So, can your auto insurance step in and cover damage from a car wash? The short answer is yes, but it’s not always straightforward. It really boils down to having a specific type of protection on your policy: comprehensive coverage. Think of this as your car's shield against all the weird, non-crash-related stuff life throws at it, including a run-in with some faulty car wash equipment.

Your Guide to Car Wash Damage Coverage

It’s a scenario that’s all too common and incredibly frustrating. You pull into the car wash expecting a sparkling clean car and drive out with a fresh scratch, a new dent, or even a snapped-off mirror. Your first thought is probably, "Is my insurance going to pay for this?" The answer hinges on your specific policy and exactly what happened.

For this kind of damage, your policy needs the right tool for the job, and that tool is comprehensive coverage. This is the part of your insurance that handles damage that isn't from a collision with another vehicle. It typically covers things like:

- Theft and vandalism

- Falling objects (think tree limbs or hail)

- Fire or flood

- Damage from malfunctioning car wash machinery

Surprisingly, not everyone has this. In fact, industry data shows that only about 74% of U.S. drivers carry comprehensive coverage. That leaves a large chunk of drivers who would have to pay out-of-pocket for repairs after a car wash incident. You can dive deeper into these trends by checking out industry analyses of car wash coverage.

Before you jump to file a claim, it's essential to understand how all the pieces fit together. Below is a quick summary of the key factors that determine if your policy will cover the damage.

Key Factors for Car Wash Damage Coverage

| Scenario | Is It Covered? | Key Factor |

|---|---|---|

| Mechanical failure of car wash equipment | Likely, with Comprehensive | The damage was caused by an external, non-collision event. |

| The car wash is clearly at fault and accepts liability | Maybe, but their insurance should pay | The car wash's business liability insurance is the primary source of coverage. |

| The damage is minor (e.g., less than your deductible) | No | The repair cost doesn't exceed your out-of-pocket deductible. |

| You don't have Comprehensive coverage | No | Your policy lacks the specific coverage needed for this type of damage. |

As the table shows, having the right coverage is just one part of the puzzle. The cost of the repair and who is ultimately at fault are just as important.

Understanding Your Deductible

Even if you have comprehensive coverage, rushing to file a claim might not be the smartest financial move. This is because of your deductible. A deductible is simply the amount you have to pay yourself before your insurance company chips in for the rest.

For instance, let's say a malfunctioning brush leaves a deep scratch that will cost $800 to fix. If your comprehensive deductible is $500, you'll pay that first, and your insurer will cover the remaining $300.

This is a critical calculation to make. If the cost to fix the damage is less than your deductible, or only slightly more, filing a claim is probably a bad idea. It can go on your record and potentially lead to higher premiums when you renew your policy, costing you more in the long run.

Determining Who Is at Fault: The Car Wash or You?

Before you even think about filing a claim, you have to figure out who's actually responsible for the damage. The answer to this question is everything—it determines whether you'll be dealing with your own policy, the car wash's insurance, or just paying out of pocket.

Generally, these situations fall into one of two buckets. First, you have damage that’s clearly caused by the car wash itself. Think of a spinning brush that goes haywire and puts a deep scratch down your door, or a piece of the machinery breaking off and denting your hood. In cases like these, the car wash is almost certainly at fault due to negligence. They have a duty to keep their equipment safe and in good working order, and when they don't, the liability falls on them.

Pre-Existing Conditions vs. New Damage

The other side of the coin involves pre-existing issues with your car. This is where things can get a little tricky. Let's say you have a custom aftermarket antenna that was already a bit wobbly. If the force of the car wash brushes snaps it off, the business will likely argue that the damage happened because the part wasn't factory-standard or was already compromised. In that case, the responsibility could shift back to you.

The core of the argument comes down to this: would the damage have happened to a standard, well-maintained vehicle?

- Car Wash Fault: A malfunctioning dryer fan blows so hard it cracks your factory-installed side mirror. This points directly to an equipment problem.

- Driver Fault: An existing rock chip in your windshield spreads into a long crack during the high-pressure rinse. This is usually seen as aggravating a pre-existing condition.

You've probably seen those "Not Responsible for Damage" signs. It's easy to see one and think you're out of luck, but those signs don't give the business a free pass for their own mistakes. A waiver often can't protect a business from its own negligence. If their faulty equipment directly caused the damage, they can still be held liable.

Figuring out this distinction is the most important first step. If it looks like the car wash is clearly at fault, your first move should be to speak with the manager right away. But if their liability is murky or they refuse to cooperate, that’s when your own comprehensive coverage becomes your best friend.

