Picking the right home insurance really comes down to two things: figuring out how much coverage you actually need, and then carefully comparing quotes from good companies. It’s a balancing act. You want enough protection to completely rebuild your life after a disaster, but you don't want to be paying for a bunch of extras you'll never use.

The goal is to find that sweet spot between cost and real-world protection.

Your Quick Guide to Selecting Home Insurance

I get it—learning how to choose home insurance can feel overwhelming. There's a lot of jargon and fine print. But you can think of this guide as your roadmap. We’re going to cut through the noise and focus on what truly matters for protecting your home.

Let's start with a bird's-eye view before we get tangled up in policy specifics. Seeing how all the pieces of the puzzle fit together first makes the whole process much less intimidating.

Key Factors at a Glance

Before we dive into the nitty-gritty of coverage types and deductibles, it helps to know what to look for. Your decision should really hinge on these three core areas.

- Coverage Adequacy: Are your policy limits high enough to cover the full cost of rebuilding your home and replacing everything inside? This is non-negotiable.

- Provider Reputation: What’s the company’s track record? You need an insurer with solid financial footing and a history of paying claims without a fight.

- Cost-Effectiveness: Once you know you're getting the right coverage from a good company, it's time to find the best price. Comparing quotes and sniffing out discounts is key. A great place to start is often by exploring options like bundling home and auto insurance.

To give you a clearer picture, here’s a quick summary of what to keep in mind throughout your search.

| Key Factors in Choosing Your Home Insurance Policy |

| :— | :— | :— |

| Factor | What to Look For | Why It Matters |

| Coverage Amount | 100% replacement cost for your dwelling; sufficient limits for personal property and liability. | Under-insuring leaves you with massive out-of-pocket costs after a total loss. |

| Deductible Level | A dollar amount you can comfortably pay on short notice (e.g., $1,000, $2,500). | A higher deductible lowers your premium but increases your financial risk during a claim. |

| Company Reputation | High ratings from agencies like AM Best; positive customer reviews on claims handling. | A cheap policy is worthless if the company won't be there for you when you need them most. |

| Price & Discounts | Competitive quotes for similar coverage; discounts for bundling, security systems, etc. | You shouldn't overpay for good protection. Smart shopping can save you hundreds. |

| Claims Service | 24/7 claims reporting; clear and efficient process. | A stressful event is made worse by a difficult claims experience. |

This table serves as your checklist. Refer back to it as you compare different policies to ensure you're making a well-rounded decision.

A cheap policy from an unreliable company is no bargain when you need to file a claim. Focusing on these elements ensures you get true value.

By framing your search around solid coverage, a reputable provider, and a fair price, you can move forward with confidence. You’re not just buying a policy; you’re investing in security for your family and your future.

Getting to Grips With Your Home Insurance Needs

When you start shopping for home insurance, it’s easy to feel like all policies are the same. But a "standard" policy is really just a blueprint. Your job is to turn that basic template into real protection that fits your home, your family, and your life. It's about looking past the jargon to understand what each type of coverage actually does for you when disaster strikes.

The biggest chunk of your premium, and rightfully so, goes toward dwelling coverage. This is what pays to rebuild your house from the ground up. Globally, this part of the policy accounts for a massive 71.1% of the market. Insurers now use sophisticated data to pinpoint risks for your specific property, so it’s critical that your coverage reflects the true cost of rebuilding in your area—not just what you paid for the house.

But a home is more than just walls and a roof. Let's dig into the other layers of protection that are just as important.

More Than Just the House Itself

A solid home insurance policy is actually a package of several distinct coverages, and each one has a very specific job. Thinking through how they apply to your situation is the secret to getting the right amount of protection without paying for things you don't need. Nailing this balance is also a key strategy in learning https://wexfordis.com/2025/06/14/how-to-lower-home-insurance-premiums/ while keeping your assets safe.

Here are the main pieces of the puzzle you'll need to consider:

- Personal Property Coverage: This covers everything inside your house—your furniture, clothes, electronics, and all the rest. I see people make this mistake all the time: they drastically underestimate how much their stuff is worth. A good starting point is to get coverage equal to 50% to 70% of your dwelling coverage, but honestly, the only way to know for sure is to create a detailed home inventory.

