When you're looking for insurance, the biggest difference between an insurance agent and a broker boils down to a simple question: Who do they work for? An insurance agent represents the insurance company. An insurance broker, on the other hand, works for you.

This single distinction changes everything—from the policies they can show you to the advice they provide.

Agent vs Broker: Understanding The Core Difference

Diving into the insurance world can feel overwhelming, and picking the right guide is your most important first step. Your choice between an agent or a broker will directly impact the variety of policies you see and the perspective behind the guidance you get. Knowing how they operate helps you find the right partner for your situation, whether you need personal coverage or are protecting a business.

At its heart, the difference is about loyalty. An agent is tied by contract to sell policies for a specific insurance company (or a few of them). Their main responsibility is to that insurer. In contrast, a broker has a fiduciary duty to you, the client. Their job is to search the entire market to find the best possible coverage that fits your specific needs.

Quick Comparison: Insurance Agent vs Broker

To really see how this plays out in the real world, let's break it down. This table offers a quick snapshot of the key characteristics that define the difference between an insurance agent and a broker.

| Characteristic | Insurance Agent | Insurance Broker |

|---|---|---|

| Representation | Represents the insurance company | Represents the client (you) |

| Allegiance | Owed to the insurer(s) they work for | Owed to the client |

| Market Access | Limited to a single or select group of insurers | Access to the entire insurance marketplace |

| Product Selection | Offers policies from their contracted carriers | Shops across numerous carriers for best fit |

| Primary Role | Sells the insurer's products | Provides advice and finds solutions |

This makes it clear that while both professionals get you insured, their approaches and what drives them are fundamentally different. It’s not just a matter of preference; it's about matching your needs with the professional who is set up to serve them best.

For a complete guide, you can learn more about the difference between an insurance agent and a broker on our blog.

The Role and Responsibilities of an Insurance Agent

An insurance agent is, first and foremost, a representative for one or more insurance companies. Their main job is to sell and manage policies on behalf of the specific carriers they have contracts with. This allegiance to the insurer is the foundation of their entire business model, influencing everything from the products they show you to the advice they give.

Because of this structure, an agent’s legal and fiduciary duty is to the insurance company, not to you, the client. They are genuine experts on the policies their company offers, which means they can provide in-depth knowledge and efficient service within that specific product line. It also means they are professionally obligated to follow their carrier's rules and standards to the letter.

Captive vs. Independent Agents

It's important to know that not all agents are the same. The key difference comes down to who they work for, which creates two very different kinds of agent relationships. Figuring this out is crucial to understanding the market access and policy options you'll get.

A captive agent works for just one insurance company. When you think of a local State Farm or Allstate agent, that's a captive agent. They know their company's products inside and out and can sometimes offer special deals or bundles you won't find anywhere else. Their expertise is incredibly deep because it’s so focused.

On the other hand, an independent agent works with a small, hand-picked group of different insurance companies. While they still represent those carriers, they can shop your policy around to their partners to find a good fit. This gives you more options than a captive agent, though not quite the full market access a broker provides.

At the end of the day, an agent's primary job is to find the right customer for their company's policies. Their expertise is deep but narrow, honed on mastering the solutions offered by the carriers they represent.

This focused role means agents are on the hook for accurately explaining policy terms and conditions. Any mistake or misrepresentation can create serious professional liability problems. That’s why most agents carry specific coverage, and you can learn more about what is errors and omissions insurance in our detailed guide.

Ultimately, the real value of working with an agent comes from their specialized product knowledge and their direct connection to the insurer, which can make the application and claims process much smoother.

How an Insurance Broker Works For You

Unlike a captive agent who works for one specific insurance company, an insurance broker’s loyalty is to you, the client. This is a fundamental distinction. Their entire process is built around your needs, not a carrier’s sales quota. At its core, a broker has a fiduciary duty to act in your best interest.

This client-first approach completely reshapes the insurance buying experience. A good broker starts by getting to know you or your business, conducting a deep dive into your specific risk profile. They aren't trying to squeeze you into a one-size-fits-all policy; they’re creating a blueprint of the exact protection you need.

A Market-Wide Search for the Best Fit

With that blueprint in hand, a broker then canvasses the entire insurance market to find policies that are a true match. They have relationships with a huge network of carriers, including large household names and smaller, niche insurers that a typical agent might not represent. This broad market access is a crucial part of the difference between insurance agents and brokers.

Let’s take a real-world example. Imagine a tech startup that needs very specific cyber liability coverage. A captive agent might only be able to offer a single, generic policy from their company. A broker, on the other hand, can shop that risk to dozens of insurers who specialize in the tech industry, find policies designed for data breach scenarios, and negotiate terms that protect the company's most critical assets.

