Think of reading your insurance policy like this: start with the Declarations Page for the high-level summary, then check the Definitions section to learn the language, and finally, dig into the Insuring Agreement and Exclusions to see what’s truly covered and what isn’t. Taking it step-by-step turns a confusing legal document into a practical tool for your financial protection.

Why Bother Reading Your Insurance Policy? It Actually Matters.

Does opening your insurance policy feel like a chore? You're definitely not alone. These documents are packed with jargon and fine print, but cracking them open is your single best defense against surprise bills and uncovered claims.

This guide is designed to help you navigate your policy like a pro. We'll walk through the key sections you'll find in almost any policy—whether it's for your car, home, or health—and show you that understanding your coverage is about much more than just paying your premium on time.

It's a Legal Contract, Not a Suggestion

At its core, your insurance policy is a legally binding agreement between you and the insurance company. You hold up your end by paying the premium. In exchange, they promise to cover specific types of losses as long as you meet certain conditions.

If you don’t know what those conditions are, you could have a claim denied for something as simple as not reporting an incident quickly enough.

Your policy isn’t just a receipt for payment; it’s the rulebook for your financial safety net. Knowing the rules is the only way to ensure it works when you need it most.

It’s About Financial Security and Peace of Mind

Understanding your policy is more important than ever. The global insurance market is enormous, with total premium income hitting around EUR 7.0 trillion, according to research from Allianz. That number shows just how many different products are out there, making it critical to know exactly what you've bought.

When you take the time to read your policy, you're really just making sure the protection you're paying for will be there when a crisis hits. It allows you to:

- Dodge Nasty Surprises: You’ll discover potential gaps, like finding out your homeowners policy doesn't cover flood damage before the storm hits.

- Confirm Everything is Correct: A quick scan of the Declarations Page ensures names, addresses, covered property, and coverage limits are all accurate. A simple typo here can cause major headaches later.

- Control Your Costs: Knowing your deductibles and premiums helps you make smarter choices. For example, you can see how different New York home insurance rates are directly tied to the coverage levels you select.

- Be Your Own Best Advocate: When you understand your policy's terms, you can have a much more productive conversation with a claims adjuster and make sure you’re being treated fairly.

Finding What Matters on the Declarations Page

Every insurance policy kicks off with what we call the "Declarations Page," or just the "dec page" for short. Think of it as the cheat sheet for your entire policy. It's the first place I always tell clients to look to get a high-level view of the who, what, when, and how much of their coverage. Before you even think about wading into the fine print, you need to make sure this page is 100% accurate.

Right off the bat, scan for the most basic, yet crucial, details. Is your name spelled correctly? Are all the other insured individuals, like your spouse or kids, listed? Double-check the policy period—the exact dates your coverage begins and ends. A simple typo here can turn into a massive headache down the line, especially if you need to file a claim.

Understanding Your Limits and Deductibles

Next, your eyes should go straight to the numbers that define your financial protection: your coverage limits and deductibles. The coverage limit is the maximum amount your insurance company will pay out for a single claim or loss. The deductible, on the other hand, is your share of the cost—it's what you have to pay out-of-pocket before the insurance company starts paying.

These two figures are a balancing act. For example, your auto policy might show a collision deductible of $500. If you get into an accident that causes $3,000 worth of damage to your car, you're on the hook for the first $500. Your insurer then steps in and covers the remaining $2,500.

Opting for a higher deductible, say $1,000, is a common way to lower your premium. But it's a trade-off. You're agreeing to take on more of the initial financial hit yourself, so make sure you'd be comfortable writing that check on short notice.

Key Takeaway: Don't just glance at the Declarations Page. Scrutinize it. If a name is wrong, a limit is too low, or a deductible isn't what you agreed to, call your agent immediately. This page is the foundation of your agreement, and getting it right from the start is non-negotiable.

