When a disaster like a fire or major storm hits your home, the first thought is often, "Where will we live?" The second is usually, "How will we afford it?" That's precisely the moment when homeowners insurance loss of use coverage, also known as Coverage D, becomes one of the most important parts of your policy. It's the financial backstop that helps you handle temporary living costs when a covered event makes your house uninhabitable.

What Is Loss of Use Coverage, Really?

Think of loss of use coverage as your policy’s emergency relocation fund. It’s built to prevent a housing crisis from turning into a financial catastrophe by helping you maintain your normal standard of living. This isn't a blank check for a five-star hotel getaway; it’s designed to cover the necessary and reasonable increase in living expenses you’re facing simply because you can't live at home.

The concept is pretty straightforward: your policy pays for the difference between your usual living costs and what it costs to live temporarily elsewhere. Let's say your monthly mortgage, utilities, and groceries normally add up to $2,500. But after a fire, you have to rent a similar-sized apartment for $3,000 a month and spend more on takeout because you don't have a full kitchen. Your loss of use coverage would step in to cover that extra $500+ in expenses.

Key Takeaway: Loss of use isn't meant to pay all your bills. It specifically covers the additional costs—the expenses that wouldn't exist if you hadn't been displaced from your home.

This financial support is a standard feature in most homeowners policies. As you explore different insurance options, understanding how this coverage works is a crucial step in learning https://wexfordis.com/2025/08/05/how-to-choose-home-insurance/ that truly fits your family's needs.

Additional Living Expenses Explained

The heart of this coverage is what we call Additional Living Expenses (ALE). These are the everyday costs that balloon when you're suddenly forced to live somewhere else.

Some common ALE reimbursements include:

- Temporary Housing: This covers the cost of staying in a hotel, motel, or a rental home or apartment that's comparable to your own.

- Increased Food Costs: If your temporary spot lacks a kitchen, the extra cost of eating out versus your normal grocery bill is often covered.

- Laundry Services: No washer and dryer in your temporary lodging? The cost of using a laundromat can be reimbursed.

- Pet Boarding: If your temporary rental doesn't allow pets, the fees for boarding your furry family members are usually covered.

- Storage Fees: You'll likely need to move your salvageable belongings out during repairs. This covers the cost of a storage unit.

To make this clearer, it helps to see what your insurance pays for versus what you're still responsible for. This table breaks it down.

Loss of Use Coverage At a Glance: Covered vs. Non-Covered Expenses

| Expense Category | What Loss of Use Typically Covers (Additional Costs) | What You Still Pay (Normal Expenses) |

|---|---|---|

| Housing | Hotel bills or rent for a temporary apartment. | Your regular mortgage payment. |

| Food | The extra cost of restaurant meals if you have no kitchen. | Your normal weekly grocery budget amount. |

| Utilities | New utility setup fees or higher costs at the temp location. | Your usual monthly utility bills for your primary home (if they continue). |

| Transportation | Extra gas money if your temporary home is further from work/school. | Your regular car payment and insurance. |

| Other Services | Laundry services, pet boarding fees, furniture rental. | Pre-existing monthly costs like a gym membership or streaming services. |

Essentially, the goal of ALE is to bridge the financial gap, not replace your entire budget.

Fair Rental Value for Landlords

There's another crucial piece to loss of use coverage that's a lifesaver for landlords. If you rent out part of your home—like a basement apartment or a separate guest house—and a covered event makes it unlivable for your tenant, this coverage can help.

It’s called Fair Rental Value, and it reimburses you for the rent payments you lose out on while the space is being repaired. This ensures that a disaster doesn’t just damage your property but also wipes out an important income stream.

While standard policies handle most common scenarios, it's also worth looking into non-standard home insurance if you have a unique property. Regardless of the policy type, this coverage is fundamental to your financial security.

How Your Coverage Springs into Action

Let’s be honest—nobody wants to think about their house being seriously damaged. But if a fire, a tornado, or a burst pipe forces you from your home, you need to know exactly how your insurance helps. This is where your homeowners insurance loss of use coverage becomes your lifeline.

