When you hear insurance folks talk about Replacement Cost Coverage, what they're really talking about is a safety net. It's the part of your policy that promises to help you rebuild your life exactly as it was before a disaster, without getting bogged down by depreciation.

In simple terms, it pays the full amount needed to replace your damaged property with brand-new items of similar quality. It's designed to make you whole again.

Understanding Replacement Cost Coverage

Let’s use a real-world example. Imagine a kitchen fire ruins your five-year-old refrigerator. An insurance policy without this coverage might only pay you what a used, five-year-old fridge is worth today—which, let's be honest, won't get you very far at the appliance store.

But with replacement cost coverage, you get the funds to buy a brand new refrigerator that's comparable to the one you lost. That’s the key difference.

This is the very heart of what replacement cost coverage is: it's all about restoration, not just reimbursement for an item's used value. It aims to put you back in the exact same spot you were in moments before the damage happened.

The Goal is to Make You Whole

The promise is straightforward: fully restore your property to its pre-loss condition. This approach doesn't care how old your stuff was; it focuses entirely on what it costs to replace it at today's market prices. Think of it as a critical layer of financial security, especially when you're facing a major loss like a tree falling on your roof or a burst pipe ruining all your furniture.

This coverage brings incredible peace of mind, though it does typically mean a slightly higher premium. For most homeowners, that extra cost is a small price to pay for such robust protection. Properly insuring your home is just one piece of the puzzle, and it's always smart to explore other strategies for how to lower home insurance premiums without cutting corners on essential coverage like this.

Replacement Cost Coverage At a Glance

To quickly recap, here are the core features of replacement cost coverage. This table breaks down exactly what you're getting.

| Feature | Description |

|---|---|

| Payout Basis | Covers the cost to replace or repair with new, similar materials at current prices. |

| Depreciation | Wear and tear (depreciation) is not deducted from your claim payout. |

| Goal of Coverage | To restore your property to the same condition it was in before the damage occurred. |

| Typical Use | This is the standard for covering the actual structure of your home (dwelling coverage). |

As you can see, the main takeaway is that this coverage is designed to get you back on your feet quickly without you having to dip into your own savings to cover the difference between "old" and "new."

How a Replacement Cost Claim Actually Works

It’s one thing to understand the definition of replacement cost coverage, but seeing how a claim plays out in the real world is where the lightbulb really goes on. Let's walk through what happens when you actually need to use it.

Picture this: a small fire in your kitchen leaves you with ruined cabinets, a fried refrigerator, and damaged flooring. After the initial shock wears off, you file a claim.

The first thing that happens is your insurance adjuster comes out to survey the damage. They’re going to come up with two key numbers: the total cost to make your kitchen brand new again (that’s the replacement cost) and its actual cash value (ACV), which is what your damaged stuff was worth right before the fire, factoring in age and general wear.

The Two-Payment System Explained

This is where things can get a little confusing for homeowners. Most replacement cost policies don't just cut you one big check. Instead, they use a two-payment system, and there’s a good reason for it. The insurance company wants to make sure the money actually goes toward rebuilding your home.

Your first check will be for the actual cash value of the damaged property, minus your deductible. This initial payment is designed to get the ball rolling. It gives you the cash you need to hire a contractor and start buying materials without delay.

The second payment, often called the recoverable depreciation, comes after the work is done. Once you’ve repaired the kitchen and replaced the appliances, you’ll send all your receipts and invoices to the insurer. This is your proof of purchase. After they review everything, they release the remaining money to cover the full replacement cost.

Key Takeaway: The first check you get is for the depreciated value (ACV). You only get the rest of the money—the difference to reach the full replacement cost—after you've actually done the repairs and shown the receipts.

A Practical Example in Action

Let's put some real numbers to this. Imagine a storm takes out a section of your wooden fence.

- The cost to build a brand-new fence today is $5,000.

- But your old fence was 10 years old, so the adjuster depreciates it and assigns it an ACV of $3,000.

- Your policy has a $500 deductible.

Here’s how the payout works. The insurer sends you a first check for $2,500 (the $3,000 ACV minus your $500 deductible). You use that money, plus some of your own, to hire a company to build the new $5,000 fence. Once it's built and you submit the final invoice, the insurance company sends you the second and final check for the remaining $2,000. In the end, you're only out your deductible.