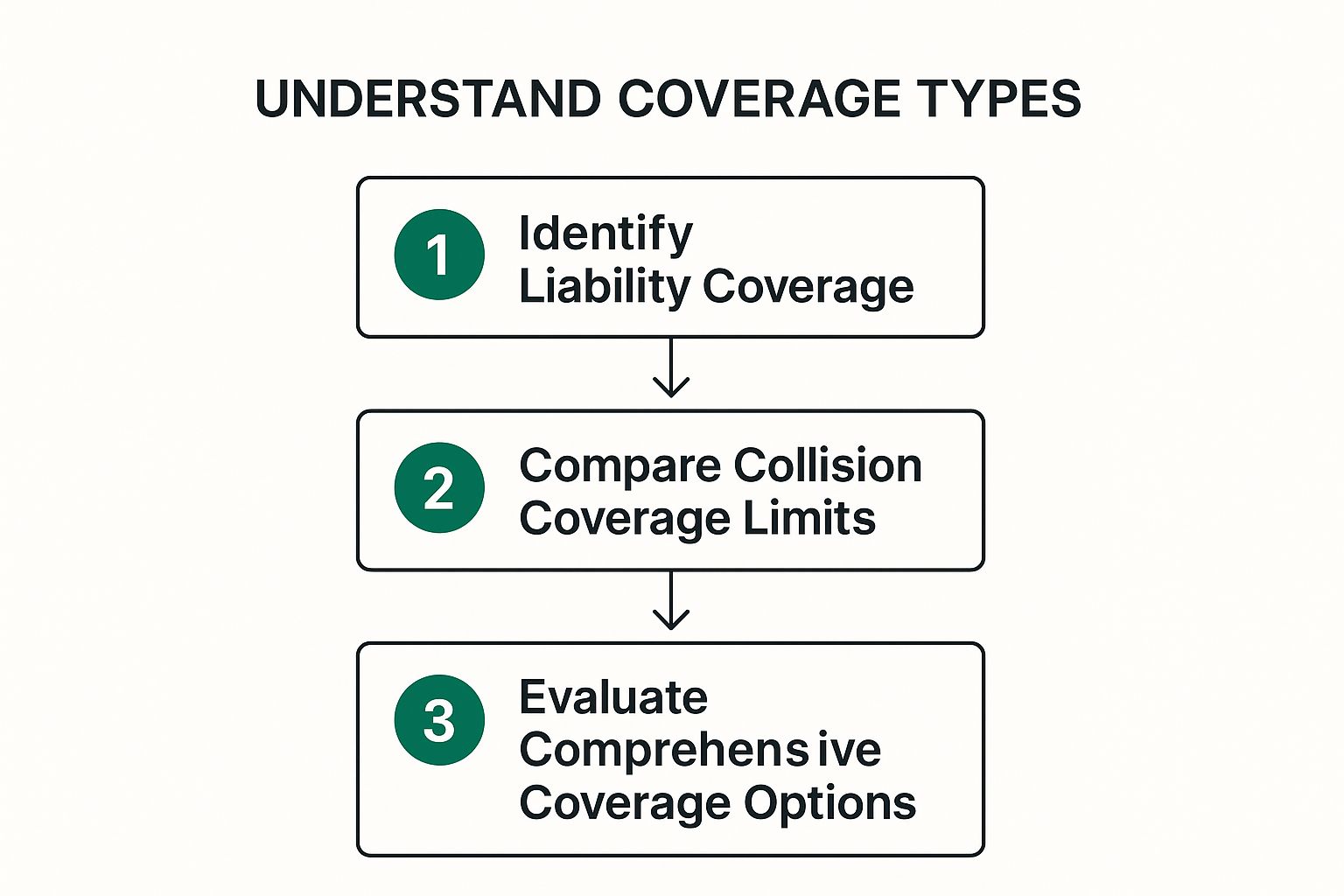

This handy visual breaks down how to approach the different types of coverage you'll see listed on a typical dec page.

As you can see, the logical flow is to first confirm your liability protection—the coverage that protects you from lawsuits—before moving on to review the limits for damage to your own property.

Everything on this final dec page should perfectly match the temporary proof of insurance you were given when you first bought the policy. To get a better handle on that document, it’s worth understanding https://wexfordis.com/2025/08/31/what-is-an-insurance-binder/. This ensures the promises made when you signed up are the same ones delivered in the official contract.

Uncovering What Is and Is Not Covered

Once you get past the Declarations Page, you’re in the real meat of the policy. This is where the rubber meets the road—where your insurer lays out exactly what they promise to protect and, just as crucially, what they won’t. Honestly, this is where most of the confusion and frustration with insurance comes from.

The whole section boils down to two main parts. First, you have the Insuring Agreement, which is the carrier’s core promise to you. It outlines the specific events (the industry calls them "perils") that your policy is built to handle.

The Insurer's Promise: The Insuring Agreement

You can think of the Insuring Agreement as the "what we actually cover" statement. It's the big-picture guarantee. For instance, a standard homeowner's policy will clearly state that it covers your property against perils like fire, theft, and windstorms.

This agreement sets the foundation for the entire contract. If a specific risk isn't mentioned or included here, it's safe to assume it's not covered unless you've added an endorsement. This is precisely why sitting down and reading your policy is so important—it’s your chance to make sure the things that keep you up at night are part of the deal.

