Thinking about switching insurance providers can feel like a hassle, but it really boils down to three straightforward moves: figuring out if your current policy still makes sense for you, shopping around for a better deal, and making a clean switch without any gaps in your coverage. Get this right, and you could pocket some serious savings while getting protection that actually fits your life.

Knowing When It's Time for a Change

Deciding to jump ship from your insurer feels like a big decision, but there are usually clear signs telling you it’s time. Sometimes, it’s not you—it’s the market. When things get more competitive, it’s the perfect opportunity to see what else is out there.

For example, when insurance companies start dropping their prices across the board, that’s your cue. Marsh's Global Insurance Market Index recently reported that composite insurance pricing fell by 4%. If rates are dropping everywhere and yours isn't, you're likely overpaying. It pays to keep an eye on these kinds of market trends, and you can see more data like this over at Marsh.com.

Personal Triggers for a Policy Review

More often than not, the push to switch comes from changes in your own life. These milestones are your personal alarm bells, signaling it’s time to take a hard look at your coverage.

-

Major Life Events: Did you just get married, welcome a new baby, or buy a house? All of these moments completely change what you need to protect. Buying a new home, for instance, is the perfect time to look into bundling policies. If you're in that boat, our guide on how to choose home insurance can walk you through it.

-

Poor Customer Experience: Nothing sours a relationship with an insurer faster than a bad claims experience or just plain terrible communication. If you feel like you’re fighting your own insurance company when you need them most, it’s a massive red flag.

-

Significant Asset Changes: Your life isn’t static, and your insurance shouldn’t be either. Buying a new car, starting a business from home, or even inheriting valuable jewelry means your old policy might not be enough to cover you anymore.

To help you decide, here’s a quick checklist of common signs that it’s time to start shopping around.

Quick Checklist: Is It Time to Switch Providers?

| Indicator | Why It Matters |

|---|---|

| Your Premium Spiked | A significant, unexplained rate hike at renewal is the most obvious reason to look elsewhere. |

| You Had a Bad Claims Experience | The whole point of insurance is to be there when you need it. If they weren't, find a provider who will be. |

| You Bought a New Home or Car | Major purchases change your risk profile and create opportunities to bundle policies for better rates. |

| You Got Married or Had a Child | Your family's financial security needs have changed. Your coverage should reflect that. |

| Your Credit Score Improved | A better credit score can often lead to significantly lower insurance premiums. |

| It's Been Over 3 Years | The market changes, new discounts appear, and your loyalty might be costing you. A regular check-up is just smart. |

If you find yourself nodding along to one or more of these points, it’s a strong signal that you could find a better fit—and a better price—with a different company.

Don't fall for the "loyalty tax." It’s a real thing where insurers quietly charge long-term customers more than new ones. Staying put without checking the market can cost you. Think of it as a regular financial health check-up.

Big life changes, like getting ready for retirement, are also prime moments to reassess all your financial protections, including insurance. For more on that specific transition, you can find some excellent retirement planning resources to help guide you.

Know What You Have Before You Shop

Before you even think about shopping for a new policy, you need to get intimately familiar with the one you already have. I'm not just talking about the premium you pay every month. Knowing how to change insurance providers effectively starts with a deep dive into your current coverage to see what's really going on.

Your policy’s declarations page is the perfect place to start. Think of it as the CliffsNotes for your insurance—it lays out all the vital stats on a single page. You'll see who is insured, what property is covered, and your policy dates. Most importantly, it spells out your coverage limits (the max your insurer will pay for a claim) and your deductibles.

A high deductible can definitely bring down your premium, which looks great on paper. But ask yourself this: could you comfortably write a check for that amount tomorrow if something happened? That’s the real-world test.

Digging Deeper for Gaps and Gotchas

Once you’ve reviewed the declarations page, it's time to play detective and look for what isn't covered. This means hunting down endorsements (add-ons that give you more coverage) and exclusions (things your policy specifically won't pay for).

- Look for Exclusions: Does your homeowner's policy cover flood damage or sewer backups? I've seen countless people get caught off guard because these are very common exclusions.

- Confirm Endorsements: Did you add a special rider for your valuable jewelry or your home office equipment a few years ago? Make sure it's still on the policy and that the coverage amount is enough for a replacement today.

Life changes, and your insurance needs to change with it. Maybe you started working from home full-time, your teenager just got their driver's license, or you put in a new swimming pool. These events change your risk, and an outdated policy can leave you dangerously underinsured.