The core function of a broker is not just to sell a policy but to act as a risk advisor and market expert. They leverage their independence to find the most suitable and cost-effective solution available anywhere, ensuring you don't overpay or leave critical gaps in your coverage.

This advisory role doesn't stop once the policy is signed. Brokers become your advocate, especially when you need them most—during a complex claim. They help you navigate the often-tricky process and work with the insurer to ensure a fair settlement. They also provide ongoing support, reviewing your coverage to make sure it adapts as your life or business changes.

Finally, a broker’s expertise is invaluable when it comes to negotiating terms and pricing. Because they understand the market inside and out, they can secure competitive rates on your behalf. Understanding what goes into those costs is key, and you can define a health insurance premium by reading our detailed guide. This negotiating power often leads to better coverage at a better price than what you could find alone.

Comparing How Agents and Brokers Actually Operate

Knowing the fundamental difference—who an agent or broker works for—is just the starting point. Now, let’s dig into how that plays out in their daily operations and what it really means for you when you're looking for coverage. The way they interact with the market, the breadth of their advice, and where their loyalty lies create two completely distinct experiences for the customer.

These operational details are what matter most. They directly shape the quality, variety, and price of the insurance policies you'll be shown. One path gives you deep, specialized knowledge of a few products, while the other offers a panoramic view of the entire market.

Allegiance and Advisory Scope

The biggest operational split comes down to allegiance. An insurance agent is legally and contractually bound to the insurance company they represent. Their advice is built around finding the best fit for you within their company's portfolio. They know these specific products inside and out and can get you set up efficiently.

On the other hand, an insurance broker has a fiduciary duty to you, the client. This is a legal obligation to act in your best interest, period. Because of this, their advisory scope is naturally much wider. They don't start with a product in mind; they start with your unique risks and then hunt across the entire market to find the right solution.

An agent's job is to find the right customer for their company's product. A broker's job is to find the right product for their customer, no matter which company offers it.

This single distinction changes everything. An agent might recommend the best home and auto bundle their company has. A broker, by contrast, might discover that the ideal auto policy is with one insurer and the best home policy is with another, truly optimizing your coverage and cost by mixing and matching.

Market Access and Product Selection

Right on the heels of allegiance comes market access. Agents provide a curated, but limited, set of products.

- Captive Agents: Offer policies from just one insurance company.

- Independent Agents: Work with a small, pre-selected group of partner insurers.

Brokers don't have these constraints. They can pull quotes and policies from dozens, sometimes even hundreds, of different national and specialty carriers. This broad access is a massive advantage, particularly for anyone with unusual or complex needs that a standard, off-the-shelf policy just can't cover.

To put it all together, here is a quick breakdown of how these roles function differently in practice.

Operational Differences Agent vs Broker

| Criteria | Insurance Agent | Insurance Broker |

|---|---|---|

| Primary Allegiance | The insurance company they represent. | The client. They have a fiduciary duty to act in the client's best interest. |

| Product Selection | Limited to the products offered by their parent company (captive) or a few partner companies (independent). | Access to a wide range of products from numerous insurance carriers across the market. |

| Advice Focus | Finding the best fit for the client within their available product lineup. | Finding the best policy for the client's needs, regardless of the insurance company. |

| Market Knowledge | Deep expertise in a specific set of products. | Broad knowledge of the overall insurance market and various carrier offerings. |

| Typical Client | Individuals or businesses with standard insurance needs who may prefer a specific brand. | Clients with complex risks, unique needs, or those wanting to compare the entire market. |

This table clearly shows that the core difference in representation creates a domino effect, influencing everything from product choice to the very nature of the advice you receive.