The Fine Print: What Your Policy Excludes

Now for the part that demands your full attention: the Exclusions section. This is a laundry list of everything your policy will not cover, period. It’s where you’ll find the common traps that lead to the dreaded "claim denied" letter.

Many people are shocked to find out that standard policies almost always exclude damage from events like:

- Floods

- Earthquakes

- Sewer backups

- Wear and tear

- Damage from pests or neglect

Similarly, a business owner might assume their general liability policy covers a data breach, but that's almost always excluded unless they have a specific cyber liability add-on. For homeowners, a frequent area of confusion is structural integrity. You can see how this plays out by exploring if homeowners insurance covers foundation repair, which is a very common exclusion.

Expert Insight: I always tell my clients to read the exclusions section first. It's often more enlightening to know what's not covered than what is. This flips the script and helps you spot the coverage gaps before an incident happens.

Insurance contracts are living documents, constantly evolving to address new risks like climate change, cyber threats, and even geopolitical events. It’s essential to understand that the language is precise for a reason.

By carefully weighing both the Insuring Agreement and the Exclusions, you get the complete picture. It's the push and pull between these two sections that truly defines the boundaries of your financial safety net.

Meeting Your Obligations as a Policyholder

An insurance policy isn't just a one-way promise from the insurer to you; it's a contract with rules for both sides. The "Conditions" section is essentially your part of the deal. Think of it as the rulebook you have to follow to keep your coverage in good standing and make sure your claims get paid.

Ignoring these conditions is one of the fastest routes to a denied claim. These aren't just friendly suggestions—they're your contractual duties. Getting a firm grip on them is a massive part of knowing how to read your policy correctly.

Your Duties When a Loss Occurs

Most of these conditions kick in right after something goes wrong, like a fender bender or a pipe bursting in your basement. Your policy will spell out, step-by-step, exactly what's expected of you.

Here are the most common responsibilities you’ll see:

- Prompt Notification: You have to let your insurance company know about the incident as soon as you reasonably can. Don't wait weeks or months; a long delay can put your entire claim at risk.

- Protect Property from Further Damage: If a hailstorm shatters a window, you're expected to board it up to stop rain from ruining your floors. Insurers call this "mitigating the loss," and they won't pay for any extra damage that you could have easily prevented.

- Provide Proof of Loss: This is a formal, sworn statement detailing what happened. You’ll need to include the date, the cause, and an itemized list of the damaged property and its value.

- Cooperate with the Investigation: Be honest and work with the claims adjuster. This means providing documents they ask for, answering their questions, and letting them inspect the damaged property.

A Real-World Scenario: Let's say you get into a minor car accident. Your immediate duties are to swap insurance info with the other driver, snap plenty of photos of the damage and the scene, and call your insurer that very day. If you put it off for a month, the insurance company could argue your delay made it impossible for them to properly investigate, and they might have grounds to deny the claim.

What Happens If You Don't Meet the Conditions

Failing to hold up your end of the bargain can have serious financial consequences. The insurer could have a perfectly valid reason to deny your claim, leaving you on the hook for the entire bill.

For example, if you refuse to provide requested documents or sit down for an interview during their investigation, they can deny the claim based on non-cooperation. It’s that simple.

Getting familiar with the specific reasons a claim might be rejected is a smart move. For a closer look, our guide on common insurance claim denial reasons breaks it down even further. At the end of the day, knowing your duties ahead of time ensures you’re prepared to act, protecting your right to the payout you deserve.

Customizing Your Policy with Riders and Endorsements

It’s a common misconception that an insurance policy is a take-it-or-leave-it deal. The reality is that no standard policy can perfectly fit everyone’s needs, which is where riders and endorsements come in.

Think of these as modifications to your main insurance contract. They are add-ons that can add, remove, or change the terms of the standard policy language. If your base policy is the factory model car, an endorsement is the custom sound system or heated seats—it’s how you tailor the standard package to fit your specific life.

Understanding these modifications is a huge part of learning how to read your insurance policy, because they can completely change the game.

How Riders and Endorsements Work

In practice, these are separate pages physically attached to your main policy, usually at the very end. But don’t let their position fool you; they legally amend the original contract and will override any conflicting language in the policy's main body. That’s why you have to read them carefully.

Here’s a real-world scenario: A standard homeowner's policy often has a pretty low limit for stolen jewelry, sometimes as little as $1,500. If your $10,000 engagement ring is stolen, you’re out thousands of dollars.

By adding a scheduled personal property endorsement (sometimes called a floater) for that ring, you ensure it’s covered for its full appraised value. It’s a simple add-on that closes a massive and very personal coverage gap.