And if you’re unhappy with how your own insurer handles the situation—or how the car wash handles you—it might be a sign that it’s time to look for a better fit. It’s always good to know how to change insurance companies when you feel you're not getting the service you pay for.

Which Insurance Actually Protects Your Car?

When your car gets banged up at a car wash, your first instinct is probably to wonder if your own insurance will step in. It’s a good question, and the answer depends entirely on the kind of policy you have. Not all coverage is built the same, and knowing the difference is key.

Think of your auto insurance policy like a toolkit. You wouldn't use a hammer to turn a screw. Similarly, the coverage you use for a fender bender isn't the one you'd use for a rogue car wash brush.

Comprehensive: Your Shield Against "Life's Little Surprises"

This is where comprehensive coverage becomes your best friend. It’s specifically designed to handle damage that isn't caused by a collision with another vehicle. We're talking about things like theft, a tree branch falling on your hood, or—you guessed it—malfunctioning car wash equipment.

Because a faulty, high-pressure sprayer or a broken brush isn't considered a "collision," any claim you file with your insurer will almost certainly be handled under your comprehensive policy. It’s the coverage for life’s unexpected mishaps. If you're fuzzy on the details, our guide explaining what is full coverage can clear things up.

Key Takeaway: Comprehensive coverage is your primary line of defense. Insurance companies classify damage from car wash machinery as an external event, not a collision, which is exactly what comprehensive is for.

With the car wash industry booming—North America alone commands over 40% of the global market—more vehicles are going through automated washes than ever before. This has naturally led to a rise in insurance claims for things like deep paint scratches and broken sensors. In fact, legal actions against car wash businesses have jumped by about 15% in developed countries, underscoring just how important it is for everyone involved to be protected.

A Quick Look at Comprehensive vs. Collision

To make it crystal clear, let's break down how these two core coverages apply (or don't apply) to car wash damage.

Comprehensive vs. Collision Coverage for Car Wash Damage

| Feature | Comprehensive Coverage | Collision Coverage |

|---|---|---|

| Typical Use | Non-collision events: theft, vandalism, falling objects, weather, and equipment malfunctions. | Accidents involving another vehicle or a stationary object (like a pole or wall). |

| Car Wash Damage | Yes. This is the correct coverage for damage from faulty car wash machinery. | No. A car wash incident isn't classified as a collision. |

| Example | A rotating brush cracks your windshield or scratches your paint. | You rear-end another car while waiting in line at the car wash. |

| Deductible | Yes, you will have to pay your comprehensive deductible. | Yes, you would pay your collision deductible, but it doesn't apply here. |

This table shows why having the right kind of insurance is so important. While both are valuable, only comprehensive is built for this specific kind of problem.

What About the Car Wash's Insurance?

It's also crucial to remember that the car wash has its own insurance policies. Any respectable business will carry general liability insurance. This is meant to cover damage to a customer's property that happens because of their own negligence or faulty equipment.

While this guide centers on the most common coverages like comprehensive, many other specific policies exist for unique situations. For example, some drivers even have car key replacement insurance for lost or damaged fobs. Knowing what your policy covers—and that the business has its own liability—gives you the full picture and puts you in a much stronger position to get things resolved.

Your Step-by-Step Guide to Filing a Damage Claim

Finding a fresh scratch or a dent after a car wash is incredibly frustrating. The good news is that the claims process itself doesn't have to be a headache. If you have a clear plan, you can navigate it smoothly, and it all starts with what you do in those first few moments at the car wash.

The absolute first thing you need to do is document everything. Don't leave the car wash! Pull out your phone and take plenty of clear photos and videos of the damage from every conceivable angle. Make sure they’re time-stamped if possible. Once you have your proof, find the manager on duty. Calmly explain what you found, show them the damage, and ask them to file an incident report. Getting a copy of that report is vital, as this initial paperwork is the bedrock of your claim.

Contacting Your Insurer

After you've gathered your evidence on-site, it's time to call your insurance company and get a claim started. To make the call as efficient as possible, have this information handy:

- The exact date and time the incident happened.

- The name and address of the car wash.

- Your photos and a copy of the incident report.

- The names and phone numbers of anyone who saw it happen.

Your insurer will then assign a claims adjuster to your case. This person’s job is to investigate what happened, which includes reviewing all the proof you collected and likely speaking with the car wash's staff. All that groundwork you did right after spotting the damage? This is where it really pays off, giving the adjuster the concrete evidence they need to process your claim.