- Liability Protection: This is your financial shield if someone gets hurt on your property and you're held responsible. Picture this: the delivery driver slips on your icy porch. Liability coverage is what pays for their medical bills and your legal defense, stopping a single accident from wiping out your savings.

- Additional Living Expenses (ALE): If a fire or another covered event forces you out of your home, ALE is a lifesaver. It pays for you to live somewhere else while repairs are underway, covering things like hotel stays, restaurant meals, and even laundry services that go beyond your normal budget.

Real-World Scenario: Imagine a grease fire in your kitchen creates so much smoke damage that your family has to move into a rental home for three months. Additional Living Expenses coverage is what turns a potential financial catastrophe into a manageable inconvenience by covering that rent and other extra costs.

Spotting Your Potential Coverage Gaps

Here’s a hard truth: no standard policy covers everything. Knowing what isn't covered is just as important as knowing what is. These exclusions are often where homeowners get caught off guard after something goes wrong.

For example, damage from floods and earthquakes is almost never included and requires a separate policy. Your insurance also won't cover gradual damage, like a slow leak or a pest infestation. That’s why proactive maintenance is so important. While your policy won't cover termite damage, you can learn more about protecting your home by checking out an essential guide to termite and pest inspection.

Taking the time to review these components and identify potential gaps is how you go from just "buying insurance" to building a smart, personalized financial safety net for your biggest asset.

Finding the Sweet Spot: Premiums, Deductibles, and Discounts

The final price you pay for home insurance isn't just about your coverage limits. It's really a balancing act between your annual premium (what you pay the insurance company) and your deductible (what you pay out-of-pocket when you file a claim). Getting this balance right is the secret to finding a policy that protects your home without breaking your budget.

Think of it like a seesaw. If you choose a higher deductible, you’re telling the insurer you'll cover more of the initial cost of a claim yourself. They like that, so they reward you with a lower premium. On the flip side, a lower deductible means they’re on the hook for more, so your premium goes up. There’s no magic number here—the right deductible is an amount you could genuinely afford to pay tomorrow without derailing your finances.

The Premium vs. Deductible Balancing Act

Picking a deductible is a moment for some real financial honesty. If a surprise $2,500 bill would send you into a panic, then a policy with a high deductible is probably a bad idea, no matter how low the premium is. You're looking for that sweet spot where the premium is comfortable, but the deductible is low enough that you'd actually be willing to use your insurance when disaster strikes.

For most people I work with, a deductible somewhere between $1,000 and $2,500 tends to be the sweet spot. It's high enough to get you a noticeable break on your premium but low enough to be manageable in an emergency.

One crucial detail to watch out for: some specific risks, like hurricanes or windstorms, can have their own separate, often much higher, deductibles. If you live in an area prone to certain disasters, you have to ask about this specifically. You can learn more about these nuances by reading our guide comparing flood insurance vs homeowners insurance.

A quick pro tip: Insurance is really meant for the big, catastrophic stuff. It’s often smarter to pay for a minor, sub-deductible repair out-of-pocket than to file a small claim that could haunt your rates for years.

How to Uncover Every Last Discount

After setting your deductible, your next best move for lowering your bill is to hunt down every possible discount. Insurers have a ton of them, but they won't always offer them up freely. You usually have to ask.

With home insurance costs rising sharply for everyone—the average premium hit $1,966 recently after a 9.3% jump—finding these savings is more critical than ever. For a deeper dive into what's driving these changes, you can check out the latest global insurance market trends on marsh.com.

Don't leave money on the table. Here are the most common discounts you should be asking about:

- Protective Devices: Have a security system or fire alarm that’s monitored by a central station? That’s a discount.

- Home Upgrades: Putting on a new roof or modernizing your plumbing or electrical systems reduces risk, and insurers love to see it. Ask for a discount.

- Claims-Free Record: If you've gone a few years (usually 3 to 5) without filing a claim, you've earned a discount. Make sure you're getting it.

- Loyalty & Bundling: This is the easiest win. Insuring your home and auto with the same company almost always unlocks significant savings.