Common Examples You Might Encounter

Riders and endorsements can be your best friend, but they can also be used to take coverage away, so it’s critical to know what you’re looking at. Here are a few common ones I see all the time:

- For Home Insurance: A "water backup and sump pump overflow" endorsement is a must-have for many homeowners. This kind of water damage is almost always excluded from a base policy, and it’s a frequent and costly claim.

- For Life Insurance: The "accelerated death benefit" rider is a powerful tool. It lets you access a portion of your policy’s death benefit while you’re still alive if you get diagnosed with a terminal illness.

- For Business Insurance: A "cyber liability" endorsement can add crucial protection against data breaches, something a standard general liability policy almost never touches.

Expert Tip: Never assume a niche risk is covered. If you own valuables, run a business from home, or live somewhere with unique threats like earthquakes, you need to ask your agent about specific endorsements. It's the only way to make a generic policy truly yours.

The insurance world is constantly in flux. For example, Marsh’s Global Insurance Market Index showed a recent dip in global rates, but certain sectors like U.S. casualty insurance are seeing prices climb due to higher claim costs. You can find the full global insurance market report on marsh.com to see these trends for yourself.

These market shifts directly impact the endorsements insurers offer and the exclusions they add. It's why reading these modifications at every renewal is so important.

Ultimately, riders and endorsements are where you get to exercise the most control over your protection. They can also be a place to find savings; for more on that, see our guide on how to lower home insurance premiums. When you review them closely, you turn your policy from a template into a personalized shield built for your life.

Still Have Questions? We've Got Answers

Even after you've broken down an insurance policy piece by piece, trying to make sense of the whole document can feel a bit overwhelming. It’s completely normal to have questions pop up. Here are some of the most common ones we hear from people just like you, along with straightforward advice to help you feel more in control.

"What Should I Do If I Don't Understand Something in My Policy?"

Great question. Your first move should be to flip to the "Definitions" section. Insurers are required by law to define the key terms they use, and more often than not, you'll find your answer waiting for you there. The language can still be a bit thick with legalese, so don't feel bad if it's still not crystal clear.

If you're still stuck, pick up the phone and call your insurance agent or the company's customer service line. Seriously. It’s their job to translate the jargon into plain English. Don't just ask for a definition; ask for a real-world example of how that term would actually play out with your coverage. You're the one paying for the policy—you have every right to understand what's in it.

"How Often Should I Really Be Reviewing My Insurance?"

At a bare minimum, you should do a full policy review once a year. The best time to do this is about 30 days before it's set to renew. That gives you a nice cushion to shop around and compare quotes if you're not happy with any changes to your coverage or, more likely, an increase in your premium.

But there’s a more important rule: review your policy immediately after any major life event. These are the moments that almost certainly change what you need to protect, and your policy has to evolve with you.

Life changes that should trigger a policy review include:

- Buying a new home or car

- Getting married or divorced

- Welcoming a new child

- Starting a business from home

- Finishing a major renovation, like adding a new room

"What's the Difference Between a 'Peril' and a 'Hazard'?"

This is one of the best questions you can ask because it gets right to the core of how insurance companies think about risk.

Here’s the simplest way I’ve found to explain it:

A peril is the thing that actually causes the loss (like a fire). A hazard is any condition that increases the likelihood of that peril happening (like faulty wiring in the walls).

Think of it this way: fire is a peril. But storing a can of gasoline right next to your furnace is a huge hazard because it dramatically increases the chance of that fire—the peril—actually starting. This is exactly why insurers ask about things like trampolines, old electrical systems, or certain dog breeds. They view them as hazards that raise the odds of a claim.

Expert Tip: When you start to see your property through an insurer's eyes, you can spot and fix hazards yourself. Reducing hazards doesn't just make your home safer; it can sometimes lead to lower insurance premiums.

"Where Do I Find All the Exclusions?"

You'll usually find a section clearly labeled "Exclusions"—this is the main list. But be careful, because that's not the only place they hide. Exclusions are often sprinkled throughout individual coverage sections, too. For instance, the part of your policy dedicated to your home's structure will have its own specific list of things it won't cover.

Reading the exclusions is not optional; it’s essential. This section tells you, in no uncertain terms, what your insurance will not pay for. This is where you'll discover that damage from floods, earthquakes, and basic wear and tear are almost universally excluded from standard home policies.

You don't have to decode your insurance policy alone. At Wexford Insurance Solutions, our job is to bring clarity to the confusion. If you have these questions or any others, we’re here to help. Contact us today for a personalized policy review.

Understand New York Home Insurance Rates | Get the Best Deals

Understand New York Home Insurance Rates | Get the Best Deals Essential Guide to General Liability Insurance for Sole Proprietorship

Essential Guide to General Liability Insurance for Sole Proprietorship