Navigating the homeowner insurance claim process becomes much less intimidating when you understand this structure.

This system applies to all sorts of things, from your roof to your appliances. Knowing the current water heater replacement cost, for example, highlights why this coverage is so vital. It’s all about making sure you can afford to buy new at today's prices, not what things were worth years ago.

Replacement Cost vs. Actual Cash Value

When you're setting up a homeowners policy, one of the most critical decisions you'll face is choosing between Replacement Cost Value (RCV) and Actual Cash Value (ACV). They might sound similar, but in the event of a claim, the financial difference is night and day. One path gets you back on your feet, while the other can leave you with a serious financial hole to climb out of.

I like to think of it this way: RCV looks forward. It gives you the money to rebuild your home or replace your belongings with brand-new materials at today's prices.

On the other hand, ACV looks backward. It pays you what your property was worth the moment before it was damaged. This calculation always includes a deduction for age and general wear and tear, a concept insurance pros call depreciation.

That little word—depreciation—is everything. It can slash your insurance payout dramatically, leaving you to cover the rest out of pocket. With RCV, depreciation isn't part of the final payout, which means you actually get the funds needed to make your home whole again.

To really nail this down, let's look at the two side-by-side.

Replacement Cost (RCV) vs Actual Cash Value (ACV)

| Aspect | Replacement Cost (RCV) | Actual Cash Value (ACV) |

|---|---|---|

| Payout Goal | To fully restore or replace your property with new, similar items. | To compensate you for the depreciated value of your property. |

| Depreciation | Not deducted from your final payout. | Deducted from the replacement cost, reducing your payout. |

| Payout Amount | Higher. Covers the cost to buy new at current market prices. | Lower. Reflects the "used" value of your damaged items. |

