultants clicks into place when you look at the kind of real-world situations that happen every day.

These aren't just wild "what-if" stories. They are grounded in the very real challenges consultants face, whether you’re in management, IT, marketing, or any other professional field.

The Management Consultant's Strategy Backfires

Let’s start with a classic example. A management consultant is hired to help a struggling company streamline its operations and boost profitability. You do your discovery, create a brilliant strategy, and oversee the implementation. But a few quarters later, the client’s profits haven't just stalled—they've plummeted.

Furious and facing major financial losses, the client sues you. They claim your strategic advice was negligent and directly caused the downturn. Right away, you’re on the hook for hiring a lawyer and funding a defense, even if you’re confident your advice was sound. That financial burden is yours alone.

Now, imagine that same scenario with an E&O policy. The client files a lawsuit seeking $250,000 in damages. Instead of panicking, you notify your insurance carrier. They immediately step in, appointing a legal team to defend you and covering the costs. If the case ends in a settlement or a court judgment against you, the policy pays that amount up to your coverage limit. What could have been a business-ending catastrophe becomes a manageable, albeit stressful, process.

The IT Consultant's Costly Oversight

Here's another one I see all the time, especially with tech consultants. An IT pro is brought in to upgrade a client's e-commerce website. They recommend and install a new platform but miss a critical security patch during the migration. It’s a small oversight in a massive project.

A few months later, disaster strikes. A data breach exposes the credit card information of thousands of customers. The client is hit with regulatory fines, brand damage, and lawsuits from angry customers. Who do they blame? The consultant whose oversight left the door open. A deep understanding of data security compliance strategies is no longer a "nice-to-have"—it's a core competency, and failing here can be devastating.

Key Takeaway: An E&O policy isn’t just about paying a final settlement. Its immediate value is covering the astronomical cost of a legal defense, which often racks up huge bills long before a case is ever decided.

These examples show how a simple mistake—or even just the allegation of a mistake—can spiral out of control. From an engineer's design flaw to a financial advisor's bad call, the scope of what can go wrong is broad. The cost of a single claim can be staggering, which is why it's so important to have the right protection in place. To get a better handle on what this protection might run you, check out our complete guide on professional liability insurance cost.

How to Choose the Right E&O Insurance Policy

Choosing the right errors and omissions insurance for consultants can feel overwhelming. You're faced with a lot of jargon and fine print, but it doesn't have to be a maze. If you break the process down, it becomes much more straightforward. The real goal is simple: get solid protection without overpaying for coverage you'll never use.

The first, most critical step is to take a hard look at your own consulting business. What exactly do you do? An IT consultant managing a client’s sensitive database faces entirely different risks than a marketing consultant developing a new brand campaign. Get specific.

Think about the clients you serve and the potential financial fallout if your advice leads to a serious issue. This kind of self-audit is essential because it helps you land on an appropriate coverage limit—that's the maximum amount an insurer will pay out for a claim or over the life of the policy.

Deciphering Key Policy Terms

Once you know what you need to protect against, you have to learn the language. With E&O insurance, a few terms are absolutely non-negotiable to understand. The biggest distinction is between "claims-made" and "occurrence" policies. Most professional liability coverage, including E&O, is claims-made.

- Claims-Made Policy: This is the industry standard. It covers claims that are actually filed while your policy is active, even if the work that caused the issue happened years ago (as long as it was after your policy's start date, known as the "retroactive date").

- Occurrence Policy: This type is rare for professional services. It covers any incident that happens during the policy period, no matter when the client gets around to filing the lawsuit.

Because you'll almost certainly have a claims-made policy, another term becomes vital: tail coverage. This is an add-on you can buy to extend the time you have to report a claim after your policy has ended. If you decide to retire, sell your business, or even just switch insurance providers, tail coverage is what protects you from old projects coming back to haunt you. Don't underestimate this; one study found that 30% of consultants faced claims after their contract was over.

Tail coverage is your safety net for the past. Without it, the moment you cancel your policy, you're on your own for every single project you've ever completed.