Don't be shy. Ask your agent to do a full discount review on your policy. It’s a simple way to cut your costs without sacrificing an ounce of coverage.

How to Vet Insurance Providers and Compare Quotes

A fantastic policy from a terrible company is a trap. I’ve seen it happen time and again: a homeowner grabs the cheapest quote only to find out their insurer fights them tooth and nail when they desperately need help. Vetting your potential insurance provider is just as crucial as understanding the coverage they offer.

The home insurance market is massive and growing—it's projected to expand from $269.92 billion to over $628.52 billion by 2034. While more options are great for consumers, it also means you have to look beyond the price tag to check an insurer's stability and service record. To get a better sense of this growth, you can explore the full home insurance market research on precedenceresearch.com.

Assessing an Insurer's Health and Reputation

Before you even start collecting quotes, it's time to do some detective work. You need to be confident that a company has the financial muscle to handle a wave of claims after a major disaster and that they actually treat their customers fairly.

Here’s where to look for unbiased insights:

- Financial Strength Ratings: I always start with A.M. Best. An "A" rating or higher is a strong signal that the insurer can meet its financial obligations—like paying your claim without a problem.

- Customer Satisfaction Scores: Check out annual studies from organizations like J.D. Power. They survey real customers about their claims experience, giving you a peek into what it’s actually like to work with that company.

- State Department of Insurance: Your state’s insurance department website is an invaluable resource. Look for their "complaint ratio," which shows how many complaints an insurer gets relative to its size.

A high number of complaints is a major red flag. It often points to systemic issues with claims processing, customer service, or communication, signaling a potentially difficult experience for you down the line.

Doing this homework first helps you weed out the weaker players right from the start.

Making a True Apples-to-Apples Comparison

Once you have quotes from a handful of reputable companies, the real work begins. It’s so tempting to just grab the lowest number, but that's a classic rookie mistake. To get the full picture, you need to line up the policies side-by-side. If you want to really master this, check out our detailed guide to compare home insurance quotes.