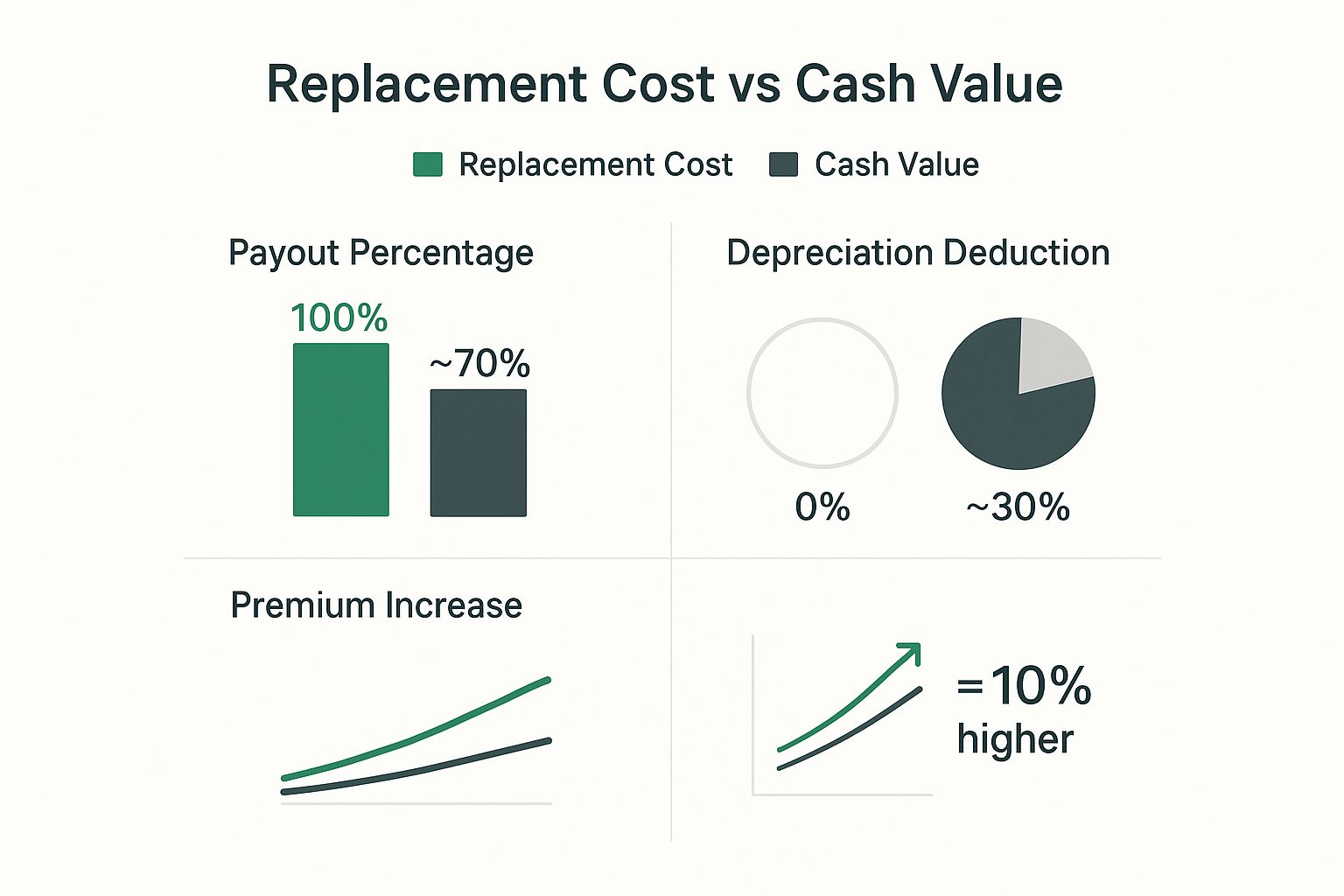

| Premiums | Typically higher (by about 10%). | Typically lower. |

| Best For | Homeowners who want to fully rebuild without out-of-pocket costs. | Older properties or those on a tight budget who can afford a gap. |

As you can see, RCV is designed for complete recovery, while ACV offers a more basic level of financial reimbursement.

How This Affects Your Payout and Premiums

The core difference is simple: RCV aims for full restoration, while ACV reimburses you for the used value of whatever was damaged.

- With Replacement Cost (RCV): Your insurance check is for the full amount it costs to repair or replace your property with new materials of a similar kind and quality (after you pay your deductible, of course).

- With Actual Cash Value (ACV): Your check is the replacement cost minus depreciation. An older roof means a smaller check. Simple as that.

Naturally, because RCV offers so much more financial protection, the premiums are a bit higher—usually around 10% more than an ACV policy. But for that small increase, you're buying incredible peace of mind and protecting yourself from potentially tens of thousands in unexpected costs after a catastrophe. Disasters like floods can add even more layers of complexity, which is why it's crucial to understand how coverage differs as we explain in our guide on flood insurance vs homeowners insurance.

This visual really helps break down the main differences in how you get paid, how depreciation is handled, and what it costs.

As the chart shows, RCV is all about covering 100% of replacement costs by taking depreciation out of the picture, and you just pay a slightly higher premium for that security.

A Real-World Roof Claim Example

Let's bring this home with a scenario I see all the time: a bad storm comes through and destroys your 15-year-old roof. The choice between RCV and ACV here isn't just academic; it has a massive impact on your bank account.

Imagine a full roof replacement costs $10,000, and your policy has a $4,000 deductible.

With RCV, it’s straightforward. The insurance company pays the full $10,000 minus your $4,000 deductible. You get a check for $6,000 to put toward your brand-new roof, regardless of how old the last one was.

Now, let's look at the same situation with an ACV policy. This is where depreciation becomes the villain of the story. The insurance adjuster might determine that due to its age, your 20-year-old roof was only worth $4,000 right before the storm. When you subtract your $4,000 deductible from that amount, your final insurance payout could be $0.

That’s right, zero. You’re left funding the entire $10,000 replacement yourself.

This example is precisely why RCV is the gold standard for dwelling coverage. It’s a financial safety net that ensures you can actually rebuild and recover from a disaster without wiping out your savings.

Why Replacement Cost Isn't Your Home's Market Value

One of the biggest points of confusion for homeowners is seeing their policy's dwelling coverage limit and thinking, "Wait, that's not what I could sell my house for!" It’s a completely normal reaction, but it stems from mixing up two very different numbers: your home’s market value and its replacement cost.

Let’s start with market value. This is the price tag. It’s what a buyer would realistically pay for your house today, factoring in everything that makes your property desirable.

This includes things like:

- The land it sits on. A quarter-acre lot in a sought-after school district is worlds apart in value from the same size lot in a rural area.