A Practical Checklist for Comparing Quotes

When the quotes start rolling in, it's tempting to just look at the price. That's a mistake. You need to compare them feature for feature to see what you're truly getting for your money. Using a structured checklist helps you make a true apples-to-apples comparison.

To make this easier, I've put together a simple table you can use as a framework.

E&O Policy Evaluation Checklist for Consultants

Use this checklist to compare different E&O insurance policies and ensure you select the best coverage for your consulting business.

| Evaluation Criteria | Policy A Details | Policy B Details | Key Considerations |

|---|---|---|---|

| Coverage Limit | $1 million per claim / $2 million aggregate | $1 million per claim / $1 million aggregate | Is this limit high enough for your biggest clients? Does the aggregate limit reset each year? |

| Deductible | $2,500 | $5,000 | This is your out-of-pocket cost per claim. Can you comfortably cover it? A higher deductible usually means a lower premium. |

| Retroactive Date | Matches my business start date | One year ago | This is crucial. Make sure the date goes back far enough to cover all your past work, otherwise, you have a major gap. |

| Key Exclusions | Excludes patent infringement | Excludes all intellectual property claims | Read the exclusions list carefully. Does it leave you unprotected in a key area of your consulting practice? |

By taking the time to assess your unique risks, learn the key terms, and methodically compare your options, you can choose the right E&O policy with confidence. This isn't just an expense; it's a foundational piece of a resilient and truly professional consulting practice.

Common Questions About E&O Insurance

Even after you get a handle on the basics, it's completely normal to have some lingering questions about how errors and omissions insurance works in the real world. To help clear up any lingering confusion, we’ve put together answers to the questions we hear most often from consultants.

Do I Really Need E&O if I Am a Solo Consultant?

Absolutely. This is a big one. It's a common myth that E&O is just for the big consulting firms. The truth is, solo consultants are often more vulnerable because they don't have the deep pockets of a larger company to absorb the shock of a lawsuit.

Just one claim—even a completely baseless one—can easily rack up tens of thousands of dollars in legal defense fees alone. For a one-person shop, that kind of financial hit can be a business-ending event. This makes errors and omissions insurance for consultants an essential safety net, no matter the size of your business.