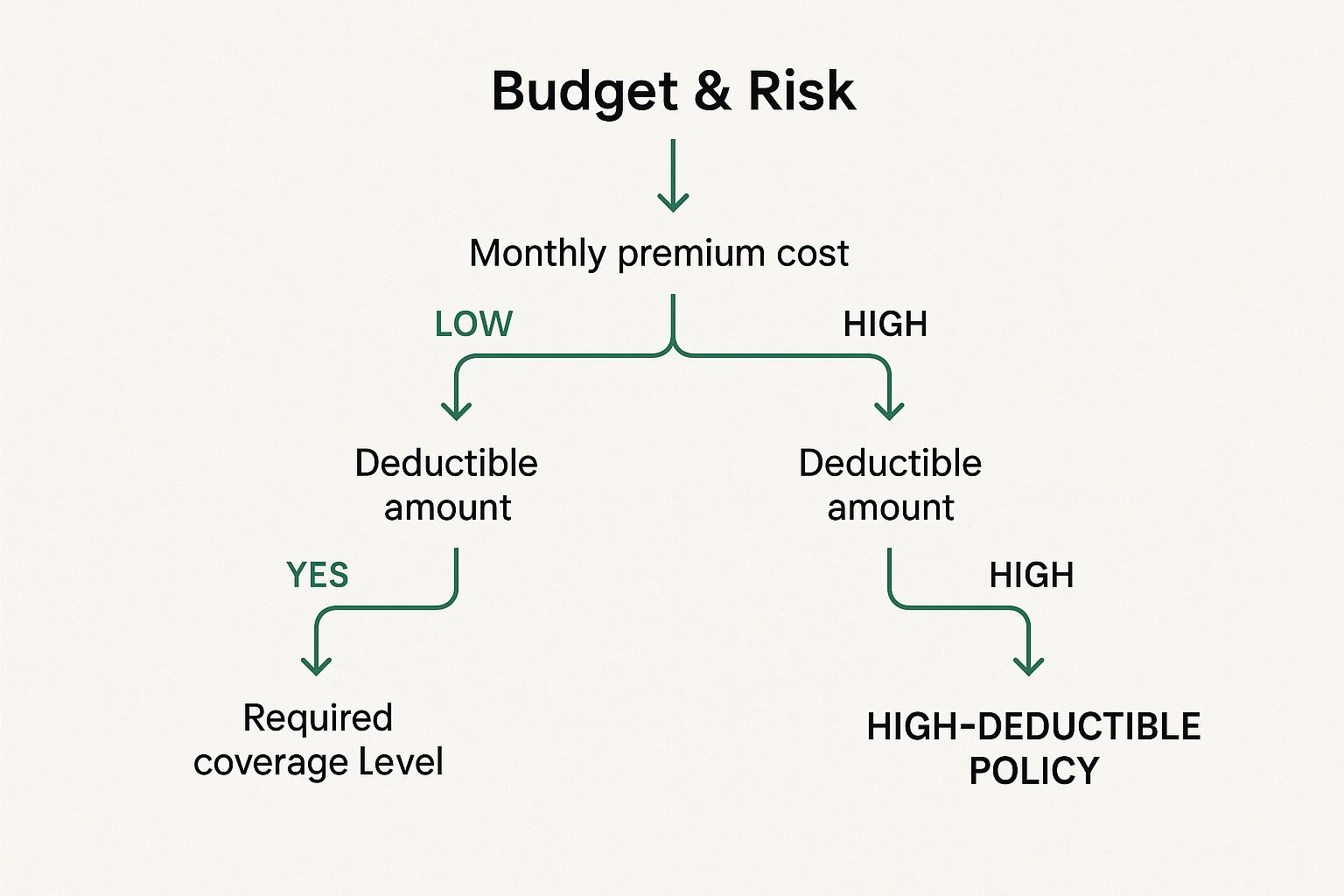

This decision tree helps visualize the trade-offs you'll need to make between your premium, deductible, budget, and coverage needs.

As you can see, your personal risk tolerance and how much cash you have on hand are key factors in finding the right balance for your policy.

To make sure you're comparing fairly, arm yourself with these specific questions for each agent:

- Is this for Replacement Cost Value (RCV) or Actual Cash Value (ACV)? You absolutely want RCV for both your house and your belongings. ACV policies deduct for depreciation, leaving you short.

- What are the specific sub-limits on valuables? Most policies have caps on things like jewelry, firearms, or art. You need to know these numbers.

- What is the wind or hurricane deductible? In many areas, this is a separate—and much higher—deductible. Don’t get caught by surprise.

- Are there any major exclusions I should know about? Ask them to point out what isn't covered beyond the usual suspects like floods and earthquakes.

When you dig into these details, you move past just comparing prices and start evaluating true value. It's the only way to be sure the policy you choose will actually be there for you when it matters most.

Finalizing Your Policy and Planning for the Future

So, you've waded through the quotes, compared the options, and picked an insurer. That's a huge step, but don't close the book just yet. Choosing a policy isn't the finish line—it's the beginning of a long-term strategy to protect what's likely your biggest asset. These final steps are what truly secure your peace of mind.

Before everything is set in stone, your chosen policy will go through underwriting. Think of this as the insurance company's final double-check. They'll verify all the details you provided and take a closer look at your property's risk profile. It’s common for this to involve a home inspection, so don't be caught off guard. An underwriter might have someone come by to photograph your home's exterior, inspect the roof's condition, or note potential hazards like an unfenced pool or large overhanging tree limbs.

The Smartest Task You Can Do Today

While the underwriters do their thing, you have the perfect window to tackle a crucial task: creating a detailed home inventory. Honestly, this might be the single most important thing you can do to ensure a smooth claims process if you ever need one. It sounds like a lot of work, but it doesn't have to be.

Just grab your smartphone and walk through your home, room by room. Take videos and photos of everything. Make sure to get clear shots of high-value items—think electronics, appliances, furniture, and any special collections. If you have receipts for big-ticket items, find them, scan them, and save everything to a secure cloud drive.

Creating a thorough home inventory now, when there’s no pressure, is infinitely easier than trying to remember every single item you owned from memory after a devastating fire or theft.