- Location, location, location. Is your neighborhood hot? Are you close to parks, shops, and good schools? All of that boosts market value.

- The housing market itself. Buyer demand, interest rates, and inventory can cause this number to swing wildly from one year to the next.

On the other hand, replacement cost is a totally different beast. It's not a real estate valuation; it's a construction estimate.

Focusing on Bricks and Mortar

When we talk about replacement cost, we ignore the land, your zip code, and what your neighbor's house just sold for. Instead, it answers one very specific question: what would it cost, in dollars and cents, to rebuild your home from the ground up on the same spot, using similar materials, at today's prices?

This value is all about the physical stuff—the lumber, drywall, roofing, and flooring. It also includes the skilled labor—the plumbers, electricians, and carpenters—needed to put it all back together exactly as it was.

The crucial takeaway is this: you're insuring the building, not the dirt it sits on. After a total loss like a fire, the land is still there. Your policy is designed to give you the funds to reconstruct the structure itself.

This distinction is a huge deal for your finances. Rebuilding costs are driven by things like inflation, supply chain issues, and labor availability. For instance, from 2021 to 2024, lumber prices alone jumped by roughly 14%. On top of that, the construction industry has been wrestling with a massive labor shortage, needing over 500,000 more workers to keep up with demand. That scarcity drives labor costs way up, as detailed in this analysis of economic factors impacting rebuilding costs on aidiconnect.com.

Why Rebuilding Can Cost More Than Buying

It might seem strange, but sometimes the replacement cost can actually be higher than your home's market value. This is especially true for older homes with unique or custom features. Why? Because rebuilding often means bringing everything up to modern, stricter building codes, which adds significant expense.

Making sure your policy reflects the true cost to rebuild is one of the most important things you can do as a homeowner. If that number is too low, you could be left dangerously underinsured and facing a massive out-of-pocket bill. It’s smart to review your coverage every year, which is also a great time to look into how to lower home insurance premiums without cutting corners on this vital protection.

Choosing the Right Level of Coverage

So, you've decided replacement cost coverage is the way to go. Great choice. But it's not quite that simple—not all replacement cost policies are created equal. You’ll find a few different tiers of coverage, each offering a different level of financial security.

Let's break them down so you can figure out what’s right for you.

The most basic option is Standard Replacement Cost. This policy covers the cost to rebuild your home up to a specific dollar amount, which is your dwelling coverage limit. If your home is insured for $350,000, that’s the absolute maximum your policy will pay out, even if rebuilding ends up costing more.

This is a solid starting point, but it has a potential blind spot. Imagine a major wildfire or hurricane hits your region. Suddenly, everyone needs to rebuild, and the demand for contractors and lumber sends prices skyrocketing. Your $350,000 limit might not be enough anymore.

Adding a Financial Safety Net

This is where policy add-ons, often called endorsements, come into play. Think of them as a financial cushion for when the unexpected happens and costs spiral out of control.

There are two main upgrades you’ll want to look at:

- Extended Replacement Cost: This is a very popular choice. It adds an extra percentage—usually between 20% to 50%—on top of your dwelling coverage. So, if your home is insured for $300,000 and you have a 25% extension, your policy will actually cover up to $375,000 for a rebuild.

- Guaranteed Replacement Cost: This is the top-tier, gold-standard option. It does exactly what it says: it guarantees to pay the full cost to rebuild your home just as it was, no matter how much it costs. The policy limit is essentially thrown out the window, giving you complete peace of mind.

These endorsements are your best defense against inflation. When a disaster strikes an entire community, the sudden surge in demand for labor and materials can make rebuilding costs soar. A standard policy limit can get eaten up in a heartbeat.

Knowing the nitty-gritty of these options helps you make a smarter choice. While we're talking about rebuilding your entire home, it's also useful to understand the actual costs of a major home renovation like a bathroom remodel to get a real sense of what property repairs can cost.

Ultimately, picking the right level of coverage is a balancing act between what you pay in premiums and how much risk you're willing to take on. It’s always a good idea to compare different policies side-by-side. For a closer look at this process, check out our guide on home and auto insurance comparison to find the best all-around protection.

Let's Bust Some Common Replacement Cost Myths

To really grasp what replacement cost coverage is, you also need to understand what it isn't. Unfortunately, a few persistent myths can cause a lot of confusion and frustration when it's time to file a claim.