This coverage, often called Coverage D, kicks in when a covered peril—an event like a fire or windstorm that your policy protects you against—makes your house unlivable. It’s not for minor inconveniences. The damage must be severe enough that you genuinely cannot live there safely. Once that line is crossed, your benefits are triggered.

From Hotel Stays to Temporary Homes

To really see how this works, let's walk through a real-life scenario. Imagine the Smith family of four has a bad kitchen fire. The smoke damage is extensive, and the structure isn't safe. Their home is officially uninhabitable.

Immediately, they need a place to sleep. Their loss of use coverage allows them to check into a local hotel for the first few nights. This gives them breathing room to figure out the next steps with their insurance adjuster without worrying about where to lay their heads. This is a classic example of what’s called Additional Living Expenses (ALE).

But repairs will take months, and living out of a hotel with a family isn't sustainable. Working with their insurer, the Smiths locate a furnished three-bedroom rental in a similar neighborhood. The key concept here is comparability. The policy pays for a temporary home that lets them maintain their normal standard of living—not a five-star resort, but a place that’s reasonably similar in size and function to the home they lost.

The core principle of loss of use is "maintaining your normal standard of living." Insurers focus on covering costs that are reasonable and necessary to replicate your lifestyle, not enhance it.

Covering Costs Beyond Just Rent

What makes this coverage so valuable is that it goes far beyond just paying for rent. It’s designed to cover all the little extra expenses that pop up when you're displaced—the costs that are above and beyond what you would normally spend each month.

For the Smiths, those extra costs started adding up quickly:

- Higher Food Bills: The rental’s kitchenette is tiny, meaning they have to eat out more often. They can claim the difference between their usual $800 monthly grocery budget and their new $1,300 food expenses.

- Laundry Services: Their temporary home doesn't have a washer and dryer. The $100 a month they now spend at the laundromat is a new, necessary expense, so it’s covered.

- Pet Boarding: The rental has a strict no-pets rule. Boarding their golden retriever costs $400 a month, another expense covered by ALE.

- Increased Commute: Being a few miles farther from work and school adds an extra $50 in gas each month. This, too, is reimbursable.

You might be surprised how often homeowners need this kind of help. In 2022, about 5% of insured homeowners filed a claim, and the leading causes were wind, fire, and water damage. These are the very events that force families from their homes and make loss of use coverage so essential. You can find more homeowners insurance claims data on MoneyGeek.com.

It’s also helpful to see how different types of insurance fit together. While loss of use handles your living expenses, other policies cover different risks entirely. For example, a professional might need to understand what is tail coverage insurance to stay protected from lawsuits after their main policy expires. It’s a completely different world from homeowners insurance, but a great example of how specialized coverage is built to solve specific problems.

Understanding Your Policy's Financial Limits

While your homeowners insurance loss of use coverage is a lifesaver after a disaster, it's important to know that it's not a blank check. Every policy has built-in financial caps that determine the absolute maximum your insurer will pay while you're displaced. Getting a handle on these limits before you need them is key to managing your budget and expectations during an already stressful time.

Most of the time, your loss of use limit is calculated as a percentage of your dwelling coverage (also known as Coverage A)—that’s the total amount your home's physical structure is insured for. The industry standard for this percentage usually lands somewhere between 20% and 30%.

So, what does that look like in the real world? Let’s say your home is insured for $400,000. If your policy has a 20% loss of use limit, you’d have $80,000 to cover your additional living expenses. A 30% limit on that same policy would give you a much more comfortable $120,000 to work with while your home is being repaired.

The Two Types of Policy Limits

When it comes to capping your benefits, insurance companies generally use one of two methods: a hard dollar amount or a time limit. It's crucial to know which one applies to you, as it directly shapes how long you'll receive financial support.

- Monetary Limits: This is the most common setup. Your coverage is capped at a specific dollar amount, like the $80,000 we just discussed. Once you hit that total, the payments stop—even if your home still isn't ready to live in.

- Time-Based Limits: Less common, some policies set a maximum duration for benefits, often for 12 or 24 months. With this structure, your reimbursements end once the clock runs out, no matter how much or how little of a dollar amount you've spent.