Your Annual Insurance Check-Up

Your life is constantly changing, so your insurance policy shouldn't be static. Make it a habit to perform an annual policy review. It's like a yearly financial health check-up, ensuring your coverage still makes sense for your current situation.

Life events are the most common trigger for a policy update. Did you finish a major kitchen remodel, add a new deck, or finally put in that swimming pool you've always wanted? These kinds of upgrades increase your home’s value, which means your dwelling coverage needs a bump to keep pace.

Other key moments that should prompt a call to your agent include:

- Starting a home-based business: A standard policy provides almost no coverage for business equipment or liability.

- Acquiring valuables: If you inherit your grandmother’s expensive jewelry or buy a piece of fine art, you'll likely need a special add-on, called an endorsement, to cover it properly.

- Improving home safety: Installing a new security system or replacing your old roof can often qualify you for new discounts.

Staying on top of your policy is the best way to keep your protection strong and relevant. For a deeper look, our complete guide to homeowners insurance offers more insights. And because protecting your home's value also means preventing problems before they start, checking out a comprehensive plumbing preventative maintenance guide is another proactive step. By planning ahead, you ensure your policy truly grows with you.

Common Questions About Home Insurance

Even after you've done your homework, a few questions are bound to pop up. That’s perfectly fine. When you're digging into the details of how to choose home insurance, you're going to have specific concerns. Let's walk through some of the questions I hear most often from homeowners.

How Much Coverage Do I Really Need?

This is the big one, and getting the answer right is absolutely critical.

For your dwelling coverage, you need enough to completely rebuild your house from the ground up. This isn't about what it would sell for on the market; it's about today's construction and labor costs. Don't just take a wild guess—sit down with your agent to calculate a solid replacement cost estimate.

When it comes to your personal belongings, a good rule of thumb is to start with 50% to 70% of your dwelling coverage. But the best way to know for sure is to do a home inventory. You'll probably be surprised by how much stuff you actually have. For liability, I always recommend at least $300,000 to $500,000. If you have significant assets, like savings or other properties, you should seriously look into an umbrella policy to add another million or more in protection.

Replacement Cost vs. Actual Cash Value

Getting this one wrong can lead to a massive financial shock after a claim. It’s vital to understand the difference.

Here’s how it breaks down:

- Replacement Cost Value (RCV): This is the gold standard. It pays to repair or replace your damaged property with new items of similar quality. There's no deduction for depreciation. This is what you want for both your home's structure and your personal belongings.

- Actual Cash Value (ACV): This pays you for the replacement cost minus depreciation. Think of it as what your 10-year-old couch is worth today, not what a new one costs. An ACV policy is always cheaper, but the payout can be painfully small, often leaving you unable to fully replace what you lost.

The lower premium of an ACV policy might look appealing, but the smaller payout after a major loss can be financially devastating. I always tell my clients to opt for RCV coverage whenever it's an option.

Will Filing a Small Claim Raise My Premium?

In almost every case, yes. Once you file a claim—no matter how small—you can expect your premium to go up at your next renewal. Any "claims-free" discount you were getting will also probably vanish for a few years.

This is exactly why it's often smarter to pay for minor repairs out of your own pocket, especially if the cost is just a little over your deductible. Your insurance should be your safety net for the big stuff you can't handle alone, not a maintenance plan for every little mishap.

How Often Should I Shop for New Insurance?

It's a smart habit to review your policy and shop for new quotes every year or two. Rates are always changing, and new discounts pop up all the time. A quick check-in ensures you aren't overpaying.

You should definitely shop around after any major life event, too. Things like a big home renovation, a significant improvement in your credit score, or a hefty rate hike from your current provider are all triggers to see what else is out there. Being proactive is the best way to keep the right coverage at the best price.

Navigating the world of home insurance can feel overwhelming, but you don't have to do it alone. The experts at Wexford Insurance Solutions are here to offer personalized guidance, helping you compare options and build a policy that truly protects what you've worked for. Contact us today to get started.

Cyber Liability Insurance for Small Business Explained

Cyber Liability Insurance for Small Business Explained 7 Fleet Management Best Practices for 2025

7 Fleet Management Best Practices for 2025