Let’s clear the air and tackle these misconceptions head-on so you know exactly what to expect.

One of the biggest mistakes people make is thinking this coverage will pay for a home upgrade. For instance, if your kitchen had standard laminate countertops before a fire, your policy is there to pay for new laminate countertops—not to spring for the high-end granite you've always wanted.

The guiding principle is always a restoration of similar kind and quality. It’s about making you whole again and getting you back to where you were, not putting you in a better financial position with luxury finishes you didn't have before.

Myth 1: Replacement Cost Covers Everything on My Property

This one trips up a lot of homeowners. It’s easy to assume "replacement cost" means the cost to replace everything, but standard policies have some very specific and important exclusions.

The most significant exclusion? The land your home sits on. A fire or a tornado can't destroy the dirt, so its value is never part of the replacement cost calculation.

Other items often not covered (or with very low limits) include:

- Foundations: Many policies exclude the cost to repair or replace the foundation.

- Landscaping: Your beautiful old trees, shrubs, and garden beds are typically not covered.

- Excavation Costs: The expense of clearing debris or prepping the site for a rebuild is frequently excluded.

Myth 2: The First Check I Get Is the Final Payout

Here's another widespread myth that causes a lot of anxiety. The initial check from your insurer is almost never the full and final payment. This misunderstanding usually pops up because people forget how the two-payment system works.

Remember, the first payment is for the Actual Cash Value (ACV), which is the value of your damaged property after accounting for depreciation. Think of it as a down payment to get the repair process started.

You only receive the second check—the "recoverable depreciation"—after you've actually completed the work and can show the receipts to prove it. This final payment is what brings your total reimbursement up to the full replacement cost. Understanding this two-step process from the start helps you budget correctly and avoids the shock of thinking you've been underpaid.

Common Questions About Replacement Cost

Even after getting the basics down, a few key questions always seem to pop up when people are trying to figure out what replacement cost coverage really means for their own home. Let's dig into the most common ones.

Does This Coverage Apply to My Personal Belongings Too?

Good question. It can, but you often have to ask for it specifically. A standard homeowners policy might default to covering your personal belongings on an Actual Cash Value (ACV) basis, which helps keep the initial premium down.

However, almost every insurer lets you add on replacement cost coverage for your contents. This is a huge upgrade. It means if your five-year-old TV gets fried in a power surge, you get the funds for a brand-new, similar model, not just the couple of hundred bucks the old one was worth. It’s a smart move if you want to be able to replace your stuff without dipping into your savings.

How Do Insurers Figure Out My Home's Replacement Cost?

It’s a lot more scientific than just looking at the real estate market. Insurance companies use sophisticated software to create a detailed cost estimate for rebuilding your home from the ground up.

This isn't a ballpark figure; the calculation gets pretty granular and looks at things like:

- Square Footage: The total living space is a major factor.

- Building Materials: The type of roof, siding, flooring, and interior finishes all matter.

- Unique Features: Things like custom-built cabinets, a stone fireplace, or unique architectural designs are factored in.

- Local Labor Rates: The going rate for skilled construction workers in your town is a huge part of the equation.

This deep dive ensures the coverage amount on your policy truly reflects the real-world cost to rebuild your home today.

Is the Higher Premium for Replacement Cost Always Worth It?

For most homeowners, the answer is a firm "yes." The premium might be a bit higher, but the financial safety net it provides is on another level. An ACV policy can leave you with a staggering out-of-pocket expense to bridge the gap between what the insurance pays and what it actually costs to rebuild.

Think of replacement cost coverage as a crucial financial strategy. It's about protecting your biggest asset from a worst-case scenario, ensuring a total loss doesn't become a total financial catastrophe. You're buying the ability to rebuild your home and your life without wiping out your savings.

Navigating all the details of homeowners insurance can feel overwhelming, but you don't have to sort it out alone. The team at Wexford Insurance Solutions is here to walk you through your options and craft a policy that gives you genuine peace of mind. Get a personalized review of your coverage by visiting us at https://www.wexfordis.com.

What Is Insurance Loss of Use Coverage

What Is Insurance Loss of Use Coverage How to Switch Auto Insurance Companies Effectively

How to Switch Auto Insurance Companies Effectively