You’ll also likely see a "reasonable time" clause in your policy's fine print. This essentially means the insurer will cover your costs for the amount of time it should realistically take to rebuild or repair your home with due diligence. It’s a way to keep the process moving forward efficiently.

Crucial Insight: The true value of your loss of use coverage is directly tied to the accuracy of your dwelling coverage. An underinsured home doesn't just put your property at risk—it jeopardizes your ability to live elsewhere during repairs.

Remember, your loss of use coverage can often help with more than just rent. It might also contribute to the cost of moving your belongings into a temporary unit. For peace of mind, it’s also smart to look into insuring items in storage for an extra layer of protection.

The Hidden Danger of Being Underinsured

One of the biggest financial risks homeowners face—often without even realizing it—is being underinsured. This happens when your dwelling coverage is too low to cover the actual cost of rebuilding your home based on today's prices for labor and materials. This shortfall creates a devastating domino effect on your loss of use coverage.

Imagine your home, insured for $400,000, would actually cost $500,000 to rebuild after a fire. You're already starting $100,000 in the hole on the rebuild alone. Because your loss of use fund is just a percentage of that inadequate $400,000, it will almost certainly be too small to support you through a long and expensive reconstruction process.

This isn't just a hypothetical problem. It's a widespread issue that can grind disaster recovery to a halt. One study found that for every 10-point increase in a homeowner's underinsurance, the likelihood of them even filing a rebuilding permit drops by 4 percentage points.

The best defense is a good offense. Sit down with your insurance agent regularly to review your policy. Make sure your limits reflect today's true replacement costs—doing so protects both your home and your financial stability when you need it most.

Navigating the Loss of Use Claims Process

When a disaster makes your home unlivable, the last thing you need is more confusion. The immediate aftermath is chaotic, but knowing the right steps to take can make all the difference. Successfully filing a homeowners insurance loss of use coverage claim starts with acting quickly and keeping detailed records.

The second you're forced out of your home, your first call should be to your insurance agent or carrier. This single action is vital—it reports the damage, officially starts the claims process, and gets an adjuster assigned to your case. Your insurer can often provide immediate help, like covering a hotel for the first few nights, giving you some much-needed breathing room.

Your First Steps and Documentation Checklist

From this point forward, think of yourself as the lead accountant for your own recovery. Every dollar you spend because you can't live at home is a potential Additional Living Expense (ALE) that can be reimbursed. But there's a catch: you have to prove it. Good organization isn't just helpful; it's your most powerful tool.

Your insurance adjuster needs a clear paper trail to approve what you've spent. Start a dedicated folder or a digital file right away and put everything in it.

Essential Documents to Save:

- Housing Receipts: Hold onto every single hotel bill, motel receipt, or the lease for your short-term rental.

- Food and Meal Invoices: When you don't have a kitchen, you'll be eating out more. Save all those restaurant and takeout receipts. Pro tip: jot a quick note on them (like "dinner for family") to provide context.

- Transportation Logs: Is your temporary place further from work or school? Track the extra mileage and keep gas receipts to show the added cost.

- Miscellaneous Service Invoices: This covers everything from laundry services and pet boarding to furniture rentals and storage unit fees.

Keeping meticulous records is the bedrock of a smooth claim. The better your documentation, the faster your adjuster can get you reimbursed. To see how this fits into the bigger picture, it helps to understand the complete homeowner insurance claim process from beginning to end.

Upfront Advances vs. Reimbursement

So, how do you actually get the money? Insurers generally use two methods to pay out loss of use benefits: advances or reimbursements. Knowing the difference is crucial for managing your finances while you're displaced.

An advance is just what it sounds like—your insurer gives you money upfront to cover big, looming expenses. Think of the first month's rent and security deposit for a temporary apartment. This can be a lifesaver when you’re facing huge bills right away.

A reimbursement, on the other hand, works by you paying for things out-of-pocket first. You then submit the receipts, and your insurer pays you back. Most ongoing, smaller costs like meals and laundry are handled this way. It's really important to talk to your adjuster about which method they'll use for different expenses so there are no surprises.