A Key Takeaway: Your insurance policy should be a living document that grows with you. A policy review isn't just a cost-saving exercise; it's about making sure the protection you pay for actually fits your life right now.

This review process is even more crucial for business owners. You'll need a clear picture of your claims history by getting a copy of your loss run report. It's essential to understand what a loss run report is because it directly affects your ability to get quotes for new coverage.

Your personal insurance needs are also influenced by bigger market shifts. With Millennials now representing over 50% of the U.S. workforce, there's a huge demand for policies that cover modern realities like the gig economy or remote work. This is a big reason so many people are looking for better options. Once you have a firm handle on what your current policy does—and doesn't—do, you’ll be in the perfect position to find the coverage you truly need.

Shopping Smart for Your New Insurance

Alright, you’ve done your homework and have a clear picture of what you need from your insurance. Now comes the part that most people dread, but it doesn't have to be a chore: shopping for a new policy. The key is to shift your mindset from finding the lowest price to finding the best value. That sweet spot where cost, coverage, and service all align.

So, where do you start? Your first move is to gather quotes, and you’ve got a few solid options here.

- Online Comparison Tools: These sites are fantastic for getting a quick, bird's-eye view of the market. They pull rates from multiple carriers at once, giving you a baseline almost instantly. The trade-off is that the service can feel a bit impersonal.

- Direct from Insurers: Don't underestimate going straight to the source. Visiting an insurer’s website can sometimes reveal special discounts or policy perks you won’t find on a comparison engine.

- Independent Agents: This is my personal favorite route for complex needs. A good independent agent is like having a professional shopper on your side. They do the legwork, explain the fine print, and help you compare apples to apples.

Looking Beyond the Price Tag

Once you have a handful of competitive quotes, it's time to put on your detective hat. A rock-bottom premium from a company that vanishes when you need them is worse than no policy at all. You need an insurer who will actually show up when disaster strikes.

First, check each company's financial strength rating. Agencies like A.M. Best provide grades (look for A- or higher) that tell you if the insurer has the financial muscle to pay out claims, even during major events. Next, dig into customer service reviews. Check the Better Business Bureau and your state’s department of insurance website. What are real customers saying about their claims experience? That’s where the truth lies.

To keep everything straight, I recommend using a simple comparison chart. It forces you to look at the whole picture, not just the monthly cost.

Provider Comparison Framework

| Feature to Compare | Provider A | Provider B | Your Current Provider |

|---|---|---|---|

| Annual Premium | |||

| Deductible Amount | |||

| Coverage Limits | |||

| A.M. Best Rating | |||

| Customer Service Score | |||

| Digital Tools (App/Portal) | |||

| Unique Discounts |

This framework helps you see, at a glance, how each option stacks up. It’s a simple but powerful way to make an informed decision.

The Digital Experience Matters

In today's world, how a company uses technology is a huge part of its service. A clunky app or a website that feels like it was designed in 1999 can turn managing your policy into a nightmare. A top-tier provider should offer a smooth digital experience, including an easy-to-use mobile app and a 24/7 online portal for viewing documents, making payments, or even starting a claim.

A provider's digital experience is no longer a "nice-to-have"—it's a critical part of their service. A frustrating online portal can make managing your policy a headache you don't need.

This isn't just about convenience; it’s a sign of a modern, efficient company. In fact, over 75% of U.S. insurers are now using advanced tech like generative AI to improve everything from underwriting to claims processing. This shift means the entire process of getting and managing insurance is becoming faster and more intuitive. As you compare your options, give serious weight to how well each company makes your life easier through technology. If you're curious about where the industry is heading, these global insurance insights from McKinsey are a great read.

Making a Seamless Transition

You've done the hard work of comparing quotes and you've found your new insurance provider. Great! But the job isn't quite done. The final stretch involves managing the switch itself, and this is where paying close attention to the details will save you from major headaches and, more importantly, a dangerous gap in your coverage.

Timing is Everything

Let's get one thing straight: you absolutely cannot have even a single day without coverage. The most critical part of this entire process is timing the switch perfectly.

Your new policy must be officially active before your old one ends. I always advise my clients to set the new policy's start date for the exact same day their old policy is set to cancel. This creates a clean, seamless handoff with zero risk.