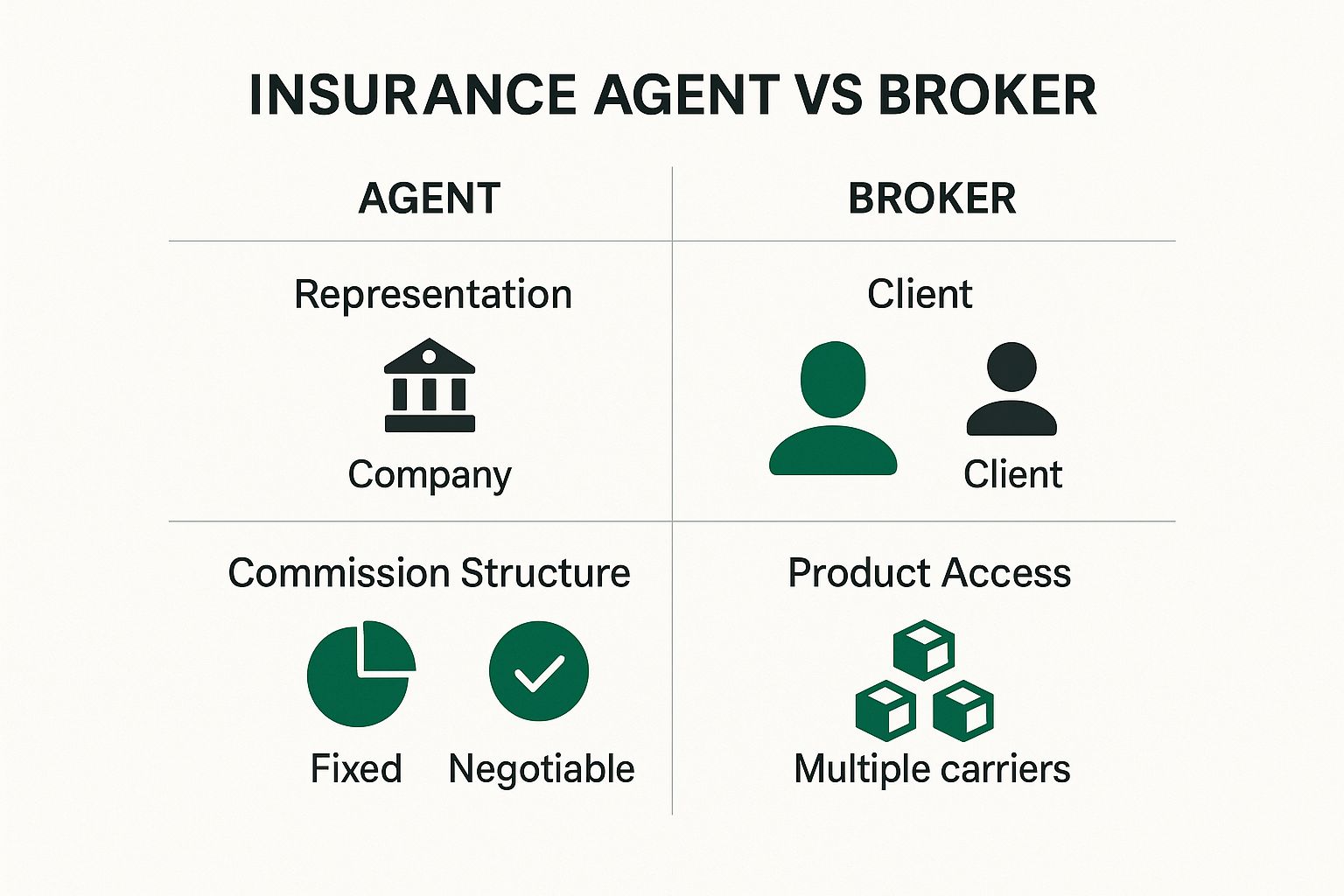

This chart helps visualize these key operational differences, showing how who they represent shapes their entire approach.

The infographic perfectly illustrates how a broker's client-first position gives them wider product access and a more adaptable commission structure.

The global insurance market, valued at USD 259.39 billion in 2022, is built on these two distinct roles. Agents give insurers a direct and reliable sales force, while brokers fuel competition by shopping their clients' needs across the whole industry. North America’s dominance, with 43% of the market share, is driven by high consumer demand for the diverse products offered through both of these vital channels. You can find more details in Zion Market Research's analysis of the global insurance market.

Ultimately, your choice depends entirely on your needs. If you have straightforward insurance needs and trust a particular brand, an agent is a fantastic and efficient resource. But if you have complex risks, specialized requirements, or simply want to see every option out there, a broker's operational model is designed from the ground up to serve you.

Analyzing Their Business Models and Market Impact

The difference between an insurance agent and a broker isn't just about who they represent; it’s baked into their entire business model and how they operate in the market. Agents and brokers exist in two very different economic worlds, each structured to handle specific client needs and levels of risk. Grasping this operational split is crucial when you're deciding who to trust with your insurance needs.

The agent’s world is often local and spread out, especially when it comes to personal insurance like home and auto policies. You'll find thousands of captive and independent agents embedded in their communities, creating a wide-reaching but decentralized network. This setup is fantastic for getting standardized products from a single carrier (or a handful of them) out to a massive consumer base.

The brokerage market, on the other hand, is the complete opposite—it's highly consolidated, especially at the top. The simple truth is that managing complex, high-stakes commercial accounts demands a level of resources, deep expertise, and global reach that only a large brokerage firm can muster. This has naturally led to a market where a few big names call the shots.

Brokerage Market Consolidation

The sheer scale of this consolidation is staggering. One of the clearest ways to see the difference between insurance agents and brokers is through their financial footprint. In 2022, the top 10 insurance brokerage firms pulled in a combined revenue of $44.4 billion. That figure represents 64.7% of the total revenue generated by the top 100 brokers. You can find more details on these brokerage market trends on MarshBerry.com.