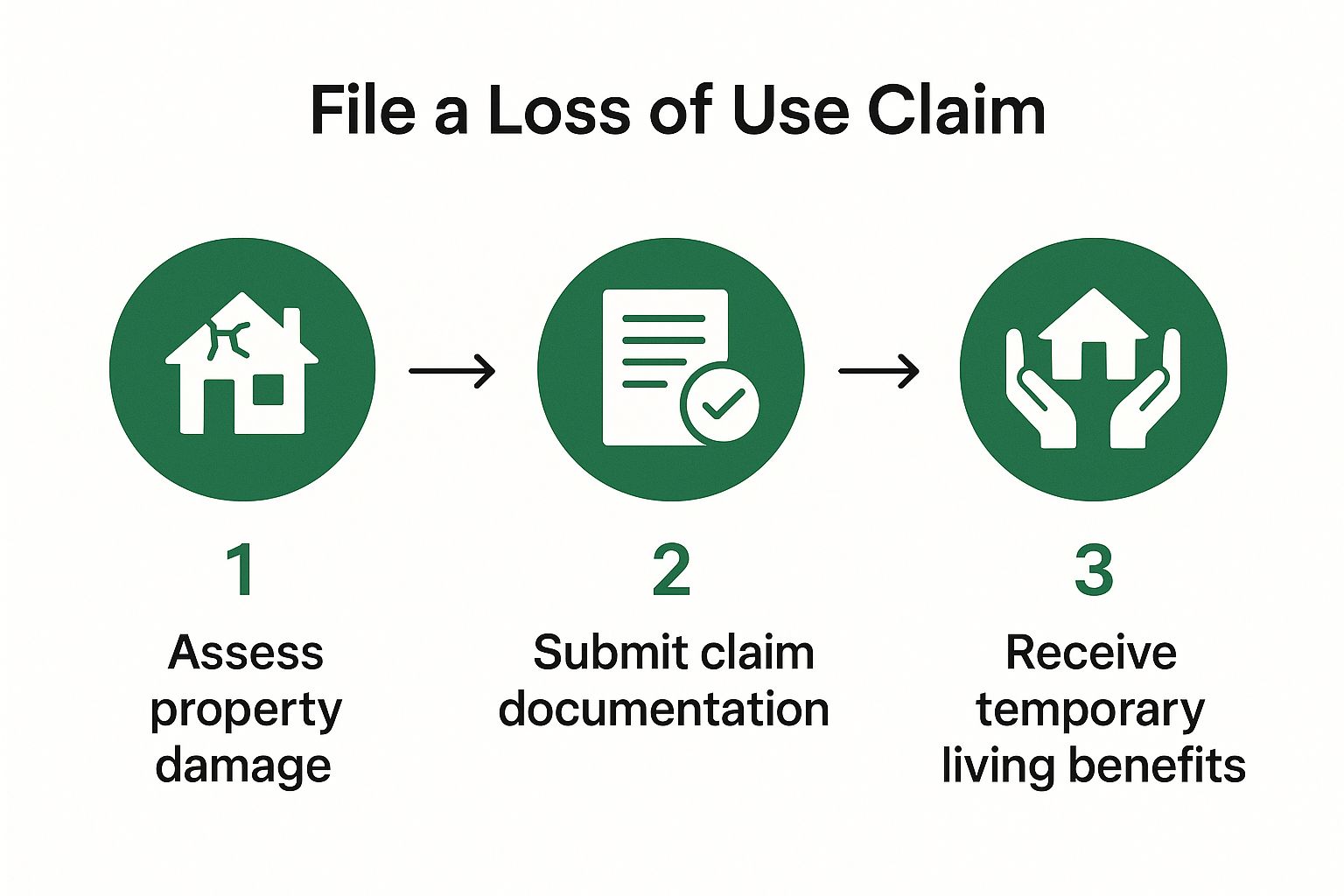

This infographic lays out the early stages of a claim, showing the path from the moment of damage to getting the support you need. Notice how each step builds on the last, reinforcing just how critical organized paperwork is.

Communicating Effectively With Your Adjuster

Your insurance adjuster isn't an adversary; they're your main point of contact and your partner in getting your life back on track. Building a good, professional relationship with them can change the entire experience for the better.