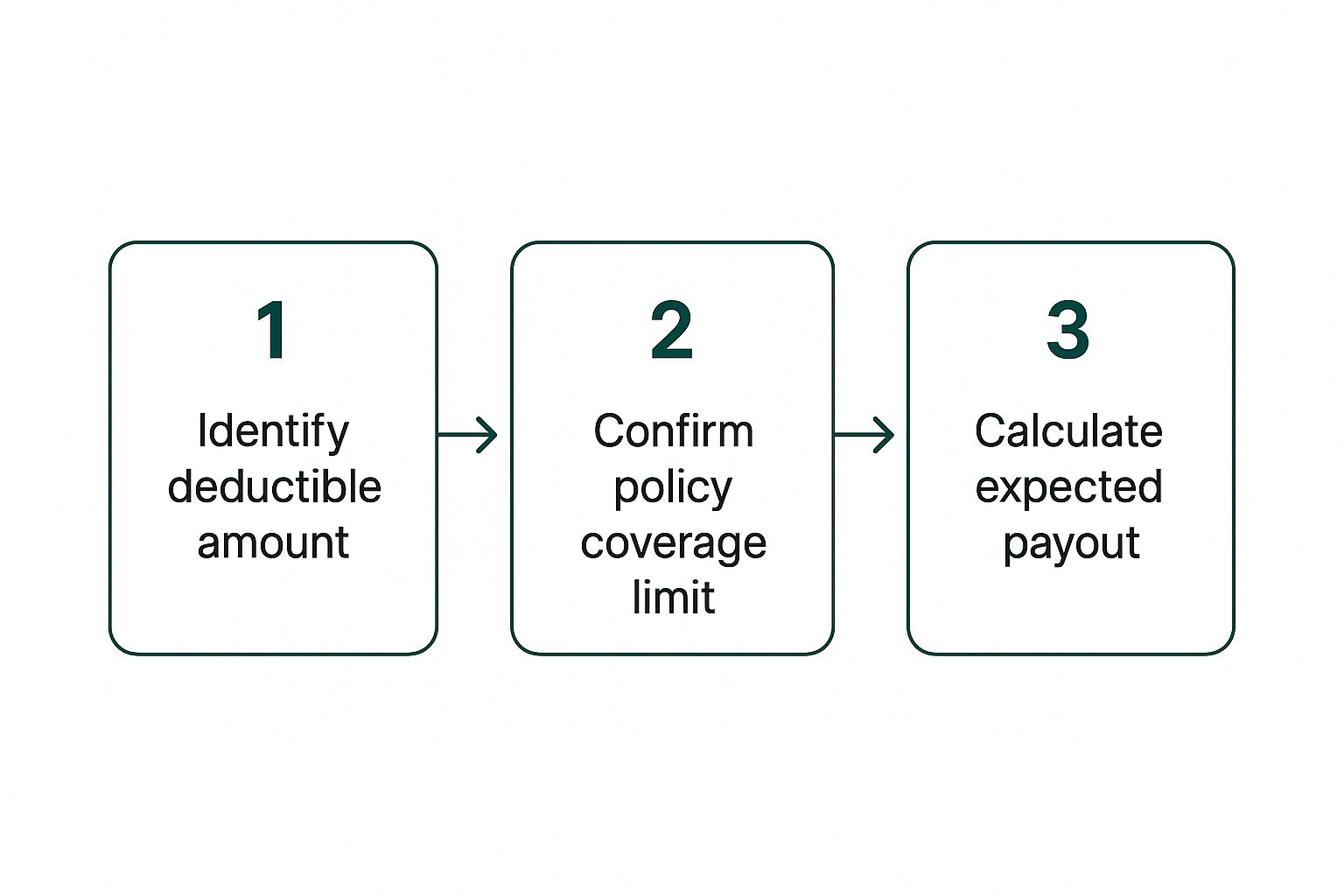

This whole process really underscores why knowing the financial side of your policy is so important before you ever need it. This visual breaks down what you can expect financially when you file a claim.

As you can see, your deductible is the first piece of the puzzle. Being prepared for these out-of-pocket costs is key. To get more comfortable with how it all works, check out our in-depth car insurance deductible explained guide.

When to Pay Out of Pocket vs. Filing a Claim

So, your policy might cover the damage. That’s great news, but hold on a second—just because you can file a claim doesn't always mean you should. Making the right call here is all about running the numbers and thinking long-term, and it all starts with your deductible.