This data paints a clear picture: the biggest firms handle the lion's share of complex, high-premium business, while individual agents work on a completely different scale.

This concentration of power creates a functional divide in the market. A multinational corporation, for instance, wouldn't dream of going to a local agent for its global risk management. It would turn to a major brokerage with specialized teams and the market clout to build a custom insurance program from the ground up—a task well outside an agent's scope. For intricate coverage needs like guaranteeing operational uptime, our guide on business continuity insurance is a great resource.

The agent model wins on accessibility and volume for personal lines, while the broker model is built on specialized expertise and scale for complex commercial risks.

Conversely, if you're just looking for a straightforward life or auto policy, an agent is often the perfect, most efficient choice. Their in-depth knowledge of one carrier’s offerings makes the whole process simple. If you're curious to learn more about the broker's side of the desk, you can find some great real-world perspectives in these lessons learned from 14 years as a broker.

Ultimately, their business models are so different that they end up thriving in separate corners of the insurance world. They rarely even compete for the same customer.

How to Choose The Right Insurance Professional

So, how do you decide? The choice between an agent and a broker isn't about one being definitively "better." It's about finding the right fit for you. The best way to make the call is to line up your personal needs with their specific business model.

If your insurance needs are pretty standard, an agent is often the perfect choice. Think straightforward home and auto policies. When you just want solid coverage from one well-known company, a captive agent's deep knowledge of their products makes for a simple, efficient process.

On the other hand, a broker really shines when your situation gets a little more complicated. Their superpower is scanning the entire market to find the best fit, which is crucial if you want to be certain you're seeing every option. Knowing all the possibilities is one of the best strategies to get cheaper auto insurance.

Scenarios Where a Broker is the Clear Choice

Sometimes, the choice is obvious. Certain situations demand the kind of broad market access and client advocacy that only a broker can provide. If you find yourself in any of these boats, your first call should probably be to a broker.

- You're a small business owner. Commercial insurance is a different beast altogether. From general liability to cyber insurance, your needs are unique, and a broker can pull together a custom plan by hand-picking policies from various specialized insurers.

- You own high-value assets. A standard policy won't cut it for fine art, custom jewelry, or a high-end home. A broker can track down specialty policies designed to protect these items, something a single-carrier agent likely can't offer.

- You have unique health needs. Navigating health insurance with a pre-existing condition can be tough. A broker can search across a wide range of health insurers to find plans with the specific doctor networks or prescription coverage you require.

The core question to ask is: "Does my situation require a custom-built solution, or will a high-quality, standard product suffice?" Your answer will point you directly to the right professional.

And remember, this decision isn't set in stone. Life changes, businesses grow, and your insurance needs will evolve right along with them. Knowing how to change insurance companies is a smart part of managing your risk for the long haul, regardless of who you're working with today.

Frequently Asked Questions

It’s natural to have questions when you’re trying to figure out who to trust with your insurance needs. Let's tackle some of the most common ones that come up when deciding between an agent and a broker.

These answers should help clear up any lingering confusion and highlight the practical differences that will affect your experience.

Is It More Expensive to Use an Insurance Broker?

Not usually, and often it can even save you money. Both brokers and agents are paid a commission by the insurance company you end up choosing, which means there's typically no direct fee passed on to you for their standard services.

While some brokers might charge a fee for highly specialized consulting work, their real value comes from shopping the entire market. They can often find you a better policy at a more competitive price, and those savings usually far outweigh any potential cost.

Who Helps with Filing an Insurance Claim?

Both will help, but their approach and allegiance are fundamentally different. An agent is your first point of contact with the insurer they represent. They’ll guide you through that specific company's claims process and act as a go-between.

A broker, on the other hand, works for you.

During a claim, a broker’s primary responsibility is to be your advocate. They'll often get directly involved in preparing your claim, negotiating with the insurer, and pushing to make sure you get the fair settlement you’re entitled to under your policy.

Is an Independent Agent the Same as a Broker?

They’re close, but there’s a key distinction. An independent agent is a big step up from a captive agent because they represent a handful of different insurance companies. This allows them to offer you a few different quotes.

A broker, however, isn’t limited to a pre-set list of partners. They have the freedom to access policies from the entire marketplace, giving them a much broader view and the ability to find more diverse and fitting solutions.

At Wexford Insurance Solutions, we bring the best of both worlds: the client-focused advocacy of a broker and the deep, specialized knowledge of an expert agent. We cut through the complexity to find the right coverage for you. Get in touch with us today.

Homeowners Insurance Loss of Use Coverage: Your Essential Guide

Homeowners Insurance Loss of Use Coverage: Your Essential Guide Financial Planning for Business Owners

Financial Planning for Business Owners