Once you have the new policy documents and ID cards in your possession, then—and only then—is it time to say goodbye to your old insurer. Don't just stop paying the premiums. That can lead to a "cancellation for non-payment" on your record, which can hurt your insurance score down the line. Instead, you need to formally cancel. A quick phone call followed by an email or letter is the professional way to handle it.

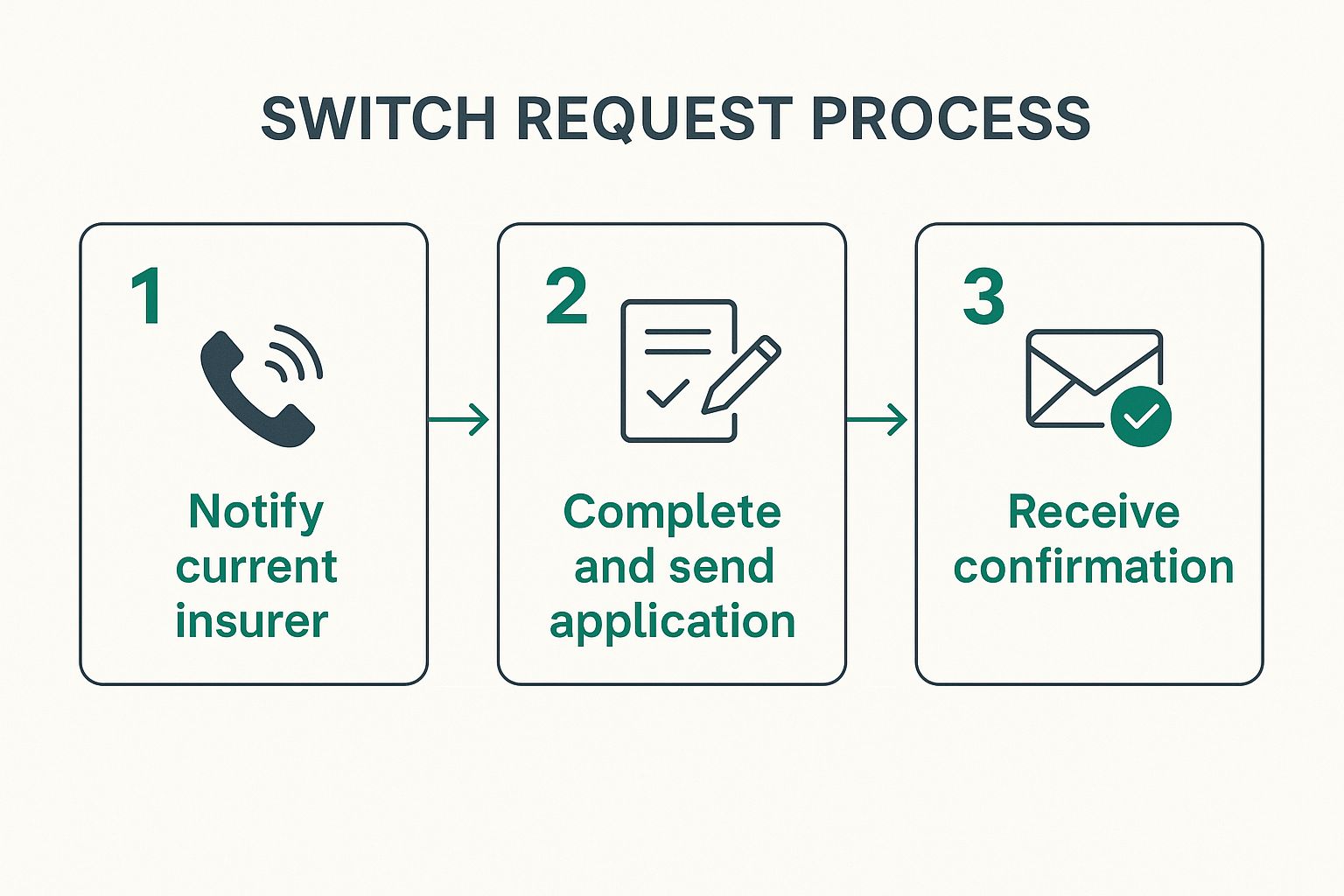

This simple flow chart breaks down the final steps.

As you can see, it's a straightforward process that keeps you in the driver's seat from the moment you notify your old company to when you get that final confirmation.

Don't Forget to Notify Other Parties

This is the step almost everyone forgets. When you change insurance providers, you have to tell anyone else who has a financial stake in your property. It’s a small task that prevents huge problems.