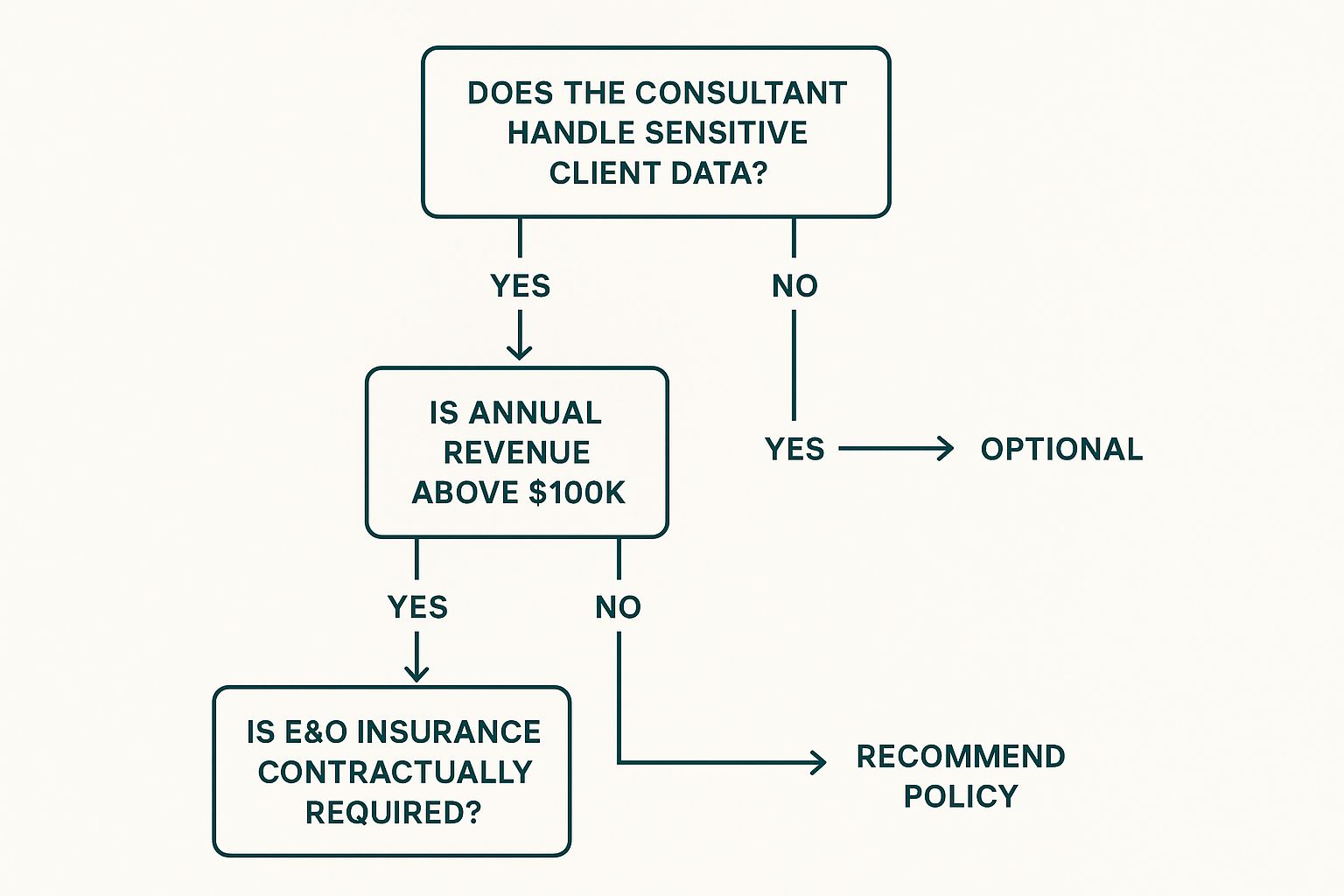

This handy visual can help you map out whether a policy is a smart move for your specific situation.

As you can see, things like handling sensitive client data, your annual revenue, and what your contracts require are all huge factors in determining your need for coverage.

What Is the Difference Between E&O and General Liability Insurance?

This is probably the most frequent point of confusion, and it’s a critical one to understand. These two policies cover completely different kinds of risk. Most consultants actually need both to be fully protected.

- Errors & Omissions (E&O) Insurance: This covers financial losses a client suffers because of your professional services, advice, or a mistake you made. Think of it as malpractice insurance for your work product.

- General Liability Insurance (GLI): This covers claims of physical injury to a person or damage to property that happens because of your business operations. Think of it as "slip-and-fall" insurance.

Let's make it concrete. If you recommend a marketing strategy that backfires and costs your client a ton of money, your E&O policy is what you'd turn to. But if that same client trips over your laptop bag in your office and breaks their arm, your General Liability policy would kick in to cover it.

Getting a firm grasp on how different policies work is vital. To dive deeper, check out our guide on the different commercial insurance types and see how they all fit together to create a solid shield for your business.

What Happens if a Claim Is Filed After My Policy Ends?

This is a fantastic question that gets right to the heart of how E&O policies work. They are typically "claims-made," which means the policy must be active when the claim is filed for there to be coverage. So, what happens if you retire or decide to switch insurance carriers?

This is where something called tail coverage becomes incredibly important. Tail coverage is an add-on you can buy that extends your reporting window for a set period after your main policy has ended. It's designed to cover work you completed while the policy was active.

Without it, the minute your coverage lapses, you're left exposed for all your past work. And considering some studies show nearly 30% of consultants face claims after a project has already wrapped up, tail coverage is a crucial piece of the puzzle for long-term peace of mind.

Insurance for High Net Worth Individuals: Expert Guide

Insurance for High Net Worth Individuals: Expert Guide Unlocking Insights with Insurance Data Analytics

Unlocking Insights with Insurance Data Analytics