Here are a few tips for making that communication work smoothly:

- Be Proactive: Don't wait to be asked for things. You know they'll need receipts, so bundle them up and send them over regularly—maybe at the end of each week.

- Ask for Clarity: If you're not sure if something is covered, ask before you spend the money. A simple email checking, "Will a six-month lease be approved?" can prevent a world of hurt later on.

- Keep a Log: After every phone call or email, jot down the date, time, and what was discussed. This simple habit prevents misunderstandings and keeps both of you on the same page.

By taking these steps, you're no longer just a victim of bad circumstances. You become an active manager of your own recovery, ensuring your homeowners insurance loss of use coverage works exactly as it’s supposed to.

Real-World Scenarios and Their True Costs

https://www.youtube.com/embed/GG_vyIR9j2k

It’s one thing to read the fine print in your policy, but it’s another thing entirely to see how homeowners insurance loss of use coverage actually performs when you need it most. Abstract terms and coverage limits suddenly become very real when disaster strikes.

Let’s walk through a few common scenarios. You'll see how this coverage, often called Additional Living Expenses (ALE), acts as a critical financial buffer, protecting families from the strain of being displaced from their homes.

Scenario 1: The Minor Kitchen Fire

Picture this: a small grease fire flares up on the stove. You grab the extinguisher and put it out, but the damage is done. The kitchen is a mess of soot and water damage from the fire suppression, and the smell of smoke has seeped into everything on the first floor. An adjuster confirms the house is uninhabitable until a professional crew can clean and repair the damage.

The family needs to move out for two weeks. This is where their homeowners insurance loss of use coverage kicks in.

- Temporary Housing: They find an extended-stay hotel with a small kitchen for $150 a night. For 14 days, that's a $2,100 bill.

- Increased Food Costs: Even with a kitchenette, they can't cook proper meals like they normally would. They end up spending an extra $400 on restaurant meals and takeout.

- Laundry Services: The hotel doesn't have laundry, so they spend $75 at a laundromat down the street.

Their monthly mortgage payment of $2,200 is still due, of course. Insurance doesn't cover existing bills, only the extra costs incurred because they were forced out of their home.

The Payout: Their insurer covers the full $2,575 in additional expenses ($2,100 for the hotel + $400 for food + $75 for laundry). Without this coverage, a relatively small incident would have cost them more than a full mortgage payment out-of-pocket.

Scenario 2: The Major Storm Damage

Now let’s scale up the damage. A severe storm tears a hole in a family’s roof, leading to intense water damage on the top floor and causing a ceiling to collapse into the living room. The house needs major structural repairs, and the contractor estimates it will take six months.

Living in a hotel for half a year just isn't practical. After talking with their adjuster, the family finds a comparable three-bedroom apartment renting for $2,800 a month.

- Temporary Housing: The total rent for the six-month stay comes to $16,800.

- Utilities: Their normal mortgage is $2,000. The rent is $800 higher, so the insurer covers this difference, totaling $4,800 over the six months.

- Moving & Storage: They need to move their undamaged furniture and belongings to a safe place. This costs $1,500 for the movers, plus $200 a month for a storage unit ($1,200 total).

- Other Costs: A longer commute from the rental apartment and other small, unexpected expenses add up to another $1,000 over the six-month period.

The Payout: The insurer covers $23,500 in total additional living expenses. This is a game-changer, preventing the family from having to raid their savings or take on debt just to keep a roof over their heads. Events like storms and floods can create complicated claims; knowing the difference between policies is key. For a deeper dive, check out our guide comparing flood insurance vs. homeowners insurance.

Scenario 3: The Total Loss Wildfire

The final scenario is the one everyone dreads: a wildfire tears through the neighborhood, and a family’s home is burned to the ground. It’s a total loss, and rebuilding from scratch will take at least a year. The volatility of such events is increasingly impacting insurers. In the first quarter of 2025, an extended wildfire season contributed to U.S. homeowners insurers experiencing their most challenging first quarter in five years, with a direct incurred loss ratio reaching 102.1%. You can learn more about the recent impact of catastrophic events from Reinsurance News reporting on market setbacks.

In this situation, the family’s loss of use coverage is set at 30% of their $500,000 dwelling coverage. This gives them a $150,000 budget for their additional living expenses.