A quick pro-tip: Always get your cancellation confirmation in writing. An email or a formal letter is your proof that the policy was terminated, protecting you if any billing disputes pop up later.

Think about it. If you have a car loan, your lender is listed on that policy and needs proof of new coverage immediately. They need to know their asset is protected. The same goes for your mortgage company. They usually pay your homeowner's premium from your escrow account, so they need the new policy information to make sure payments go to the right place and your loan stays in good standing. A quick phone call or email with your new policy declarations page is all it takes.

Navigating the Switch: Common Mistakes to Sidestep

Learning how to change insurance providers smoothly often means knowing what not to do. I’ve seen many people make a few common, and costly, mistakes along the way.

It’s incredibly easy to get tunnel vision and focus only on the bottom-line price. But chasing the absolute lowest premium can backfire spectacularly. A cheap policy isn't a good deal if it’s riddled with coverage gaps that only show up when you're filing a claim.

Another common slip-up is getting the wrong idea about loyalty. While it's smart to shop around because your current insurer might not be giving you the best rate anymore, you shouldn't assume that any new offer is automatically better. Always do a true apples-to-apples comparison to make sure you're actually getting a better deal, not just different paperwork for a few dollars less.

Your Application: Honesty is the Only Policy

This is the big one. The single most damaging mistake you can make is not being 100% truthful on your new application. It can be tempting to fudge the details—maybe leave out that small fender bender from two years ago or underestimate your daily commute mileage to save a few bucks. Don't do it.

Insurers have ways to verify everything you tell them, and they will.

The consequences are severe. If an insurer finds out you misrepresented anything, they can legally deny a future claim or, even worse, cancel your policy from the day it started. Suddenly, you’re uninsured and personally liable for thousands in damages. The risk just isn't worth the small, temporary savings.

Being completely transparent from the get-go is crucial. It ensures your new policy is valid and that the protection you’re paying for will actually be there for you. For more legitimate ways to save, take a look at our guide on how to lower home insurance premiums.

Got Questions About Switching Your Insurance?

Making the final decision to switch insurance providers can feel a bit like standing on a diving board—you're ready to jump, but a few last-minute questions might be holding you back. Let's clear up some of the most common concerns so you can make the move with total confidence.

Can a New Insurance Company Just Say No?

Absolutely. An insurer can deny your application based on their specific underwriting criteria. Think of it from their perspective: they're assessing risk. Things like a history of frequent claims, a spotty driving record, or even a low credit score (in most states) can raise red flags and lead to a denial.

This is precisely why you should never, ever cancel your current policy until your new one is fully approved and officially in effect. If you do get denied, don't just walk away. Ask the insurer for the exact reason. Knowing why gives you a clear roadmap of what you might need to address before you try applying elsewhere.

Is There a Penalty for Switching Mid-Policy?

For the most part, no. You're typically free to switch your home or auto insurance provider whenever you want without getting hit with a penalty. In fact, you'll usually get a prorated refund for any premium you've already paid for the rest of your policy term.

It's always a smart move to quickly scan your current policy documents for any mention of cancellation fees, but honestly, they're pretty uncommon for personal insurance. The real rule to live by is simple: make sure your new policy is active before you cut ties with the old one. That's how you prevent dangerous gaps in coverage.

For professionals, the stakes can be a bit different, and understanding your liability is crucial. Specialized policies come into play here, and our guide on what errors and omissions insurance is can shed more light on that.

How Does This Affect My Car Loan or DMV Registration?

This is a big one, and you need to act fast. Once you switch your auto insurance, you have to provide your new proof of insurance to your state's DMV. This is a legal requirement to keep your vehicle's registration valid.

Don't forget about your lender, either. If you have a car loan or are leasing, you need to notify them of the change right away. They are listed as a "loss payee" on your policy, and they need your new insurance details to ensure their financial stake in your car is still protected.

At Wexford Insurance Solutions, we're here to make managing your insurance feel less like a chore and more like a smart, empowering decision. If you’re looking for a partner who offers real-world advice with the ease of modern tools, visit us at https://www.wexfordis.com and see how we can help you secure the right coverage at the right price.

What Is a Loss Run Report? Essential Guide for Better Insurance Rates

What Is a Loss Run Report? Essential Guide for Better Insurance Rates Will My Insurance Cover Car Wash Damage? Find Out Now

Will My Insurance Cover Car Wash Damage? Find Out Now