Think of your deductible as your share of the repair bill. It's the amount you have to pay yourself before your insurance company steps in to help.

The very first thing to do, before you even think about calling your agent, is to get a professional repair estimate. Understanding the cost of car body repairs is the most critical piece of the puzzle. This number will tell you everything you need to know.

The Critical Calculation

Once you have that estimate in hand, put it side-by-side with your comprehensive deductible. The math is simple, but the answer is powerful.

- Repair Cost is Less Than Your Deductible: This one's easy. If the fix costs $400 and your deductible is $500, you’ll want to pay out of pocket. Filing a claim would be pointless since your insurance wouldn't pay a dime until you've met that $500 threshold.

- Repair Cost is Slightly More Than Your Deductible: Here's where it gets tricky. Let's say the repairs are $700 and your deductible is $500. You could file a claim and get a $200 check from your insurer.

But is that $200 really worth it? You have to consider the potential fallout. Even a "not-at-fault" comprehensive claim can trigger a premium increase when your policy renews. Insurers get nervous when they see a history of frequent claims, no matter how small, and might start seeing you as a higher risk.

Filing a small claim could easily cost you more in higher rates over the next few years than the initial payout you received. Often, the smartest financial move is to just handle the minor stuff yourself. It's the same strategic thinking you'd apply to the homeowner insurance claim process, where avoiding small claims is key to protecting your rates and claims history.

Answering Your Top Car Wash Damage Questions

Even after you know the basics of the claims process, a lot of questions pop up when you're standing there looking at a fresh scratch on your car. Dealing with damage from a car wash can feel overwhelming, but getting straight answers to the most common concerns can make all the difference.

Let's break down what people usually ask.

What if the Car Wash Has a Disclaimer Sign?

You’ve probably seen them: signs that say the car wash isn’t responsible for damage to antennas, non-factory parts, or pre-existing issues. While these signs give the business a layer of protection, they aren’t a magical shield against their own negligence.

Think of it this way: if a piece of their equipment malfunctions and rips off your standard factory-installed mirror, that disclaimer probably won't hold up. On the other hand, if your aftermarket spoiler was a bit loose and the wash knocked it off, they have a much stronger argument. It's always a good idea to read those signs, but don't assume they let the business off the hook for everything.

Will My Insurance Premium Increase After a Claim?

This is the big one, isn't it? It’s a very real possibility. A claim for car wash damage typically falls under your comprehensive coverage, which is for "not-at-fault" incidents. That means it’s less likely to spike your rates than an at-fault collision claim would.

However, insurers look at your entire claims history. Filing multiple claims, even small ones, can signal that you're a higher risk, and you might see a rate increase when your policy renews. The cost of the damage also plays a role. It’s always a smart move to chat with your insurance agent about the potential rate impact before you file, especially if the repair cost is barely over your deductible.

Expert Insight: You have to weigh the immediate payout against the potential for higher premiums down the road. Filing a small claim might save you $300 now, but it could cost you more than that in increased rates over the next few years.

How Do I Prove the Car Wash Caused the Damage?

Good, solid proof is your best friend here, and timing is everything. The most compelling evidence is evidence you gather before you drive off the car wash lot.

- Use Your Smartphone: Immediately take time-stamped photos and videos of the damage from every conceivable angle.

- Get the Manager: Find the manager on duty right away. Show them the damage and ask them to fill out an incident report.

- Ask for Video: Politely ask if they have security cameras that recorded your car’s trip through the wash.

If you wait, the car wash—or even your own insurance company—could argue the damage happened after you left. This makes your case much, much harder to win. For businesses, properly documenting these incidents is a crucial part of being prepared, a concept we dive into in our article on business continuity insurance.

Who Should I Contact First?

Always start with the car wash manager or owner. Go to them first, right then and there. Many reputable businesses will offer to pay for the repairs out of pocket to avoid having an insurance claim filed against them. For minor damage, this is almost always the quickest and easiest solution.

If they refuse to cooperate or the damage is significant, then it’s time to call your insurance company. By approaching the business first, you show that you tried to handle it in good faith, which can only help your case. It’s also helpful to understand the different ways a car can be washed; some people prefer the convenience of mobile car wash services, which come with their own set of considerations.

How to Change Insurance Providers: A Quick Guide

How to Change Insurance Providers: A Quick Guide Homeowners Insurance Loss of Use Coverage: Your Essential Guide

Homeowners Insurance Loss of Use Coverage: Your Essential Guide