- Long-Term Rental: They find a similar home to rent for $3,500 per month, which totals $42,000 for the year.

- Furniture Rental: They need to furnish the entire rental home, which costs $500 a month ($6,000 total for the year).

- All Other Costs: Over the course of a full year, the accumulation of higher food bills, new commute patterns, pet boarding, and other necessary expenses adds up to $12,000.

The Payout: The family's total additional living expenses are $60,000. This amount is well within their $150,000 policy limit. That financial peace of mind allows them to live with some normalcy and maintain their standard of living during the long, emotional process of rebuilding their lives from the ground up.

Answering Your Top Loss of Use Questions

Even after you grasp the basics, it's natural to have specific, real-world questions about homeowners insurance loss of use coverage. These questions often pop up when you're in the middle of a stressful situation and need answers fast.

Let's walk through some of the most common questions homeowners ask about Coverage D. Getting these details straight can make a world of difference in how smoothly your recovery goes and help you manage your finances during a tough time.

Does Loss of Use Coverage Pay My Mortgage?

This is probably the number one question we hear, and the answer is a straightforward no. Loss of use coverage is not designed to pay your mortgage. That payment is a fixed expense you had before the disaster and would have anyway.

Instead, this coverage is all about handling the new, extra costs you're facing because you can't live in your home. Let's put it in real numbers: say your monthly mortgage is $2,000, and a comparable temporary rental costs $2,800. Your policy is there to cover that $800 difference. You’re still on the hook for your regular mortgage, but the insurance shoulders the additional financial load of temporary housing.

What if I Stay with Family Instead of Renting?

This is a smart and common move for many families. If you bunk with relatives or friends for free, your policy won't pay for rent because, well, you didn't actually pay any. You can’t claim an expense you never had.

But that doesn't mean your claim is a bust. You can still be reimbursed for other legitimate extra costs. For example, you might be able to claim funds for reasonably contributing to your host's higher utility bills or grocery expenses. Other valid costs could include moving your things to a storage unit or using a laundromat if you don’t have access to a washer and dryer.

Pro Tip: Keep detailed records of every single expense, no matter how small. It’s also wise to talk to your adjuster about your living situation from the get-go to confirm what they’ll cover. Good communication is everything.

Some insurers might even offer a small "thank you" payment to your generous hosts, though this is a company-by-company perk and not a guarantee.

What Is Fair Rental Value Coverage?

Fair Rental Value is a specific part of your loss of use coverage that’s incredibly important for landlords. It's built for homeowners who rent out a piece of their property, like a basement apartment, a guesthouse, or one side of a duplex.

If a covered disaster damages that rented space and makes it uninhabitable, this coverage steps in to reimburse you for the lost rental income you would have collected while it's being repaired. It’s there to protect your income stream when your property can't produce it.

This is completely separate from Additional Living Expenses (ALE), which covers your costs if you're displaced from the part of the home you live in. If you live in one unit and rent out another, you could potentially file claims for both ALE and Fair Rental Value at the same time. This is a crucial piece of your policy if you rely on that rental income. For a deeper dive into your entire policy, check out our comprehensive guide to homeowners insurance.

Can I Upgrade My Lifestyle with This Coverage?

The short answer is no. The core principle of loss of use coverage is to help you maintain your normal standard of living—not to bankroll a temporary lifestyle upgrade.

Insurance companies will approve expenses for temporary housing that are comparable to your damaged home and your usual budget. If you live in a 1,800-square-foot, three-bedroom home in the suburbs, your policy will cover a similar rental. It won't, however, approve your claim for a luxury downtown penthouse with a doorman and a rooftop pool.

Trying to claim extravagant expenses that are clearly a step up from your normal life will only raise red flags. It can lead to claim delays, arguments with your adjuster, and ultimately, a denial of those expenses. The two words to live by during a claim are "reasonable" and "necessary." Stick to that, and the whole process will be much less of a headache.

Will My Insurance Cover Car Wash Damage? Find Out Now

Will My Insurance Cover Car Wash Damage? Find Out Now Difference Between Insurance Agents and Brokers Explained

Difference Between Insurance Agents and Brokers Explained